NASDAQ futures are coming into the week up a few points after an overnight session featuring normal range and volume. Price worked lower Sunday evening but discovered before midnight and spent the rest of extended trade slowly working higher.

The economic calendar is light today. We only have a 3- and 6-month T-bill auction at 11:30am to concern ourselves with.

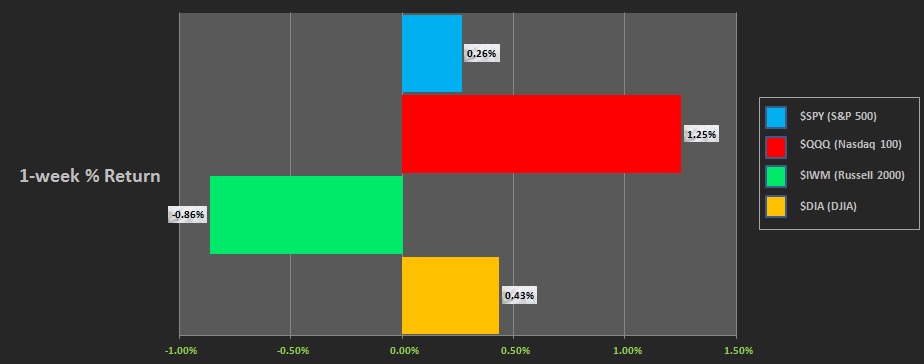

Last week markets worked sideways early in the week. They drifted slightly higher. Thursday morning feature selling, then Thursday afternoon through the close of the week featured a strong rally—just like we saw in the two weeks prior. The Russell lagged, but the Russell made an outsized move during September that it is still consolidating. The last week performance of each major index is shown below:

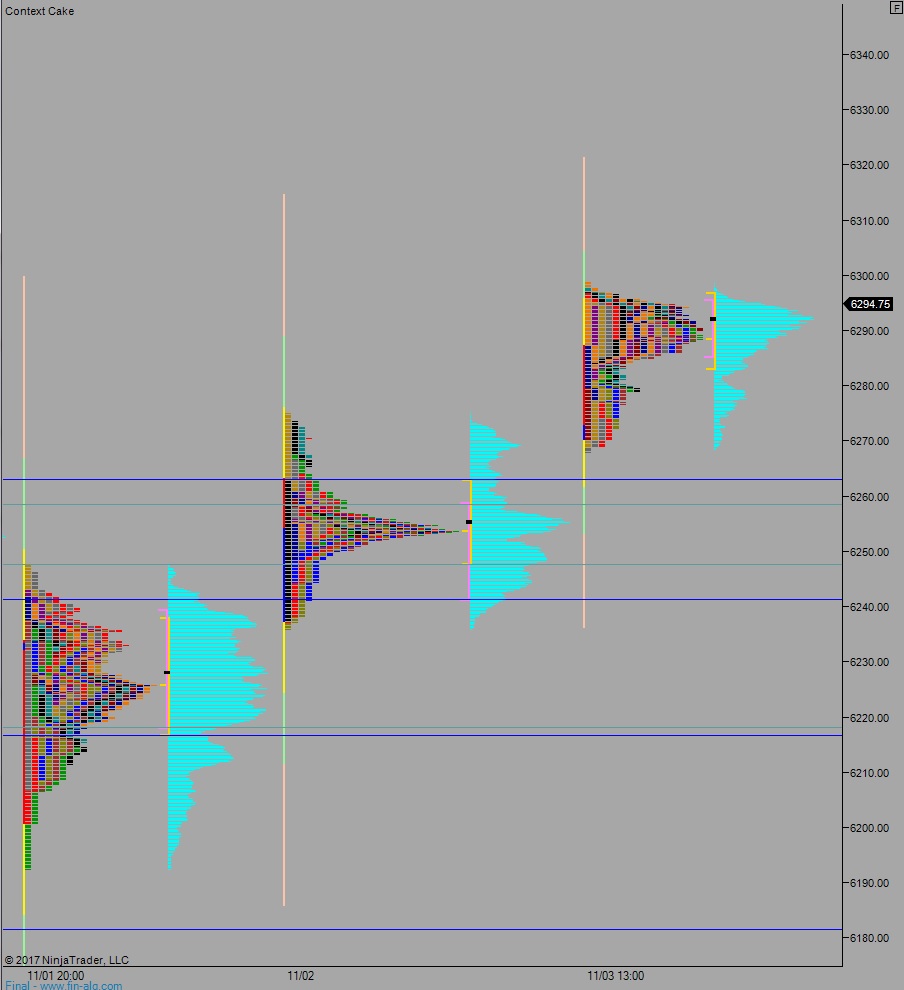

On Friday the NASDAQ printed a double distribution trend day. The day began gap up. Sellers quickly closed the overnight gap and a responsive bid showed up right around the Thursday close. Buyers aggressively defended the area and we spent the rest of the day trending higher.

Heading into today my primary expectation is for sellers to press into the overnight inventory and work down through overnight low 6268. Look for buyers down at 6263.25 and two way trade to ensue.

Hypo 2 buyers press up through overnight high 6298.75 and struggle around the 6300 century mark before two way trade ensues.

Hypo 3 stronger buyers work up to 6243.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: