Unlike some folks, I do not want to be bearish. I do not have a cognitive bias that constantly reassures me the world is fucked and so is everyone in it. I do not seek out headlines to affirm a morose disposition [though RAUL’s inner masochist does].

I think people, in general, are good. And I believe we are in the midst of an economic expansion phase the likes of which no living human has ever seen. The internet has removed all the roadblocks that served to oppress ambitious souls for 100s of years. We have the tools readily available to become great at whatever we choose. I think our planet is in trouble environmentally, but I also believe good people are working to create solutions.

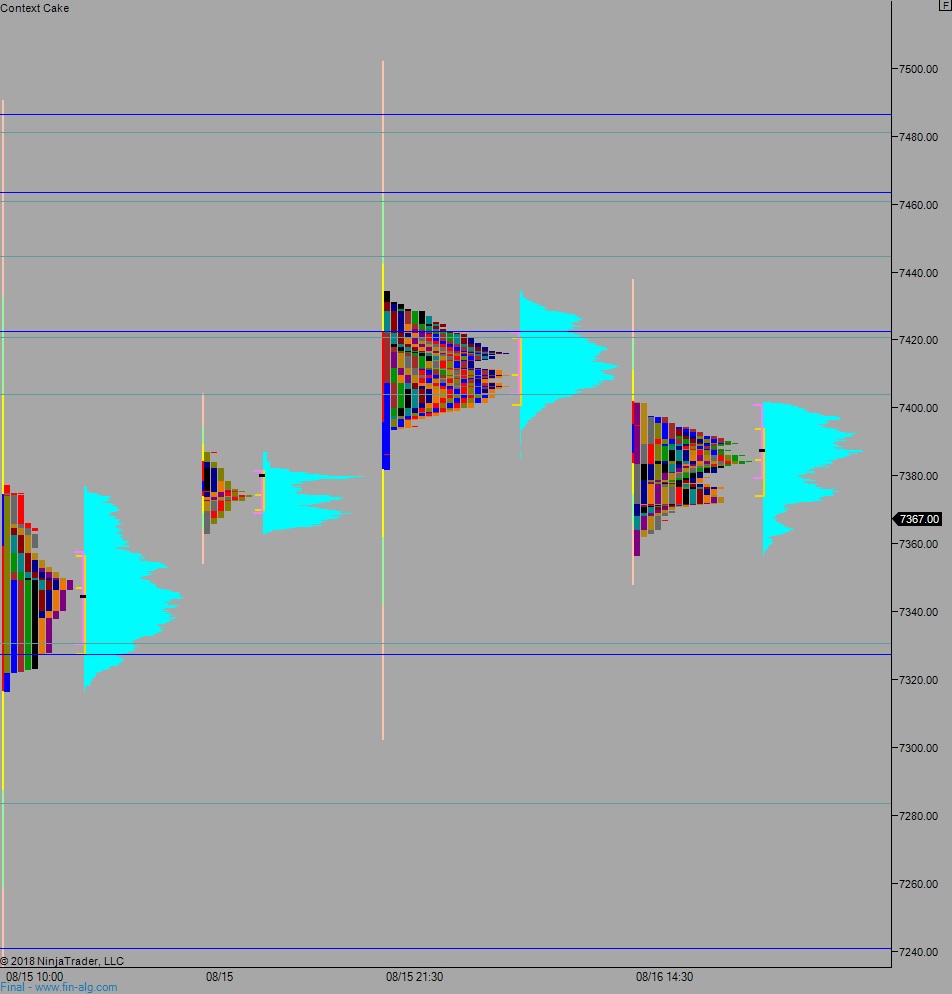

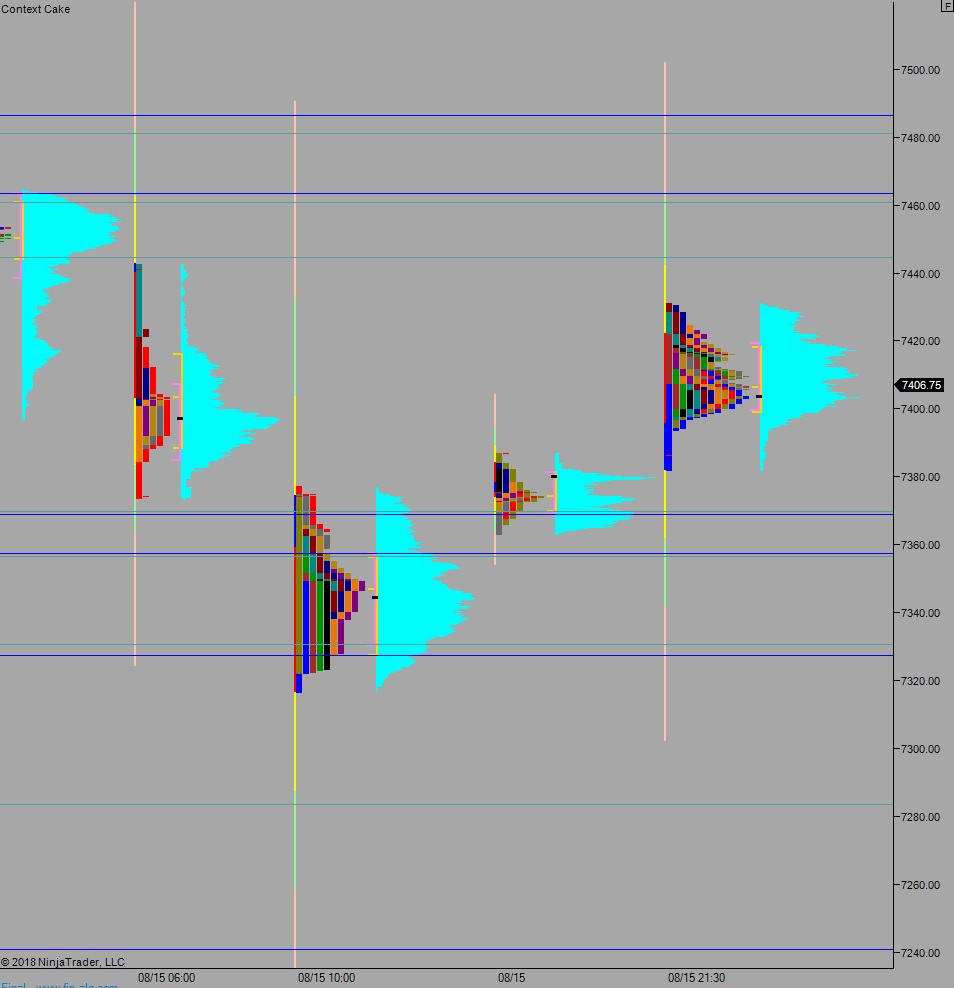

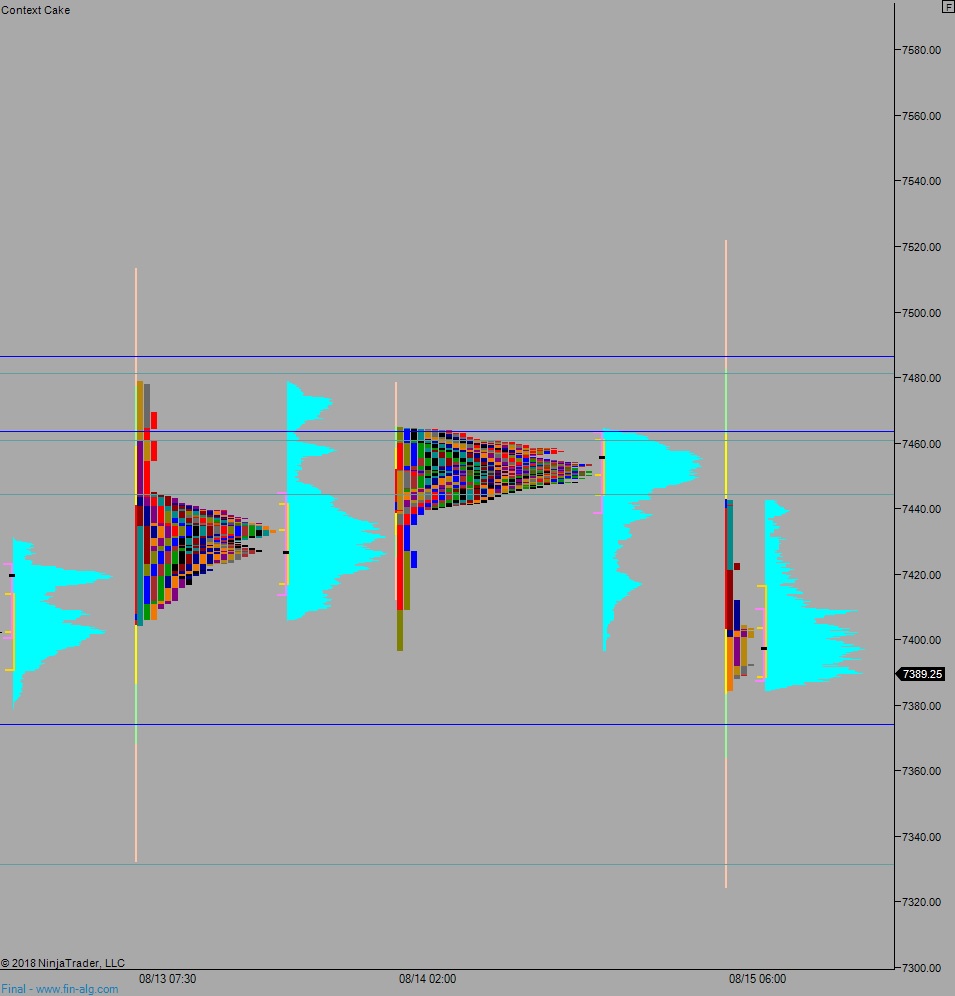

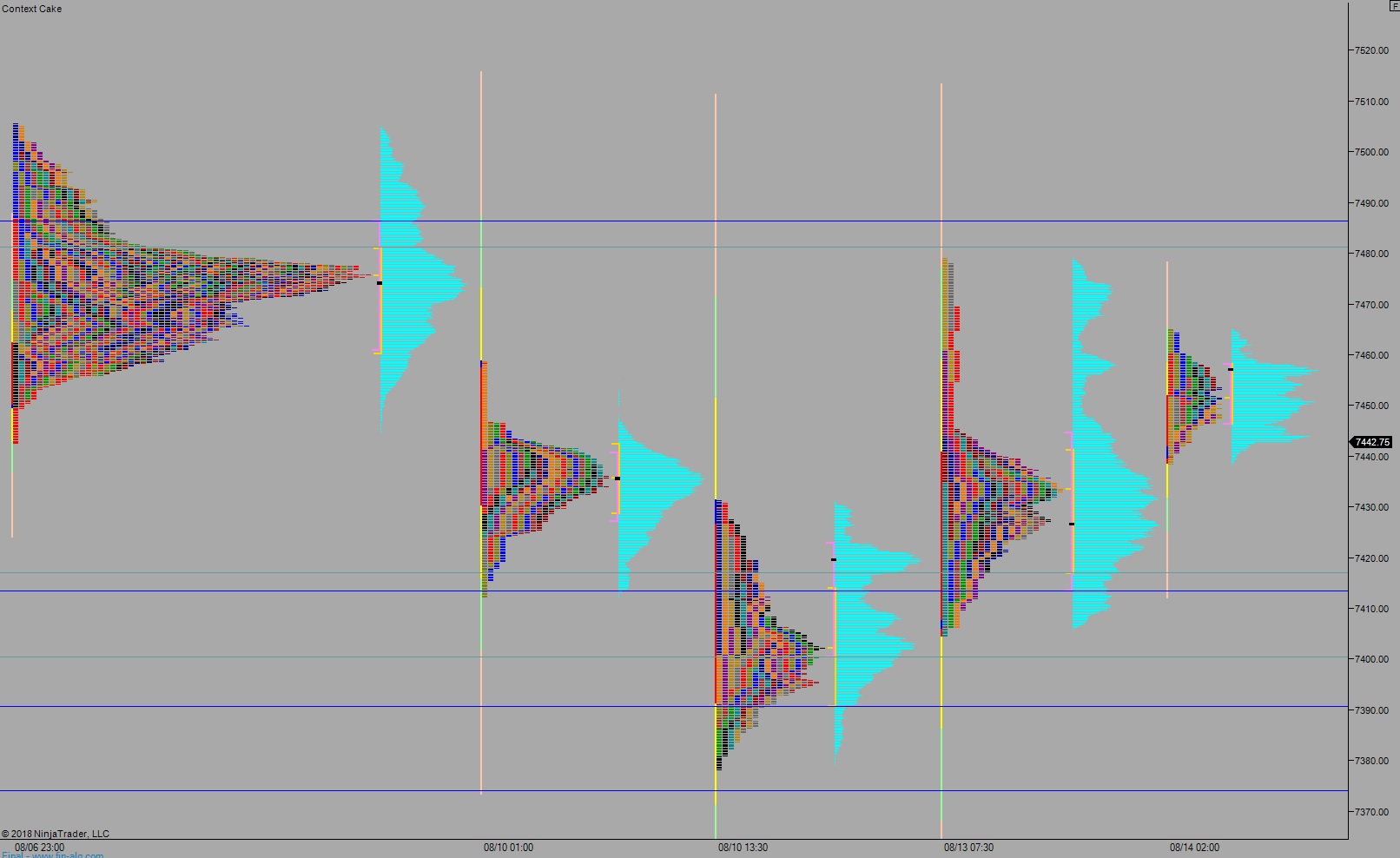

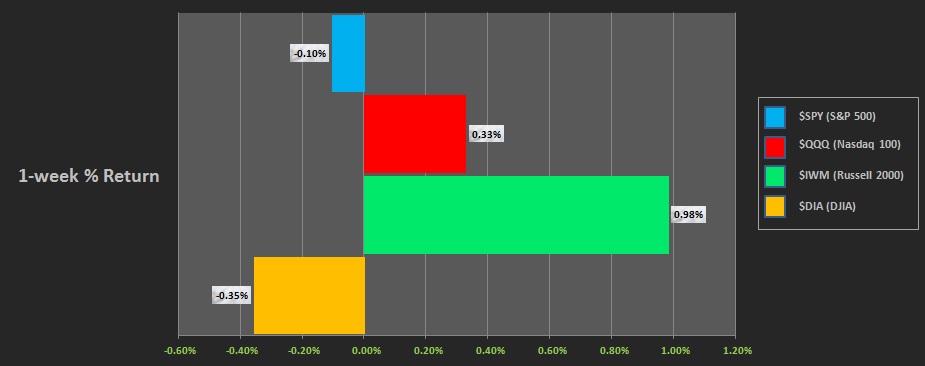

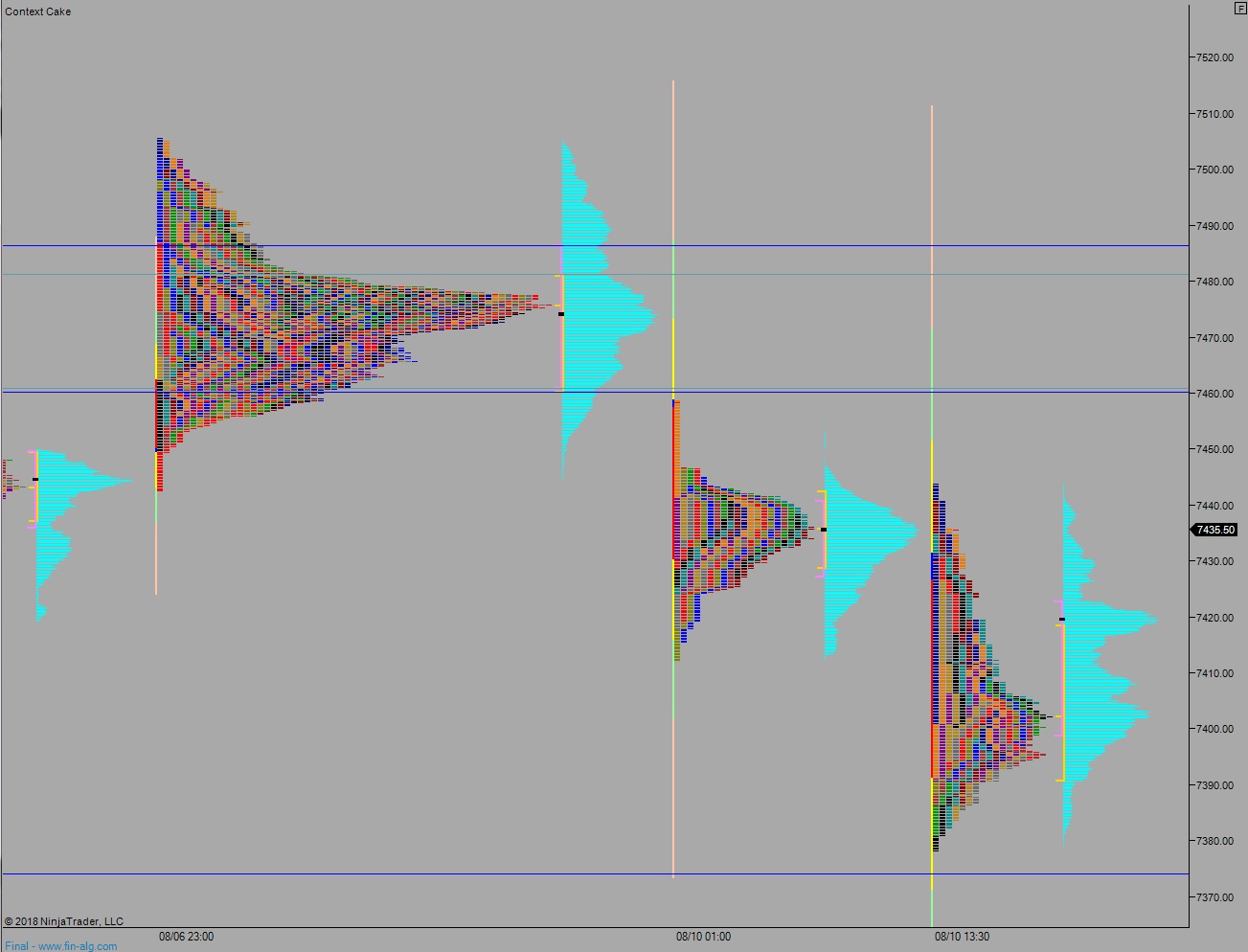

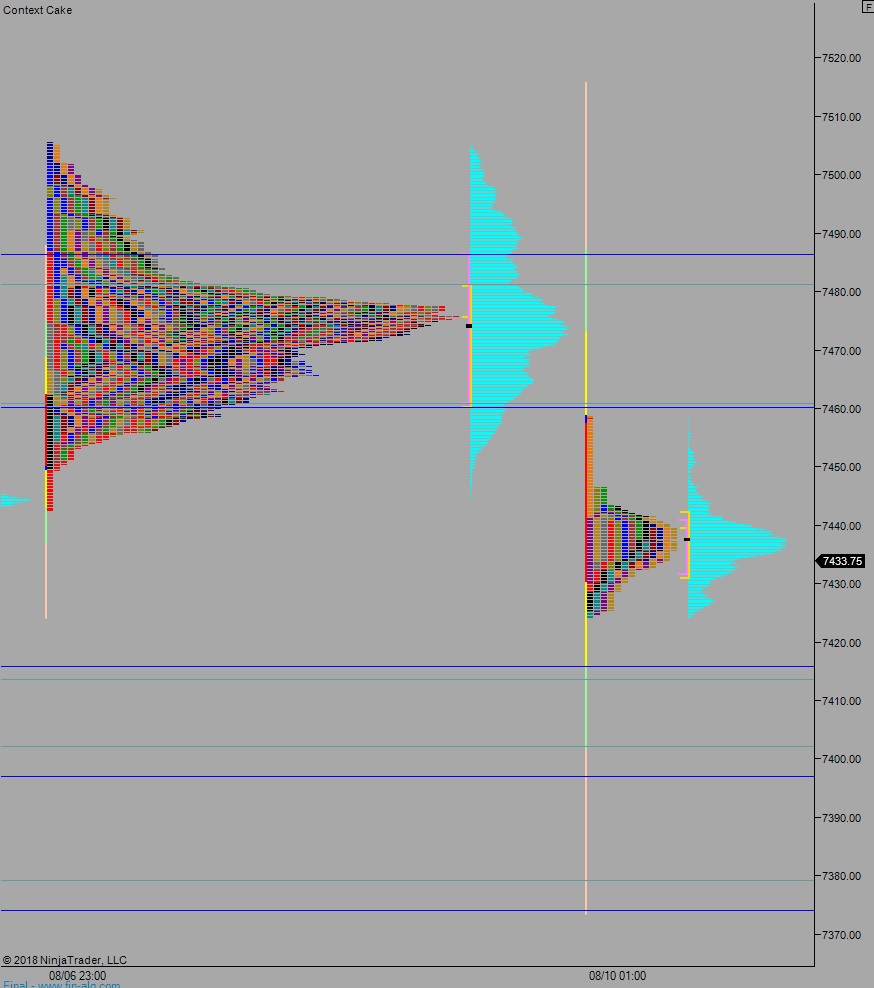

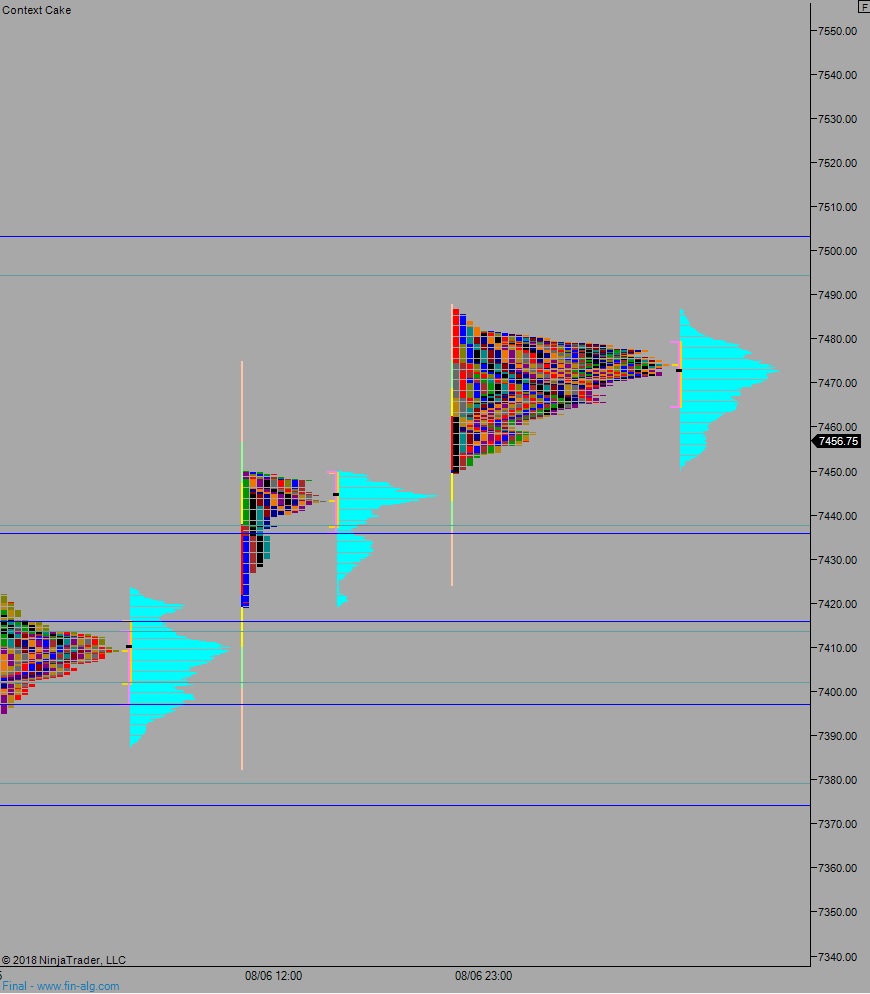

But the model is the model is the model and if it signals bearish, by golly I have to formulate a plan for betting against the stock market. Fortunately the signals generated by IndexModel only last one week. Also, the weekly ATR brackets are a mandatory checkpoint. They mark a fork in the road. A place to stand up and stretch your legs and reassess. If we blow past them and keep discovering new prices, we are likely experiencing something more than a methodical price gyration. Last week all four major indices tagged their lower ATR band by 10am Wednesday. Then a strong bid stepped in. Orderly behavior.

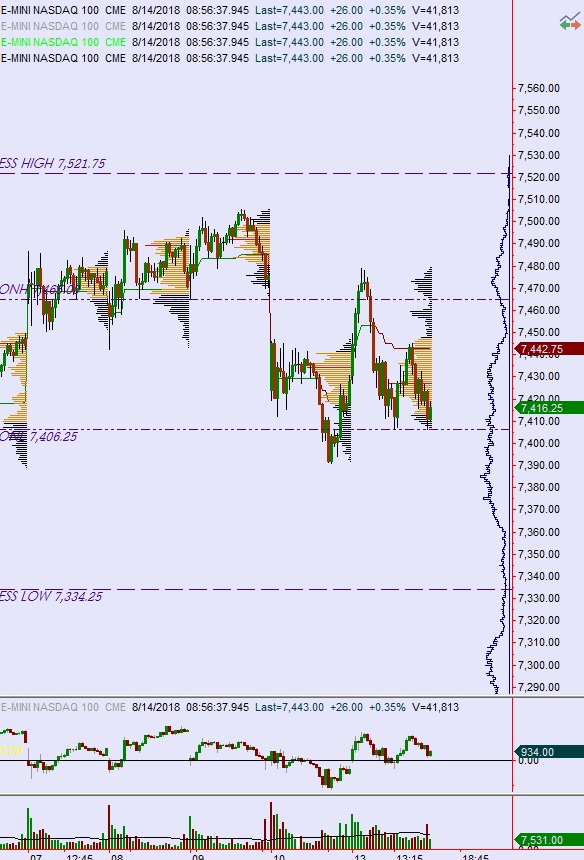

I held my proxy SQQQ trade overnight Wednesday and into Thursday but by Wednesday afternoon I had already begun doubting the short bias.

now it becomes tricky

we're off the lows

the market did what the algo said it would

and now we're in uncharted waters

low-of-week could be in$WMT earnings on deck with $NVDA in the hole

hmm…

— RAUL (@IndexModel) August 15, 2018

The lower bands were tagged so in terms of model mechanics and one of the ways the model measures its effectiveness, the model was statistically proven right. From Wednesday afternoon onward I had to improvise, sort of. I wrote a plan last Sunday that discussed what I should do midweek.

Anyways I deviated from the plan and screwed up:

Sunday RAUL was way more woke than Thursday morning RAUL pic.twitter.com/nIwaDmFmzE

— RAUL (@IndexModel) August 16, 2018

I top-ticked the NASDAQ on Thursday morning when we went range extension up. I attribute the error in part to a lack of clarity in my written plan. The thing is, the farther out I look when forecasting, the more murky it becomes. There may not be a way to address this shortcoming.

Those Thursday morning Walmart numbers were so strong I felt them. A vibration in my bones. I may have given them too much importance. It was not a career ending mistake. I had a solid week inside the #nq_f arena, bagging multiple 40 point moves. The thing is, the ingredient that I cannot share with you no matter how many blogs or Youtubes or tweets I create, is that I want to be the best NASDAQ 100 trader in the world. Wanting…needing to be better then everyone else including billion dollar institutions is my edge.

The last thing I’ll mention about this error is that messiness is never the god. I need to put out cleaner trading plans when my forecasting models (Exodus and IndexModel) hand out a statistical advantage.

Alright, I’m diving back into this week’s Exodus Strategy Session.

Comments »