NASDAQ futures are coming into Friday with a slight gap down after an overnight session featuring normal range and volume. Price was contained to the upper half of Thursday’s range during extended trade. At 8:30am Consumer Price Index and Advance Retail Sales data both came out worse than expected.

Also on the docket today we have the preliminary May reading of Confidence by the University of Michigan at 10am followed by the Baker Hughes rig count at 1pm.

Yesterday we printed a neutral extreme up. The day began with a gap down and sellers pushing down near the Monday/weekly lows. Down here, in the late morning, the market found a responsive bid. We spent the rest of the day rallying, with price stalling just 1-tick shy of the overnight gap.

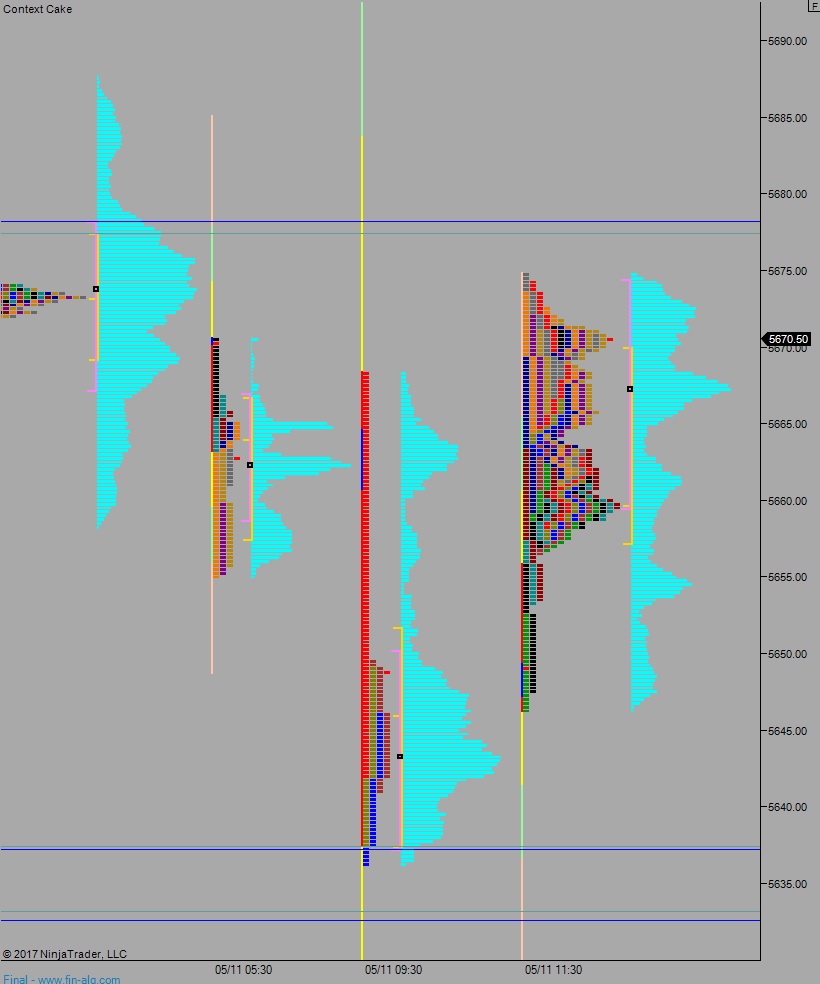

Heading into today my primary expectation is for buyers to work into the overnight inventory and take out overnight high 5672.50 then continue higher to close the gap at 5675. Look for sellers up at 5677.25 and two way trade to ensue.

Hypo 2 stronger buyers press to new weekly high, up to 5688.50 then sustain trade above it, setting up a rally into the weekend.

Hypo 3 sellers work down through overnight low 5656.50 triggering a liquidation down to 5637.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: