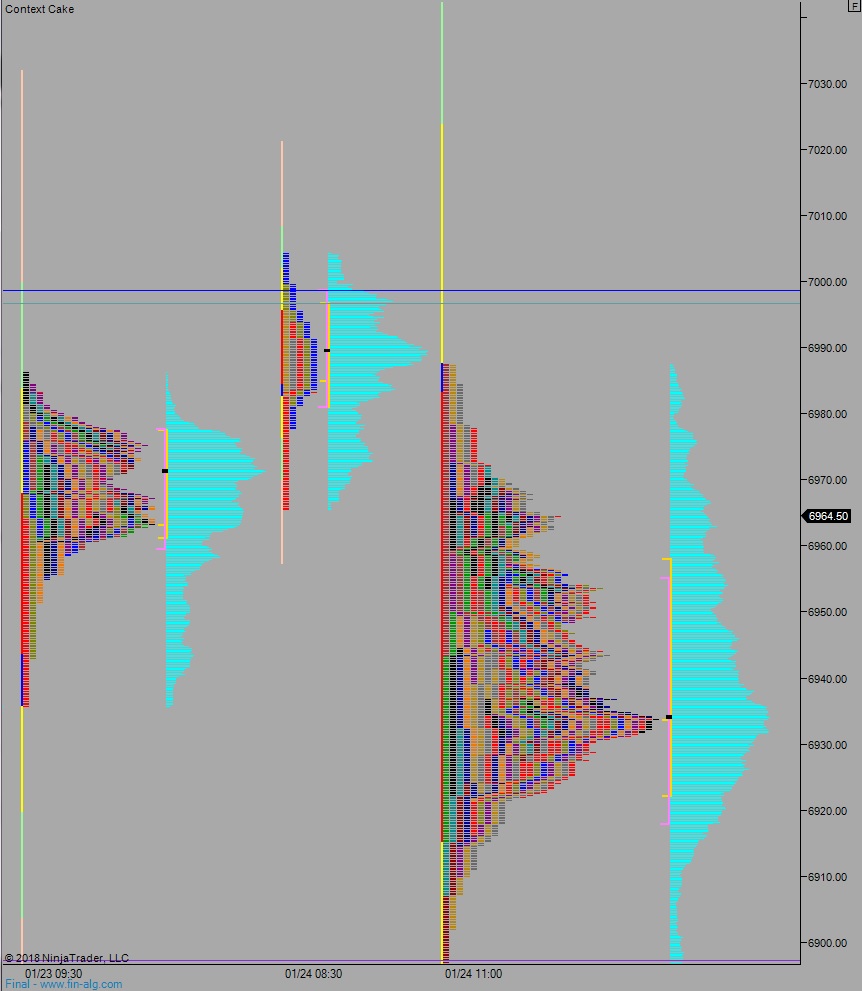

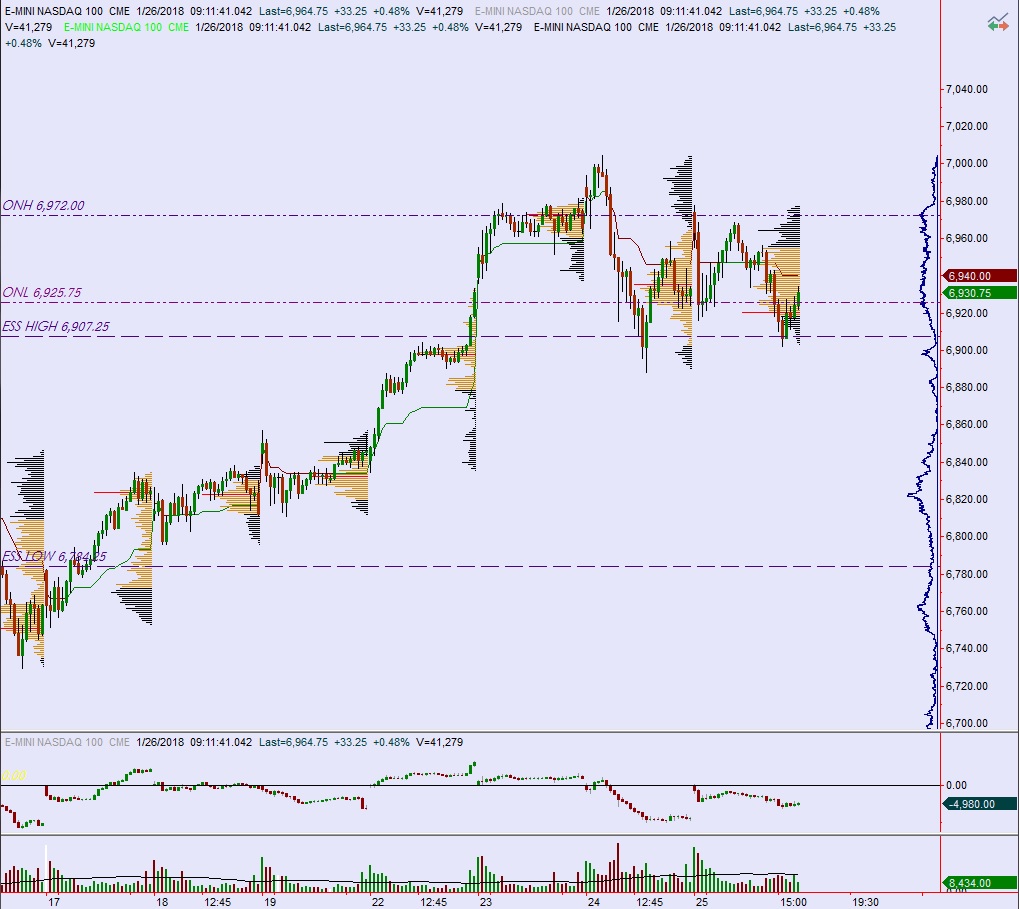

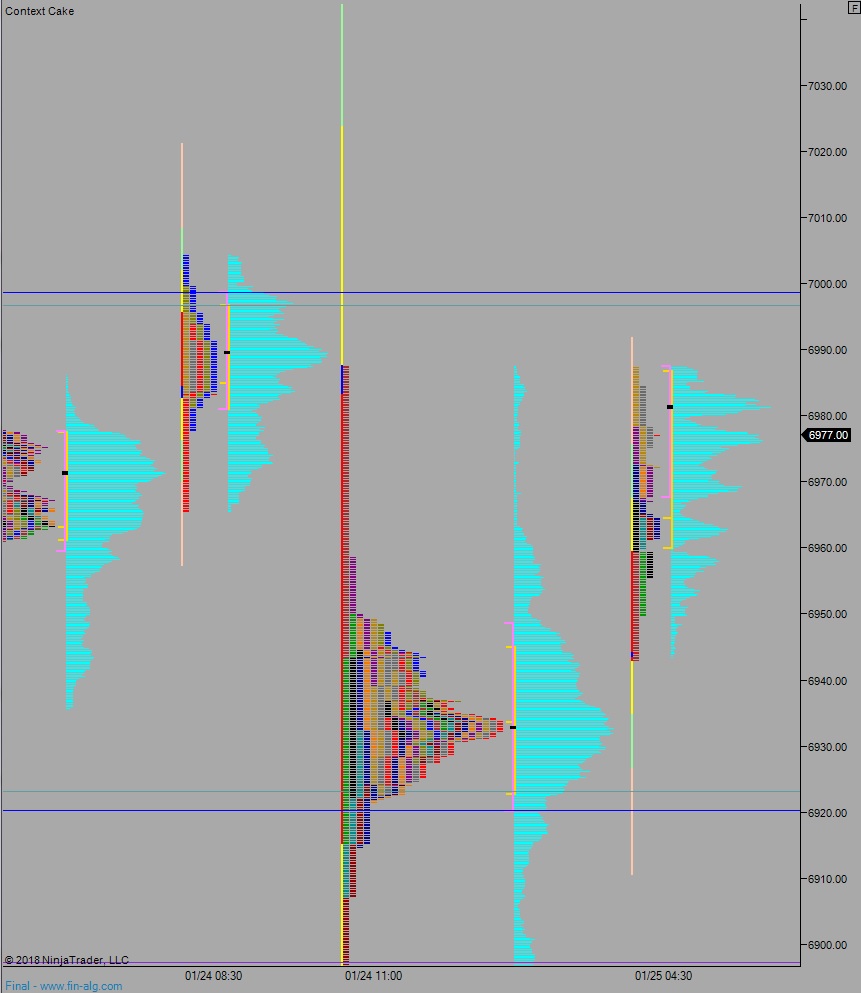

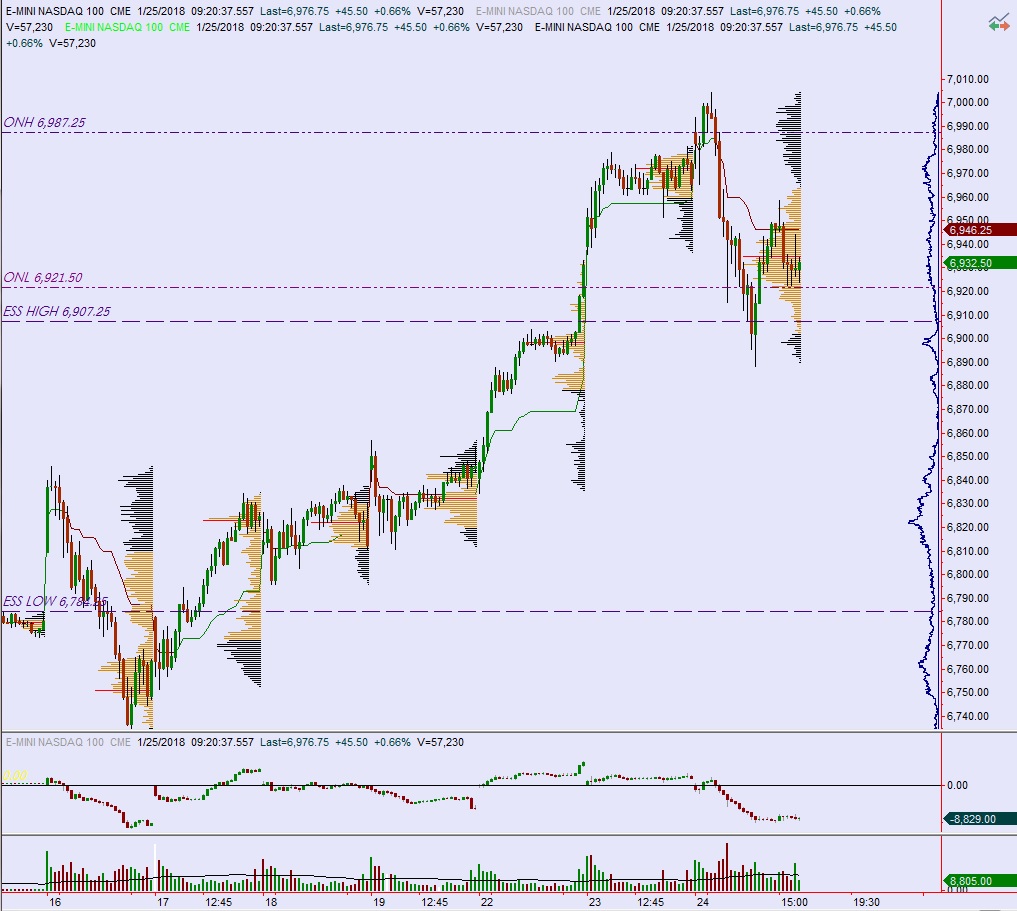

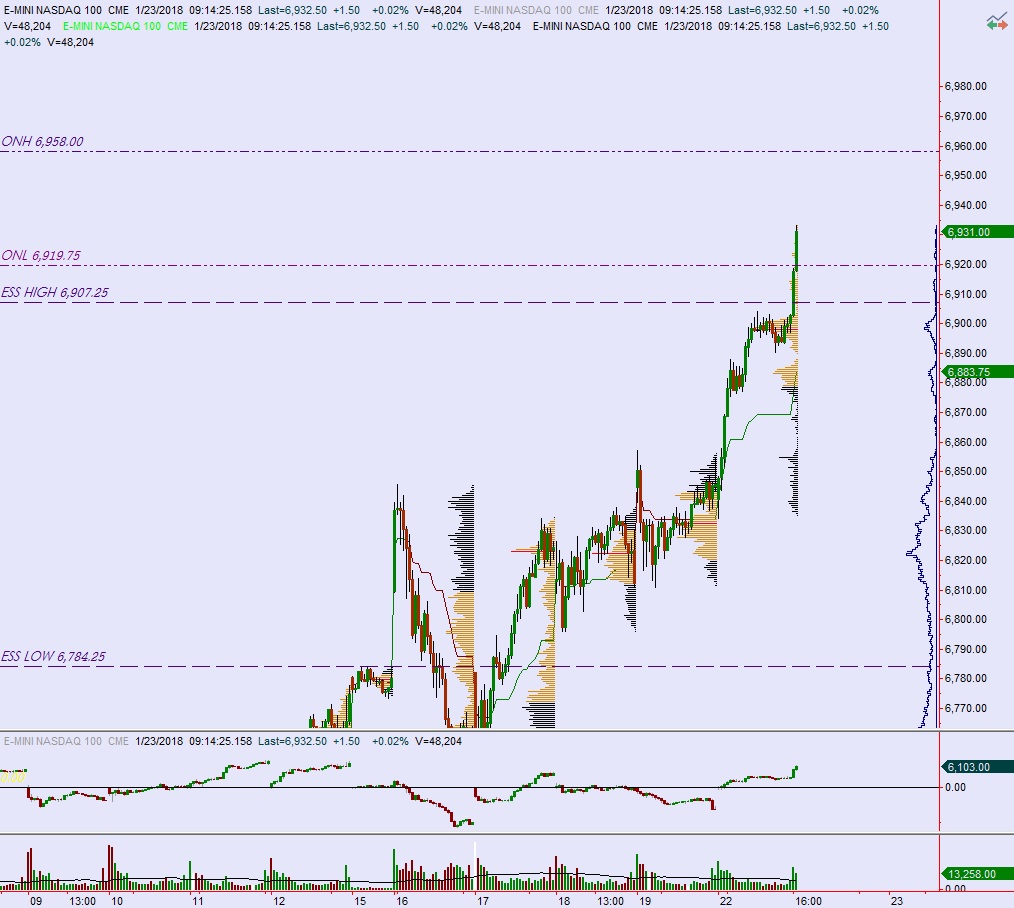

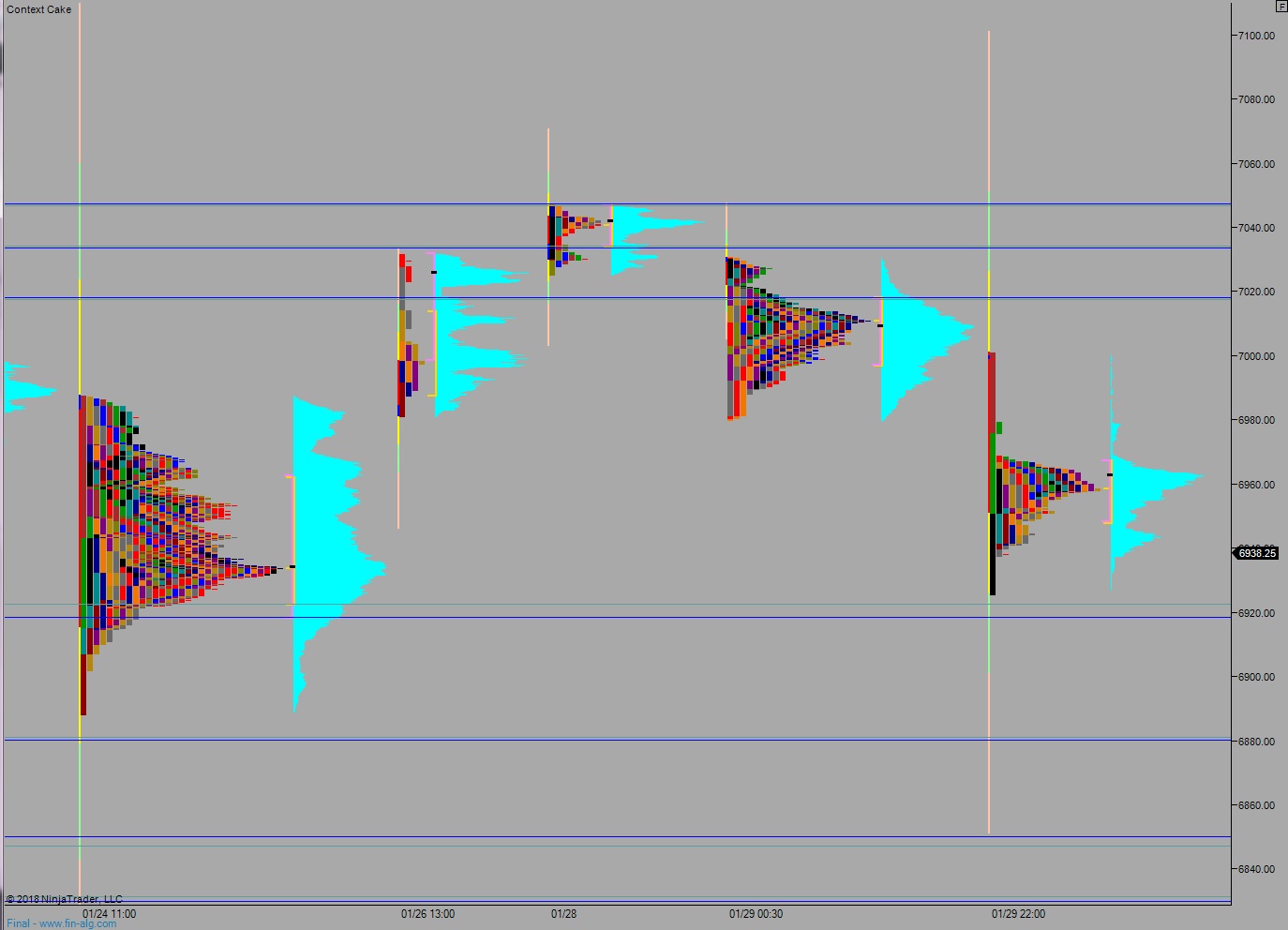

NASDAQ futures are coming into Tuesday pro-gap down after an overnight session featuring extreme range and volume. Price worked lower, hard and fast overnight, trading down to the open gap left behind last Friday morning.

On the economic calendar today we have consumer confidence at 10am and a 4- and 52-week T-bill auction at 11:30am. The Presidential State of The Union Address is at 9pm.

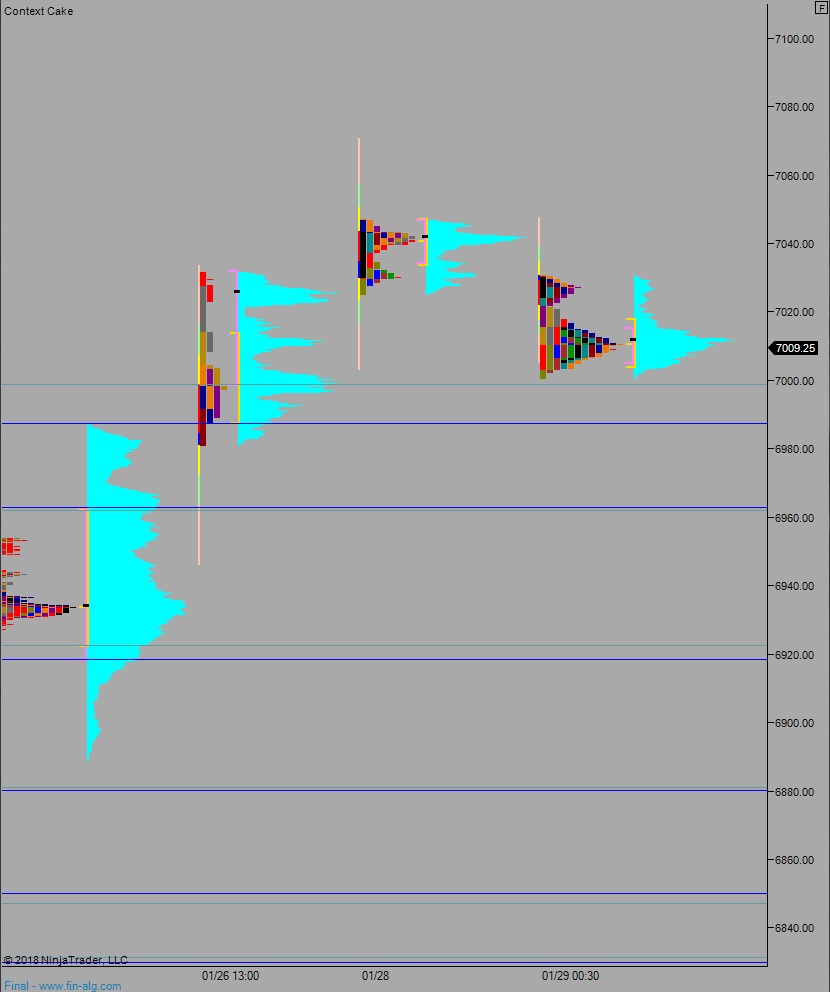

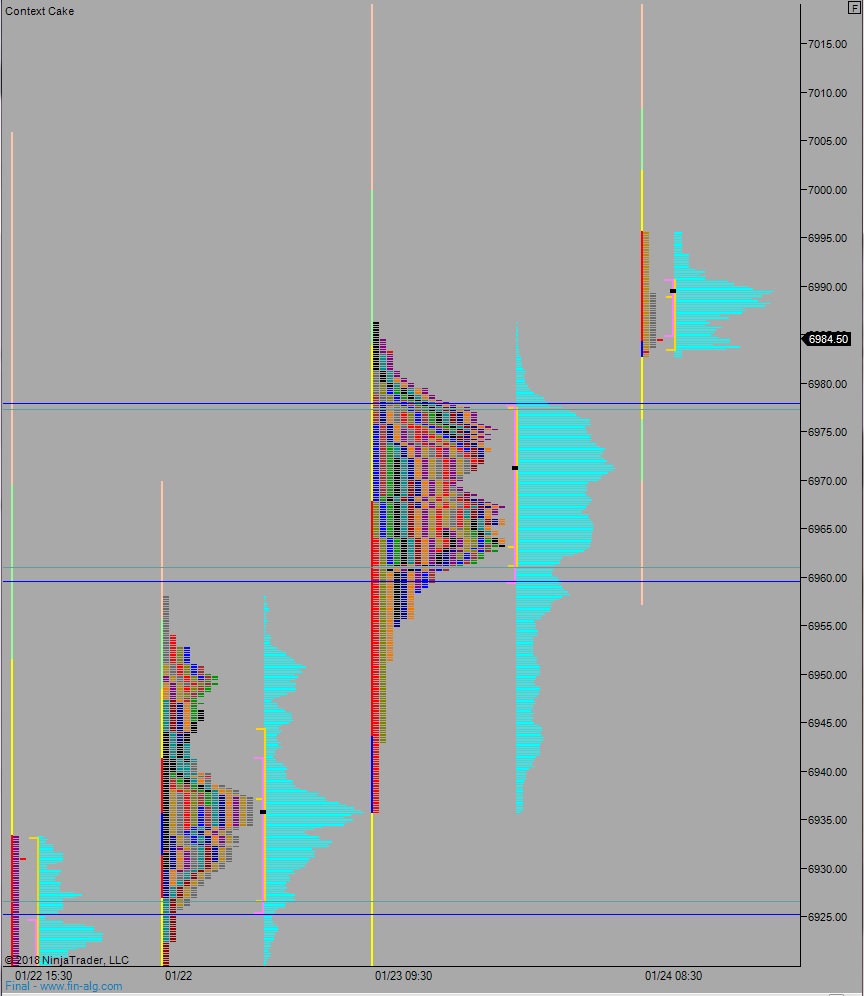

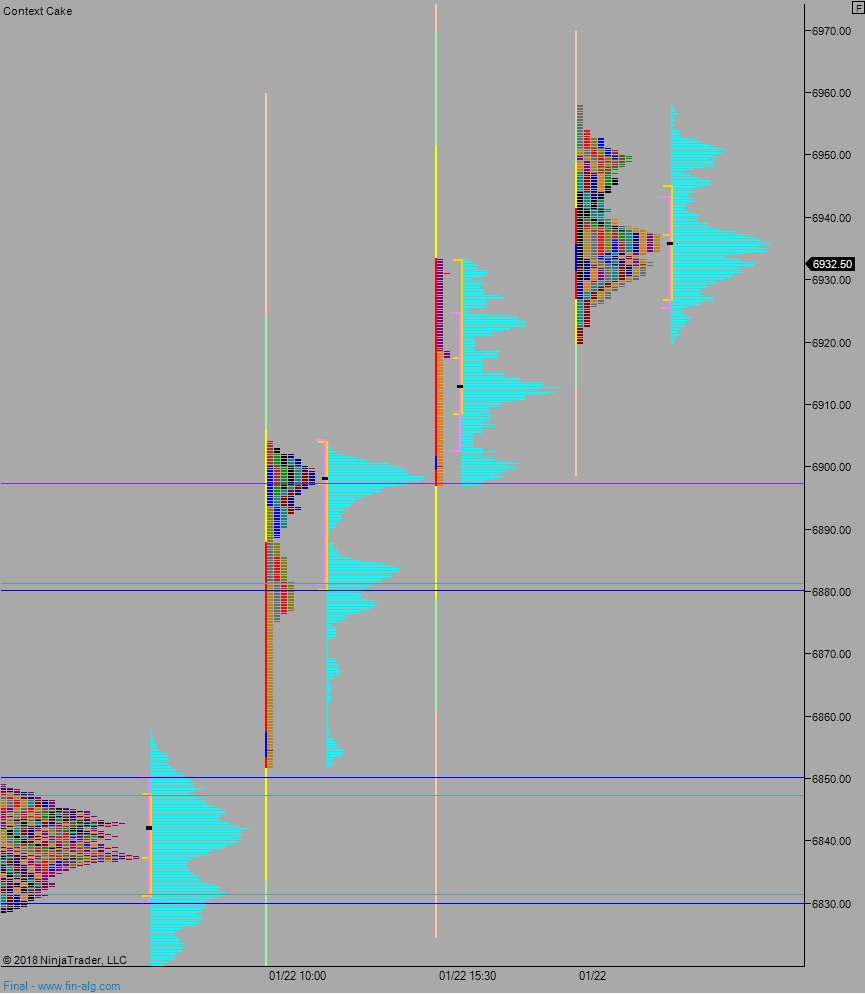

Yesterday we printed a neutral extreme down. The day began gap down and after a choppy opening battle we went range extension down. By late lunch we had traversed the entire daily range and gone up through initial balance high, making us neutral. However buyers could not close the overnight gap and we worked back down into the lower third of the range, earning the neutral extreme designation.

Heading into today my primary expectation is for a gap-and-go lower, down though overnight low 6925.75. Look for buyers down at 6918.50 and two way trade to ensue.

Hypo 2 buyers work higher and attempt a move back into the Monday range 6980. Sellers defend here and two way trade ensues.

Hypo 3 stronger sellers trade us down to 6880.75 before two way trade ensues.

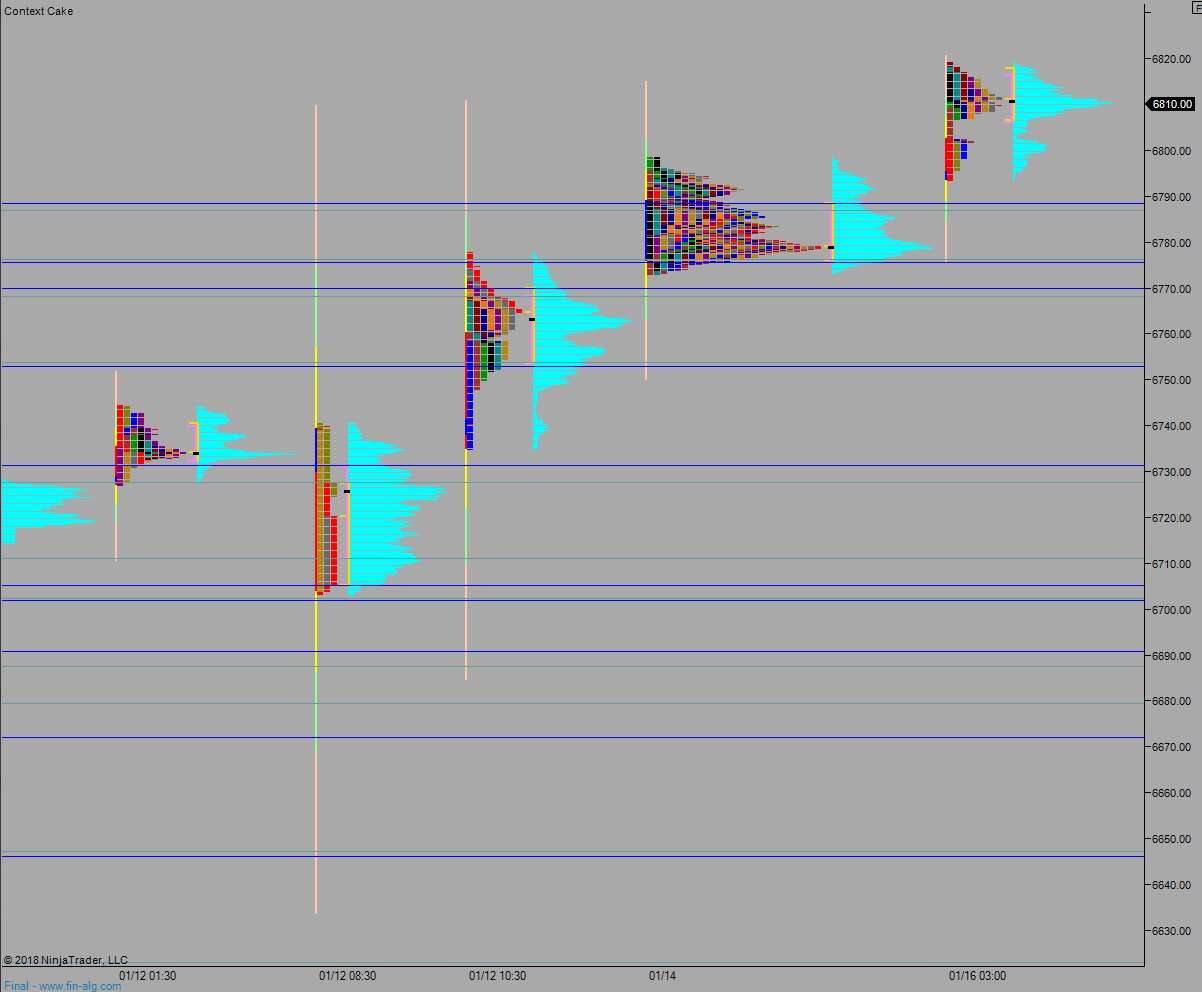

Levels:

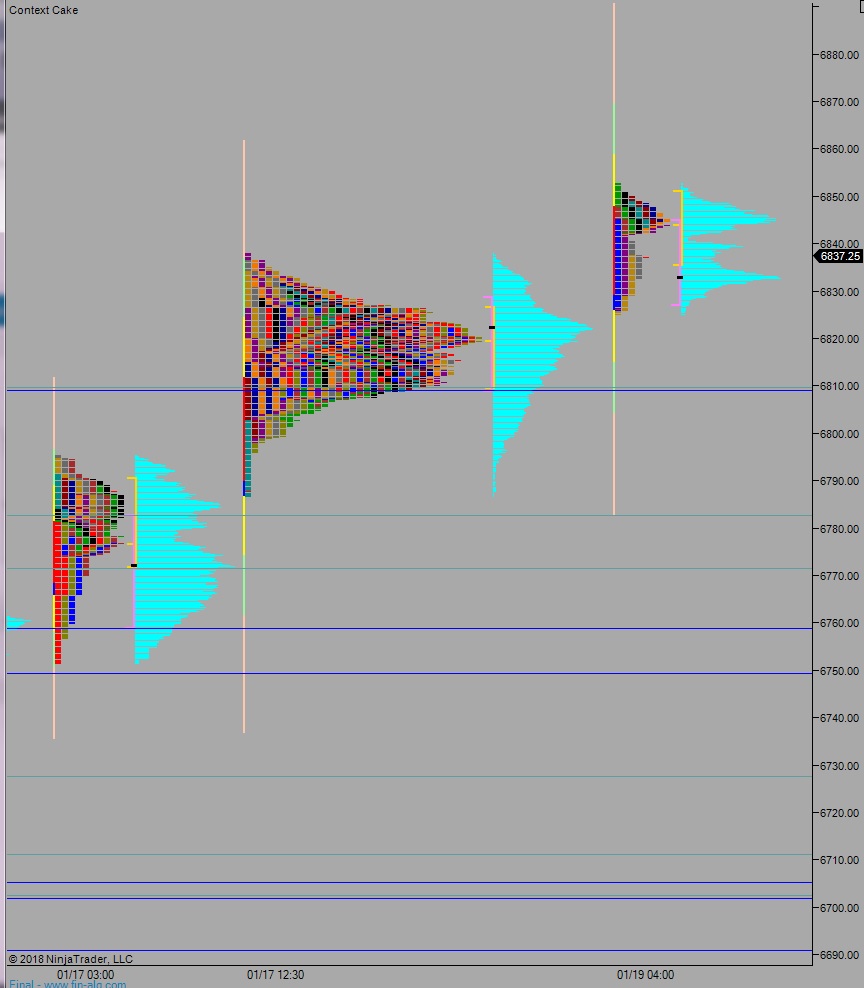

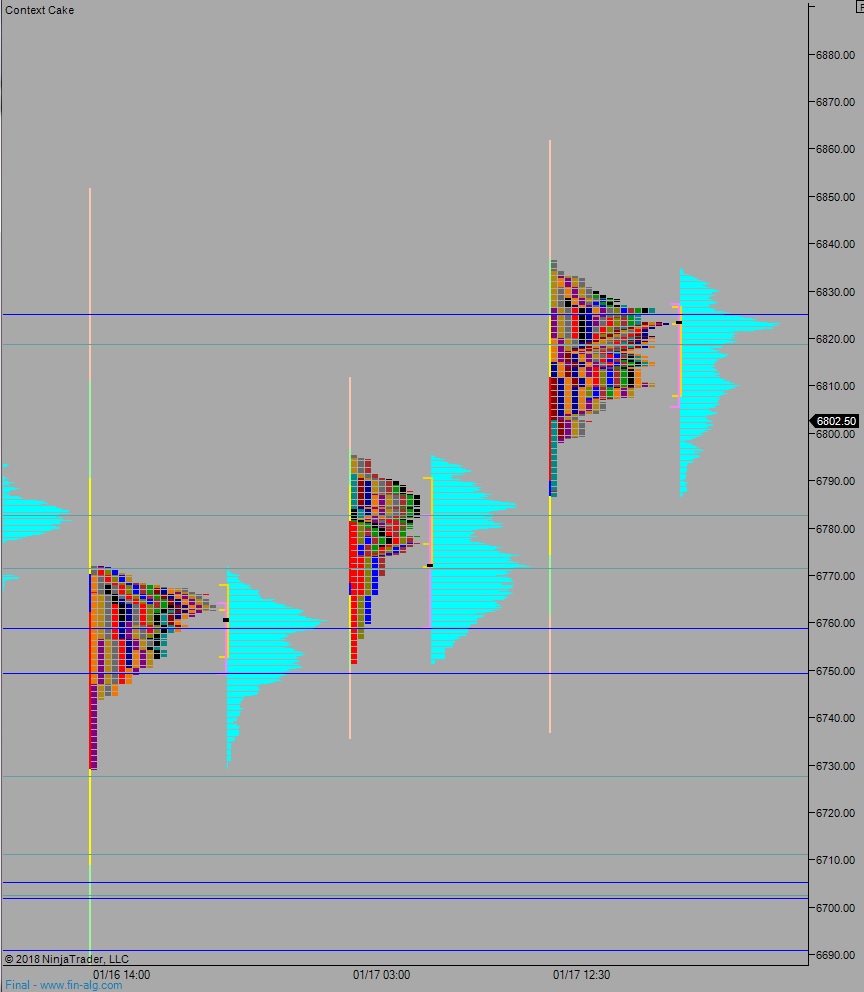

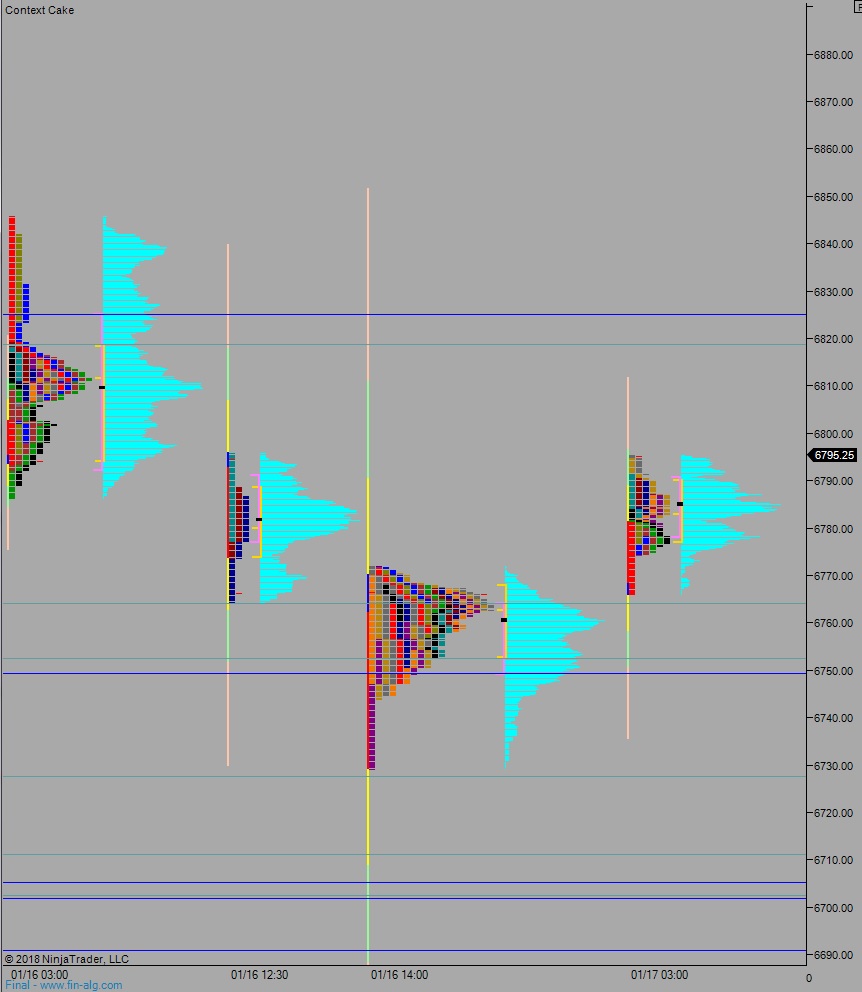

Volume profiles, gaps, and measured moves: