NASDAQ futures are coming into Monday gap down after an overnight session featuring normal range and volume. Price held inside the upper quadrant of the Friday range.

The economic calendar is light this week. Today we have a 3- and 6-month T-bill auction at 11:30am then Consumer Credit at 3pm.

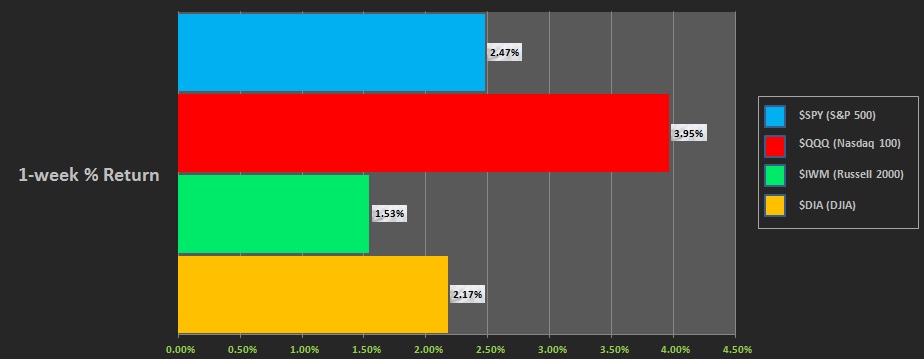

Last week was a holiday shortened week. The markets were closed Monday in observation of New Year’s day. The rest of the week was spent trend up, with the NASDAQ leading the way. The last week performance of each major US index is shown below:

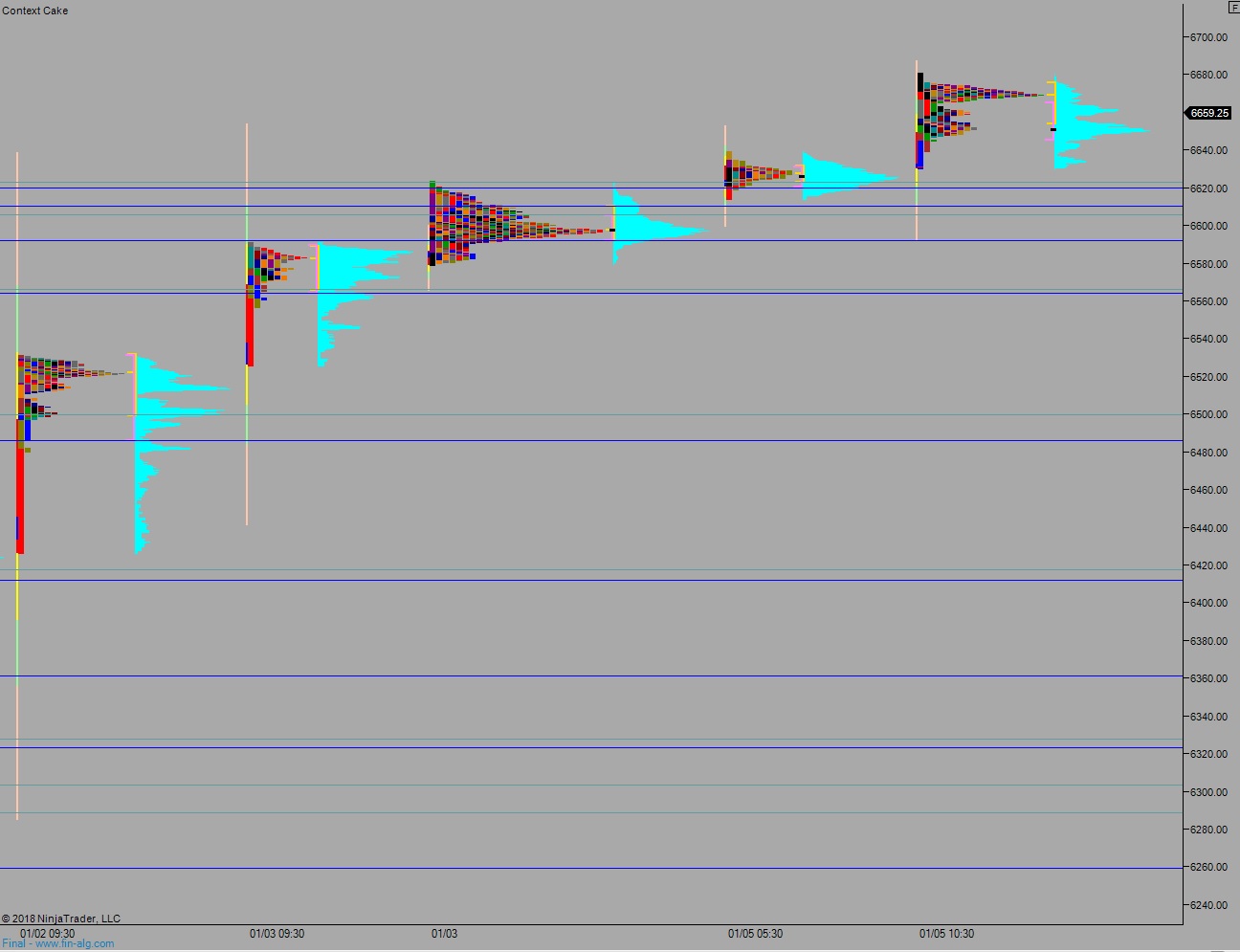

On Friday the NASDAQ printed a double distribution trend up. The day began with a small gap up. Sellers were unable to regain the Thursday range and we spent the rest of the morning slowly trending higher. Then, after a sideways lull through most of the afternoon, initiative buyers stepped in and rallied the market into the weekend.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6668.25. From here we continue higher, up through overnight high 6681.25. Open air. Look for sellers ahead of 6725.25 and two way trade to ensue.

Hypo 2 sellers press of the open, trade us down through overnight low 6653.25. Look for buyers down at 6622.75 and two way trade to ensue.

Hypo 3 stronger sellers trade us down to the open gap at 6604 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: