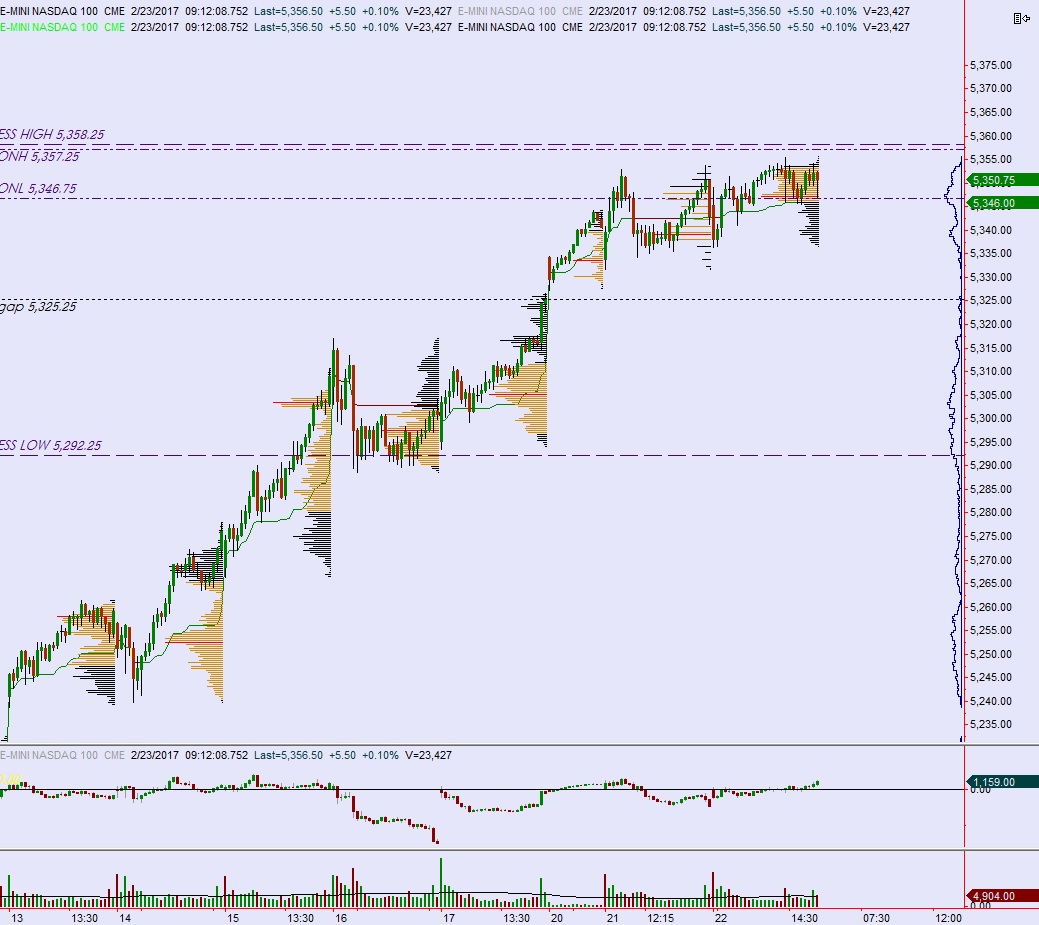

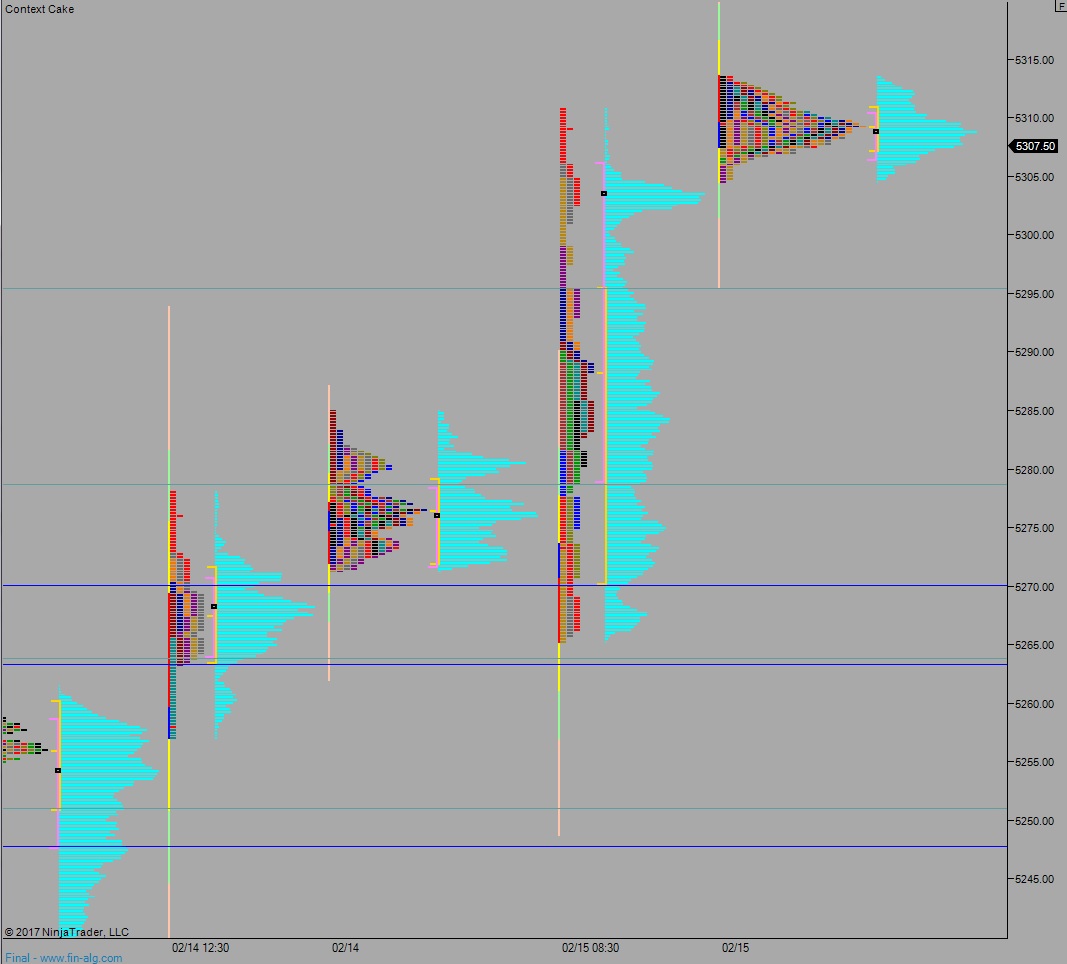

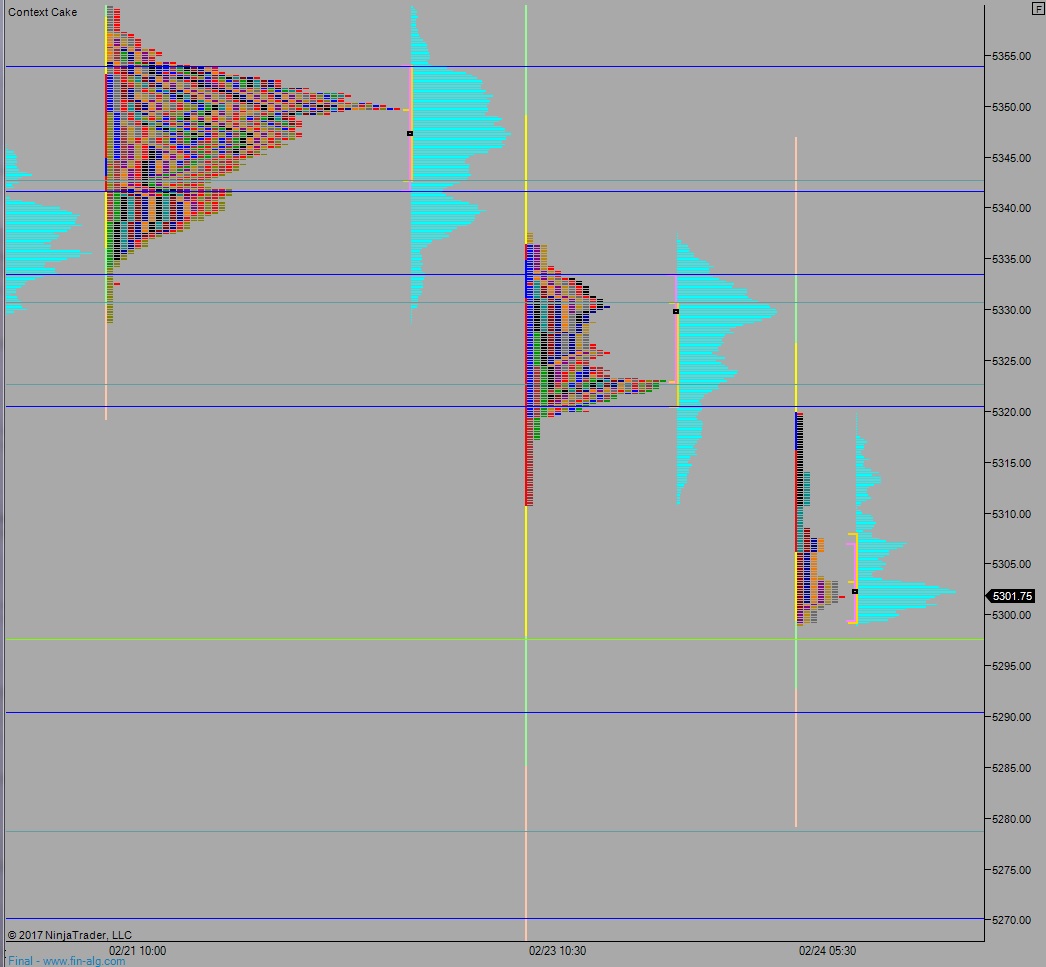

NASDAQ futures are coming into Friday gap down after an overnight session featuring normal range and volume. Price worked lower during the entire globex session, pressing to a new weekly low and deep into last Friday’s range.

On the economic calendar today we have New Home Sales and the final February reading of Confidence from the University of Michigan at 10am, then the Baker Hughes rig count at 1pm.

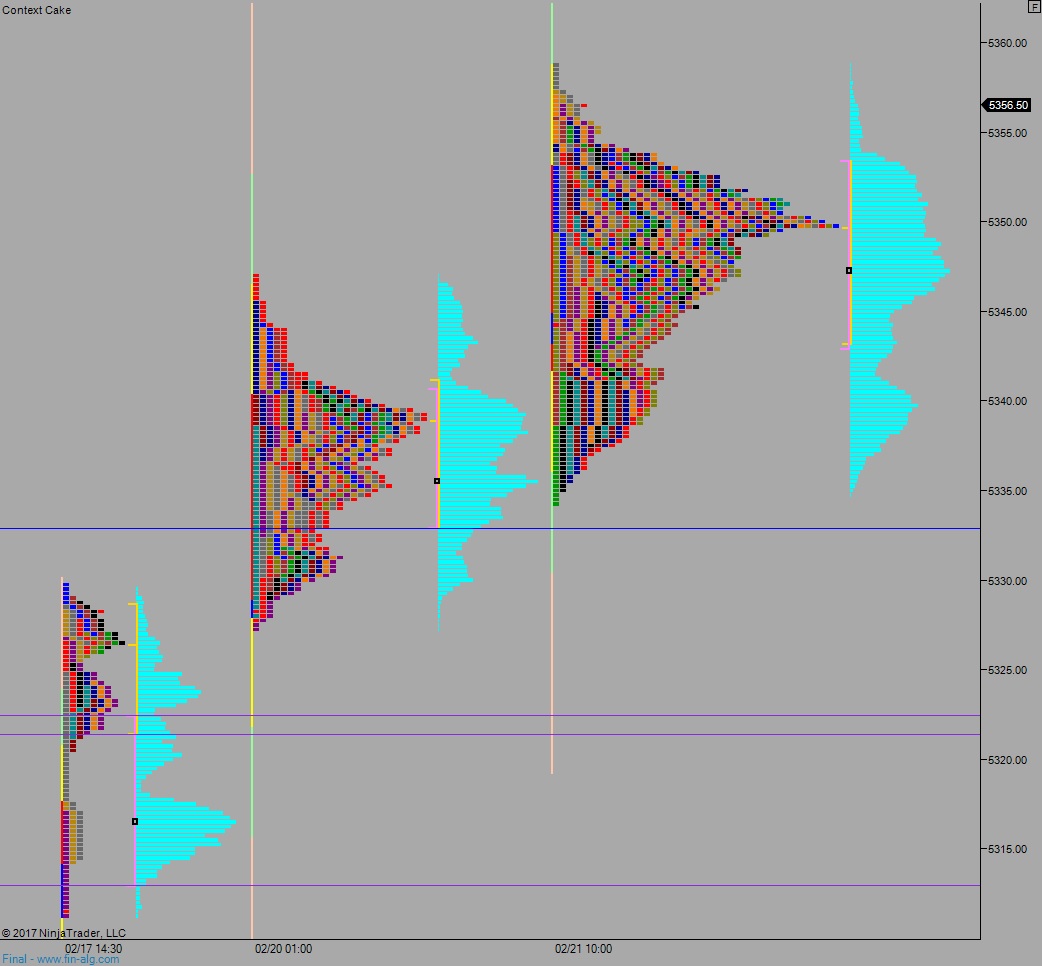

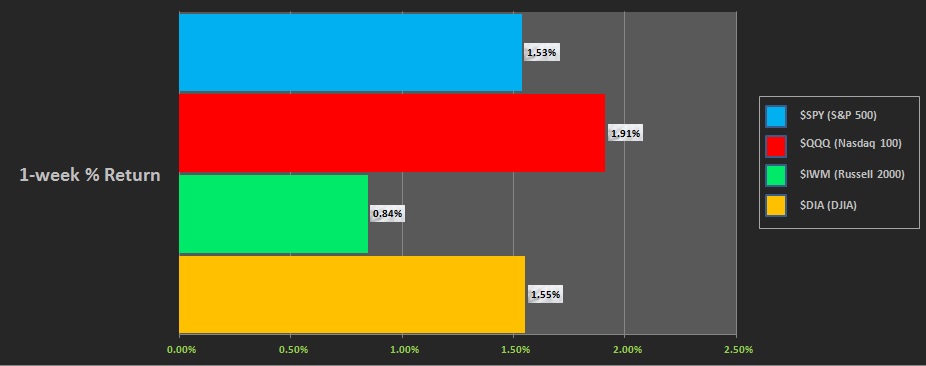

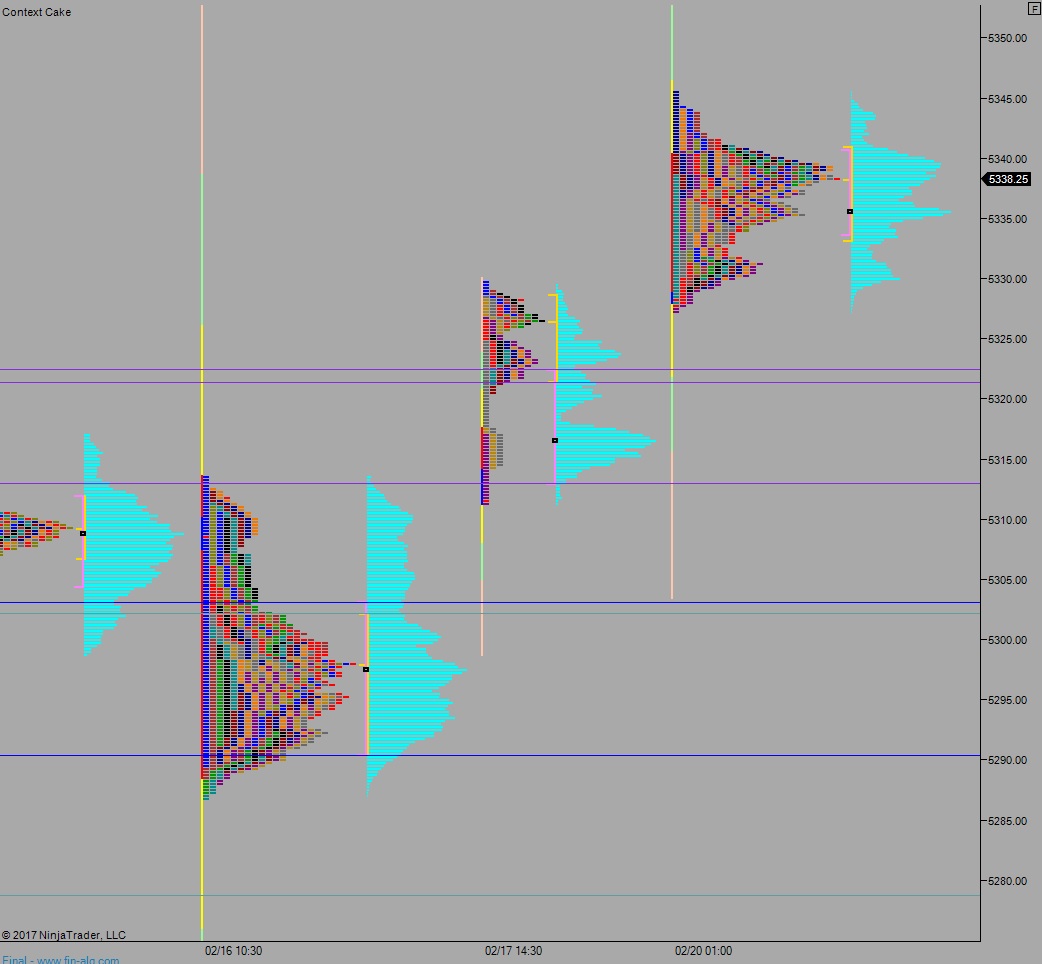

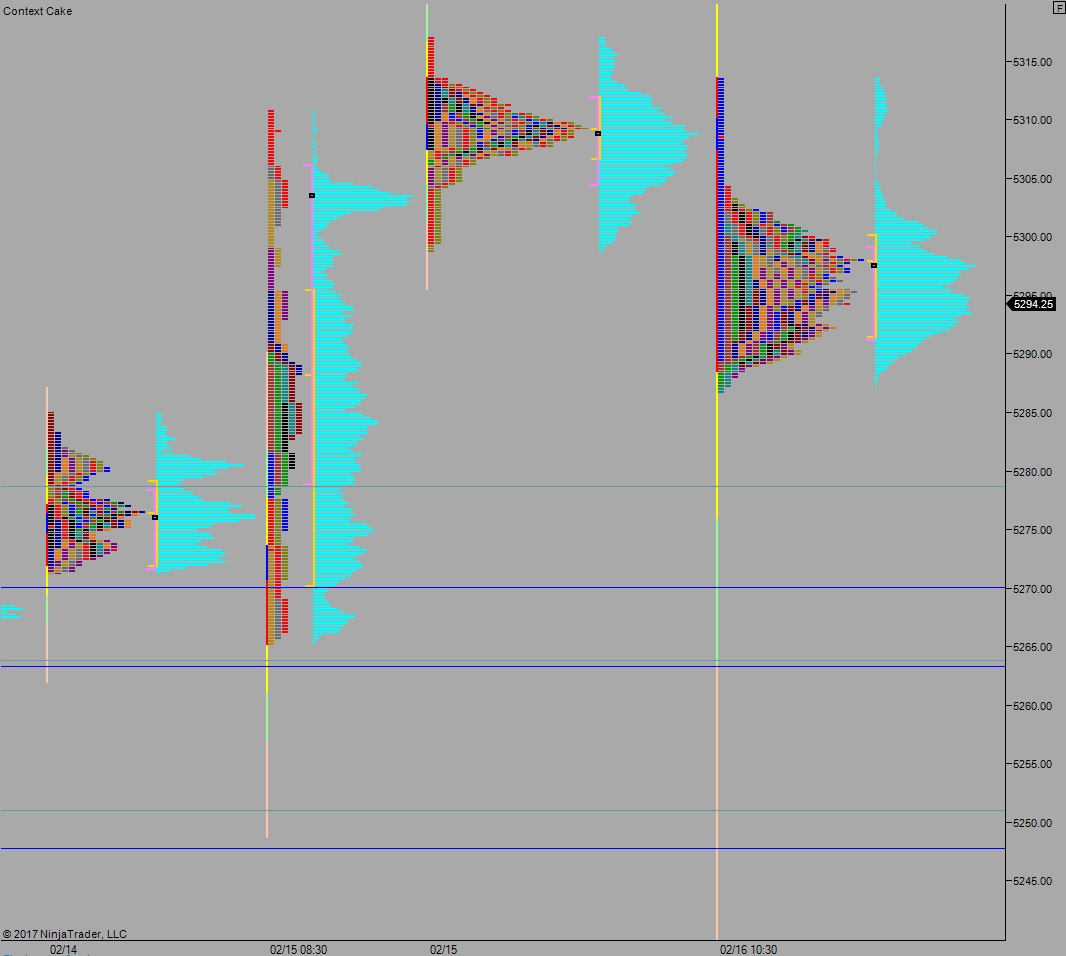

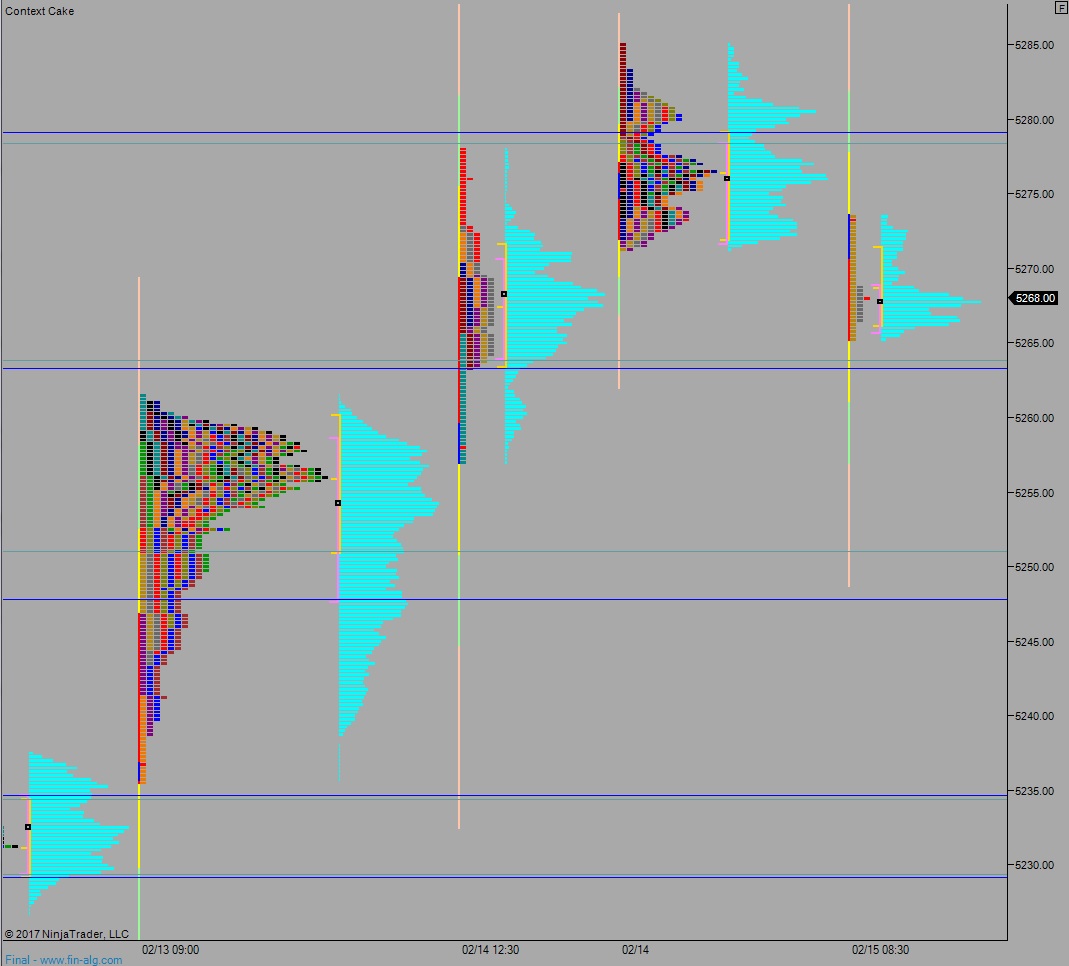

Yesterday we printed a double distribution trend down. After a morning spike to new all-time highs, sellers swiftly entered the market and reversed all of the week’s gains. The move was faded by responsive buyers who stepped in near the value high from last Friday.

Heading into today my primary expectation is for buyers to work into the overnight inventory and try to regain the Thursday range. Look for them to succeed at reclaiming 5310.75 setting up a move to target 5320.50 before two way trade ensues.

Hypo 2 sellers work lower, down to 5290.50 before two way trade ensues.

Hypo 3 strong buyers work a gap fill up to 5333 then take out overnight high 5334.25 before two way trade ensues.

Hypo 4 liquidation. Sellers sustain trade below 5290 setting up a move to target 5278.50 then 5270.25.

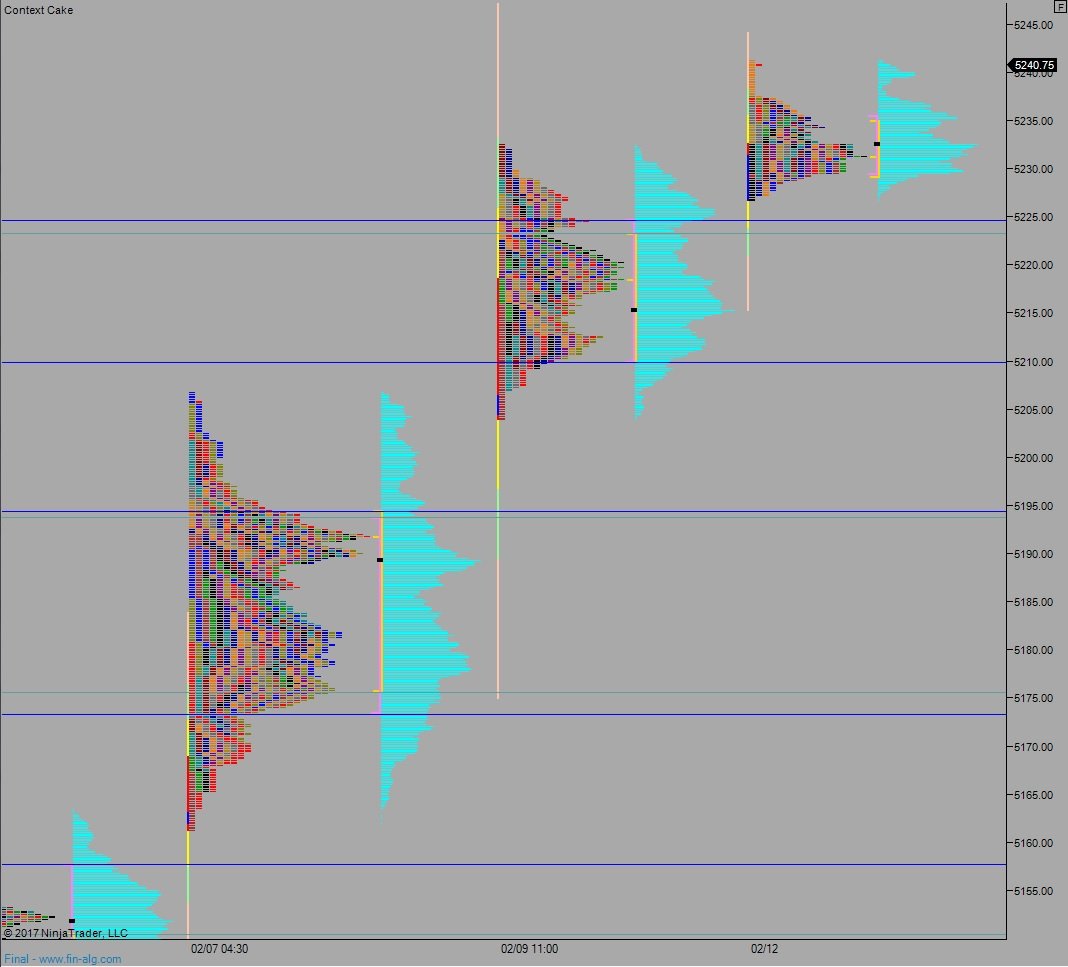

Levels:

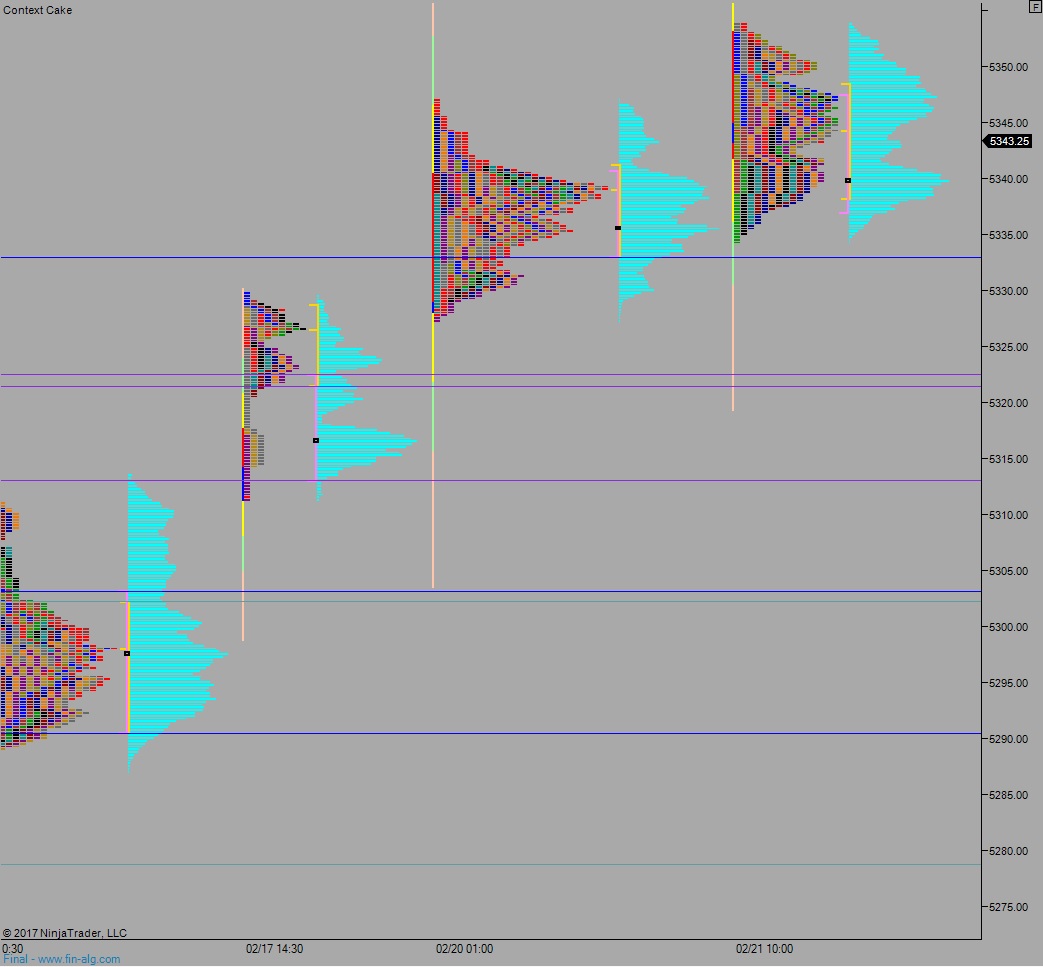

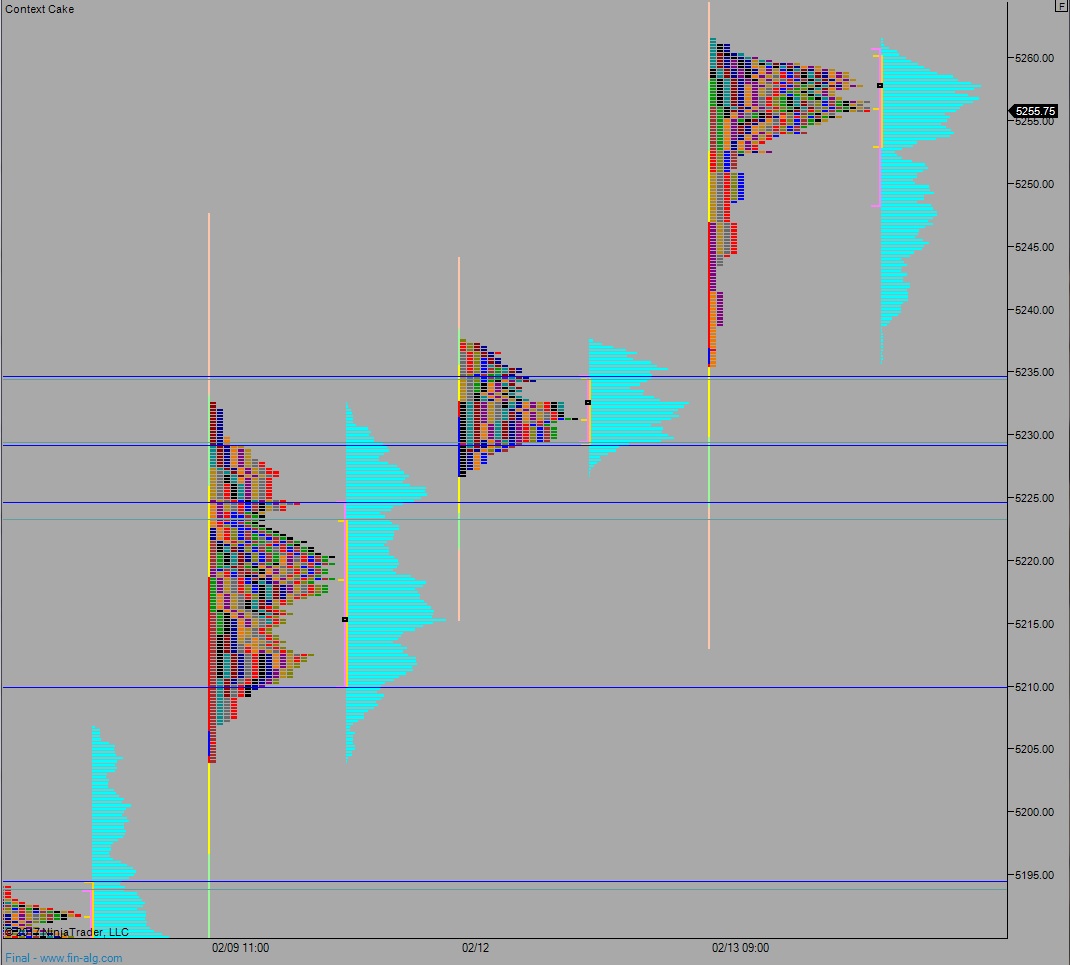

Volume profiles, gaps, and measured moves: