Life can seem meaningless at times. Pacing around scanning your mind for purpose. Work is a way for many to define themselves. So is writing. Writing is a serious matter. If you cannot code then writing is your only whack at leaving behind something that shows future generations how you ticked.

My uncle passed away last night. He worked nearly his entire life. 35 years at big telecom. He liked his job. Just last Wednesday he decided he’d had enough and was going to retire. On Thursday he brought home an assortment of odd trinkets from his desk including several pens and cassette tapes. He was a gifted musician who recorded 100s of his own songs. We all went to dinner Friday night and celebrated. He was driving my aunt mad with cockamamie plans of spending all his retirement money fast. He set aside nearly a million dollars.

And for what? He was sold on the American dream they pitched to baby boomers—put in your 30 years and you’re free—to live out your golden years loafing about town doing old people things.

I am shaken. The black ‘flowers of death’ bloomed in front of my house on Tuesday and I’ve been too busy to tell anyone. They have portended a fast and hard down move in the stock market two years in a row. I could chalk it up to seasonality, but the blooms happen on slightly different dates every year. This year they portended actual death.

And the Exodus strategy session I prepared this morning has 666 words. I didn’t notice it until after it was submitted. I have been reading and studying Pontius Pilate all month. I have been listening to Rolling Stones Beggars Banquet album over-and-over again all week. I have been reading stories about the devil and wrapping my mind around the black magician’s ways and the philisophic purpose of such a character. I am shaken.

I don’t like these black flowers. A pest always chews up the foliage and I let it. But I won’t kill the unnerving perennial. I don’t have the stomach for killing plants.

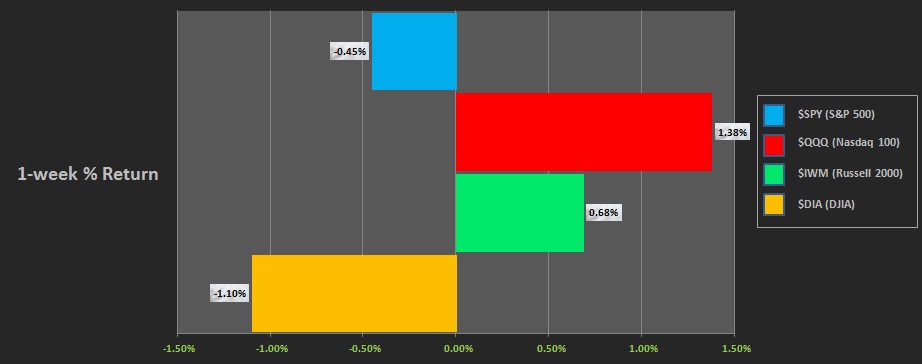

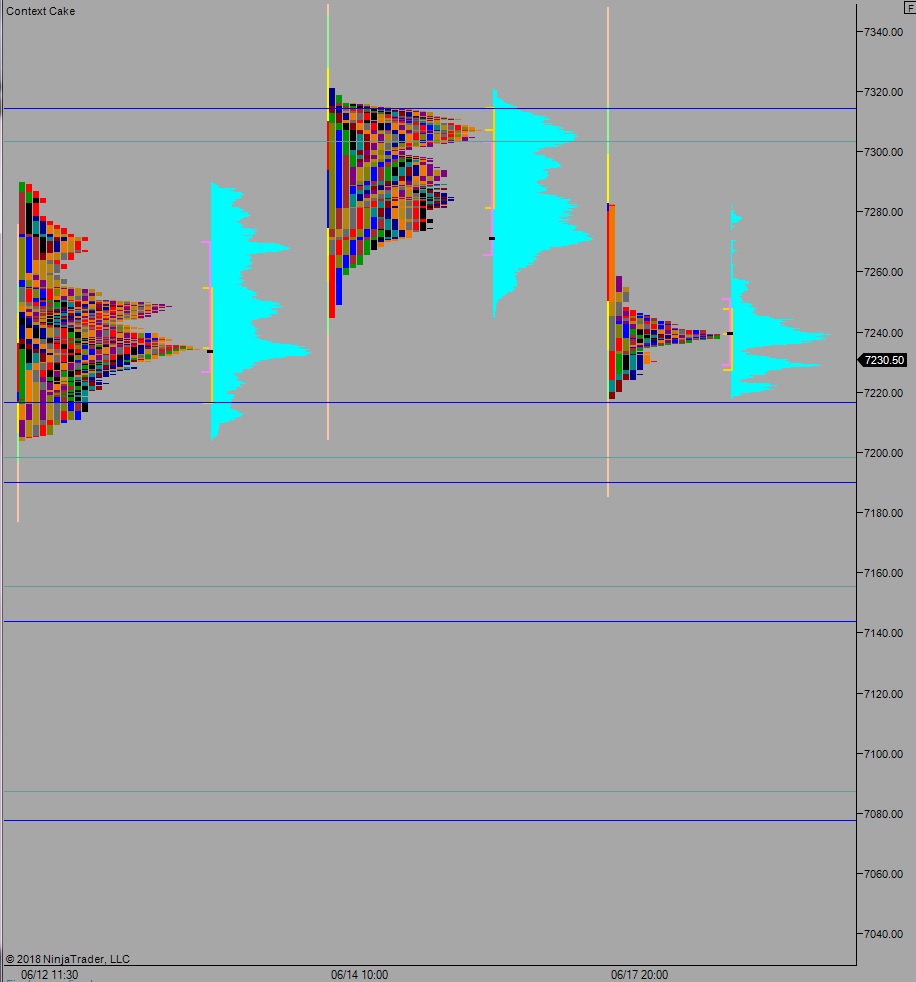

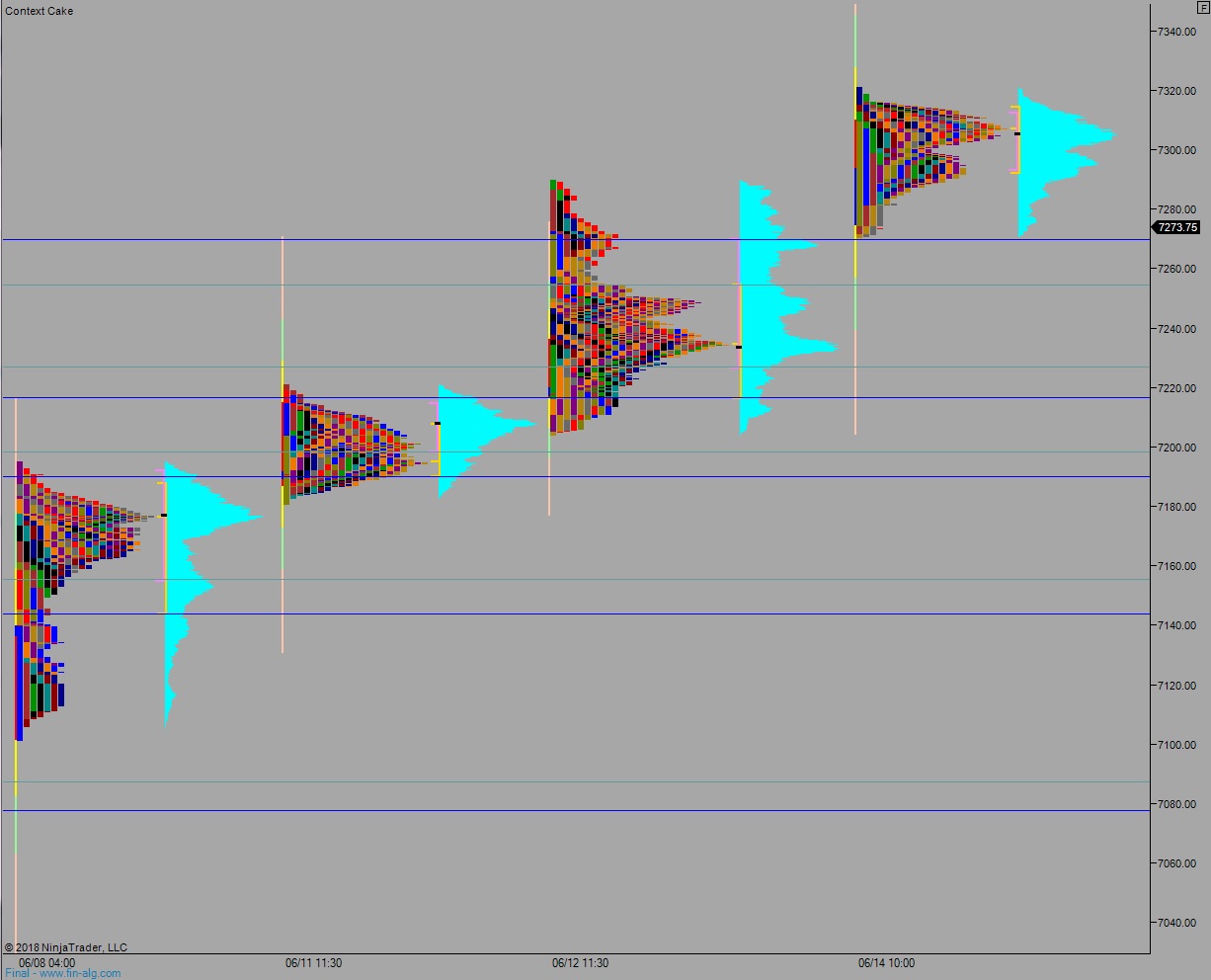

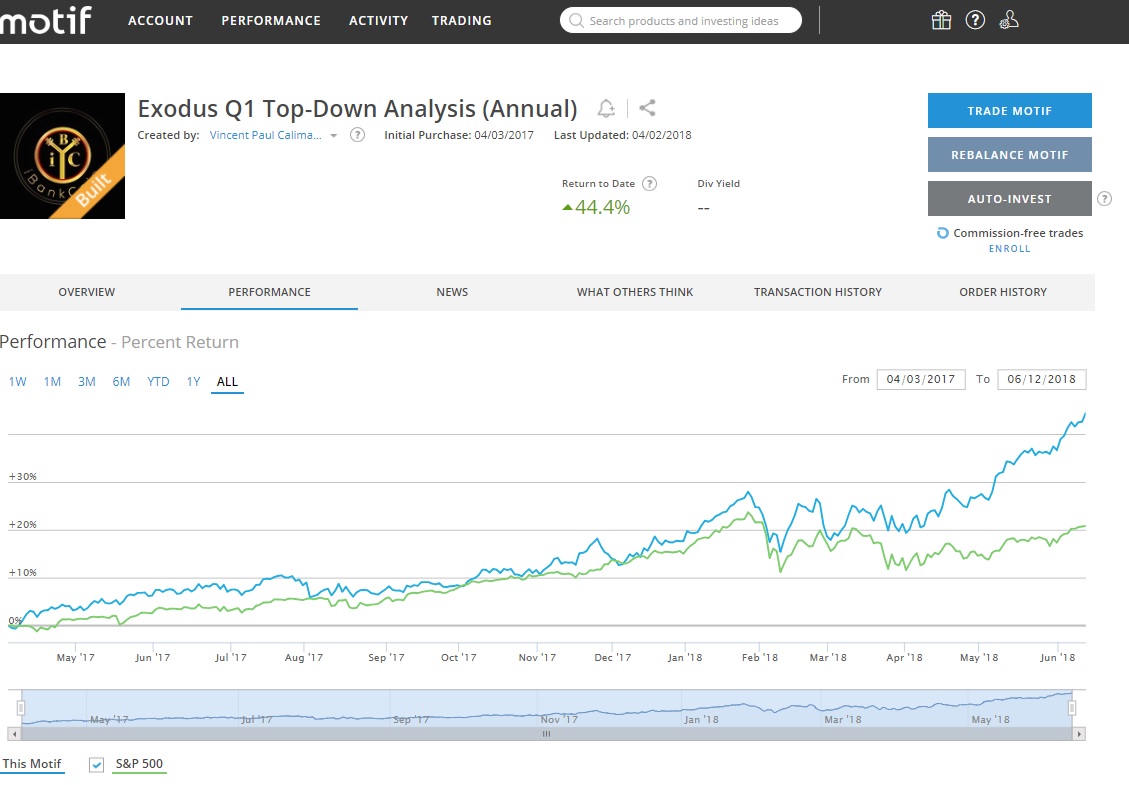

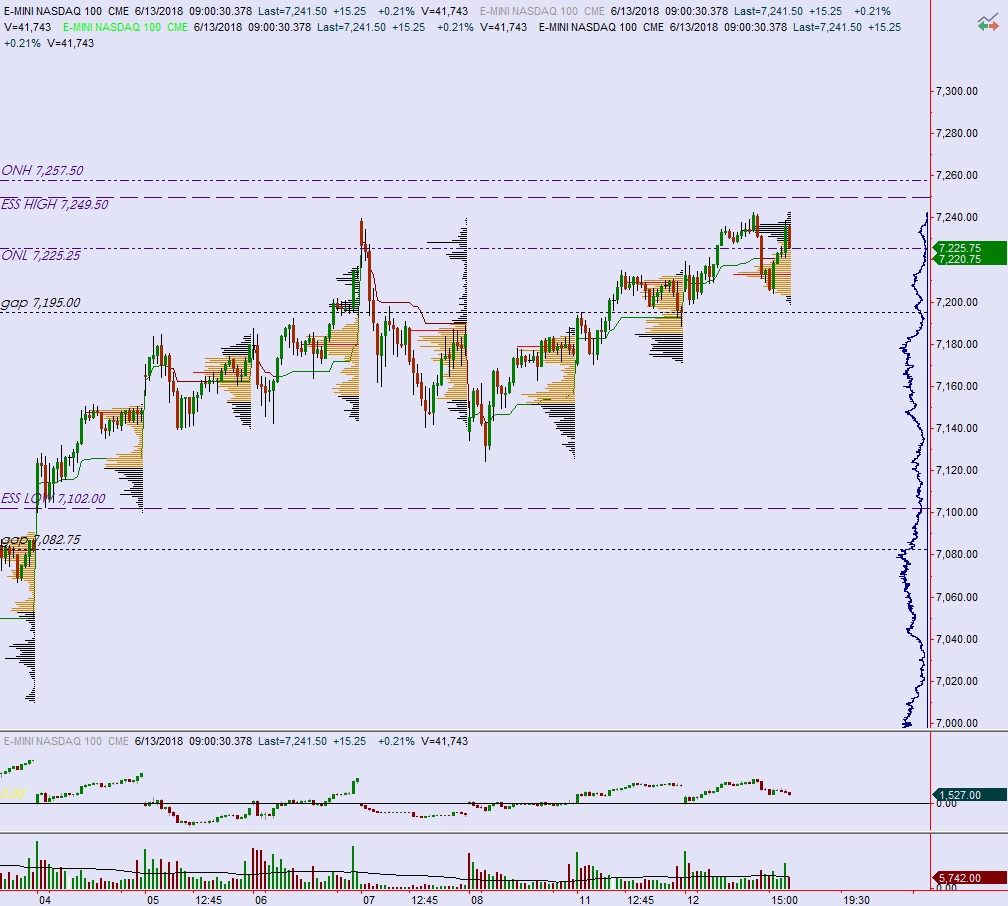

The strategy session flipped neutral after four weeks of being bullish. I won’t be trading this week but I will be around the interwebs if any of you need anything. Because that is why I blog and take speaking engagements and organize these silly meetups in the city. I am creating my own playground, with more talented speculators around who I can ask questions, and less talented speculators that I can give answers to. This is a powerful learning position to be in and I think I have been clear with my intentions for a long time. I intend to be the finest speculator that ever existed. So if you have any questions, ask away.

RIP LAZARD AND LAZARD, A DACTLE CORPORATION

Comments »