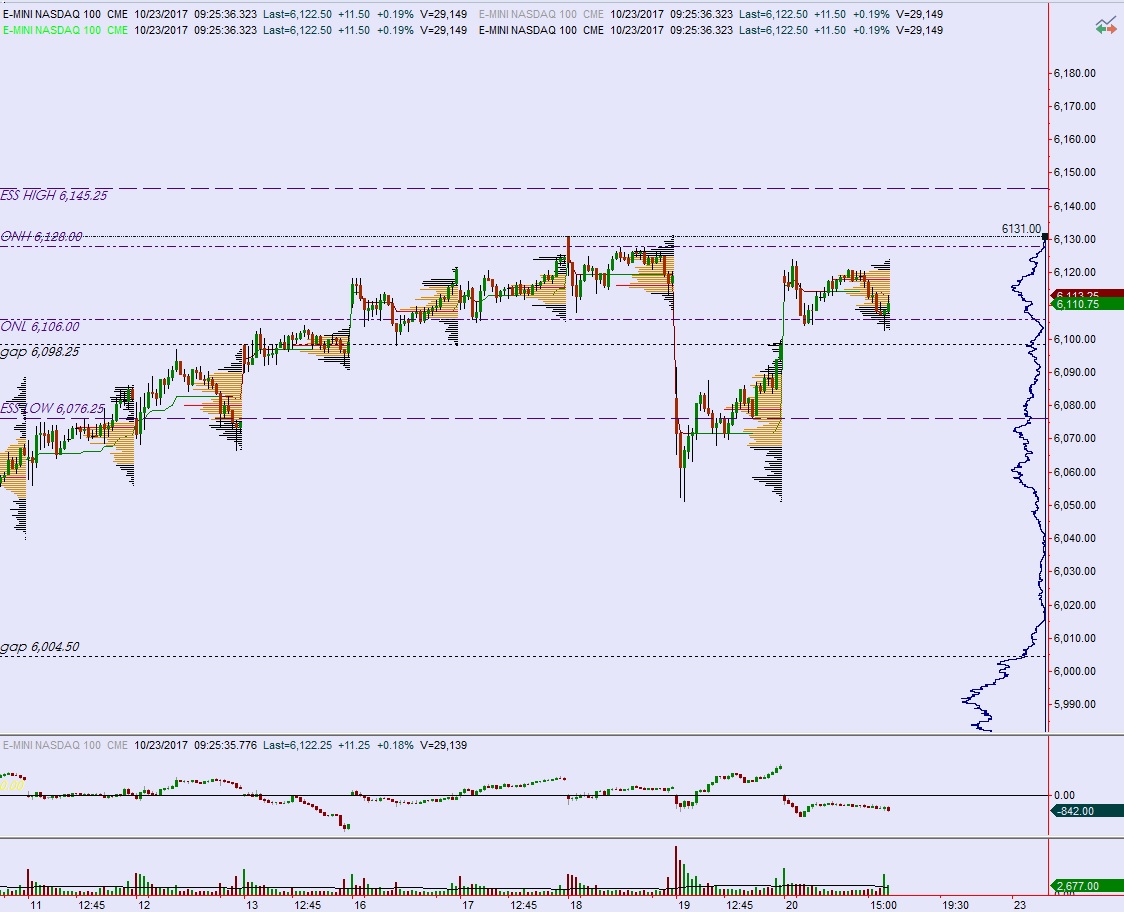

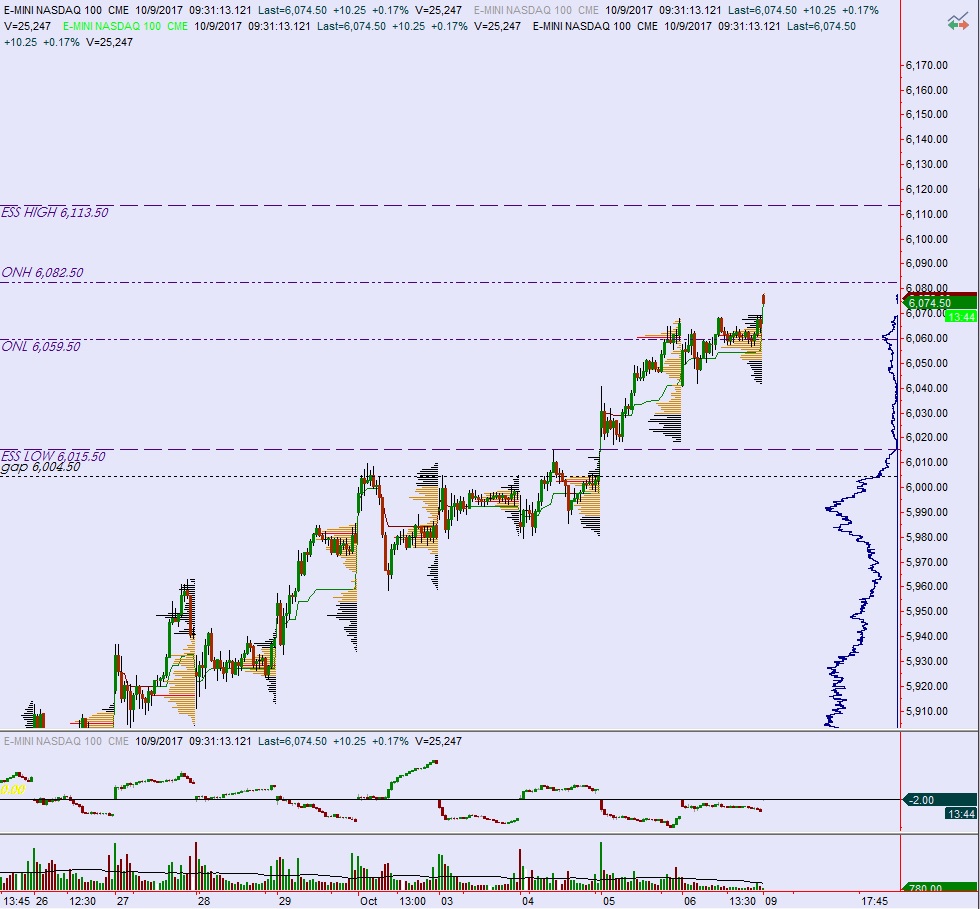

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked back up to record highs overnight, slow-and-steady.

Economic calendar is light today. We have the Case-Shiller Home Price index at 9am, Consumer Confidence at 10am, and a 4-week T-bill auction at 11:30am.

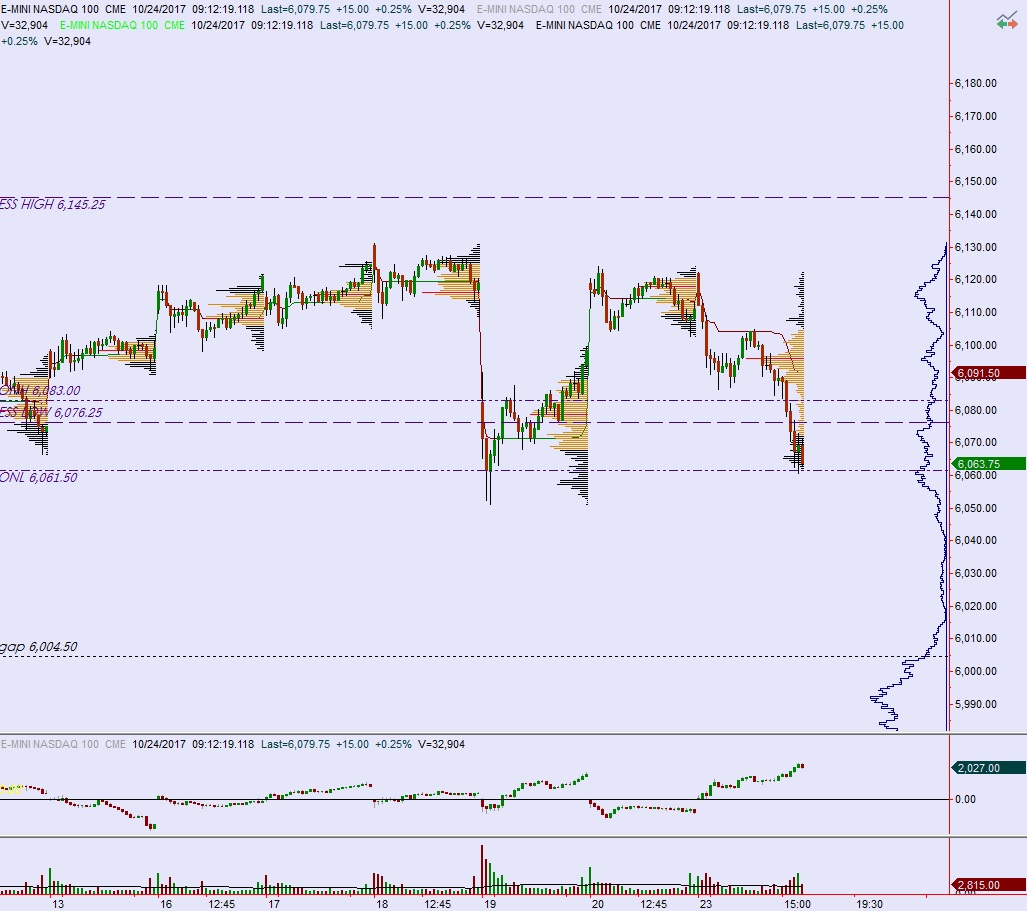

Yesterday we printed a neutral day. Monday began with a gap down. We quickly filled it and then took out overnight high before reversing down through the entire range and poking below overnight low. Then a responsive bid stepped in to the neutral tape and two-way trade ensued.

Heading into today my primary expectation is for a gap-and-go higher—a move up to 6263.75 before two-way trade ensues.

Hypo 2 sellers press into overnight inventory and close the gap down to 6227 then take out overnight low 6219.25. Look for buyers ahead of 6200 and two way trade.

Hypo 3 stronger selling down to 6181.50 before two way trade.

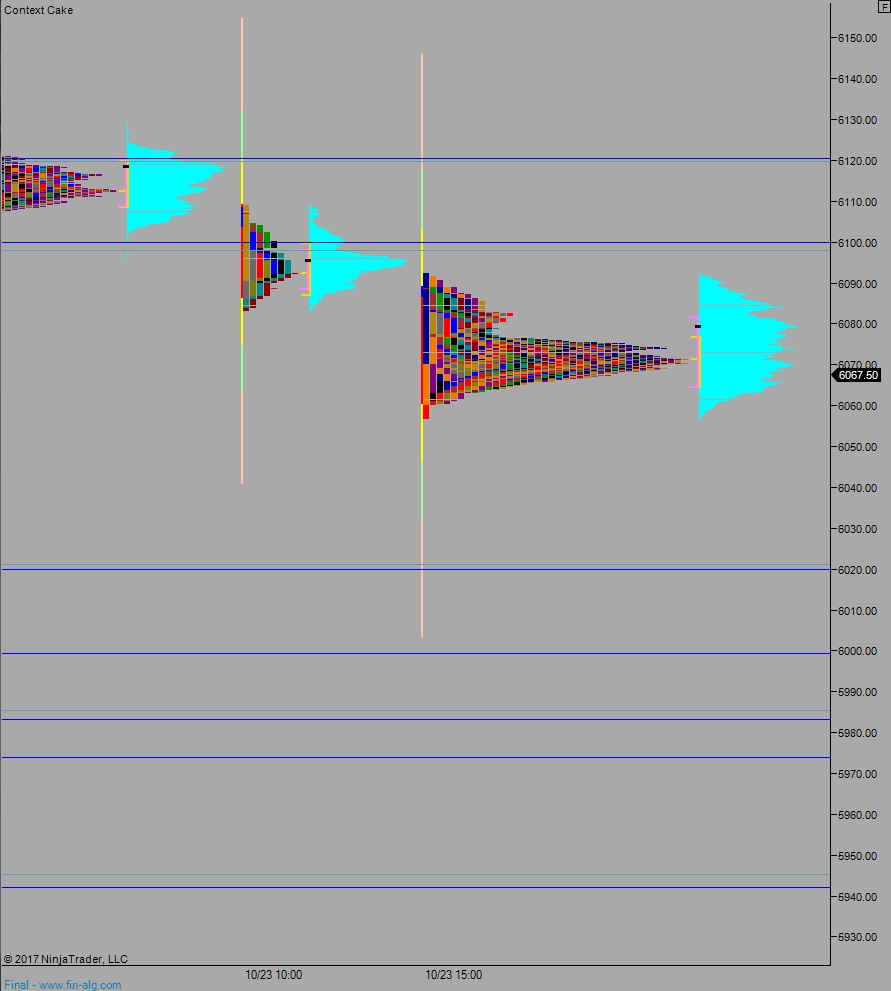

Levels:

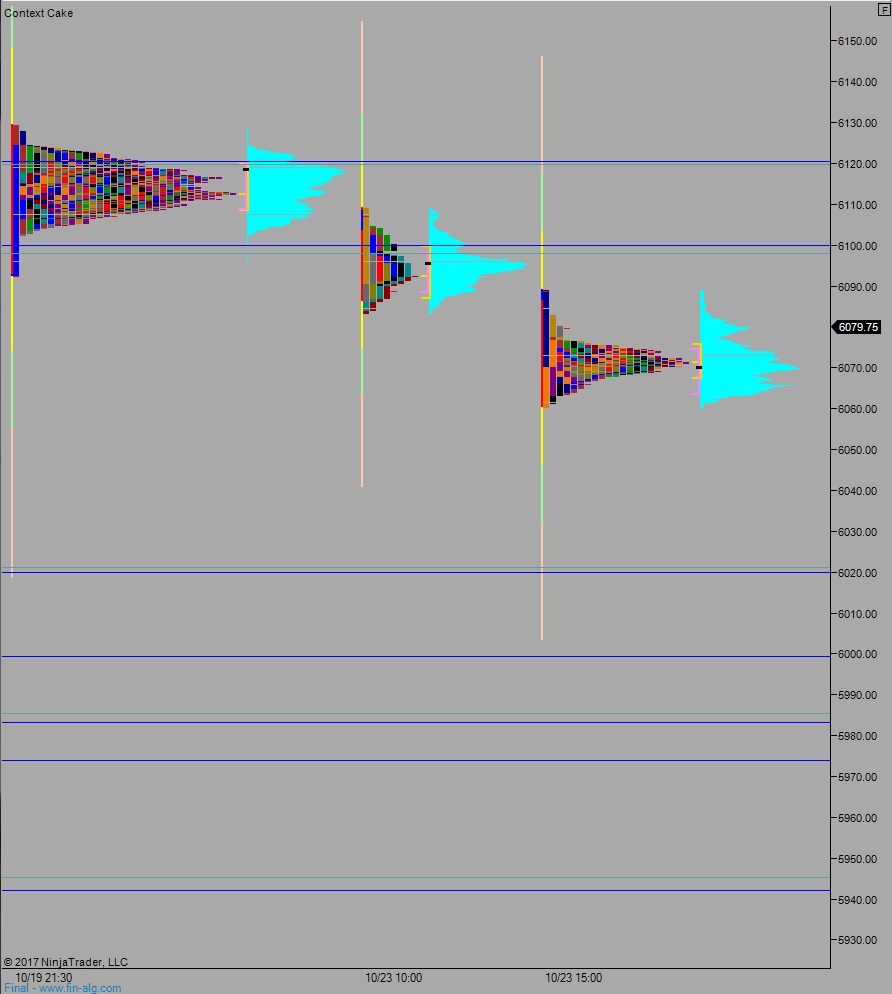

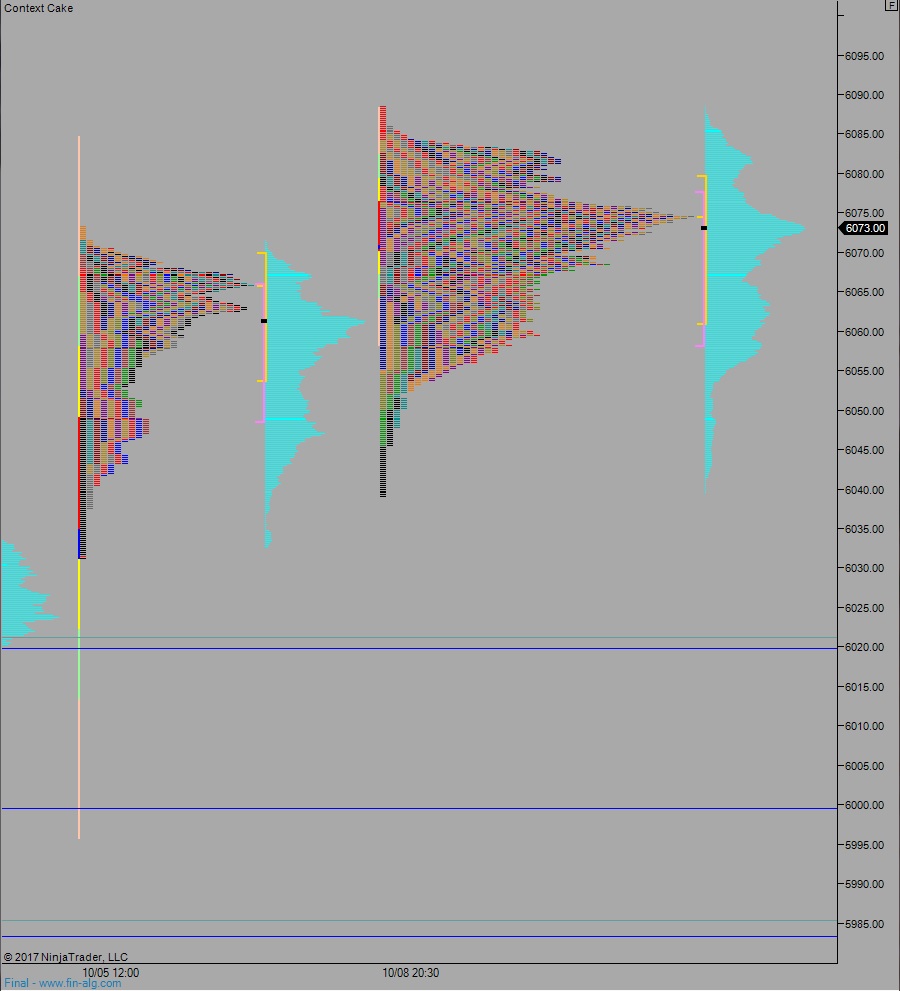

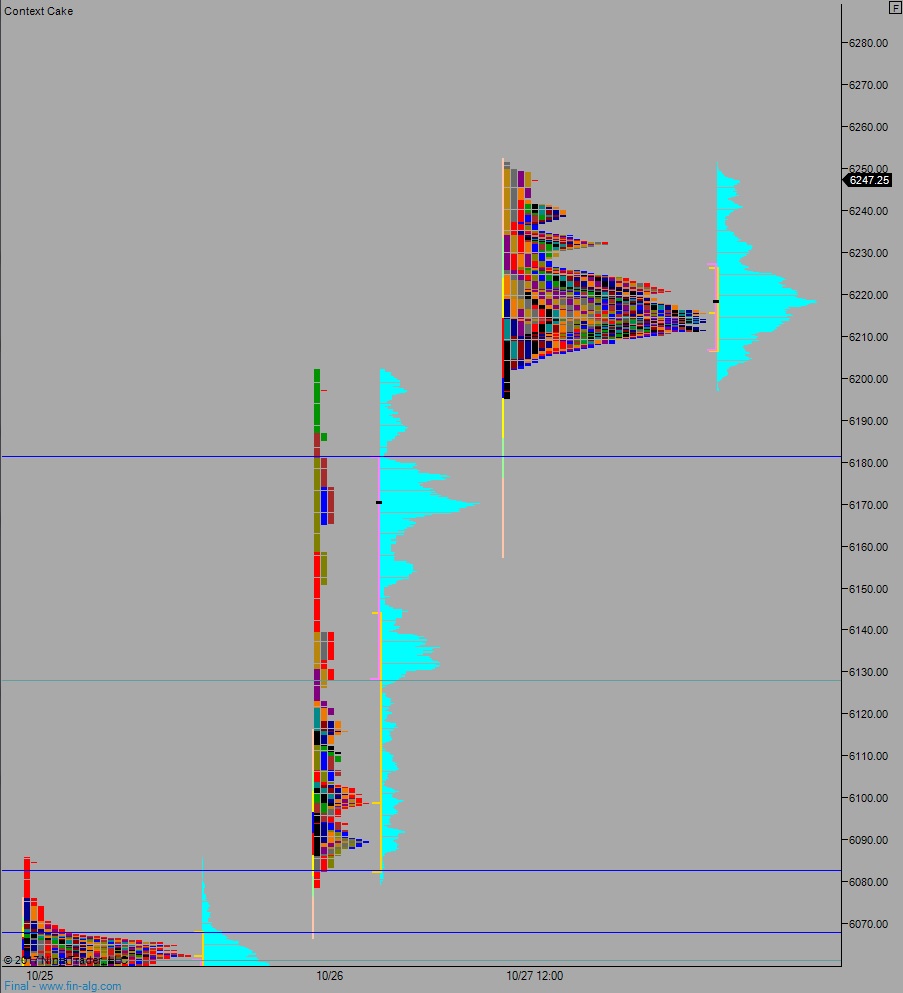

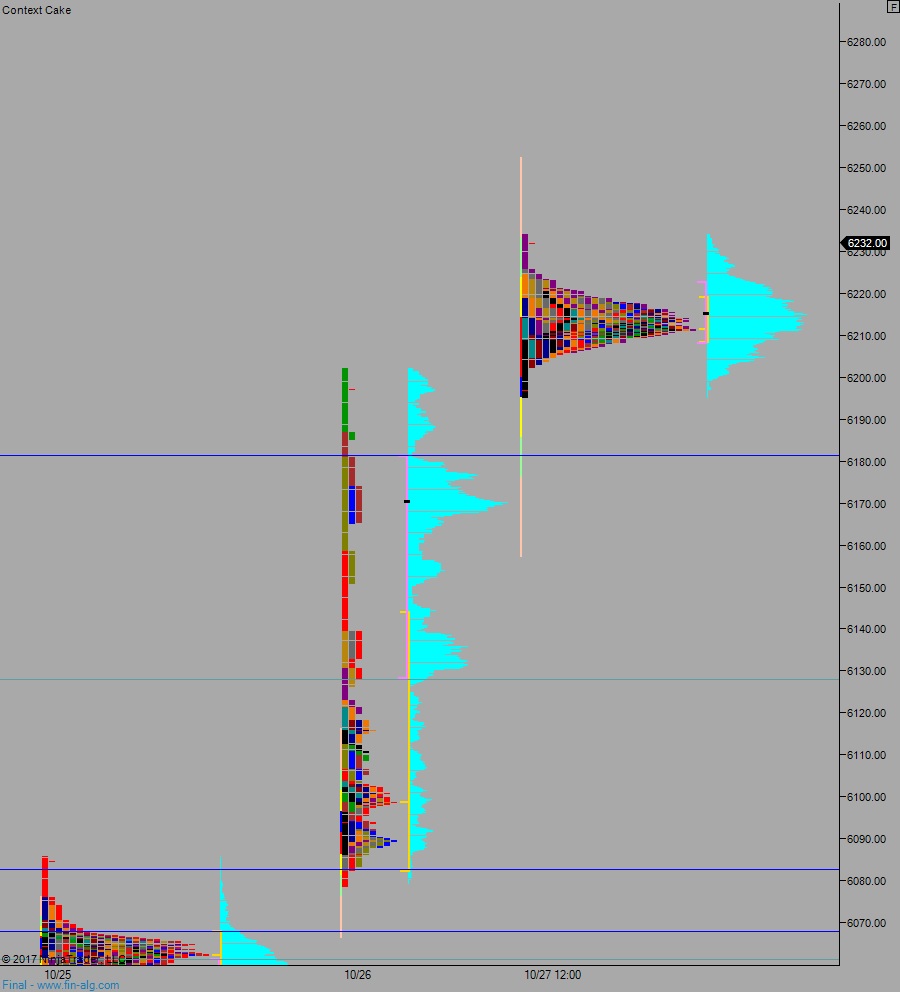

Volume profiles, gaps, and measured moves:

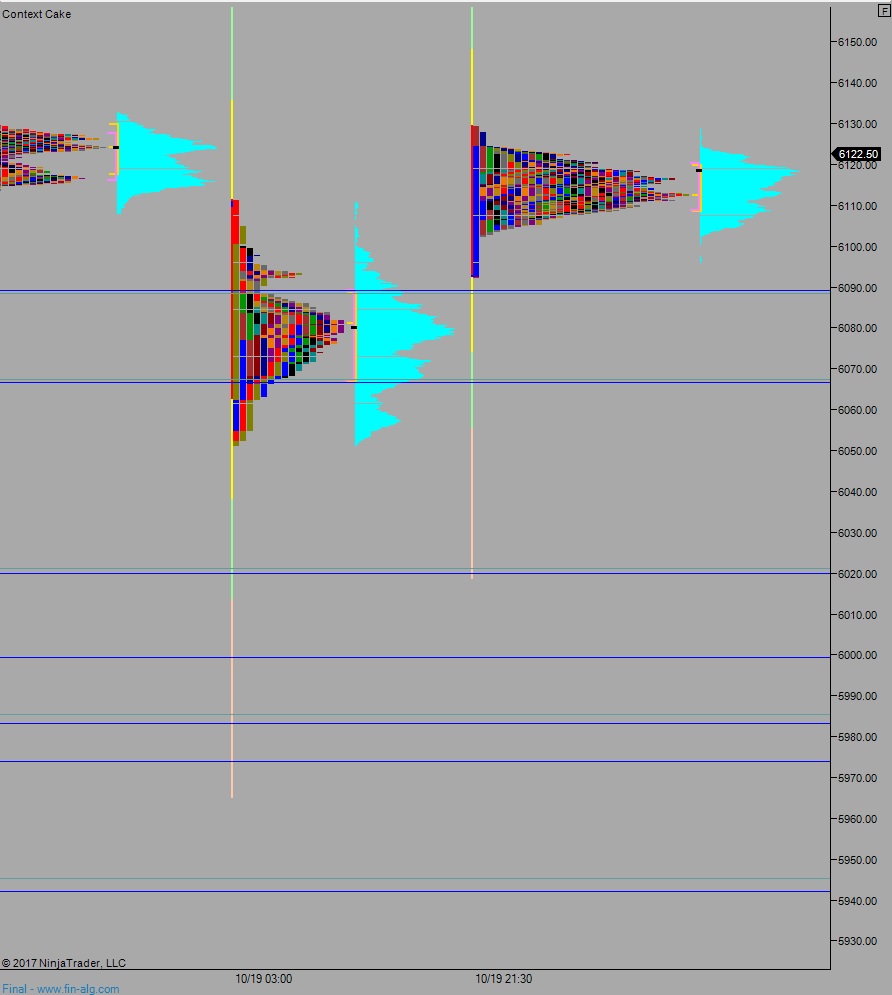

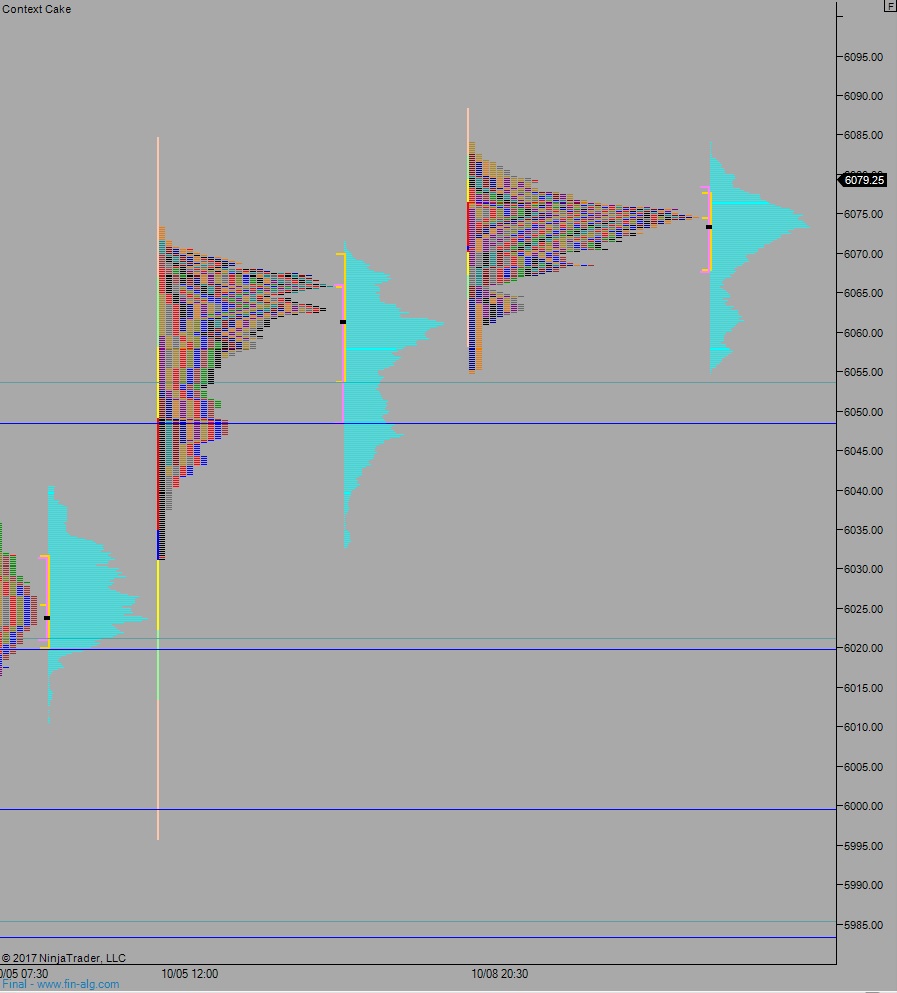

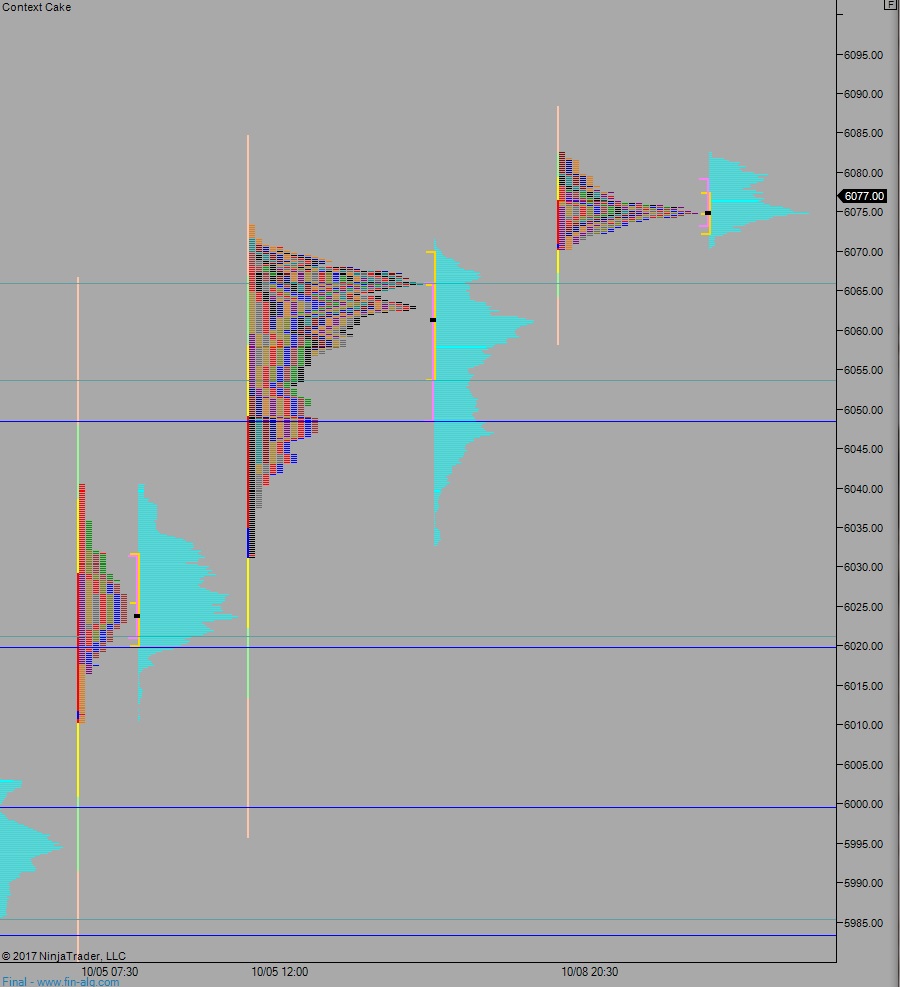

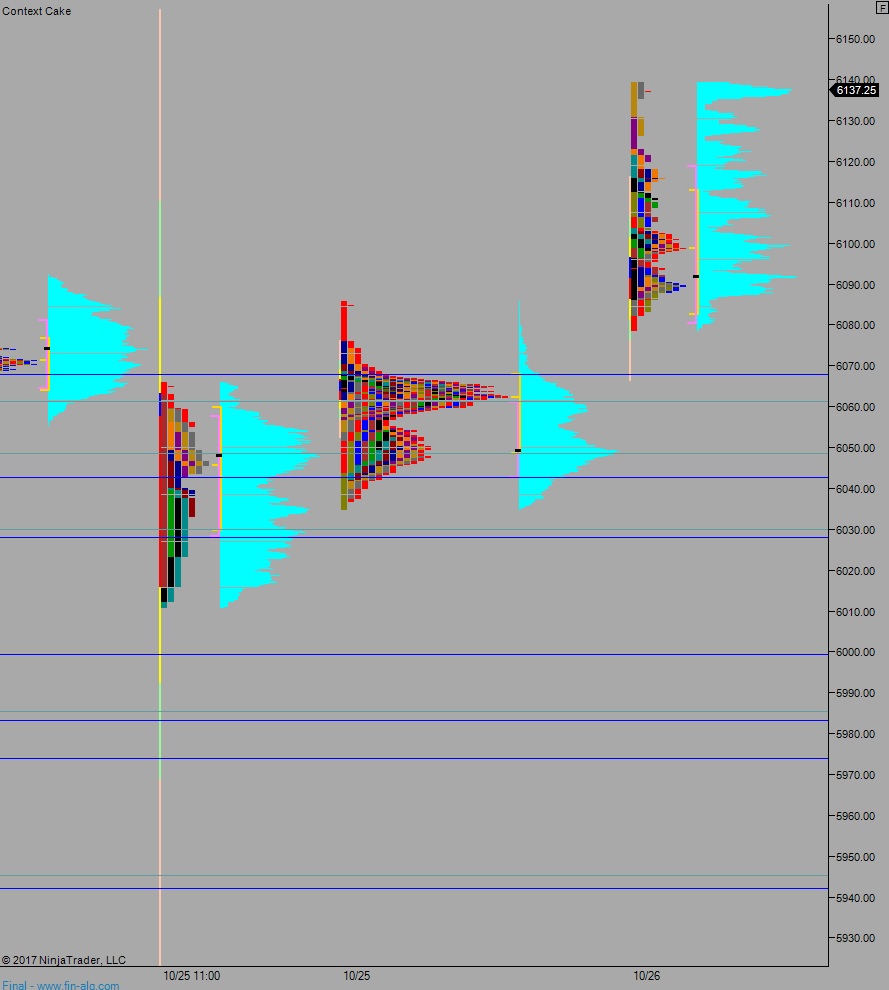

Volume profiles, gaps, and measured moves:

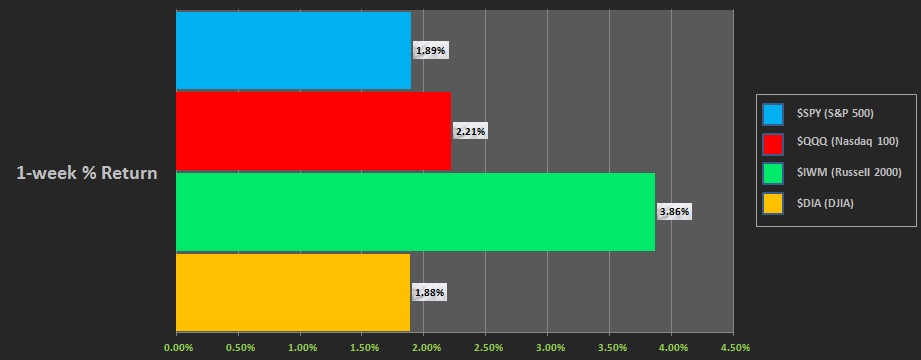

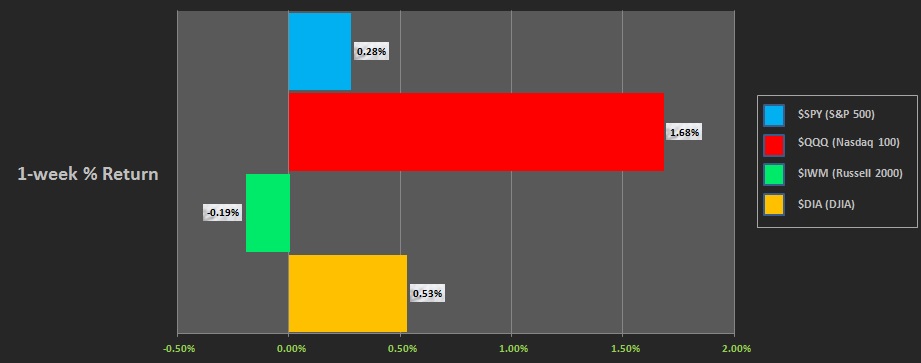

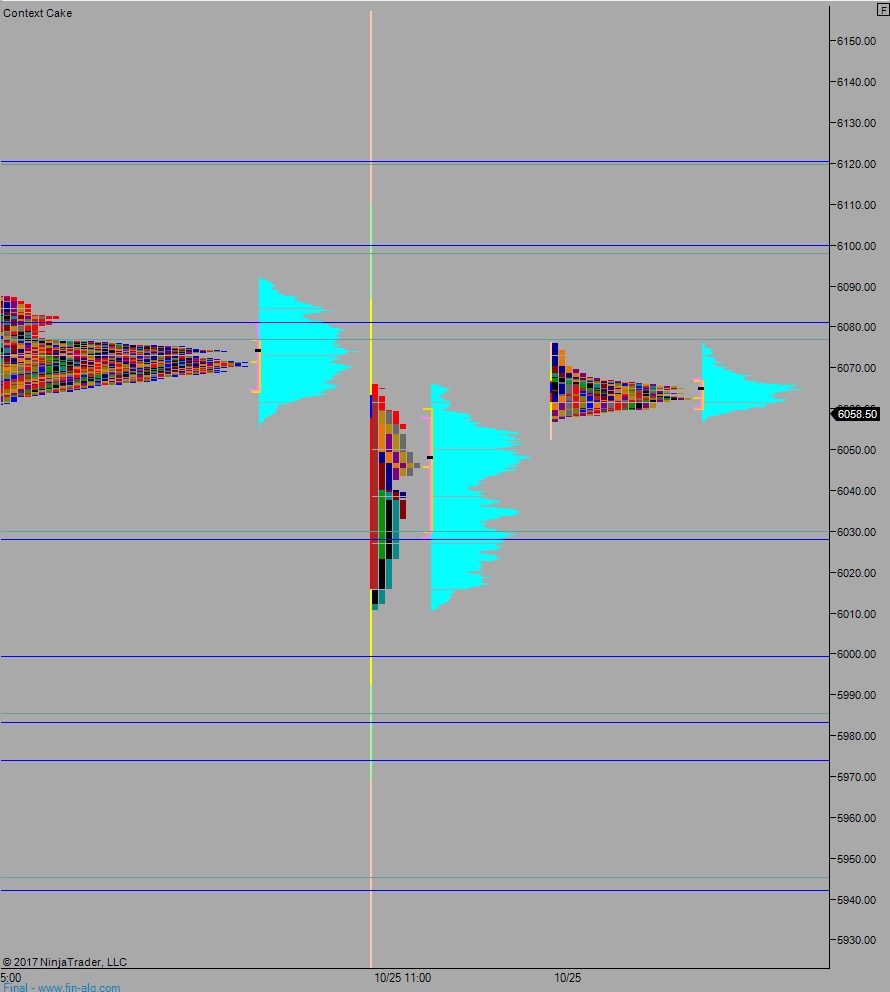

Volume profiles, gaps, and measured moves: