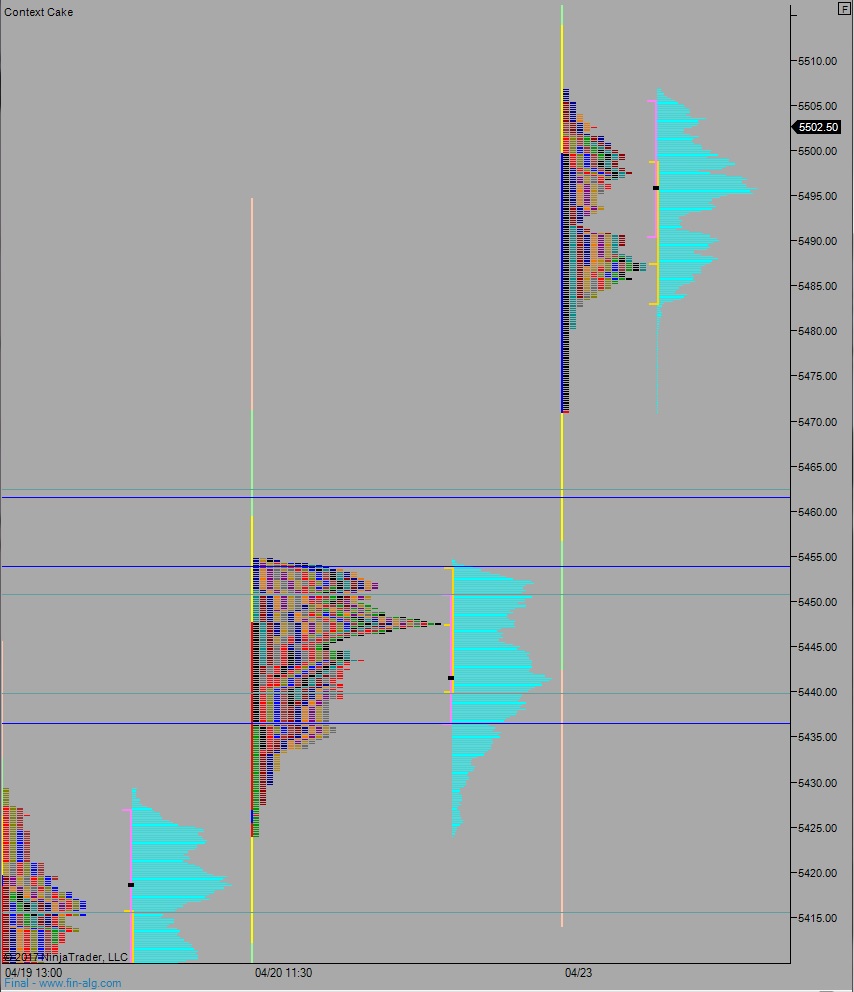

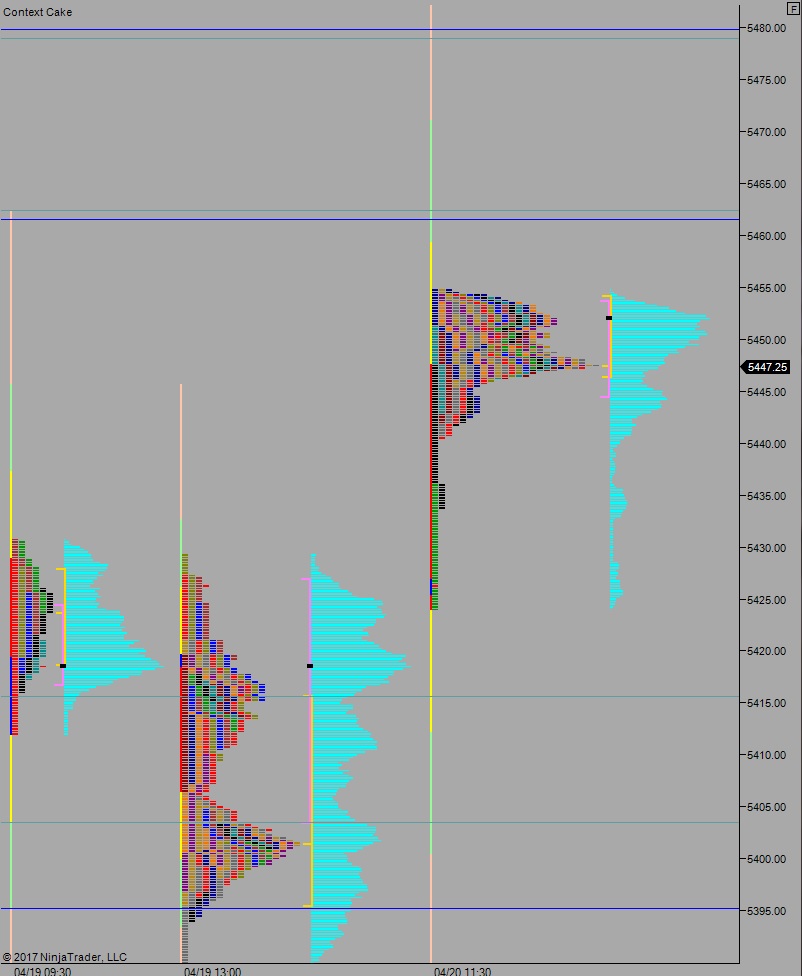

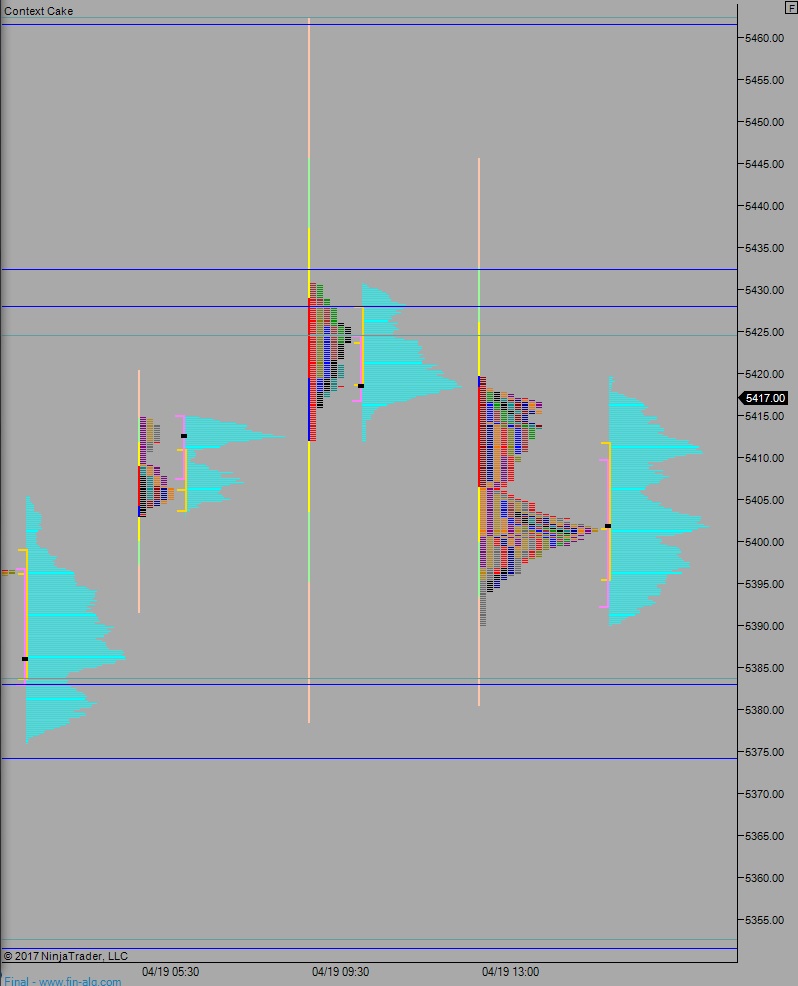

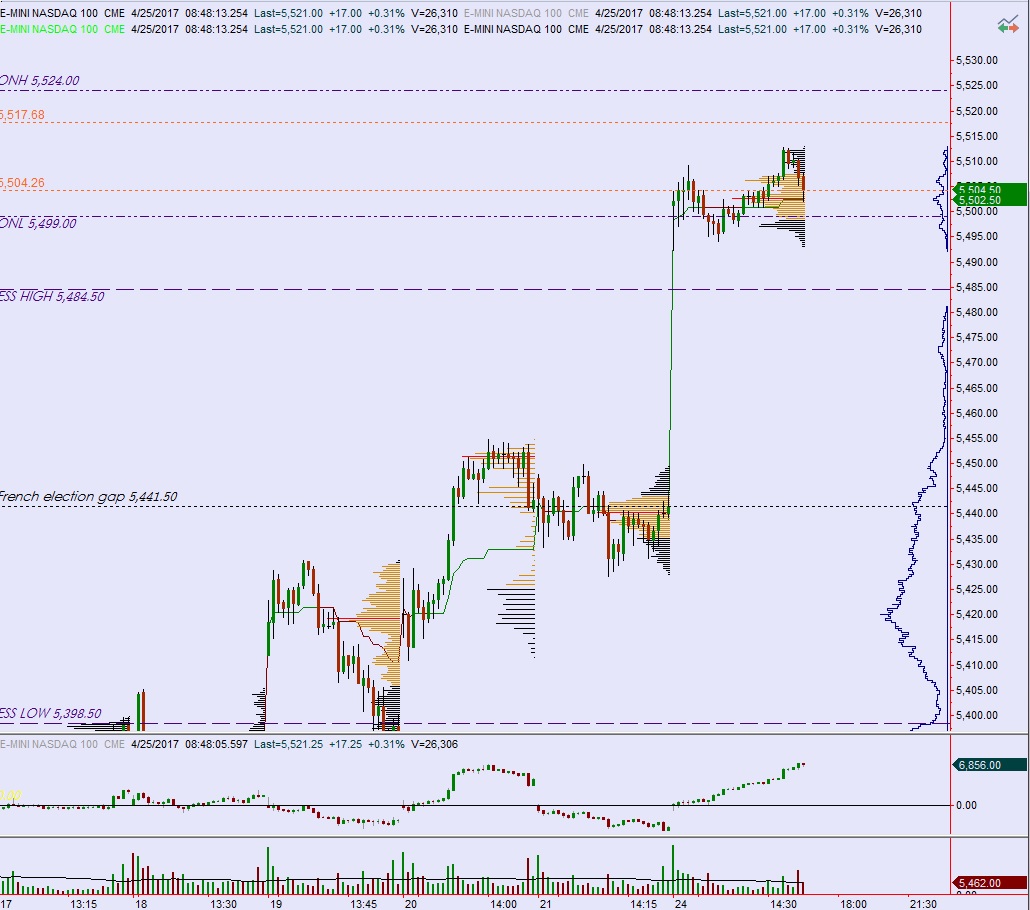

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, briefly resting at the Monday high before continuing to work higher. As we head into cash open, prices are hovering at all-time highs.

On the economic docket today we have House Price Index at 9am, New Home Sales and Consumer Confidence at 10am, 4- and 52-week T-bill auctions at 11:30am, and a 2-year Note auction at 1pm.

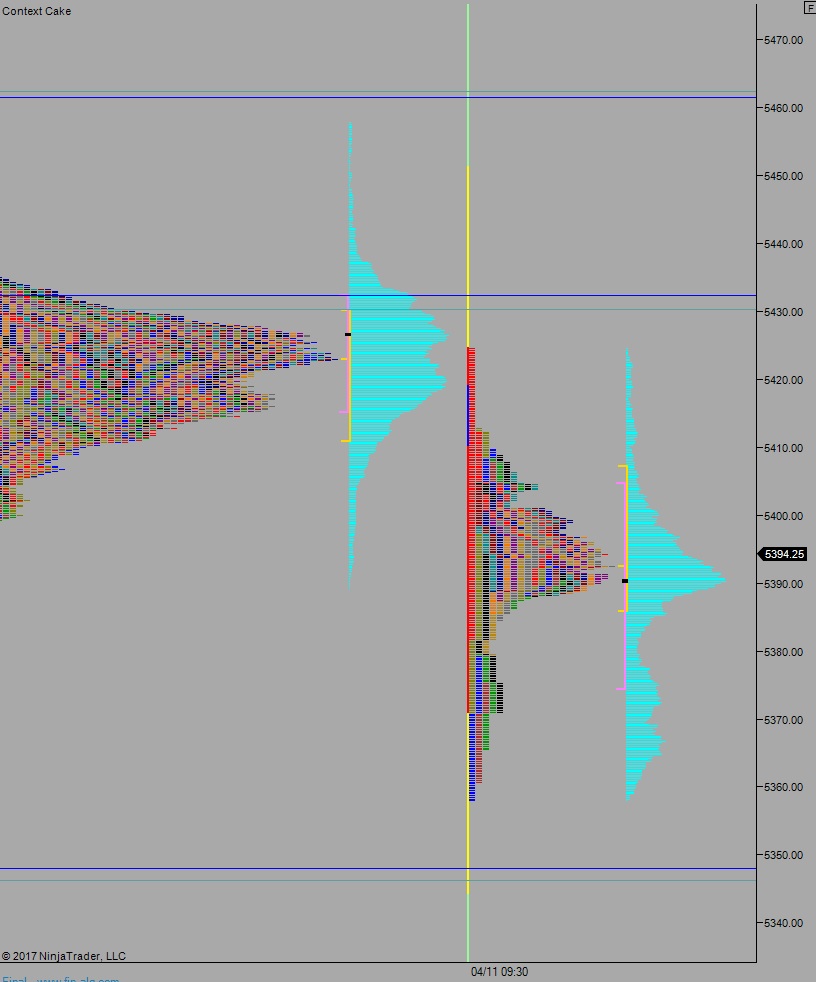

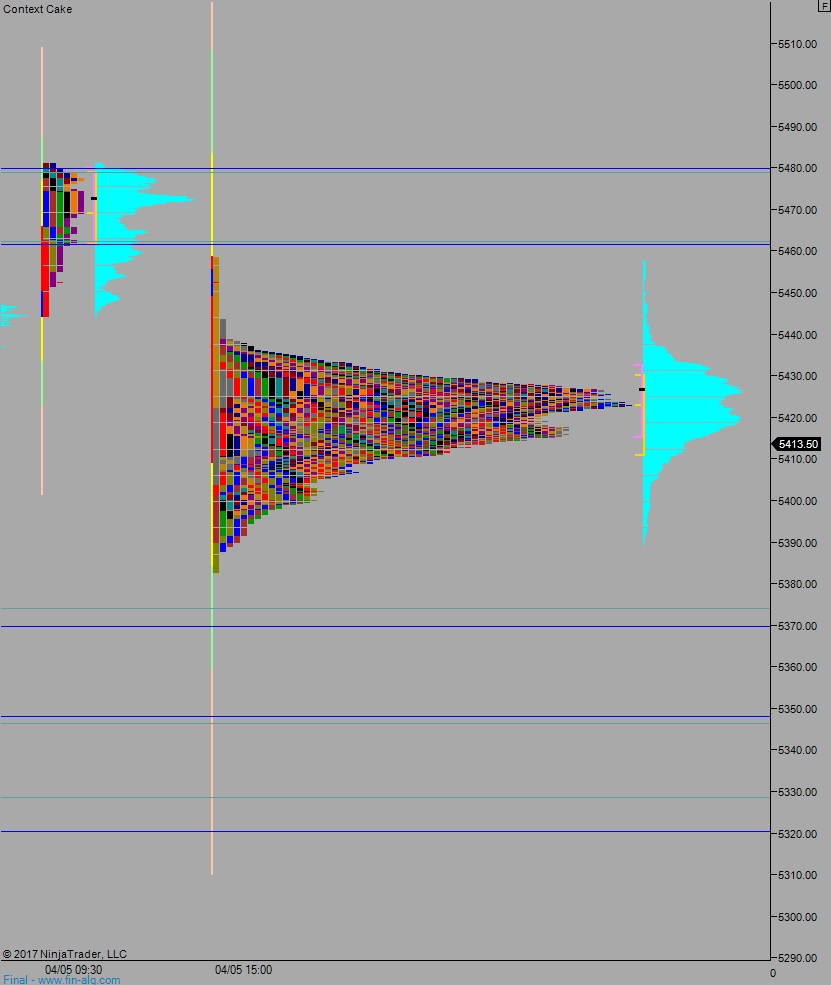

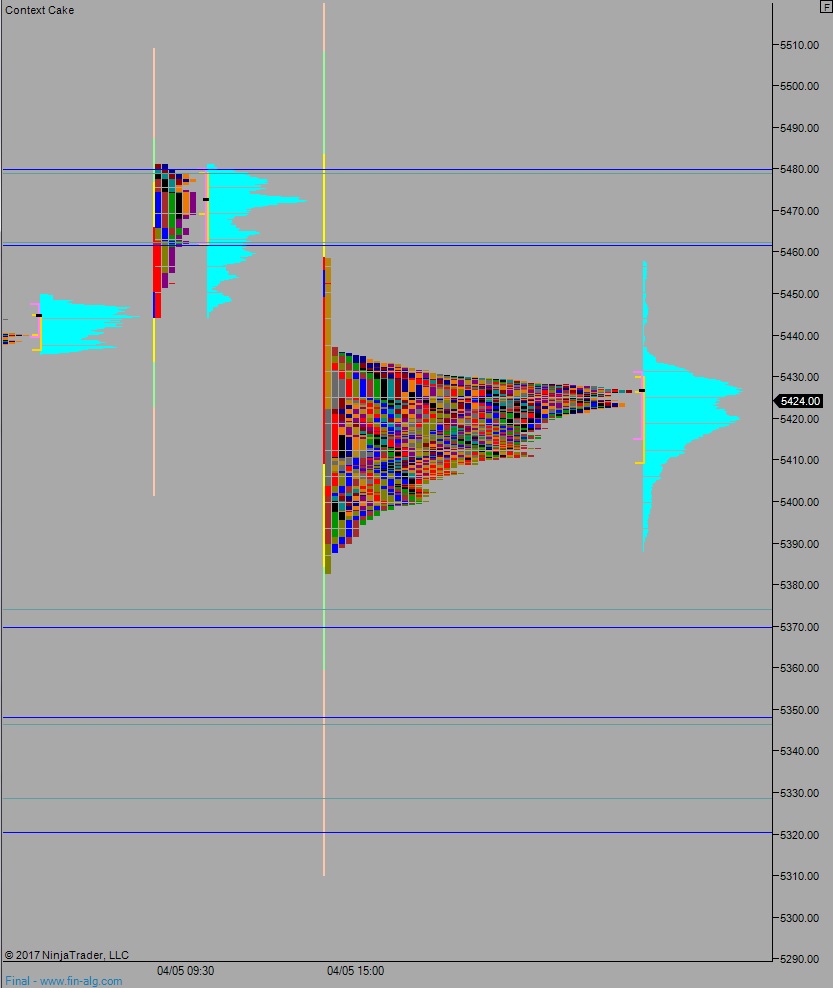

Yesterday we printed a normal variation up. The details of the session were recapped yesterday afternoon.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 5504.50. Look for price to continue lower, down through the 5500 century mark and testing 5495.50 before two way trade ensues.

Hypo 2 buyers gap-and-go, continue exploring higher prices beyond the current swing high 5524.

Hypo 3 strong selling takes price down to 5462.25 before two way trade ensues.

Levels:

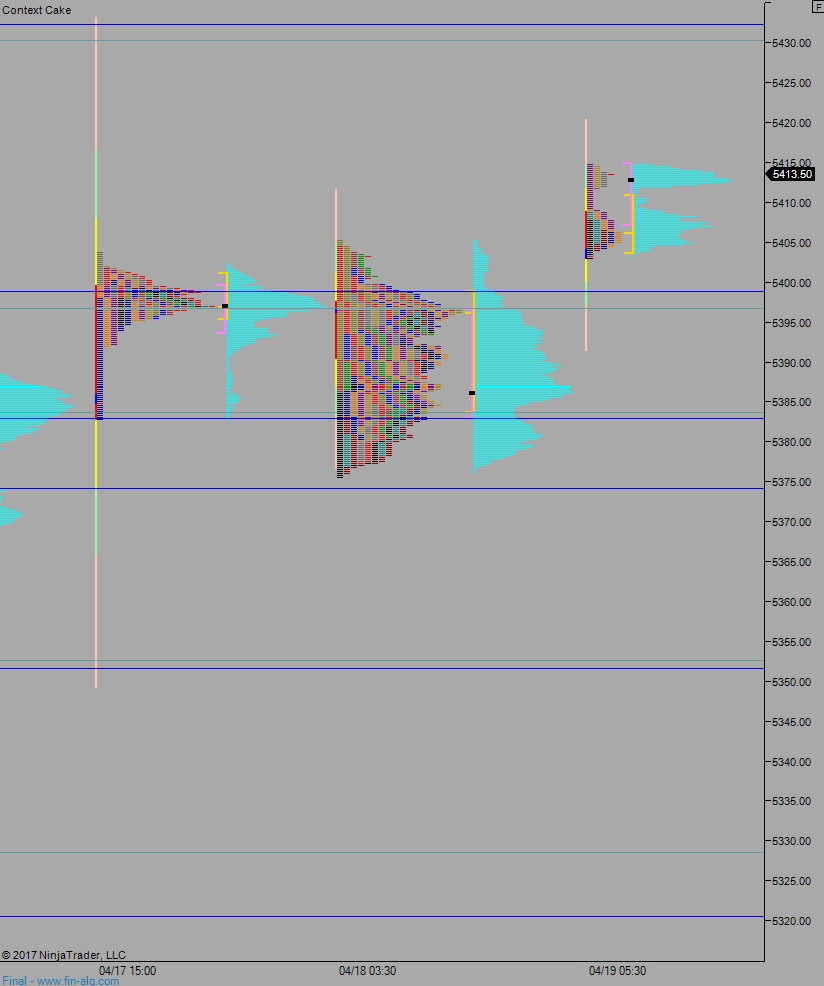

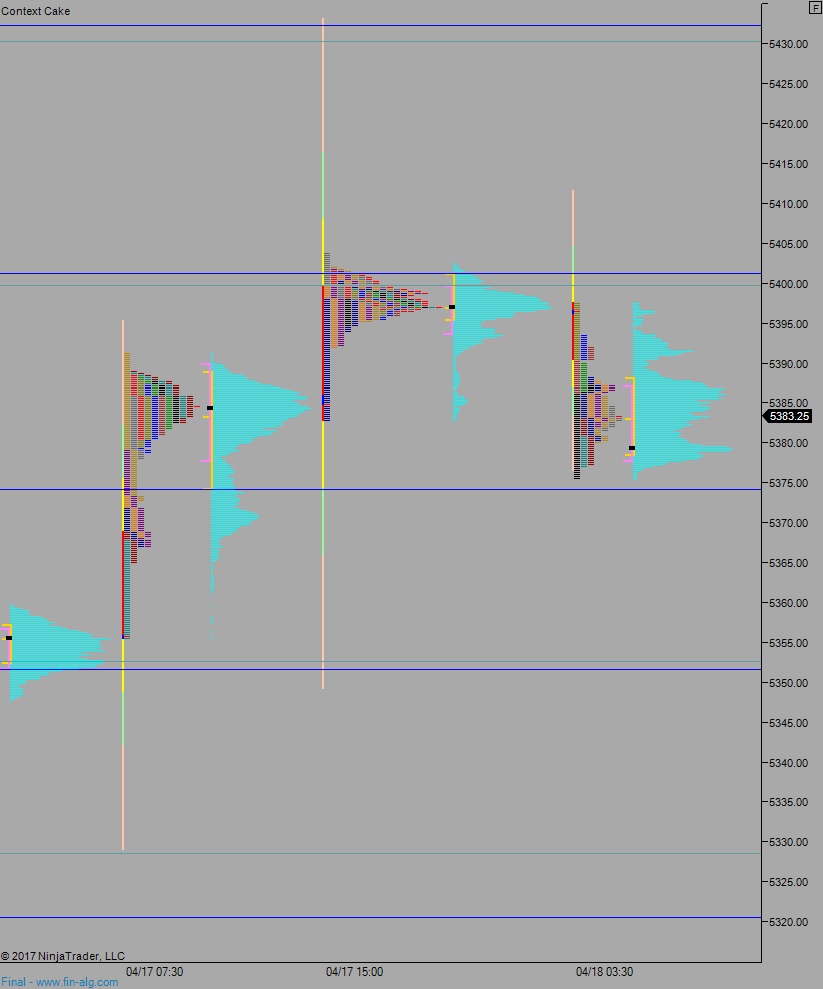

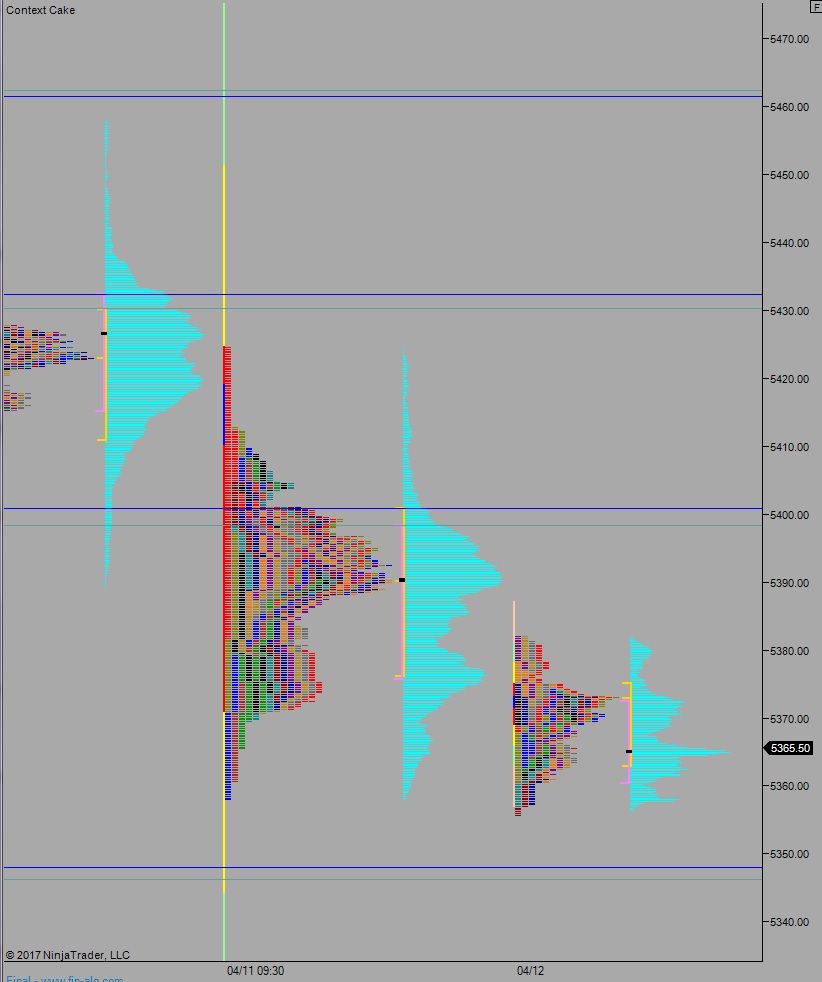

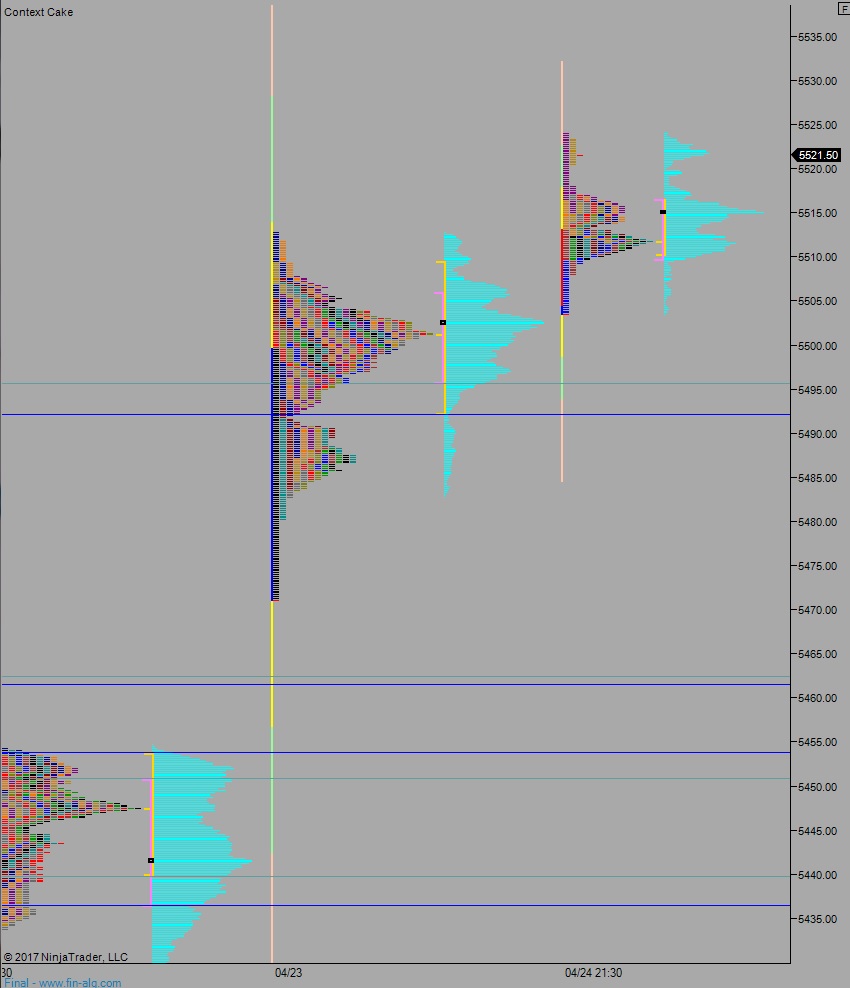

Volume profiles, gaps, and measured moves

Comments »