Anyone who embraces modern computing understands we create a gigantic amount of data through our daily internet interactions. As traders, we have intimate knowledge of big data, the more the better. Market stats, performance stats, fundamentals, volume footprints; the list is endless. If you’re serious about trading, you love data, period. I’ll stick to letting my gut decide what’s for lunch.

Also, we’re ushering in the age of small devices accessing the cloud. Gone are the days of needing all your memory in one place. RAX is my favorite cloud storage play, and they’re approaching their busiest time of the year as they ramp up service to sites like AMZN for the madness of Cyber Monday.

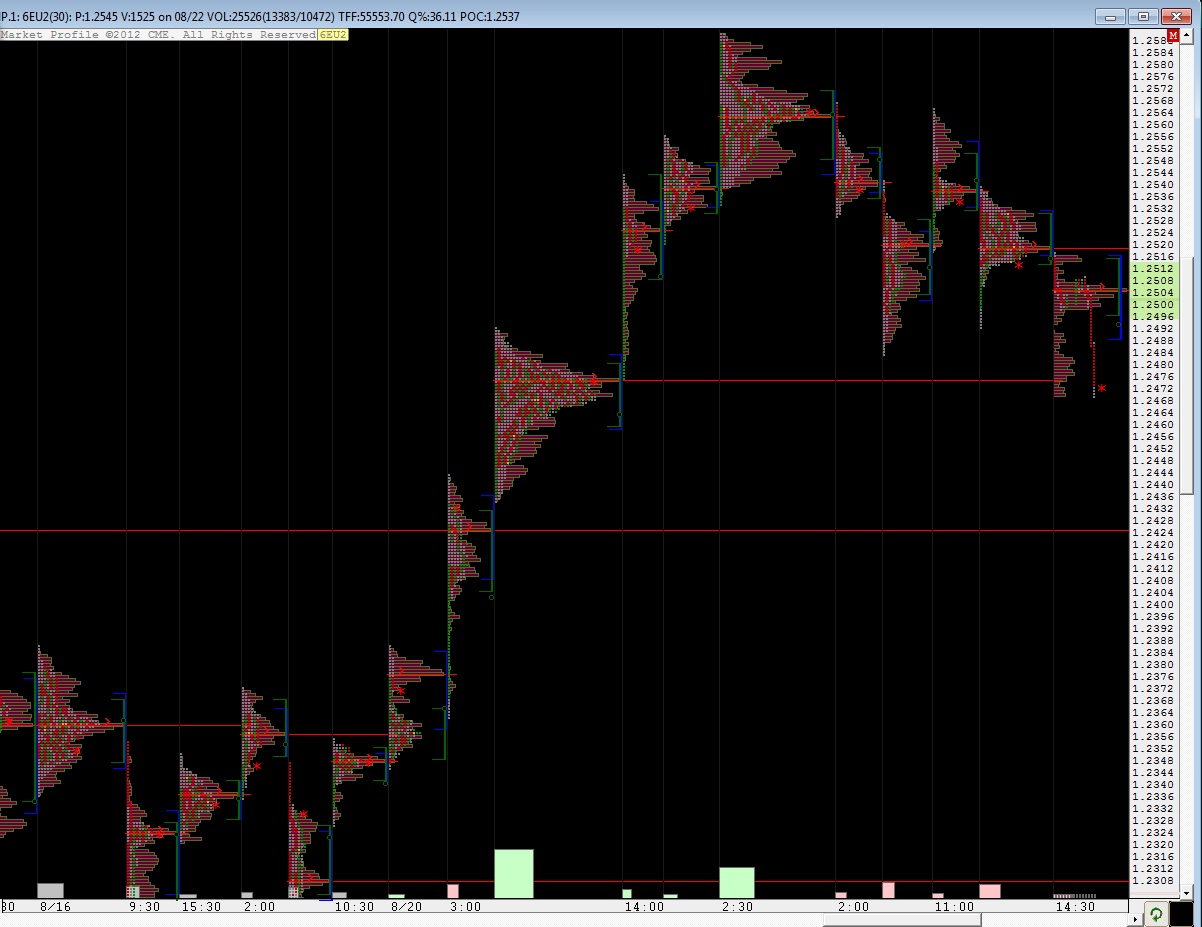

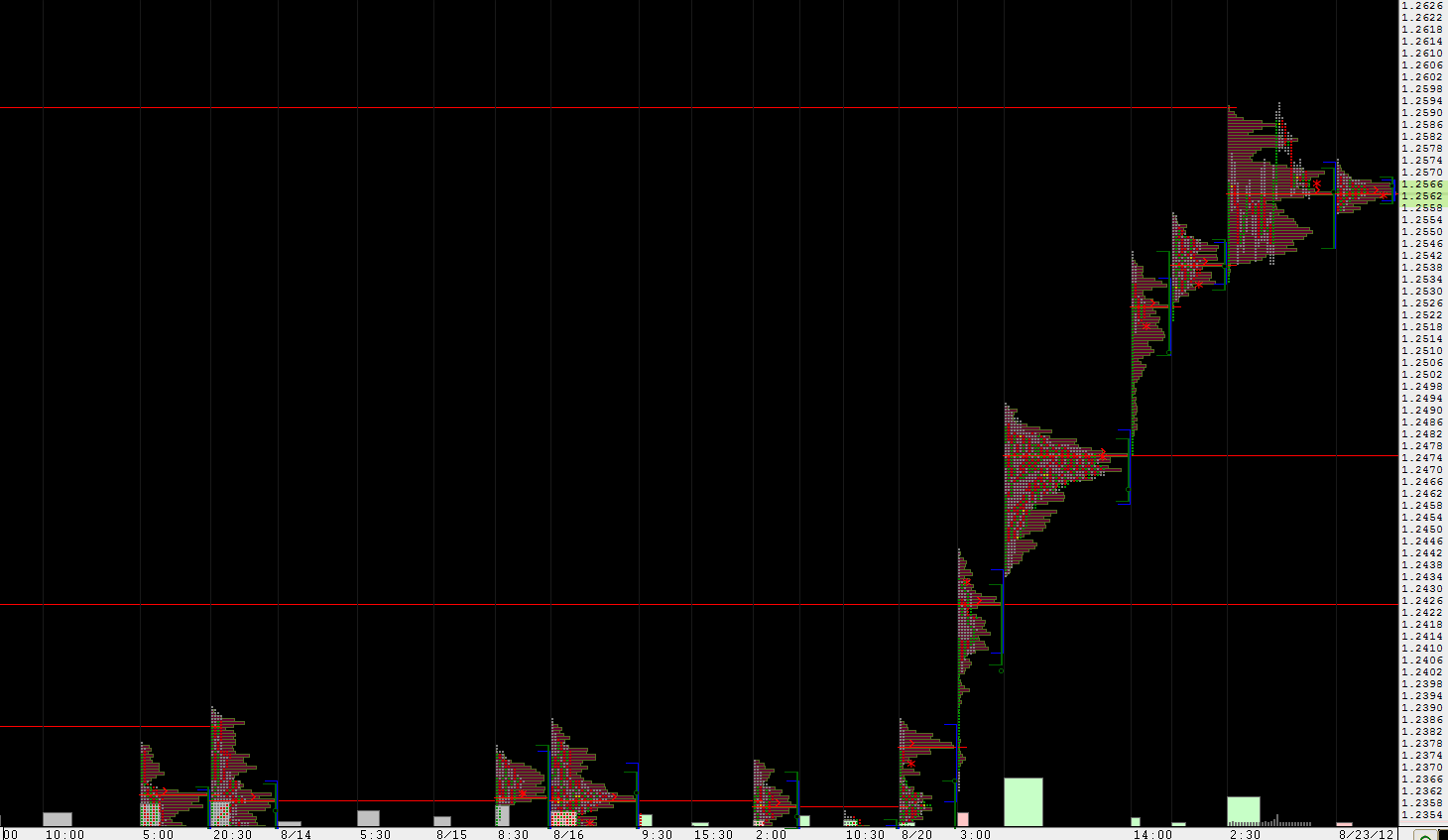

Late to the game as I usually am, Mellanox (MLNX) came to my attention after smashing earnings last July. I was immediately intrigued by the Israeli firm’s product line: the pipes that make the cloud hum. Since then I wanted to build a position in the name. However, it never pulled back and offered me entry during its late summer ramp. The gap left behind troubled me also, as nature abhors a gap. Unnatural as today’s markets may seem, they’re the purest place left in the world. Gaps left below have two forces, nature’s desire to fill gaps and gravity, working against them.

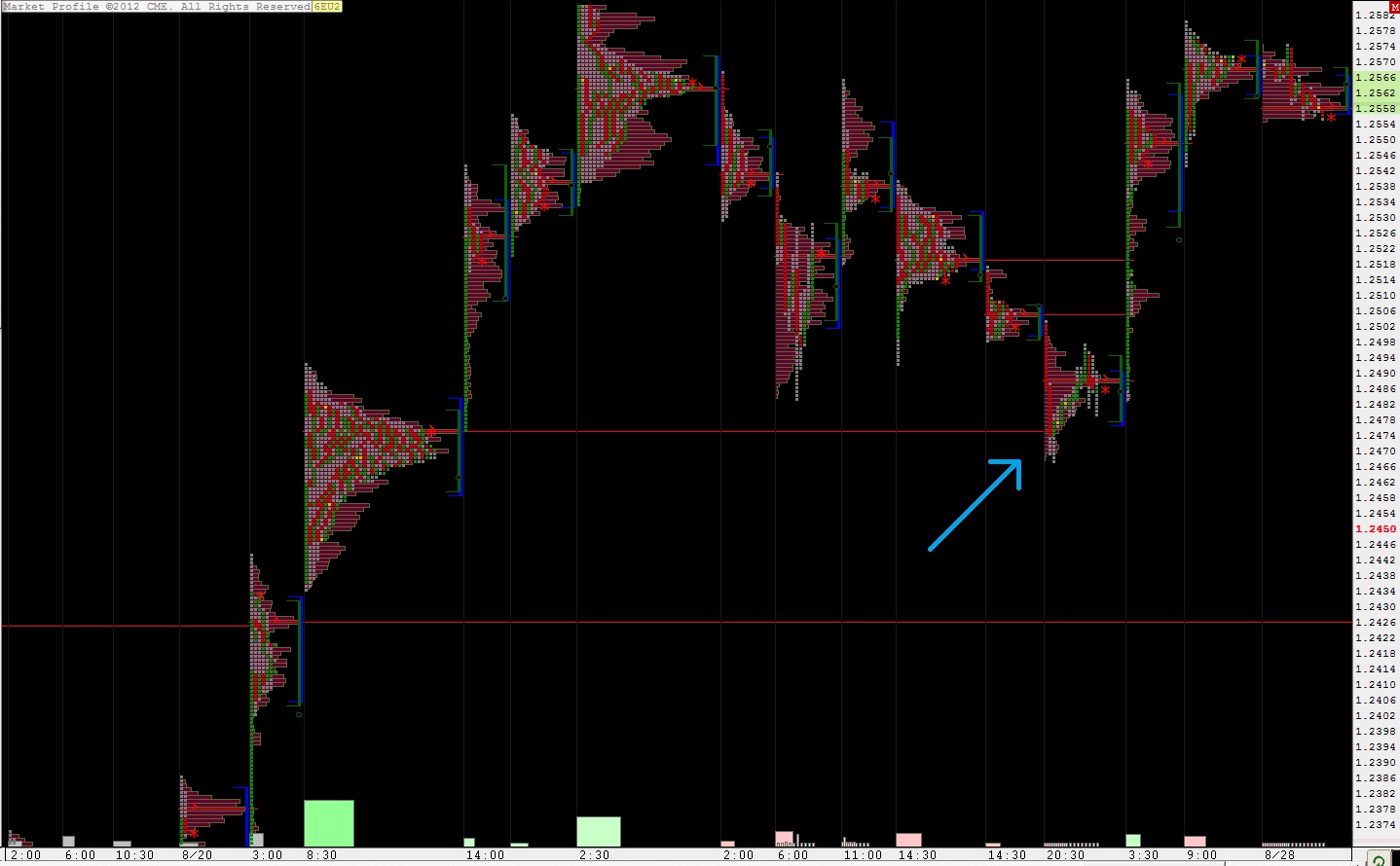

I’ve kept the name on my radar, and have watched as it spent the remainder of the year in no man’s land until finally falling back into the gap. What we’ve seen since returning to the gap is a healthy auction. At this point, price has auctioned the area well, and buyers and sellers appear to be in agreement where the value of this stock resides. Now we have some well-defined goal posts as I’ve noted below.

And traders should practice one of our better traits at this point, waiting for price to tip its hand, and let us know where we head next.

May you have a warm Thanksgiving, spending your time exactly how you see fit

Comments »