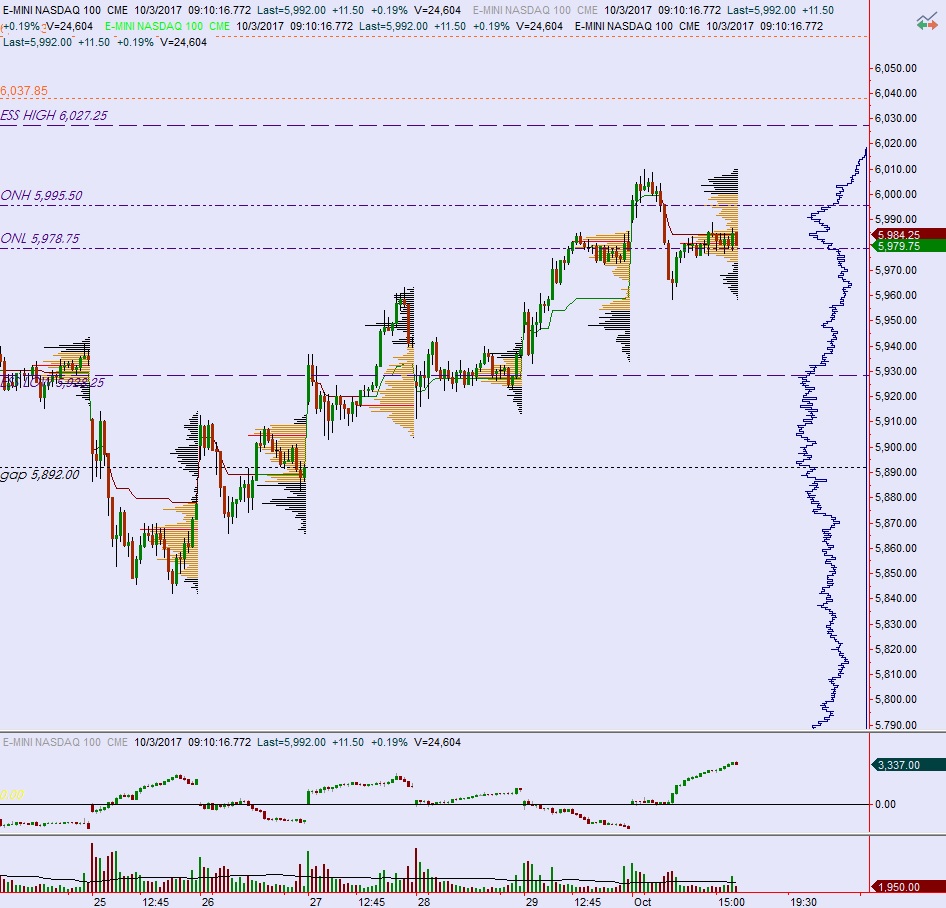

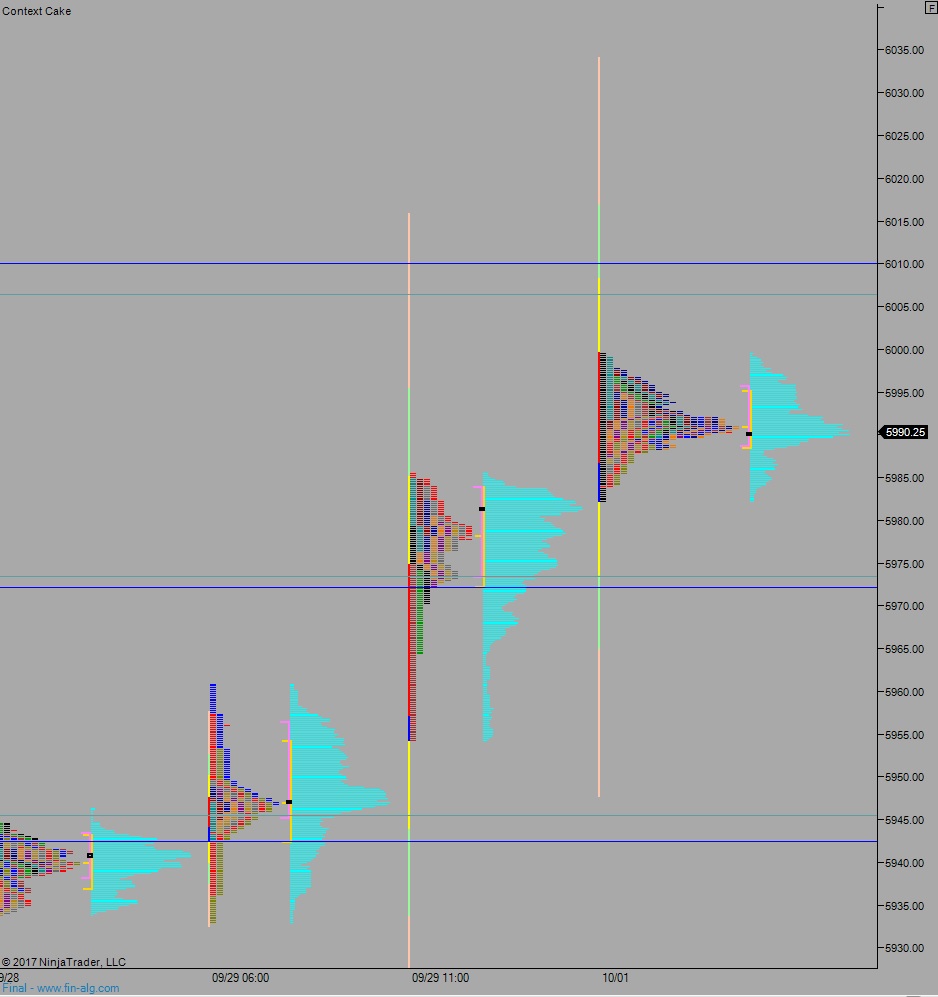

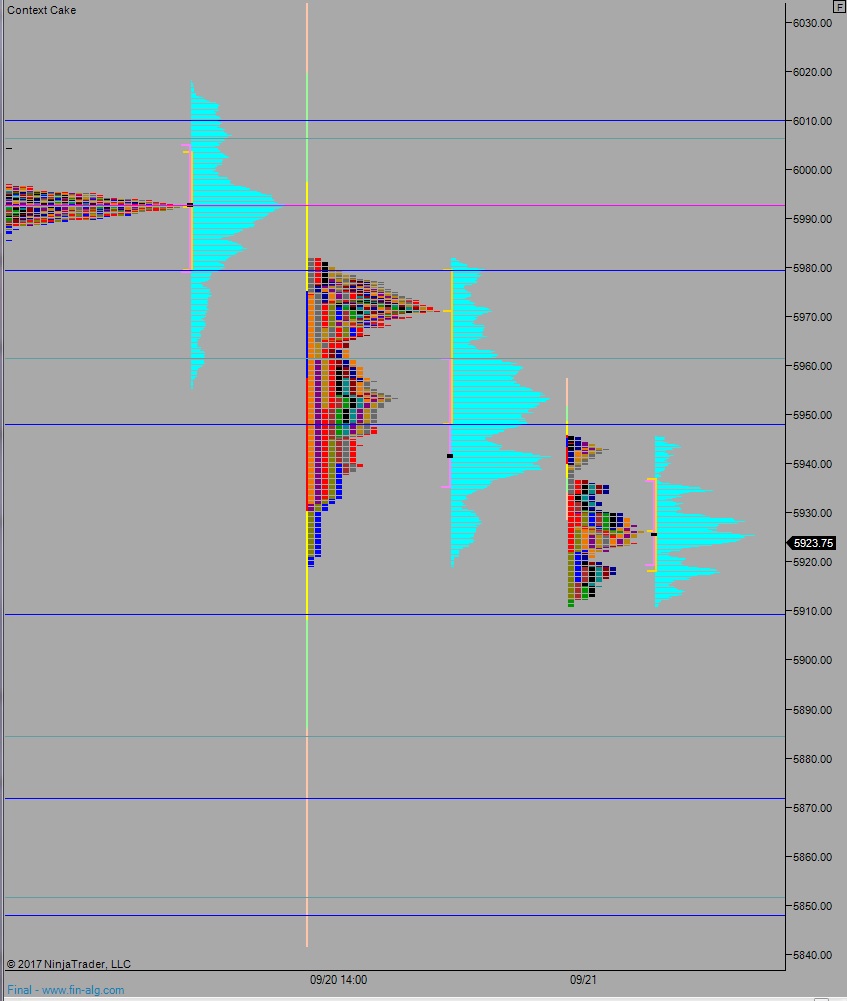

NASDAQ futures are coming into Friday gap down after an overnight session featuring elevated range and normal volume. Price worked to a new record high overnight. Then, at 8:30am non-farm payroll data came out mixed and sellers introduced themselves to the market. So far they have pressed back down to the midpoint from Thursday.

The only other economic event of note today is consumer credit at 3pm.

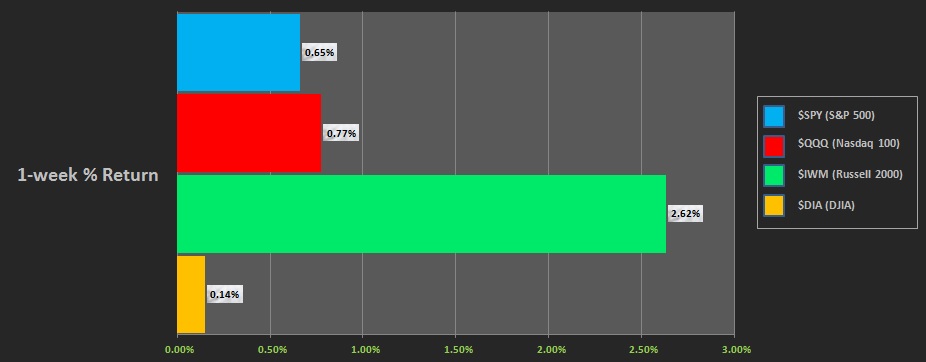

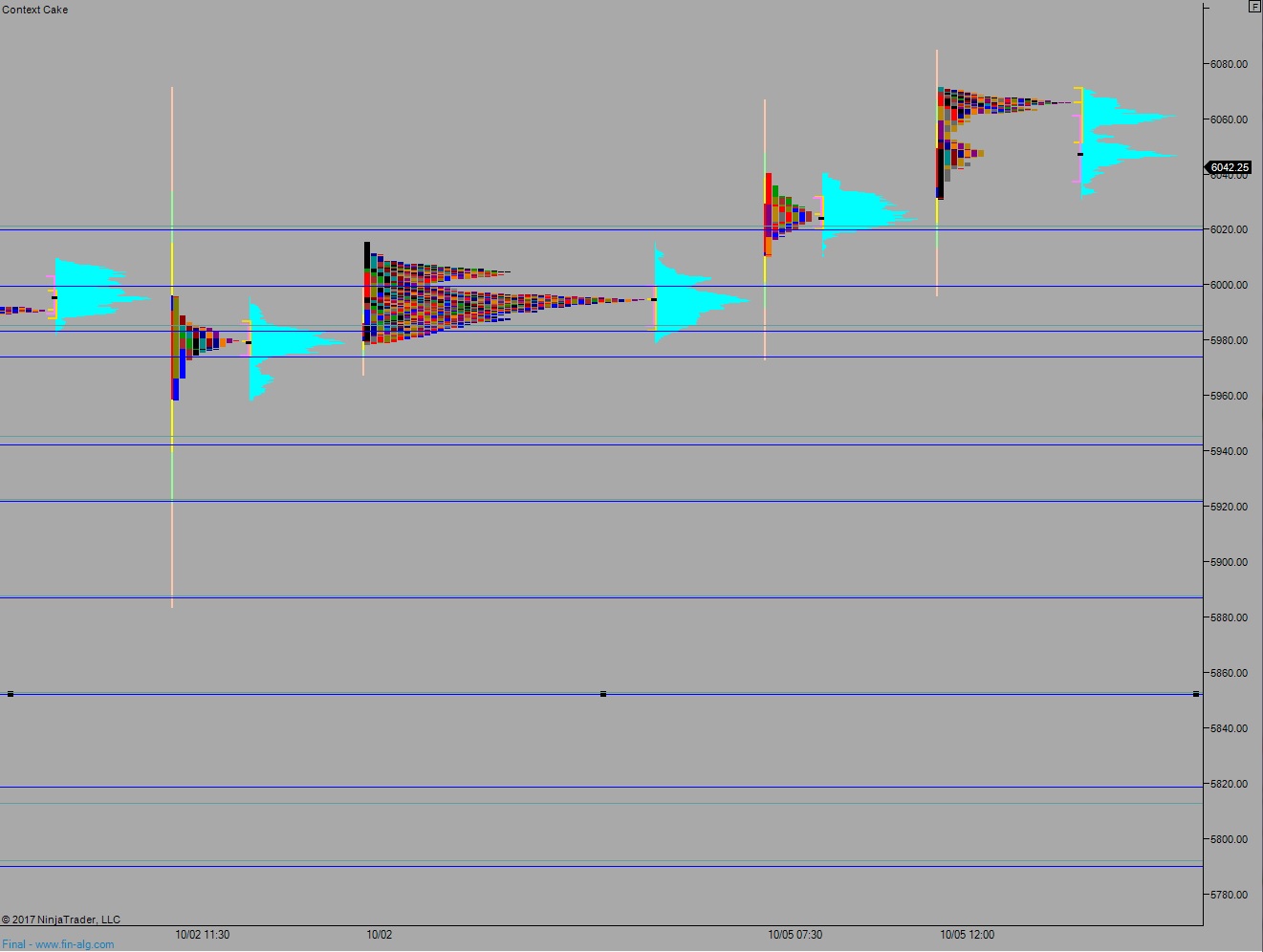

Yesterday we printed a double distribution trend up. The day began with a gap up above all prior highs. Buyers defended an attempt back down into the Wednesday range and we spent the rest of the day rallying. We took a brief pause at the strategy session measured move high 6050 but made one final push into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 6055.25. From here we trade lower, down through overnight low 6040. Look for buyers down at 6021.25 and two way trade to ensue.

Hypo 2 stronger buyers fill the gap up to 6066 and continue higher, up through overnight (record) high 6071.50. Open air.

Hypo 3 stronger sellers press a gap fill down to 6004.50.

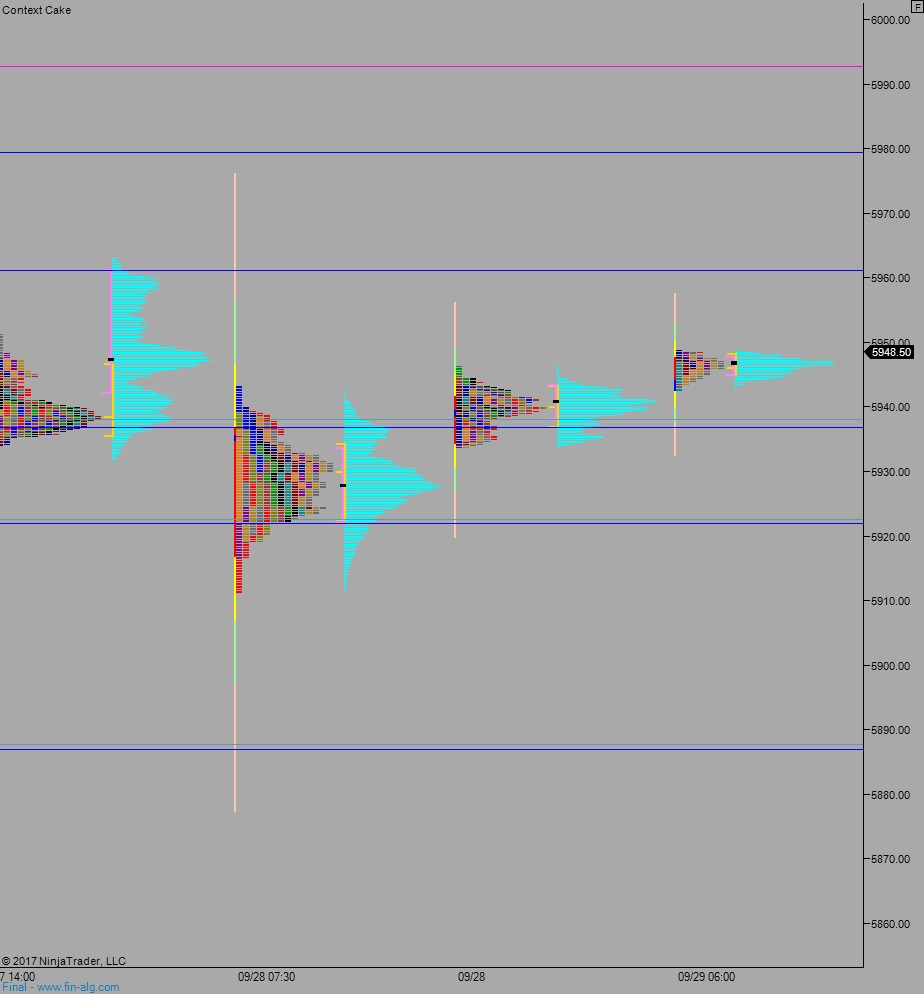

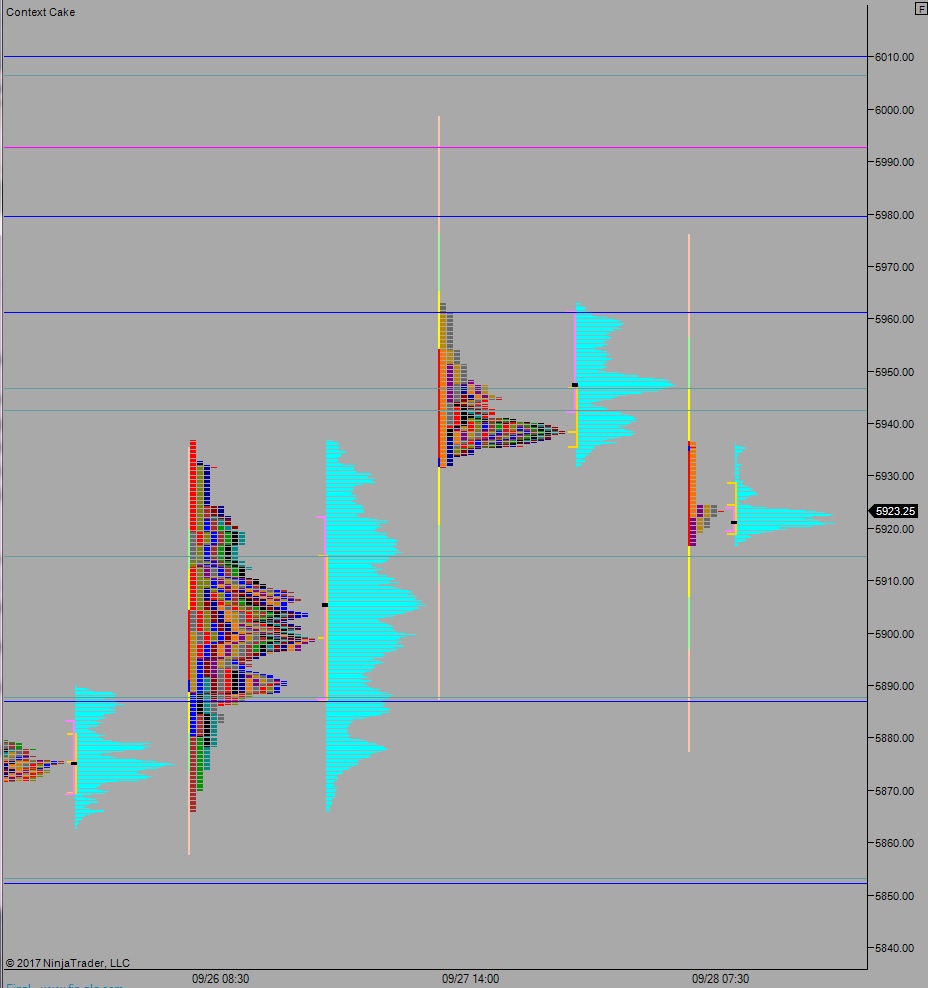

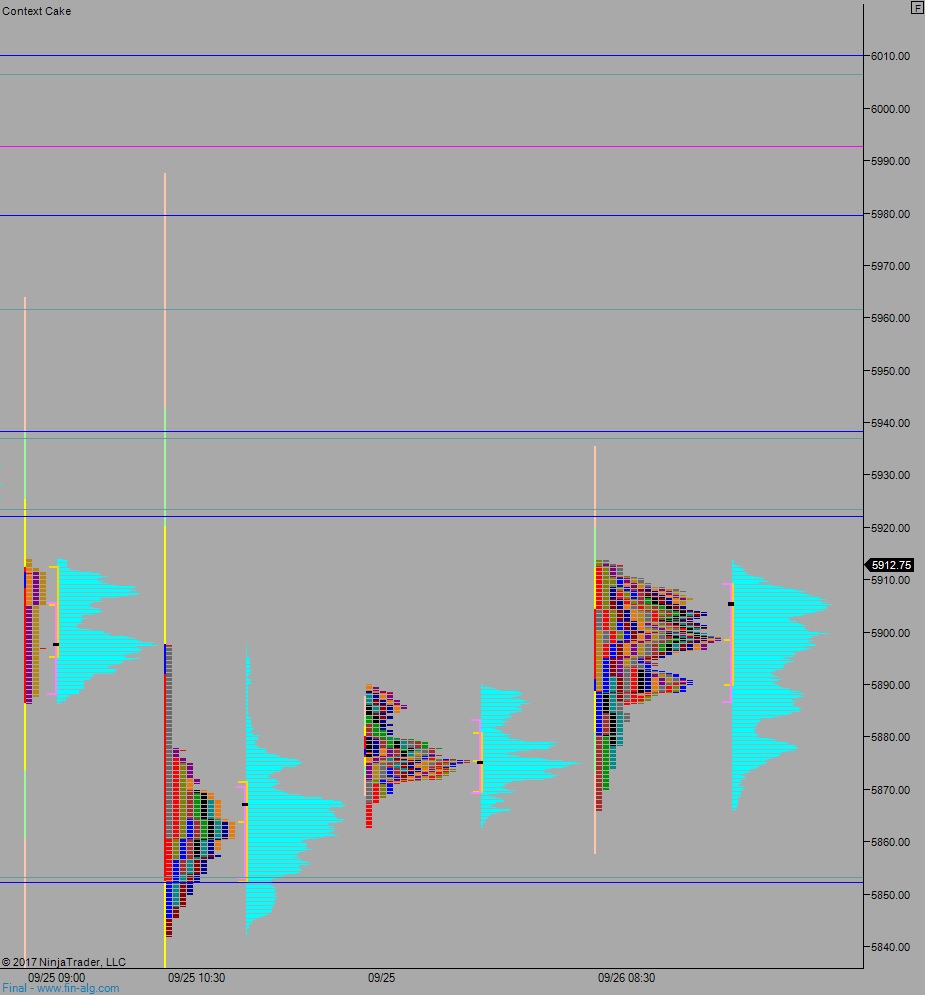

Levels:

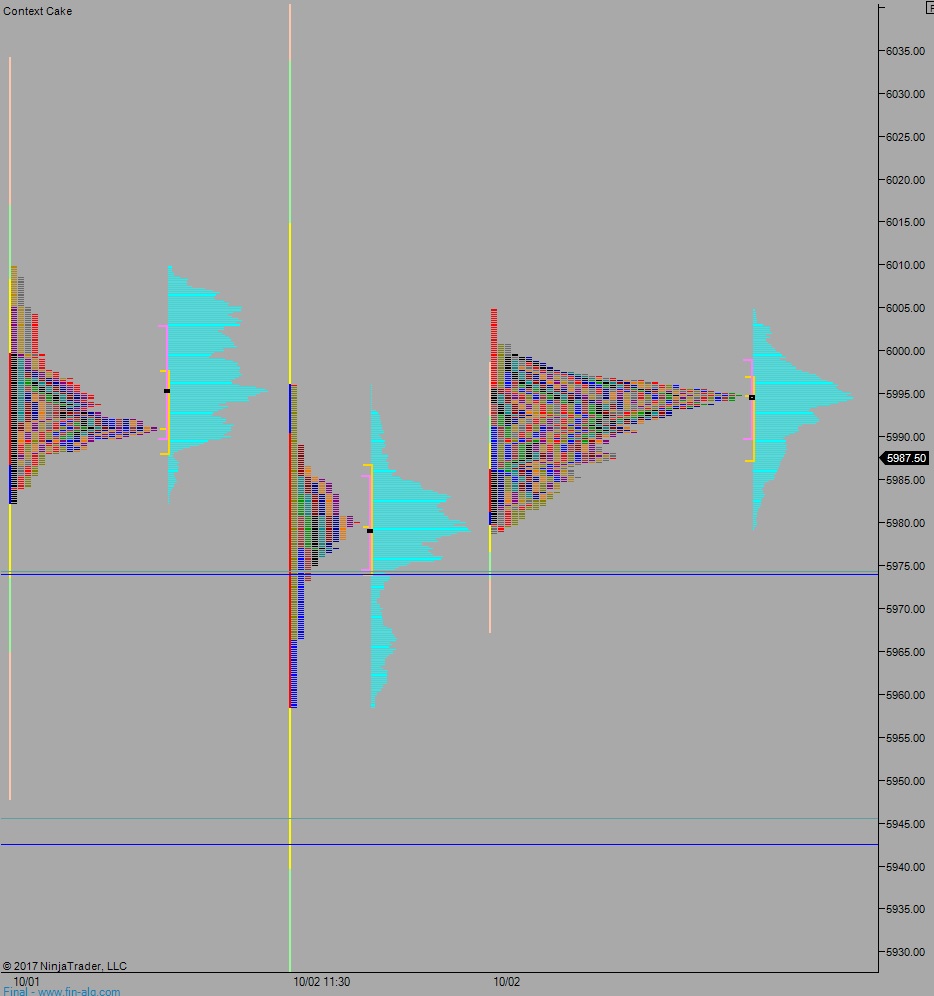

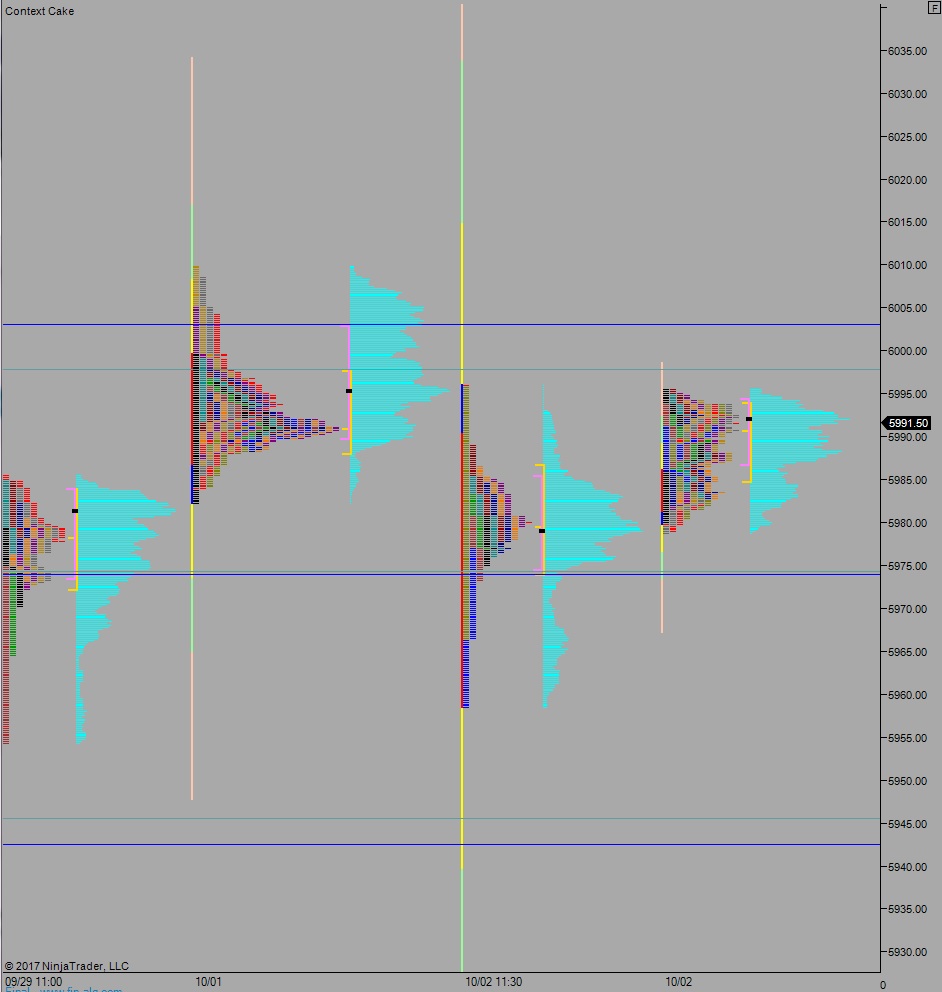

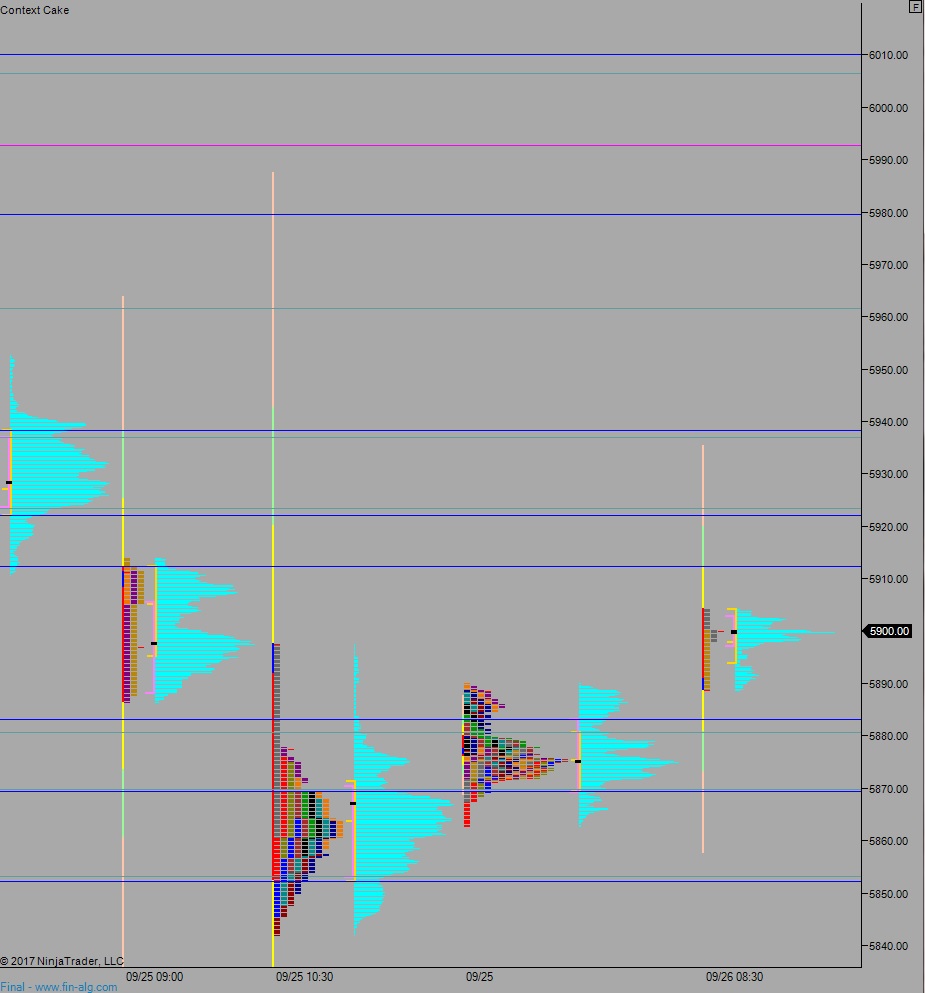

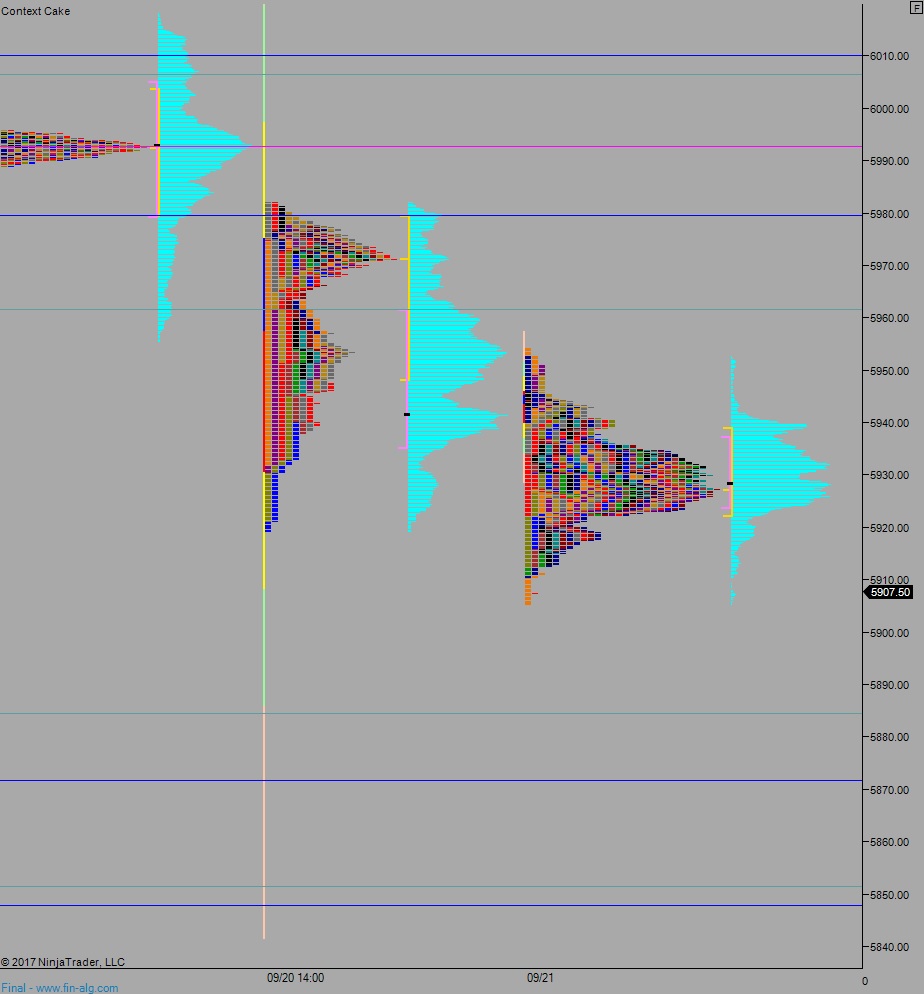

Volume profiles, gaps, and measured moves: