Greetings time travelers!

The Fed minutes are out, and some sellers have introduced themselves to the marketplace since they were dropped. So far, the week is playing out much like our laboratory team anticipated in the Sunday Strategy Session:

Strategy session is long and filled with tons of technical trading guff that only hardcore traders understand. That is why each report is capped off with an Executive Summary. Despite being the first bullet point of the report, it is written last, after all the complications of the Index Model and other objective instruments have been calibrated and read.

It is for the C-suite types who have not the time nor care to sift through spreadsheets and charts. Hopefully you guys are finding the research helpful. It helps us immensely to put our research into as few words as possible—to make the words count—to clarify our findings. Then execute.

This morning’s primary hypothesis played out almost exactly, as did yesterdays. This has resulted in solid execution in the NASDAQ arena. Hopefully, my demonstrating the power of auction theory live is also making a few of you connect the dots in your trading approach.

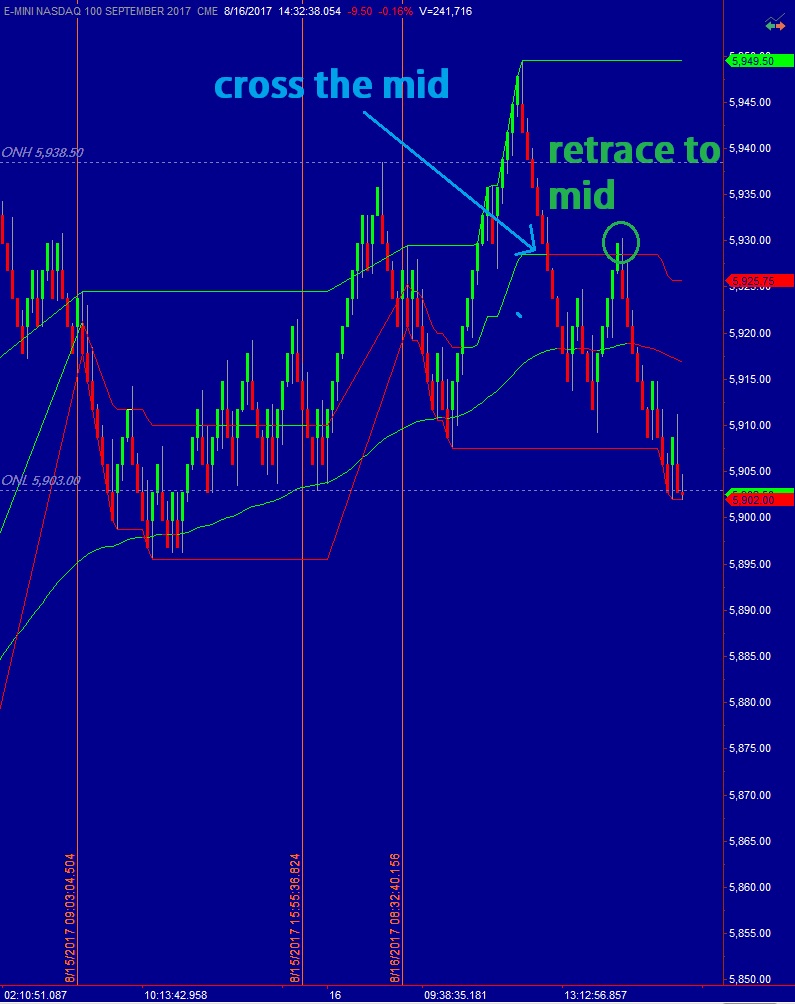

There was a bonus trade today, outside of the confines of the primary hypo. It came just before the FOMC minutes. It is a long-time favorite of mine and it ran congruent with the overarching forecast from the Strategy Session. Put simply, the trade is triggered when price crosses the daily mid-point then retraces back to the mid-point from the other side. It looks like this:

There was enough room between the mid-point and my only EMA to make a nice profit.

So now what? That should be your question after reading through all the historical information above…

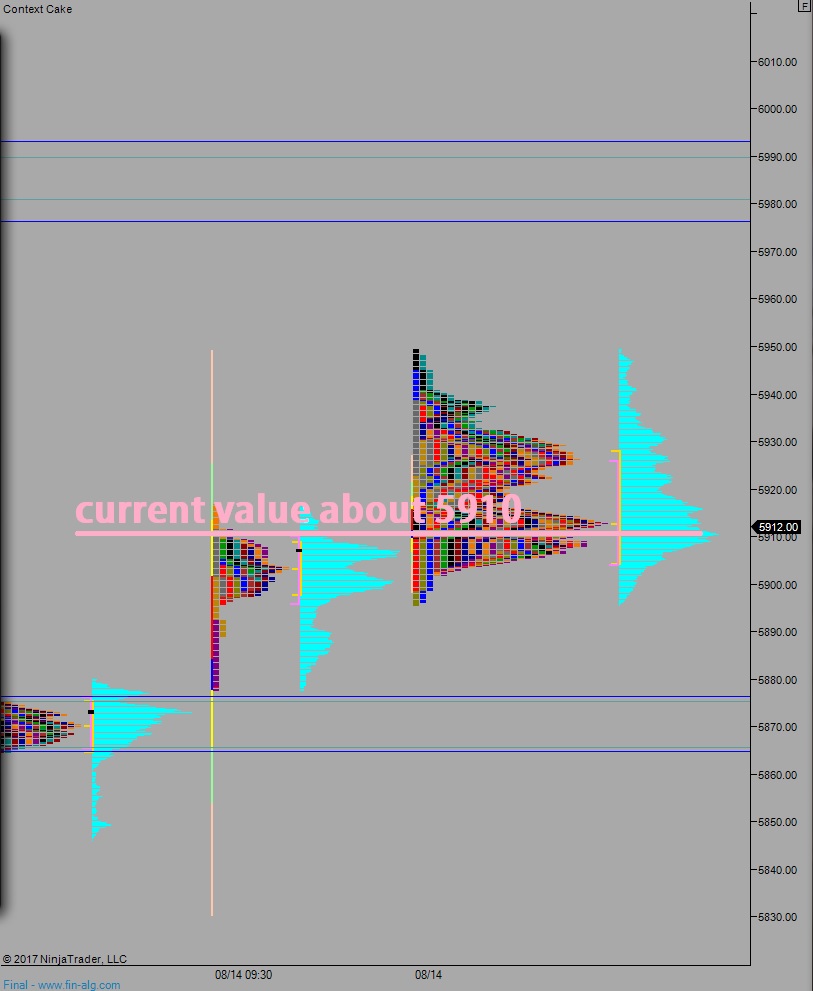

The day has gone neutral. That means we went range extension up, and now we are range extension down. The most likely outcome in a neutral scenario is a push back to value before we head anywhere else. The interesting thing is, where we are sitting now, at neutral extreme low, is right at value, look:

My primary expectation is that we trade lower into end of day. My conviction in afternoon trading is low, so I shall not partake. But if I were, I would continue working the sell side, looking to target a probe below Tuesday’s low 5895.50 before two way trade ensues.

Given the strength seen Monday, it is unlikely sellers will gain any major traction and begin initiating aggressive selling this week unless an unexpected news item hits the wires.

So while the Exodus Strategy Session expected the sellers to step in around 2pm Wednesday, AFTER A SHORT SQUEEZE, which they are, it seems unlikely we go back down to last week’s lows, given the progress made Monday. However, given the effectiveness of Sunday’s forecast, commentor Slippy is requested at this time to bend the knee and get to sucking on these plums:

#tradeaccordingly

If you enjoy the content at iBankCoin, please follow us on Twitter

One of those days. A nice 20 point day, and I still feel I traded like shit. Hate that.

EXODUS: def. a solemn procession, departure; death,” literally “a going out,”

lolol. how those plums taste

Haha Slippy. Haters gonna have a hard time against those who do their homework. Another great Strategy Session as usual.