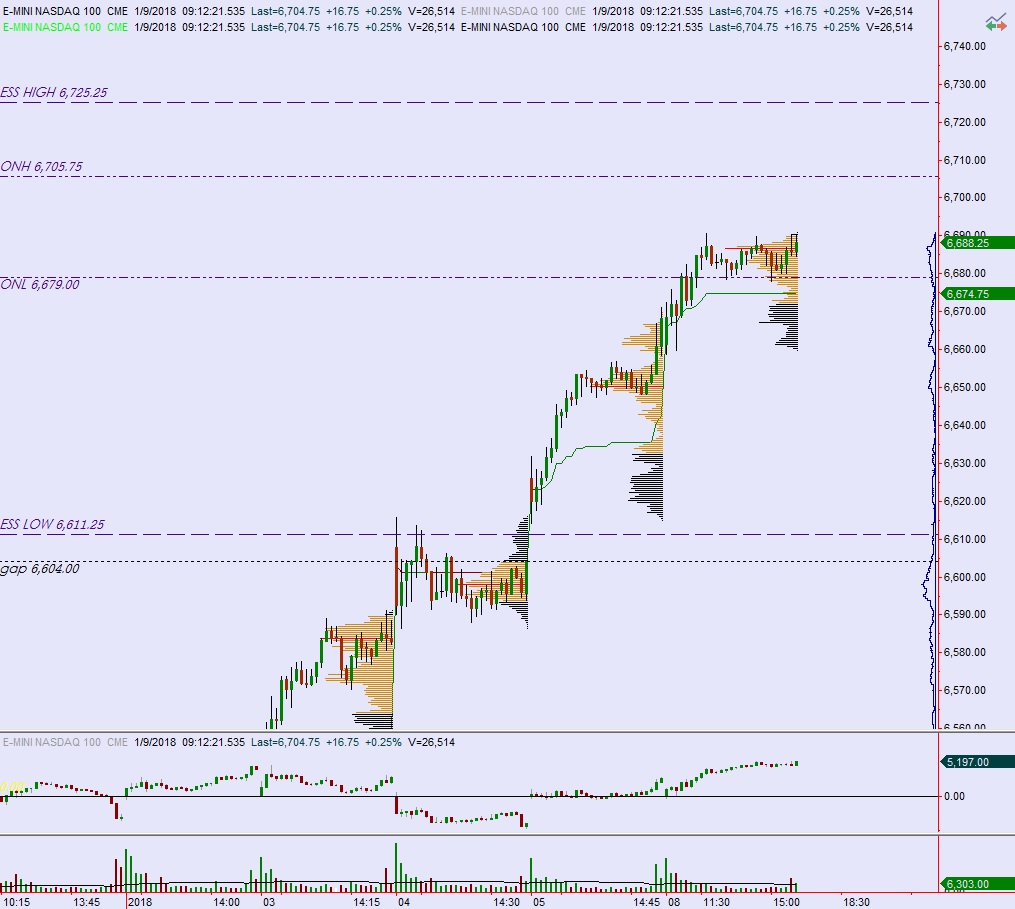

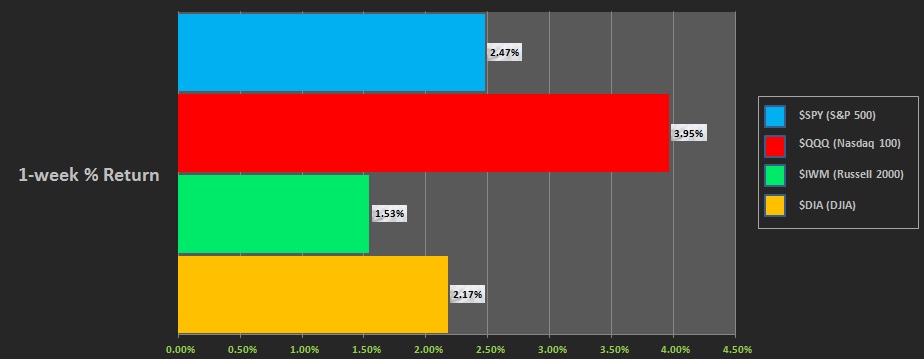

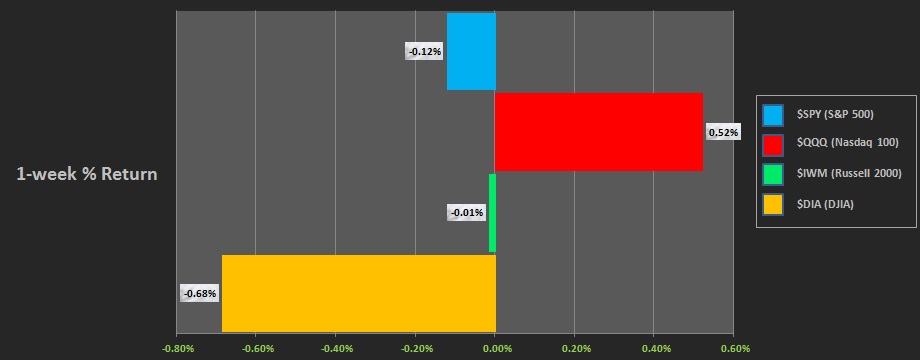

NASDAQ futures are coming into Friday gap down after an overnight session featuring elevated range and volume. Price worked to a new record high overnight before falling lower right around 8:30am. At 8:30am Consumer Price index data was better than expected and advance retail sales data was below expectations. Not sure if these data points moved the market.

There was also some news out of Facebook this morning that had the shares lower by as much as -4%.

The only other economic event scheduled for today is business inventories at 10am.

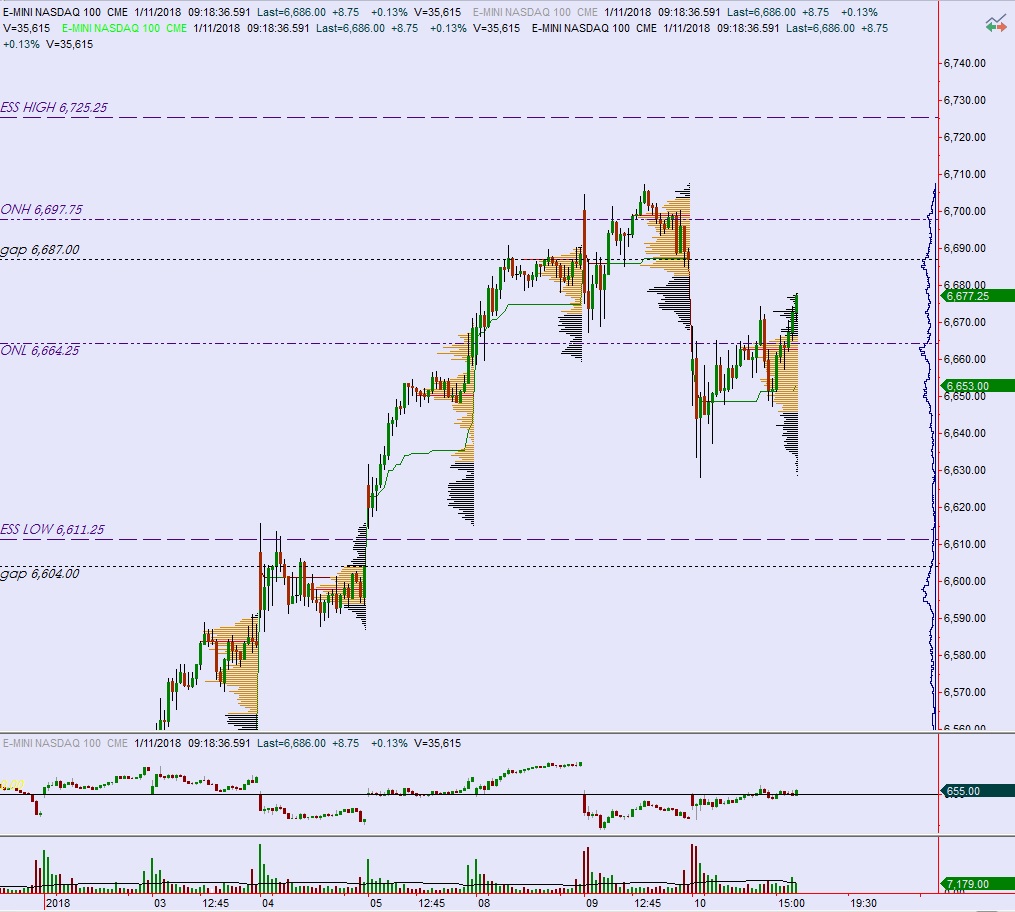

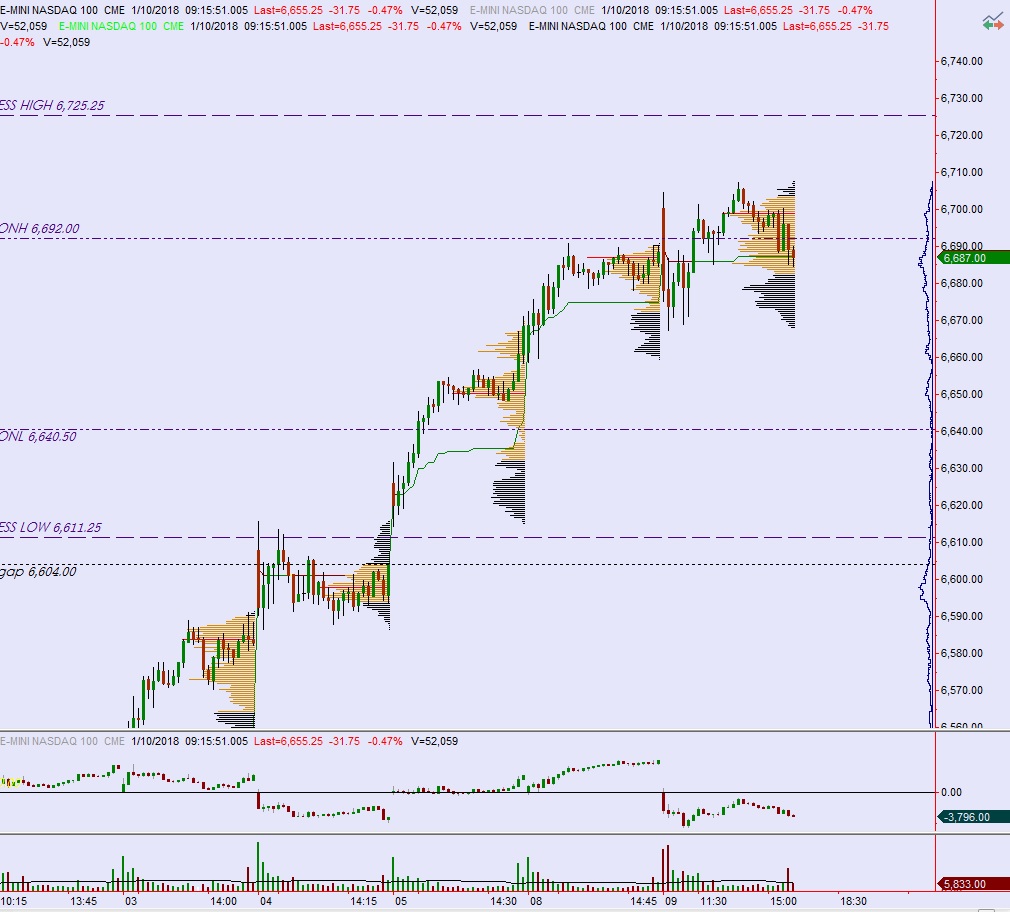

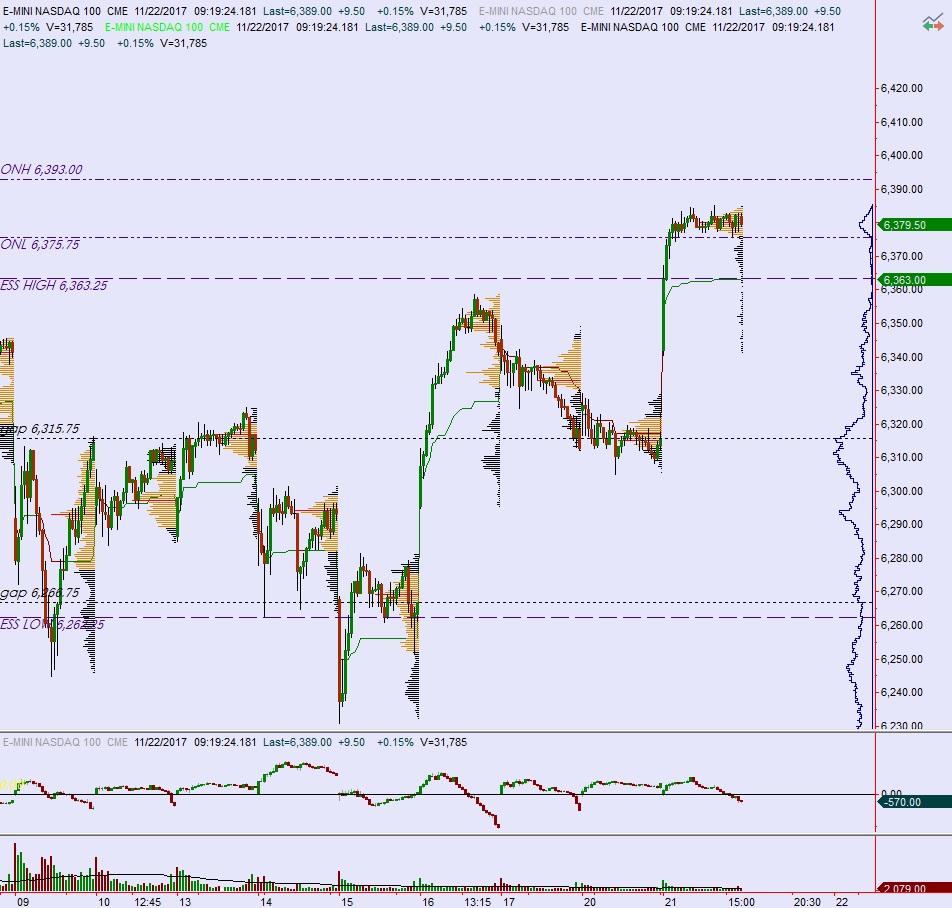

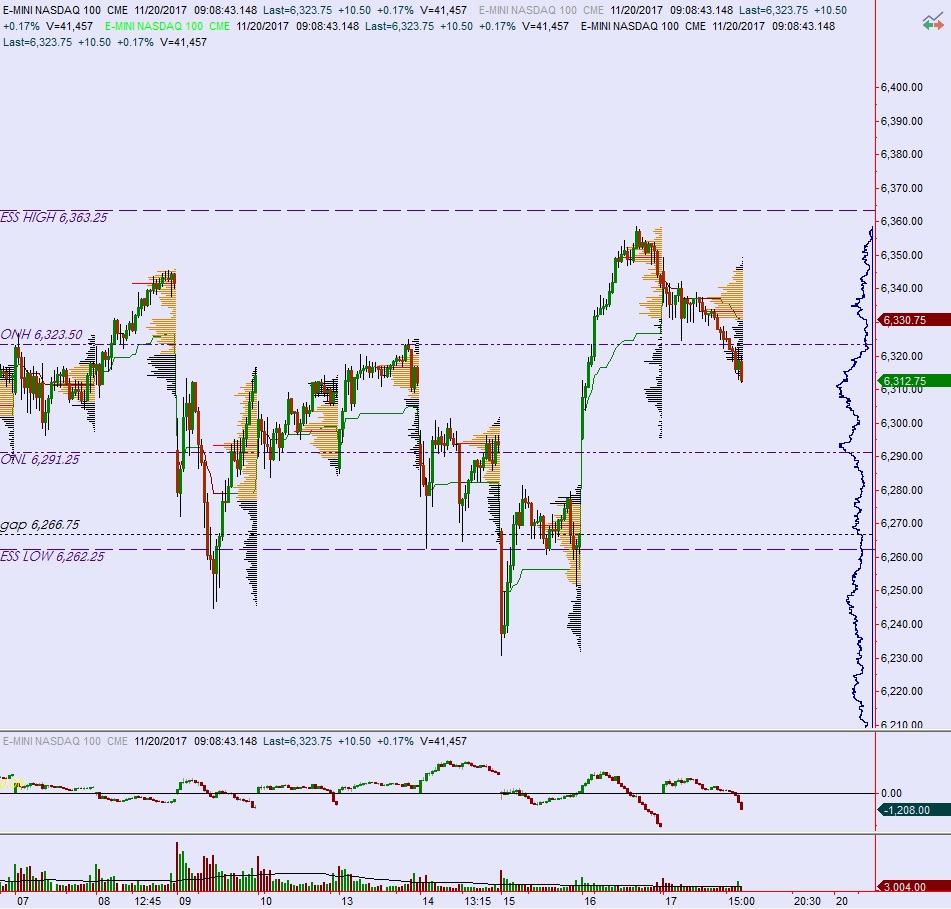

Yesterday we printed a neutral extreme up. The day began gap up and after a brief morning rally, we traded lower, range extension down, and closed the overnight gap. Then we traversed the entire daily range and rallied beyond it, closing near the highs, and earning the extreme designation to our neutral day.

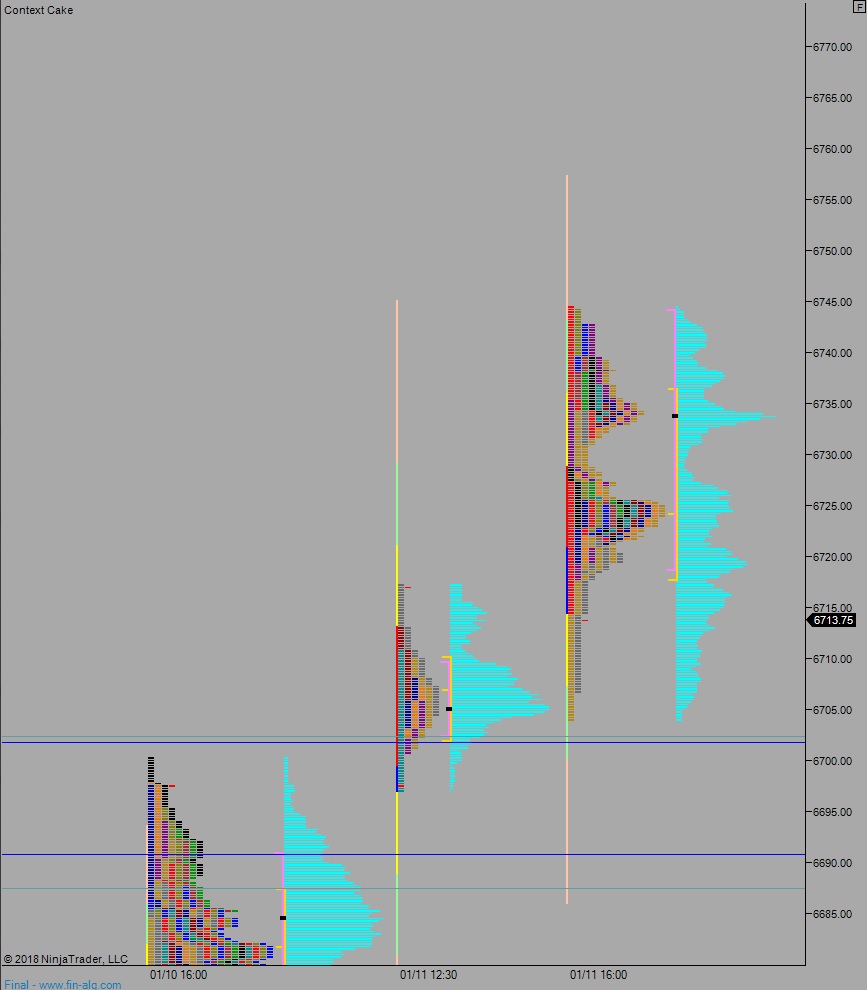

Heading into today my primary expectation is for a battle at the open. Look for sellers to test down through overnight low 6704 but look for buyers down at 6702.25 and then a move higher to close the overnight gap before two way trade ensues.

Hypo 2 stronger sellers trade down to 6690.75 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory straight off the open, close overnight gap up top 6726.75 then continue working higher, up through overnight high 6744.50 before two way trade ensues.

levels:

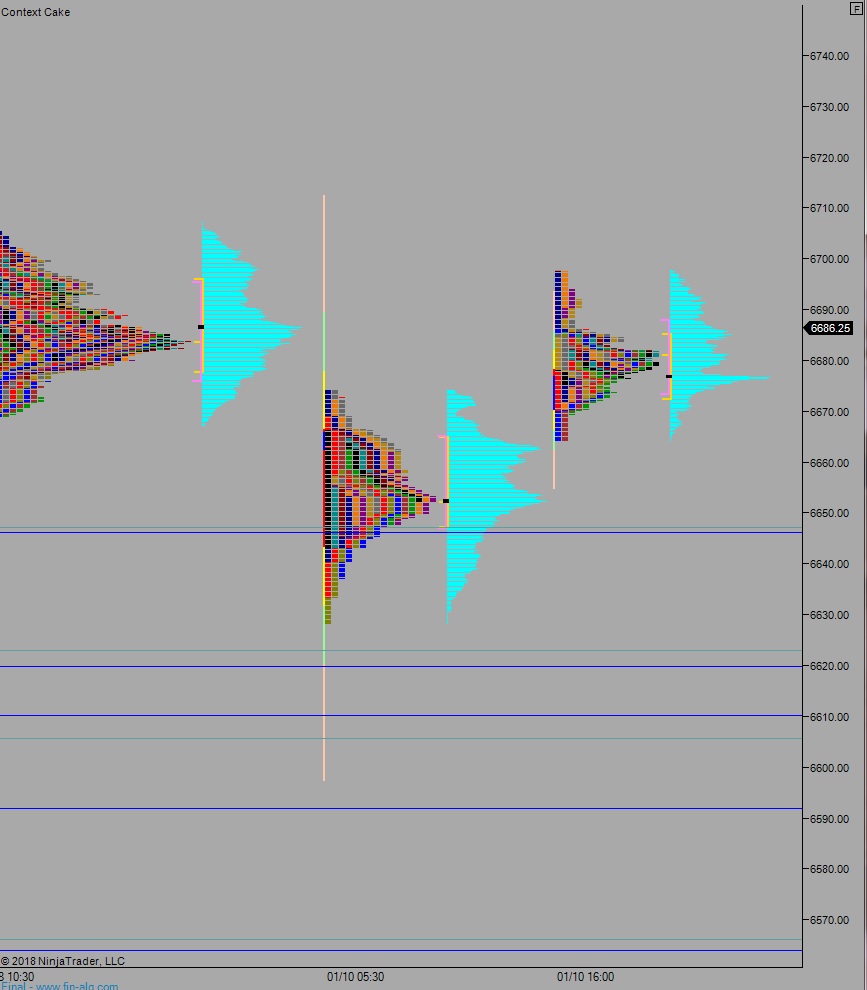

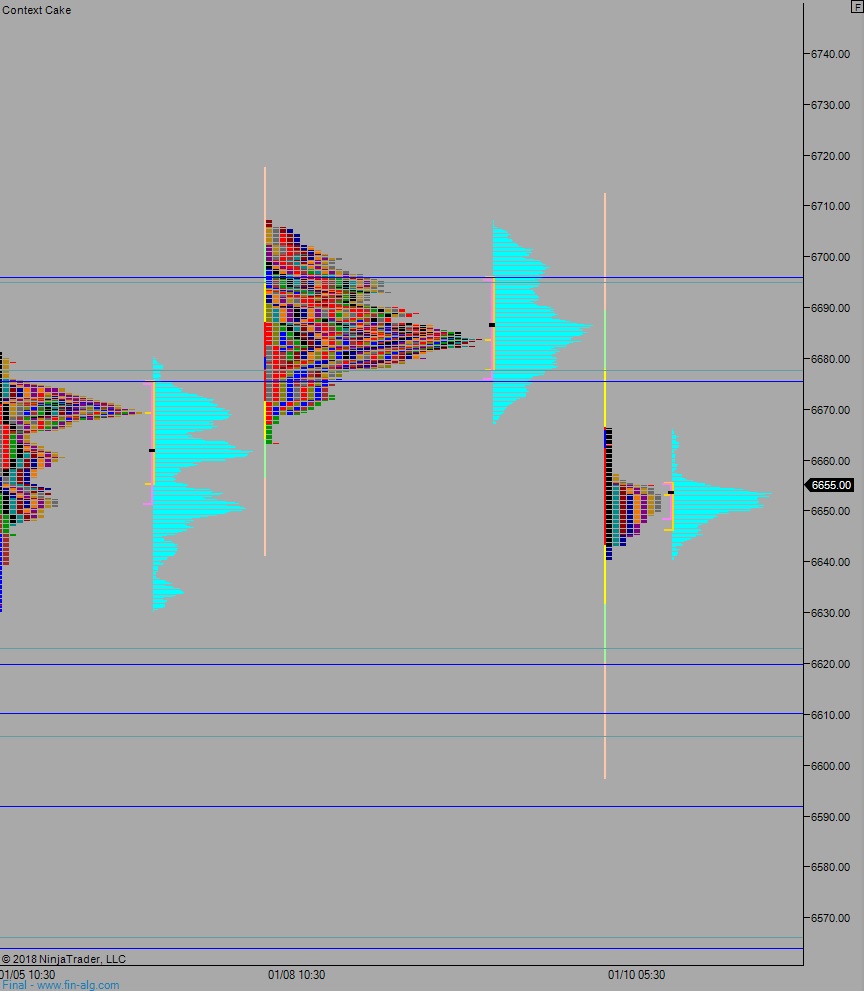

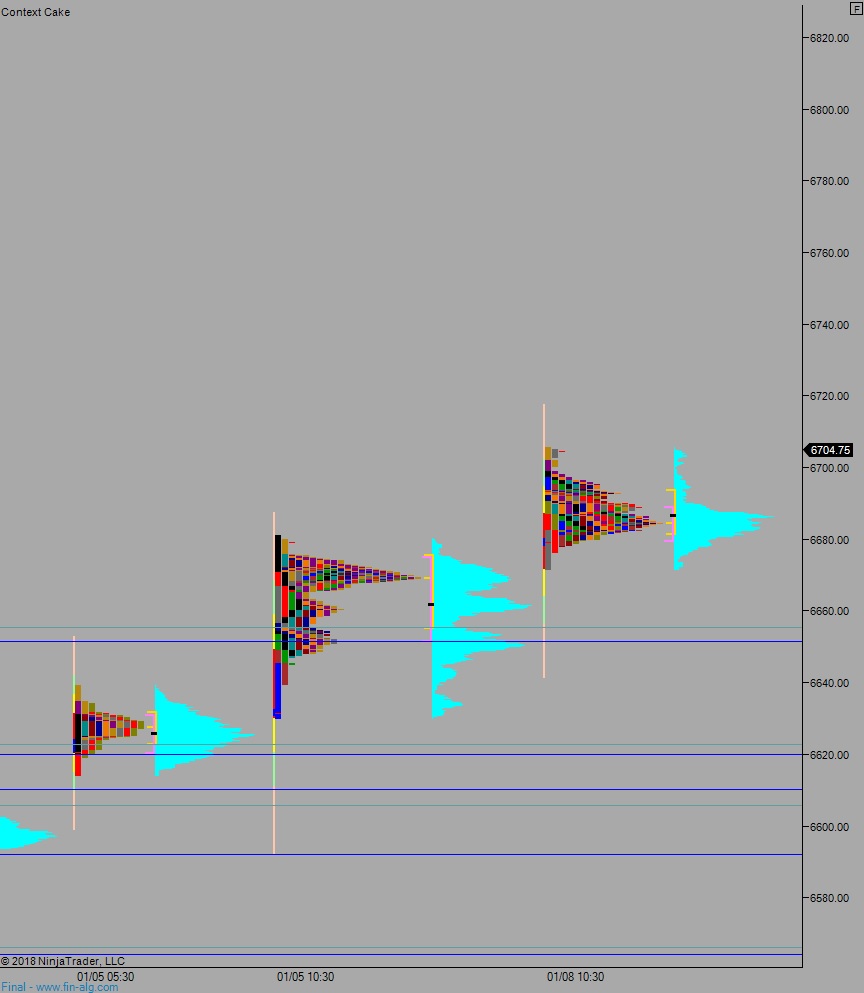

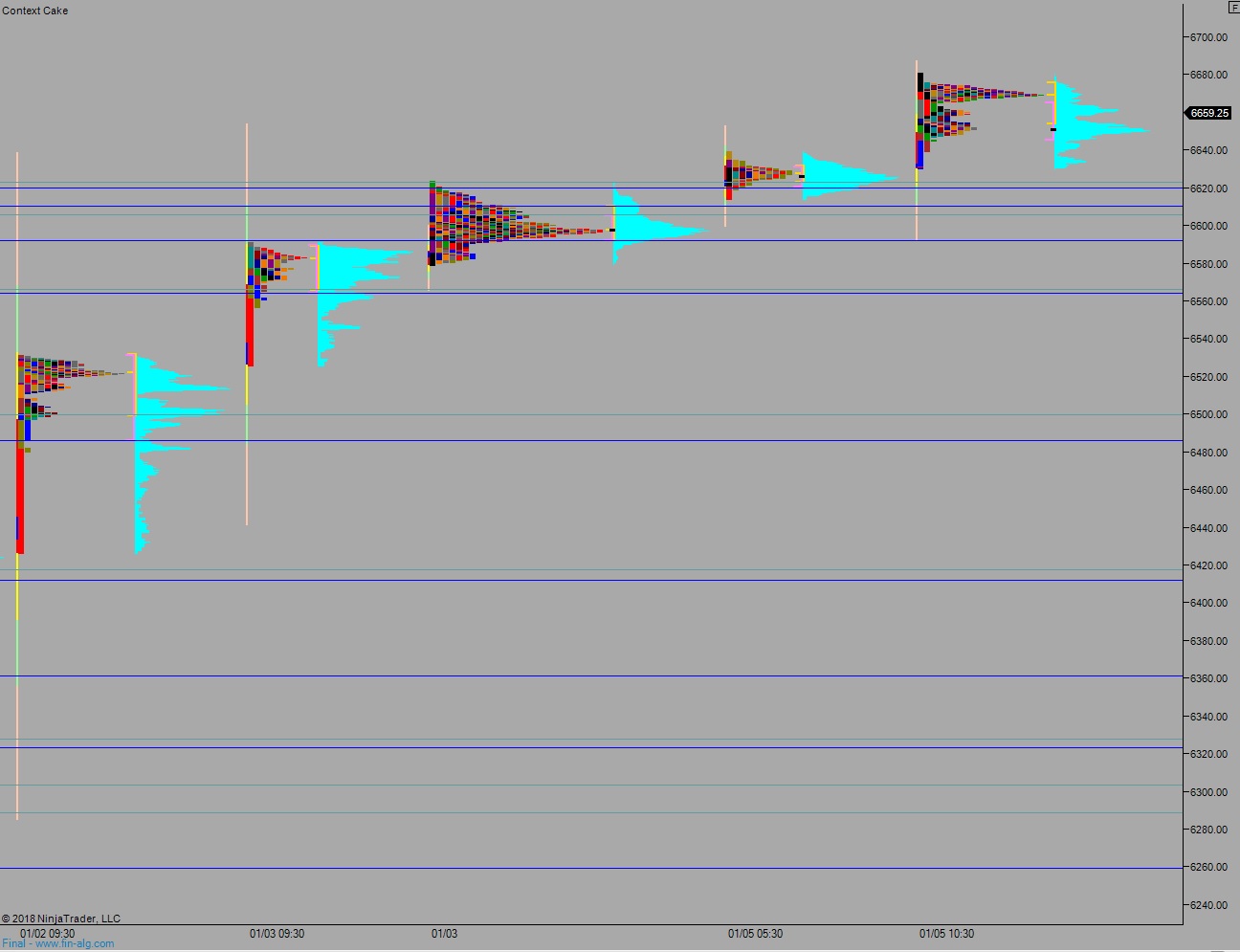

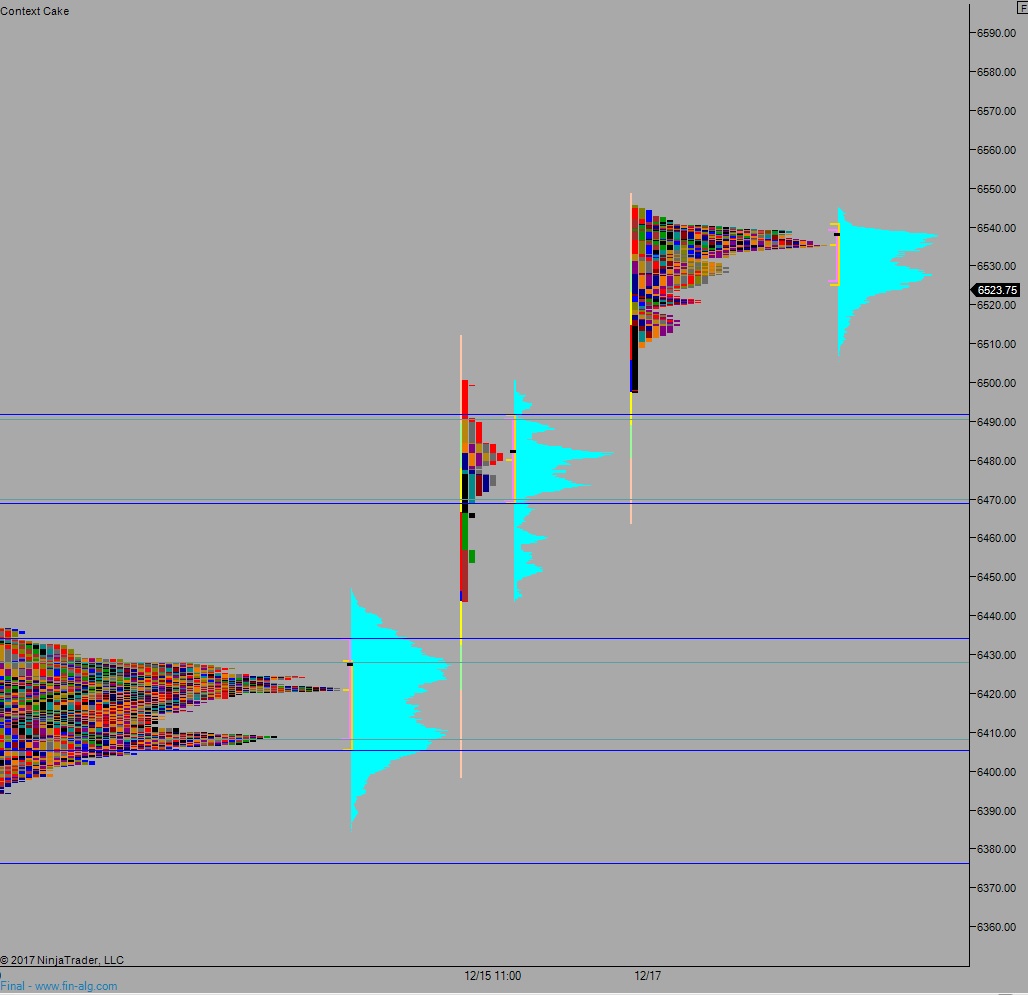

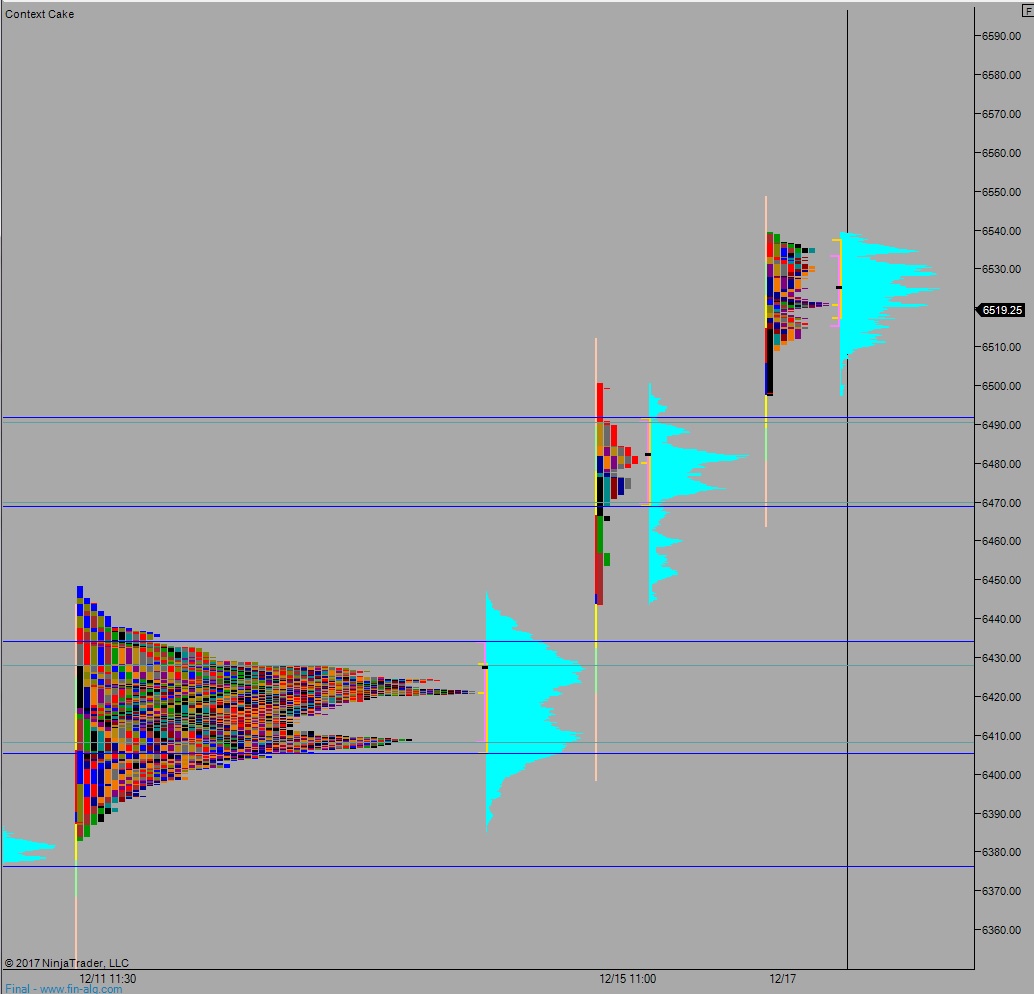

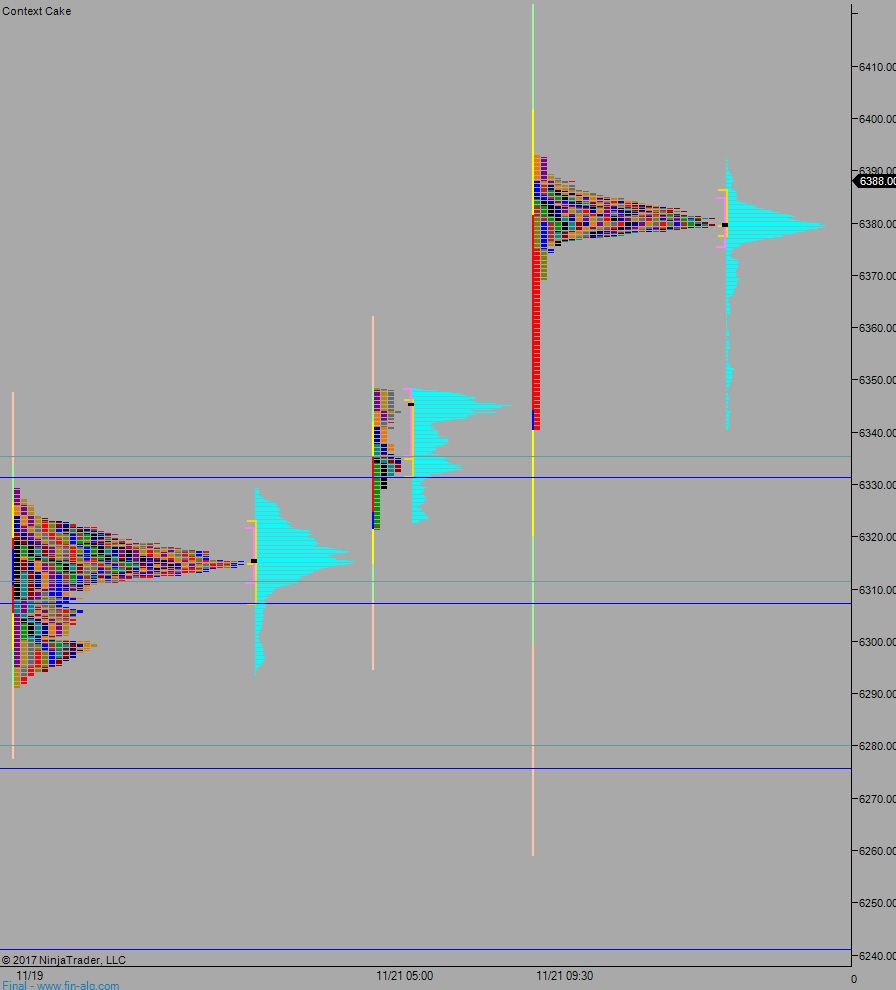

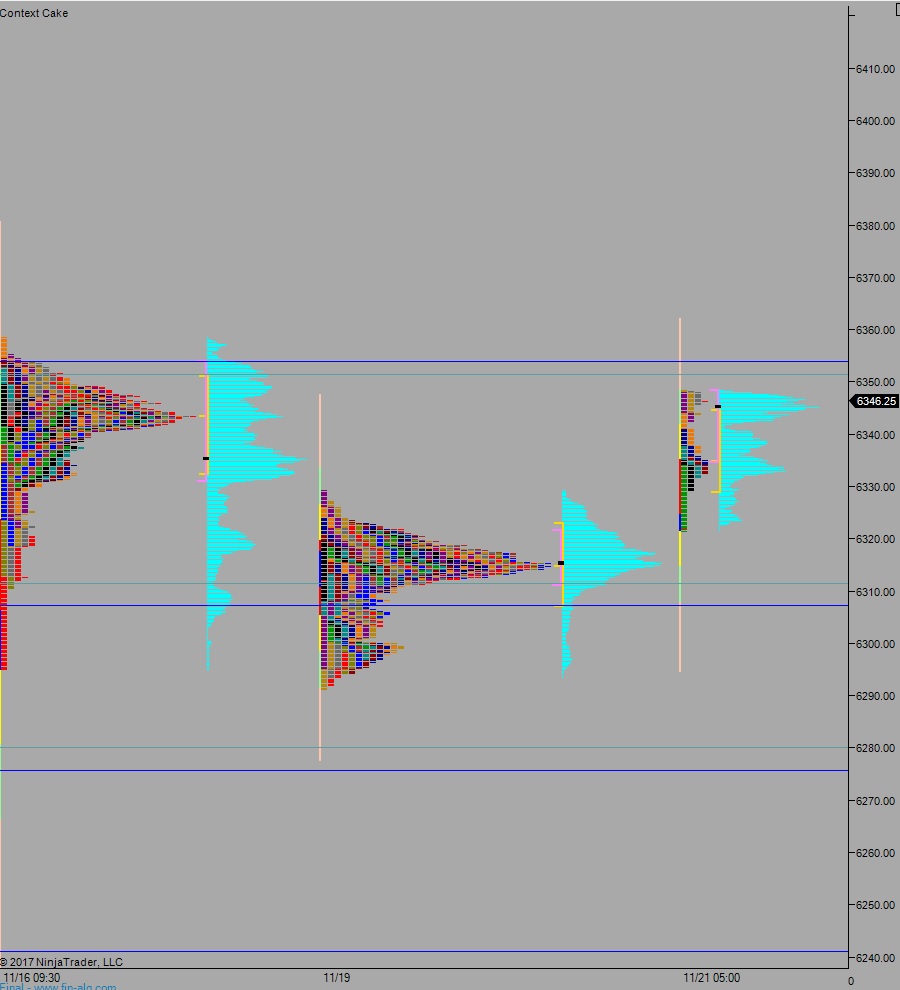

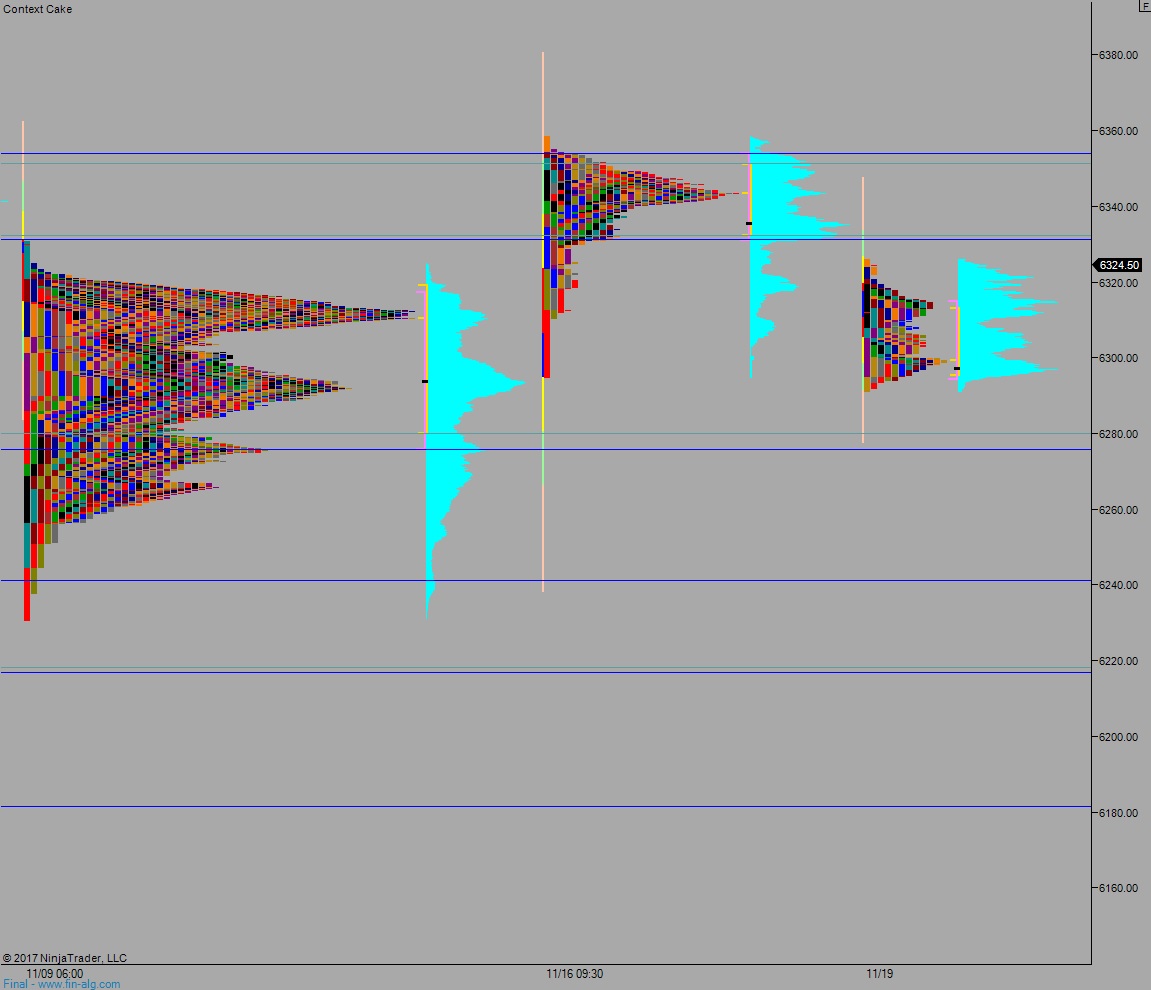

Volume profiles, gaps, and measured moves: