Guys I cannot keep updating my thoughts throughout the day and trade to the best of my ability. Some of you are asking and while I appreciate that you find value in my writing I write what I write so that you can understand and implement the process on your own terms.

Here is a quick recap of how I’ve found myself long two units heading into the closing bell and Apple earnings.

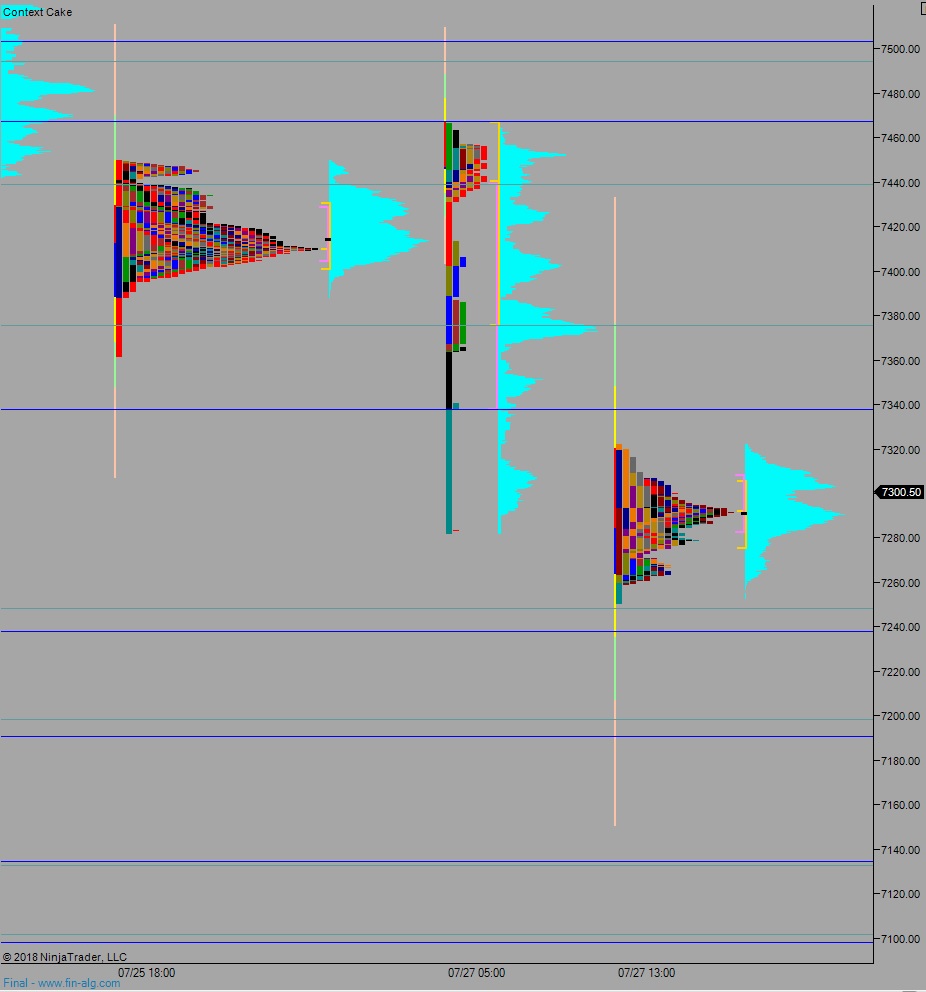

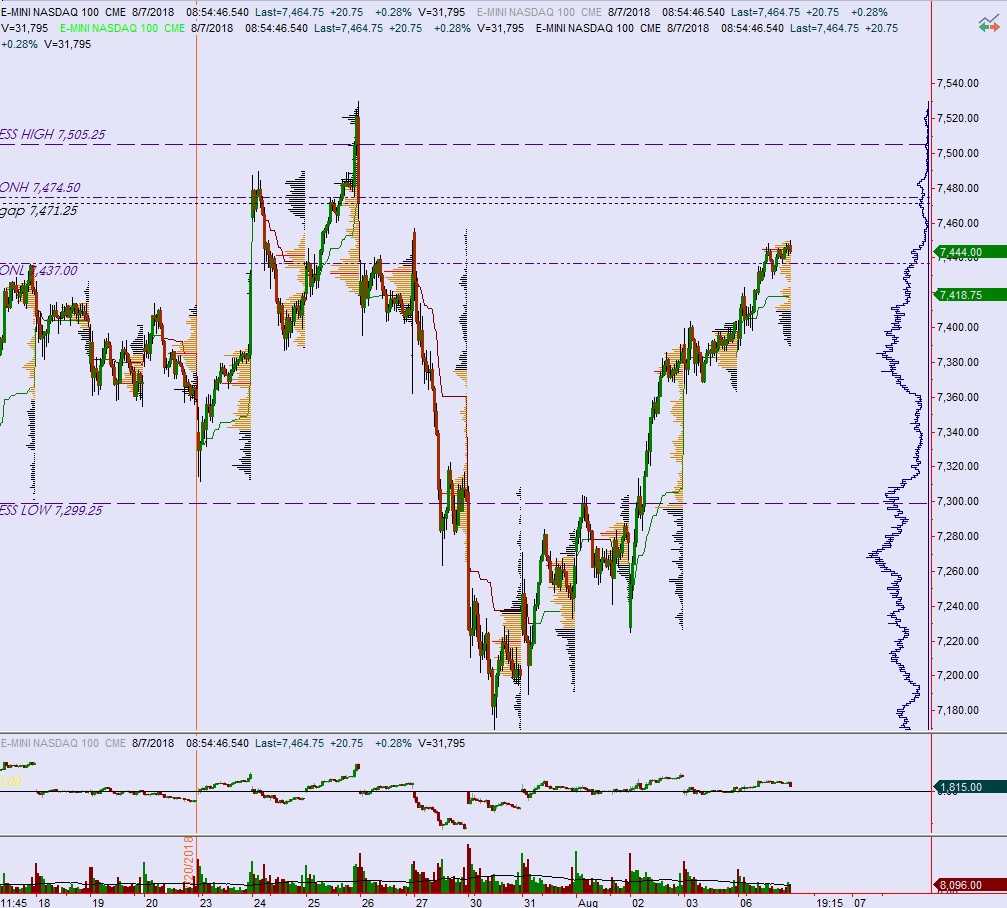

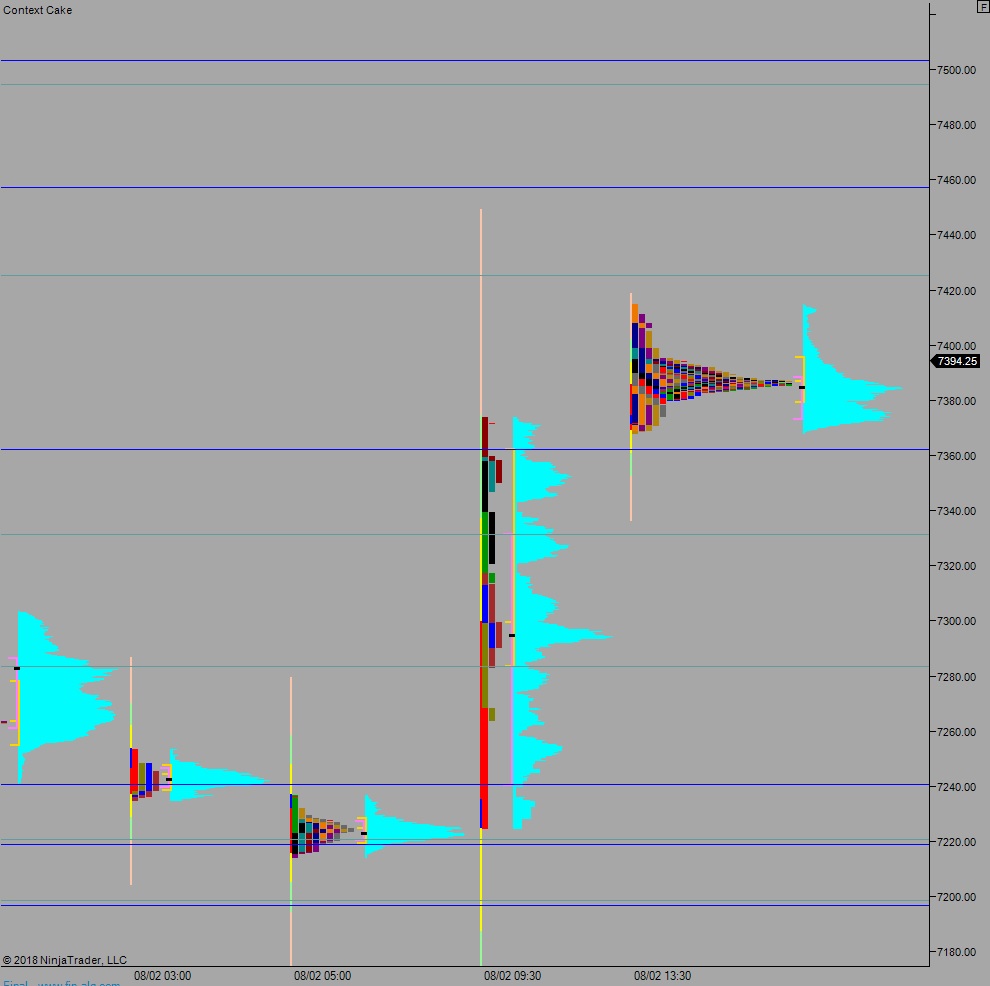

This morning’s hypo 2 did a good job of identifying where sellers were likely to show up should the market’s first matter of business be to test higher:

Hypo 2 buyers gap-and-go higher, trading up through overnight high 7230. Look for sellers to defend around last Friday’s low 7263.50 and two way trade to ensue.

Hypo 2 was off a bit off. While I attempt to make these price levels as precise as possible, this is nature and nature will do natural things. The NASDAQ is a slippery instrument, it sloshed past 7263.50 but peaked out a touch higher at 7271.25.

I tweeted:

So I thought we’d already seen all the upside for today but then something happened. We made a sharp low before 10:30am. Why does that matter? There is a 72.6% probability that either the high OR low of the NASDAQs initial balance [first hour’s range] is exceeded before end-of-day.

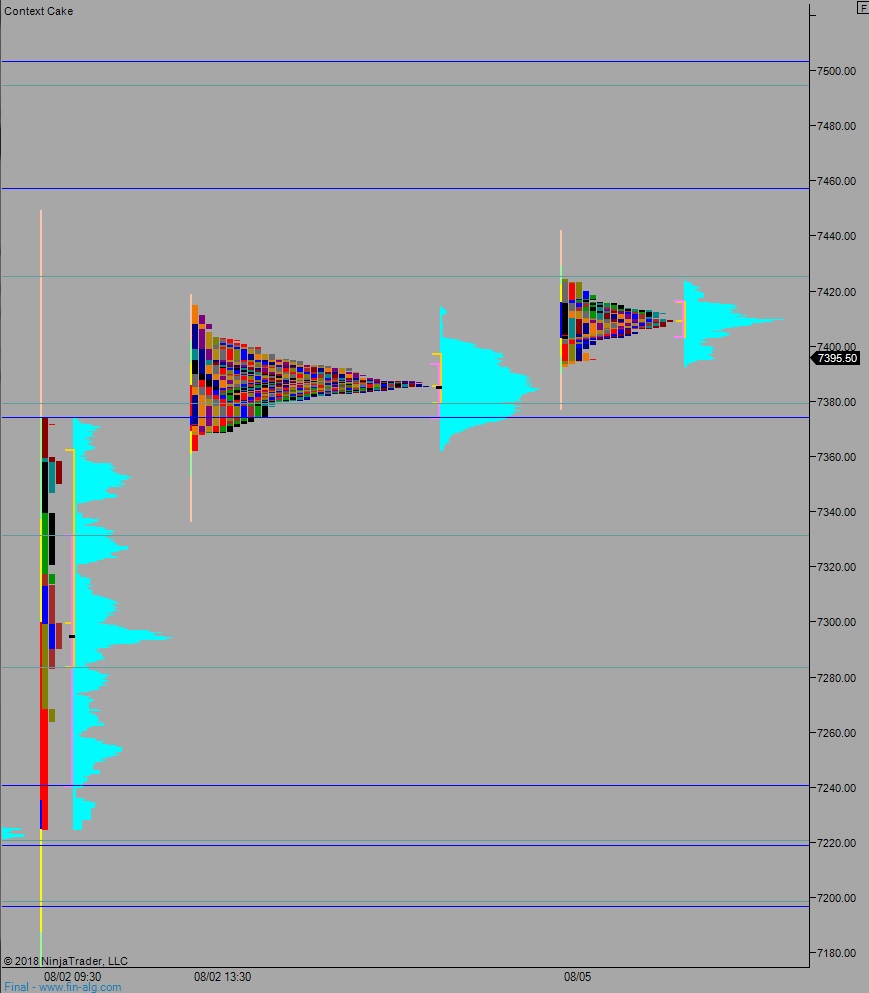

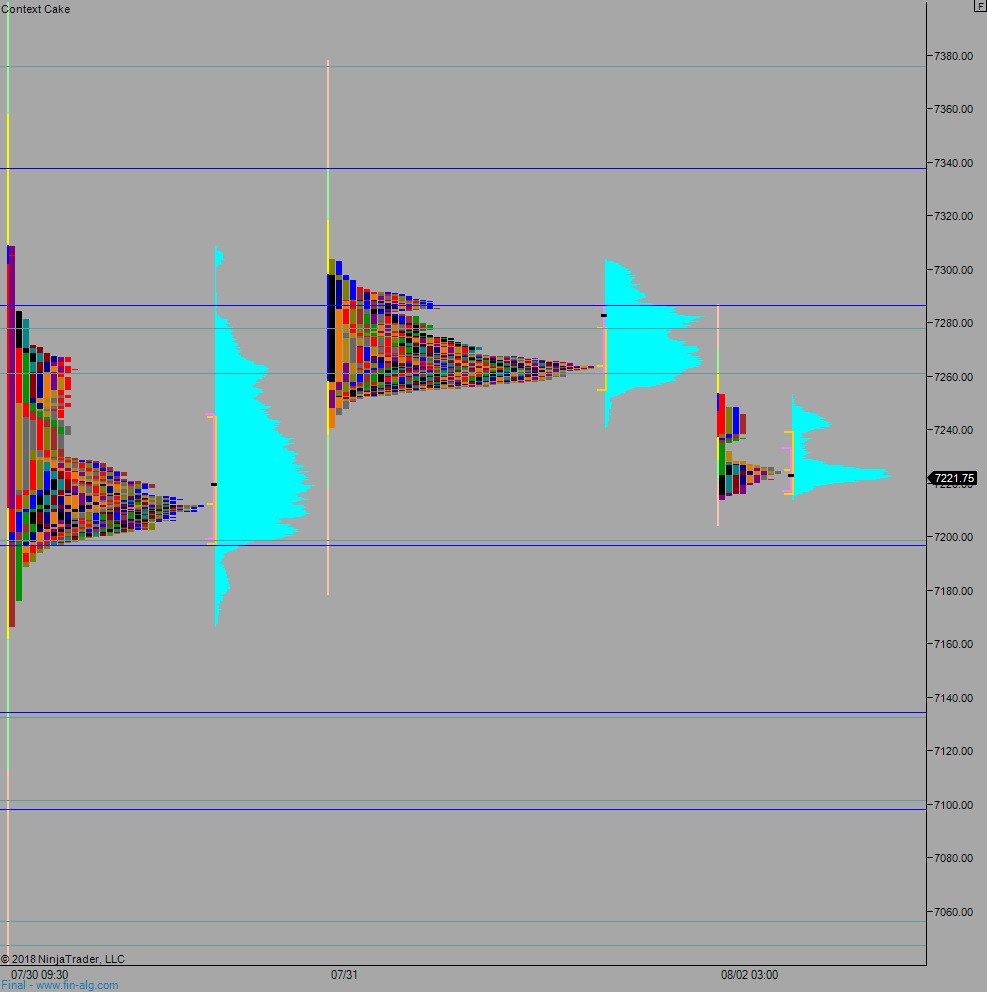

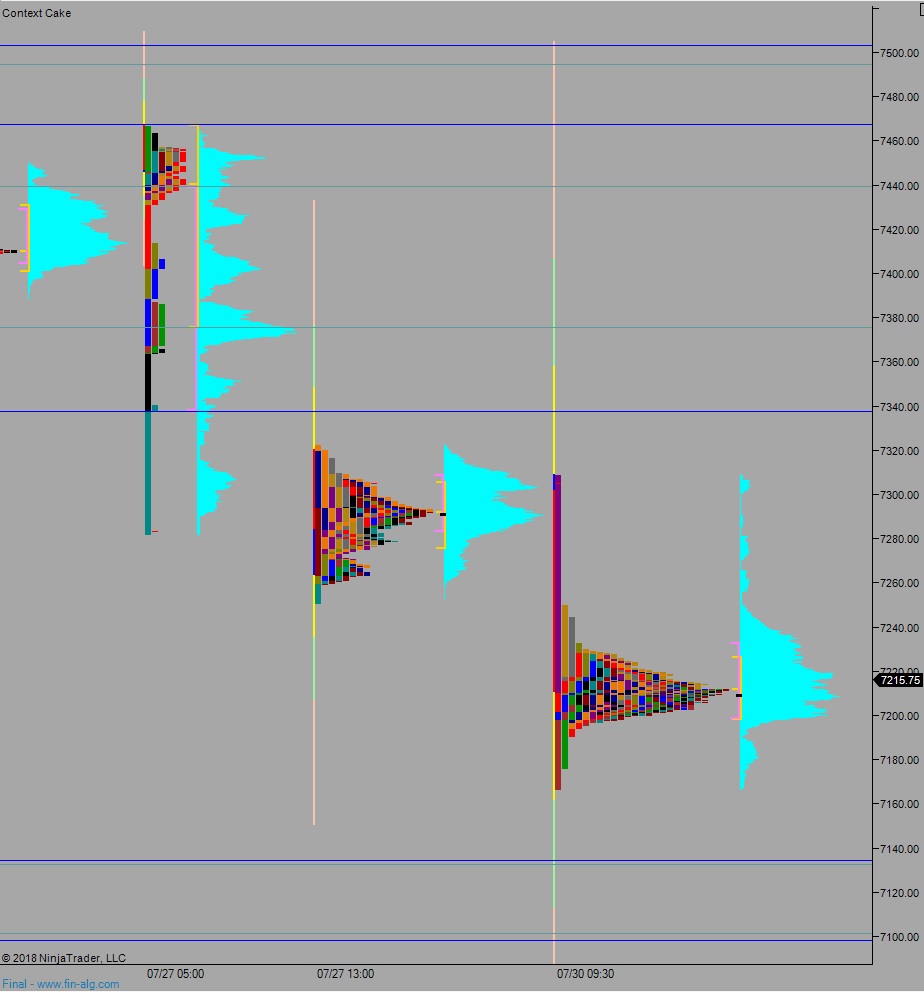

Then there is [was] that rare b-shaped profile we are [were] working inside of [we still kind of are but it’s filled in]. It looked even more b-shaped this morning, remember?

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”

My muscle memories:

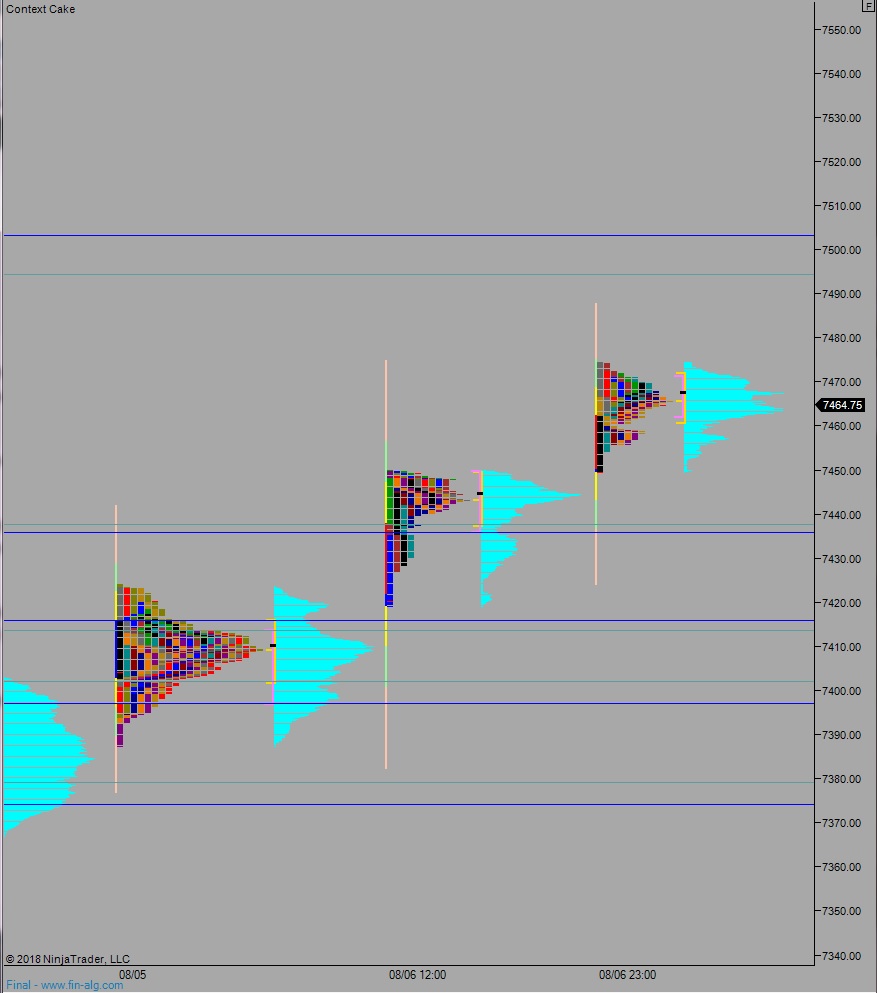

Market profile context said we could be nearing a bottom. The ATR bracket from Exodus Strategy Session was tagged by /es_f Monday and we formed a good looking bottom. And Apple reports earnings after the bell.

We all know Apple reports earnings after the bell…how is the market going to behave after the report?

We don’t know.

But Apple earnings are a wildcard. That much is fact. And

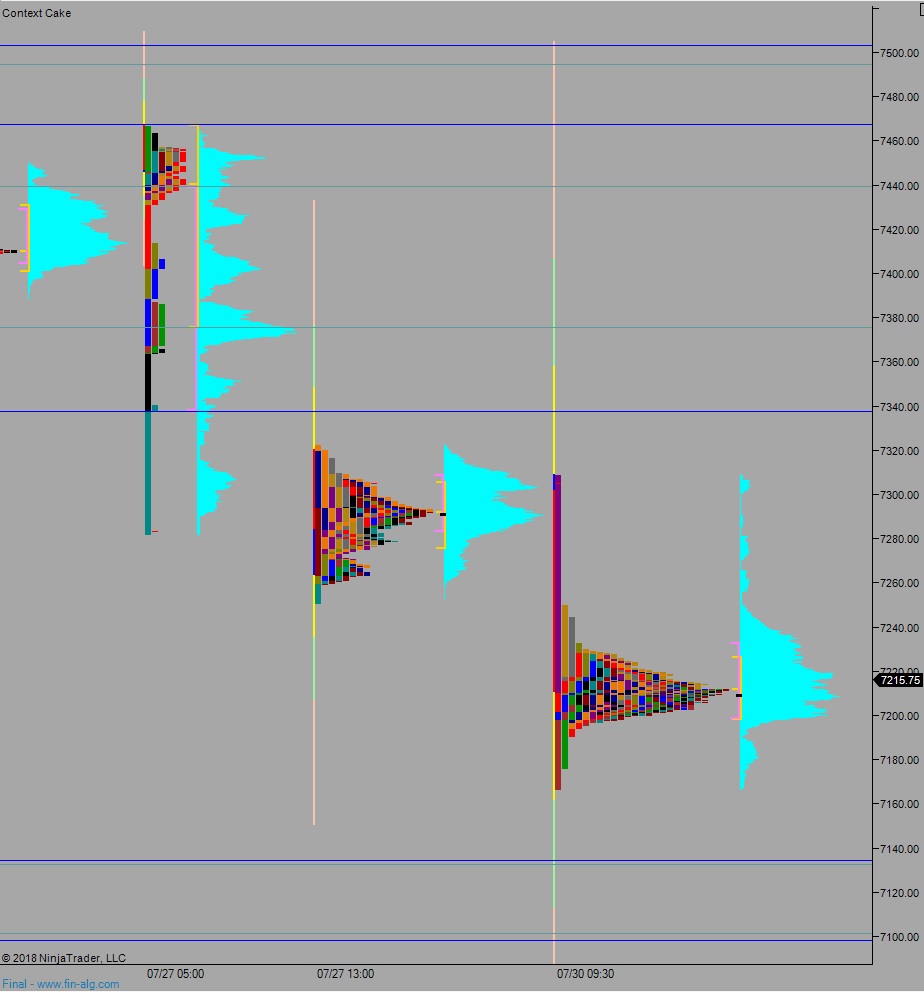

I had the 72.6% stat. Mothership signaled I could go long so I went long and targeted IB high. By noon we took out IB high, I left one contract on and went to the gym.

This next part is absurd but I managed the runner from the gym using the logical 7250 level as my stop on the final unit.

But why?

Per the morning homework I though we’d already seen as much upside as the day had to offer before Apple earnings. And now we had gone range extension up, so that stat was complete too. There’s no real reason I should still be long. Looking at /ES $IBB and /YM I can see that if we take out 7250 those instruments have a long way to fall before any logical support.

But there is a wildcard. And a nice, bi-centennial price level that every trading desk around the world is watching. 7250.

When I returned home to Mothership from the gym we were churrning the 7250 level and I managed to size my position back on and scalp it back off.

Though scaling off from the initial position, then adding and scaling again, I’ve significantly reduced my cost basis on my /nq_f long. So, while I have a stop in place, I’m going [hopefully] let a piece ride into the wildcard.

Comments »

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”

“As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.”