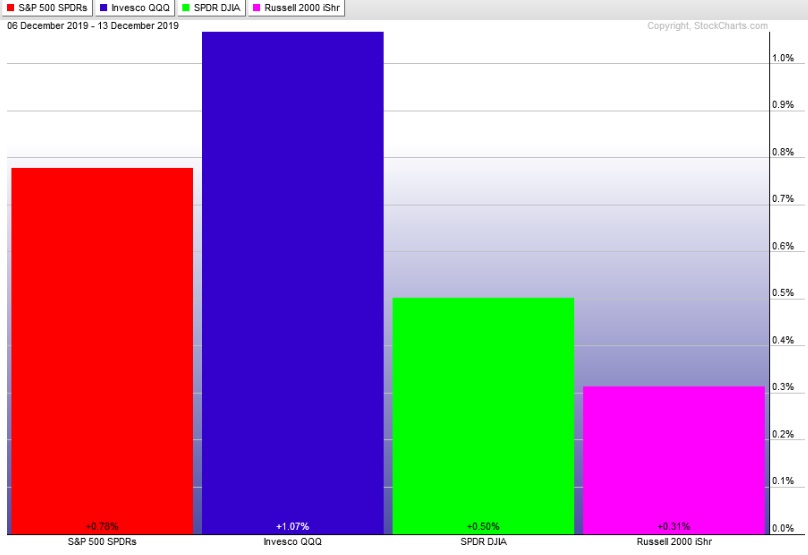

If you recall, dear and faithful reader of the Humble Raul blog (HRb), I was debating an escape to the highlands last Sunday based on the notion that silver and gold outperformed all other major asset classes two week’s back:

So when silver and gold outperform all other industry groups, like they did last week while most Americans celebrated pagan x-mas, it makes me want to pack up a few vital survival items (along with my snowboard of course) and head west—as far north and to as high an altitude as my constitution allows. To a remote outpost where I can eat canned fish, drink hooch, and observe the foolishness of the collective human conscience from a distance.

Three things have happened since then that have pulled me off the proverbial fence and into action.

The northern rocky mountains were blasted with a thick layer of fresh snow powder. Over 73 centimeters of snow fell last week (we discuss these matters in centimeters because we are not slaves to imperial rule), bringing the season total up near the 5.5 meter mark. That is over half the annual average and we are only in early January. Can you say climate change? There is more snow in the forecast.

President Donald Trump, who has been impeached mind you, ordered an airstrike in Iraq that we are being told successfully killed Qassem Soleimani, Iranian Major General in the Islamic Revolutionary Guard Corps. The impeached President was acting on the behalf of intelligence agencies employed by America. The whole thing stinks. Qassem, for his part, played the roll of a villain well. He wore black, is seen in several online photos sporting a sinister grimace, and has a resume that reads like an application to the Dr. Evil’s club of people who would execute Austin Powers via some elaborate and draconian means. The dominant voting base of America’s bible belt, populated heavily by calvinist Jesus freaks so isolated from reality they can be easily conditioned via around-the-clock cable news, are in awe of the President. Meanwhile the urban community and their organizers, decent folks if perhaps only a bit too emotional, condemn the action, or any action for that matter, but nonetheless are especially condemning this action. So bent up they’re busy planning their way to a rally alongside Hanoi Jane. These people want what I am sure we all want which is peace, of course. They want peace so badly they’ve nearly forgotten the President is impeached. Meanwhile, this dramatic moment is being yawned off by Wall Street, who is emboldened by the Fed’s overly-accommodative stance on the economy. The snakes of real estate finance are running advertisements in high gear, insisting every hard working middle class citizen refinance, using their home as a bank in an attempt to fill that void in their being with bourgeoisie possessions.

Third and perhaps most important—these twitter fucking people I swear to god they become more insufferable every year. OH, DID YOU MAKE BANK IN 2019 “TRADING STOCKS” AND SUCH? Congratulations, so did everyone with a smart phone who wasn’t dumb enough to A. bet against the greatest secular bull run of our lifetime or B. be tricked into gambling on short-expiration paper via a series of aggressive directional option bets. So much self-righteous trash is spewed onto my dear Twitter. Perhaps I am no better.

However, I man this humble post with the utmost seriousness. I blog as a means of clarifying my own thoughts. Of keeping a record of what my head-space was in any given moment, and what ensued during that time. Written human language is one of the most powerful psychotechnologies ever created by homosapiens. Its effect on our development as a species can be traced back to our transition out of the upper paleolithic period and into a time when humans were able to use coins as a way of cooperating in larger abstract societies.

The fact that most of these fintwitter fuckwads use the written word to sell bullshit, self aggrandize and outwardly project other disturbingly-salacious obsessions with money is unfortunately beyond my control. What I can control is how I choose to react to these matters and also how I choose to conduct myself in this space.

The stated mission of the Raul blog is to extract as many fiat american dollars as possible from the global financial complex. Said fiat dollars will then be converted into even longer term assets. Real assets like land as far north and at as high an altitude as my constitution allows. Said land will then be developed using brawn and steel and cement to build a self-sufficient facility with greenhouses and machines and large cisterns. Air filtration, solar and hydro electric, the whole nine yards.

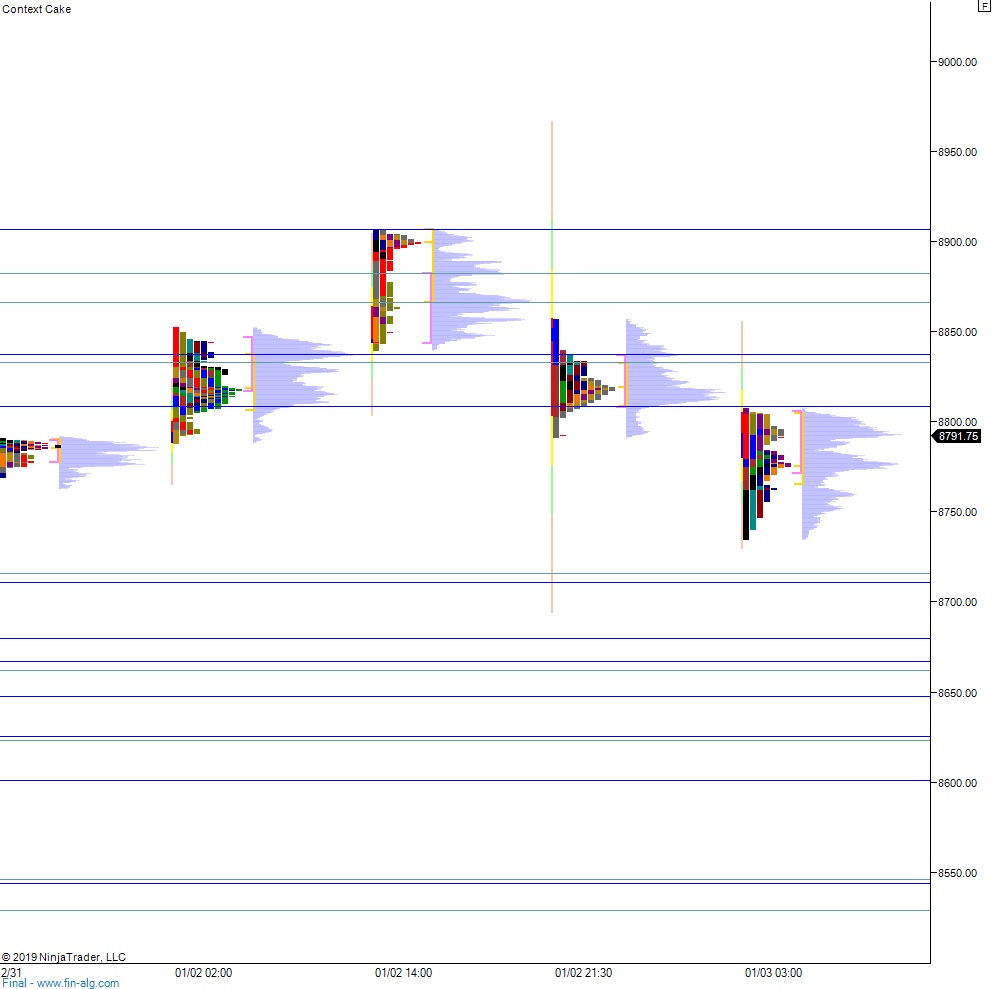

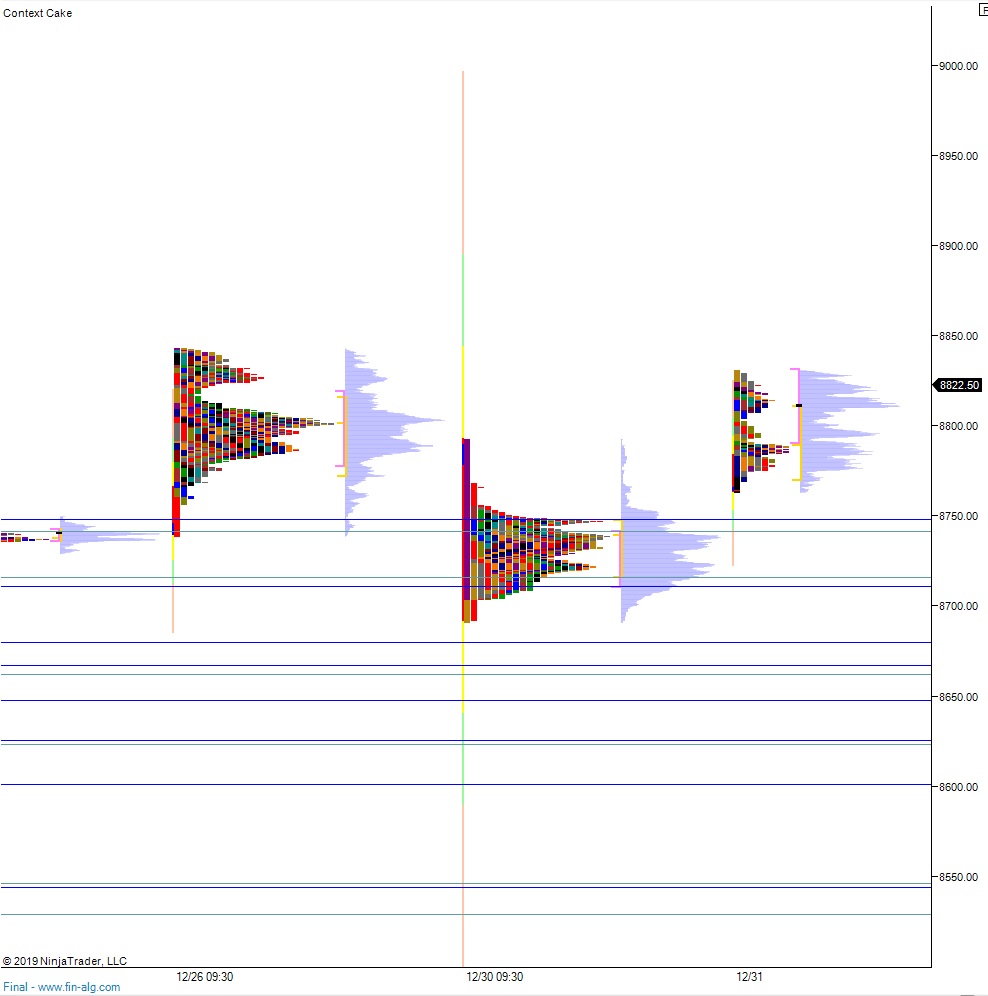

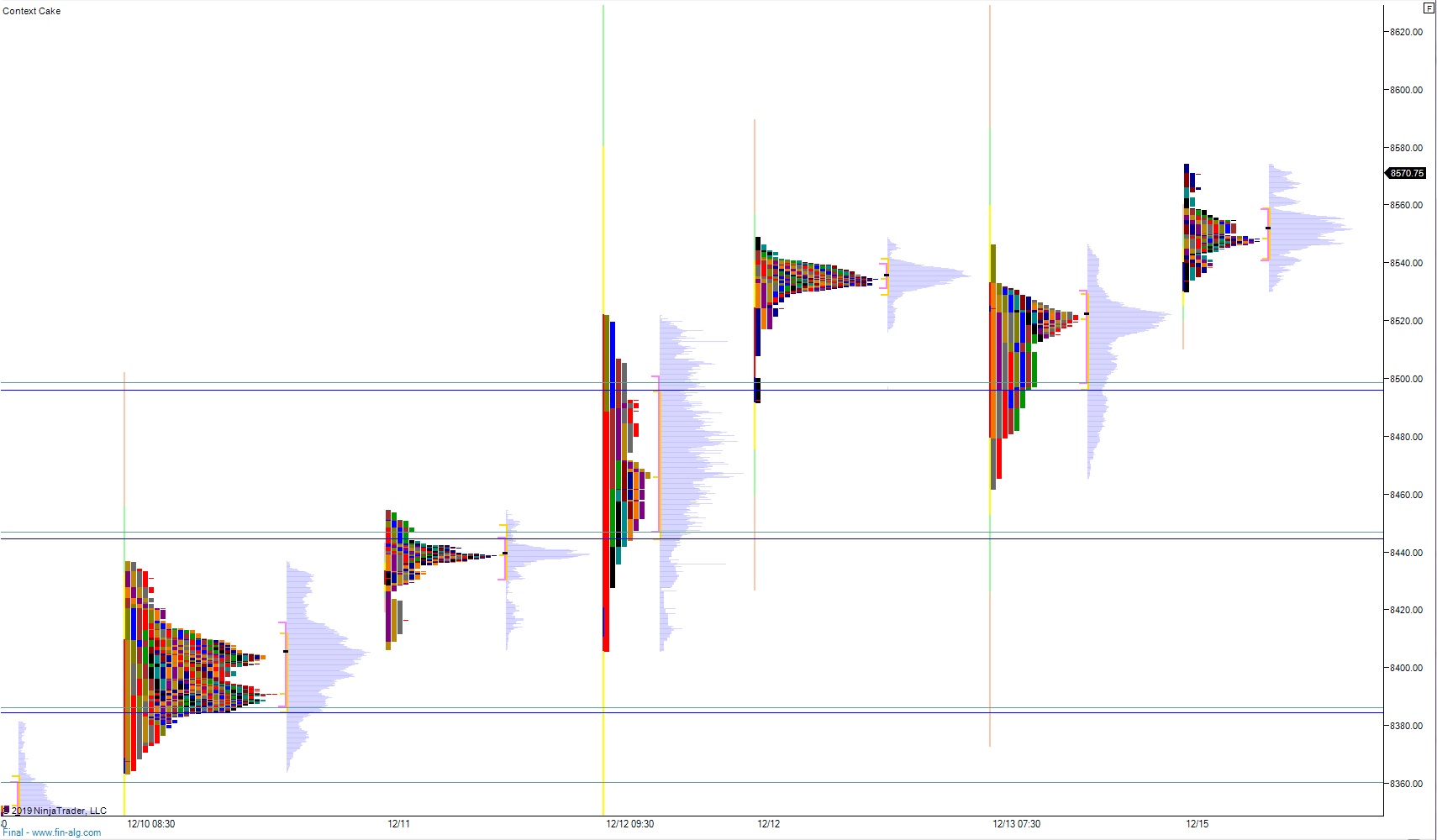

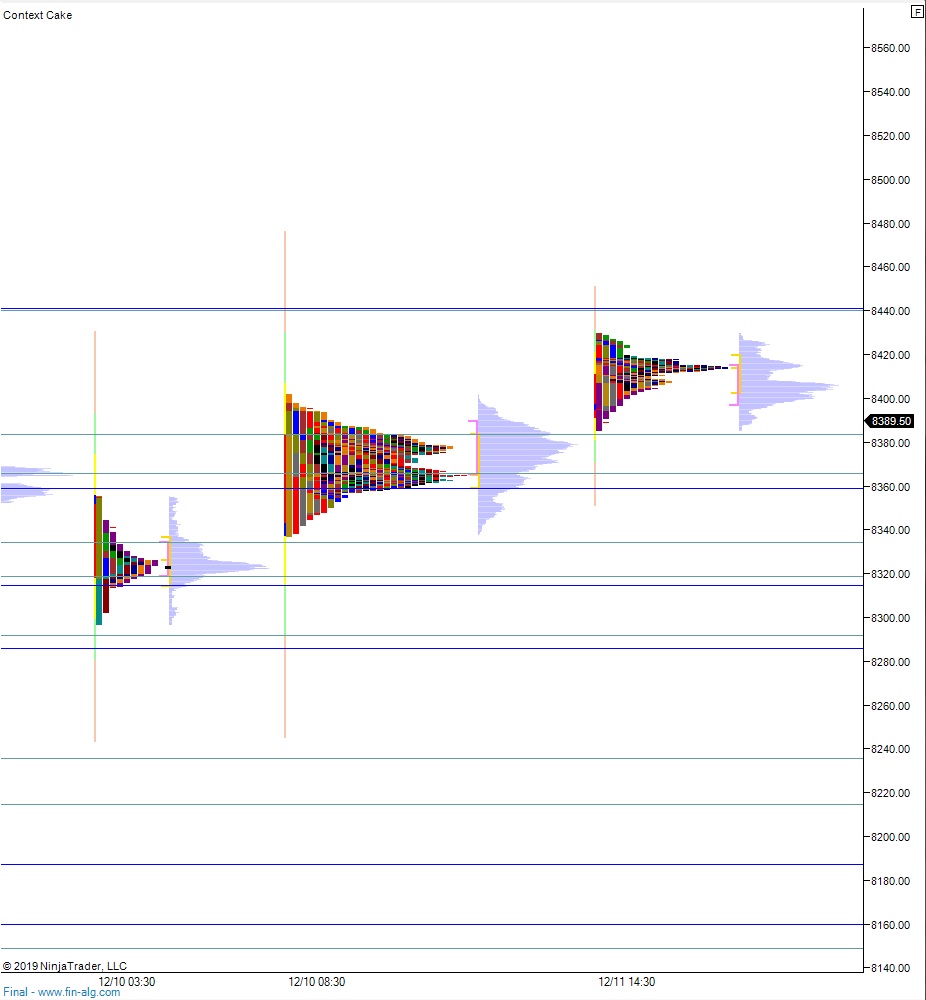

I am not here to sell you on anything. I am here to demonstrate, day-after-day, week-after-week, how I go about preparing myself to compete in one of the most highly-competitive arenas in the world, NASDAQ 100 futures. Doing so as kindly as possible, empathetic to any eager new learners who stumble onto my content and immensely grateful for advanced operators who toss me the occasional wisdom bone.

My goodness have I gone on a rant and digression. This is what I am talking about and why I need to pack up and head for the hills. I prepared the Exodus Strategy session today. Saturday instead of Sunday because come sunset I will begin to travel through the night, like a gypsy. I will head as far north and to as high an altitude as my constitution allows. Once I have jettisoned my rig up somewhere into the Canadian Rocky Mountains, I will establish camp by festooning my belonging across these majestic and foreign lands. If the gods see fit, I will be granted the clarity I seek, allowing me the headspace to formulate my next move.

Best case scenario I hike and snowboard around for a while, capturing a few moments of natural splendor more life changing than any clergyman’s sermon. I sit around eating canned fish and drinking hooch, jotting a few notes into my journal.

Worst case, the Iranians retaliate, World War III ensues while my person is safely inhabiting some remote outpost up beyond the logging roads of Canada—one of the world’s last remaining frontiers.

One last thing. I put a hedge on Friday morning via SQQQ. It may have been a fool’s errand, but I shall not make myself into a coxcomb dandy, flitting around the northern territories while my stock market gains are anchored by some stupid hedge. I have left clear instructions with my China correspondent, the venerable ROBERTO BREGANTE, to close my position if the markets are higher or flat Monday. The only instance he is permitted to ping the expensive (per minute, like the 80’s) satellite phone is if markets are LOWER. In the even of lower markets ROBERTO BREGANTE has been advised to contact me and provide me quotes.

Raul Santos, January 4th, 2020

Exodus members, the 268th edition of Strategy Session is live, go check it out! I may not return in time to produce the 269th edition. If that happens, I will do my best to update the model when I do return. Cheers.

Comments »