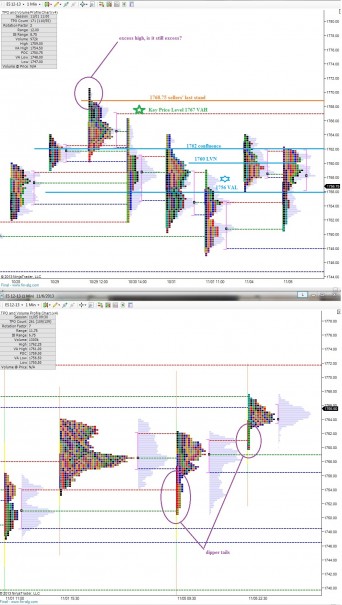

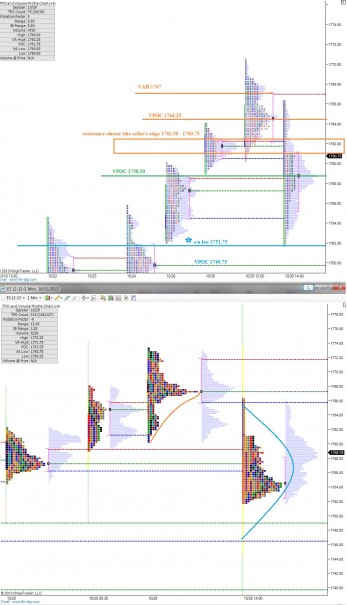

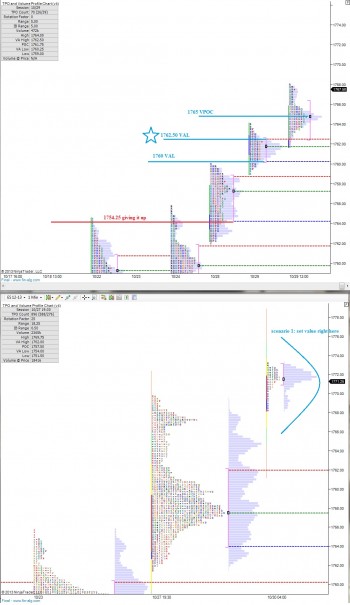

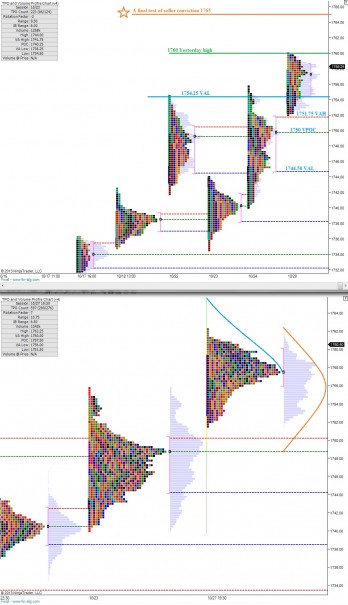

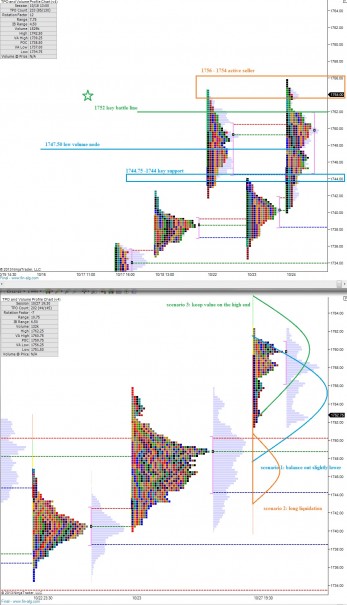

The markets auctioned very methodical all week ahead of what is likely to be an interesting Friday. We tracked the control of sellers which began on Monday and came into question Wednesday with a violent neutral session. Thursday the market told us it accepted the current prices by balancing out inside of the large neutral day and is waiting for new information before exploring elsewhere.

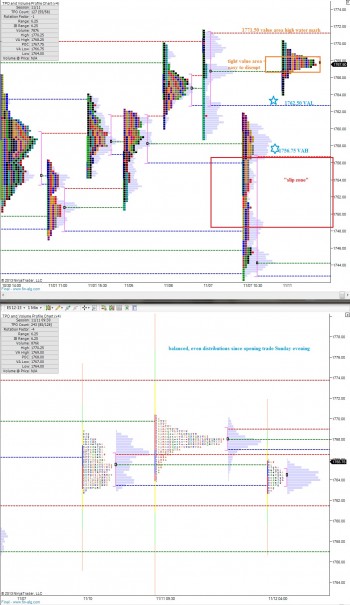

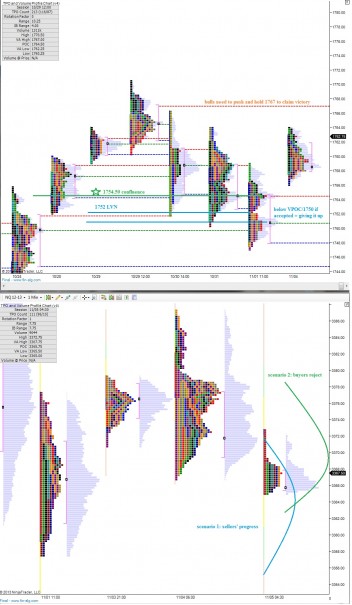

Overnight the NASDAQ divided itself into three micro sessions by auctioning then breaking a bit higher, auctioning then breaking higher, and finally auctioning as the USA come online. The action overnight suggests buyers have the early edge. However they have also pressed us into very short term overbought conditions.

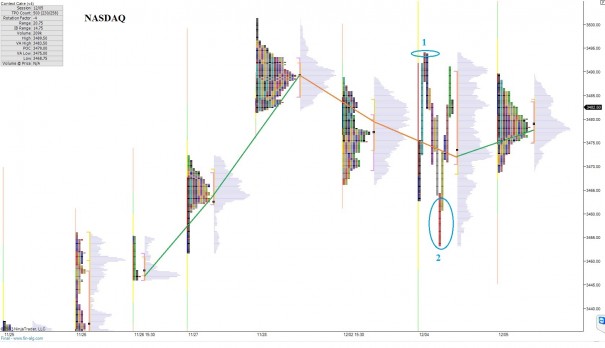

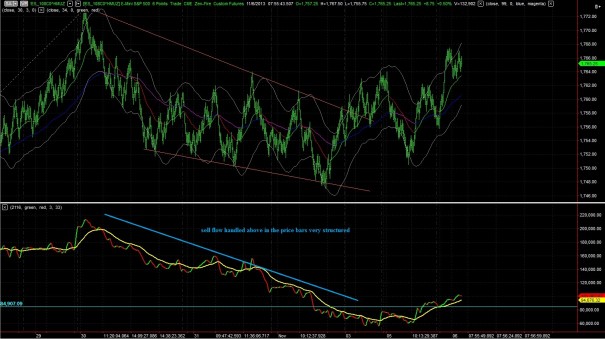

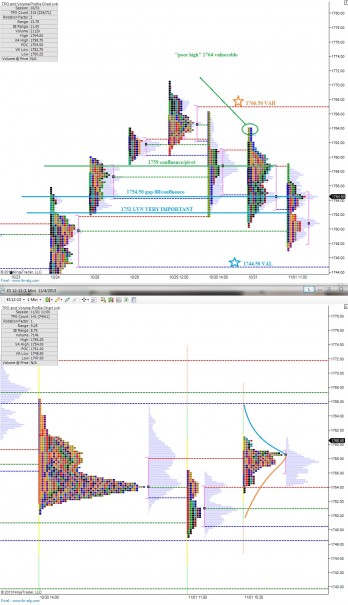

Taking a look at the longer term via value migration, you can see the relative strength of the NASDAQ verses the S&P:

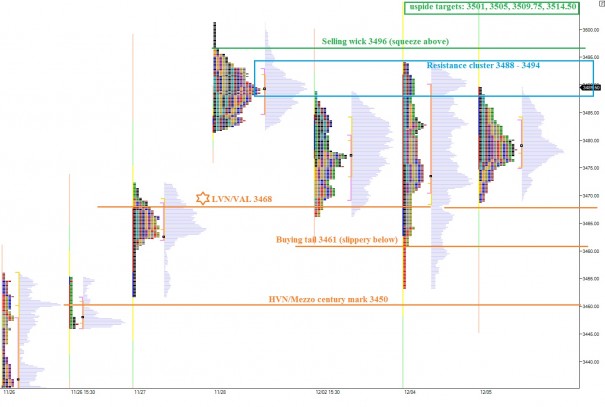

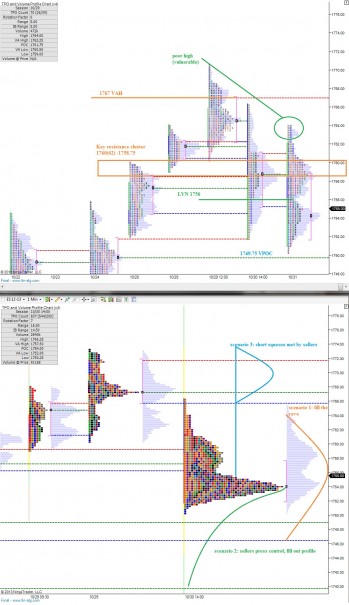

Early on we have employment data which may better set the tone for our session, but the following reference points will still be relevant in determining whether the market is breaking out of balance to the upside or the downside:

Comments »