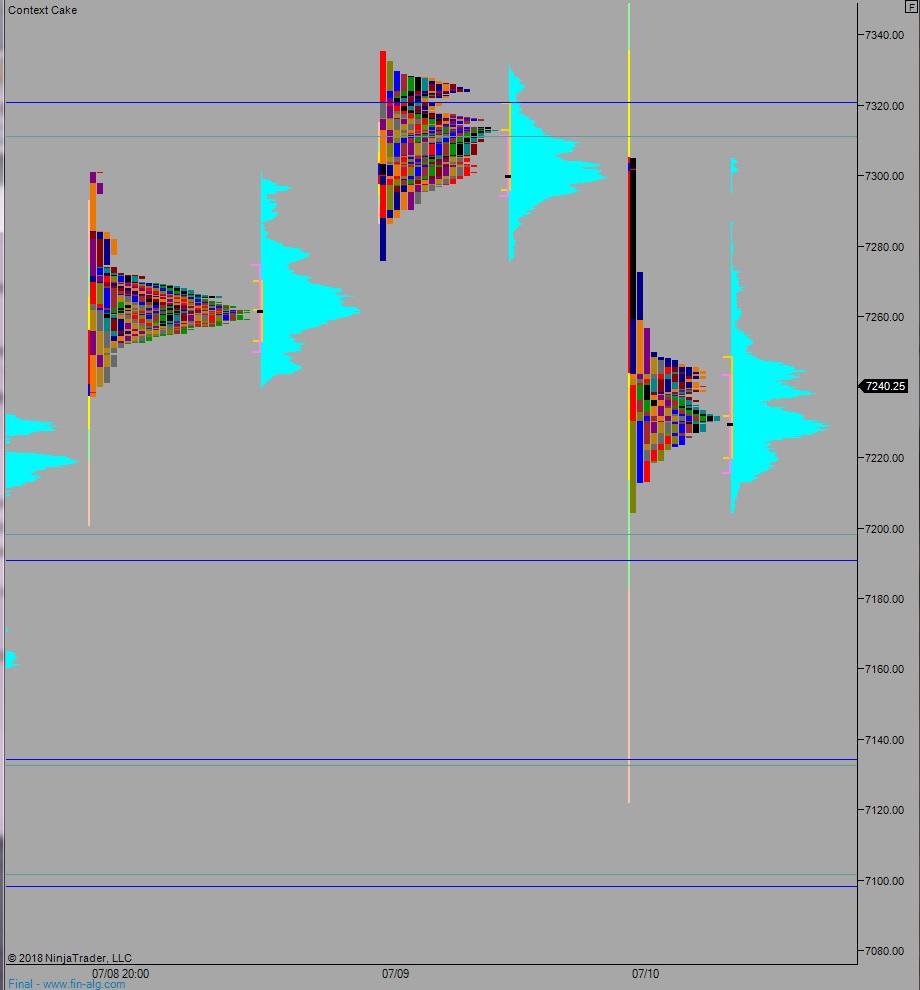

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. The move was news driven. After closing bell Tuesday tariff news came out and spooked futures lower. Price worked down into the upper quadrant of last Friday’s trend day before a responsive bid stepped in and balance formed.

On the economic calendar today we have crude oil inventories at 10:30am and a 10-year note auction at 1pm.

Yesterday we printed a neutral day. The day began gap up which sellers quickly resolved. Buyers came in well above the Monday midpoint and we pushed higher, going RE up by late-morning. The bidding stalled, and we traversed the entire range and went RE down, putting us into a neutral print. Price then returned to the daily midpoint and chopping along it into the close.

Neutral day.

Heading into today my primary expectation is for buyers to push into the overnight inventory and return to the ‘scene of the crime’ which aligns with the overnight gap 7301.25. From here we continue up through overnight high 7305.75. Look for sellers a tad higher at 7311 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 7204.50 setting up a move to target 7198.50 before two way trade ensues.

Hypo 3 full-on liquidation. Sellers sustain trade below 7198.50 setting up a move to target 7154.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: