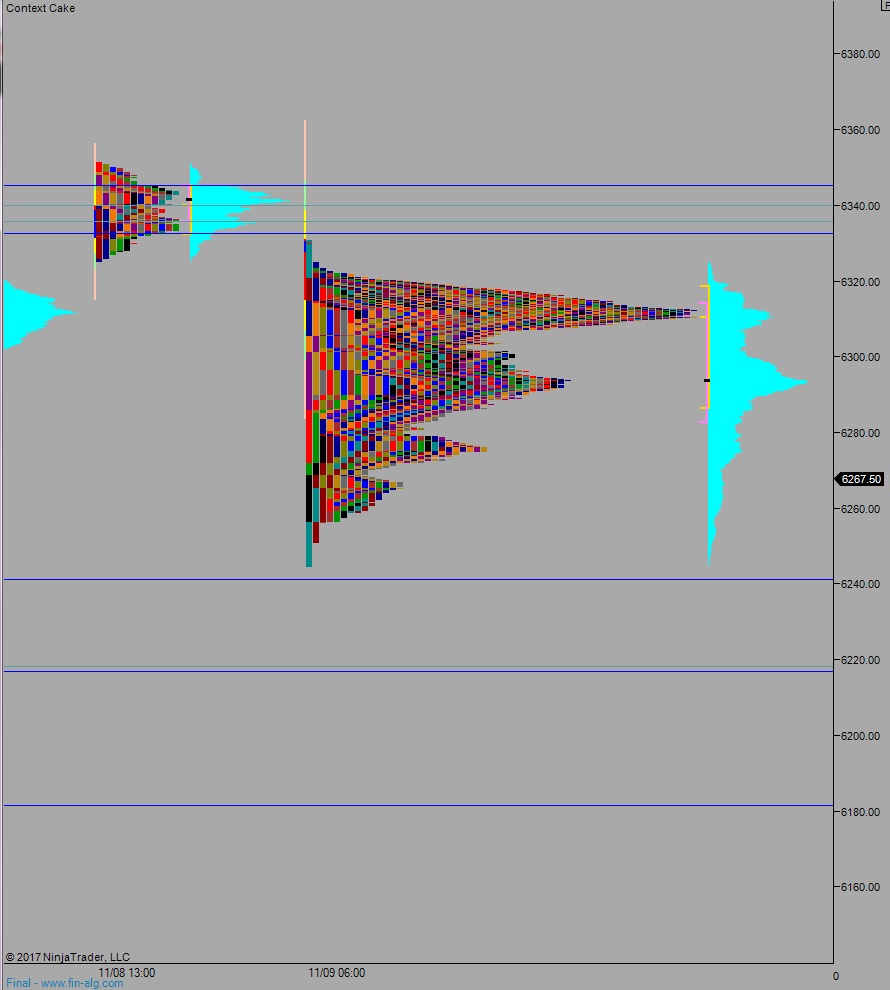

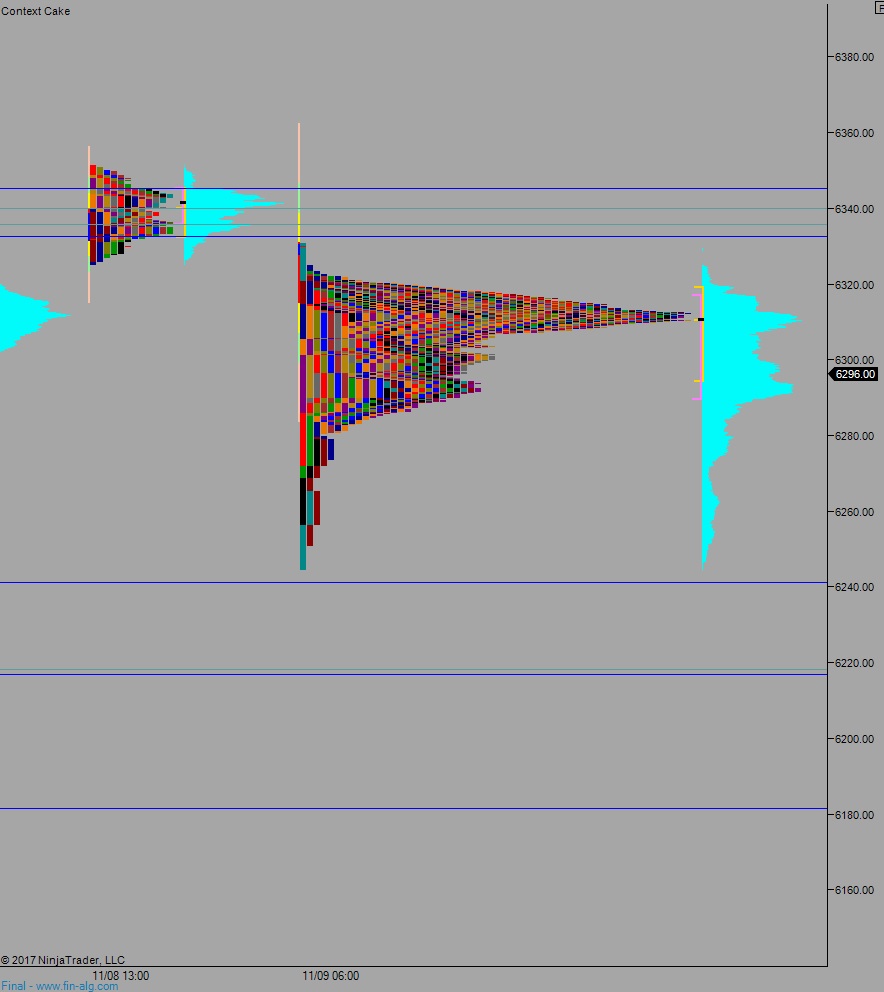

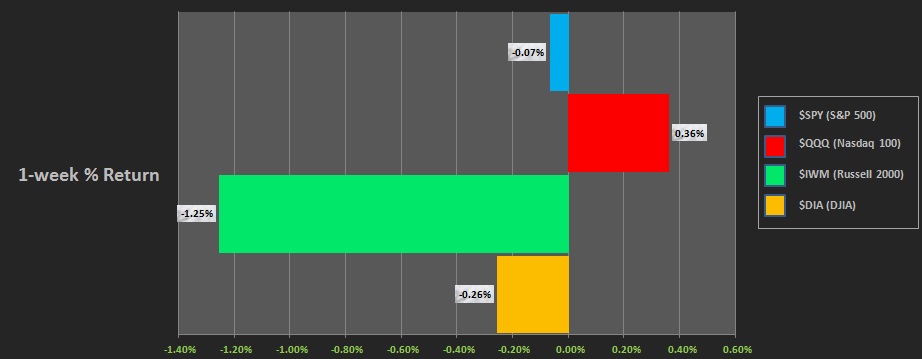

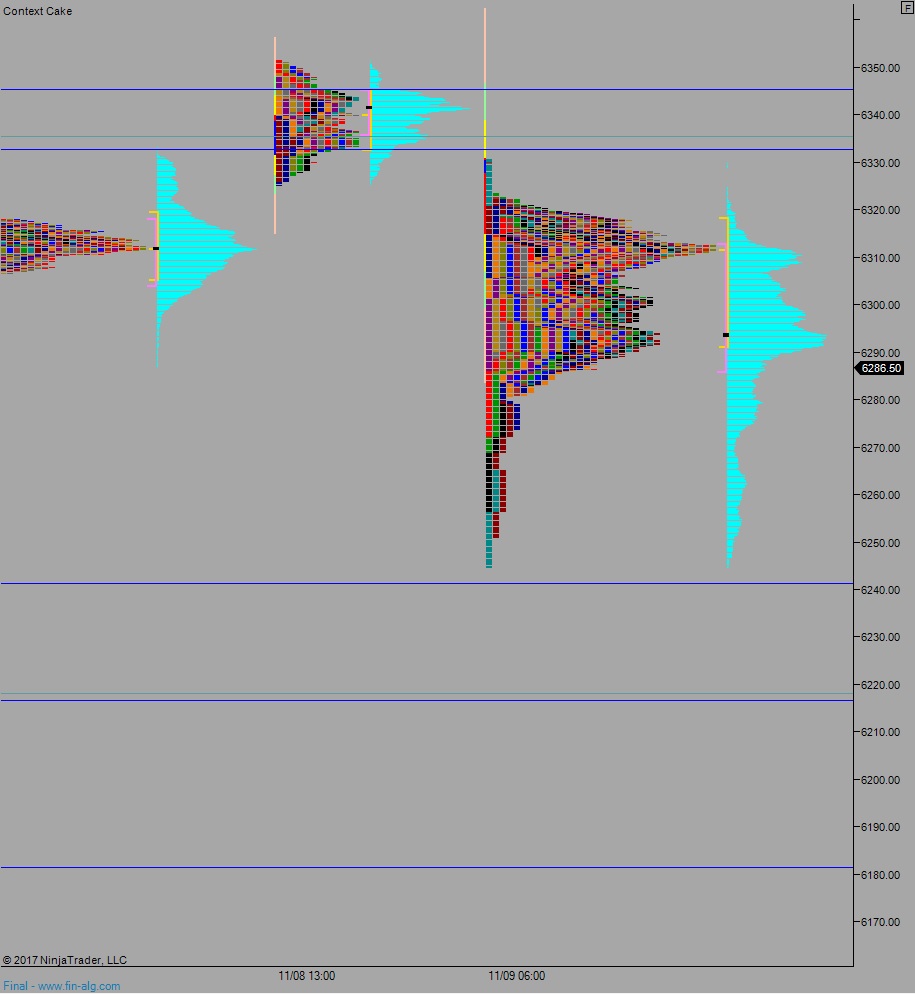

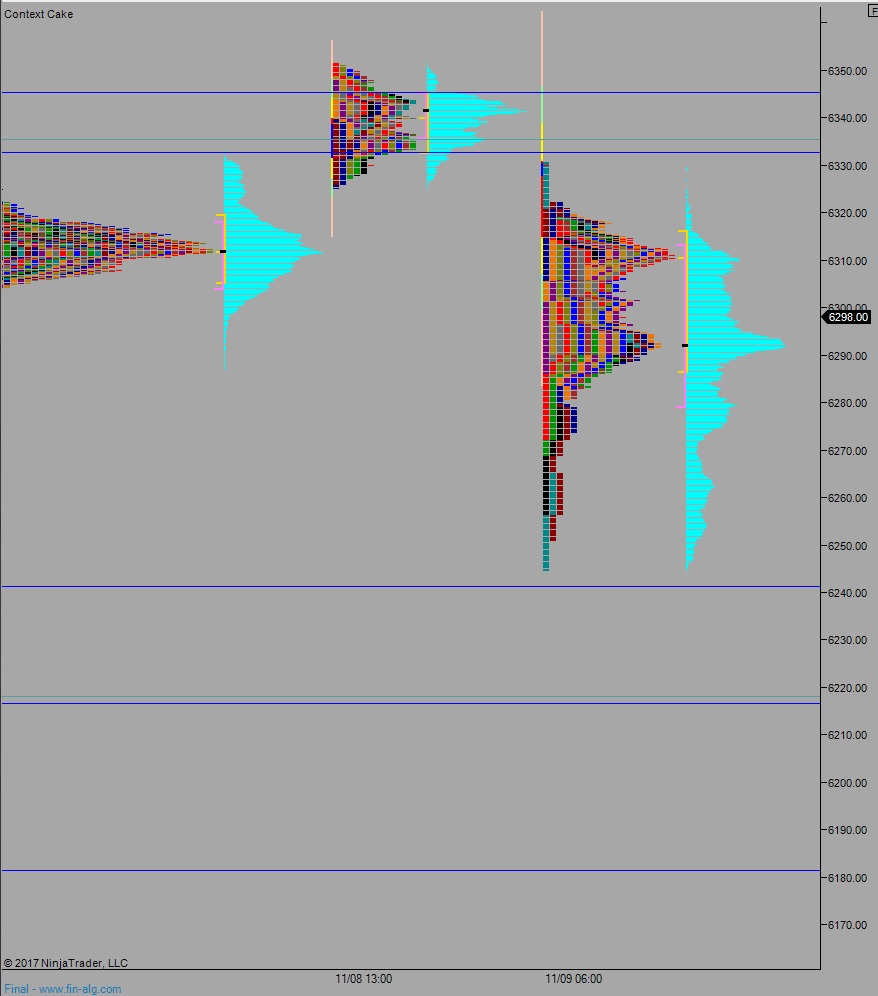

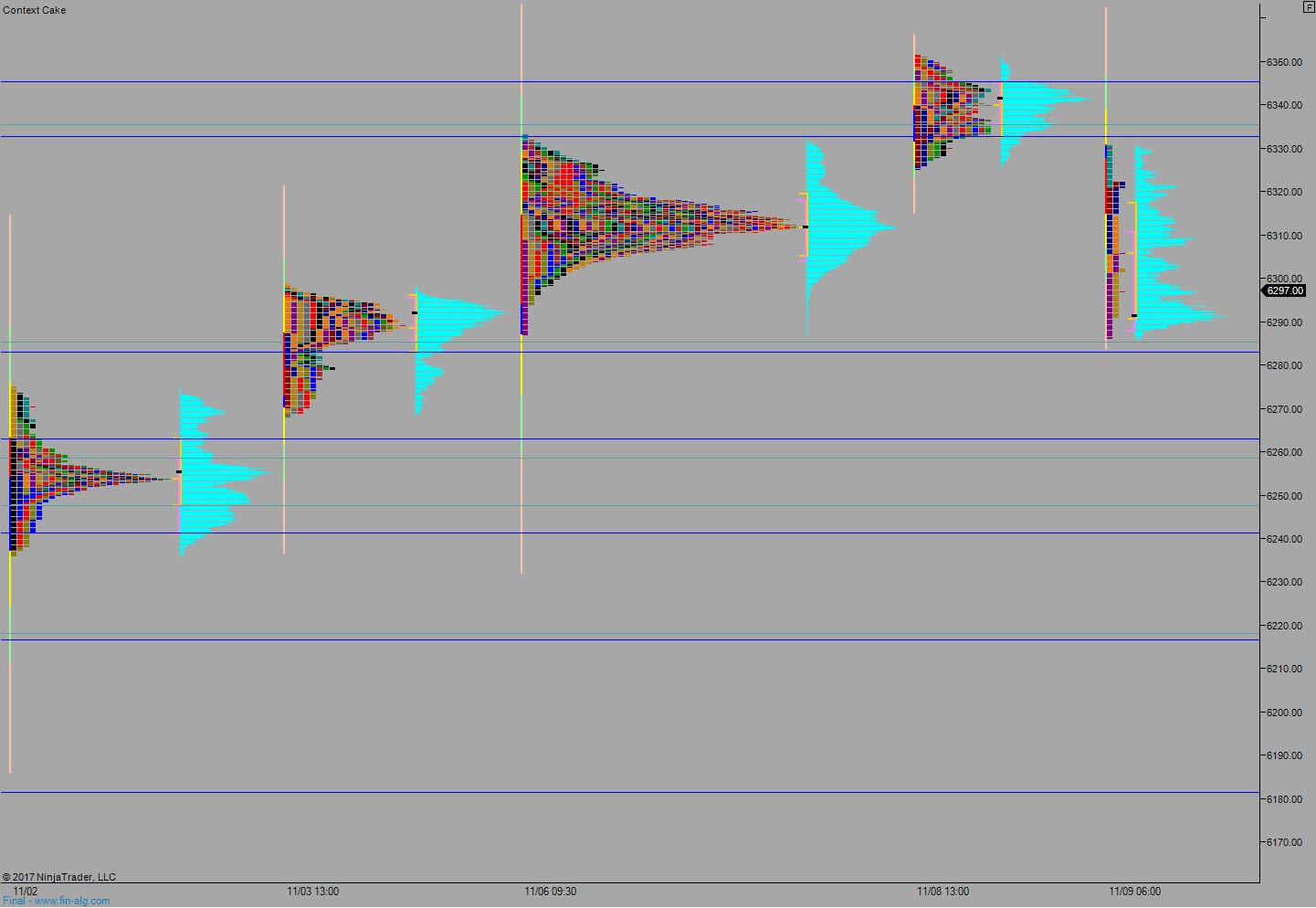

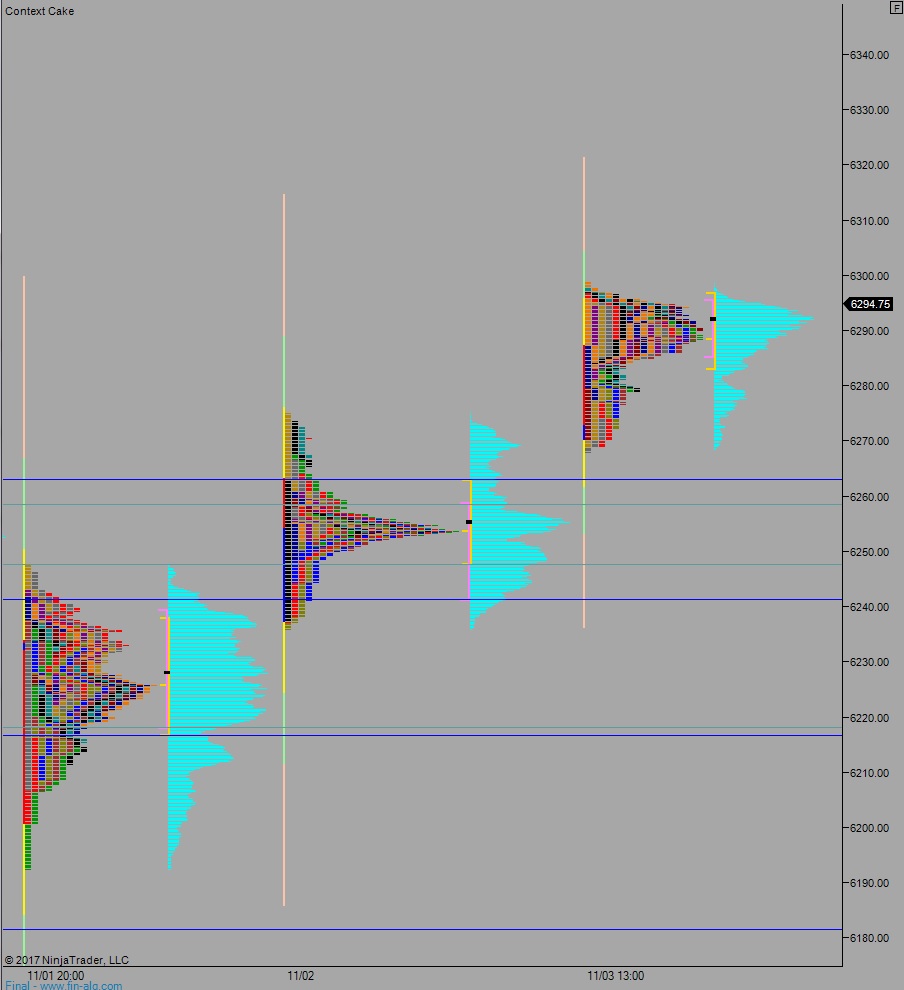

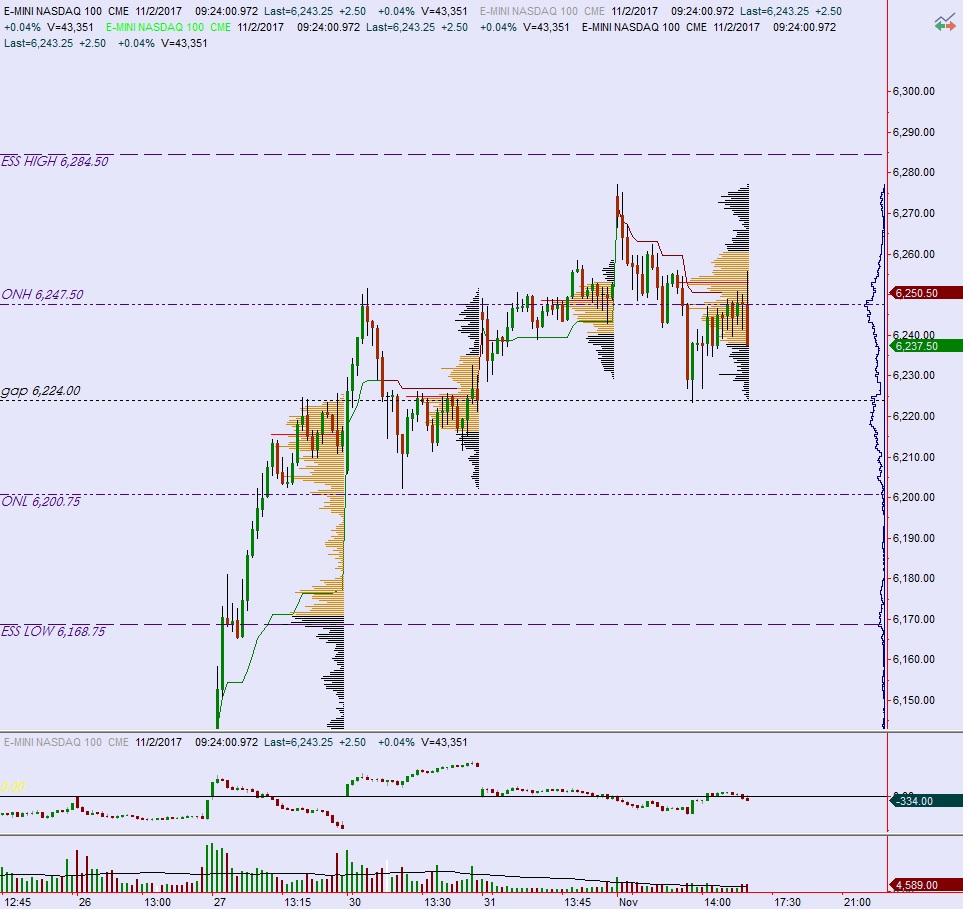

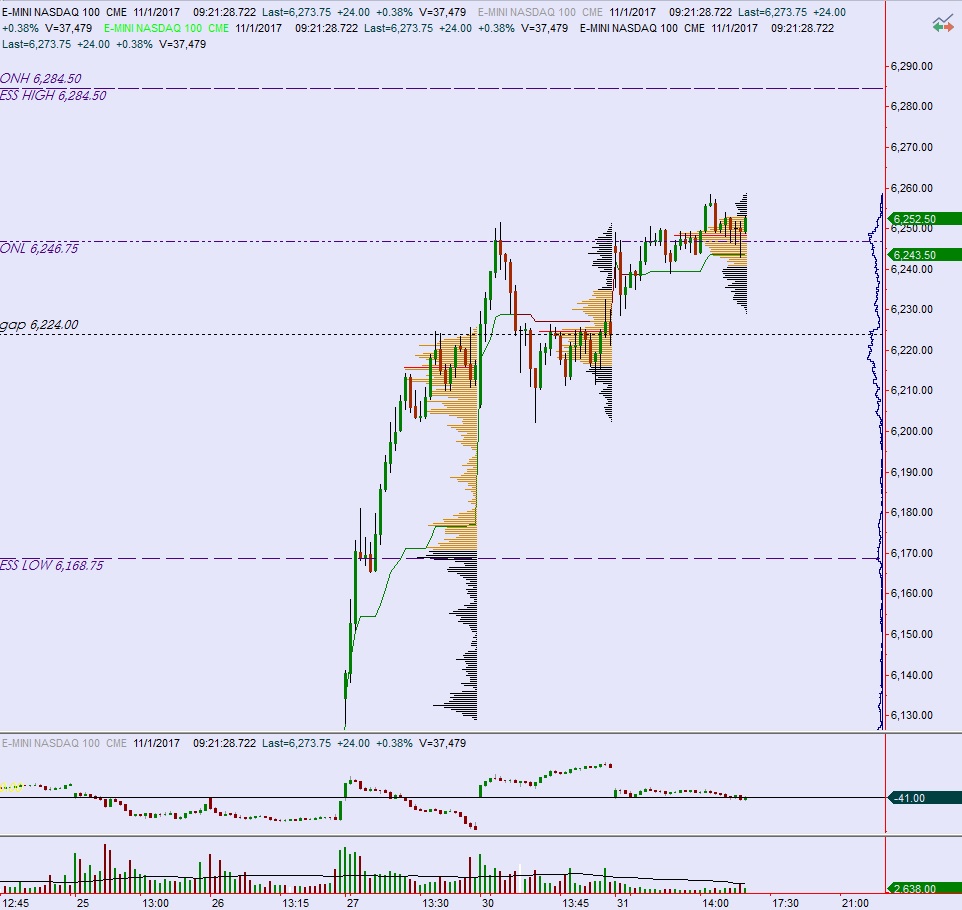

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated volume on normal range. Price was balanced overnight, holding up along the upper quadrant of the Thursday trend day.

Any economic events to concern yourself with are already public knowledge. At 8:30am both Housing Starts and Building Permits were solid beats. Strong economy.

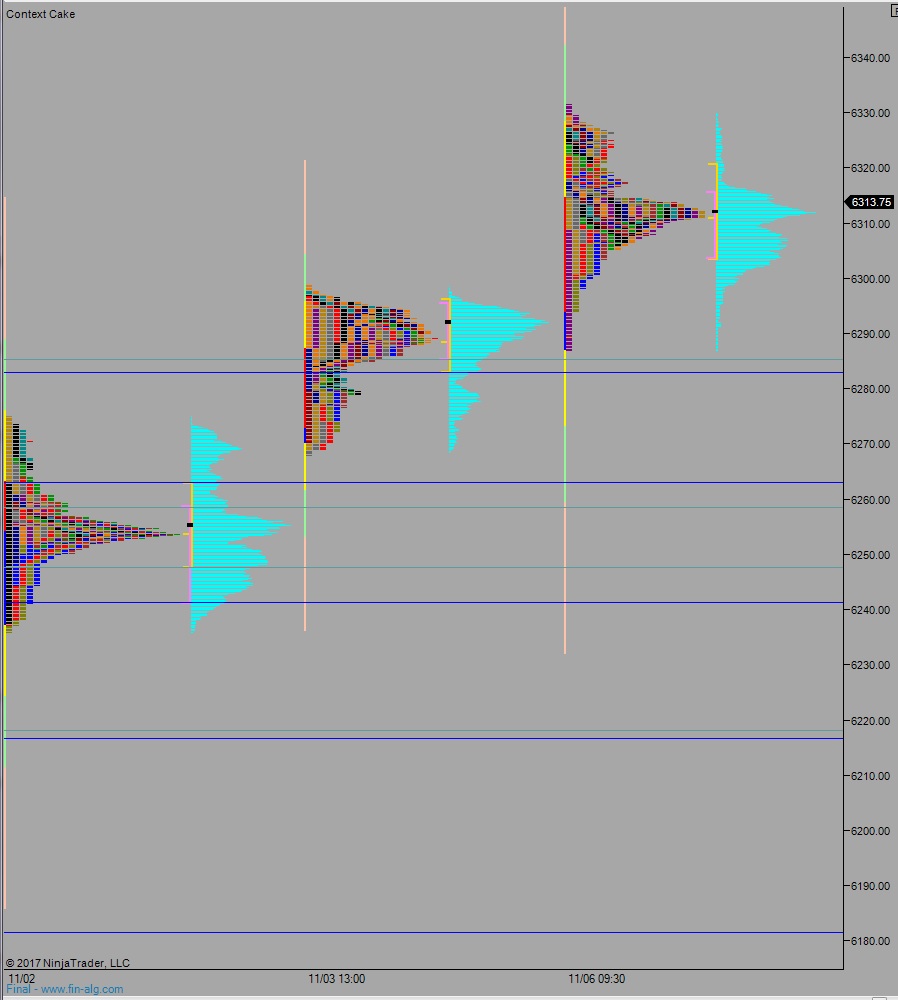

Yesterday we printed a trend day. A pro gap up set the NASDAQ up to open along the top-edge of the Tuesday range. Buyers immediately drove higher off the open, pressing to a new record high then continuing to slowly press all day. A bit of profit taking came in near the end of the day.

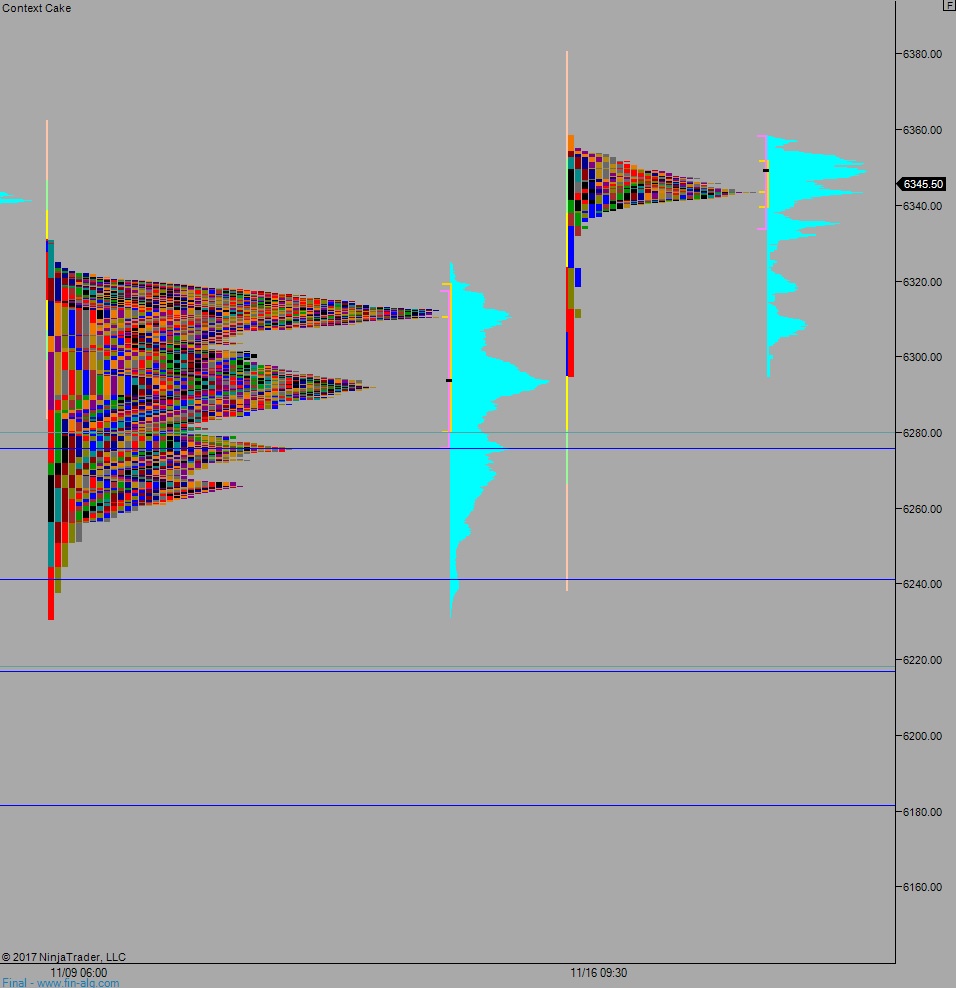

Heading into today my primary expectation is for buyers to work higher, up through overnight high 6351.75 and poke beyond the Thursday high 6358.50. Look for sellers up at 6364.75 and two way trade to ensue.

Hypo 2 buyers sustain prices above 6364.75 triggering a continuation of the trending higher. Open air.

It really is that simple.

Hypo 3 sellers take out overnight low 6335.75. Look for buyers ahead of 6327 and two way trade to ensue.

Levels:

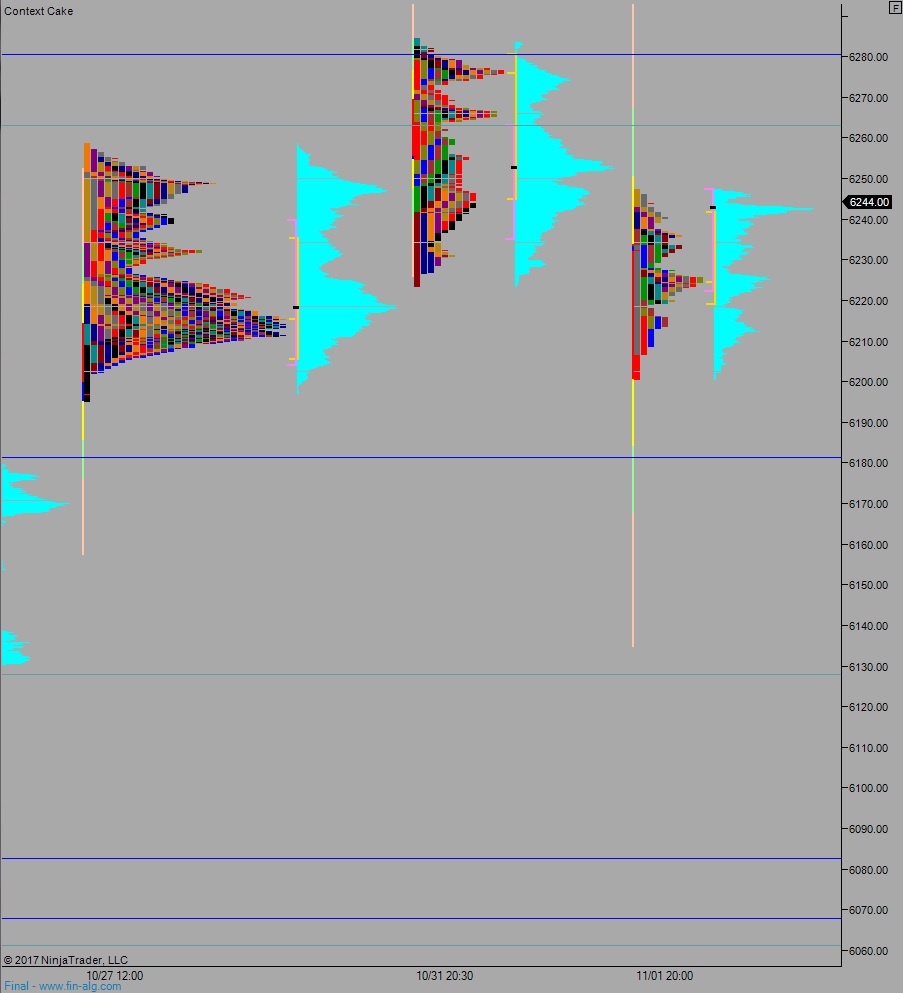

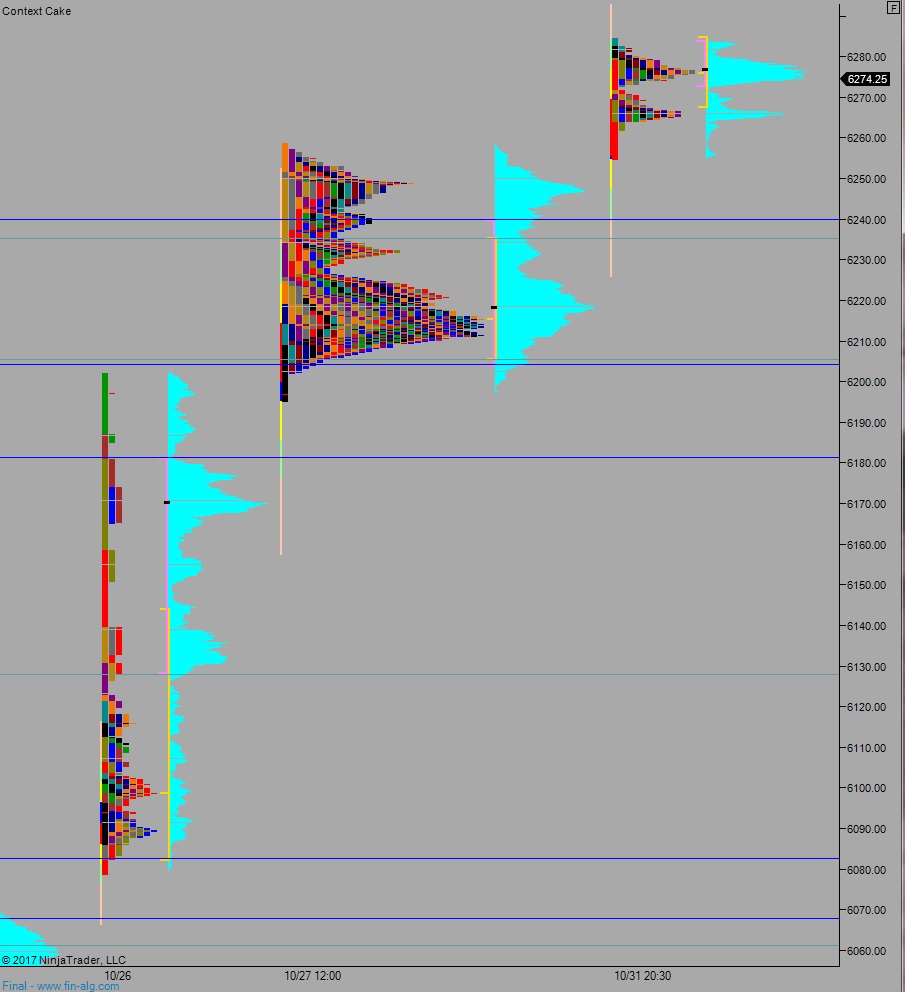

Volume profiles, gaps, and measured moves: