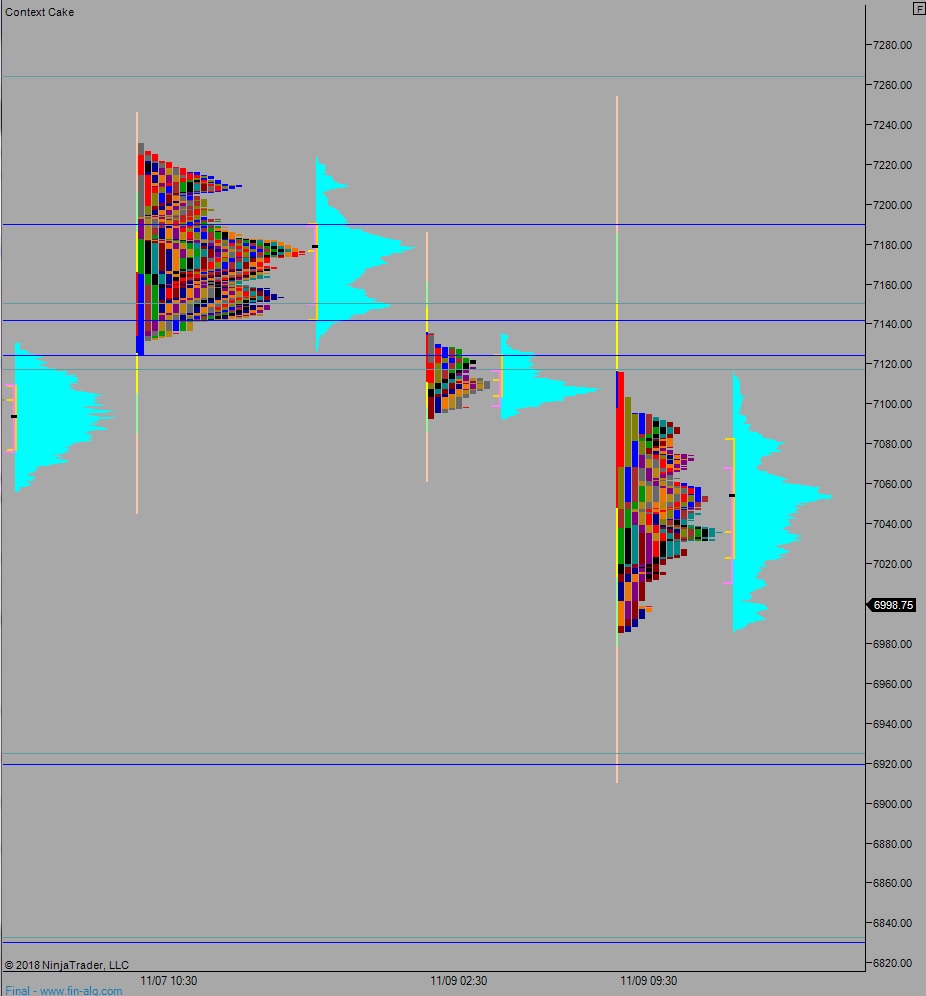

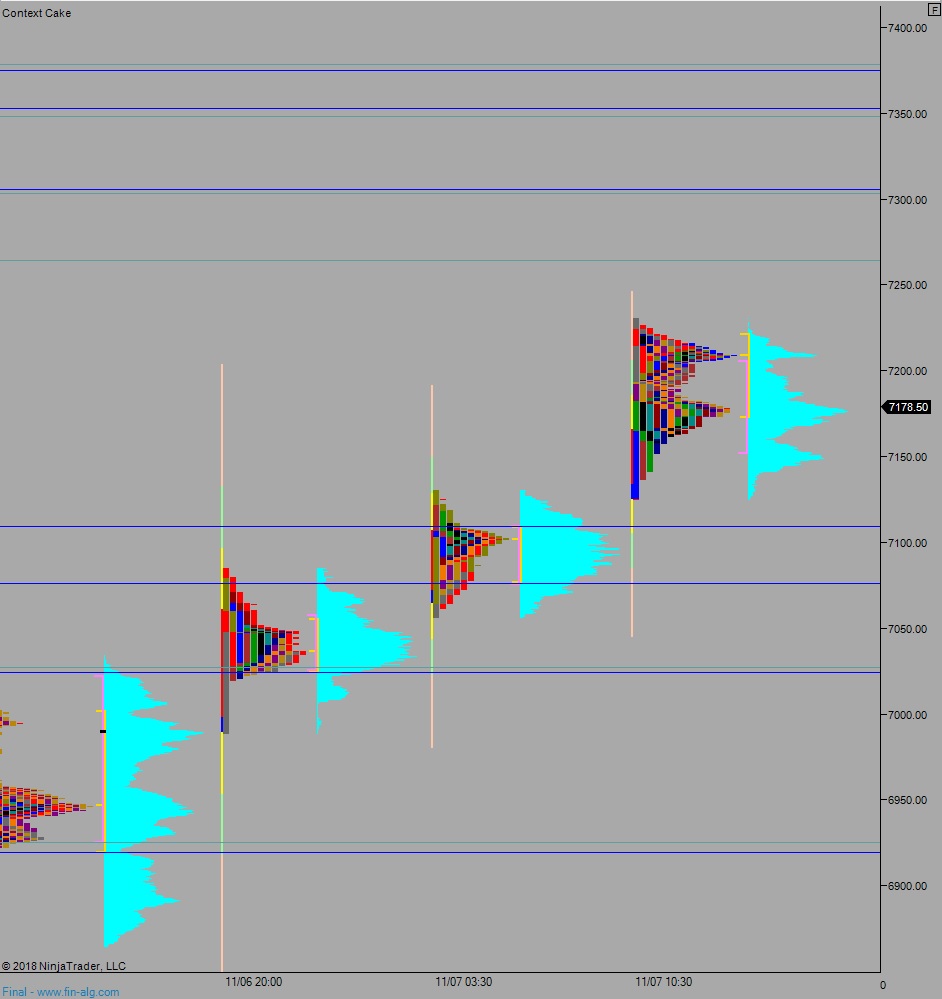

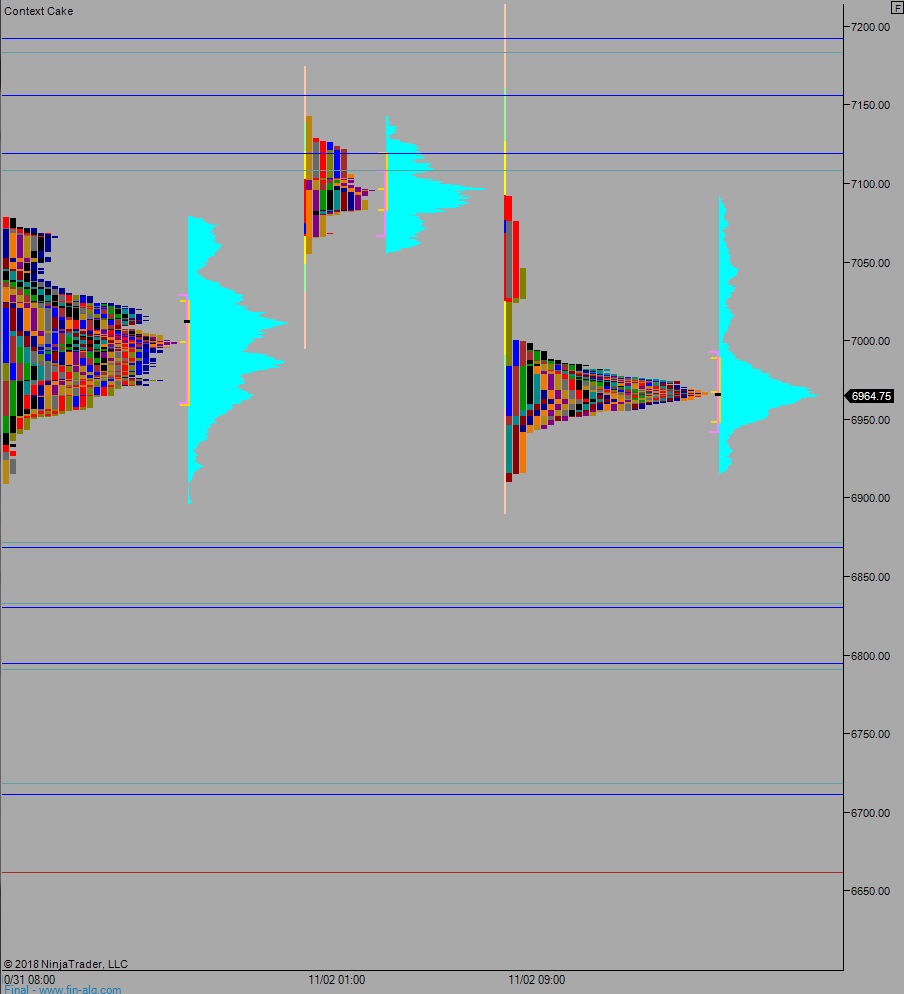

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price briefly took out the Monday low overnight before rallying back up near the Monday midpoint. As we approach cash open, price is hovering in the lower quadrant of Monday’s range.

On the economic calendar today we have a 3- and 6-month T-bill auction at 11:30am, a 4-and 8-week T-bill auction at 1pm, and a monthly budget statement at 2pm.

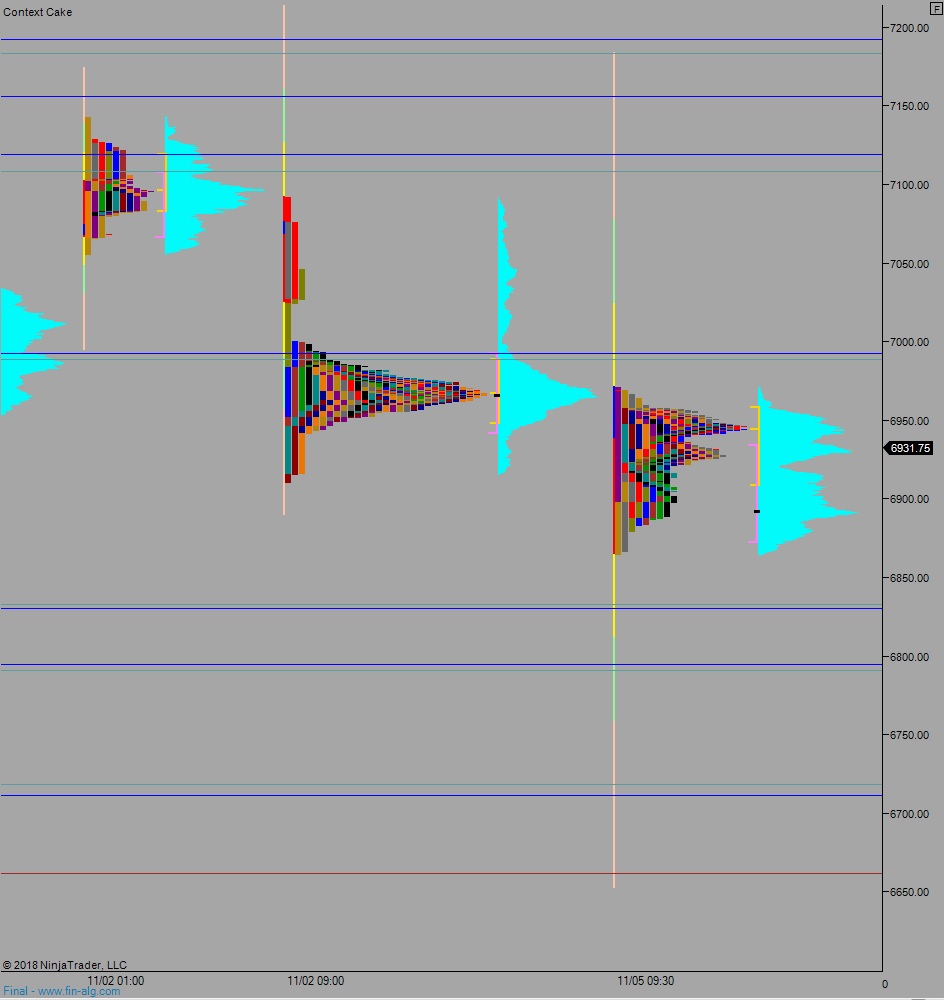

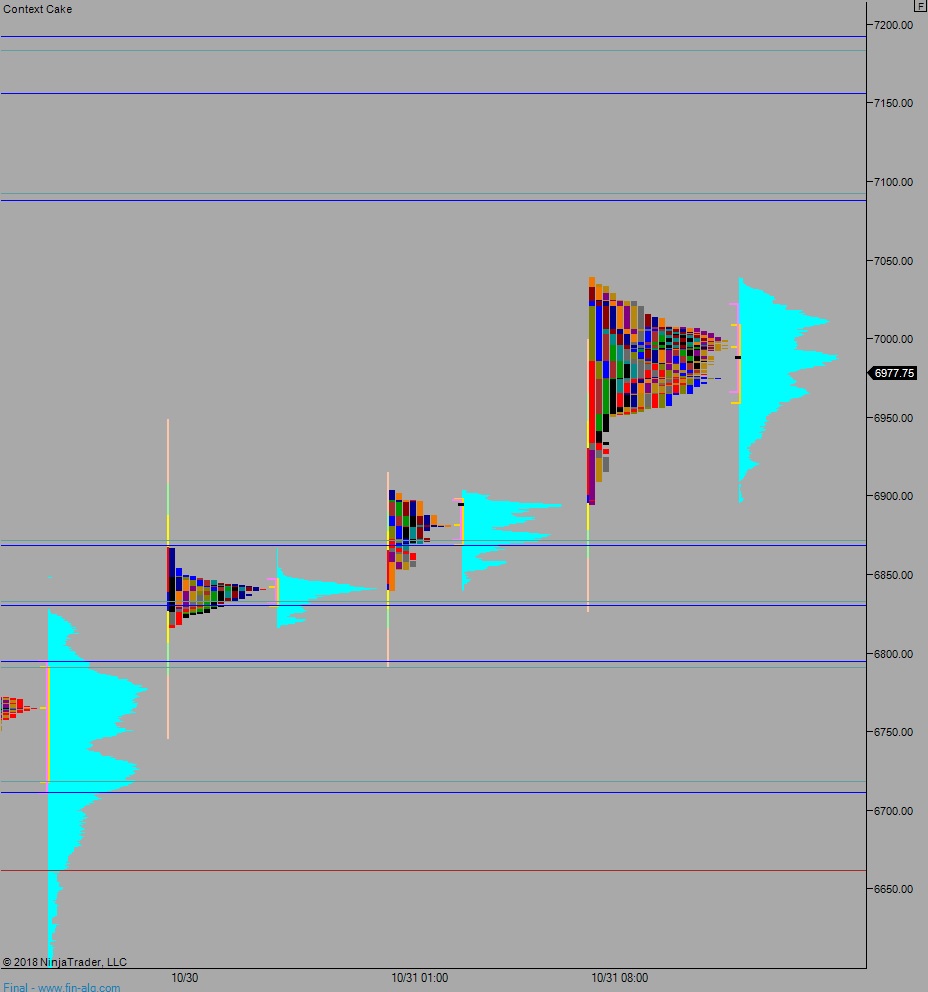

Yesterday we printed a double distribution trend down. The day began with a gap down near last Friday’s low followed by a drive lower. Sellers drove clean through the composite VPOC 6950, continuing to probe lower prices until about 11:45am when a responsive bid stepped in at the weekly ATR band 6825.75. From then onward the market balanced, forming a wide balance from about 6900-6840. Price moved back down near session low as we ended the day.

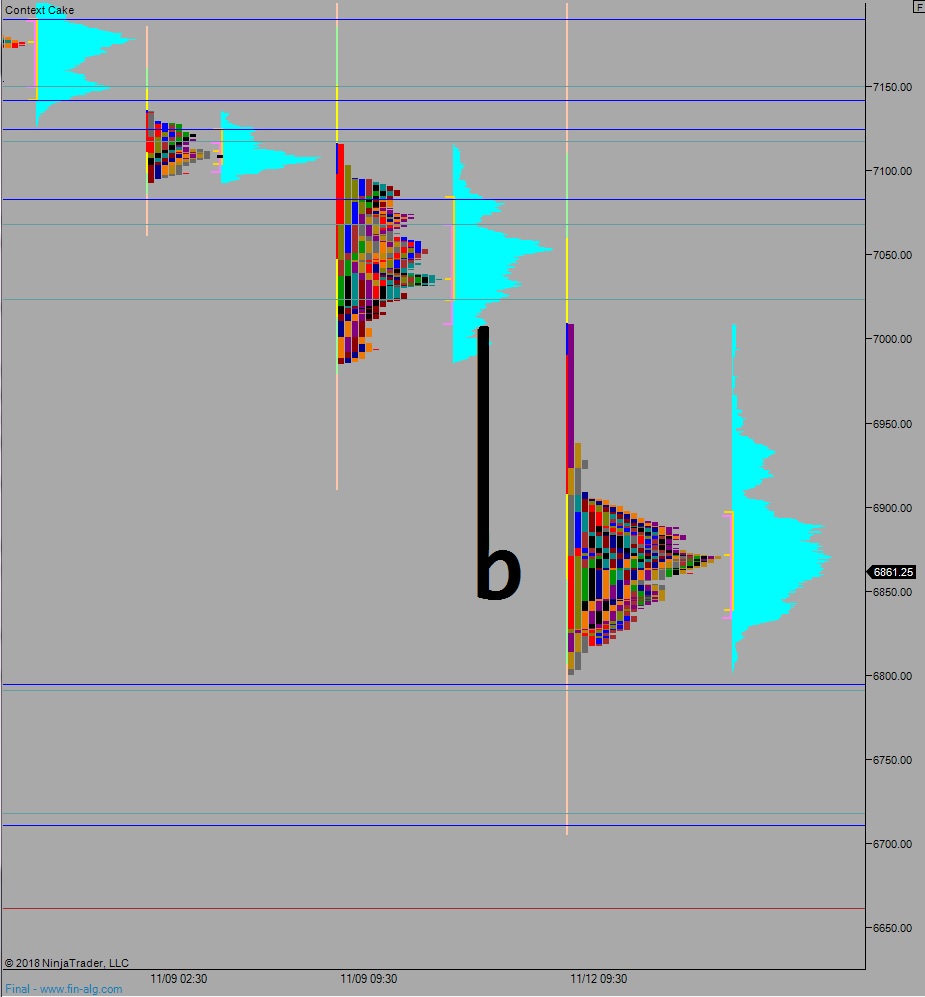

Overall the current market profile has a lowercase letter-b shape which is indicative of a long liquidation—a temporary phenomenon often seen near swing low (see market profile chart below).

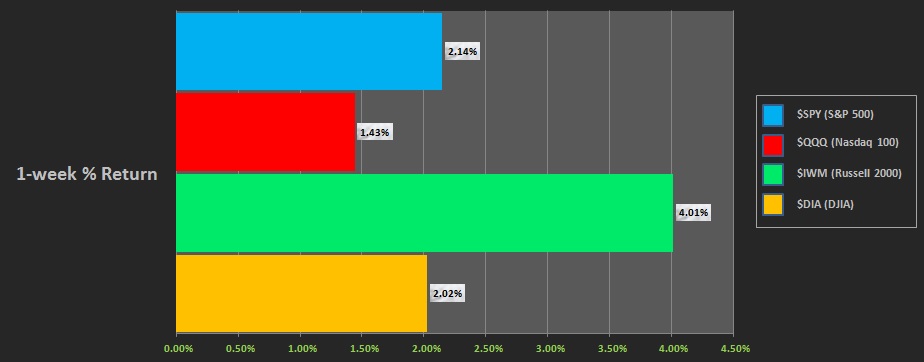

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6836.75. From here we continue lower, down through overnight low 6801.25. Look for buyers just below at 6795 and two way trade to ensue.

Hypo 2 long liquidation continues, stronger sellers drive us down to 6718.50 before two way trade ensues.

hypo 3 gap-and-go higher, sloppy low. Buyers work up through overnight high 6909.25 setting up a move to target the composite VPOC at 6950 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: