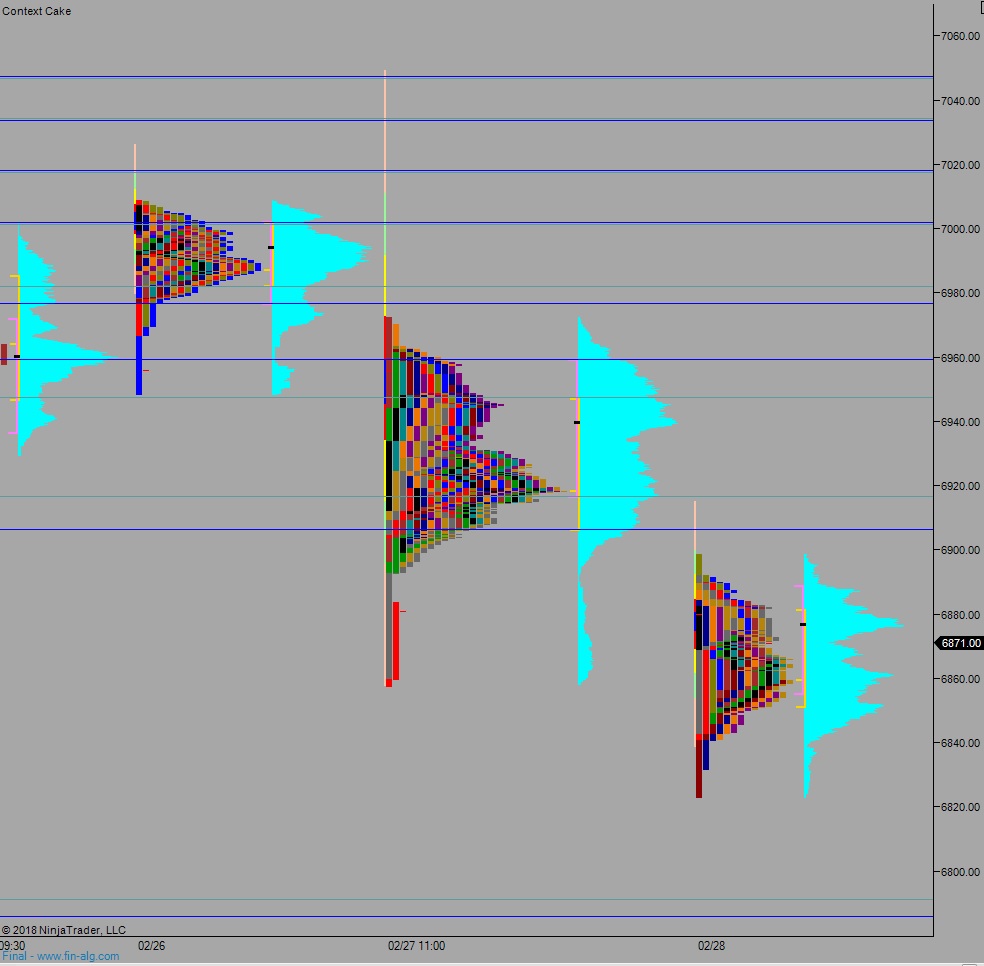

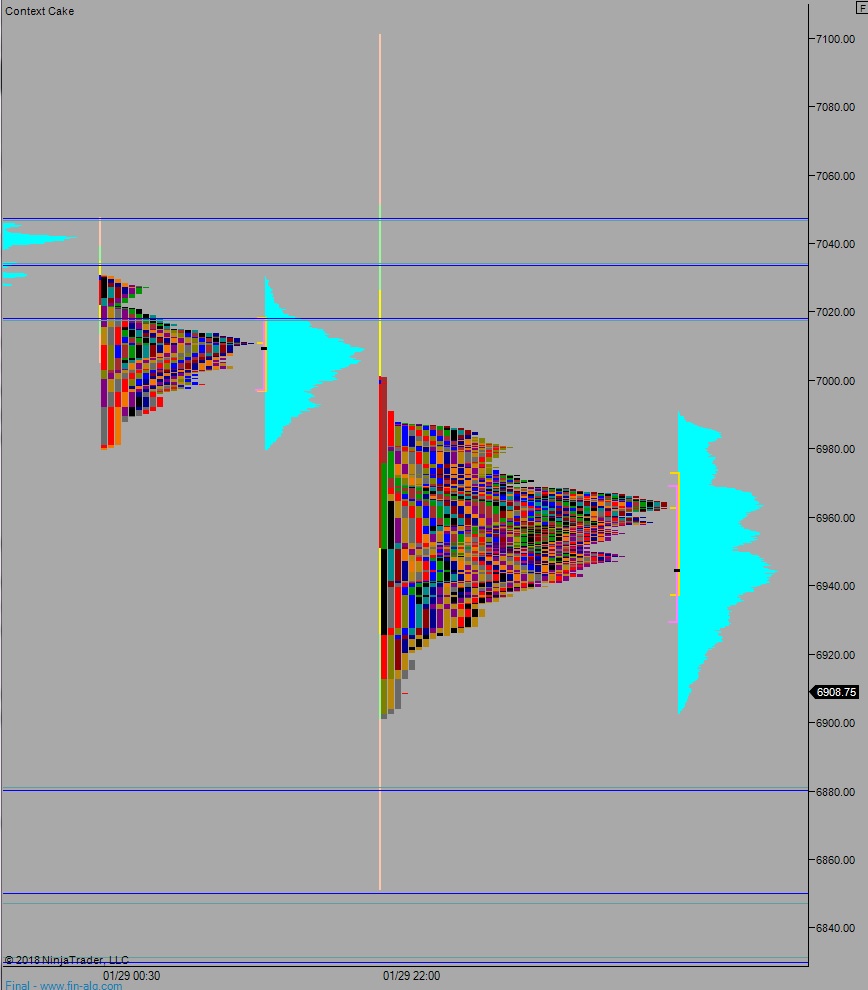

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring elevated range and extreme volume. Price steadily campaigned higher overnight, taking out the Monday high along the way.

On the economic calendar today we have factory/durable goods orders at 10am then a 4-week T-bill auction at 11:30am.

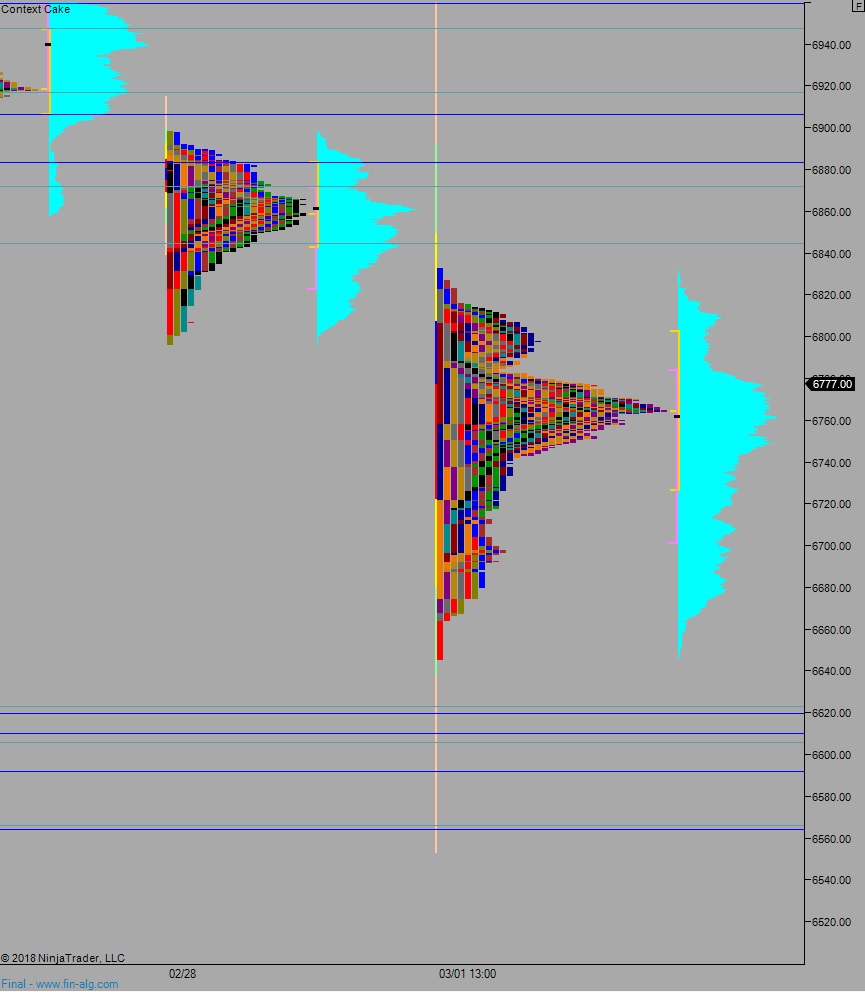

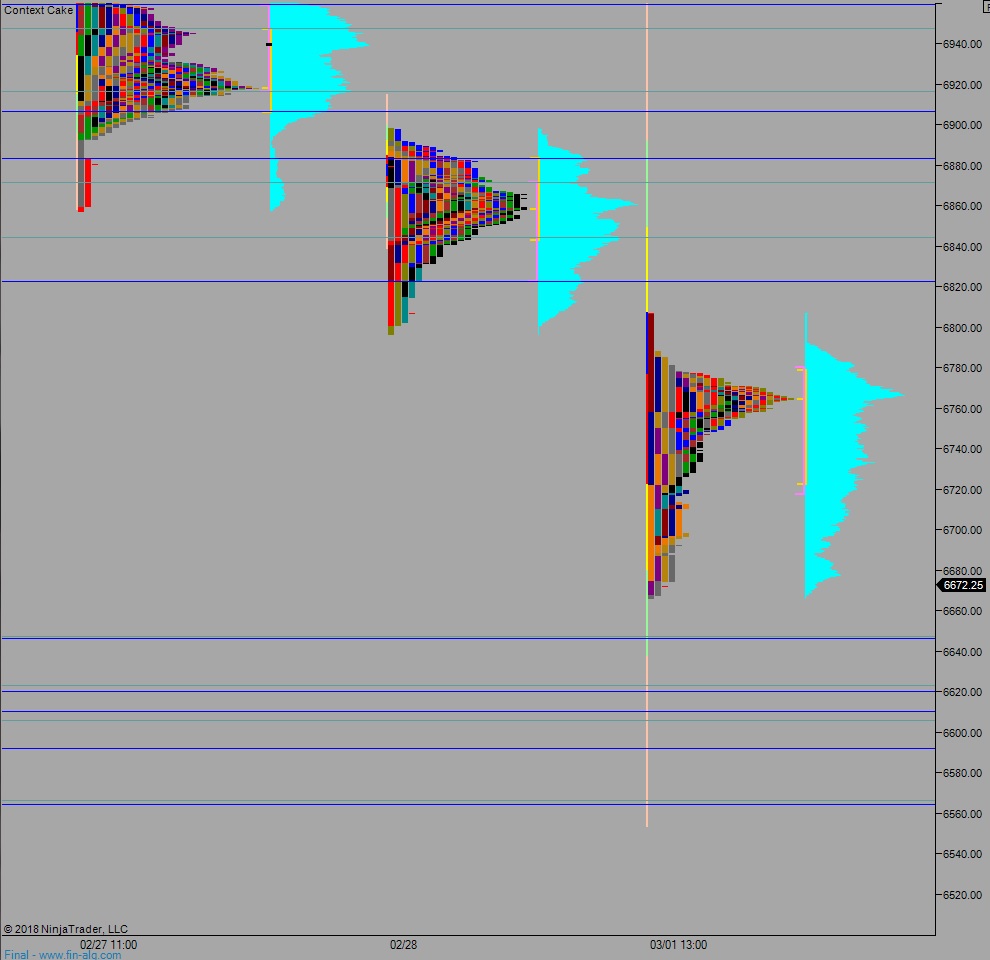

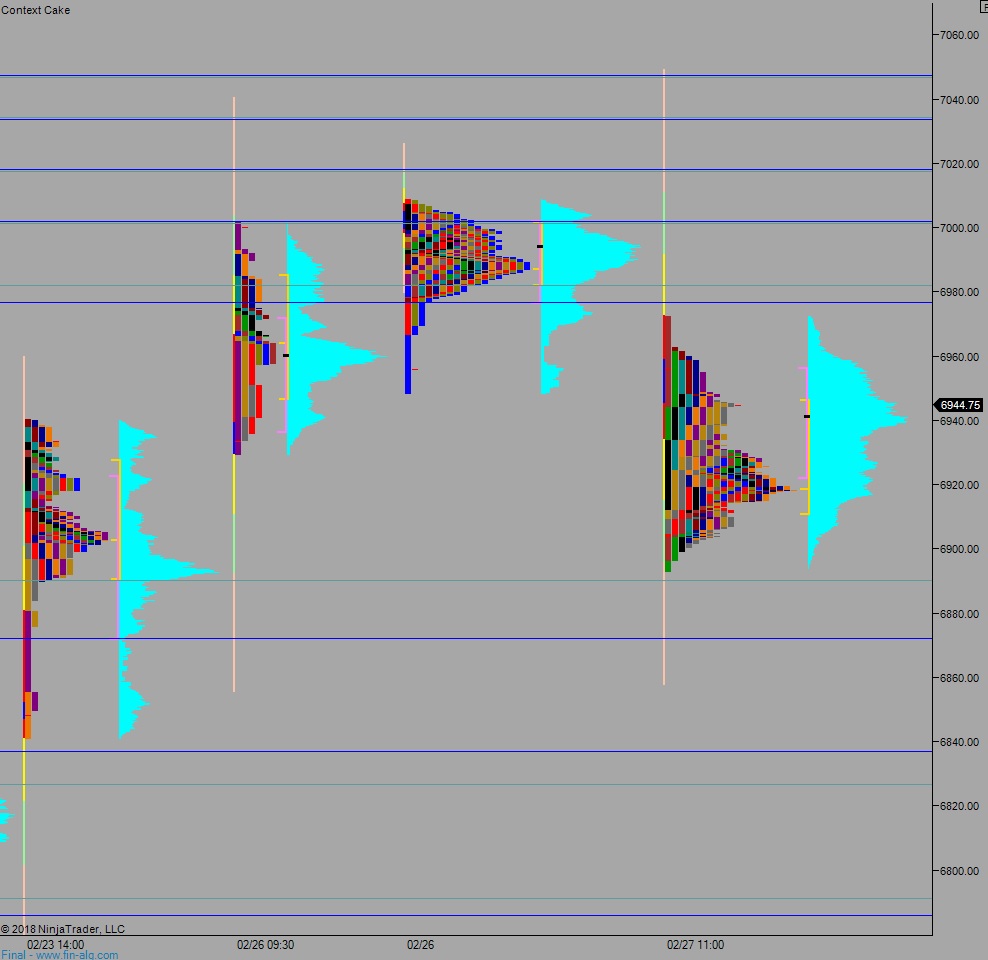

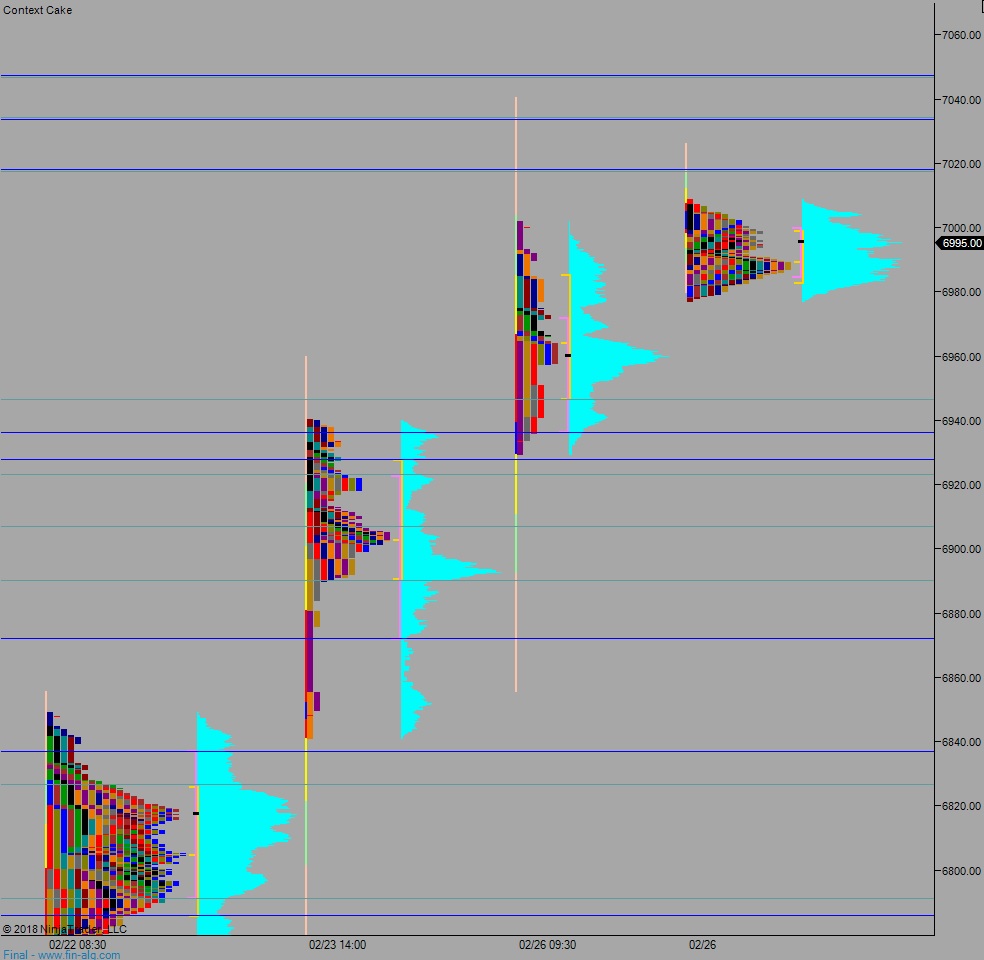

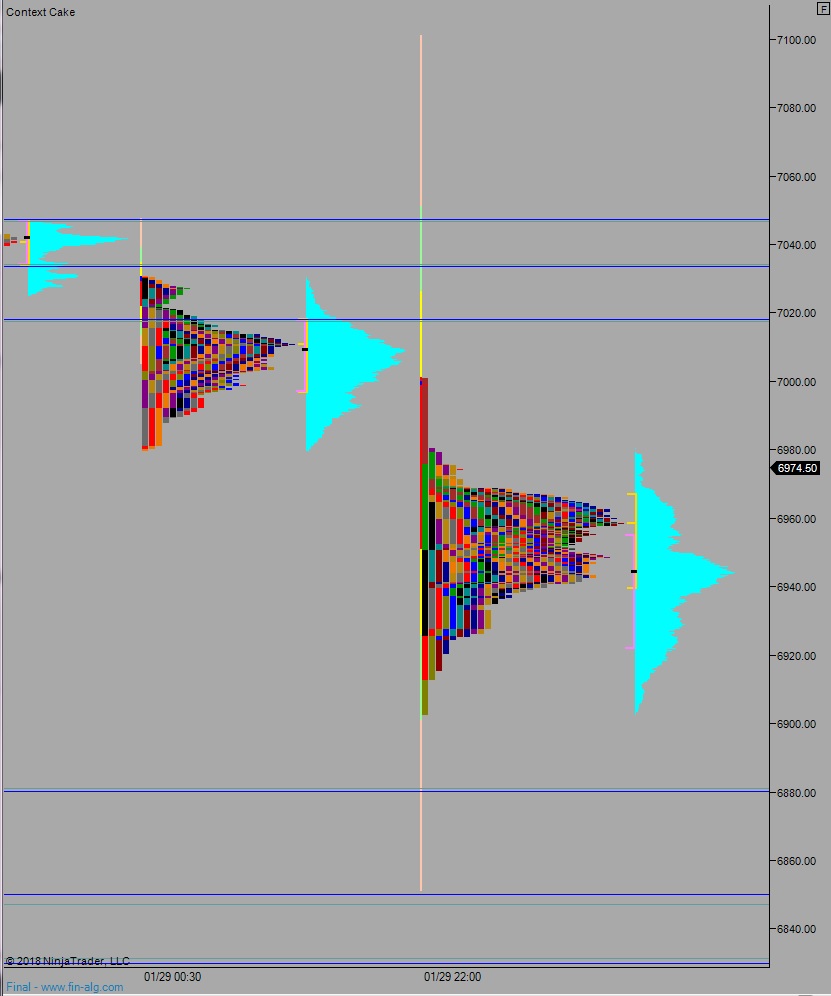

Yesterday we printed a double distribution trend up. The day began with a gap down that was quickly resolved. Then, an attempt lower was rejected when responsive buyers defended the area around last Friday’s NVPOC. We spent the rest of the day working higher, up through overnight high and beyond, eventually testing above last Thursday’s trend down before close of business.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6877. From here we continue lower, down through overnight low 6876. Look for buyers ahead of 6850 and two way trade ensues.

Hypo 2 gap-and-go higher up through overnight high 6926. Look for to defend the NVPOC from 2/28 (last day of February) up at 6950 and two way trade to ensue.

Hypo 3 stronger buyers take us up to 6960 before two way trade ensues.

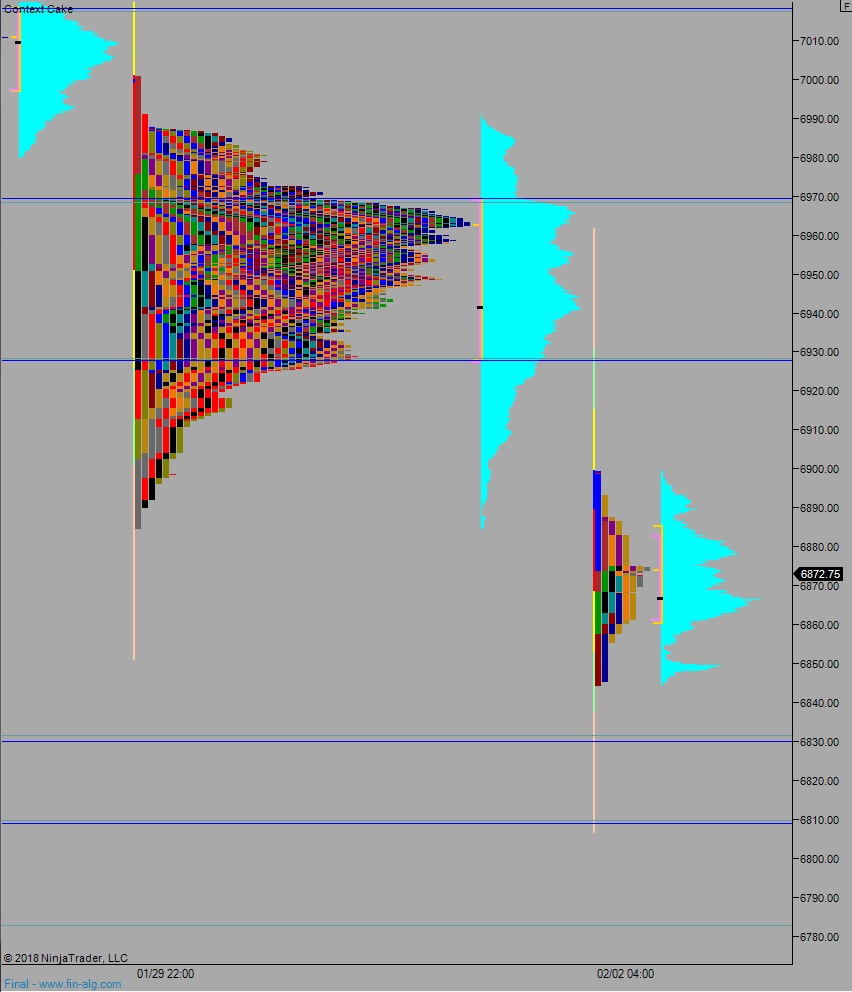

Levels:

Volume profiles, gaps, and measured moves: