It took longer than normal to update all research needed to be ready to engage the futures but not as long as I expected. After the french press kicked in and, all the muscle memory came back and, the model was in front of me well, the my old friend the flow came back. I split the morning between devising a weekly trading plan and watering the yard’s spring shrub transplants. Mature shrubs are a joy millennials might not appreciate yet but, by the time they do I’ll have a house they’d like to buy but, they better be ready to put that premium up.

Looks like I didn’t miss much skipping out on July trading. That’s usually the case. Chop and noise. All the big players out enjoying life. Put the ambitious youths in charge. Work them until they break. Promote the survivors replace the weak. This is summer in America.

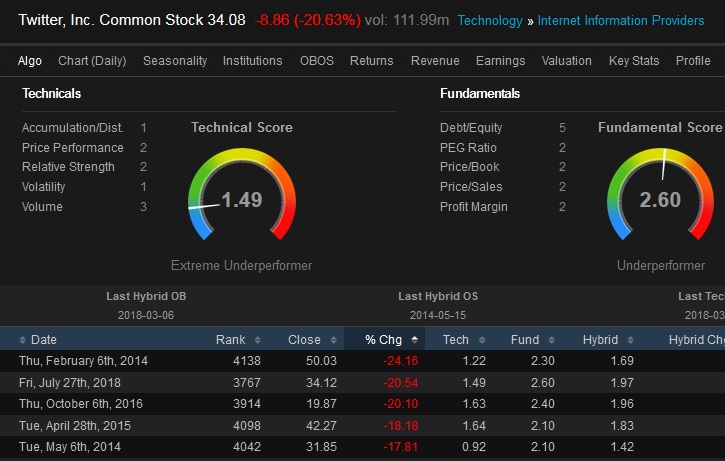

But I’m back in time for the action to pick up. How do I know? I’m a bit of a futurist. Sometimes I gaze deeply into the abyss and see slow revolutions taking shape. Disciples preaching monotheistic faith after Pontious Pilate sealed Yeshua’s fate. But there’s not much I can do to prepare for a historic shift beyond a few broad brush strokes. Tesla. Twitter. Crypto. But these next five days, these next five days…

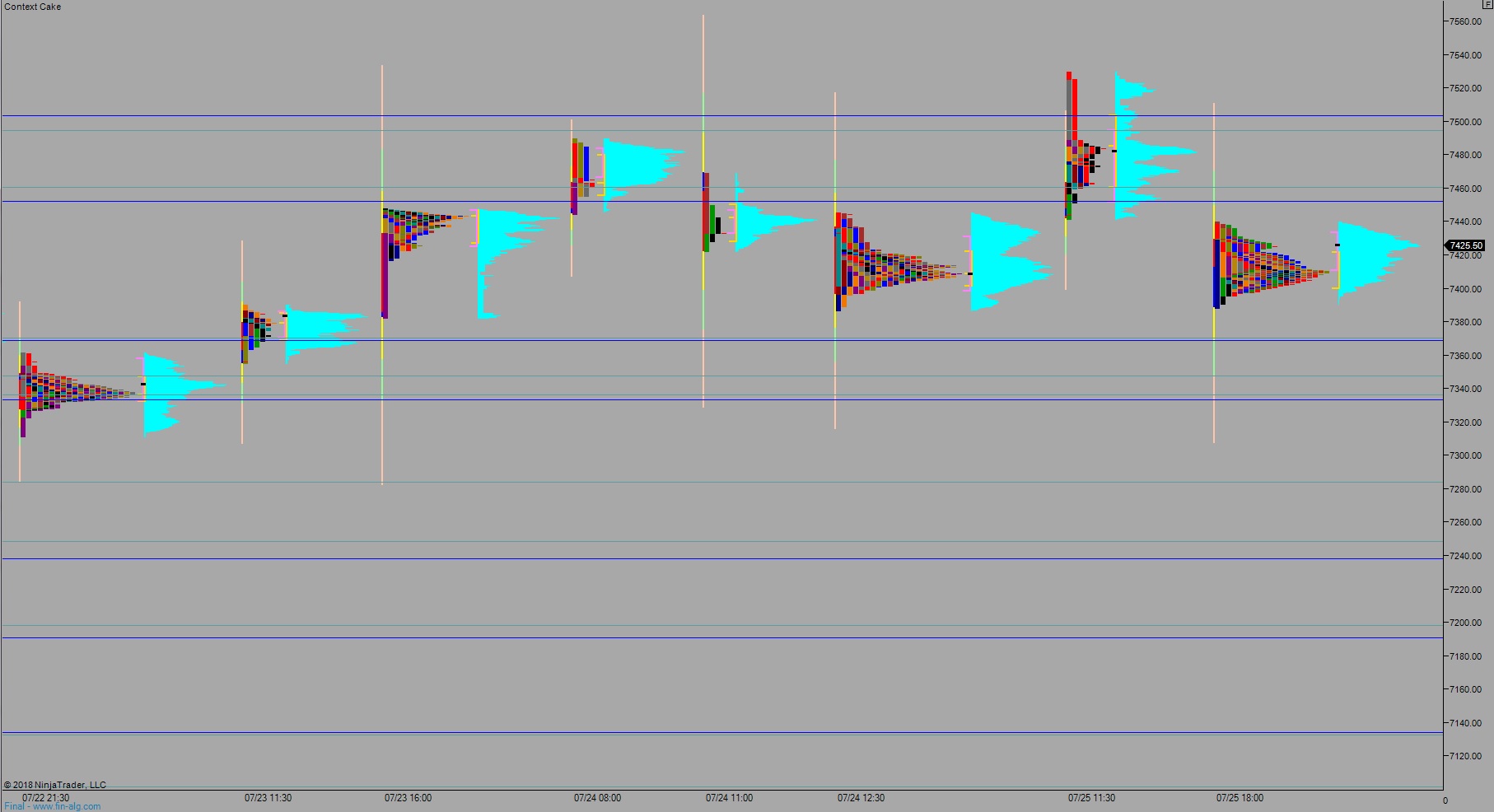

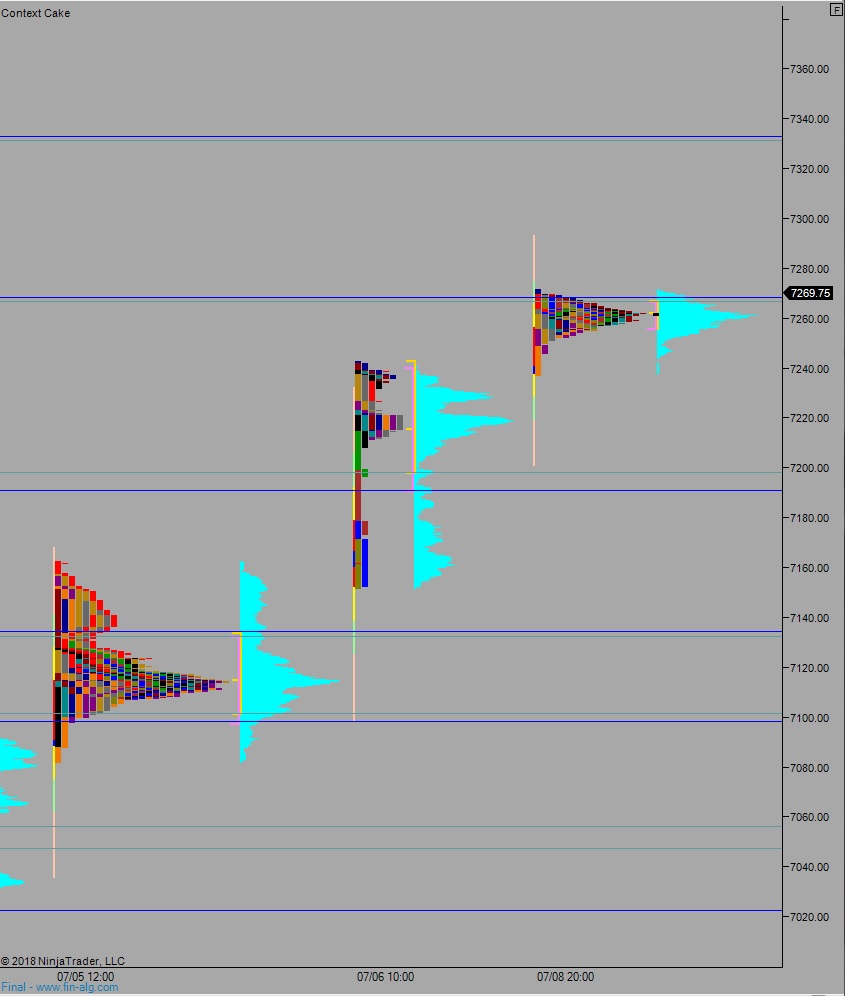

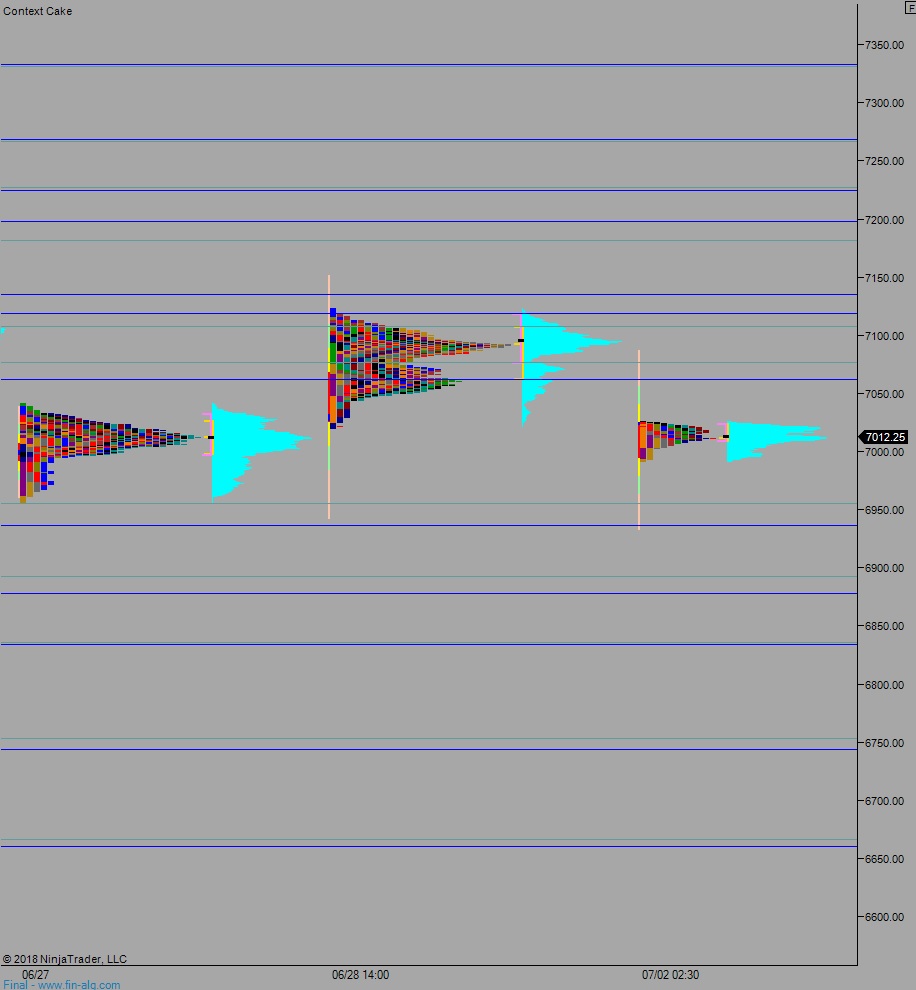

They’re less hazy. I have the right equipment to bring them into focus. Not perfectly but pretty good. Then as each day comes closer I’ll be ready for small precise on the fly movements. Hopefully my old friend the flow shows up again. I can see some lines. Those lines could be the right place to stand and wait for natural forces to bring me my shot; I can see me nailing the shot.

Sometimes my position is run over. Then I have to focus on damage control. That’s where muscle memory kicks in.

What size renko bar am I using? How many NASDAQ points did I risk? How many units are in place right now? What’s this trade’s cost basis? When will I know the trade is wrong? If that’s the case, then should I take action right now? Should I size back in? Or eat the loss? What is the market trying to do?

And so on.

There are huge market moving events scheduled for the upcoming week. Something, maybe the sudden quantity of black flies around my house or the way Mars is dancing with the buck moon, tells me everyone will be greeted with a fresh geopolitical distraction. But these information snippets below are the real things you need to be aware of.

Apple reports earnings after market close Tuesday. They can move the entire market. Look, this is all you need to see to believe me, a viral tweet from superstar investor and titan of finance Michael Batnick:

The market cap of the top 5 S&P 500 companies:

$4,095,058,706,432

The market cap of the bottom 282 S&P 500 companies:

$4,092,769,755,136 pic.twitter.com/qqcuOs0Qki

— Michael Batnick (@michaelbatnick) July 18, 2018

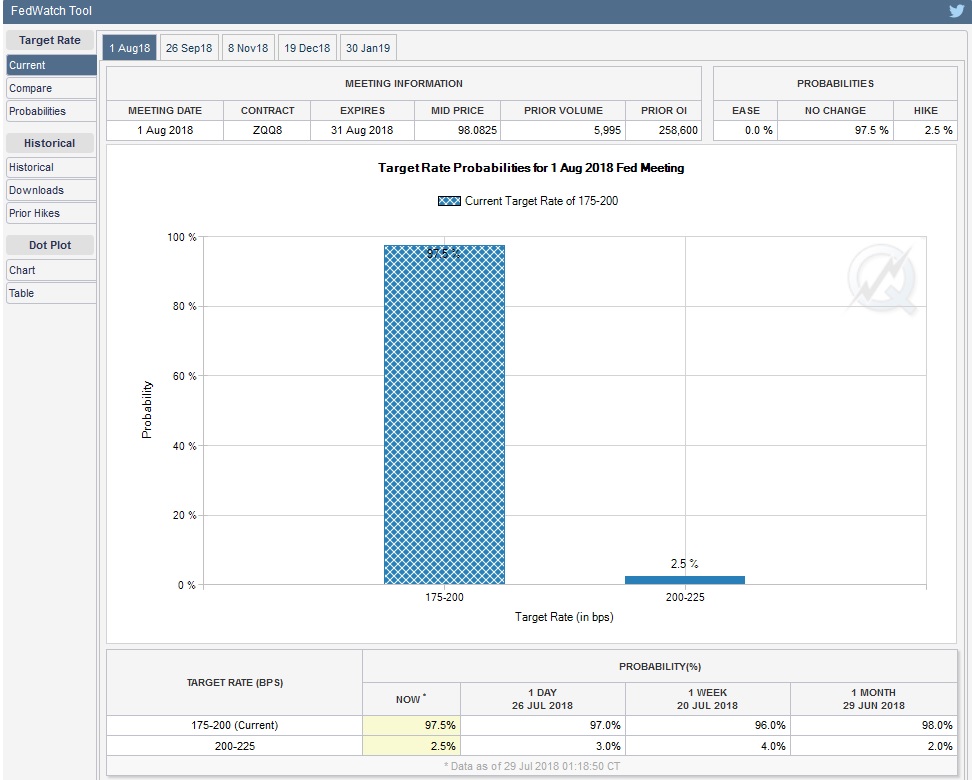

Wednesday is the first of the month AND the Federal Reserve has an announcement scheduled for the afternoon. This announcement will come after what is not considered a live meeting. There is no post-announcement press conference scheduled, which means Jerome Powell is probably in Nantucket somewhere enjoying a glass of iced milk with his fellow private equity thugs.

Nevertheless, Fed announcements almost always send a tradeable burst of energy through the market. Be on the lookout for one around 2pm Wednesday. I am of course referring to New York time.

The gambling halls in Chicago are currently placing 97.5% odds The Fed will leave their benchmark borrowing rate unchanged:

I’ll be watching for the third move after the FOMC meeting to dictate direction into the second half of the week. But there’s a wildcard.

Nonfarm payroll data is due out Friday morning, premarket. My primary expectation is for this data to exacerbate whatever move is happening head into the number. Meaning, if we are selling into it, we accelerate to the downside. If buying, the rally jolts higher with vigor. If chop, more chop. And so on.

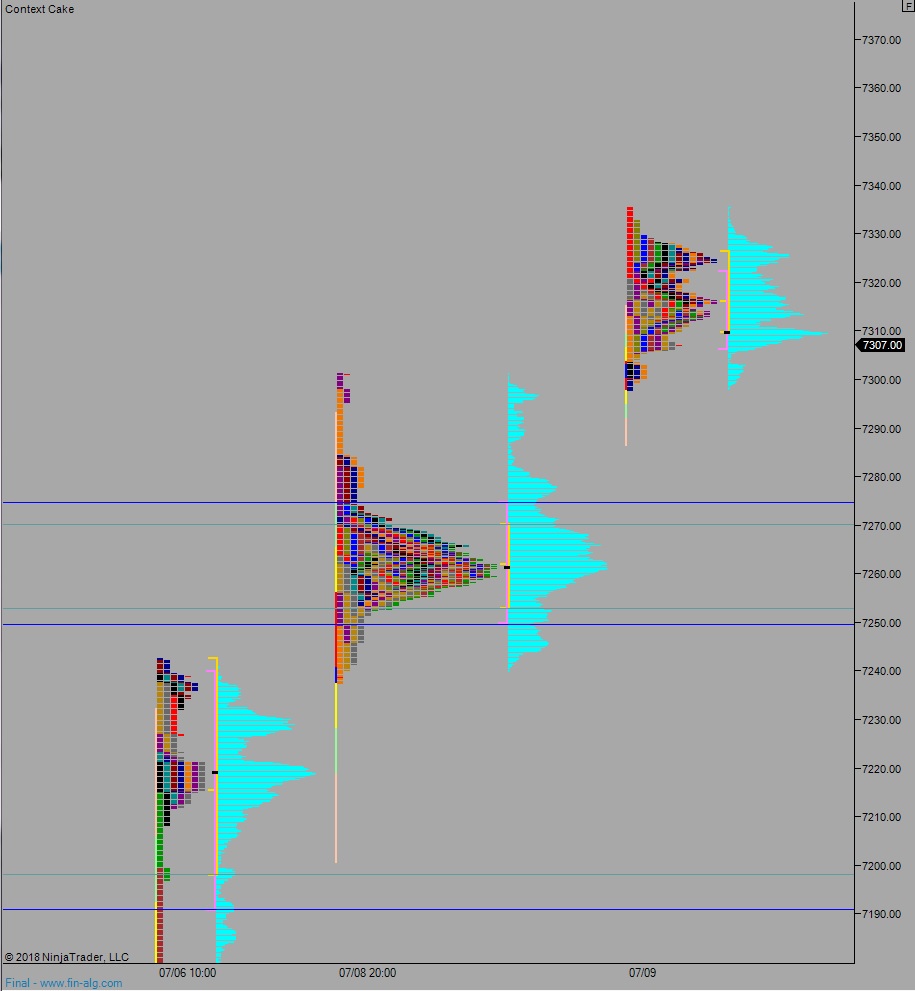

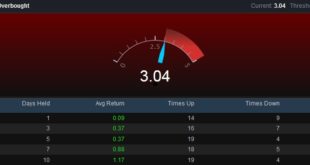

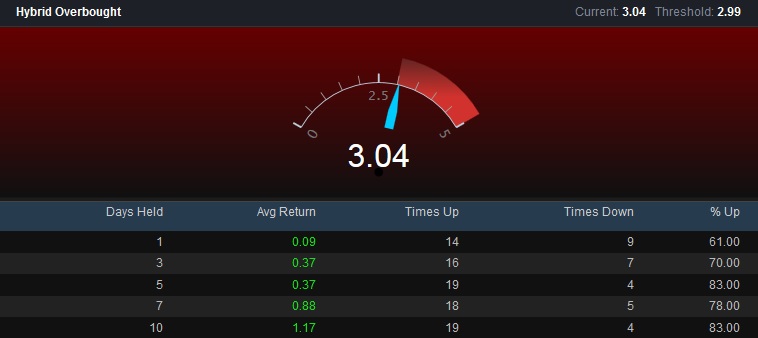

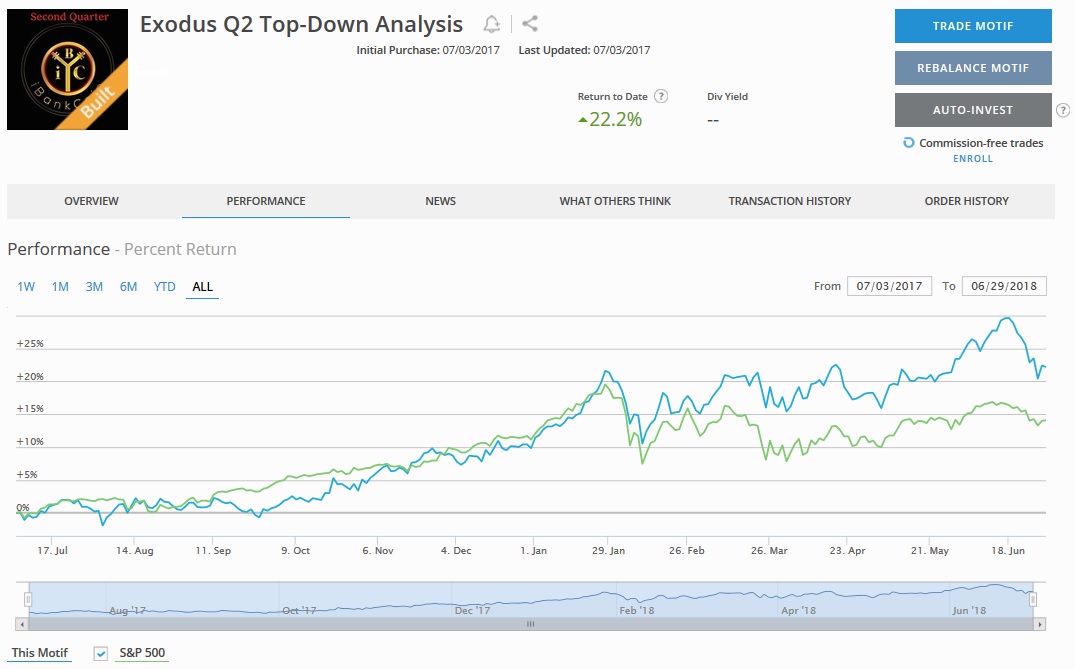

Turning our attention to the indices (after all, they don’t call me @IndexModel for nothing) the Russell is showing subtle topping signs. There was much stock market optimism during Q2 and it carried into Q3. But Q3 grows old. The Russell may be whispering caution. It’s up against a resilient Dow Jones however. And as for the index model itself, which codifies the major indicies and is prepared as part of the Exodus Strategy Session, it’s:

Neutral. I repeat, the model is neutral.

The Exodus mother algo is also neutral. The most recent cycle began Friday, July 6th at market close and spanned through to Friday, July 20th end-of-day.

There hasn’t been a 3rd sigma TICK generated on the NYSE all summer. If you’re new here, I have access to super high quality raw data directly from the New York Stock exchange. I receive it from IQFeed. They have two NYSE ticks. They made a dumbed down one because peanut-brained people wanted a NYSE TICK that pinged +/-1000 more often. So IQ Fed made them one. But they kept the real one. I use the real one. The right one. Anyhow we have no signal coming out from the internals. Shout out Trent for the hook up that discount code for IQFeed.

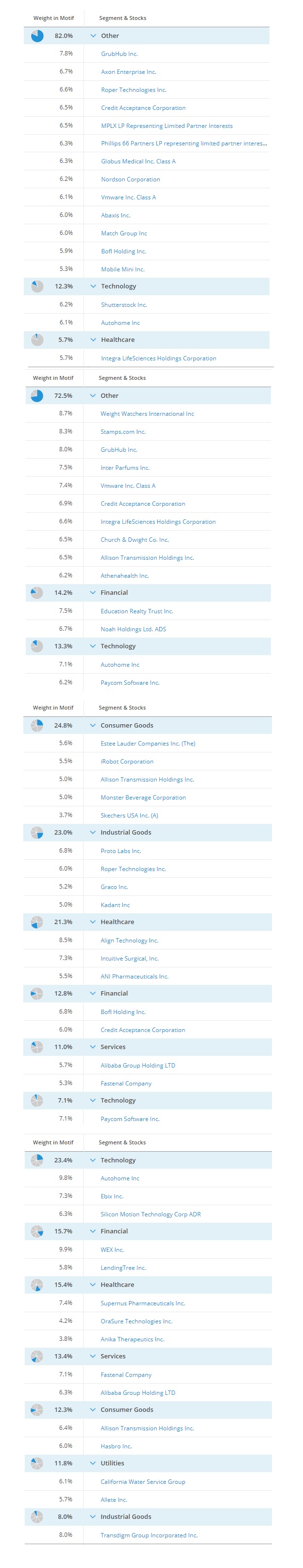

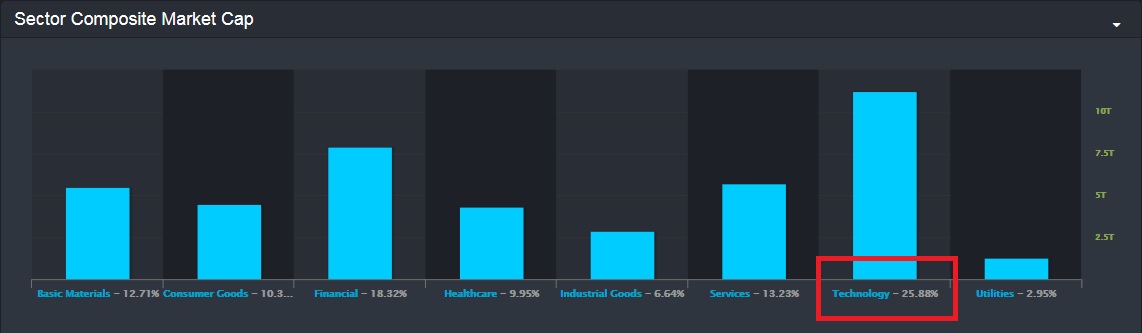

Top-down analysis shows broad strength across most sectors but weak Tech. Weak tech kind of matters more than broad market strength because technology now represents about 25% of all stock market capitalization. I can see this very clearly on the Dashboard inside Exodus:

See how this isn’t rocket science? We leave rocket science to Our Dear Leader and his team of SpaceX scientists and engineers. Moving on…

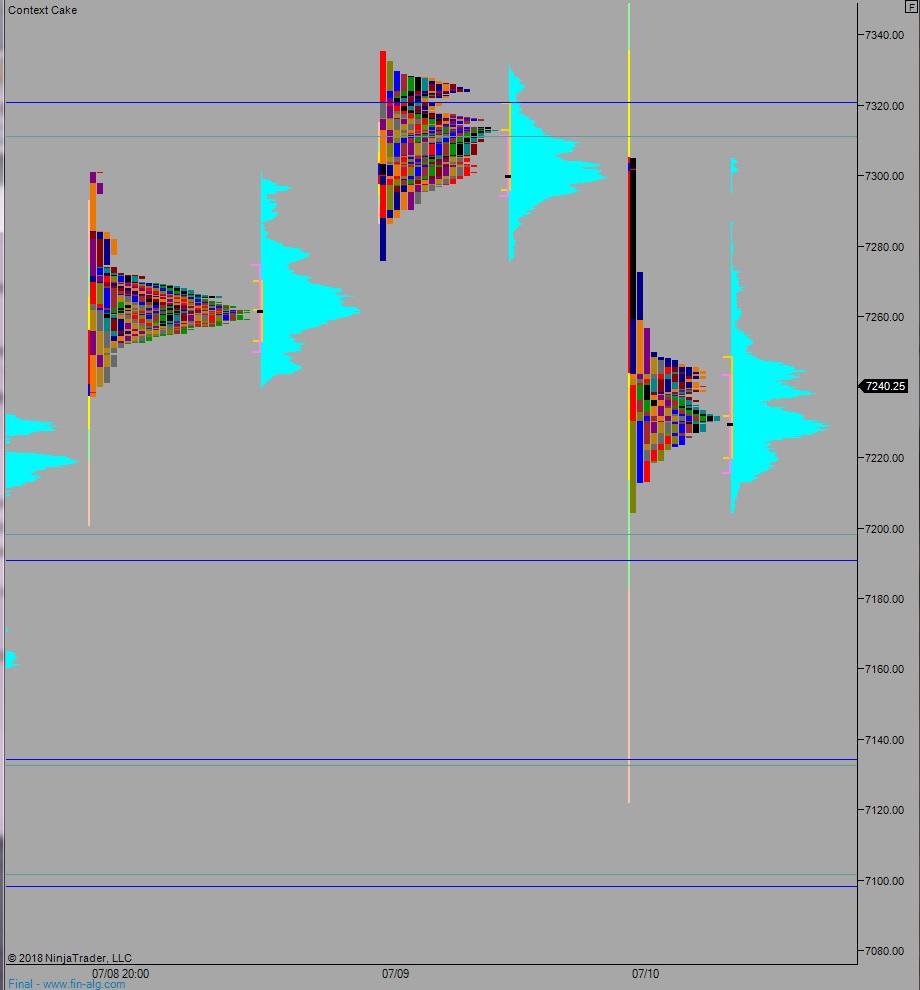

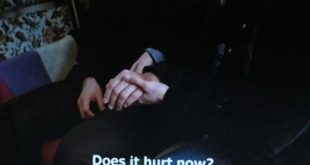

Weak tech kind of matter more than broad market strength which makes it kind of sweet that NAS-100 futures are my most understood instrument. I will be reporting every morning which price levels matter because it’s part of my morning homework, which I freely publish because I know that even if I lead a horse directly do my favorite watering hole, they likely won’t take a drink. And even if they do, nature replenishes these capitalist fountains quite well. We could all have a drink.

I cannot emphasize enough that Apple can swing this entire market. Our life is in Tim Cook’s very gay hands. How’s that make you feel big tough guy?

And I’m ready to trade the way Tim Cook’s Apple earnings are received.

Sunday research is complete. Exodus subs, the 191st (should be the 193rd but I slept on my research duties) edition of Strategy Session is live, go check it out. If you think it would be a convenient feature to have the Sunday Strategy Session automatically sent to your email inbox, please let me know in the comments below.

With research complete I feel ready for the week. Once I write my morning plan, I’ll feel ready to trade Monday’s open. After I prepare Tuesday’s plan, trade Tuesdays. Wednesday, Wednesday’s. But maybe Monday I’ll just sit back for the first few hours and let the big dogs slug it out. If it seems like we’re way out of balance. If that’s the case then I’ll wait. Then after the dust settles I’ll fox scuttle in and start picking up scraps.

Comments »