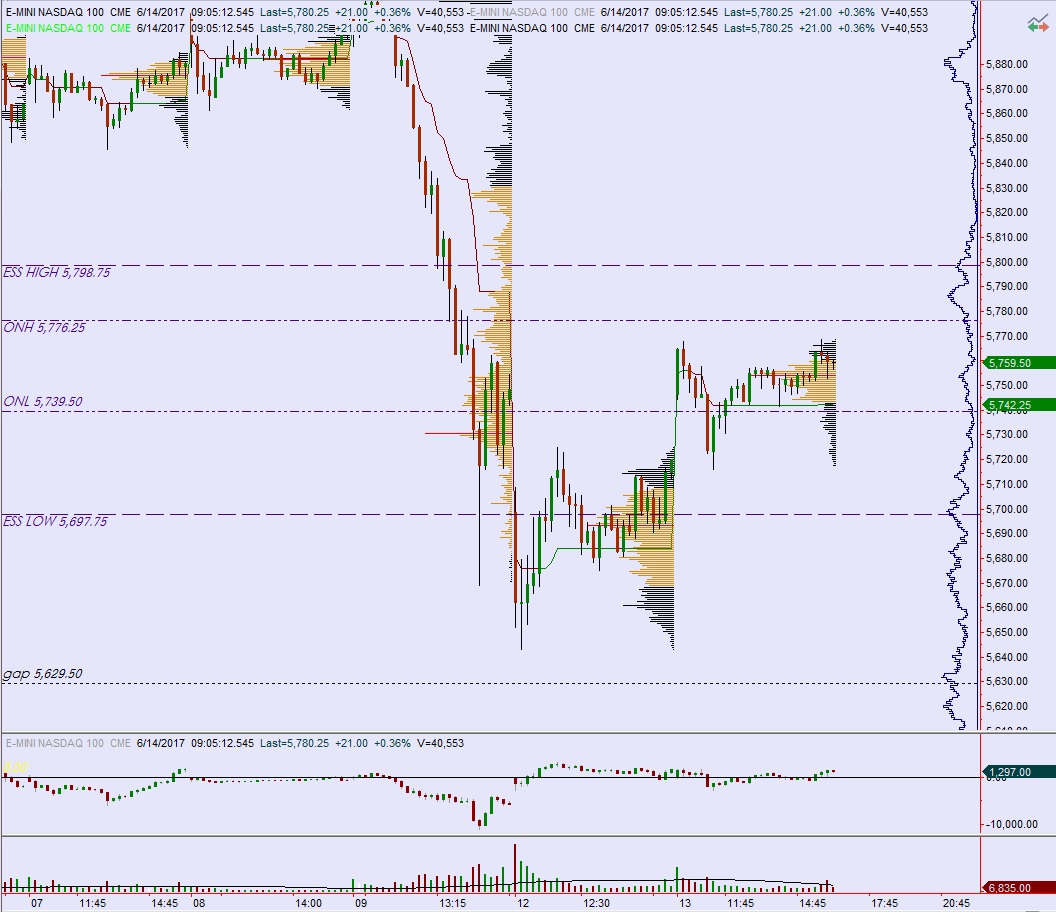

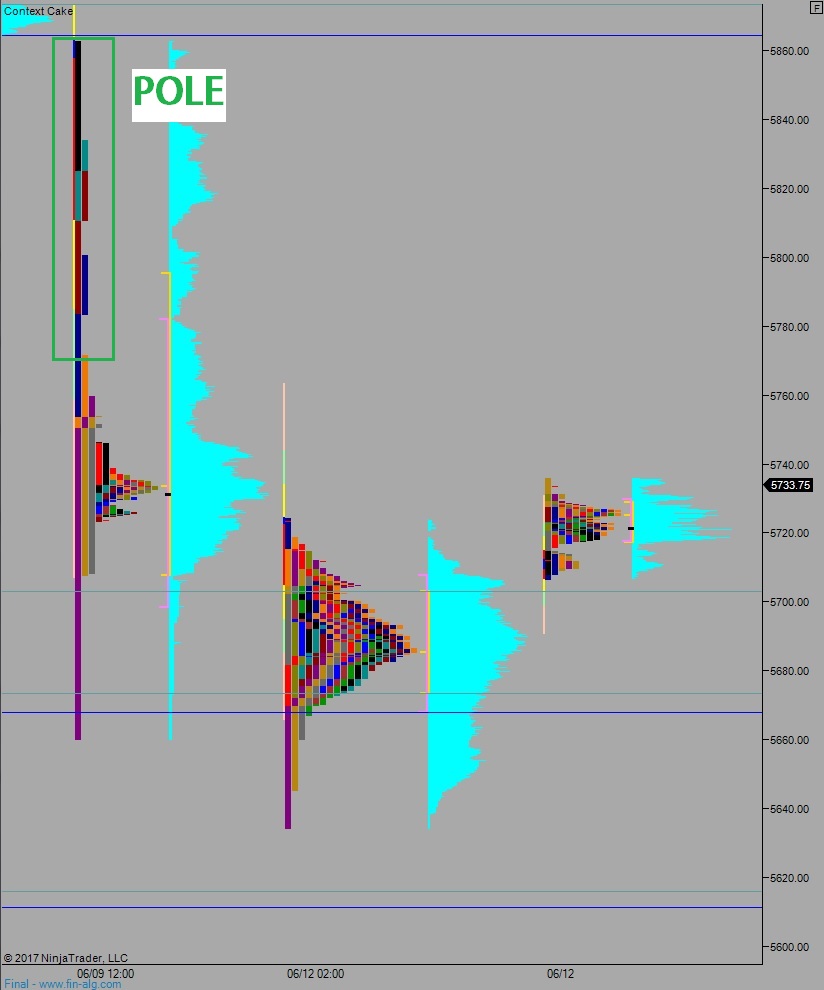

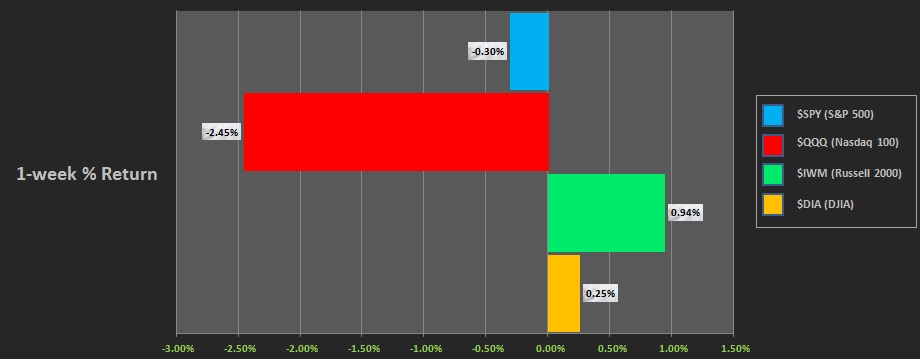

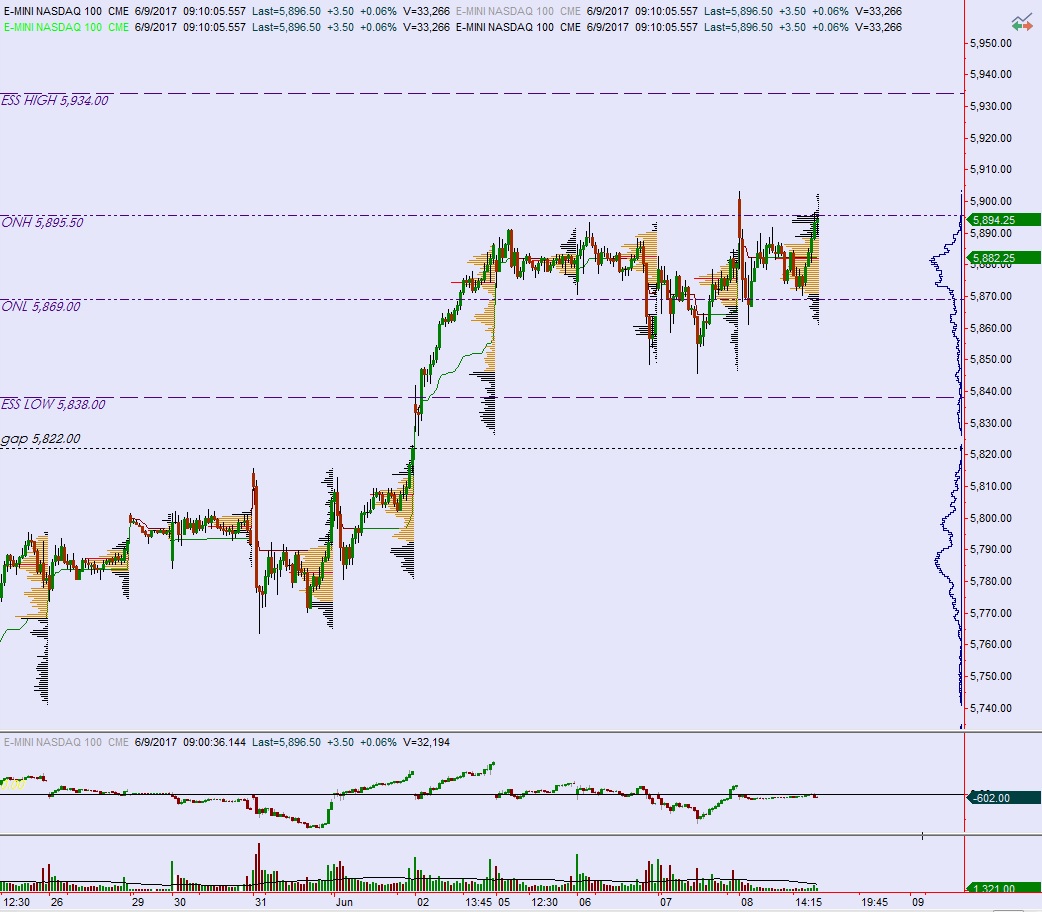

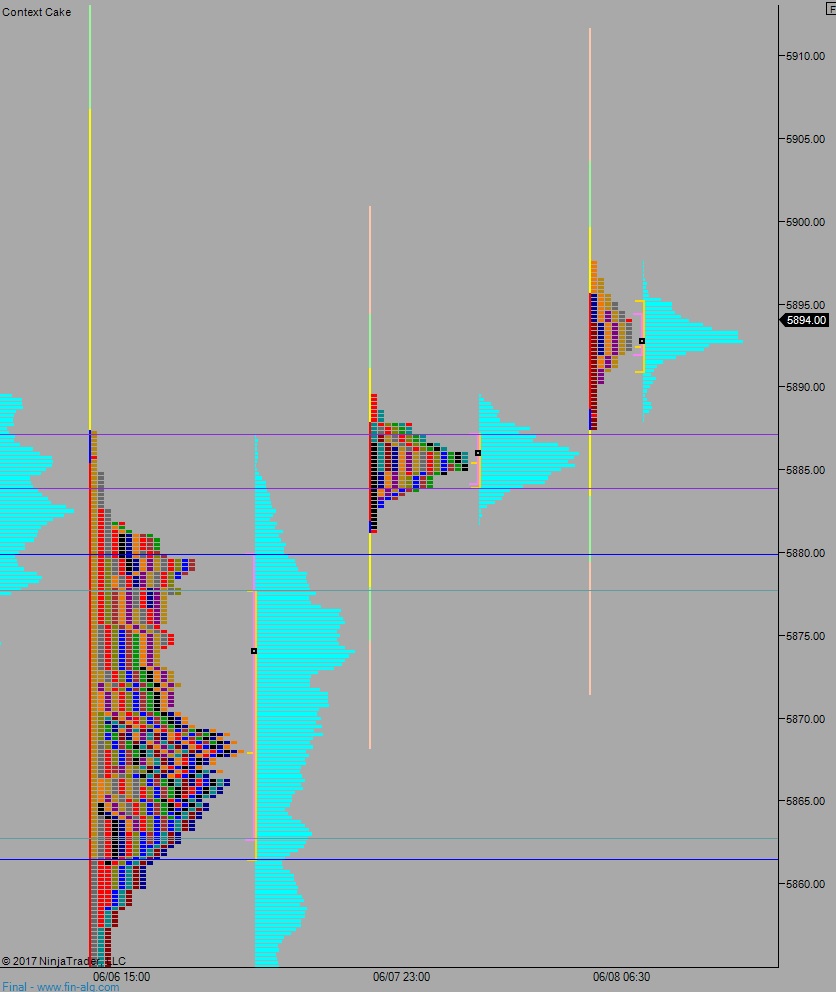

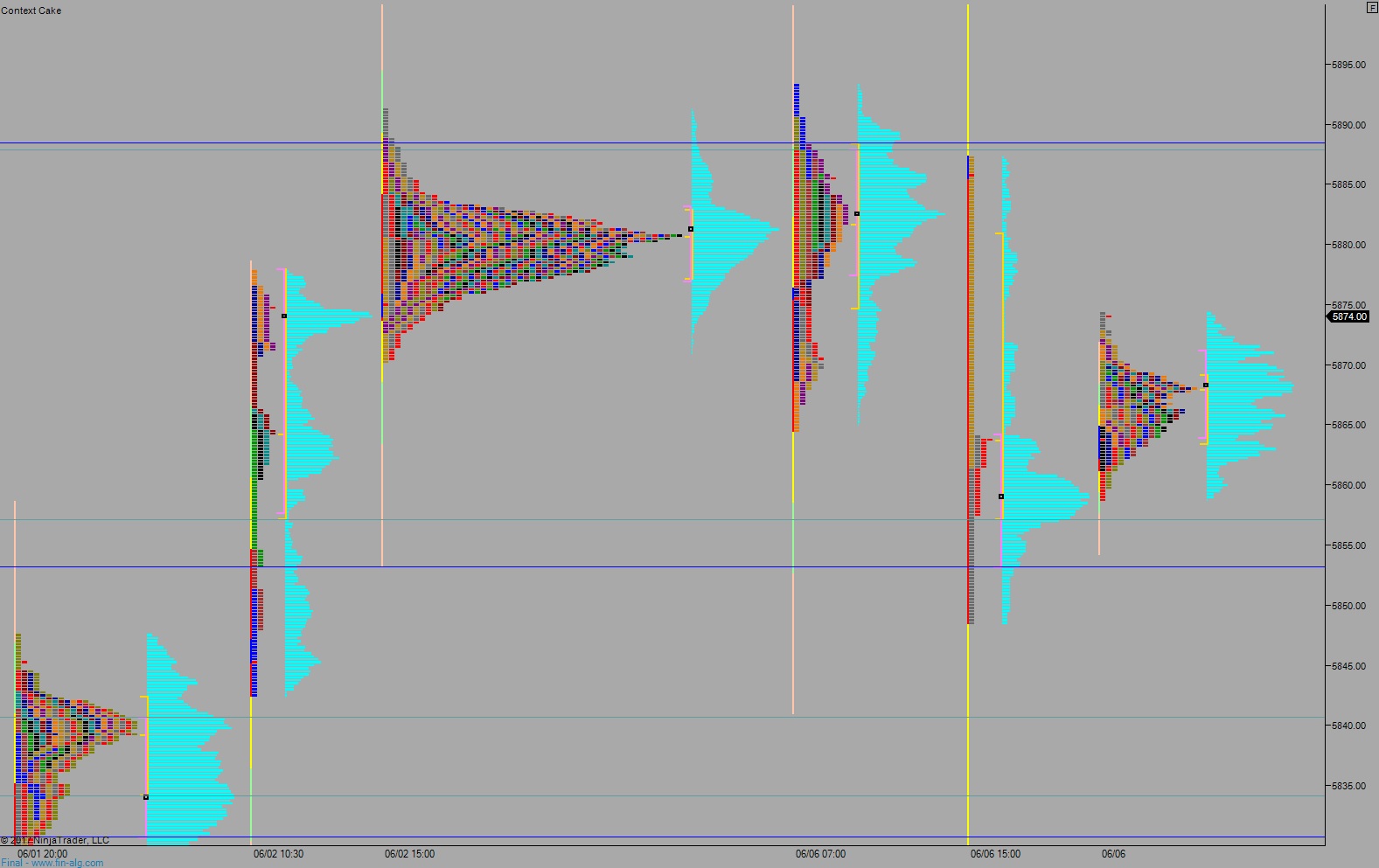

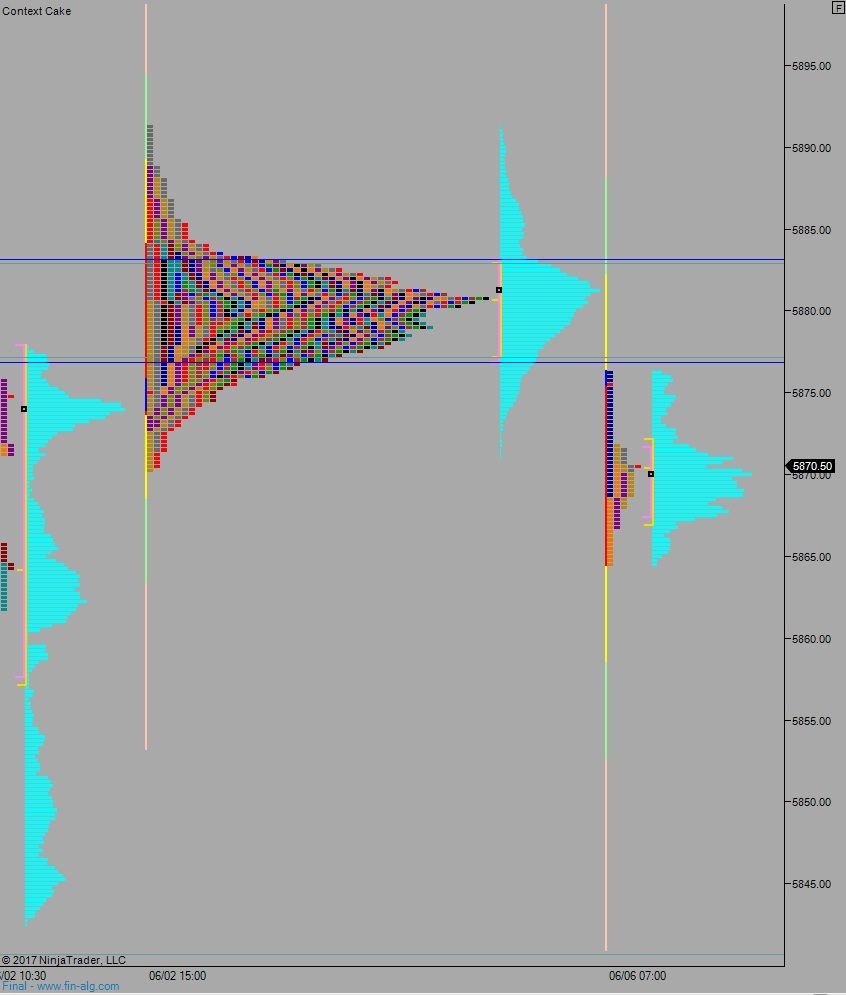

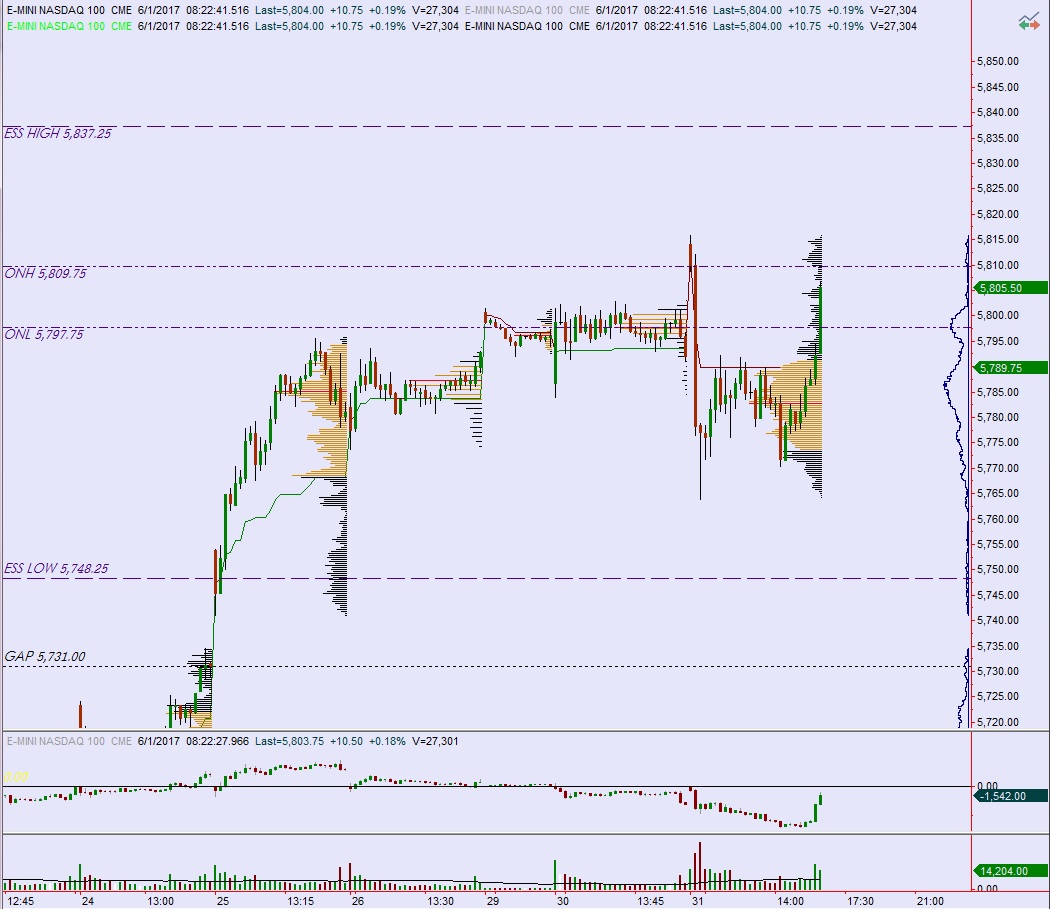

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight and has been nudging up into the ‘pole climb’ area on market profile. At 7am MBA mortgage applications came out positive but lower than last week. At 8:30am Consumer Price Index and Advance Retail Sales both came out below expectations.

Also on the economic agenda today we have Business Inventories at 10am, crude oil inventories at 10:30am, and most importantly an FOMC rate decision at 2pm.

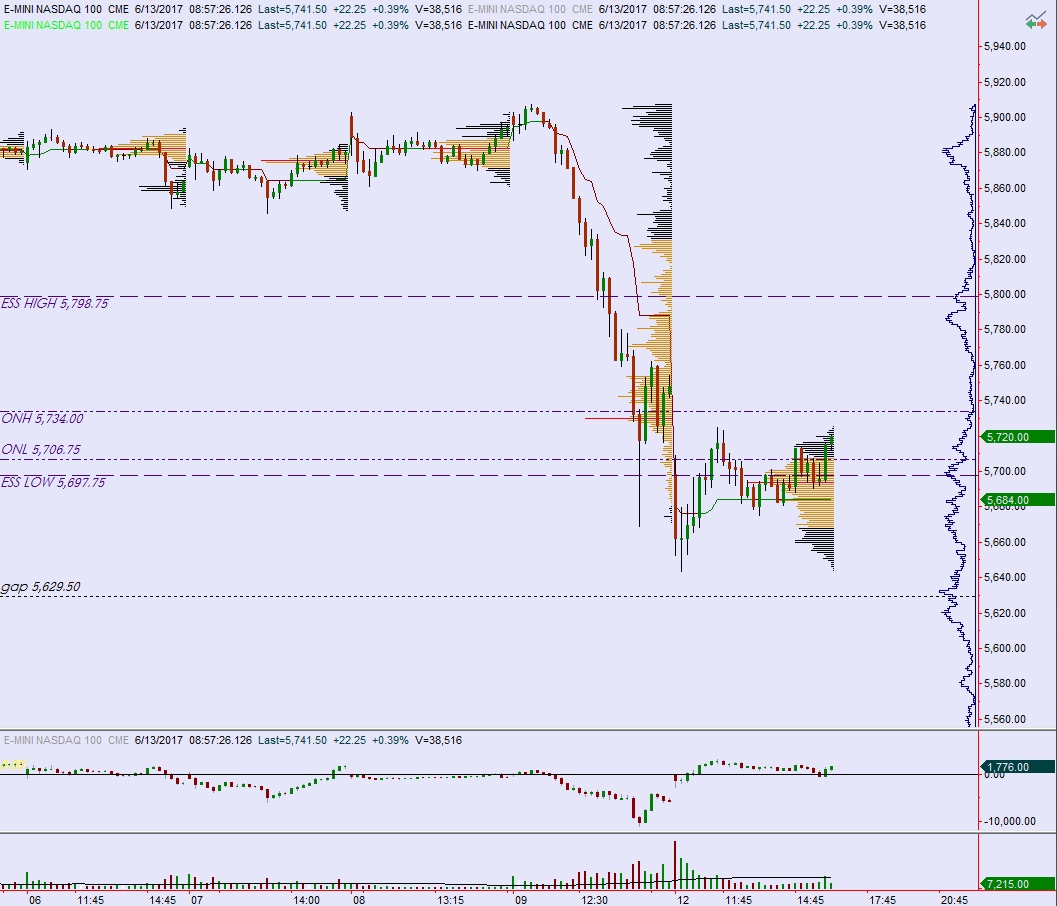

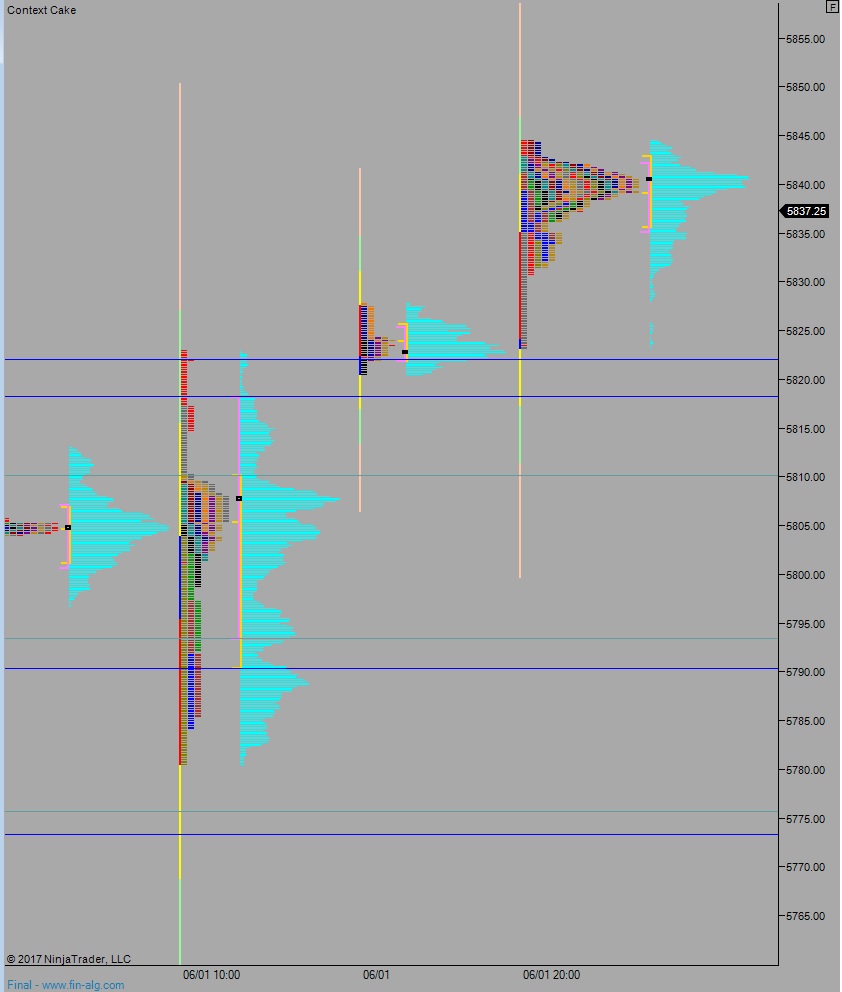

Yesterday we printed a neutral extreme up. Day began with a gap up, sellers worked into overnight inventory and closed the gap. An excess low formed, and we spent the rest of the day bidding higher, ultimately traversing the entire day’s range and closing near session high.

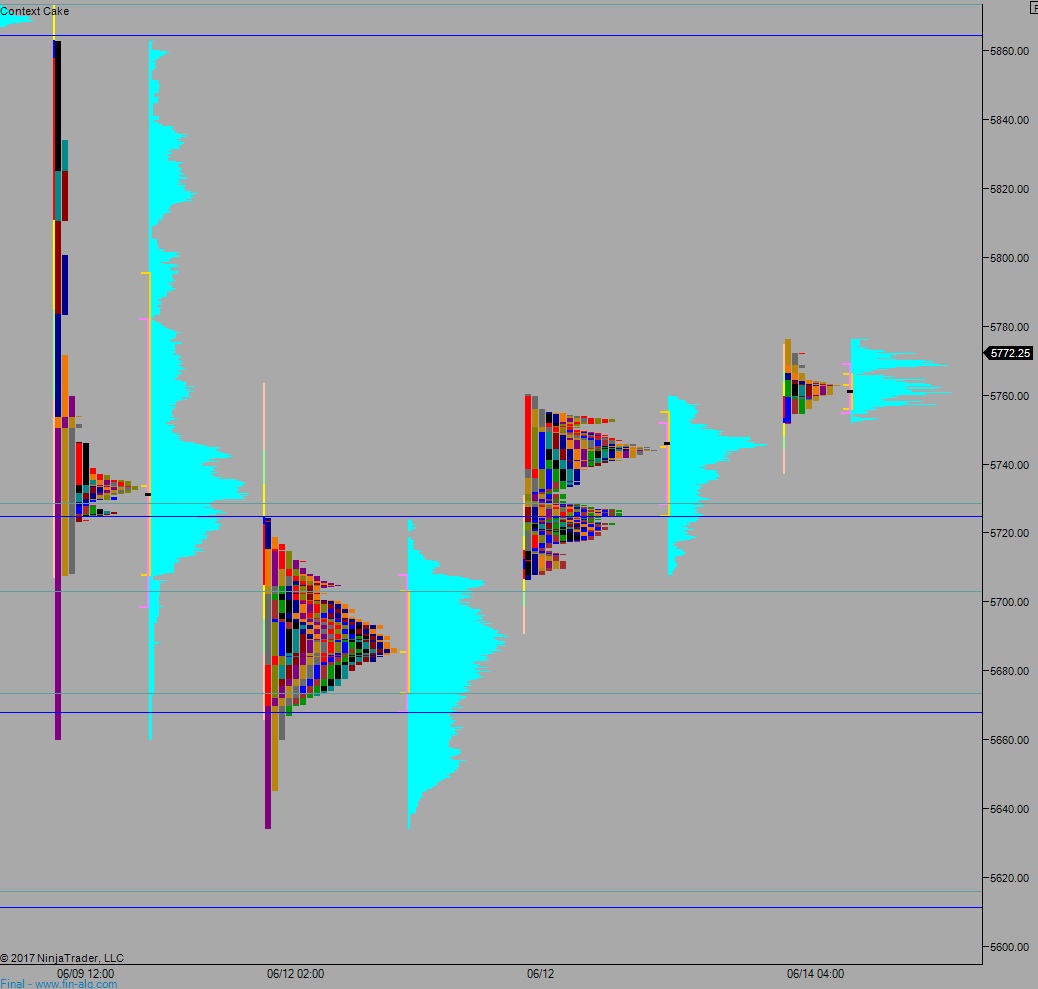

Heading into today my primary expectation is for a gap-and-go higher, up to 5800 before we pause ahead of the FOMC decision.

Hypo 2 sellers work into overnight inventory and close gap down to 5759.50 then continue down though overnight low 5739.50. Look for buyers down at 5728.75 ahead of the FOMC decision.

Hypo 3 stronger sellers press to 5703 before FOMC.

Use third reaction analysis after the FOMC decision to determine direction into the afternoon and the rest of the week.

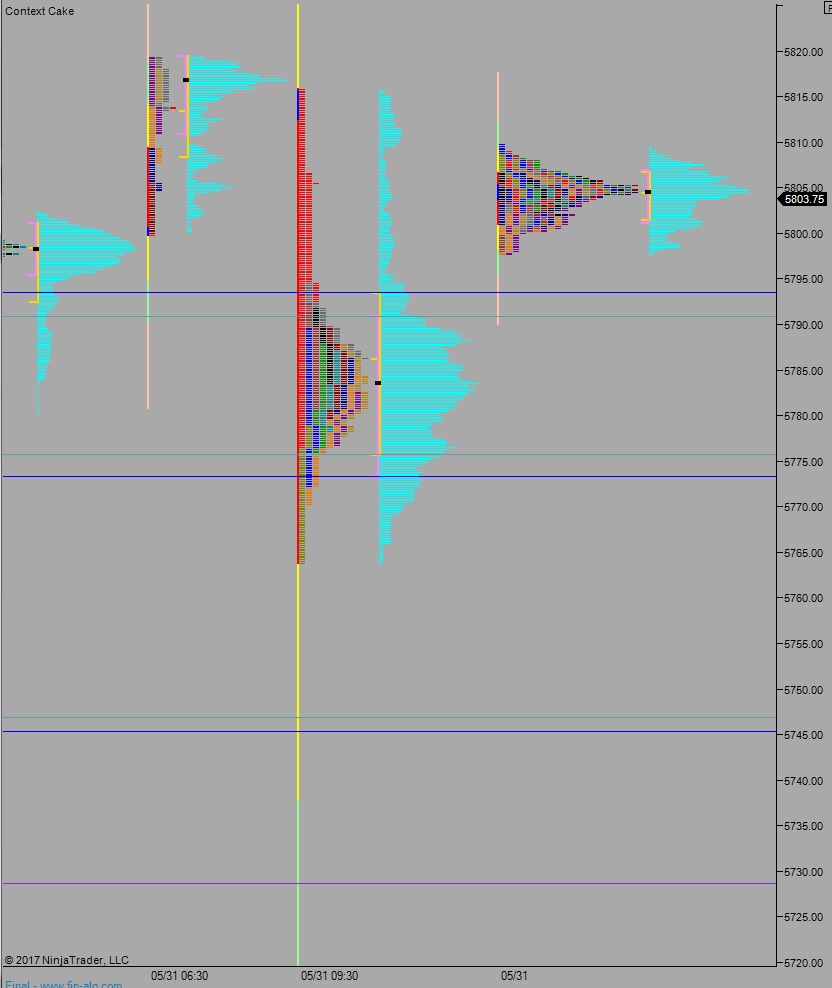

Levels:

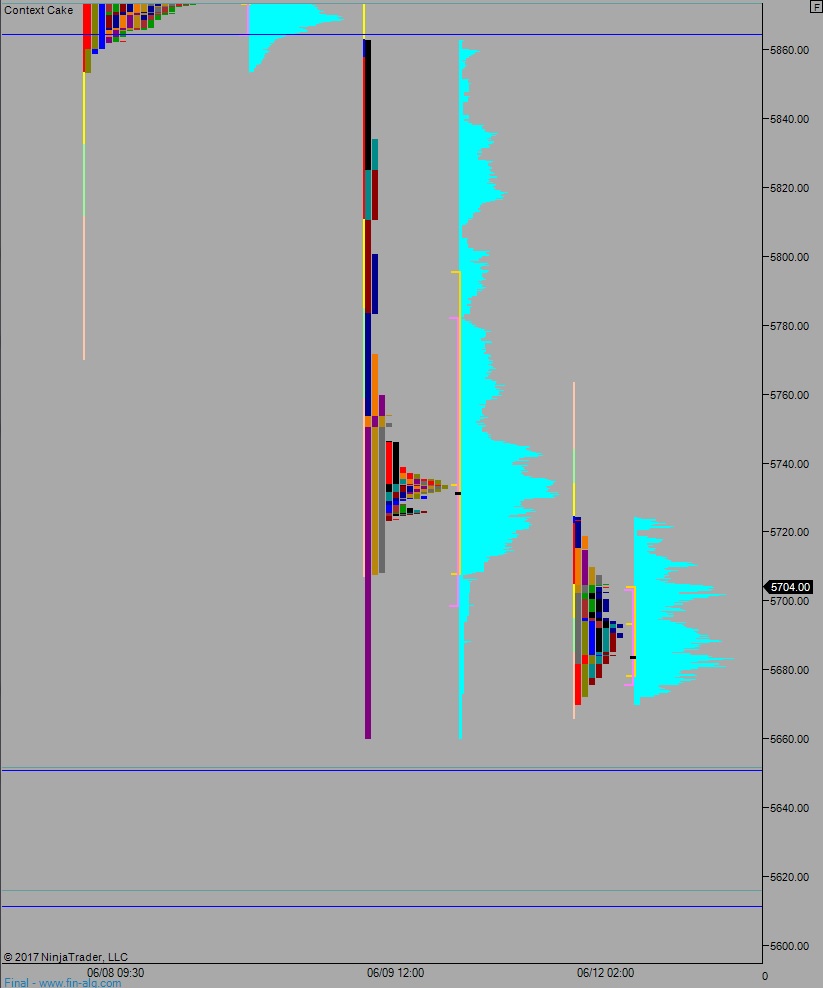

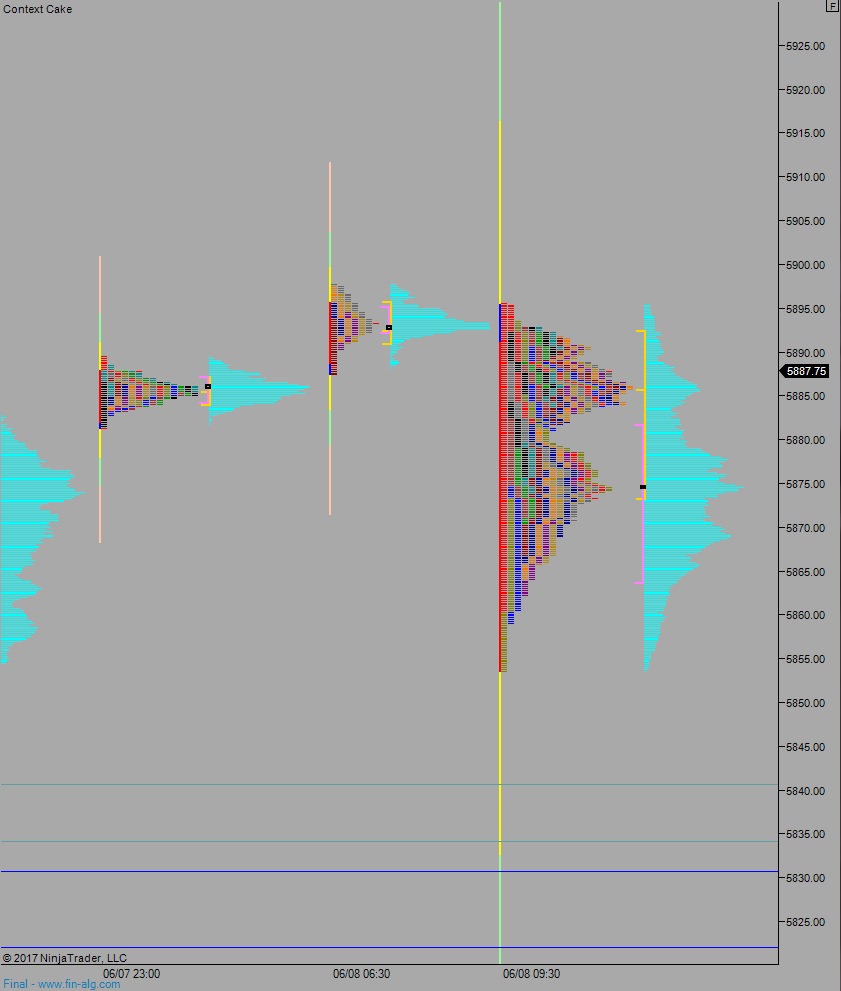

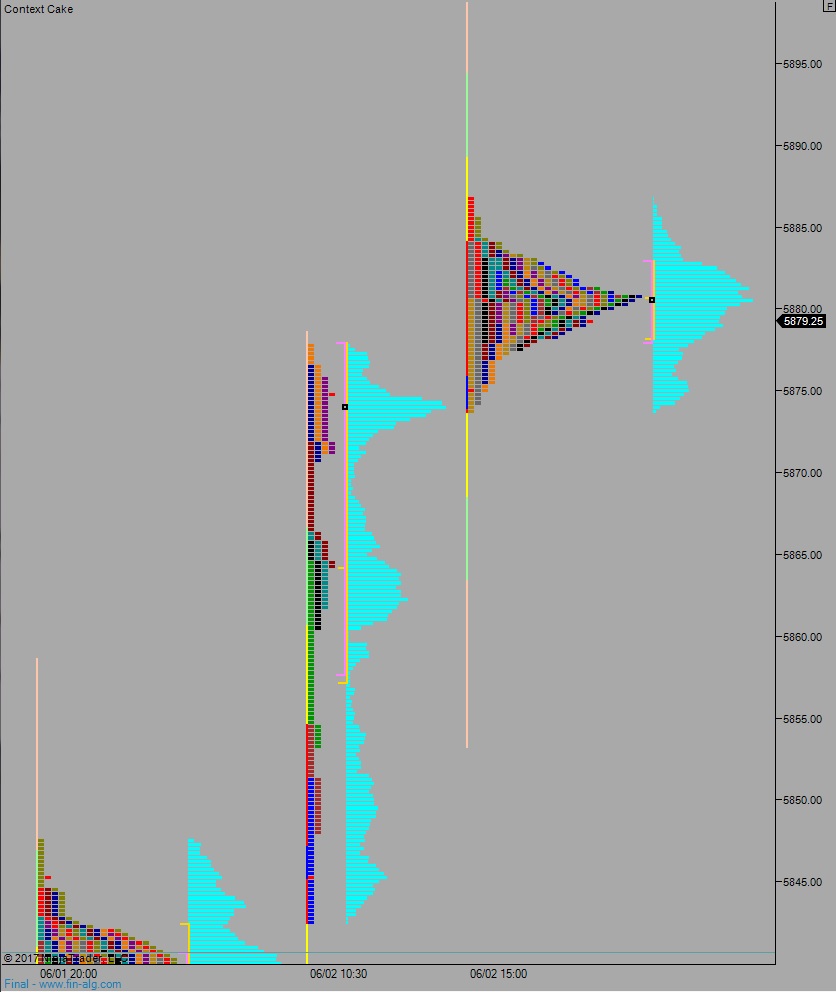

Volume profiles, gaps, and measured moves: