NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher in an unobstructed, linear manner overnight while our President continued his international tour of holy lands. At 7am MBA Mortgage applications came out better than last week.

We have a busy economic calendar for Wednesday. Existing Home Sales at 10am, crude oil inventories at 10:30am, 2-year Note auction at 11:30am, a 5-year Note auction at 1pm. Most importantly, we have FOMC Minutes from the May 3rd meeting at 2pm.

And while it’s likely to be ignored by investors, The Fed’s ‘crazy-eyed’ Kashkari is speaking in Wisconsin at 6:30pm.

Yesterday we printed a normal variation down. Price opened gap up and quickly drove lower, closing the gap. Sellers then backed off, and two way trade ensued along the top-side of Monday’s range.

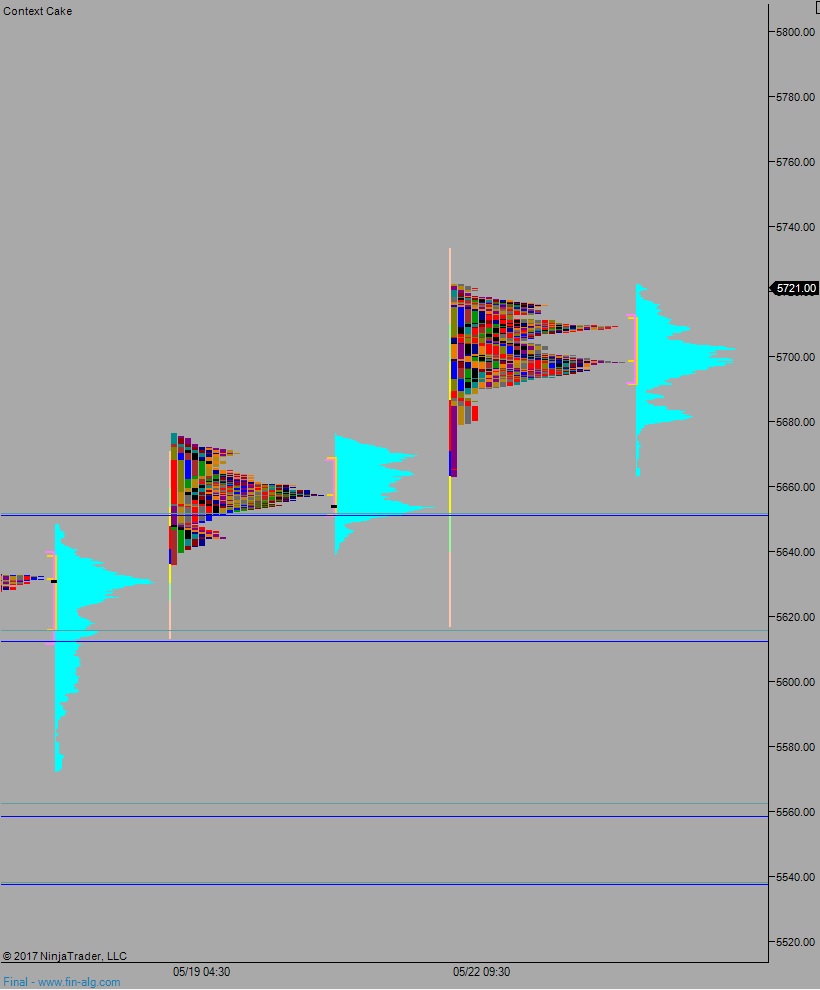

Heading into today my primary expectation is for an early push higher. There’s an open gap at 5724.75 that was left behind last Wednesday when the democrats thought they had some real obstruction of justice dirt on our wall-loving President. We have returned to the ‘scene of the crime’. Look for price to continue higher, up to 5754 before two way trade ensues.

Hypo 2 sellers press into the overnight inventory and close the gap down to 5712 then continue lower, down through overnight low 5705.25. Look for buyers down at 5700 and two way trade to ensue ahead of FOMC minuets.

Hypo 3 a probe above all-time highs 5727.25 finds strong sellers and we are thrown into two-way trade ahead of FOMC minutes.

Levels:

Volume profiles, gaps, and measured moves: