NASDAQ futures are set to open gap up after an overnight session featuring normal range and volume. Price held yesterday’s range before thrusting higher, back up to the Tuesday midpoint.

On the economic calendar today we have Existing Home Sales at 10am and Crude Oil Inventories at 10:30am. No major tech earnings are due out today, but the reacting to yesterday evenings Intel earnings will be useful context as we navigate today’s NASDAQ trade.

See Also: Take a Close Look at Semiconductors Ahead of Intel Earnings

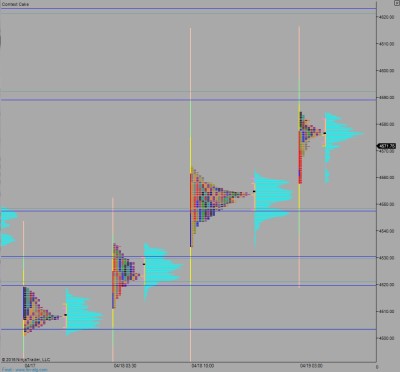

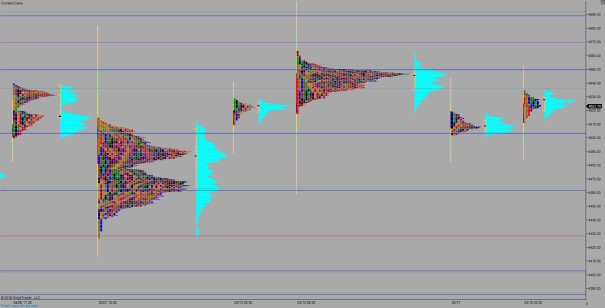

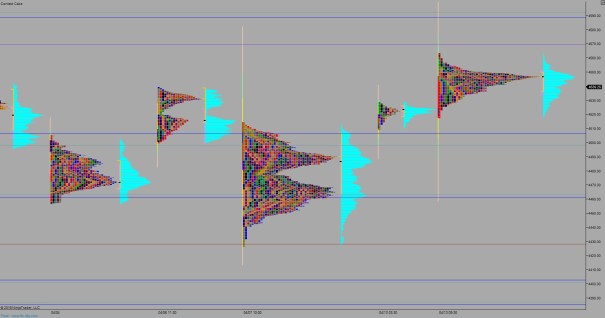

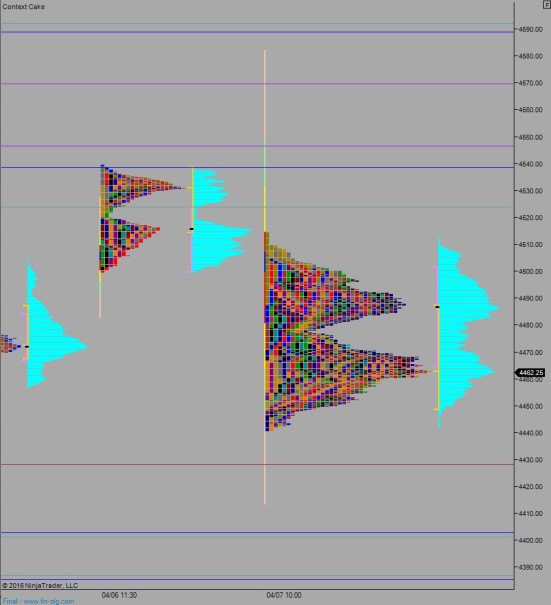

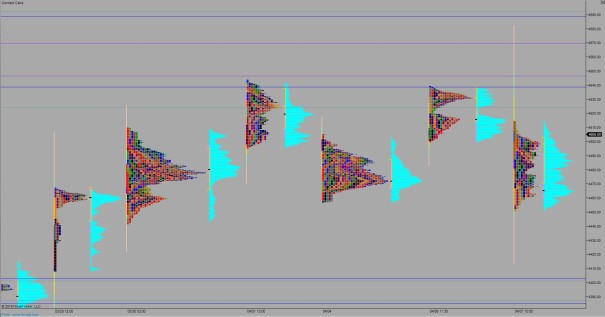

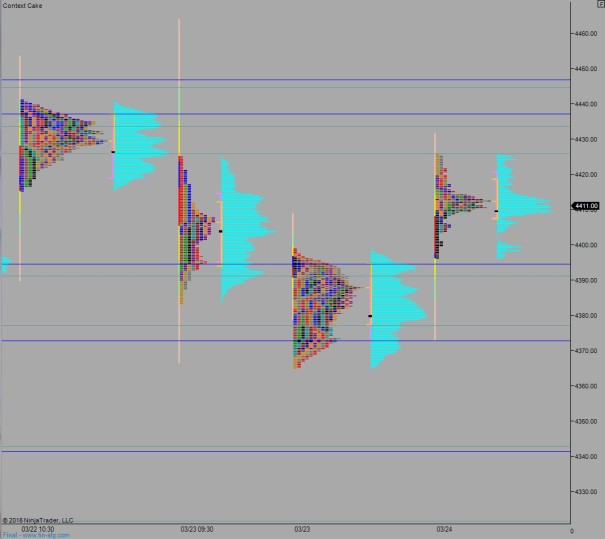

Yesterday we printed a normal variation down. The day started with a drive down which set the tone on the session. A strong secondary rotation pushed price to test the micro-composite value area high [MCVAH] where responsive buyers stepped in and squeezed price back to the mid.

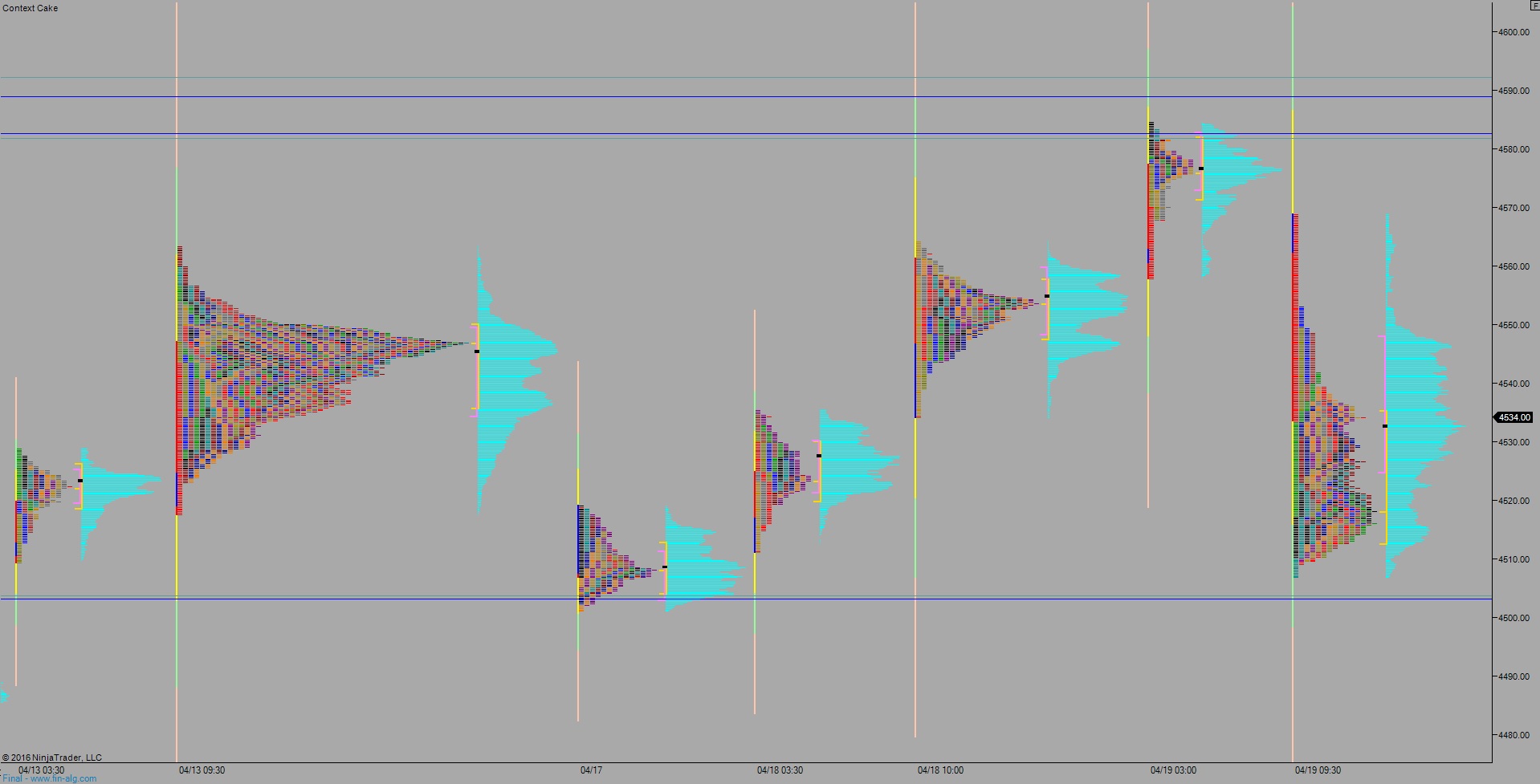

Heading into today my primary expectation is for buyers to make an early push above overnight high 4538. Look for responsive sellers up near 4548 and two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 4526.75. Responsive buyers step in around 4518 and work higher to take out overnight high 4538 before two way trade ensues.

Hypo 3 sellers close overnight gap down to 4526.75 then set their sights on overnight low 4509. This sets up a move down to 4503.50. Stretch target is the open gap down at 4489.75.

Levels:

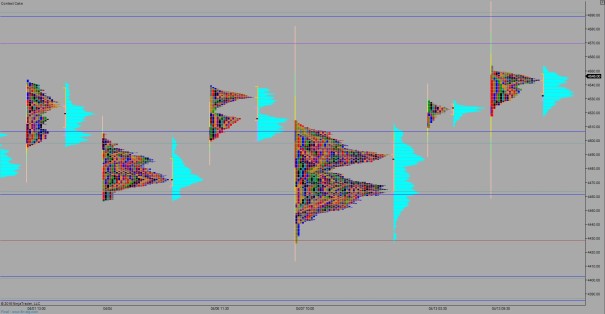

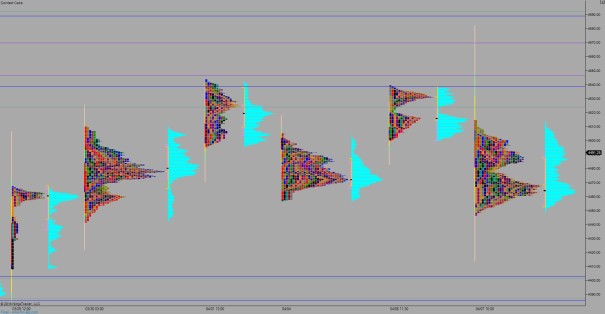

Volume profiles, gaps, and measured moves: