NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight before eventually breaking lower and trading down near last weeks low. As we approach cash open price is hovering below last Thursday’s midpoint.

On the economic calendar today we have ISM Manufacturing/Employment at 10am, then the US Treasury auctioning off 4-week, 3- and 6-month T-bills at 11:30am.

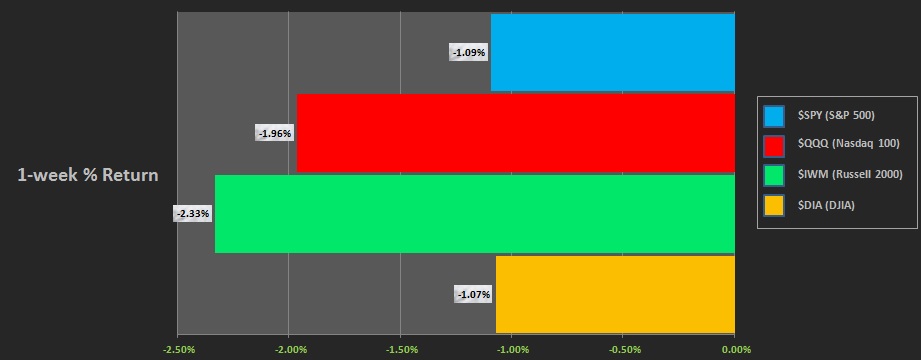

Last week began with a quick gap down lower too. It was sold into Monday, then a late-day ramp occurred. Prices held the ramp levels until Wednesday afternoon when another leg of selling pushed through, making new weekly lows. Thursday opened near the lows, two-way auction ensued and eventually broke higher. Friday was spent balancing out. The last week performance of each major index is shown below:

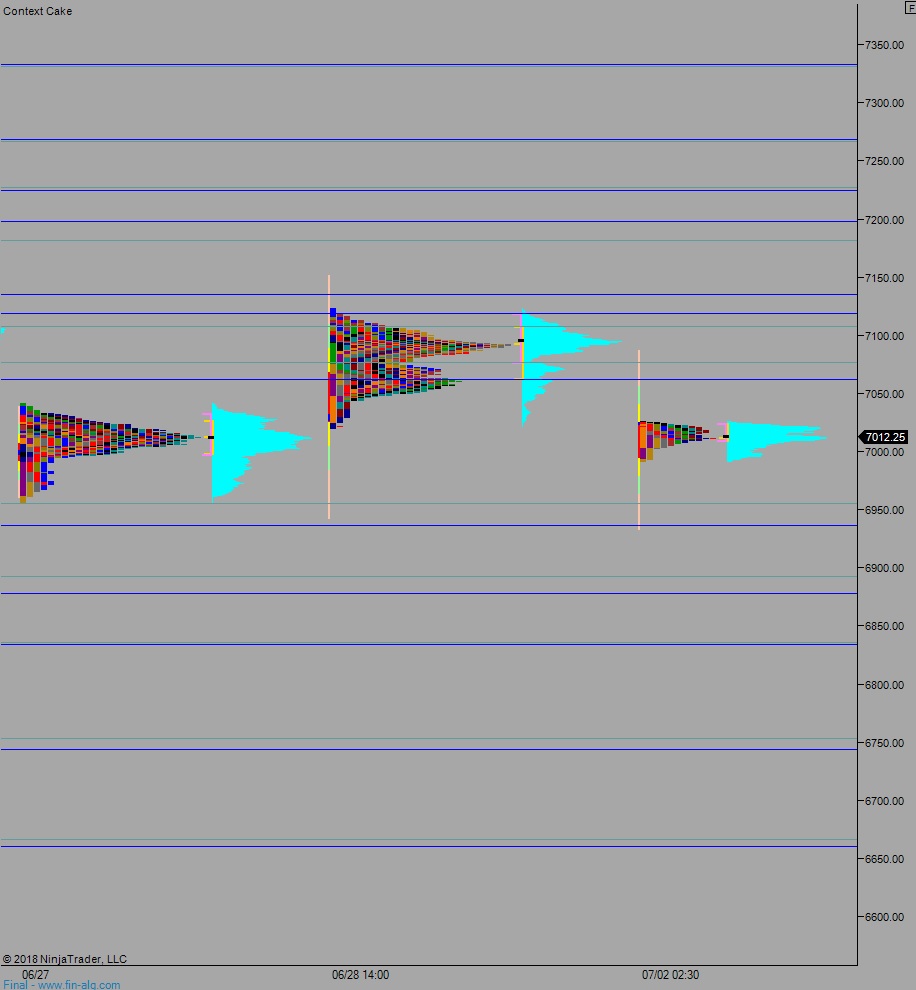

On Friday the NASDAQ printed a neutral extreme down. The day began gap up and out of Thursday range. A morning two-way auction broke higher briefly before responsive sellers stepped in and erased the morning gains then continued pushing lower, reclaiming the Thursday range late in the day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 7162. Sellers reject a move back into the Friday low 7061.25 and two way trade ensues.

Hypo 2 stronger buyers work a full gap fill up to 7072.75 then sustain trade above 7061.25 setting up a move to take out overnight high 7088 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, down through overnight low 6992.25. Look for buyers down at 6892 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

“Last week began with a quick gap down lower too. It was sold into Monday, then a late-day ramp occurred.”

Deja Vu