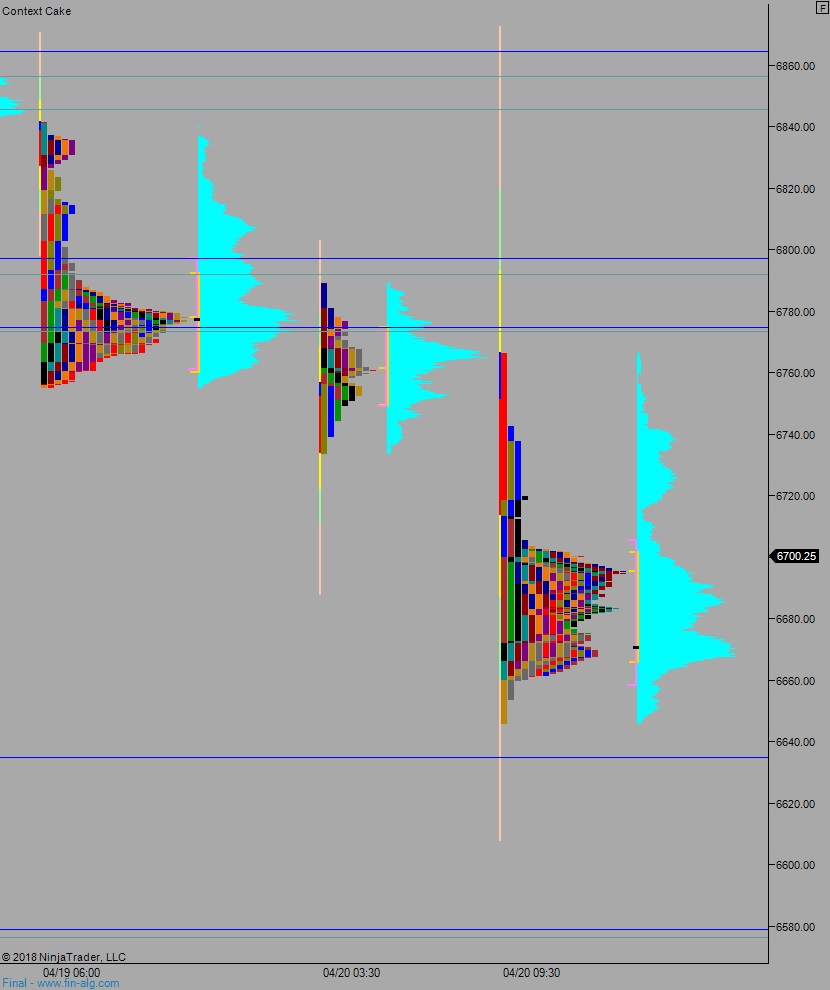

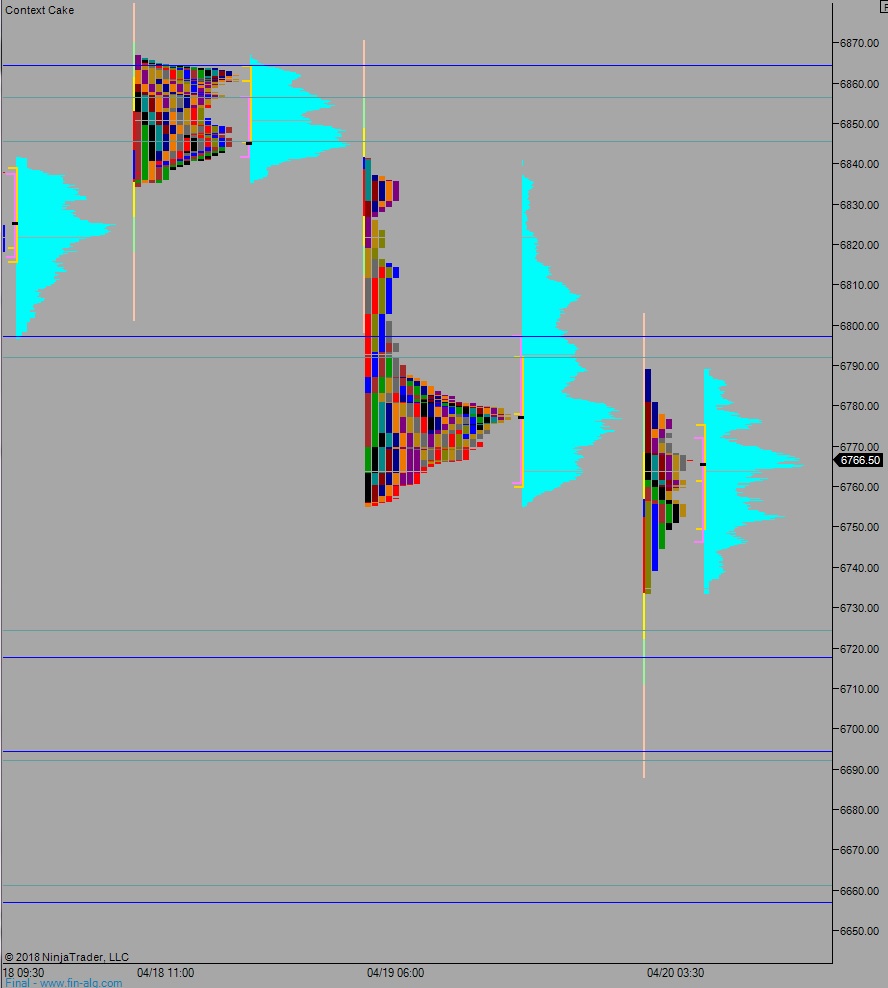

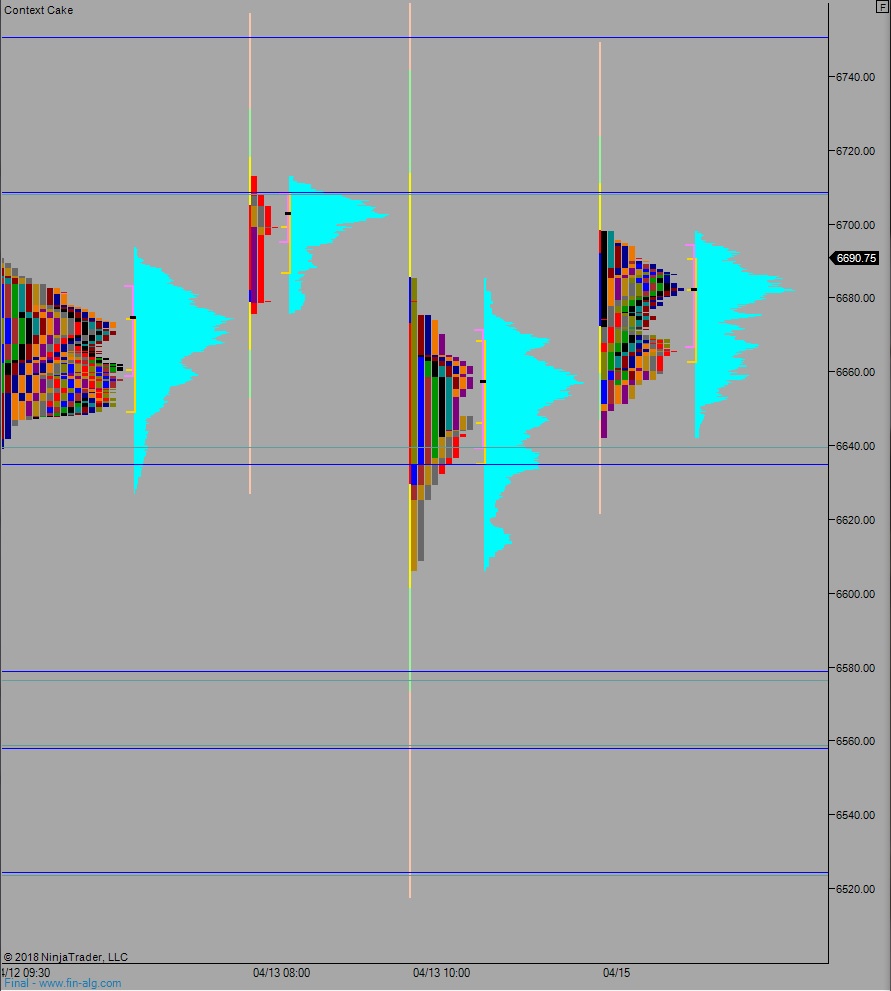

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring elevated volume on extreme range. Price worked higher overnight, staying inside the Monday cash range. As we approach cash open price is hovering above Monday’s midpoint.

On the economic agenda today we have new home sales and consumer confidence at 10am, 4- and 52-week T-bill auctions at 11:30am, and a 2-year Note auction at 1pm.

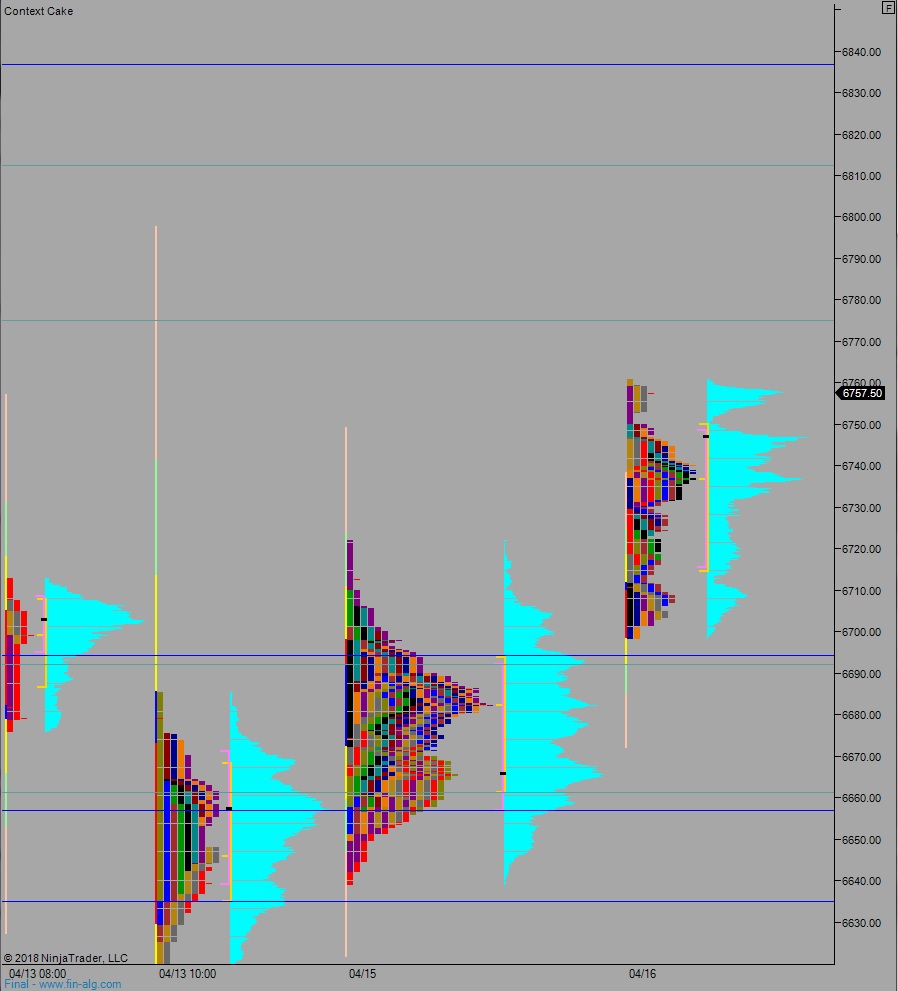

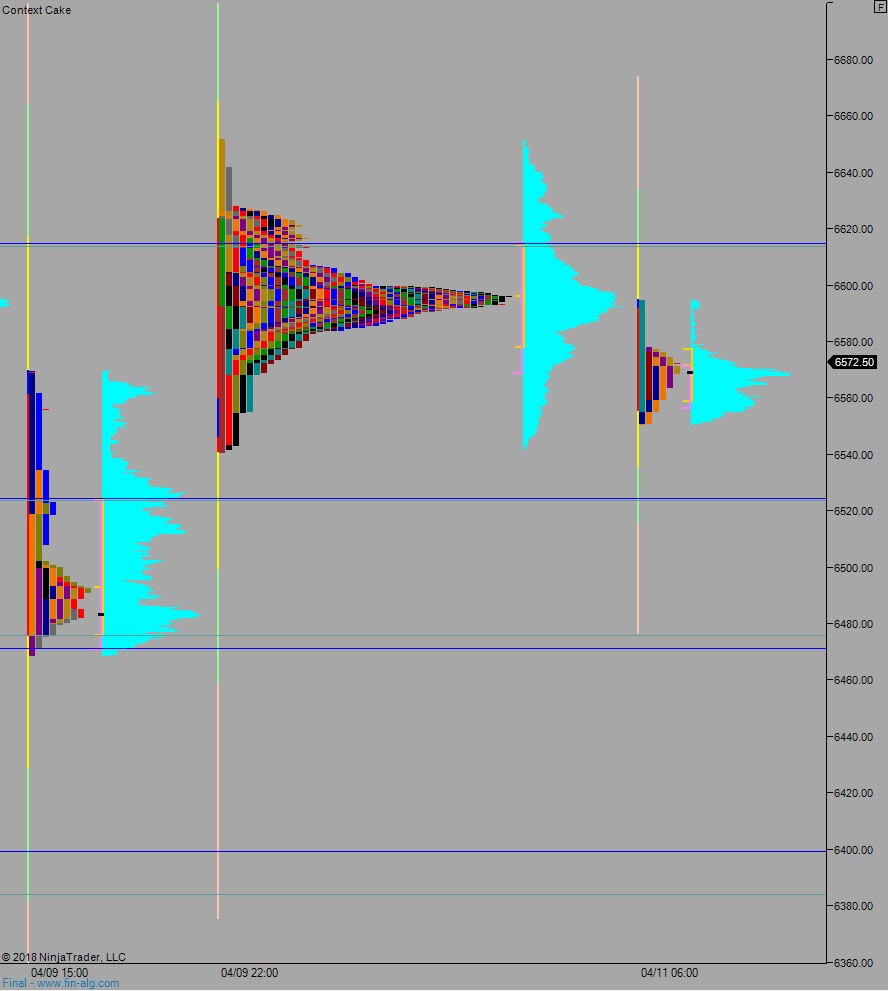

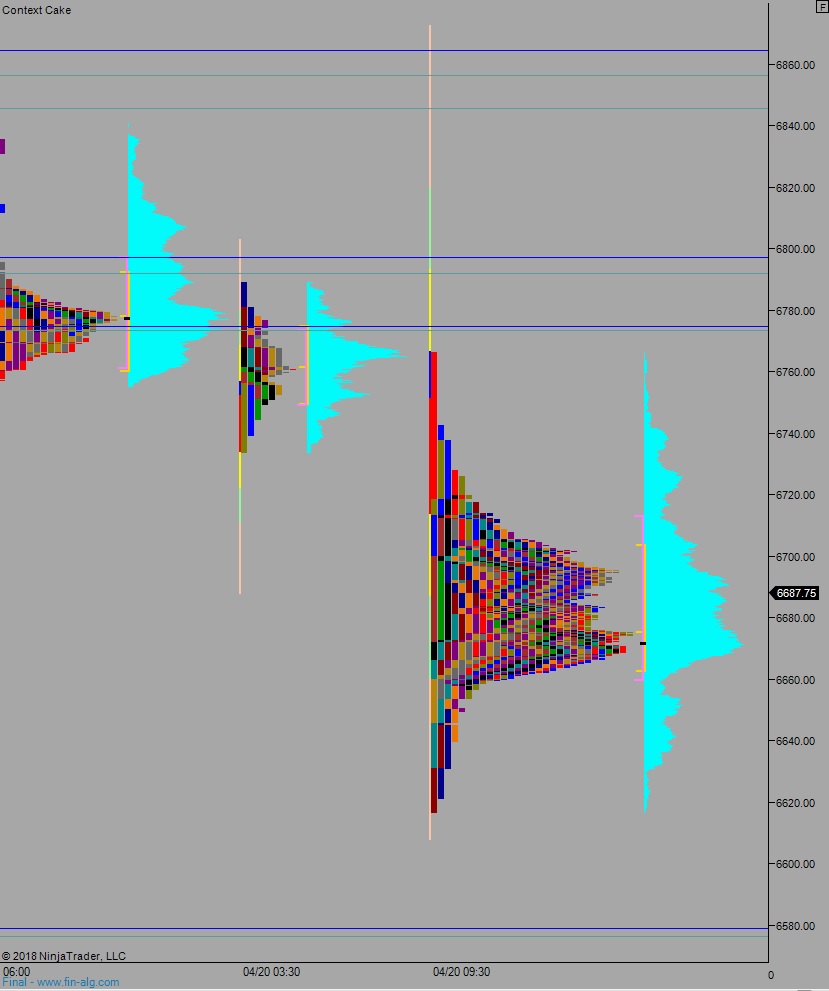

Yesterday we printed a neutral day. The day began gap up which sellers quickly worked closed before a strong responsive bid stepped in ahead of last Friday’s low. Buyers stalled out just beyond last Friday’s midpoint and we worked lower, down through the daily range making a new session low. We ramped higher into the bell and then spiked a bit more to the upside after Alphabet reported earnings.

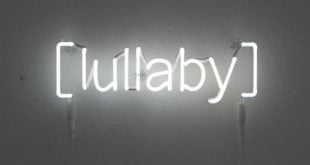

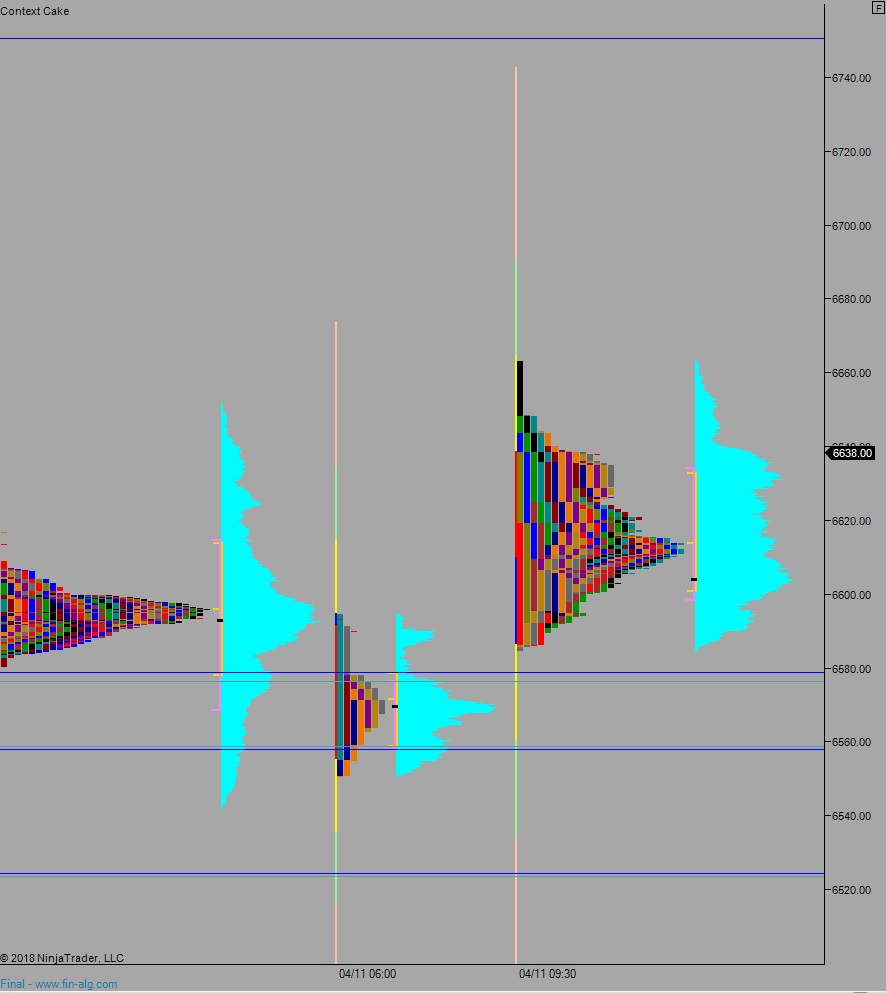

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6665.50 From here we continue lower, down through overnight low 6654 before two way trade ensues.

Hypo 2 buyers gap and go higher, sustaining trade above 6700 setting up a move to take out overnight hgih 6717.75 before two way trade ensues.

Hypo 3 stronger sellers come in and we liquidate down to 6600 before two way trade ensues. Stretch downside target is 6578.

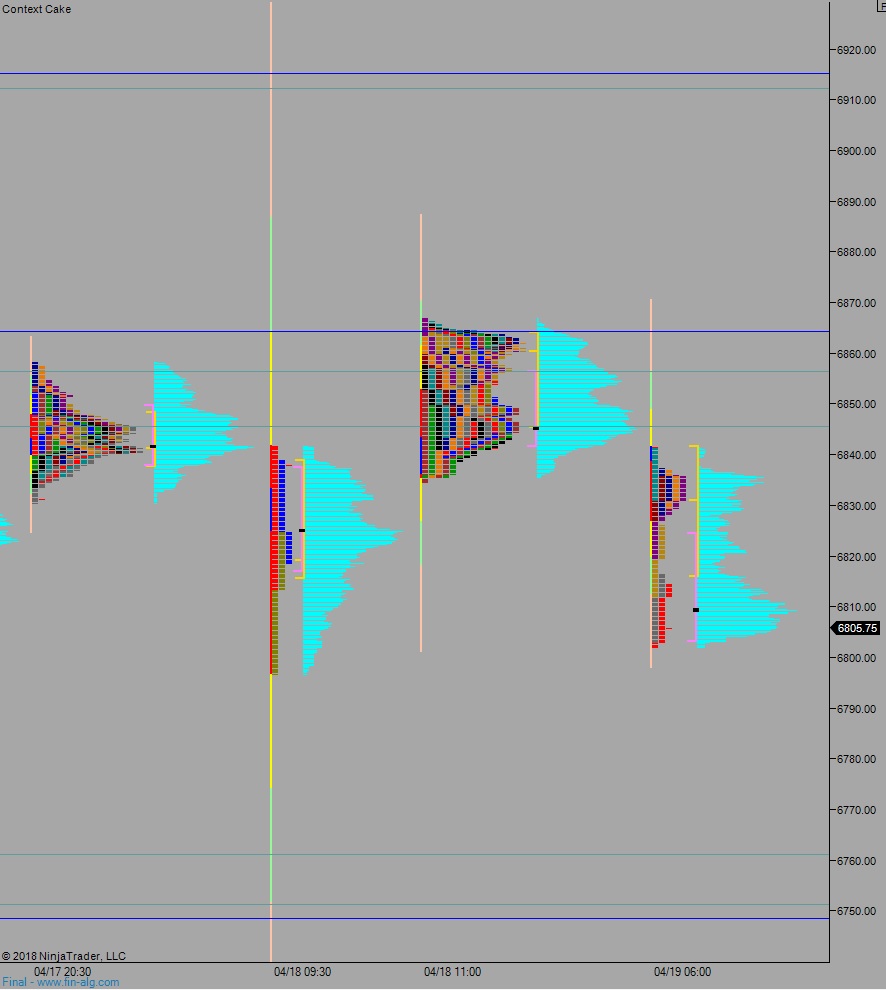

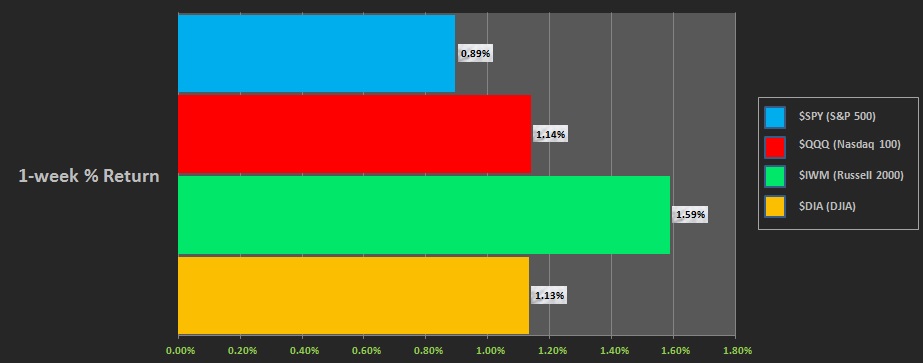

Levels:

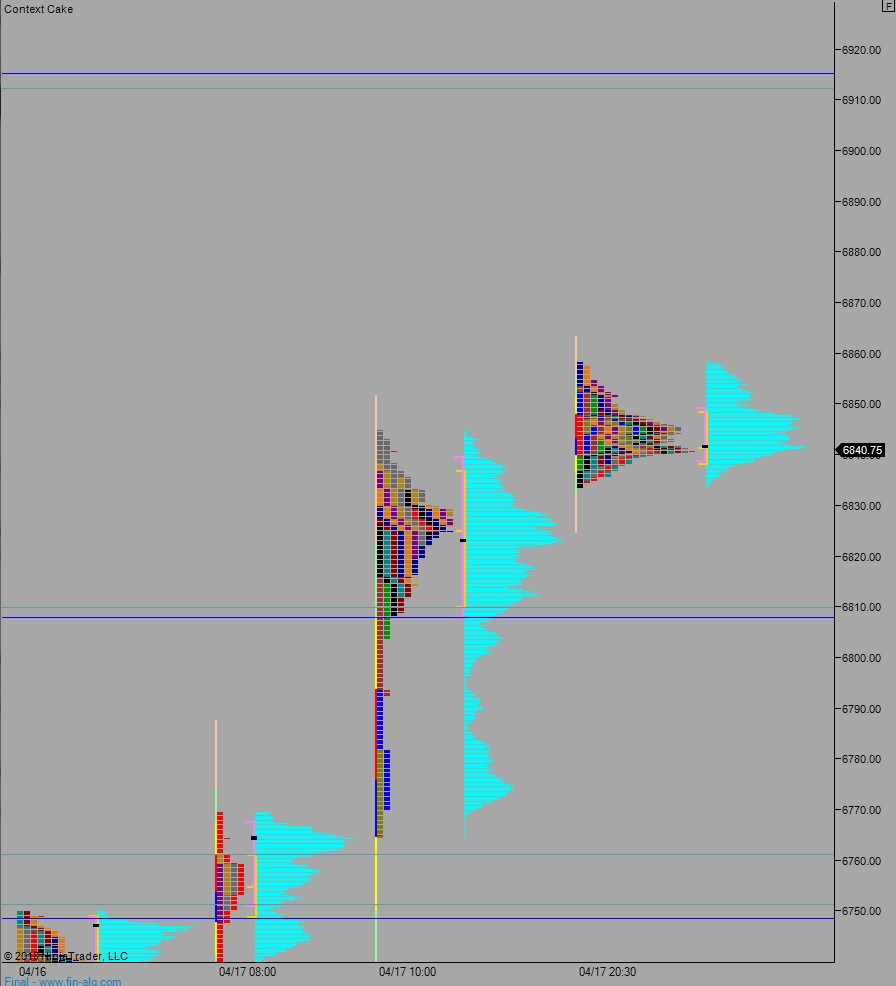

Volume profiles, gaps, and measured moves: