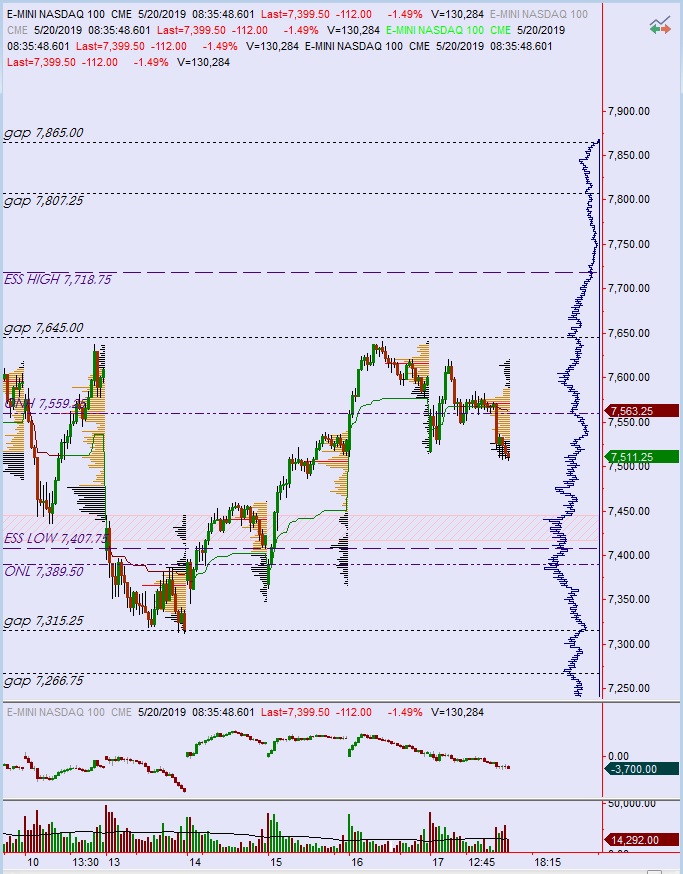

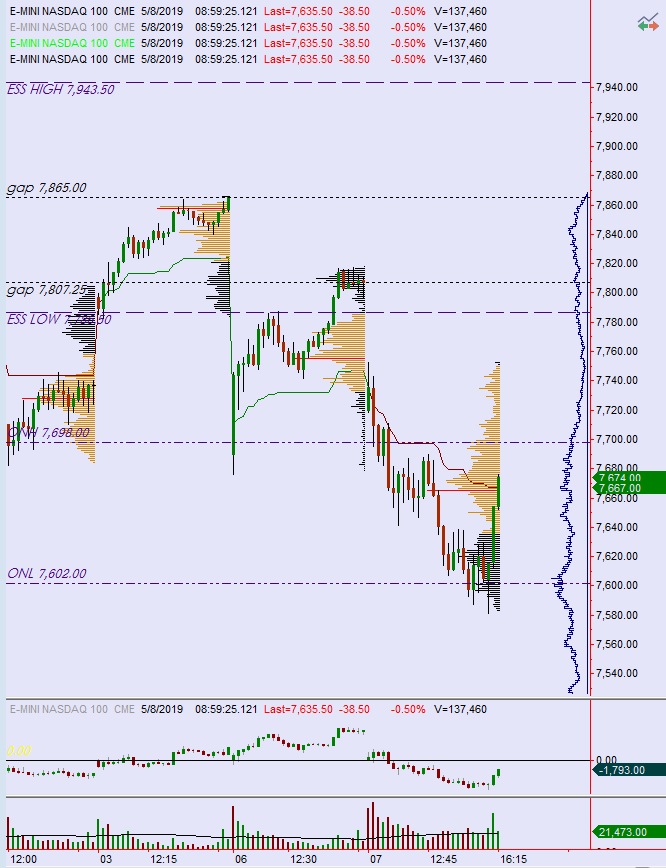

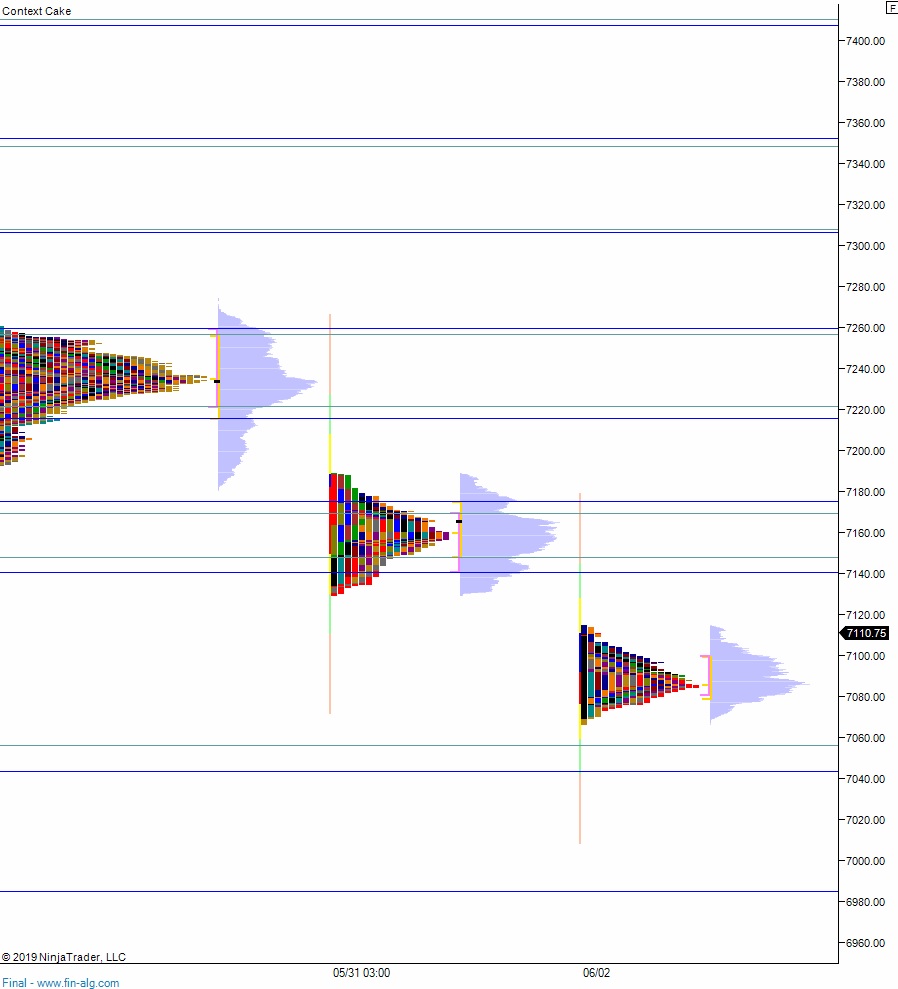

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated range on extreme volume. Price worked higher overnight, after being balanced until about 5am New York. Price probed up into last Thursday’s range before finding responsive sellers. At 8:15am ADP employment data came out well below expectations. As we approach cash open, price is hovering below last Thursday’s midpoint.

Also on the economic calendar today we have ISM non-manufacturing/services data at 1oam followed by crude oil inventories at 10:30am and Fed beige book at 2pm.

Yesterday we printed a trend up. The day began with a gap up and two-way auction before buyers stepped in and drove higher. Said buyers reversed all of Monday’s selling pressure by late morning then continued to campaign higher throughout the afternoon, eventually ending the day at high-of-day, near last Friday’s high.

Trend up.

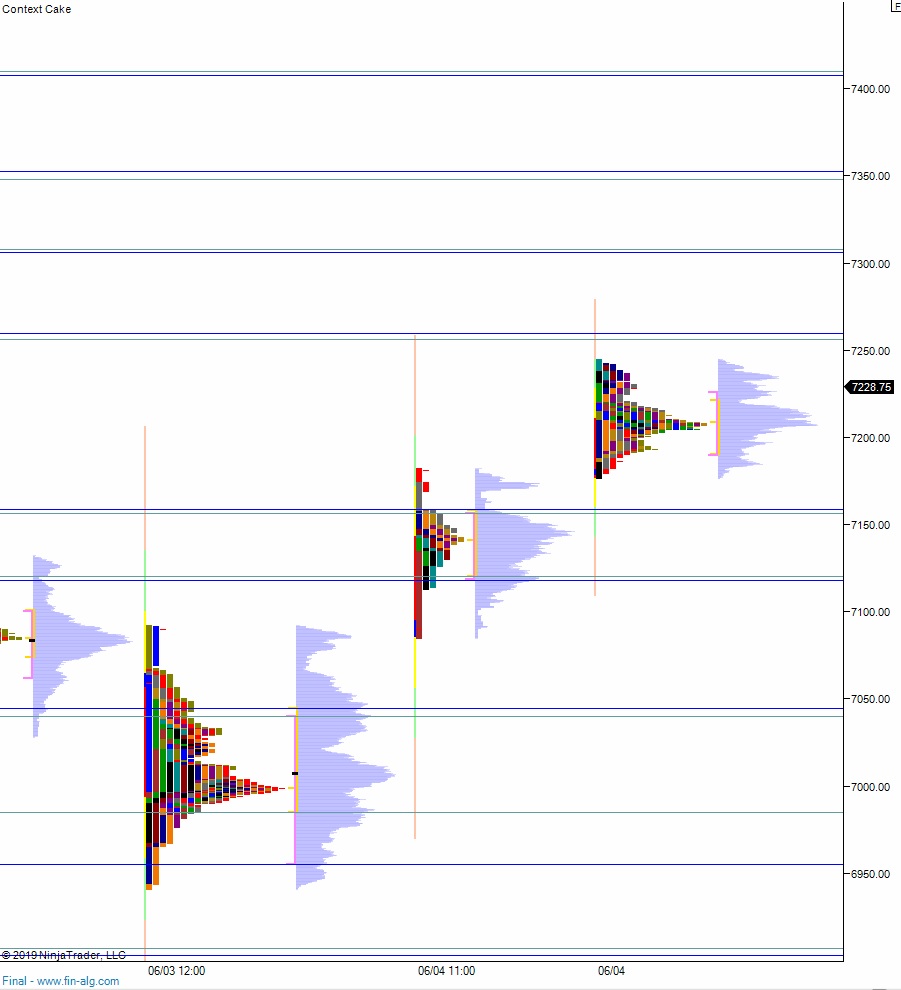

Heading into today my primary expectation is for sellers to press into the overnight inventory and trade us down to 7200. Buyers step in here, ahead of the gap fill, and work us up through overnight high 7245.25. Look for sellers up at 7256.25 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, sustaining trade above 7259.50 to set up a move to target the open gap at 7294.75. Look for sellers at the 7300 century mark and two-way trade to ensue.

Hypo 3 stronger sellers work a full gap fill down to 7181.50 then continue lower, down through overnight low 7176.75. Look for buyers down at 7158.25 and two way trade to ensue.

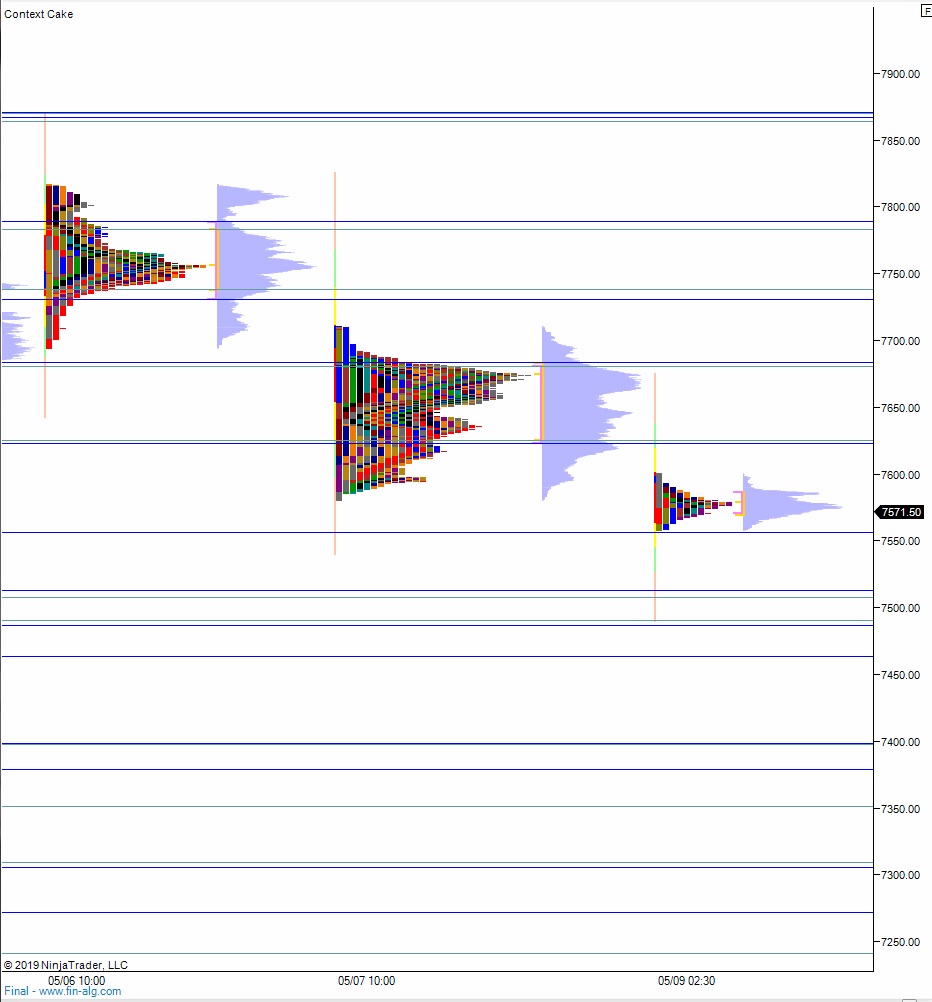

Levels:

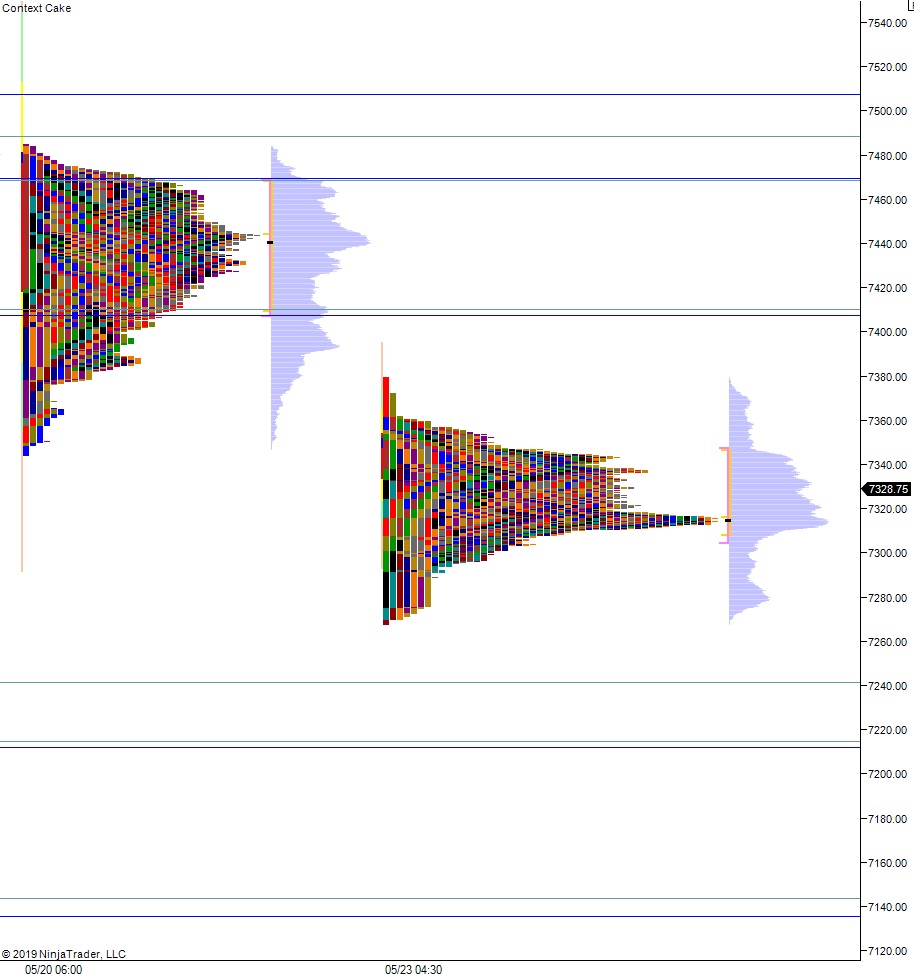

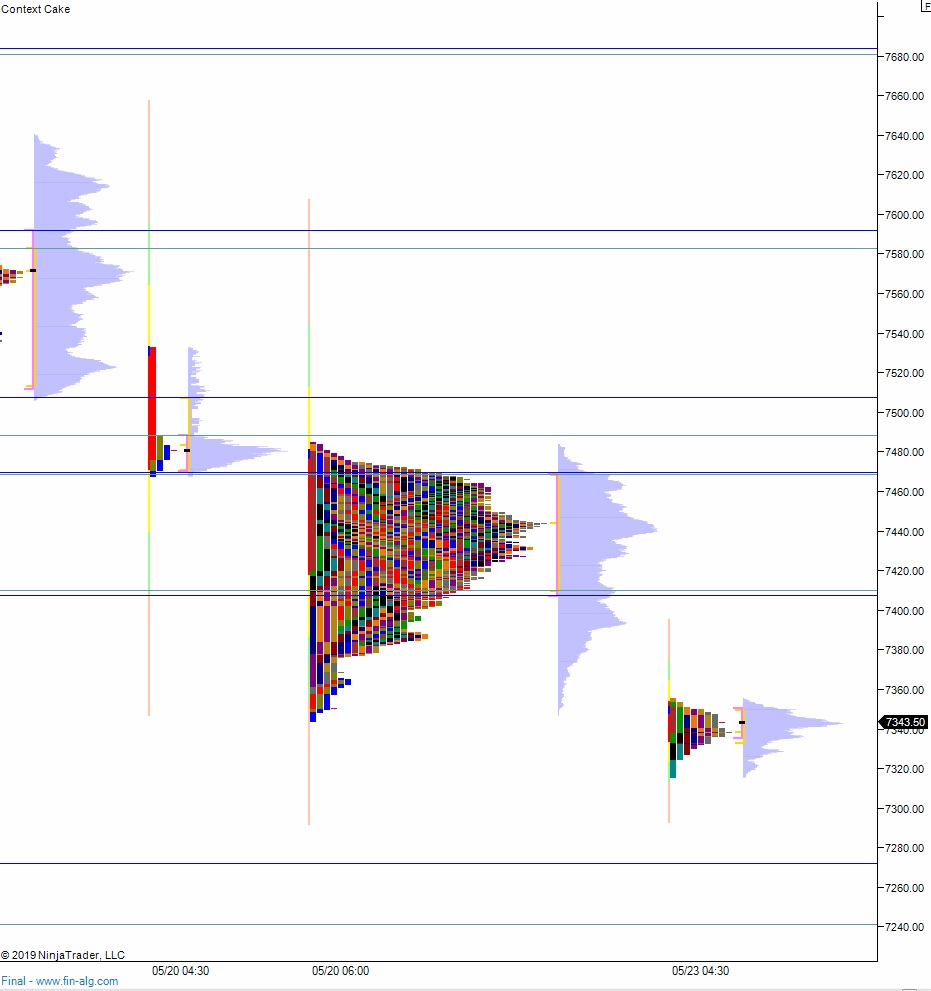

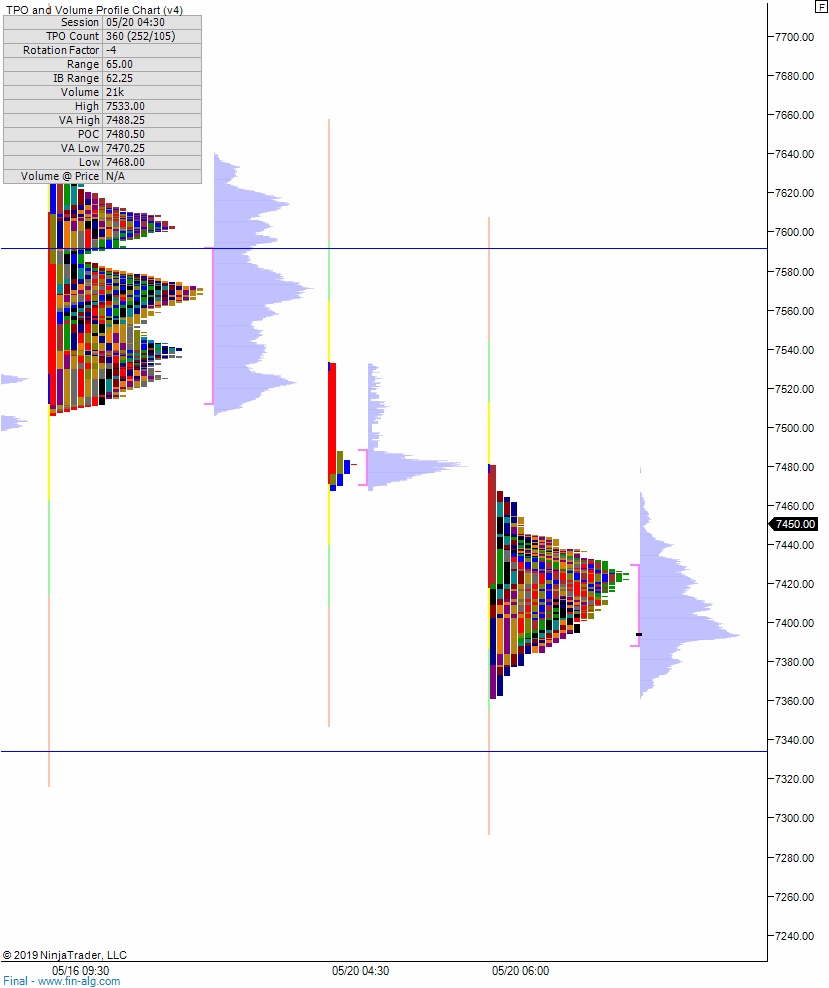

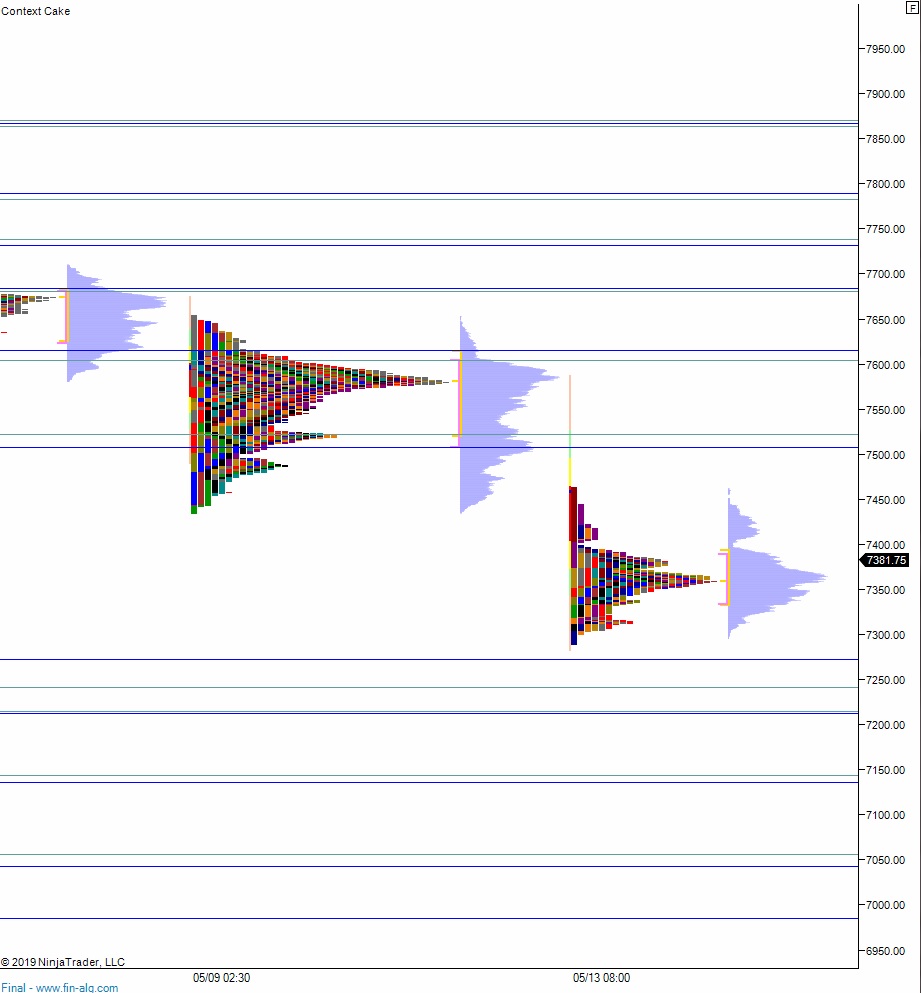

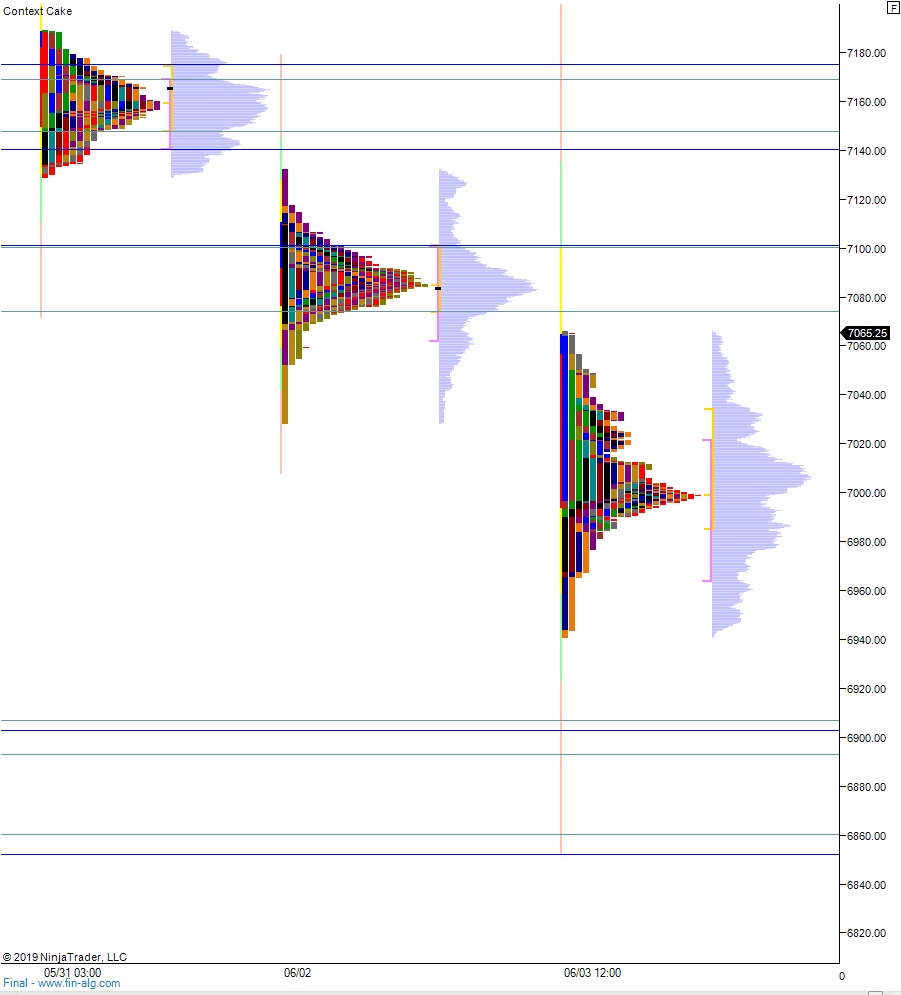

Volume profiles, gaps, and measured moves:

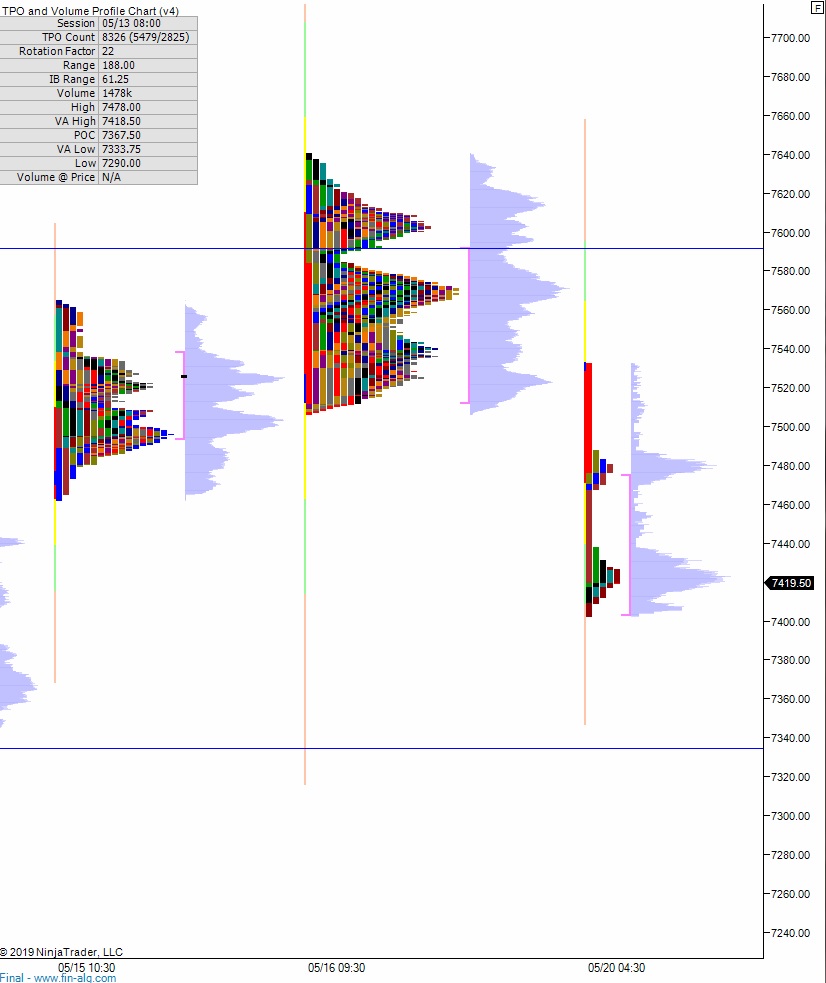

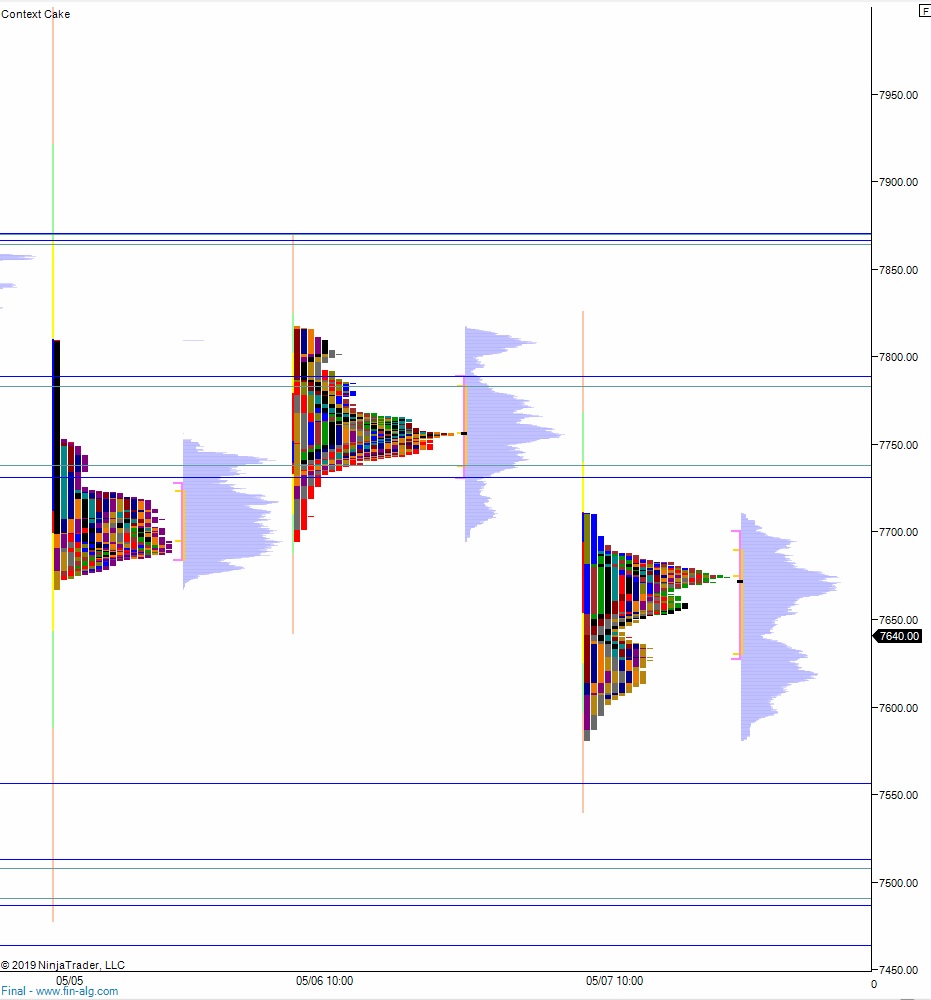

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up above Thursday’s range. An early attempt higher discovered responsive sellers inside last Monday’s range. Said sellers reclaimed the Thursday range and made short work of closing the overnight gap before price worked back up to kiss the midpoint, find initiative sellers, and we eventually closed back down at low-of-day, right near the Thursday close.

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up above Thursday’s range. An early attempt higher discovered responsive sellers inside last Monday’s range. Said sellers reclaimed the Thursday range and made short work of closing the overnight gap before price worked back up to kiss the midpoint, find initiative sellers, and we eventually closed back down at low-of-day, right near the Thursday close.