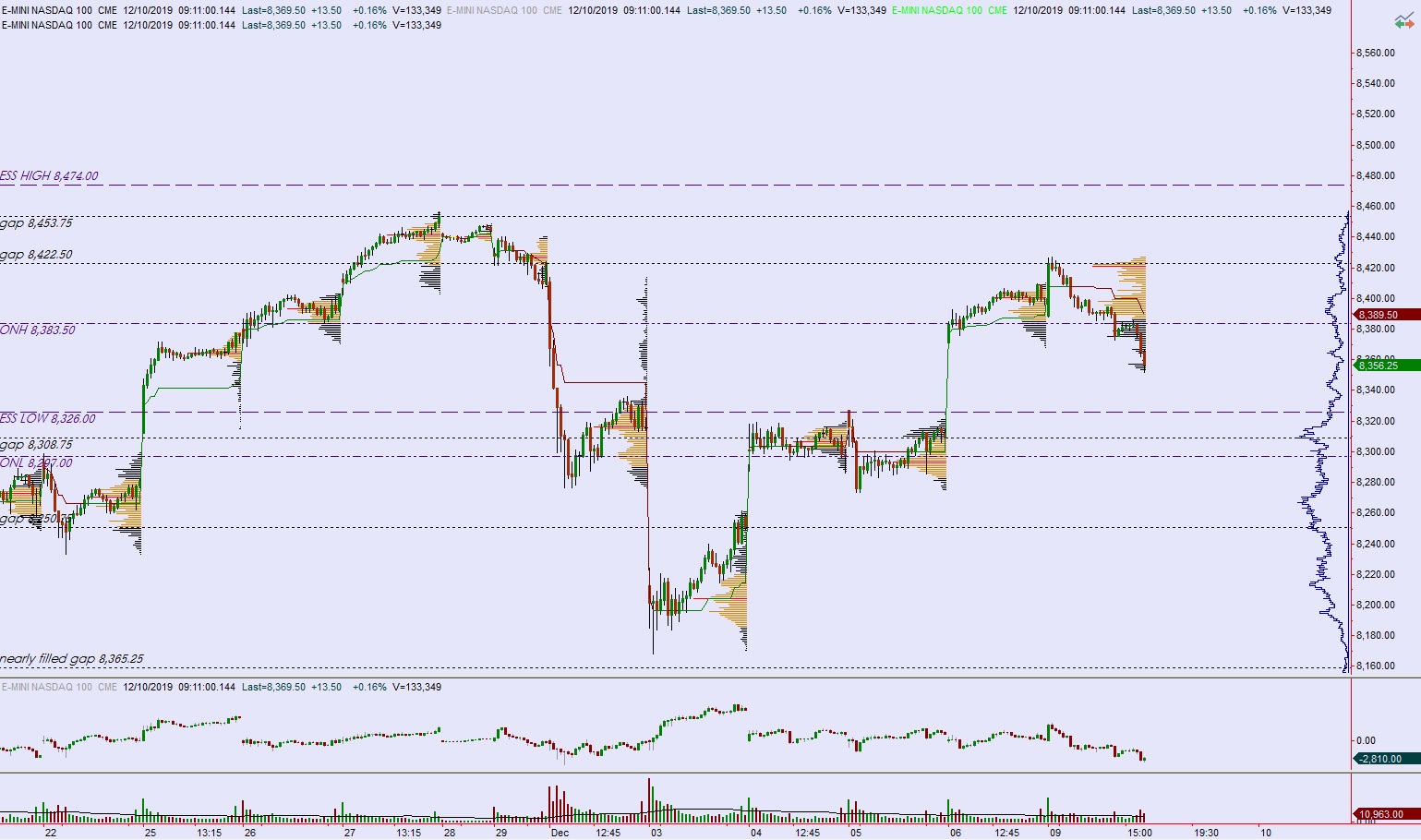

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked lower overnight, trading down a few ticks below Tuesday’s midpoint before finding a responsive bid around 6am New York. Then at around 8:13am Commerce Secretary Wilbur Ross spoke optimistically about finalizing changes to the U.S.-Canada-Mexico trade agreement, sending futures spiraling higher. As we approach cash open, price is hovering below the Monday midpoint.

On the economic calendar today we have 4- and 8-week T-bill auctions at 11am followed by a 10-year Note auction at 1pm.

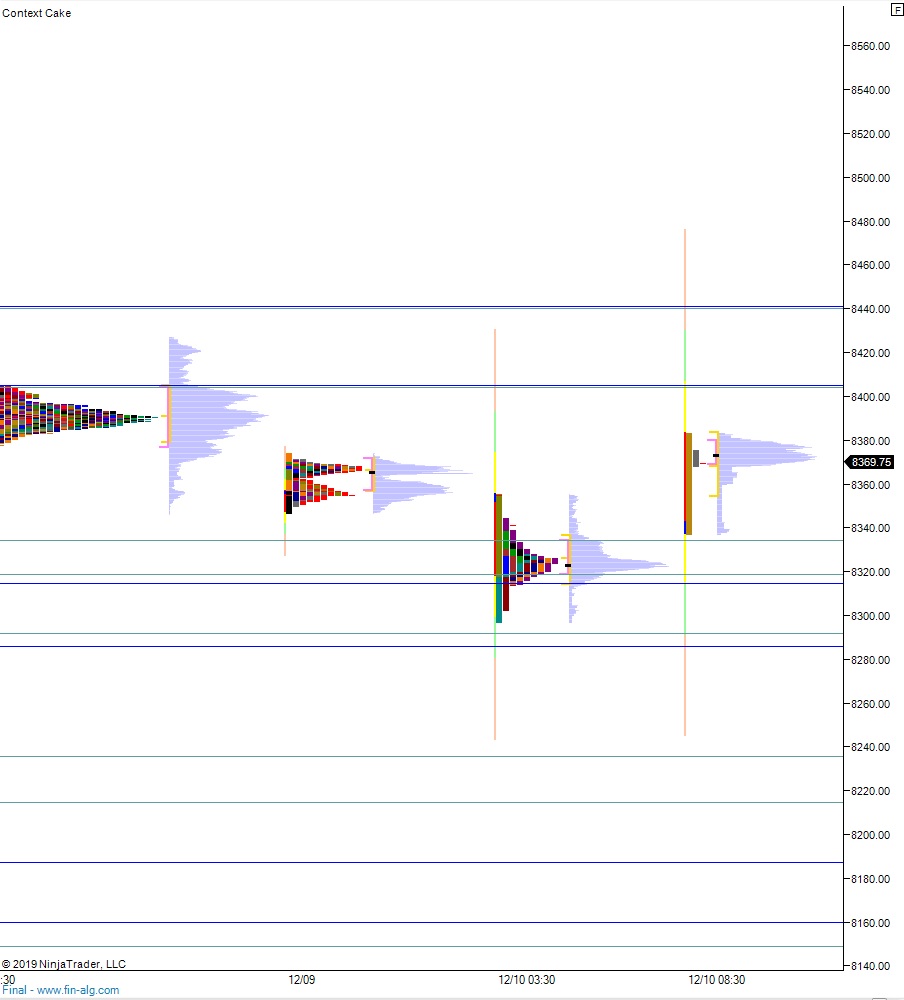

Yesterday we printed a double distribution trend down. The day began with a slight gap down that buyers drove higher into. Said buying stalled just above overnight high, just after tagging the open gap left behind on the last trading day of November. From then, onward price rotated lower, suggesting that the conviction sellers spotted on December 2nd were still active and defending their entry. Price methodically traded lower, closing near low-of-day.

Heading into today my primary expectation is for sellers to press into this trade deal spike, closing the overnight gap down to 8356.25. From there we continue lower, down to 8330 before two way trade ensues.

Hypo 2 stronger sellers reverse the entire trade deal spike, trading down through overnight low 8297. Look for buyers down at 8291.25 and two way trade to ensue.

Hypo 3 buyers press up through overnight high 8383.50, working up to 8400. Look for sellers up at 8404.50 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: