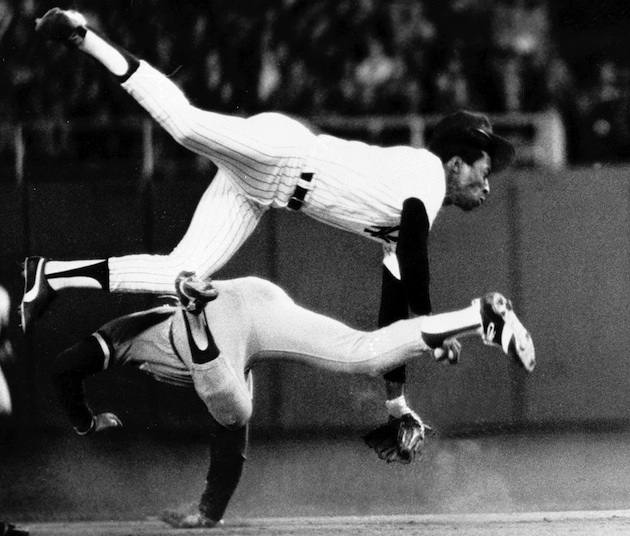

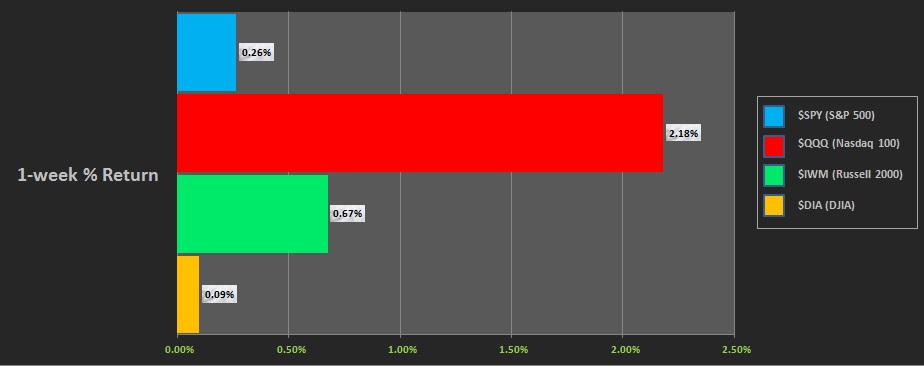

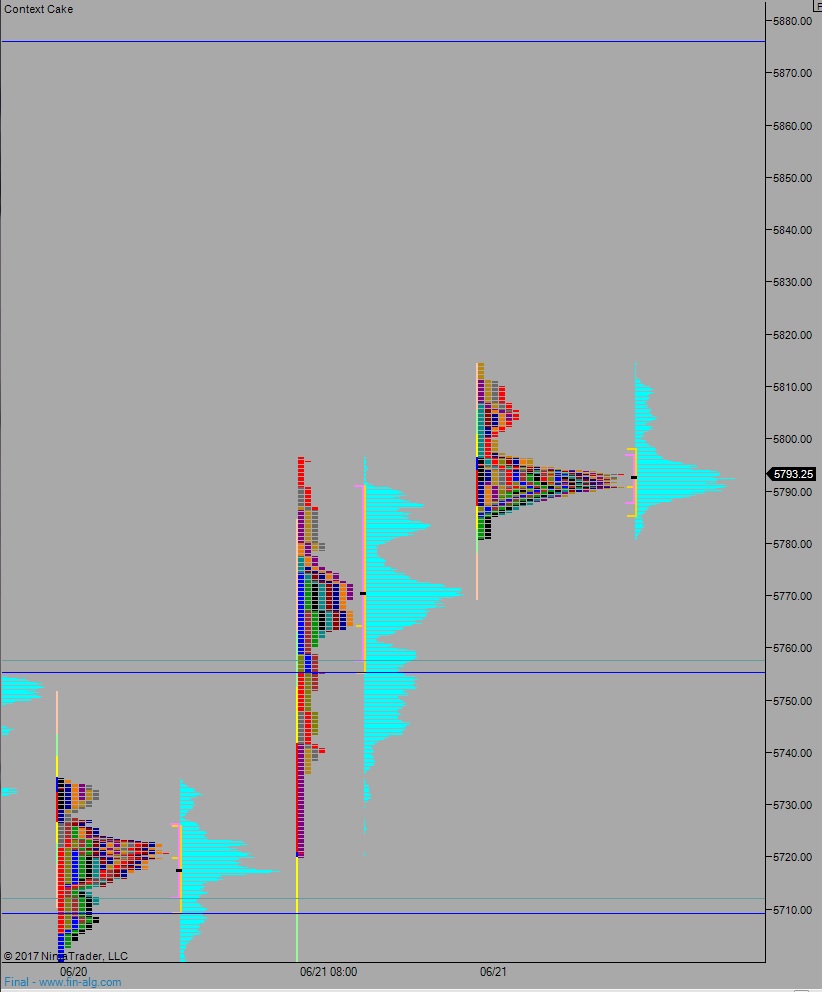

NASDAQ futures are coming into Friday flat after an overnight session featuring elevated range and volume. Price held the Thursday range overnight during a balanced session. At 8:30am, Personal Consumption Expenditure data was in-line with expectations.

Also on the economic agenda today we have Chicago purchasing manager at 9:45am and the final June reading of U. of Michigan Confidence at 10am.

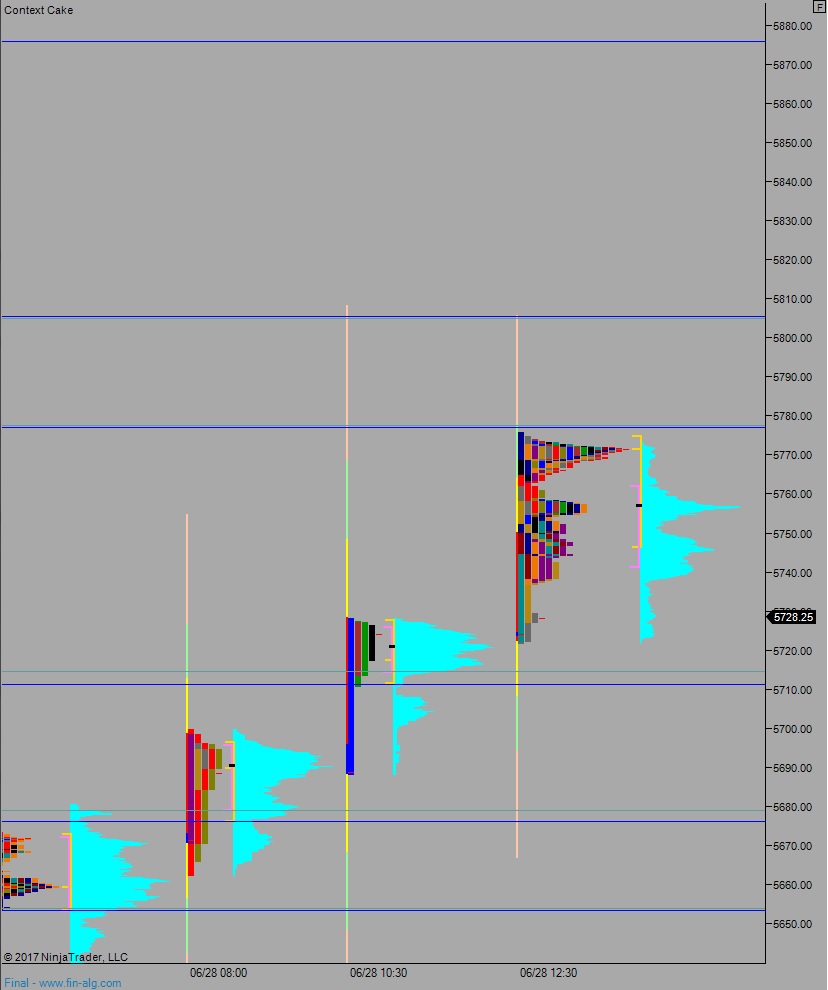

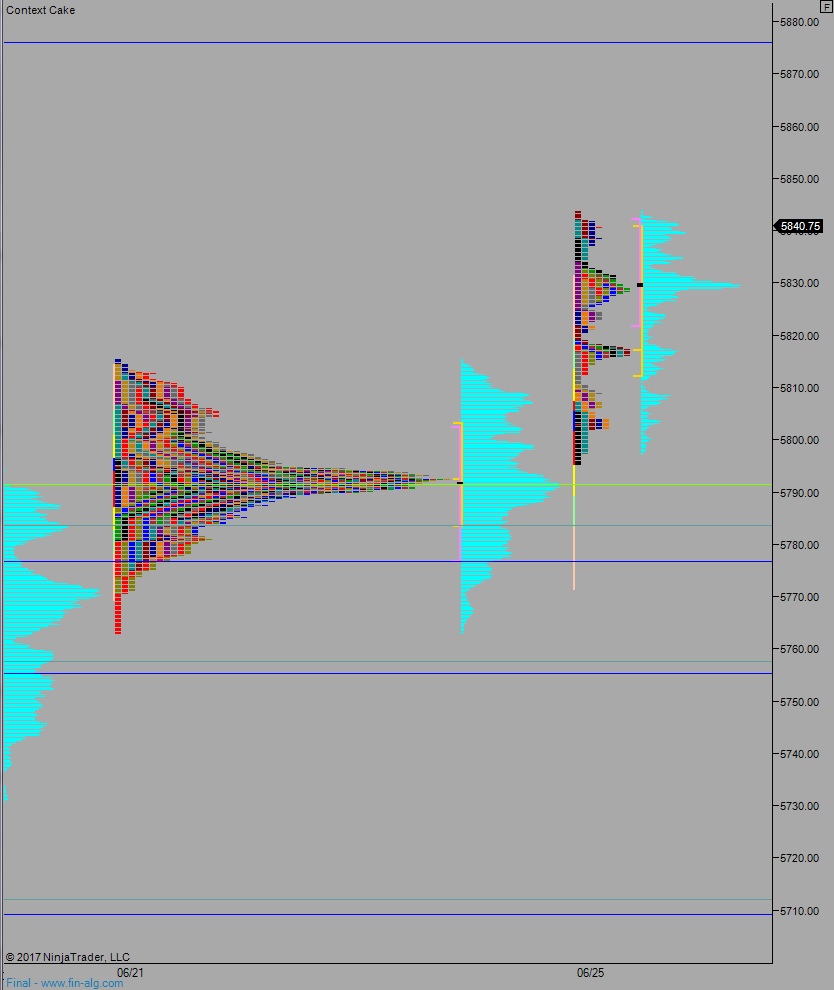

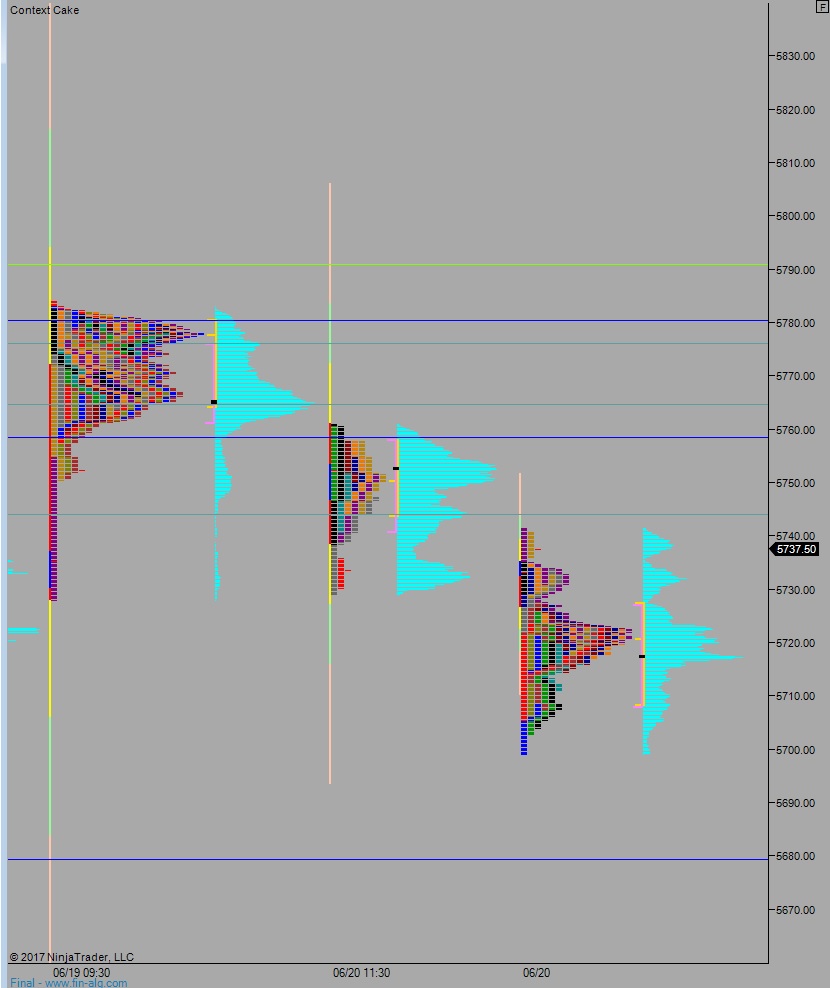

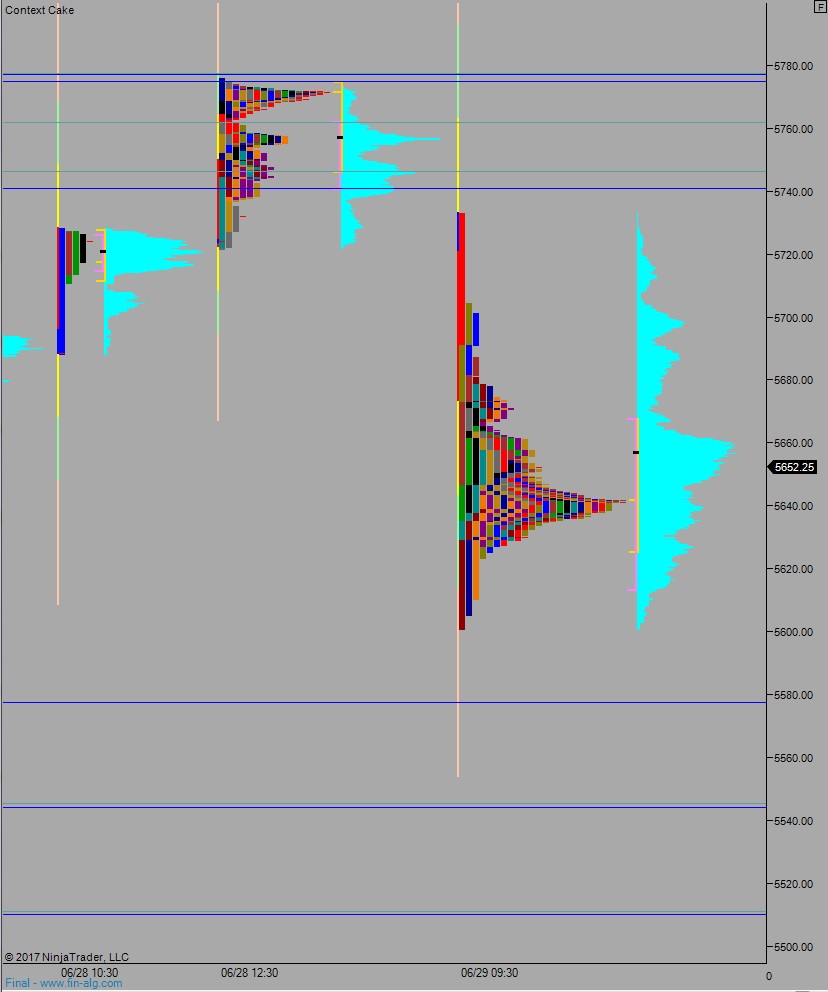

Yesterday we printed a double distribution trend down. The day began with a gap down and drive lover. This continued well through lunchtime. Responsive buyers stepped in and defended ahead of May 18th lows and we worked back to the daily midpoint by the close of trade.

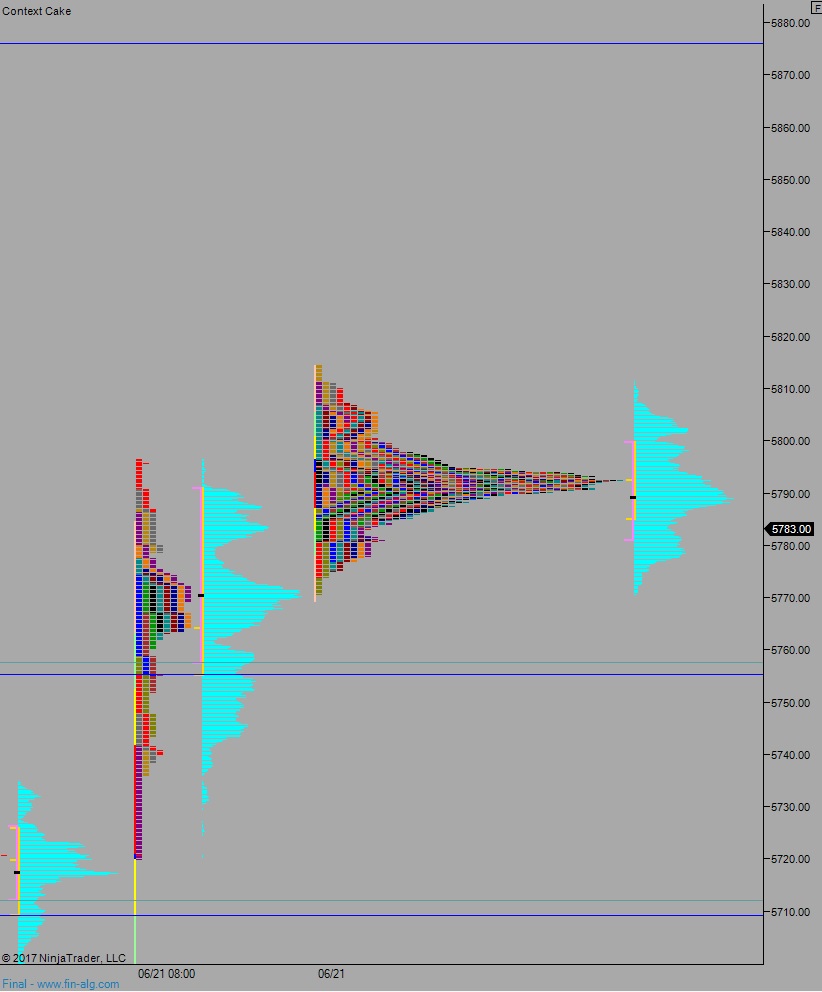

Heading into today my primary expectation is for sellers to work down through overnight low 5623.50 and test below the Thursday low 5601. Look for buyers down at 5577 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 5681 and continue higher, up to 5700 before two way trade ensues.

Hypo 3 chop, contained trade between about 5680 and 5620. Drift into the holiday.

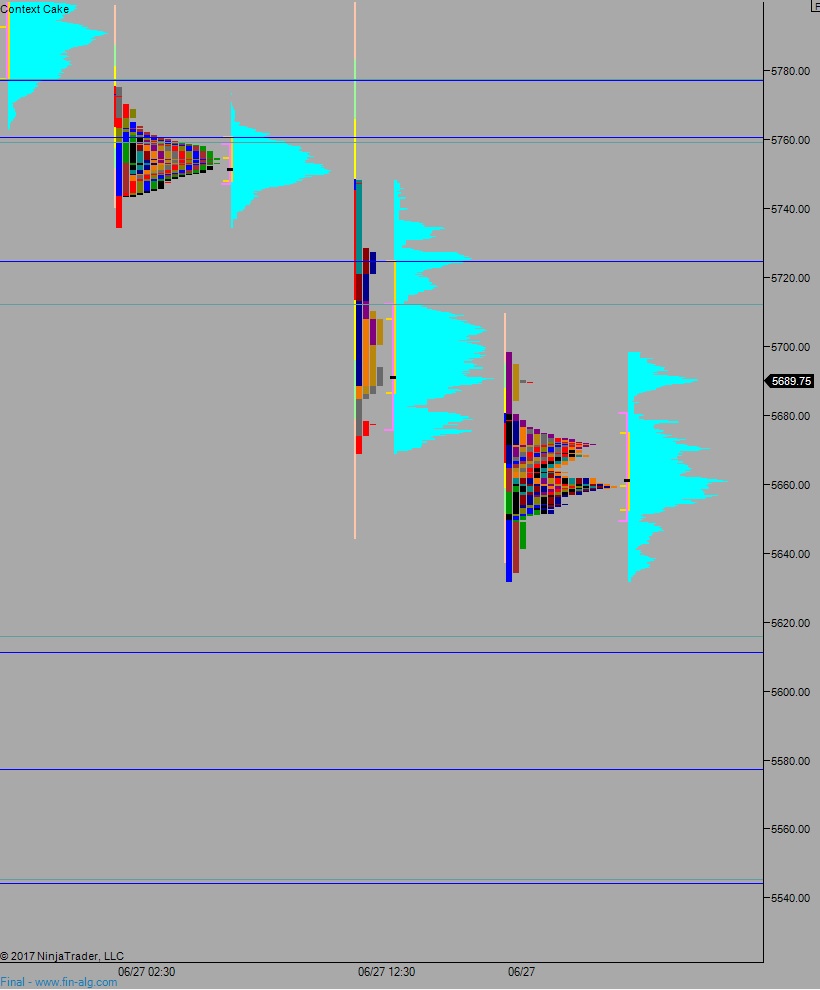

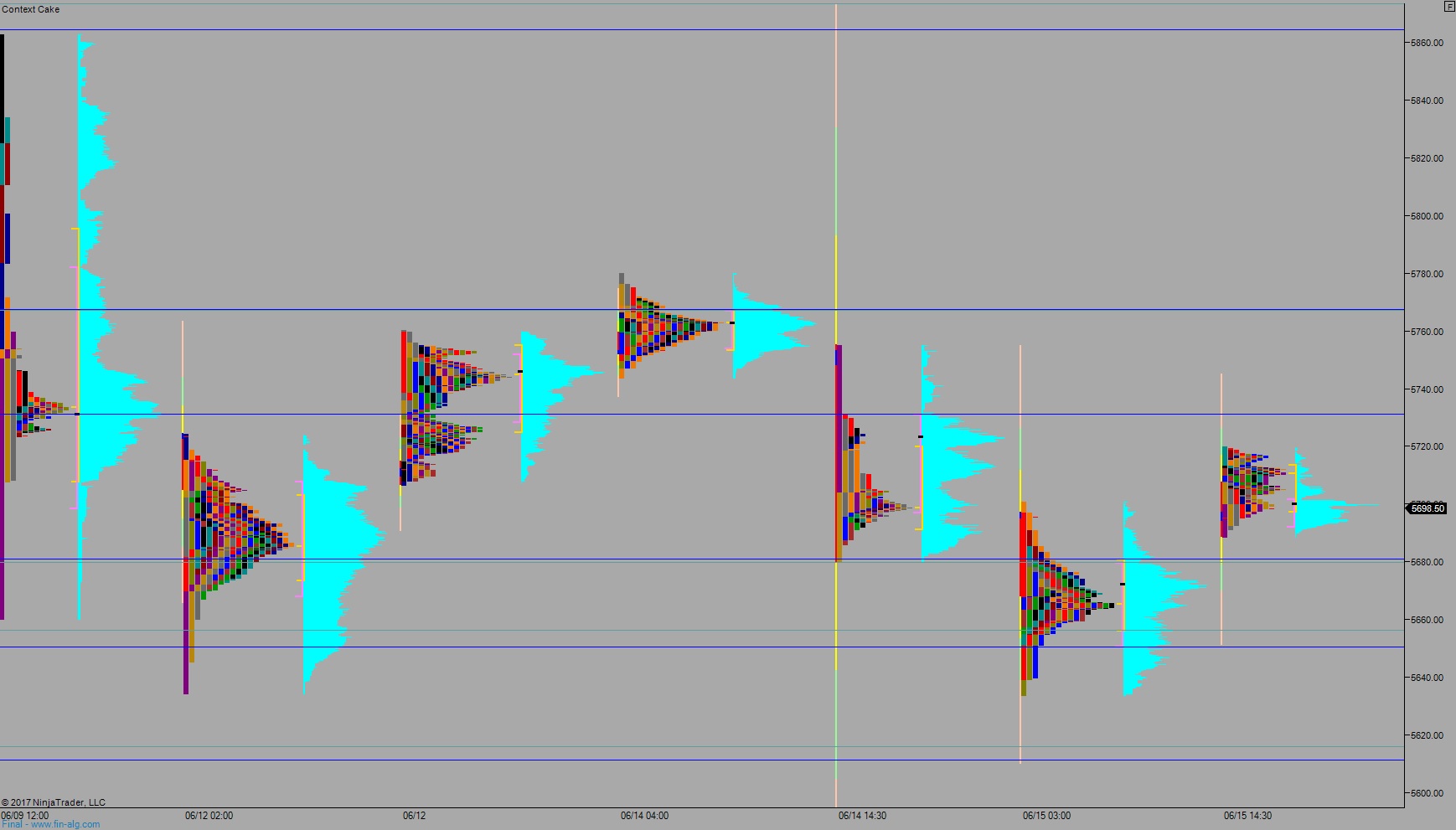

Levels:

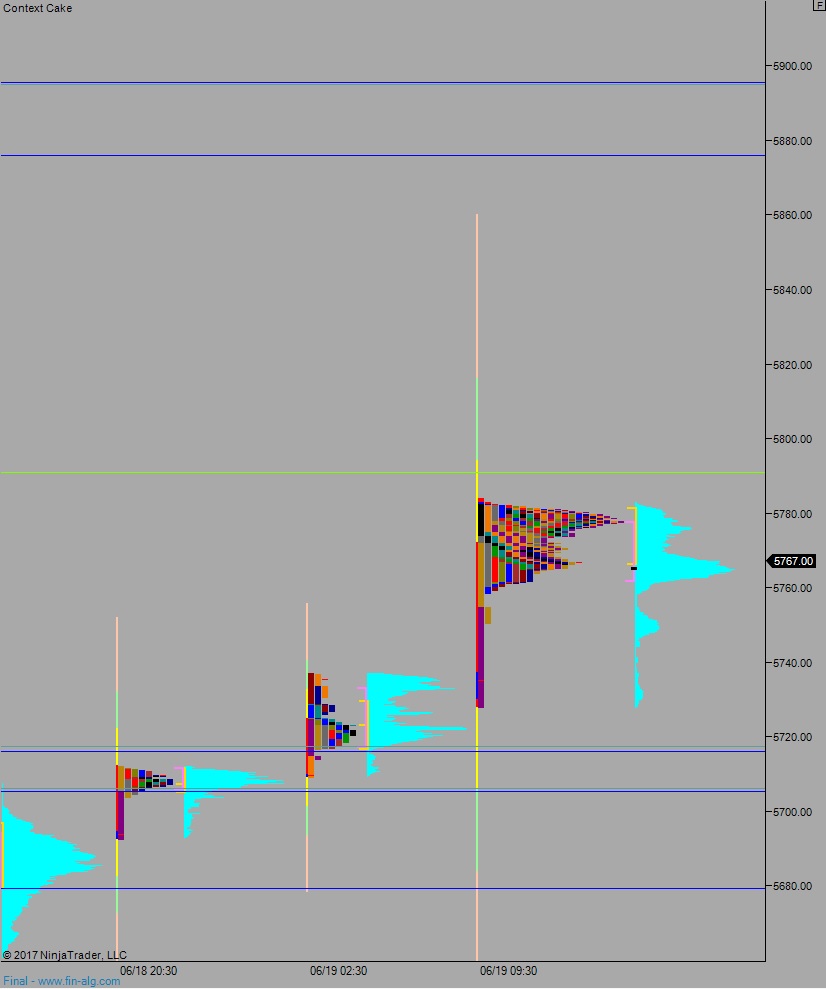

Volume profiles, gaps, and measured moves: