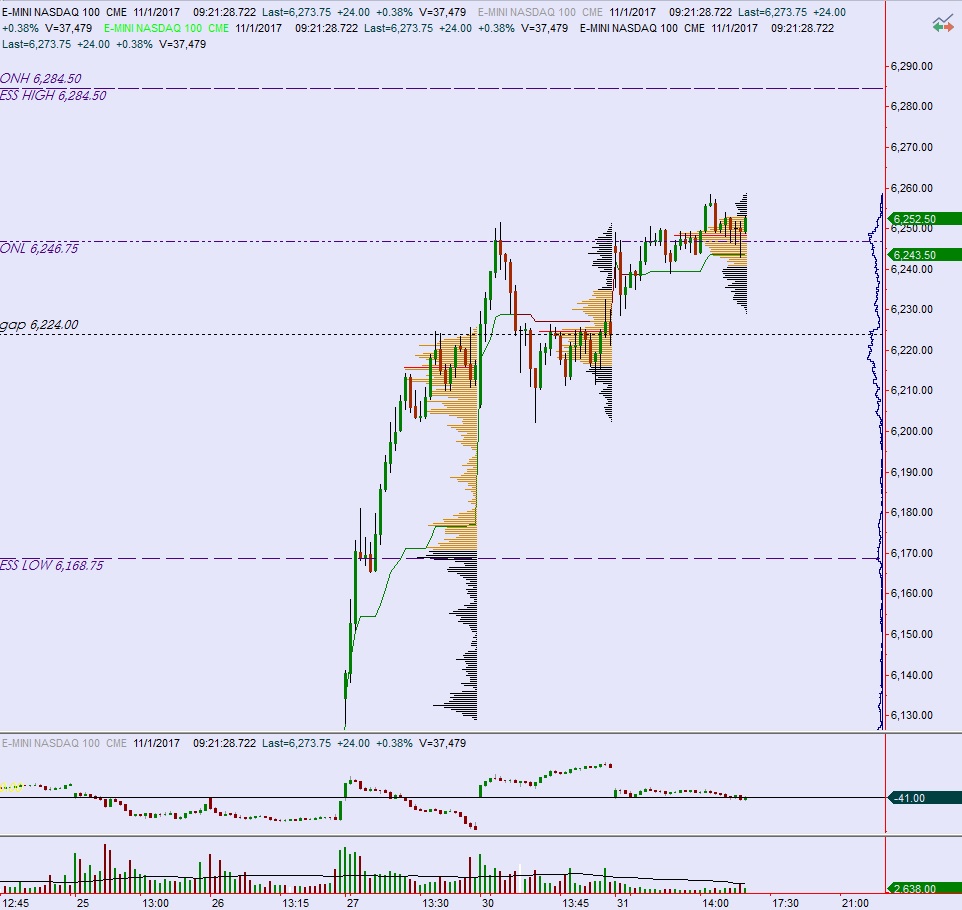

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, nearly uninterrupted, exploring open air during the Halloween night. At 9:15am ADP employment data came out much better than expected.

We have an FOMC rate decision today at 2pm. Traders down at the CME are currently pricing in a 98.5% probability of rates staying unchanged. However, the third reaction after the decision is likely to dictate direction into the end of the week.

Also on the docket today we have ISM Manufacturing/Employment at 10am and crude oil inventories at 10:30am.

Yesterday we printed a normal variation up. Your ‘clue’ to work the long side was seller’s inability to close the overnight gap. Instead responsive buyers stepped in ahead of the gap and we slowly worked higher, slowly working to new record heights.

Heading into today my primary expectation is for sellers to work into the overnight inventory and attempt a move back into the Thursday range up at 6258.50. Sellers fail, and we rally up through overnight high 6284.50 and continue exploring open air until 2pm, then use third reaction to dictate action into the afternoon.

Hypo 2 sellers press a full gap fill down to 6252.50 then we continue lower, down through overnight low 6246.75. Look for buyers down at 6240 and two way trade until 2pm, then use third reaction to dictate action into the afternoon.

Hypo 3 gap-and-go higher, open air rally until FOMC at 2pm, then use third reaction to dictate action into the afternoon.

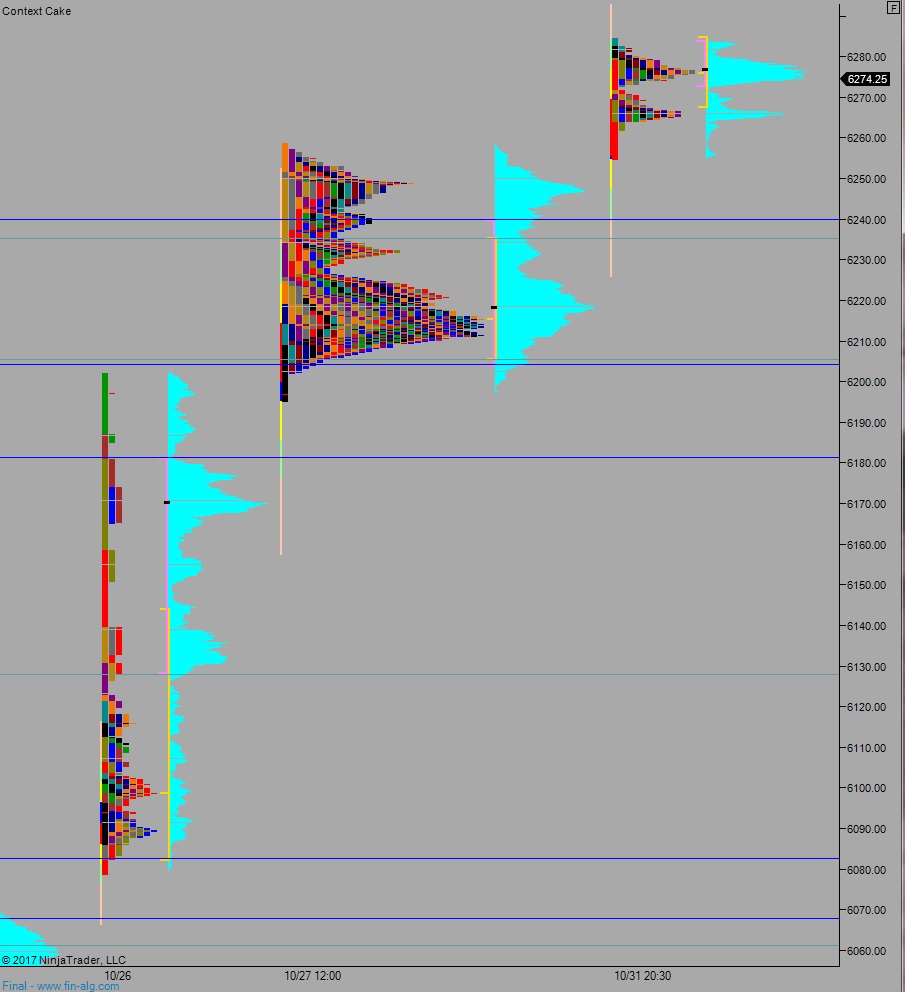

Levels:

Volume profiles, gaps, and measured moves: