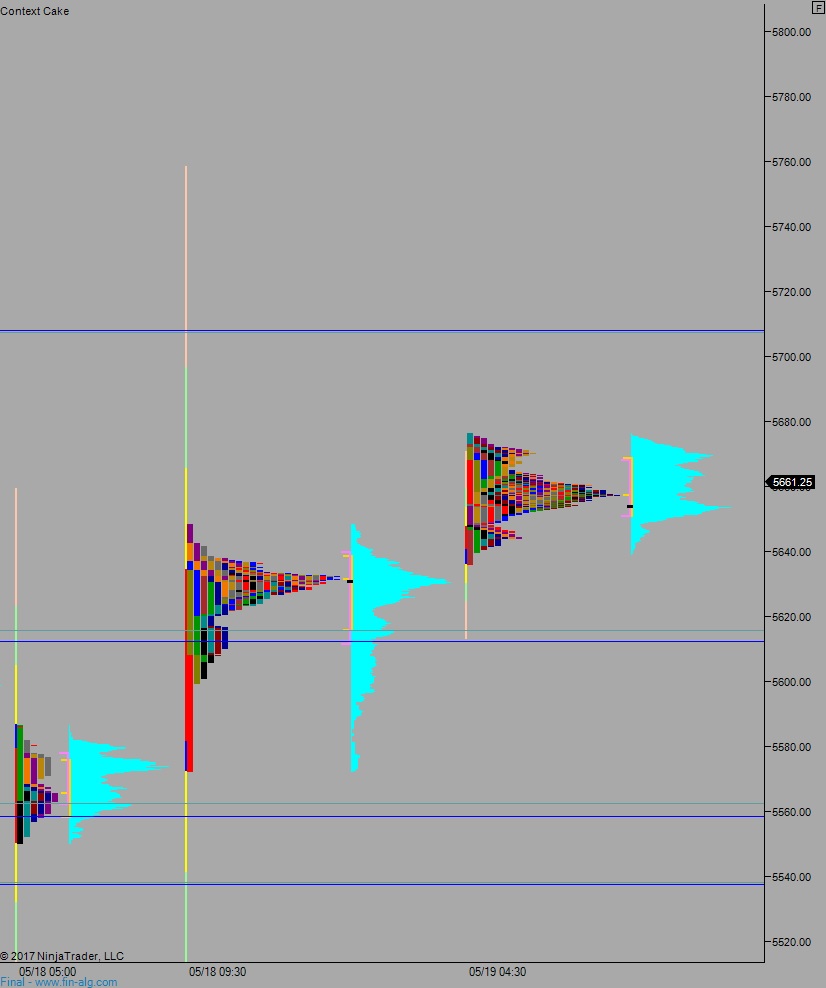

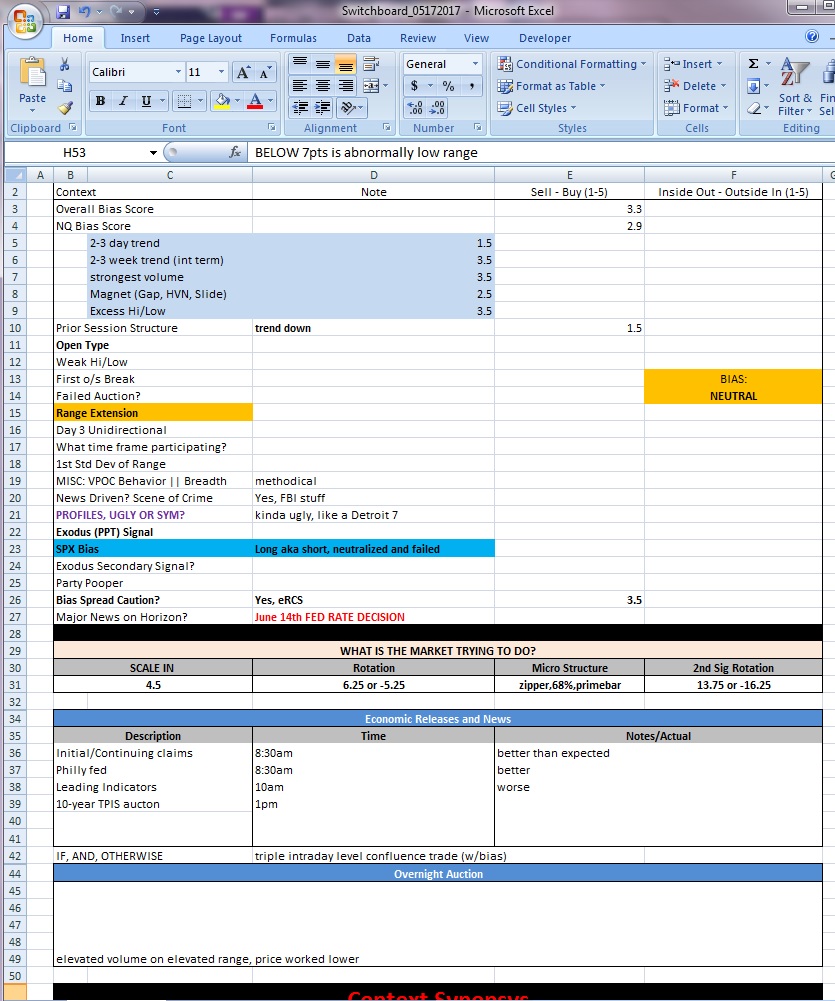

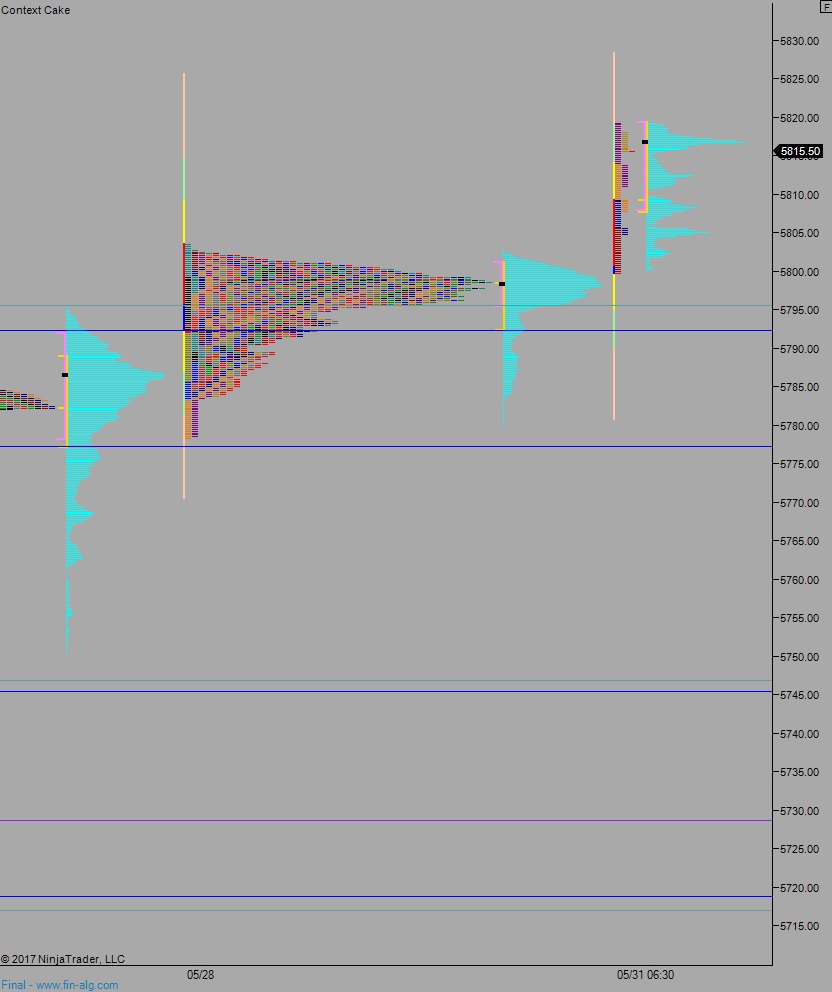

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, achieving new record gains and sustaining the advance as we approach cash open. At 7am MBA Mortgage Applications came out worse than last week.

Also on the economic calendar today we have Chicago Purchasing Manager at 9:45am, Pending Home Sales at 10am, and the Fed’s Beige Book at 2pm.

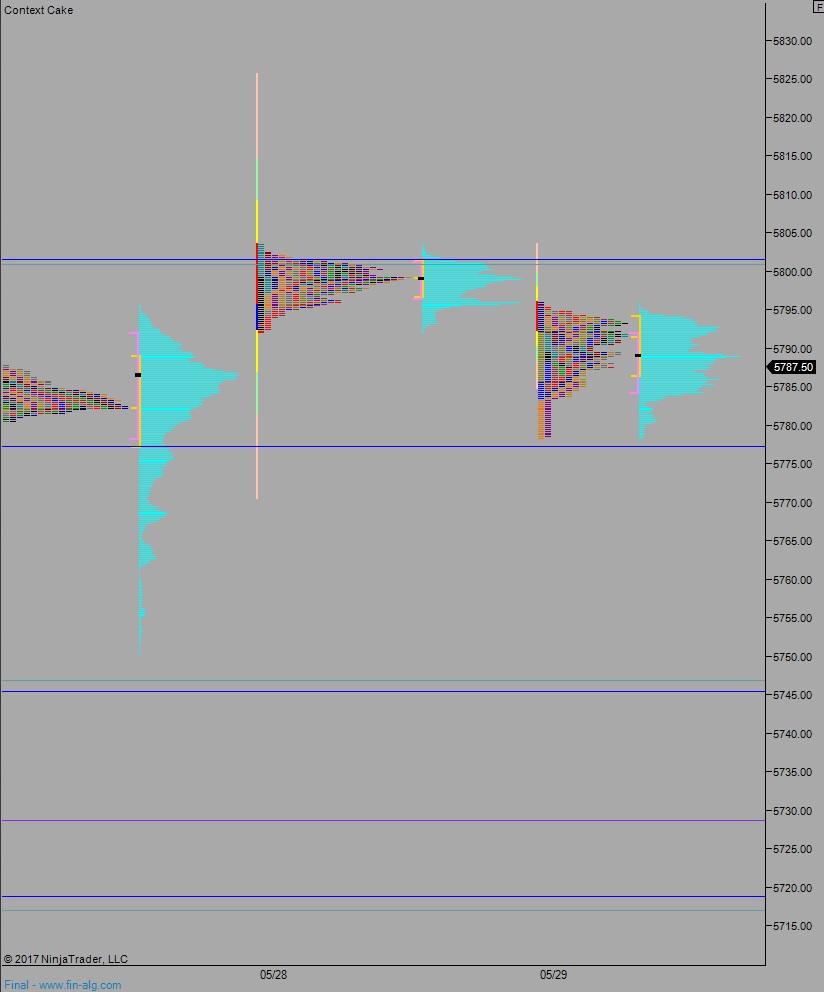

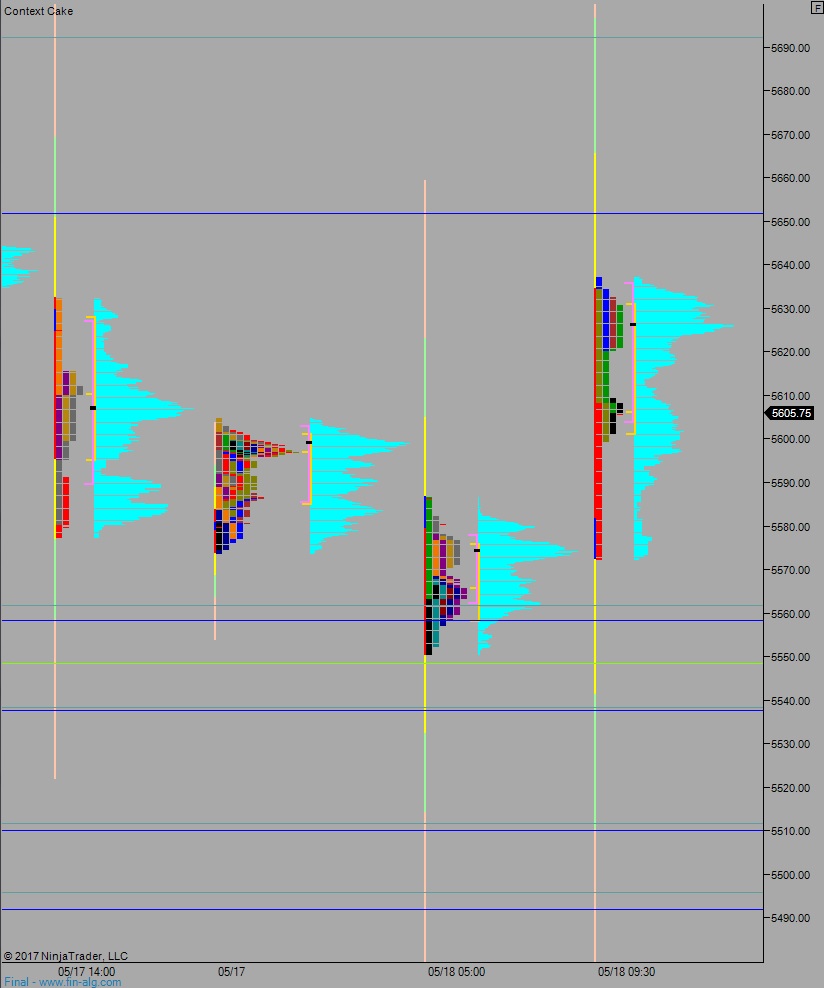

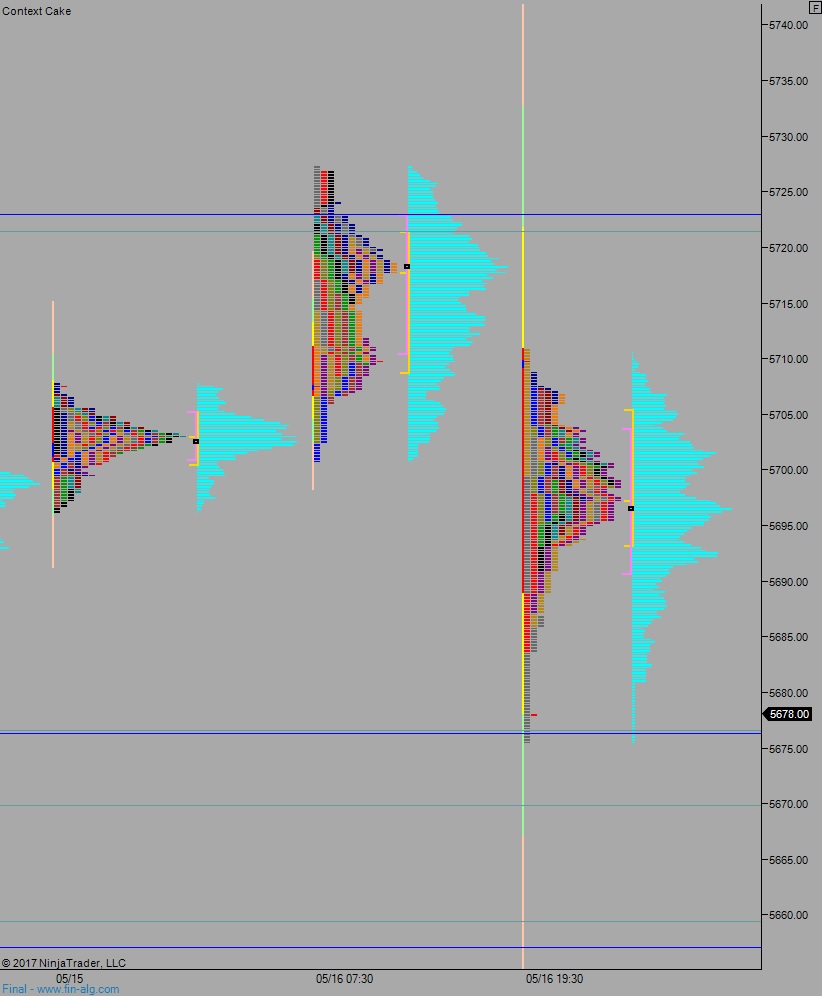

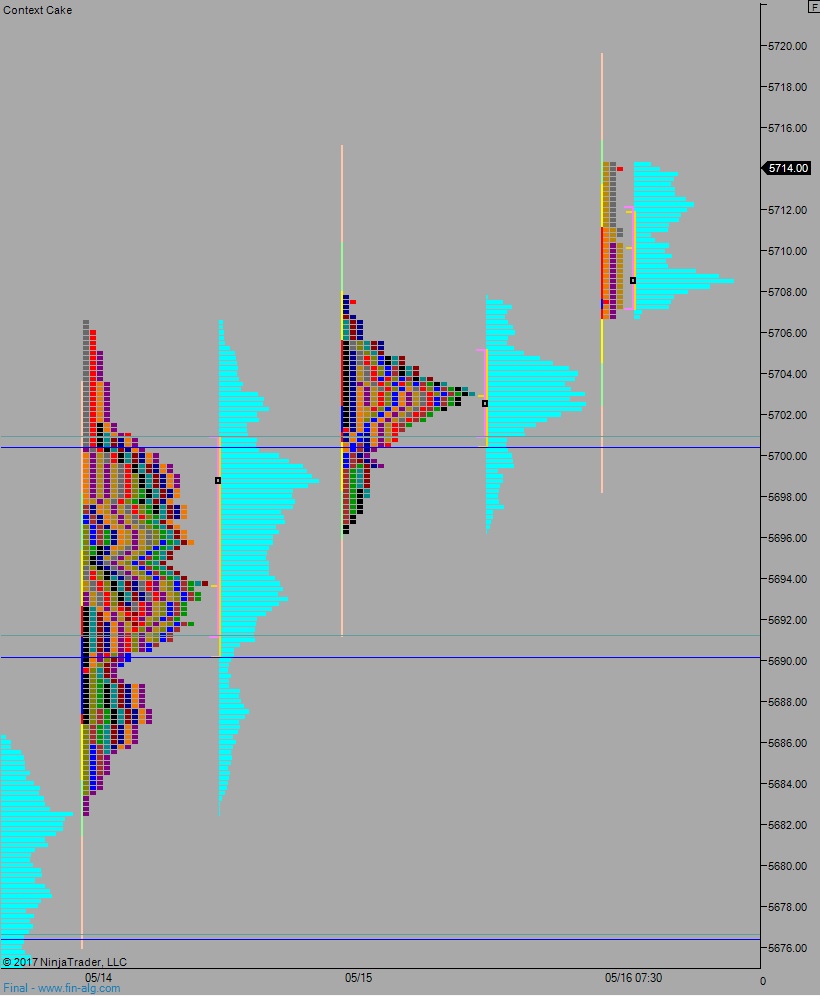

Yesterday we printed a normal variation up. After beginning the holiday shortened week gap down buyers aggressively stepped in at the open and drove price higher. A bit later in the day buyers managed to push price range extension up, by two ticks, before settling into two-way trade.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5792 before two way trade ensues.

Hypo 2 buyers gap-and-go, trading up to 5837.25 before two way trade ensues.

Hypo 3 strong sellers press down through overnight low 5791.25 and trade down to 5777 before two way trade ensues.

Levels:

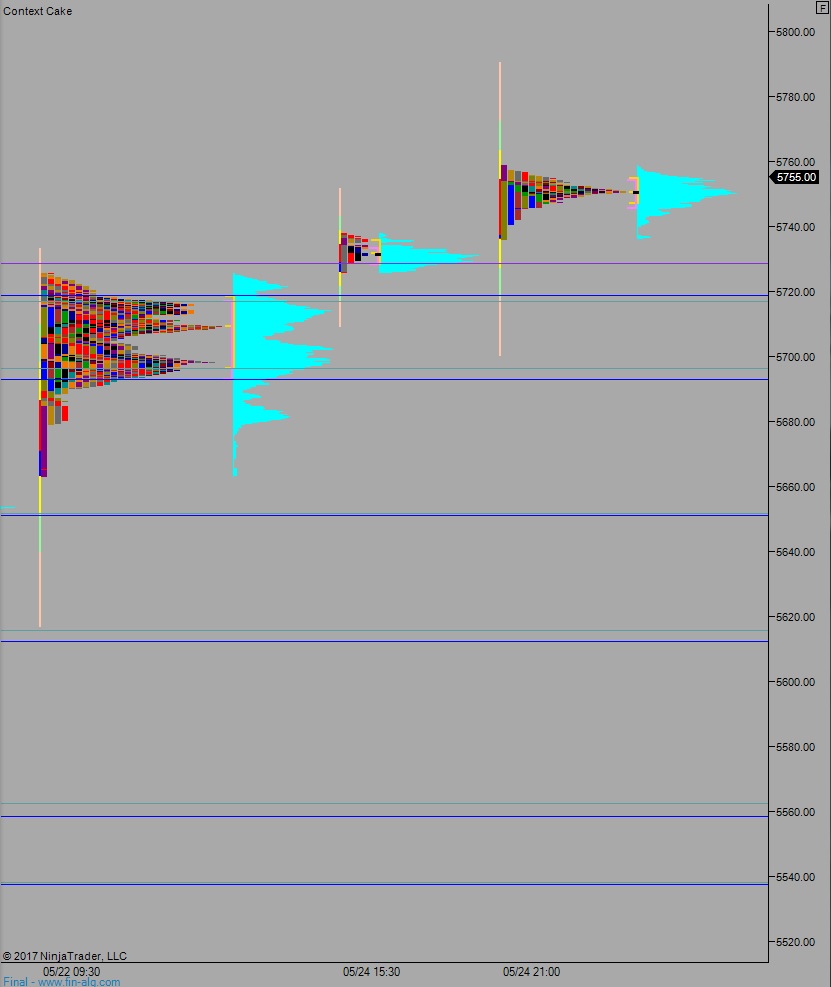

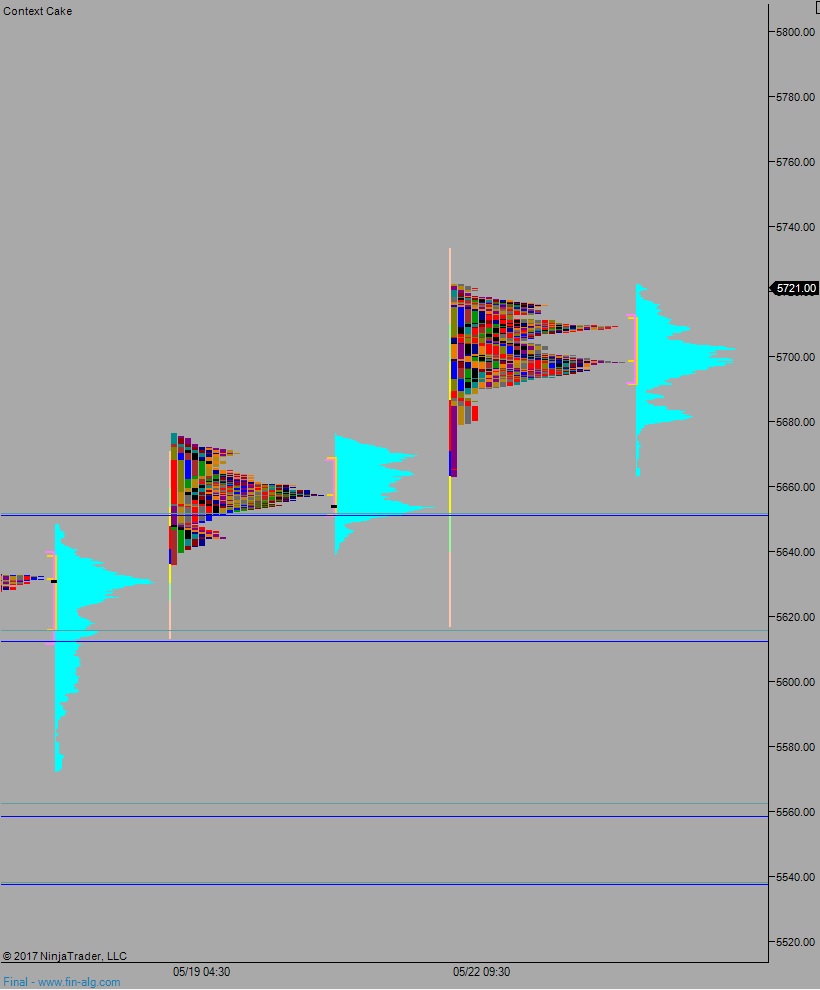

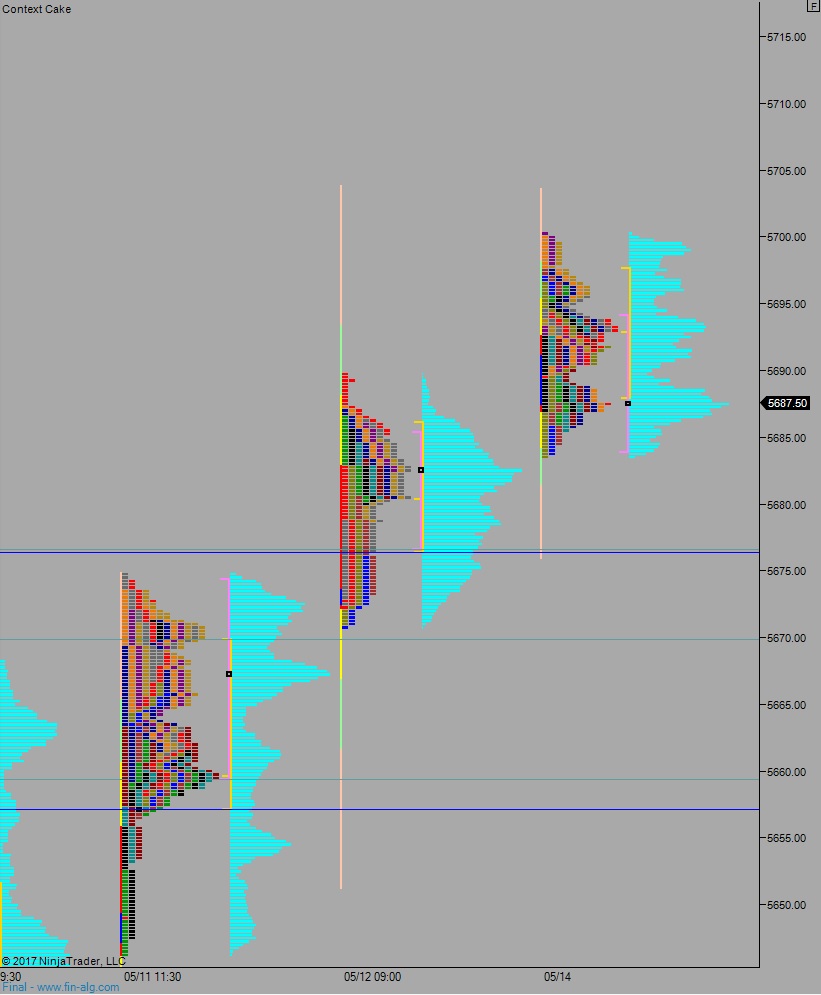

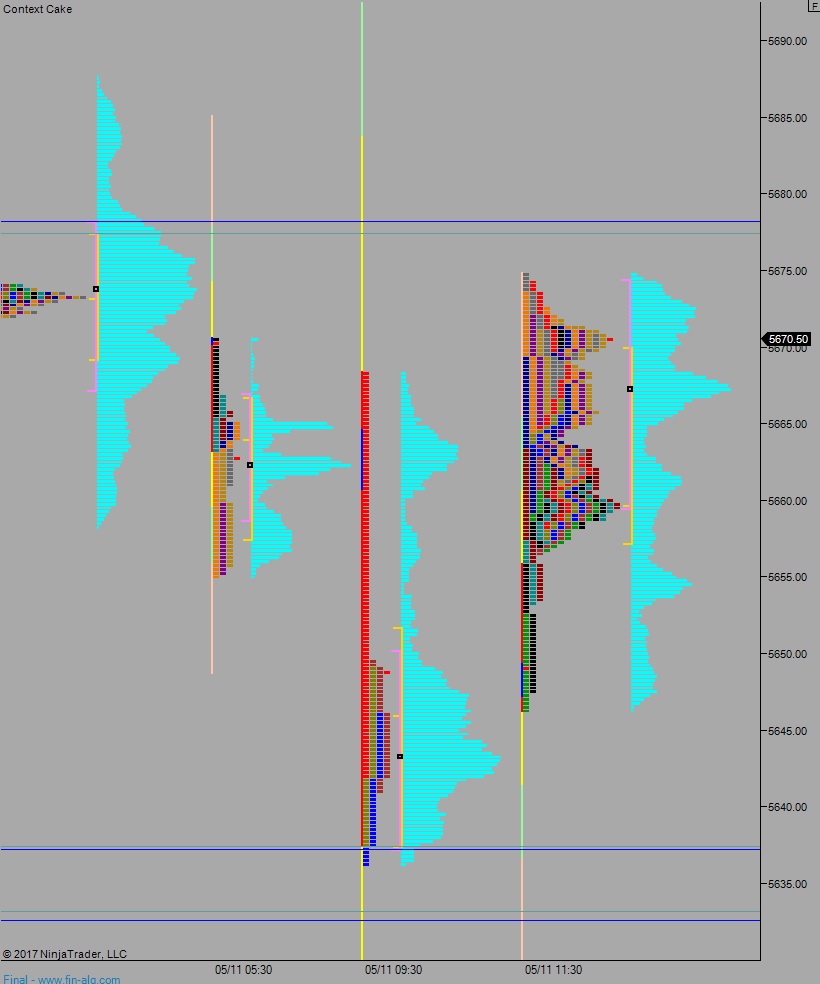

Volume profiles, gaps, and measured moves: