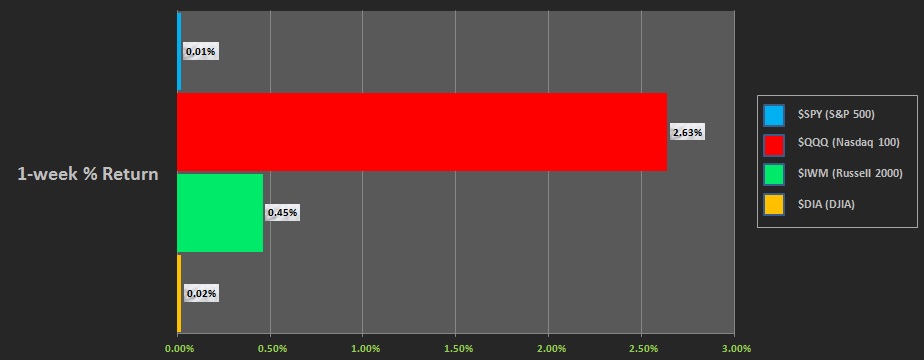

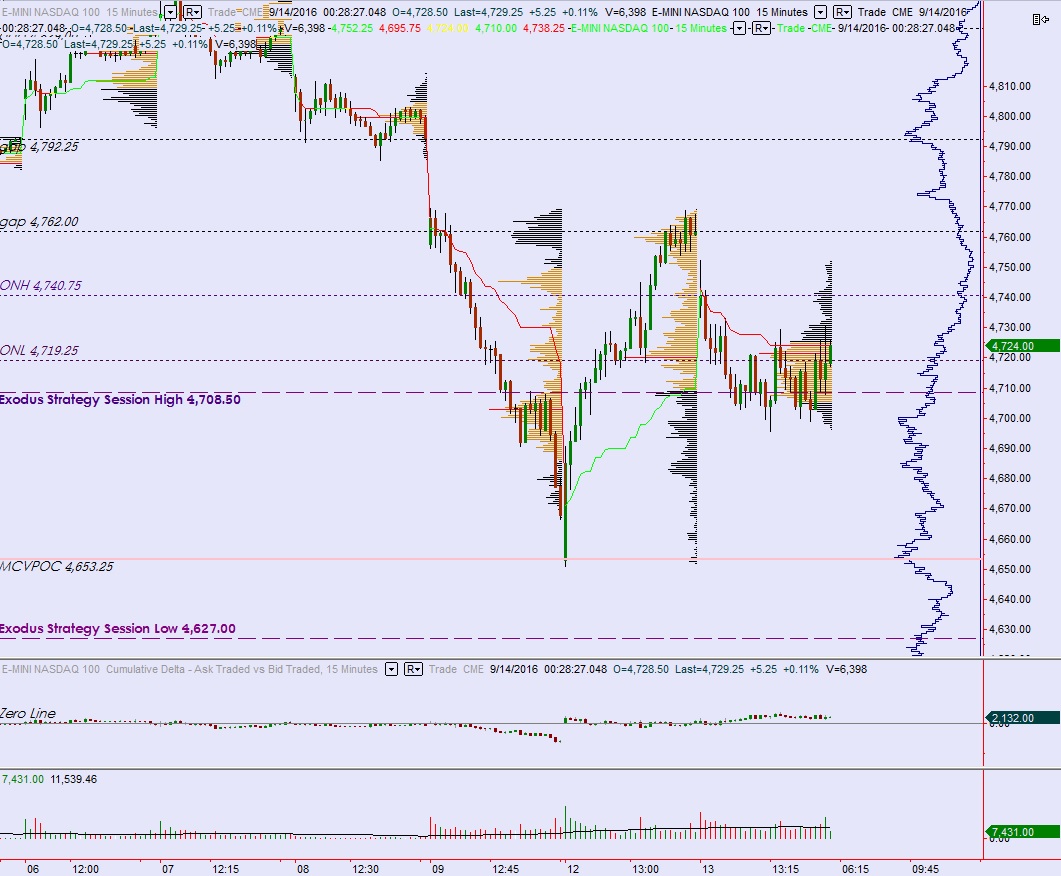

NASDAQ futures are coming into Thursday gap up after an overnight session featuring normal range and volume. Price has worked higher since 2am, rapidly at times, and managed to print a new all-time high price. At 8:30am Initial/Continuing jobless claims data came out better than expected.

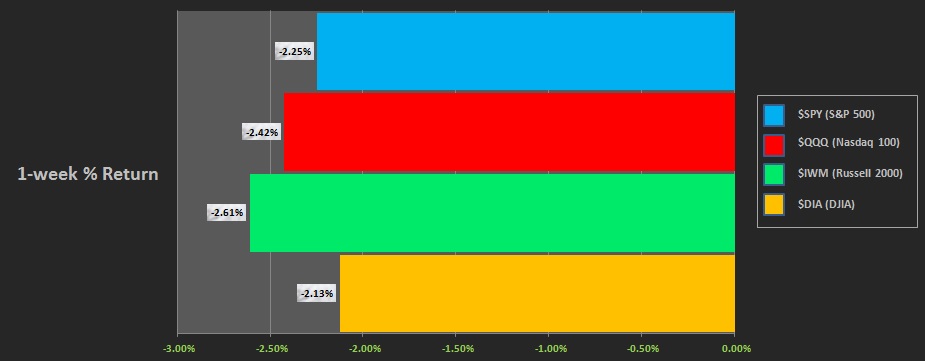

But most investors were concerned with yesterday’s FOMC decision. Yesterday the Fed left their key interest rate unchanged and hinted of a rate hike by year end. The event sent markets higher.

Other economic events on the docket today include Existing Home Sales at 9am, Leading Indicators at 10am, and a 10-Year TIPS auction at 1pm.

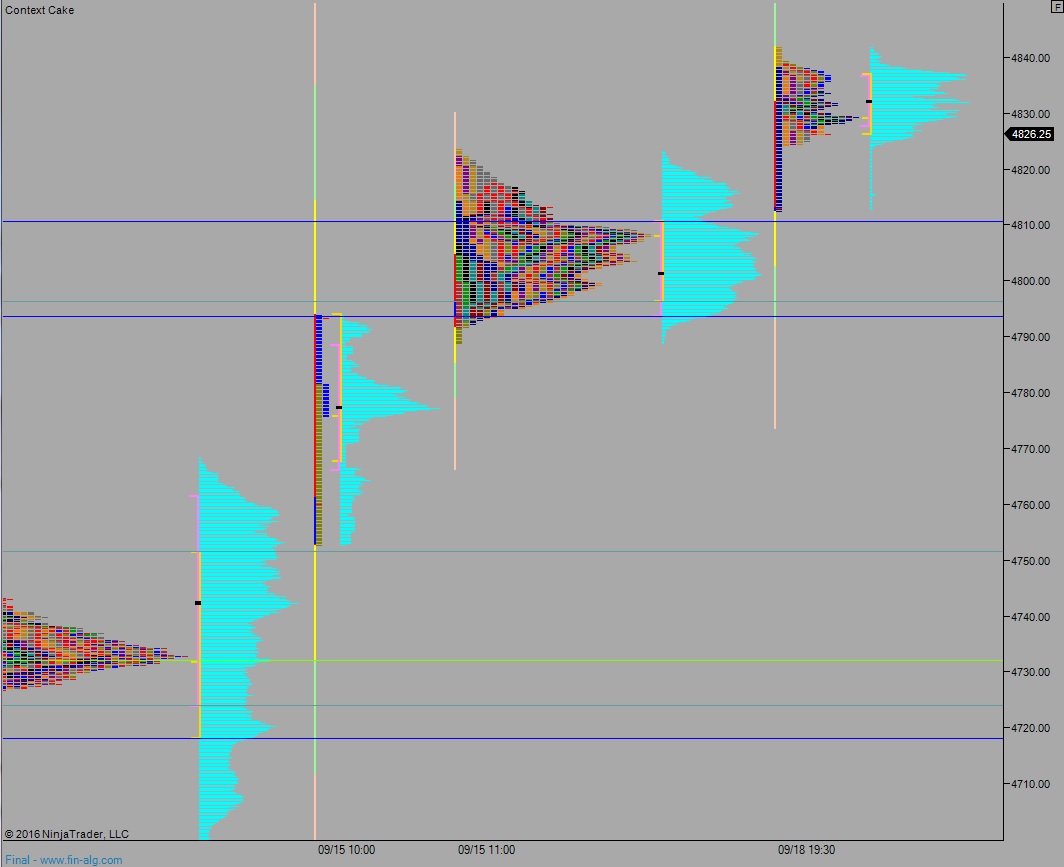

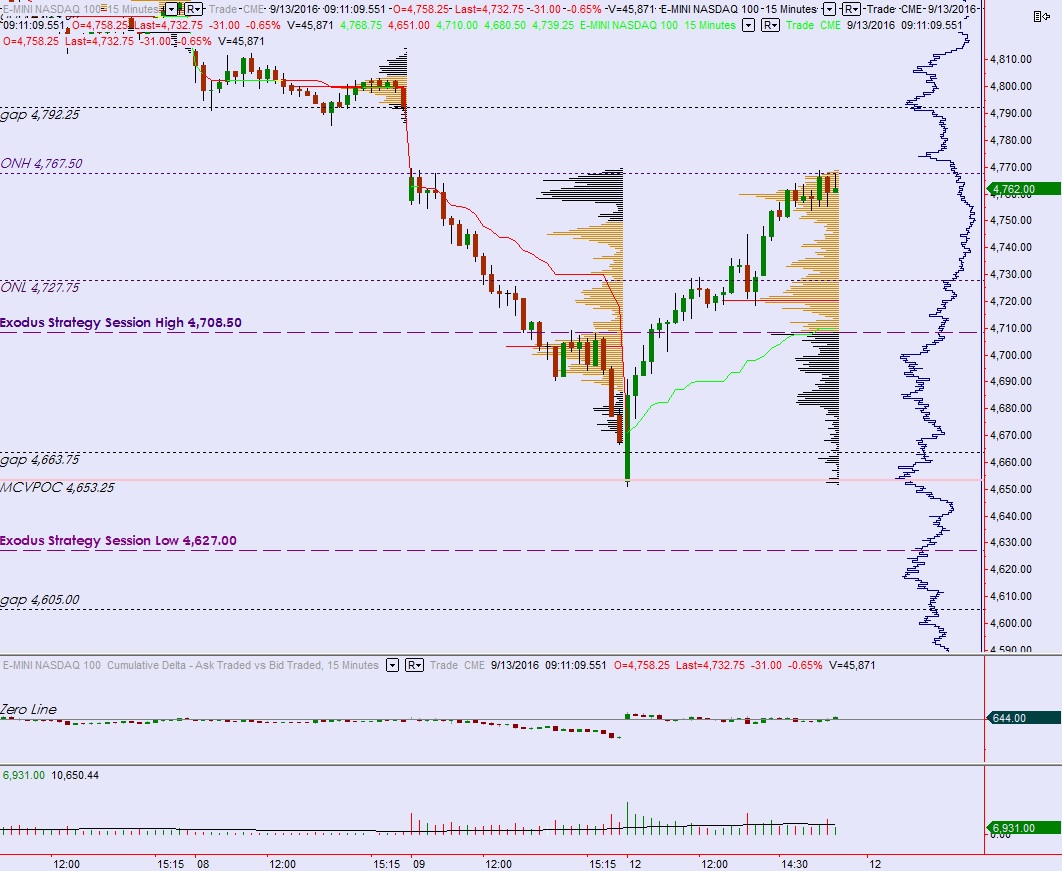

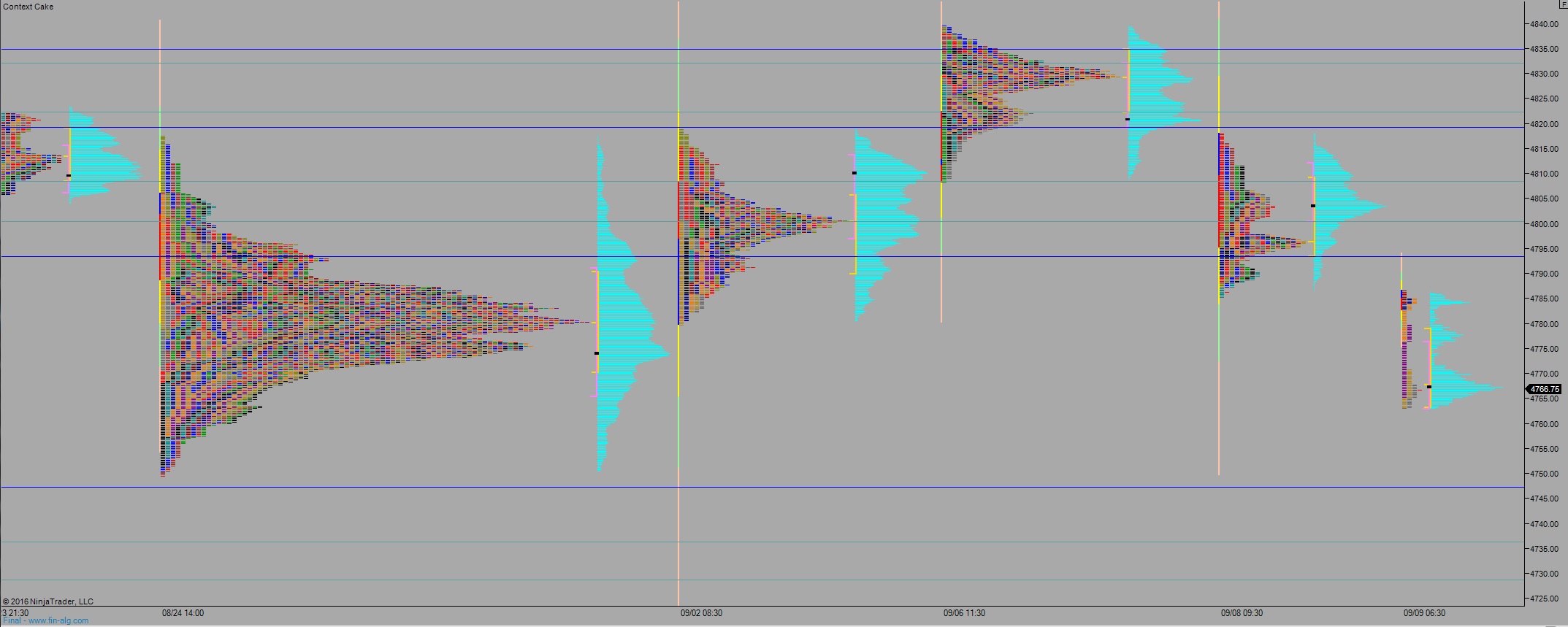

Yesterday we printed a neutral extreme up. After opening gap up and a 2-way auction sellers stepped in and close the overnight gap. They 2-ticked Tuesday’s low before the market reversed. Then, following the FOMC rate decision, third reaction analysis yielded the buy and price went trend up into the close.

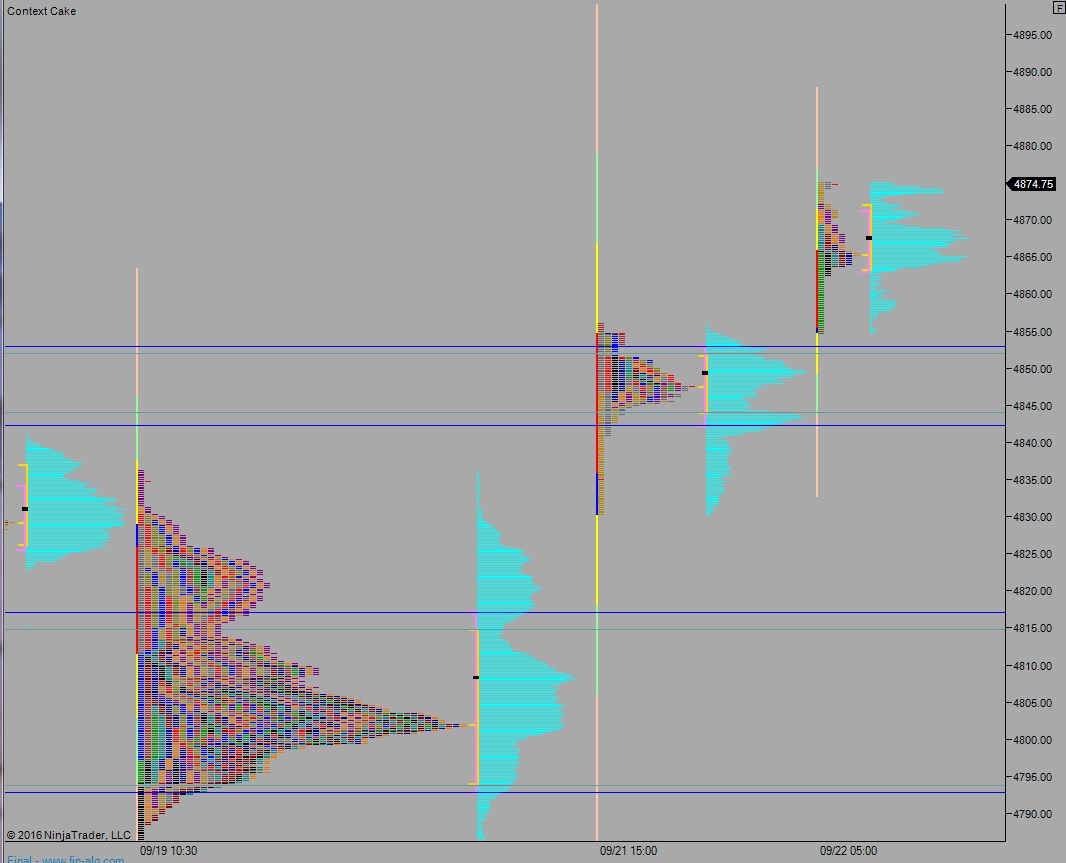

Heading into today my primary expectation is for sellers to work into the overnight inventory and work price down to 4853. Buyers step in here and we work up through overnight high 4873. Look for sellers at 4890.50 and two way trade to ensue.

Hypo 2 buyers gap and go, push up to 4890.50 and find sellers. Balance ensues up here before a secondary push which continues trending higher.

Hypo 3 sellers complete a full gap fill down to 4849.50 then take out overnight low 4842.75 before two way trade ensues.

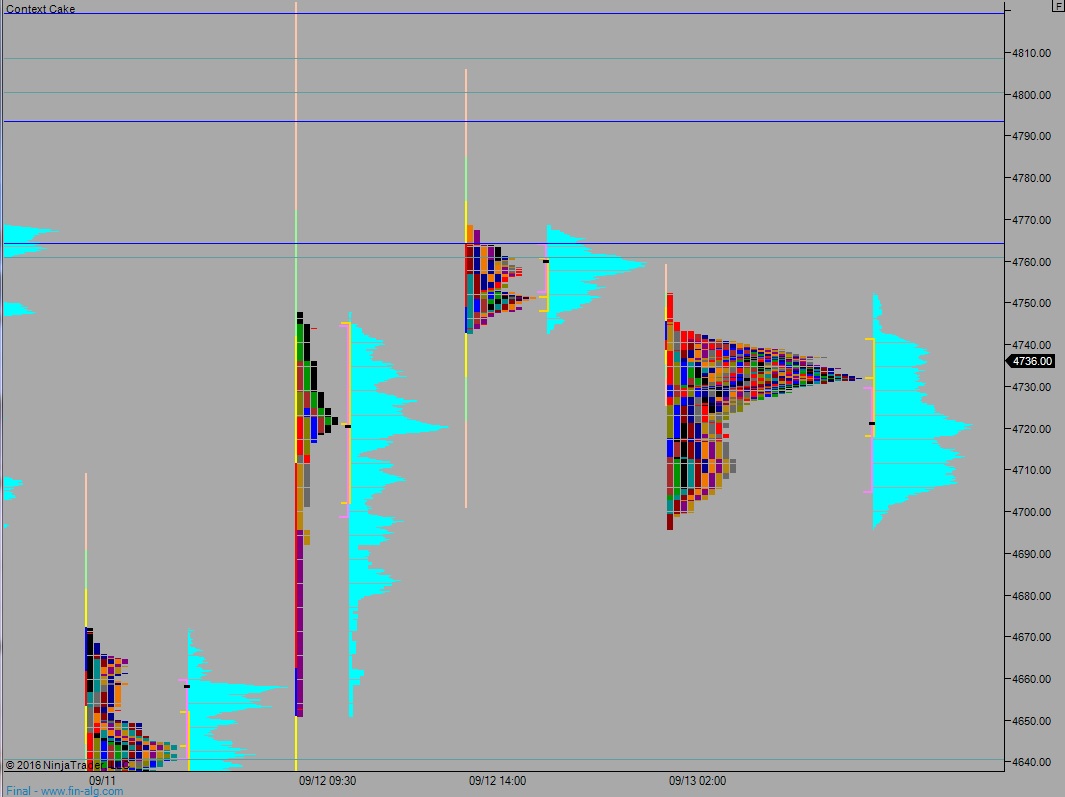

Levels:

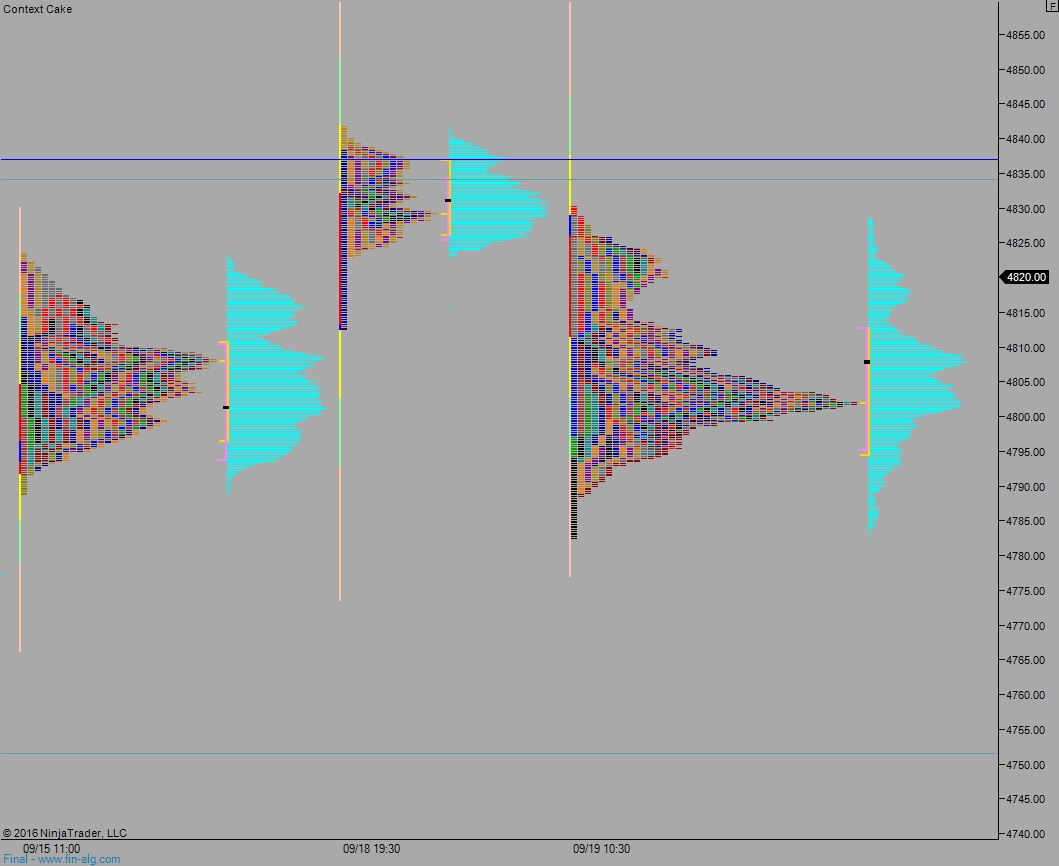

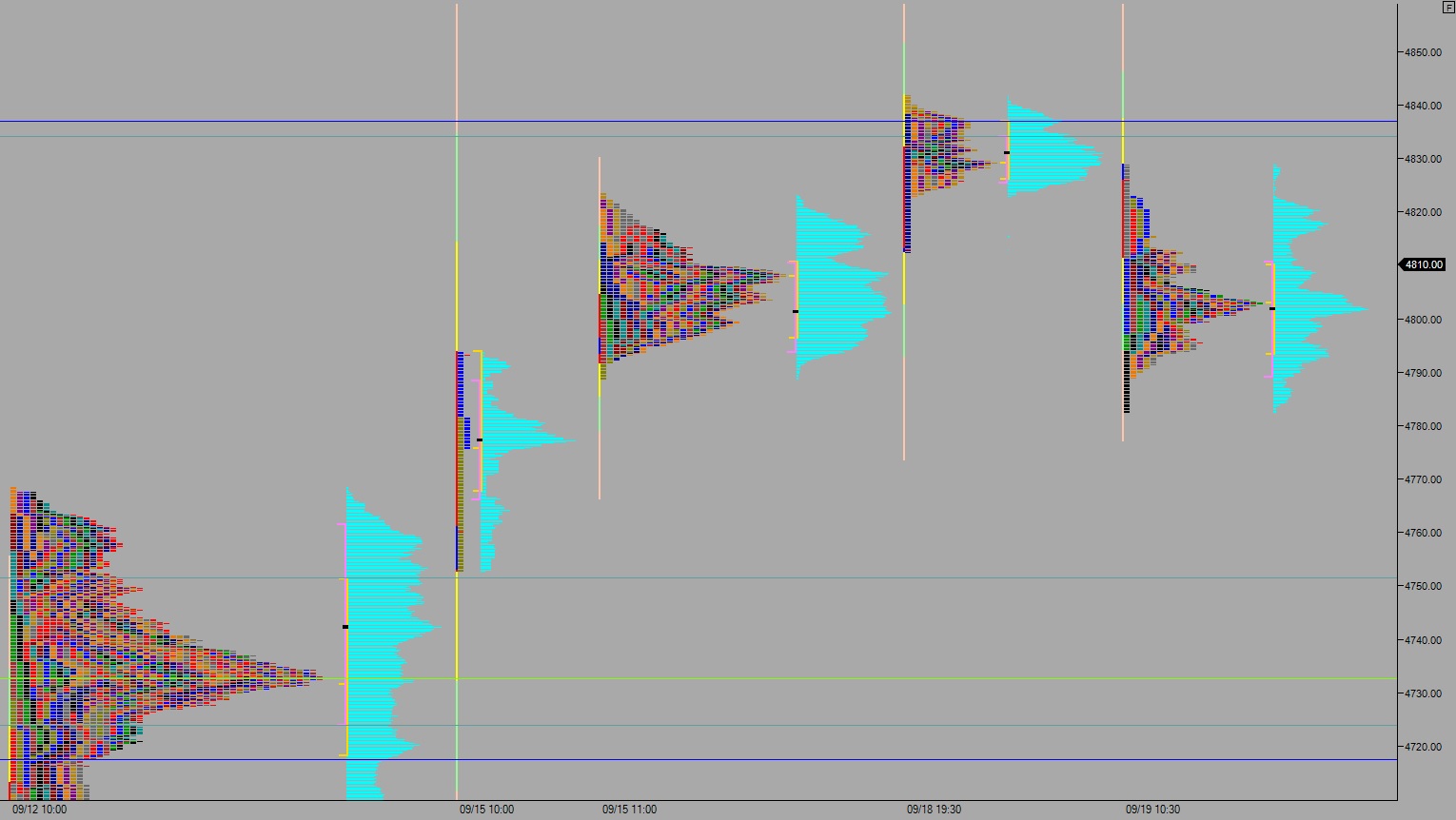

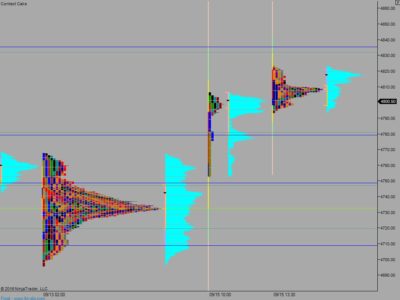

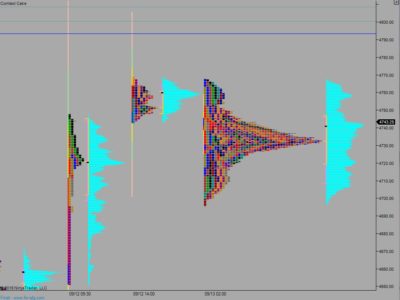

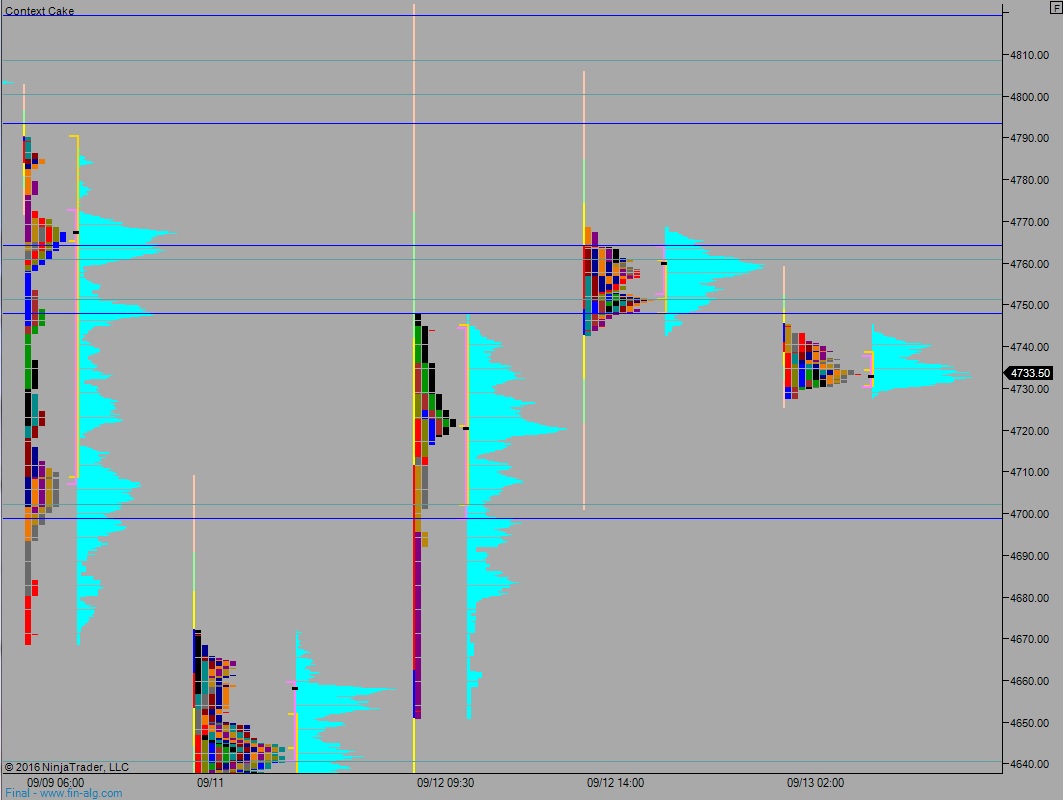

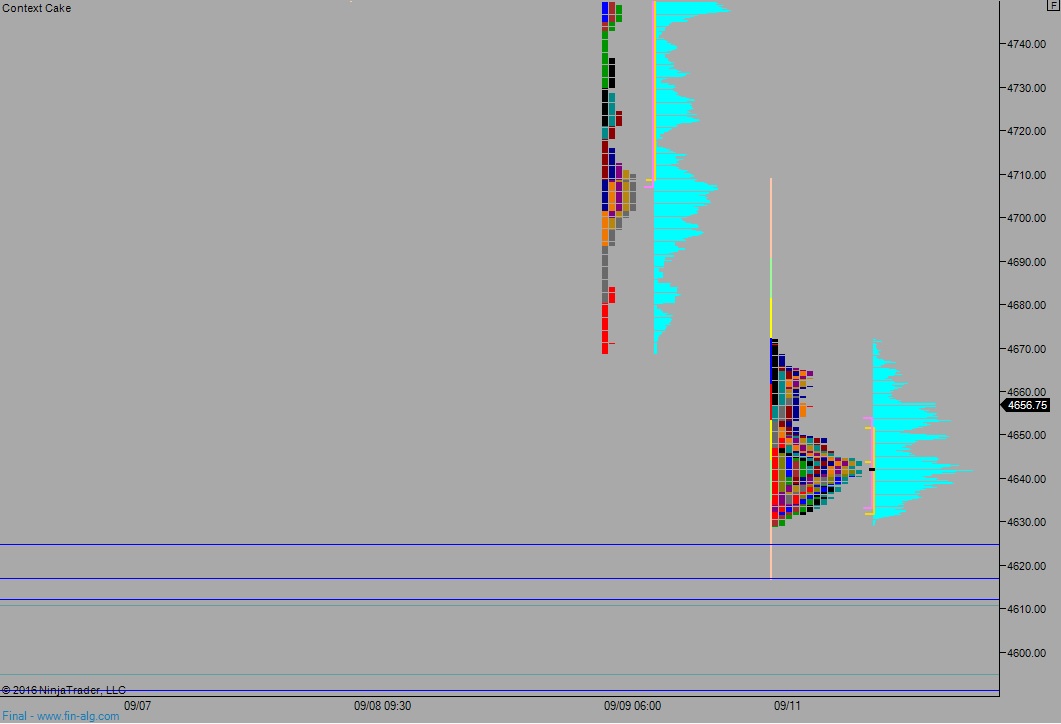

Volume profiles, gaps, and measured moves: