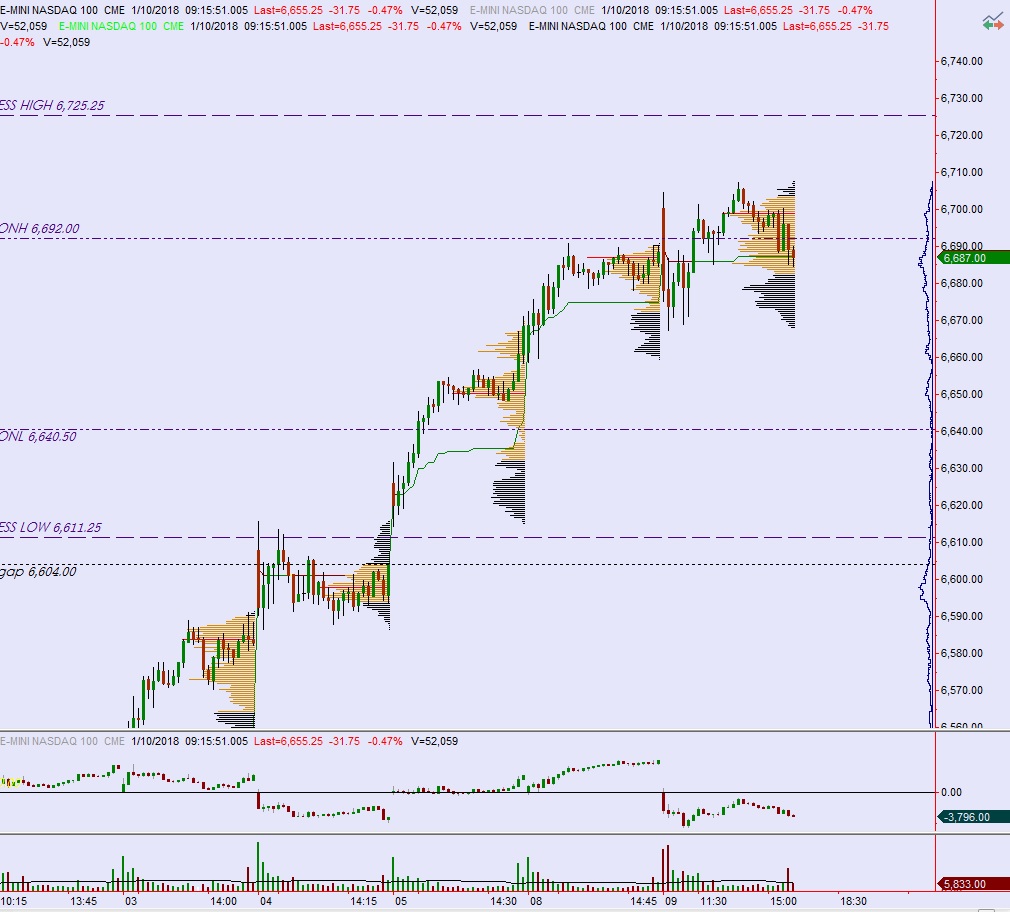

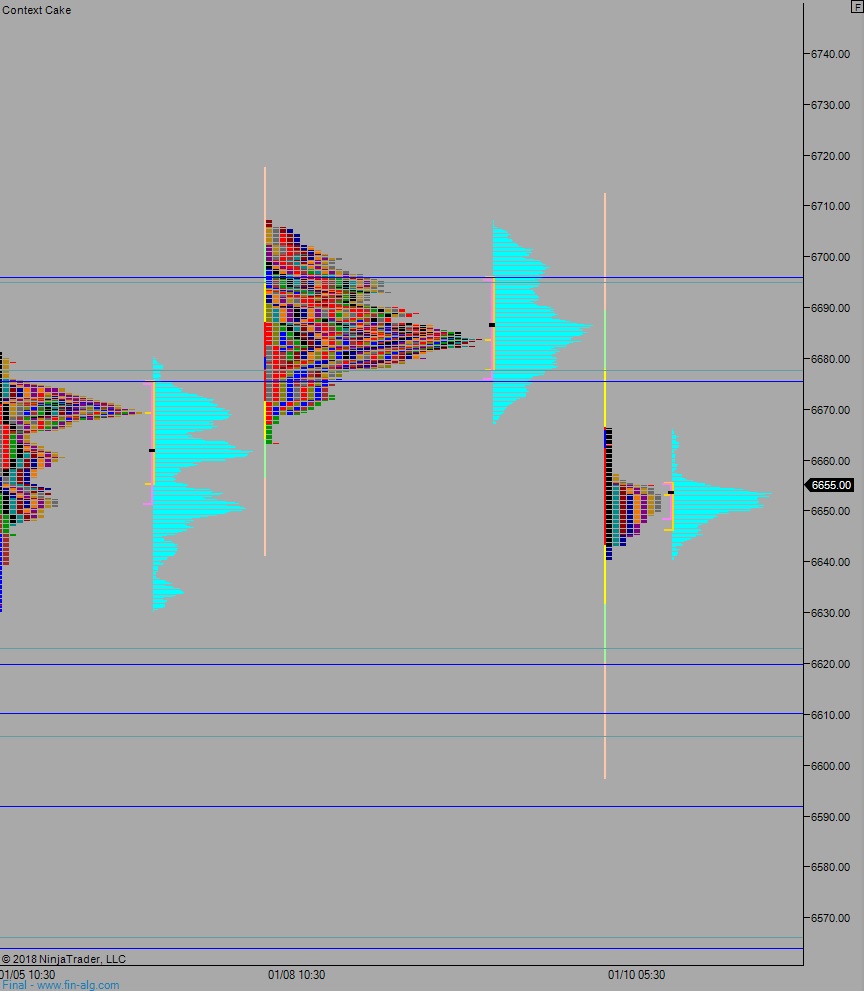

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring elevated range and volume. Price worked lower overnight before eventually finding balance halfway down into last Friday’s double distribution trend. At 7am MBA mortgage applications came out much stronger than last week.

Also on the economic calendar today we have crude oil inventories at 10:30am and a 10-year note auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap up which sellers drove down into at the open. Responsive buyers stepped in around the Monday midpoint and we spent the rest of the morning and lunch hour working higher, eventually taking out IB high briefly before drifting back down to the midpoint to end the day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and test re-entry into the Tuesday range 6667.25. Sellers defend here and we go down to take out overnight low 6640.50. From here we continue lower, down to 6622.75 before two way trade ensues.

Hypo 2 buyers reclaim 6667.25 and work up to 6675.50 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 6675.50 and go up to take out overnight high 6692. Look for sellers at 6694 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: