Greeting lads, and an early well wishing, of a Happy Dr. Martin Luther King, Jr. day to you all.

Dr. King inspired the greatest movement our country has ever seen, and despite the efforts of some to belittle the civil rights movements, or the proclivity of others to persist in the hatred of their fellow man due to race or sex or creed, here in America we are closer than ever to True Freedom and Zion.

I’ve been in the mountains for a while, high atop the peaks of the Canadian Rockies, undoubtedly the most beautiful place on earth. No longer being a tender youth, some of the side effects of age reared up while I was trekking at altitude. My knees were barking. When I crane my neck during a hunkered down mountain traverse, searing pain signals were issued from my cervical spine. During a 25 kilometer hike to a hot spring my IT band seized up, converting my gate into a trudge that would make Quasimodo blush.

But man did it feel good to send my person careening down steep cornices and couloirs with their clarity and dedication of a committed send artist. Between brave acts of physicality I read philosophy books and fiction, journaled my own altered-state thoughts with pen and paper, and did my best to operate precision photography equipment in the unforgiving wet and cold of the north.

While I’ve been back since early Monday, I’ve sort of stayed in the mountains mentally. Opting to cook soups and sip tea whilst burning thickets of incense, floating around the house in a contemplative state, tweeting occasionally along the way. Aside from caring for the people who mean the most to me, I have been sitting in silence, and reading. Studying.

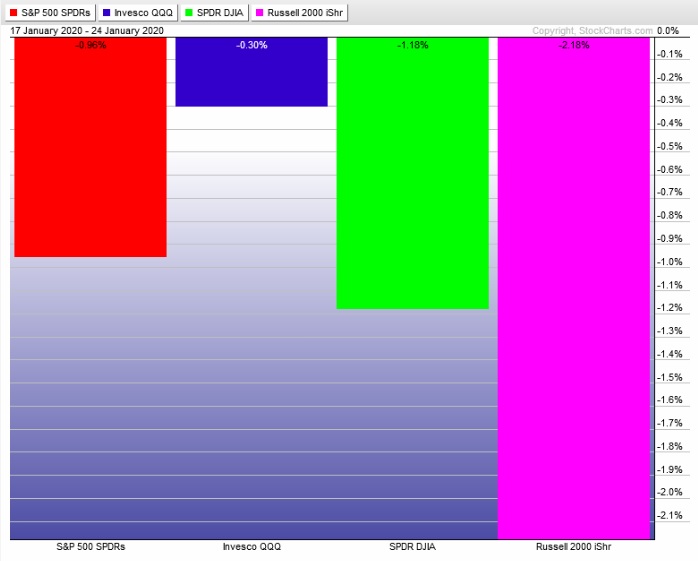

Last night I did most of my research and updated Index Model. It is bullish for the eighth consecutive week.

I’ve been keeping Mothership at 52 degrees Fahrenheit. Ever since I left the tent I haven’t been able to handle warm places. My blood is thick—my cock and constitution hard. My mind is at peace.

But I do have an important message to bring to you, noble reader of the Humble Raul blog (HRb). For many of my young developmental years as a trader, as a seeker of knowledge in the way of a consistently profitable operator, I would always reach an impasse with my mentors and peers at a critical juncture. Some called it feel, or gut. The better teachers called it context. But none of them could describe to me what context was but they all insisted it was what separated the winners from the losers. After about 15 years, I think I know why.

There are two type of knowing—-having and being. We can have a set of tools, charts and indicators and entry/exit strategies and models and bla bla bla lots of it. We KNOW what these things are. This is our KNOWLEDGE. It is useful

Then there is being. Being a trader. Observing your emotions. The behavior of others. The interplay of your KNOWLEDGE, your tools, in real time. That listless gaze we take on when we are mindful and fully emerged in our craft. Optimal grip. Not too tight or loose. This is WISDOM. And wisdom cannot be taught. Wisdom is difficult to put into words. You must feel it, around you, around all of us. The force that delicately interconnects everything.

Depending on the path you take, that context will come to you differently. You perception is like a lens and it can deceive you. We all know those who harbor prejudice are far less likely to cut through the bullshit and see, SEE, clearly. All life is suffering, rather, all life has the ability to deceive us into forfeiting our freedom, our own reasoned choice. The only thing we truly have control over.

That’s the message I bring from the mountains.

It is good to be back and I know it can seem redundant but it is an honor to write these thoughts and know people are reading them. Thank you. Cheers, and again, Happy Dr. Martin Luther King, Jr. day.

Raul Santos, January 19th, 2020

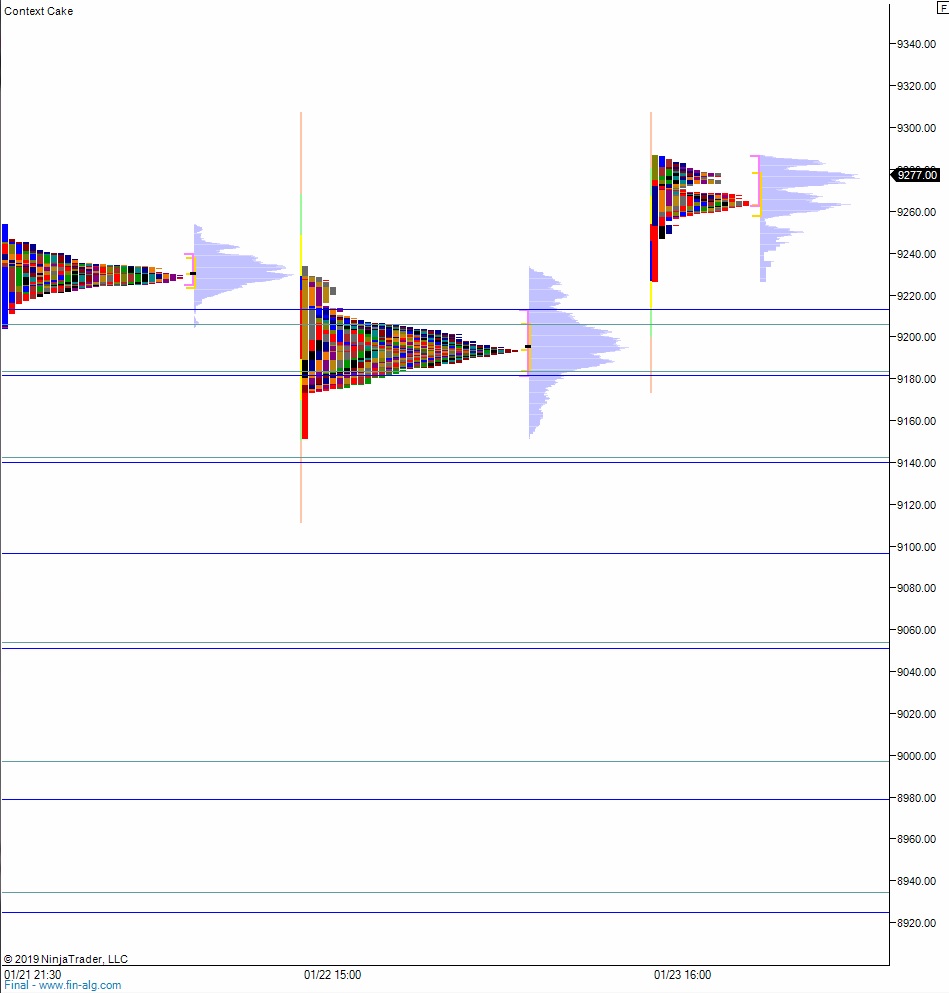

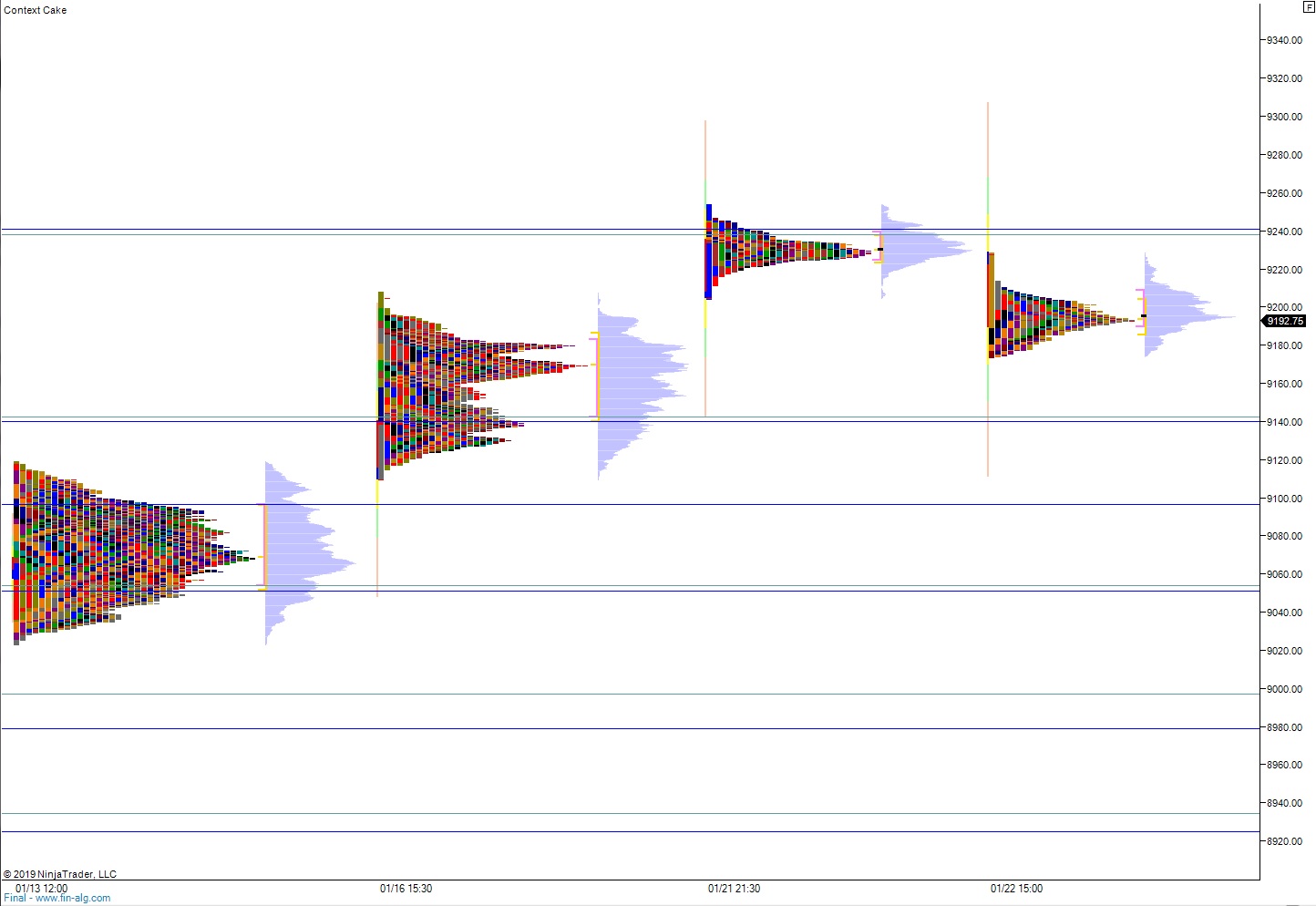

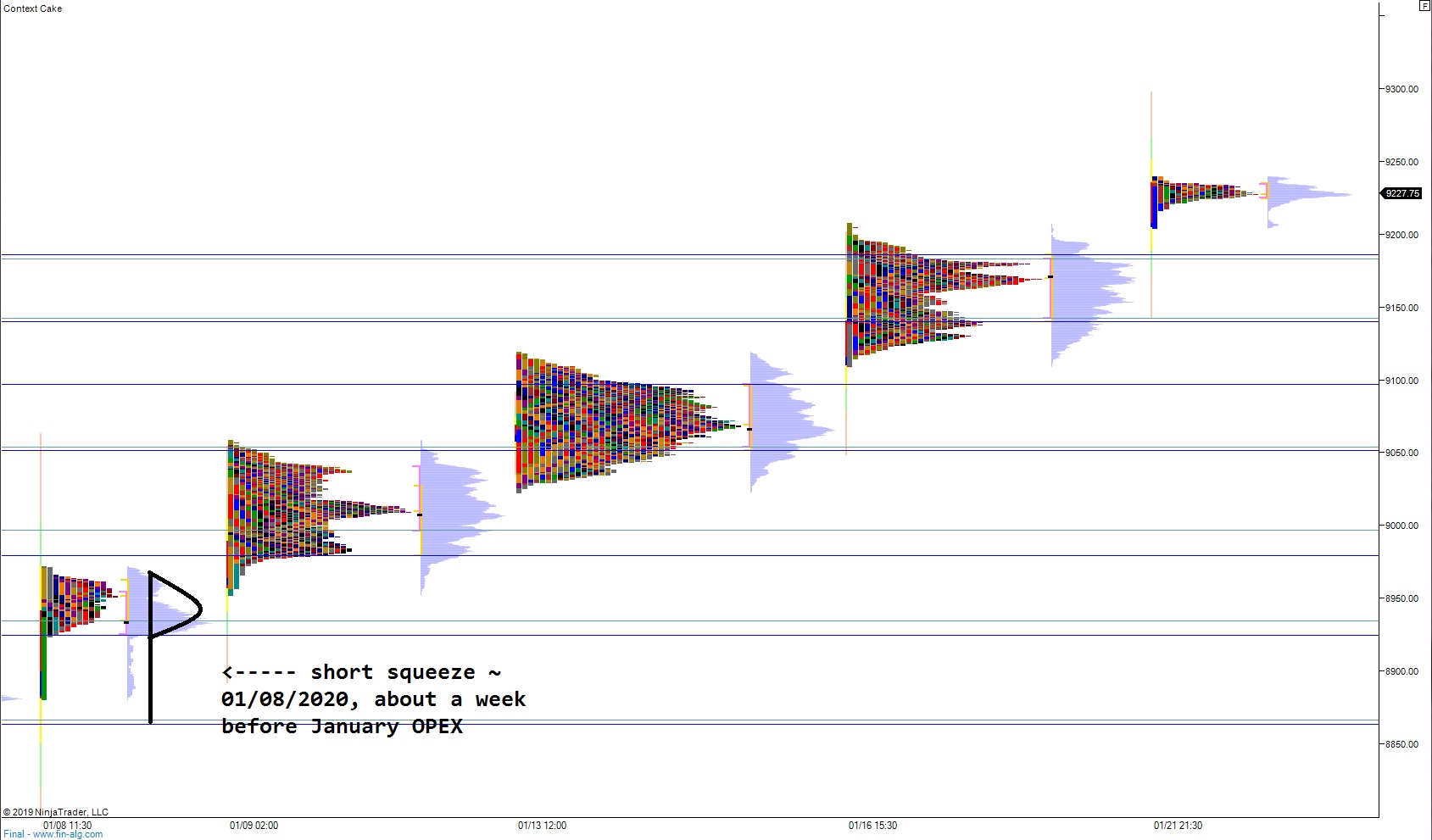

Exodus members, the 270th edition of Strategy Session is live. YOU HAVE TO be aware of what is happening on the NASDAQ transportation index. Check out Section IV, if nothing else.

Comments »