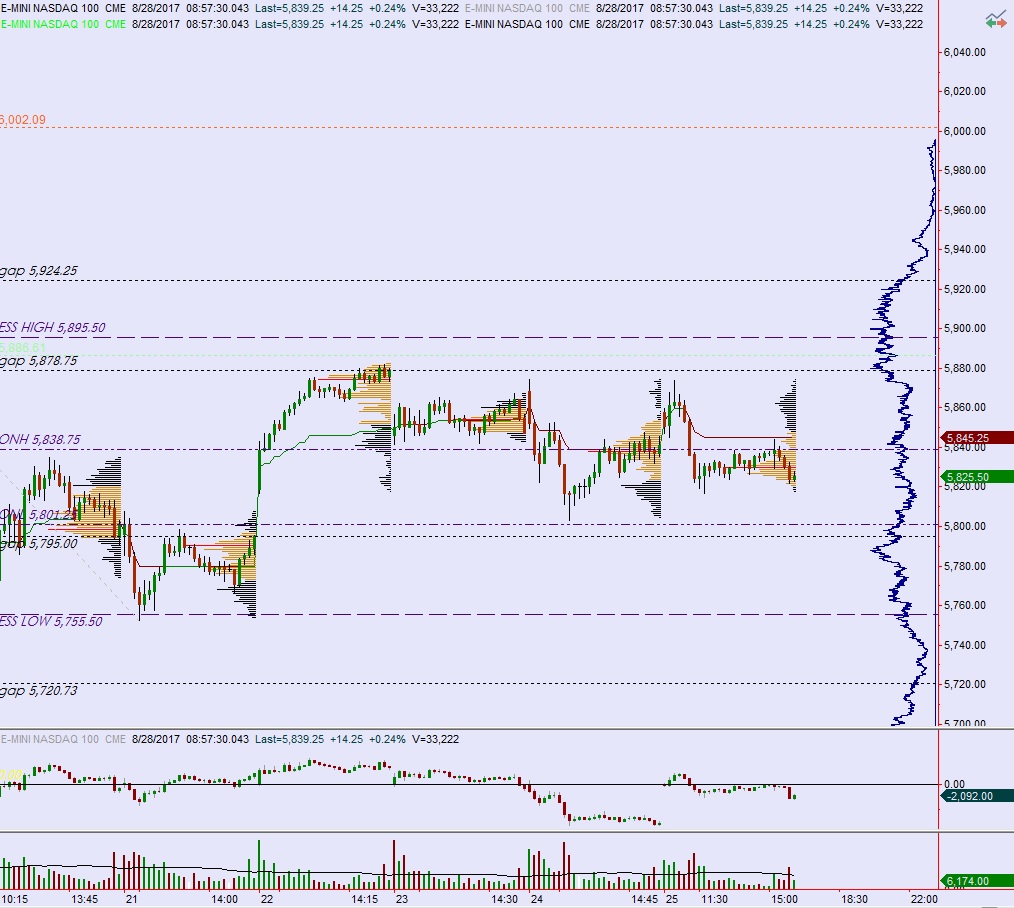

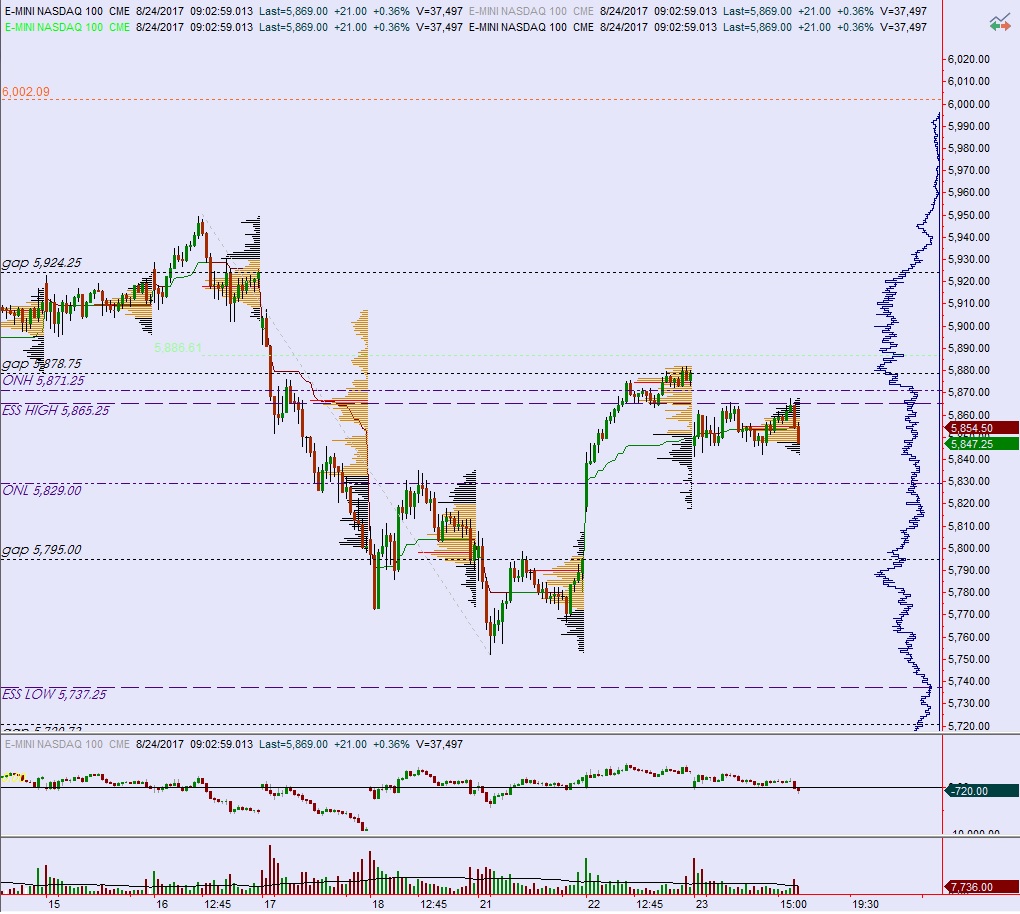

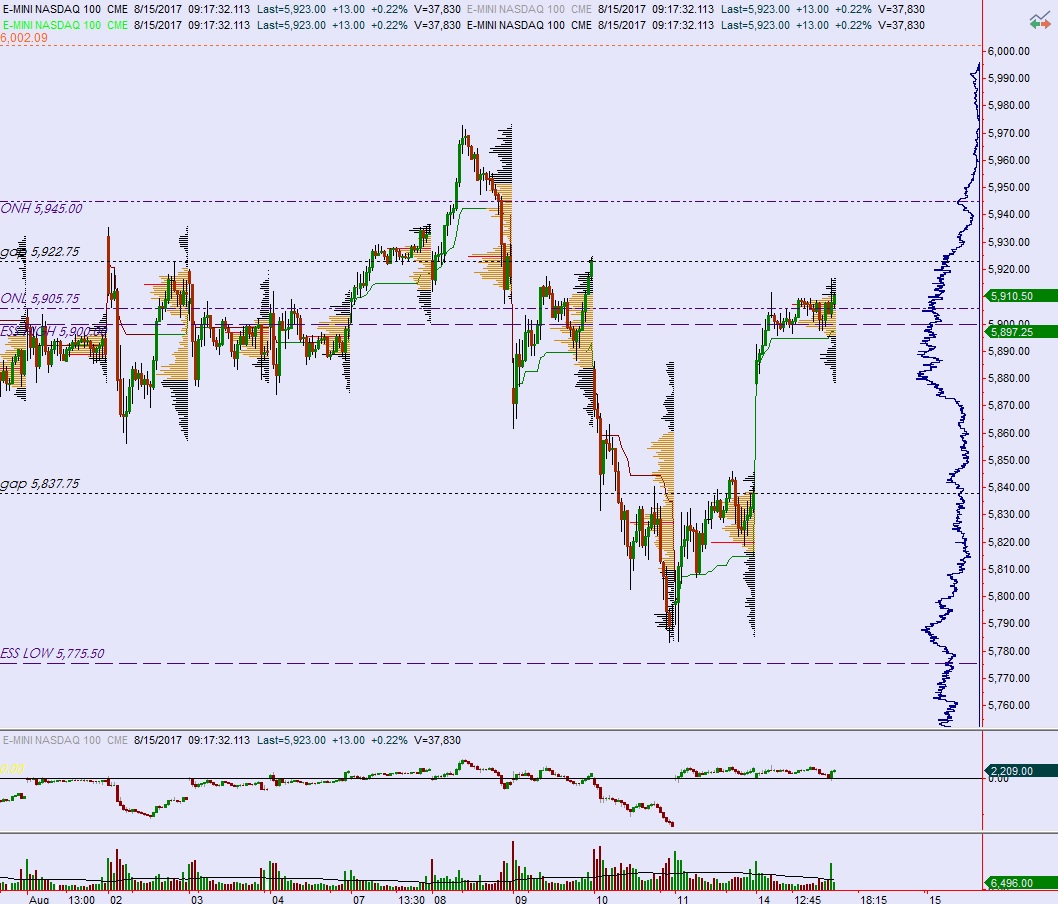

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked lower quickly, then slowly at times, and for the most part in an orderly manner.

There are some economic events to be aware of. Case-shiller house price index at 9am, Consumer Confidence at 10am, 4-week T-bill auction at 11:30am, and a 7-year note auction at 1pm.

Also, the overnight move was news driven, an impulse reaction to reports of North Korea firing an intercontinental ballistic missile over Japan. Our expectation with any news driven market reaction is a return to ‘the scene of the crime’ at some point.

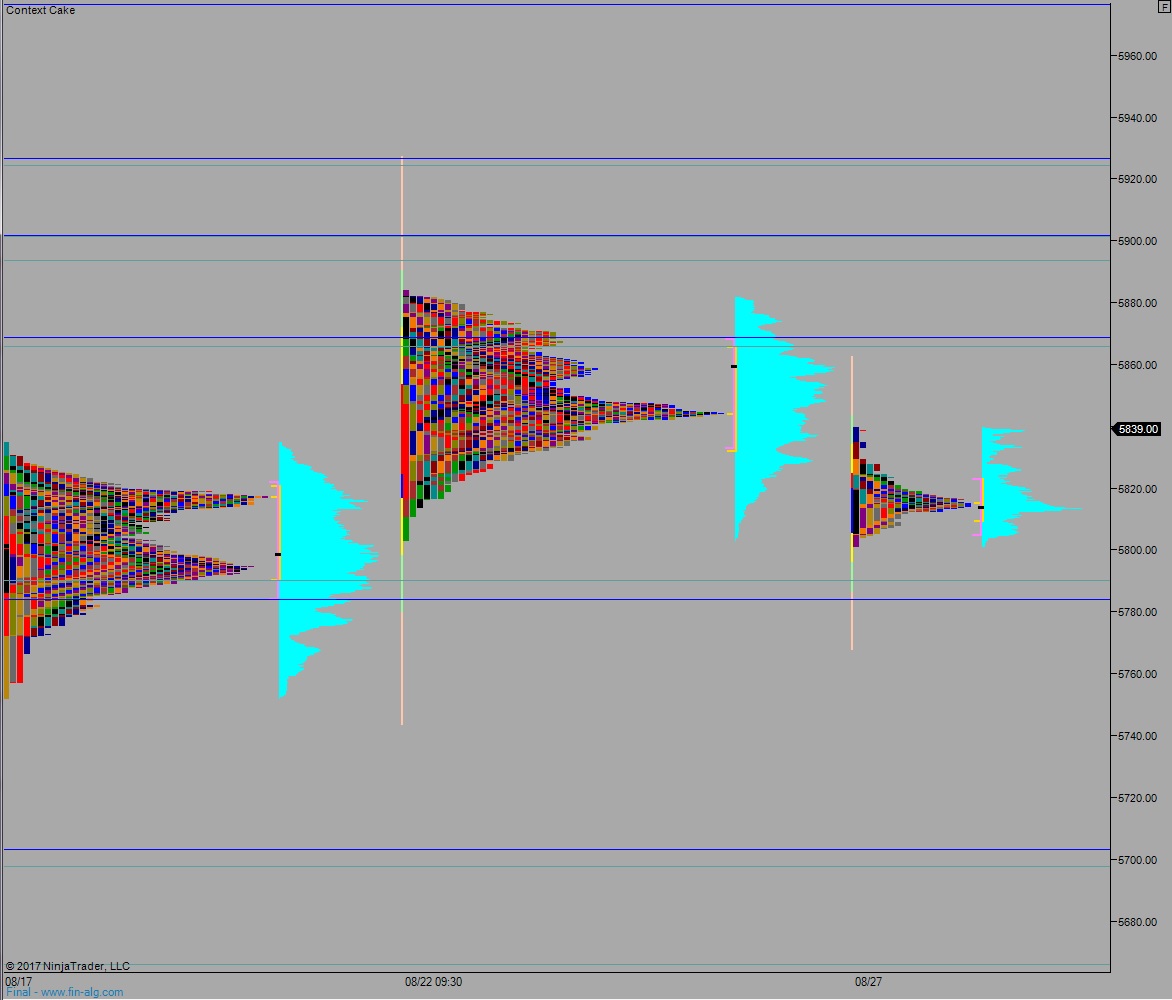

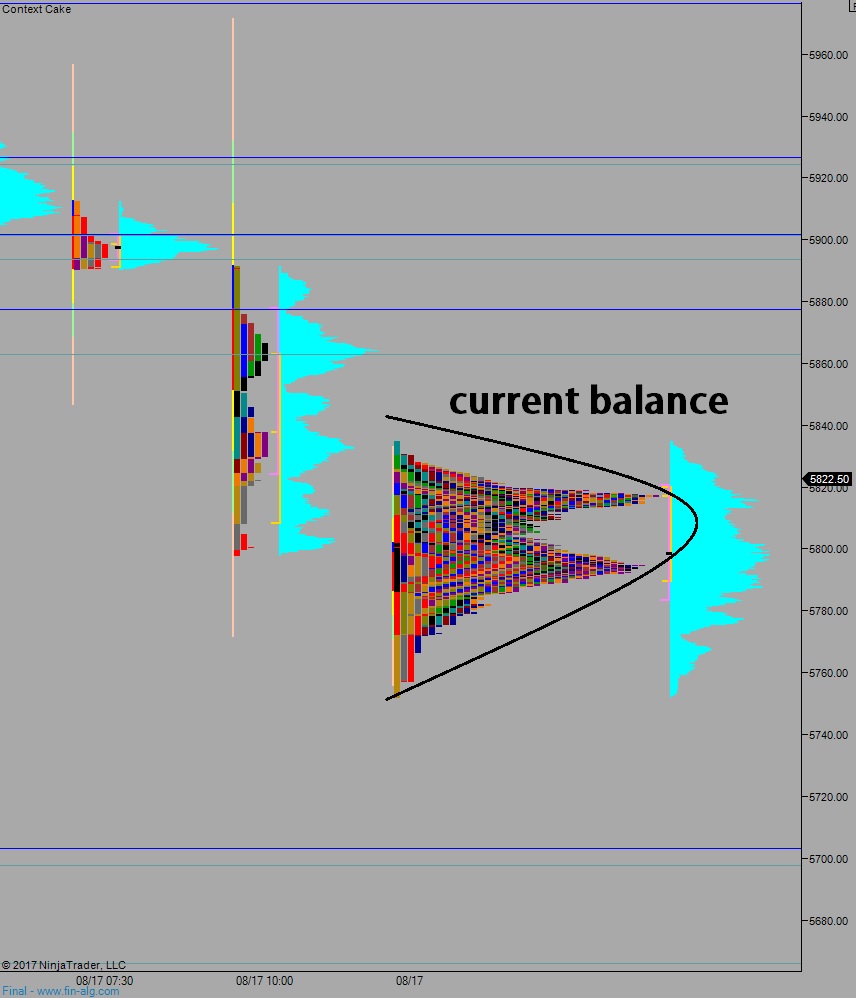

Yesterday we printed a normal variation up. The day began with a big gap up and sellers quickly worked it closed. Then, after closing the gaps a responsive bid stepped in and we rallied a bit, keeping the action inside of Friday’s range before the ensuing two-way trade.

Heading into today my primary expectation is for a gap-and-go liquidation. Look for a move down to 5755.50 before two way trade ensues.

Hypo 2 stronger sellers work down to the open gap at 5720.75 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 5845 before two way trade ensues.

Levels:

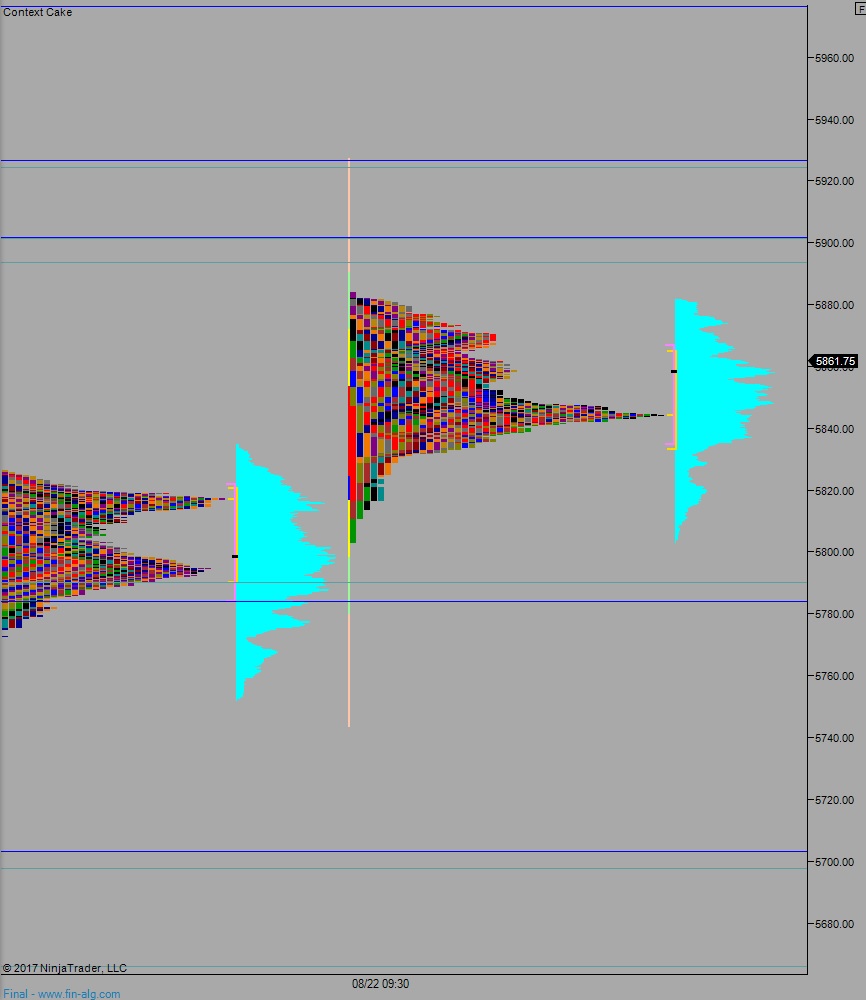

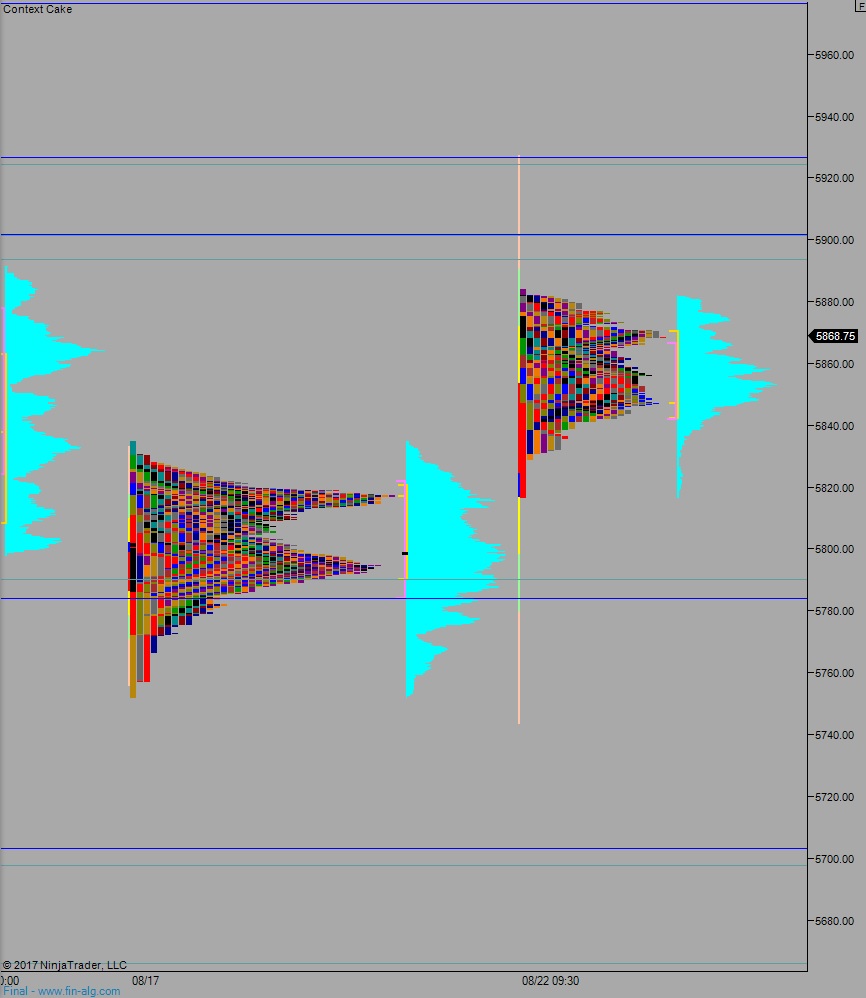

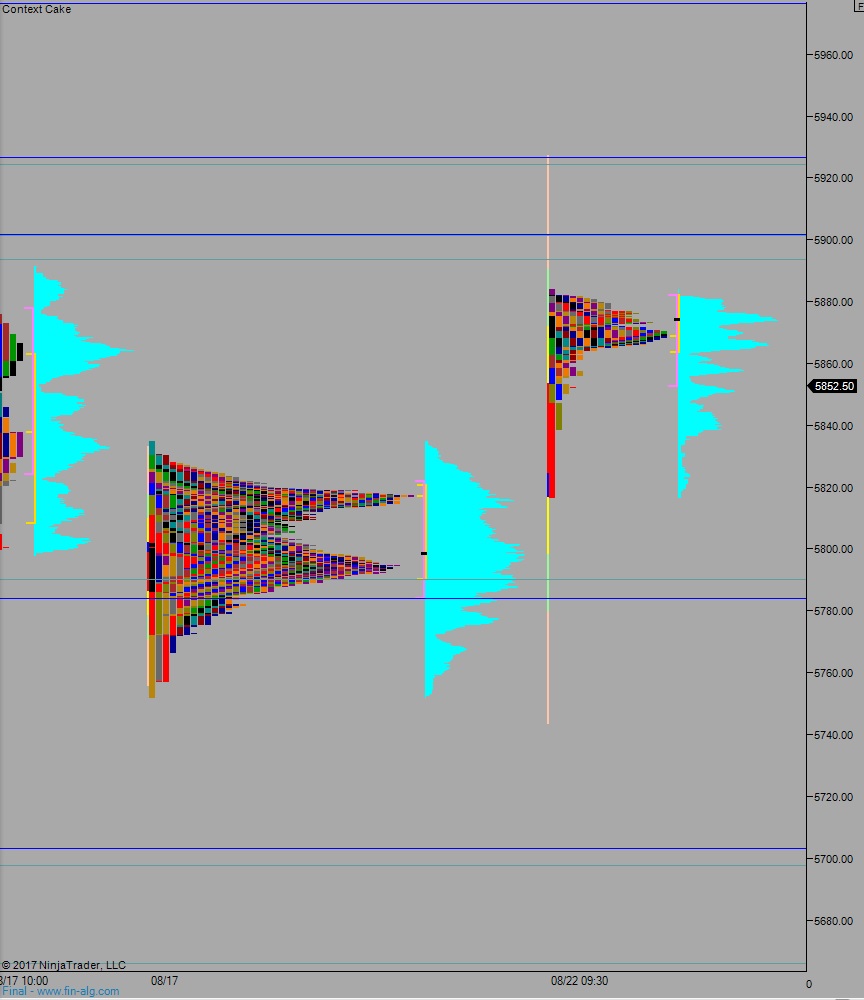

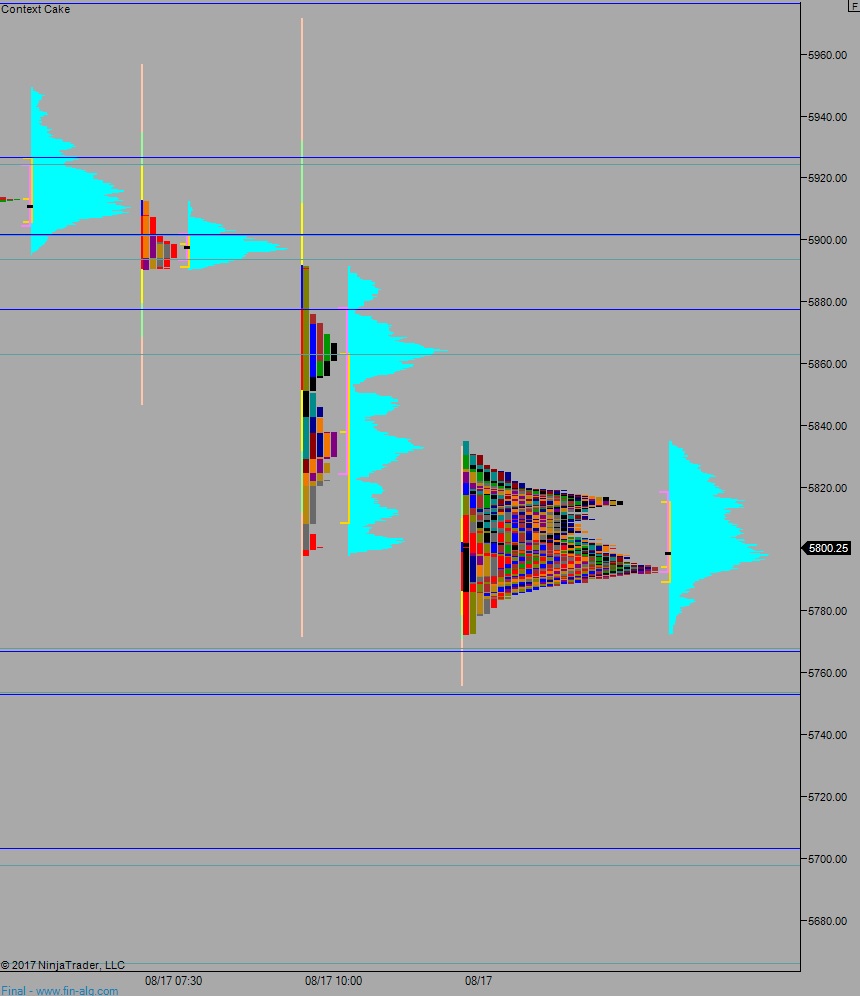

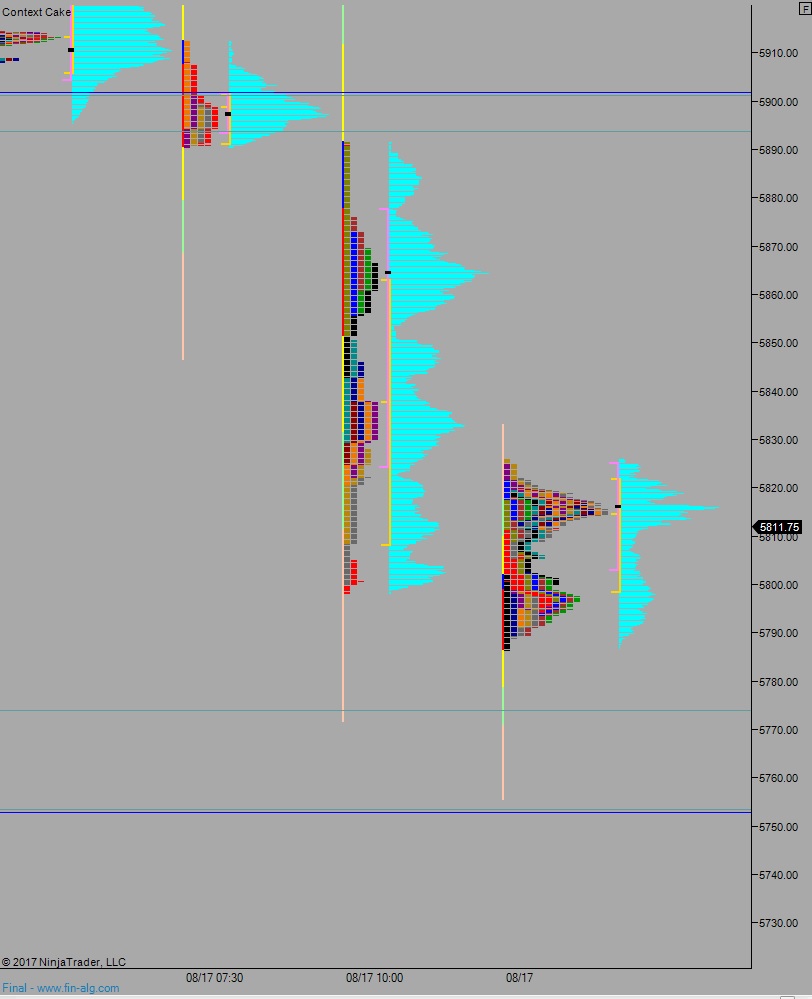

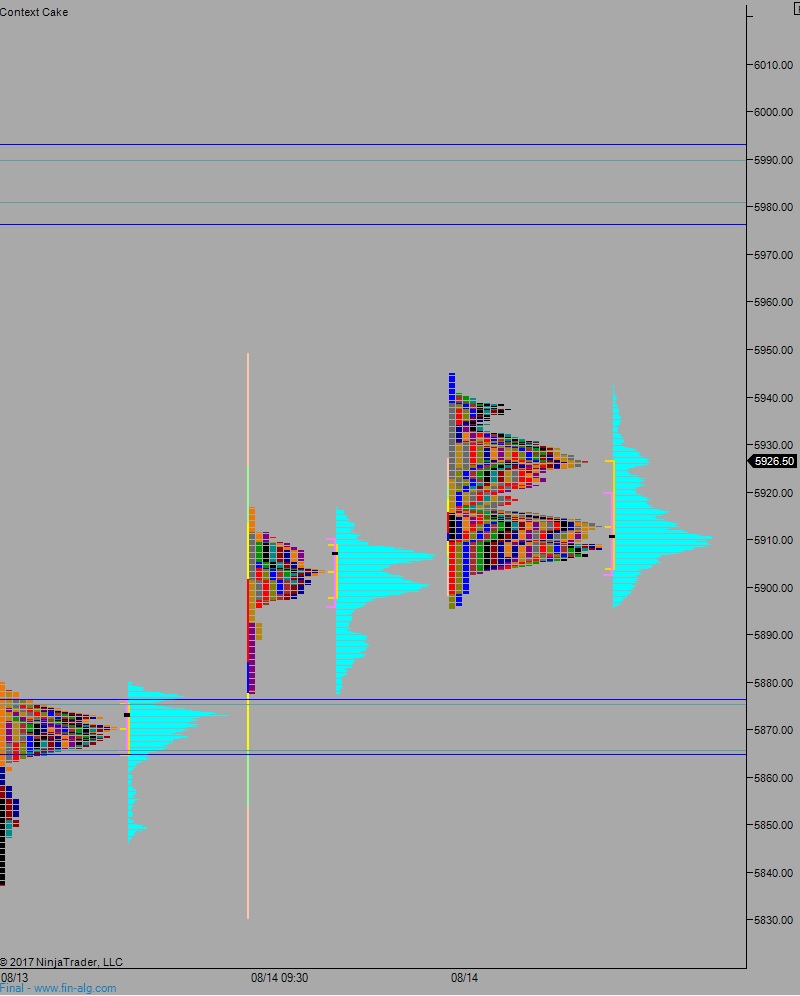

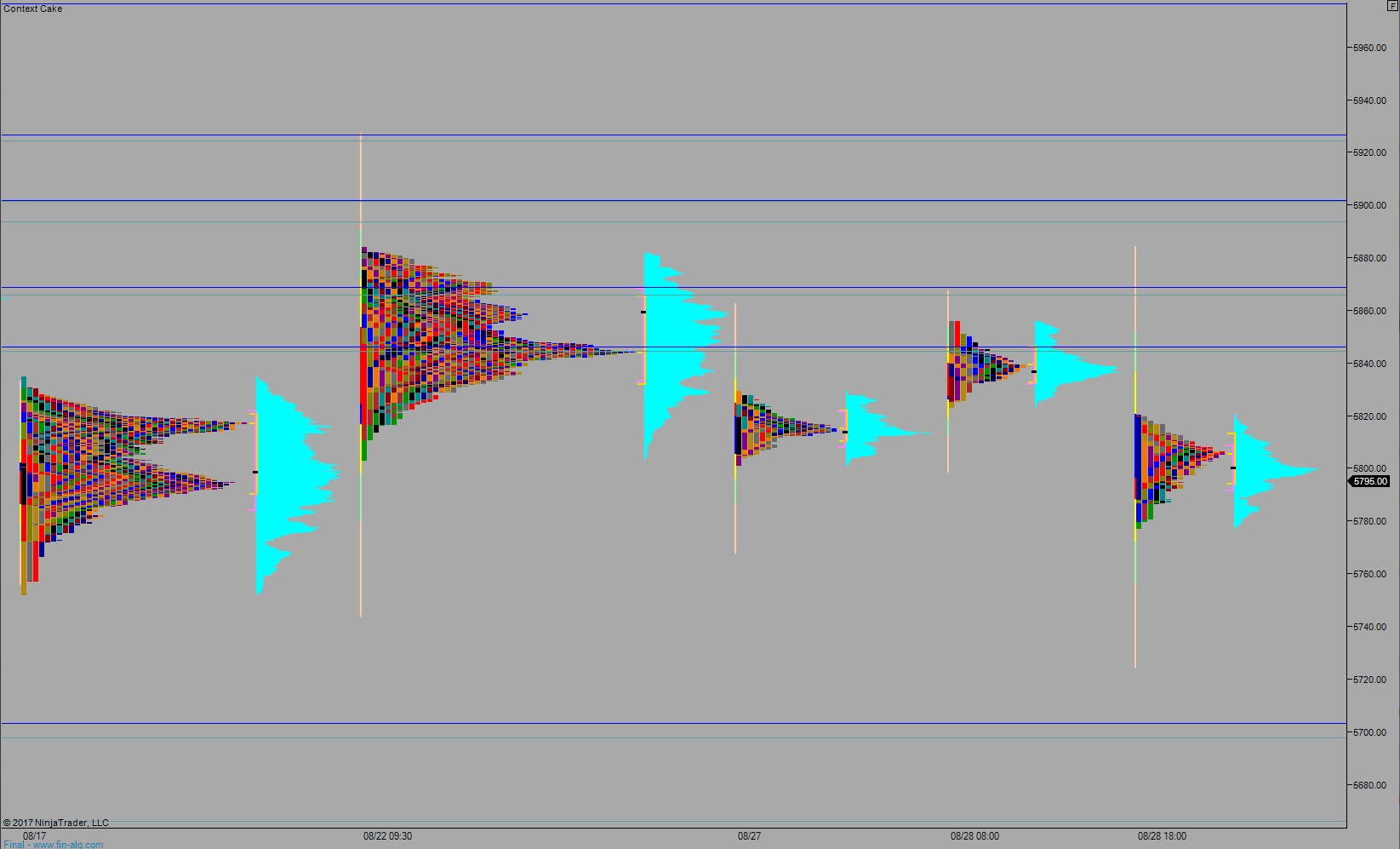

Volume profiles, gaps, and measured moves: