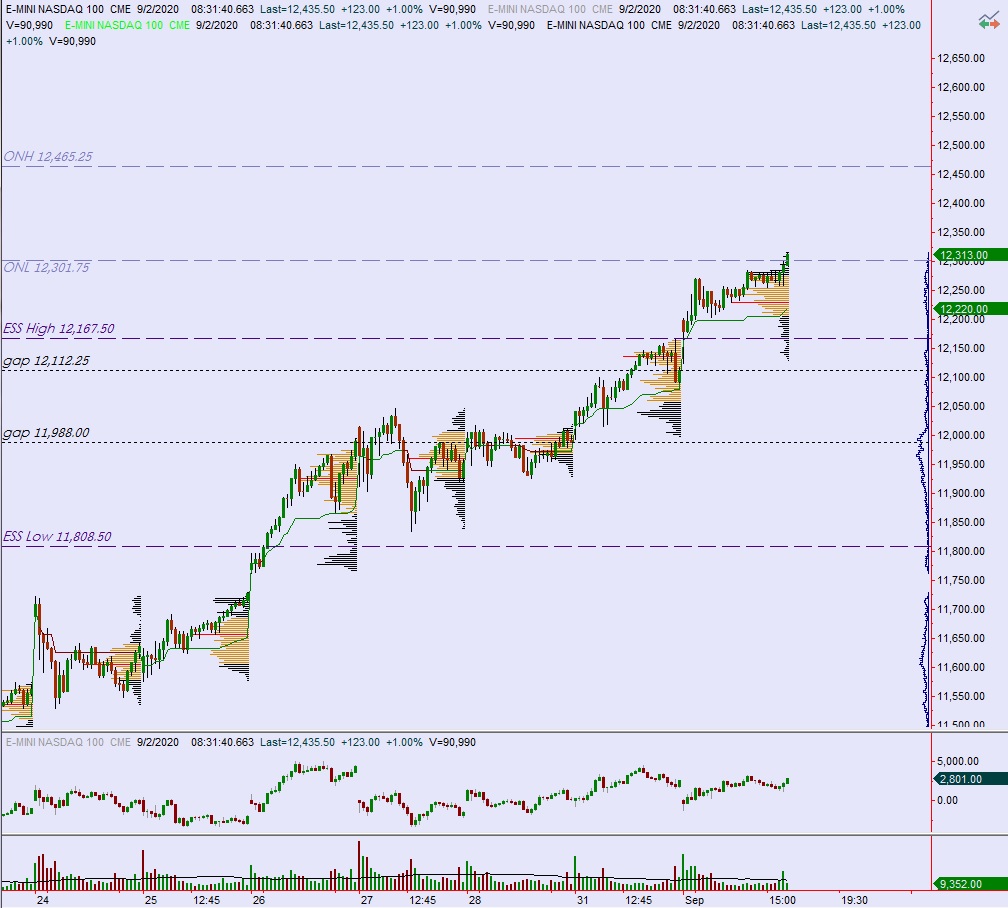

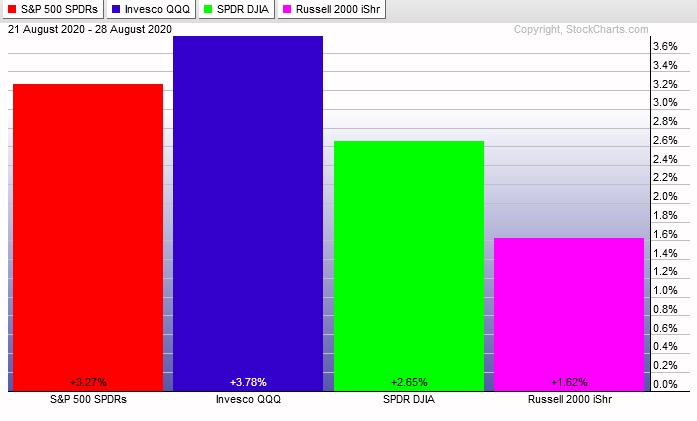

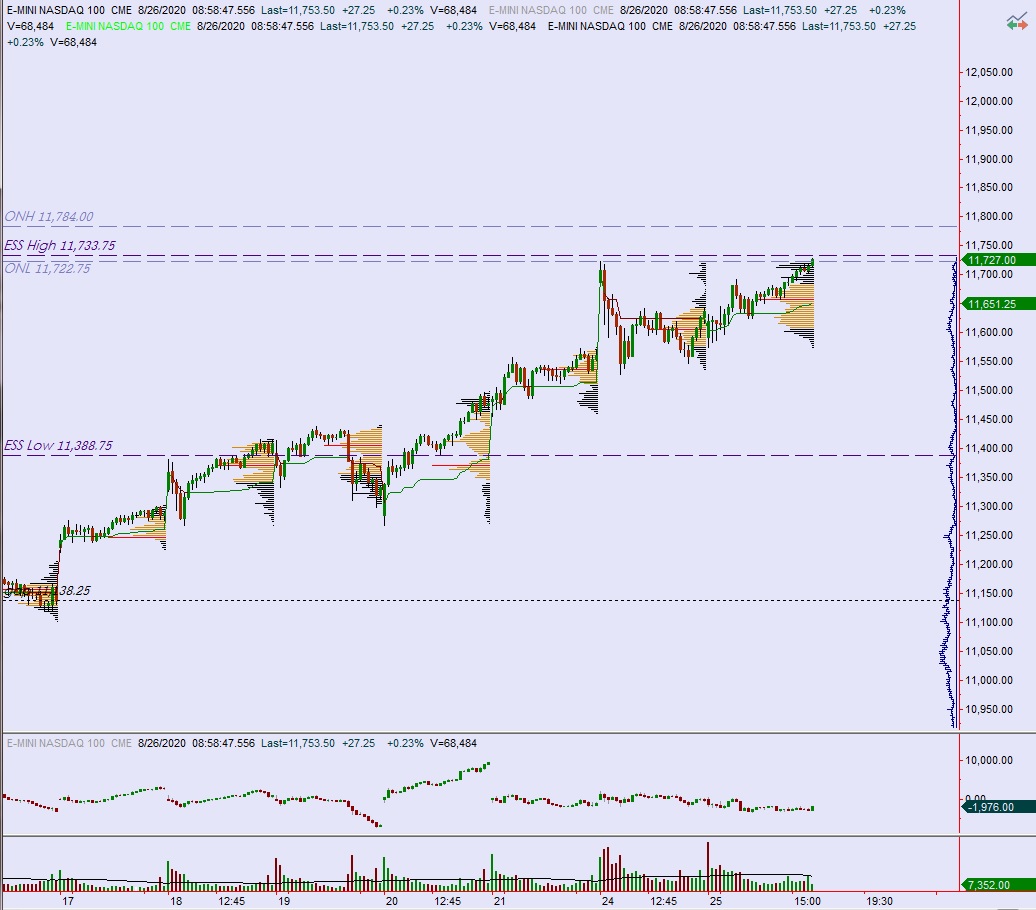

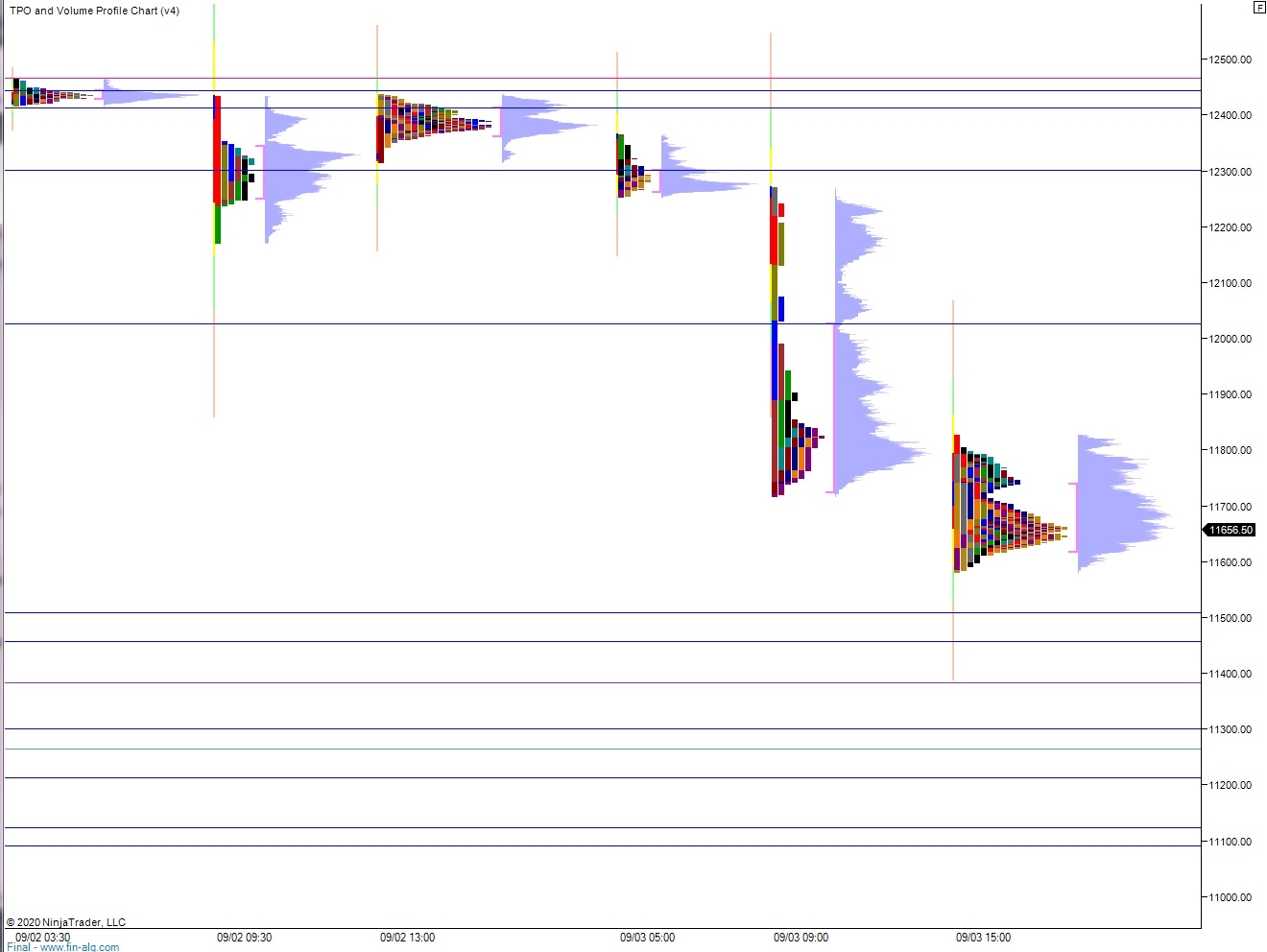

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price was choppy overnight, first working to erase the Thursday afternoon ramp then continuing a bit lower. From then on it was a chop, chopping along the lower quadrant of Thursday’s range. At 8:30am Nonfarm payroll data came out stronger than expected. As we approach cash open, price is hovering along the Thursday low.

There are no other important economic events today.

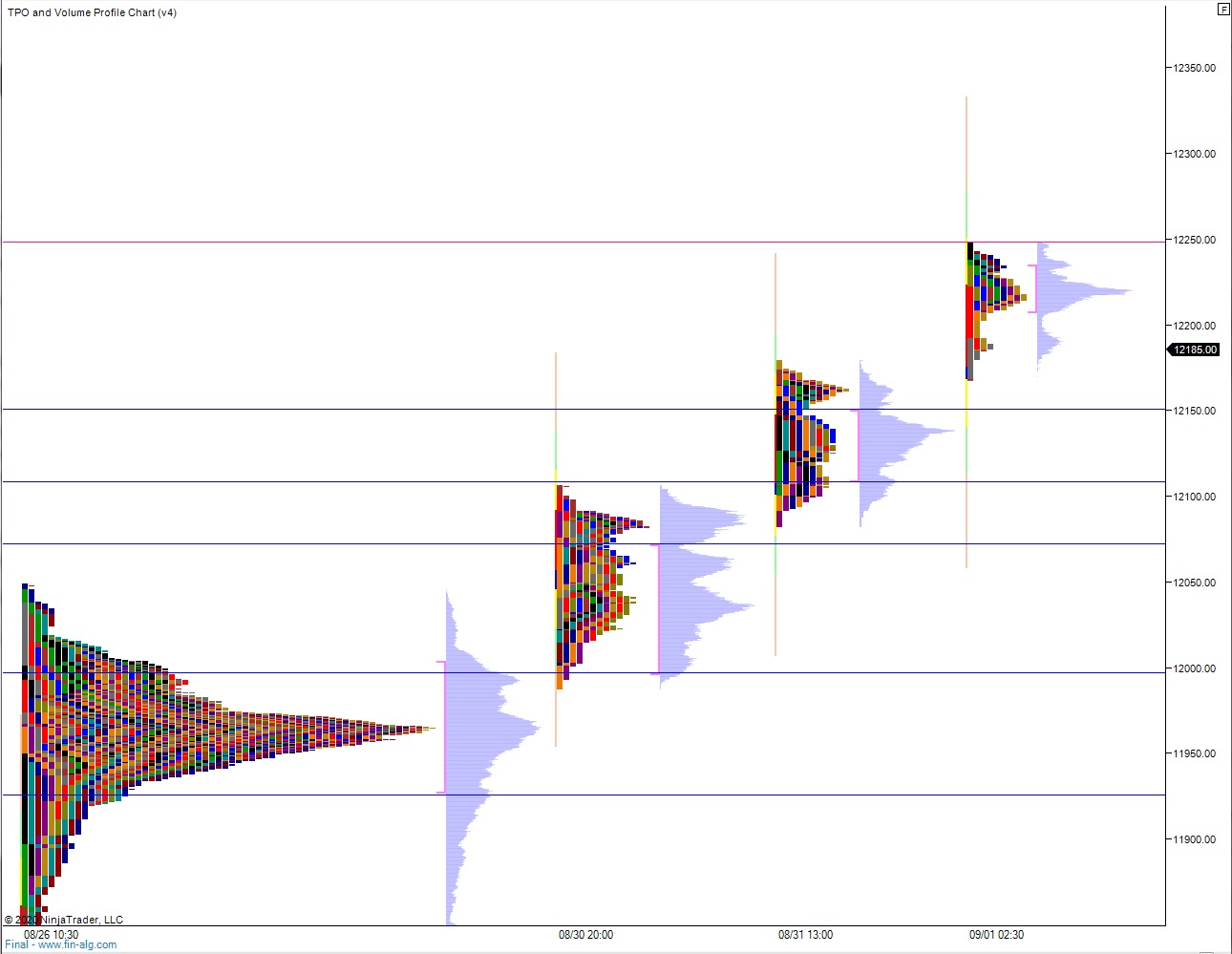

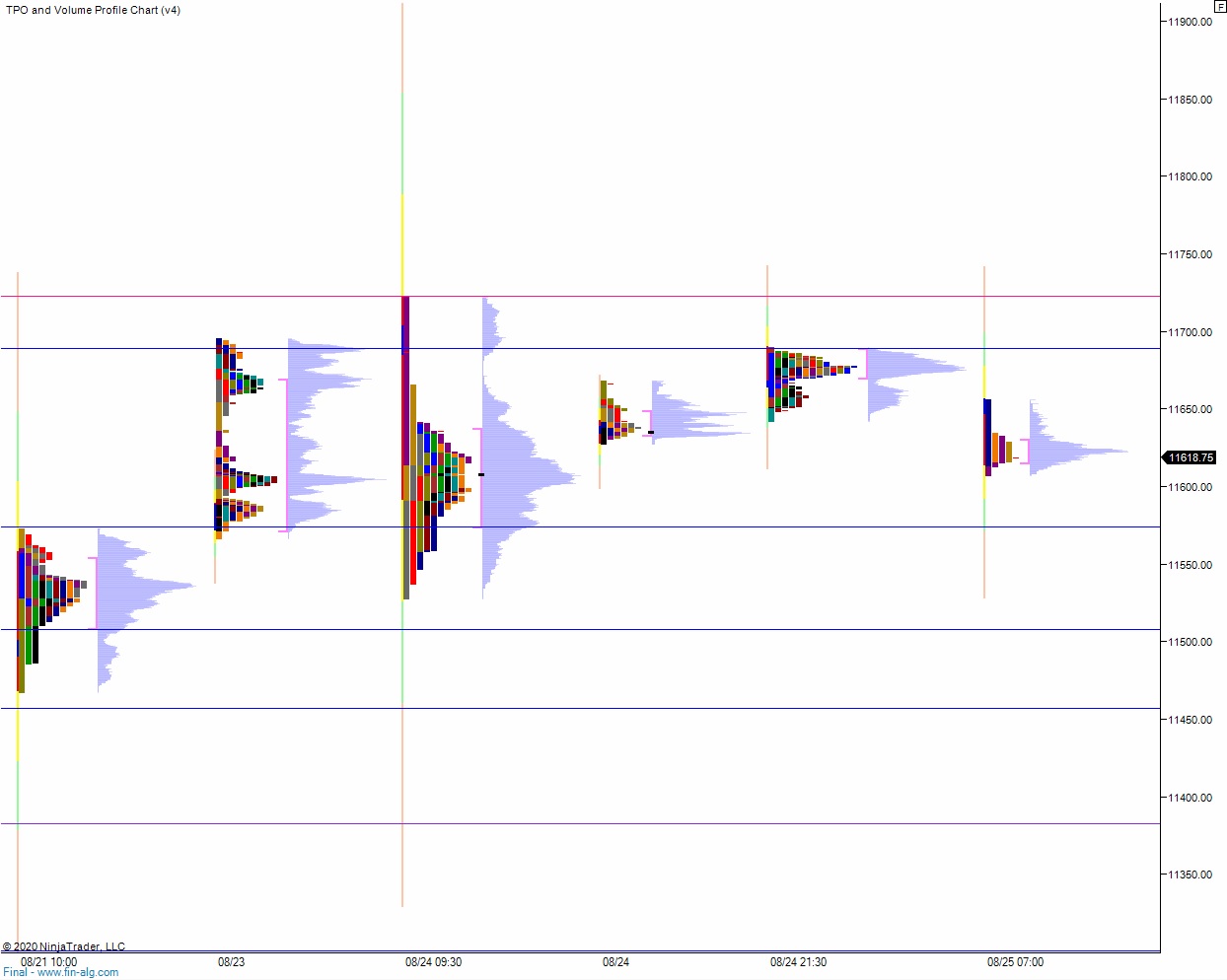

Yesterday we printed a trend down. The day began with a gap down near the Wednesday low but still in range. After an open two-way auction sellers began to rotate price lower, taking out the Thursday low in a choppy battle with buyers before accelerating the selling down through the open gap left behind on 08/31 (month end)., Sellers drove lower until about 11:30am when some responsive buyers were found ahead of the 08/26 gap. After an hour long battle, sellers resumed their campaign, stalling out just above the 08/26 naked vpoc. There was a slight ramp near the end of the day.

Heading into today my primary expectation is for sellers to gap-and-go lower, tagging 11,500 before two way trade ensues.

Hypo 2 stronger sellers tag 11,383 before two way trade ensues.

Hypo 3 is for buyers to work into the overnight inventory and close the gap up to 11,797.50. Look for sellers up at 11,808.50 and two way trade to ensue.

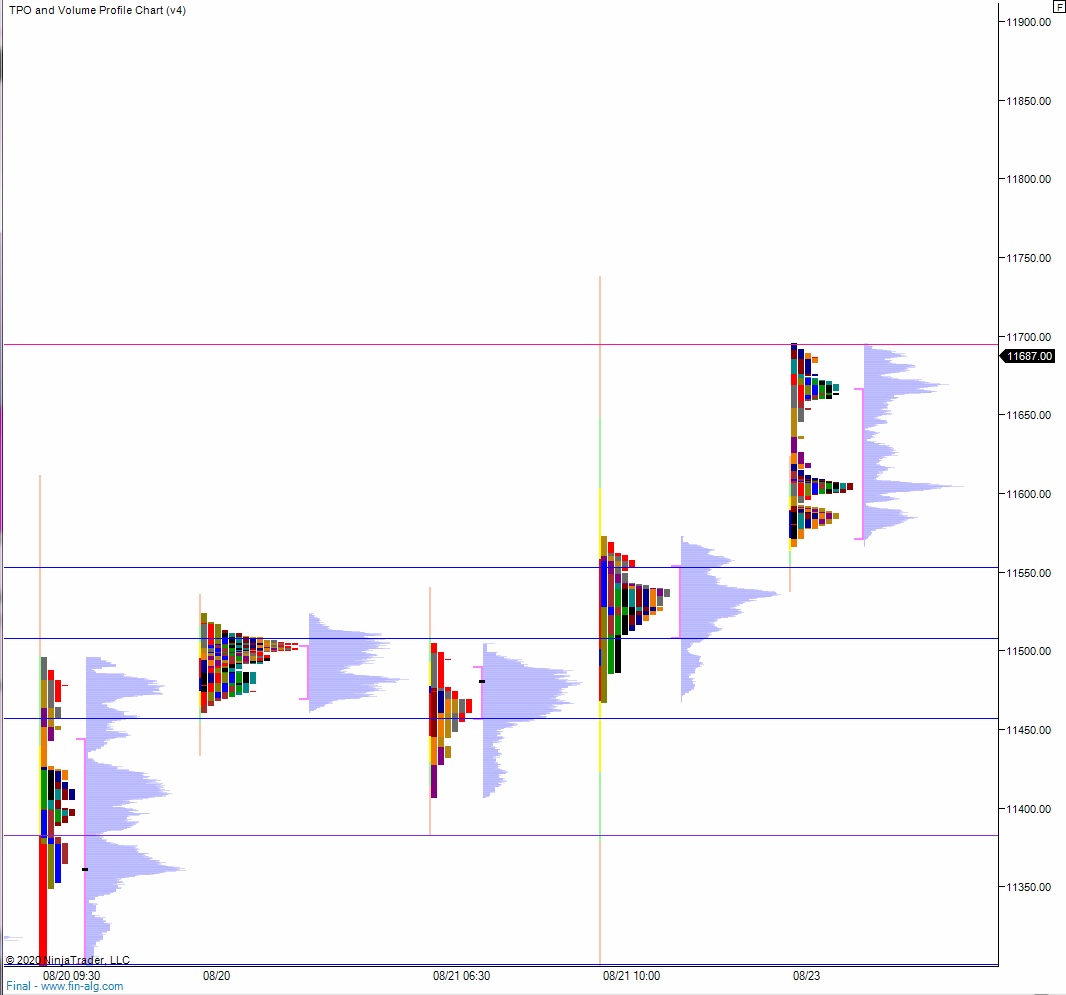

Levels:

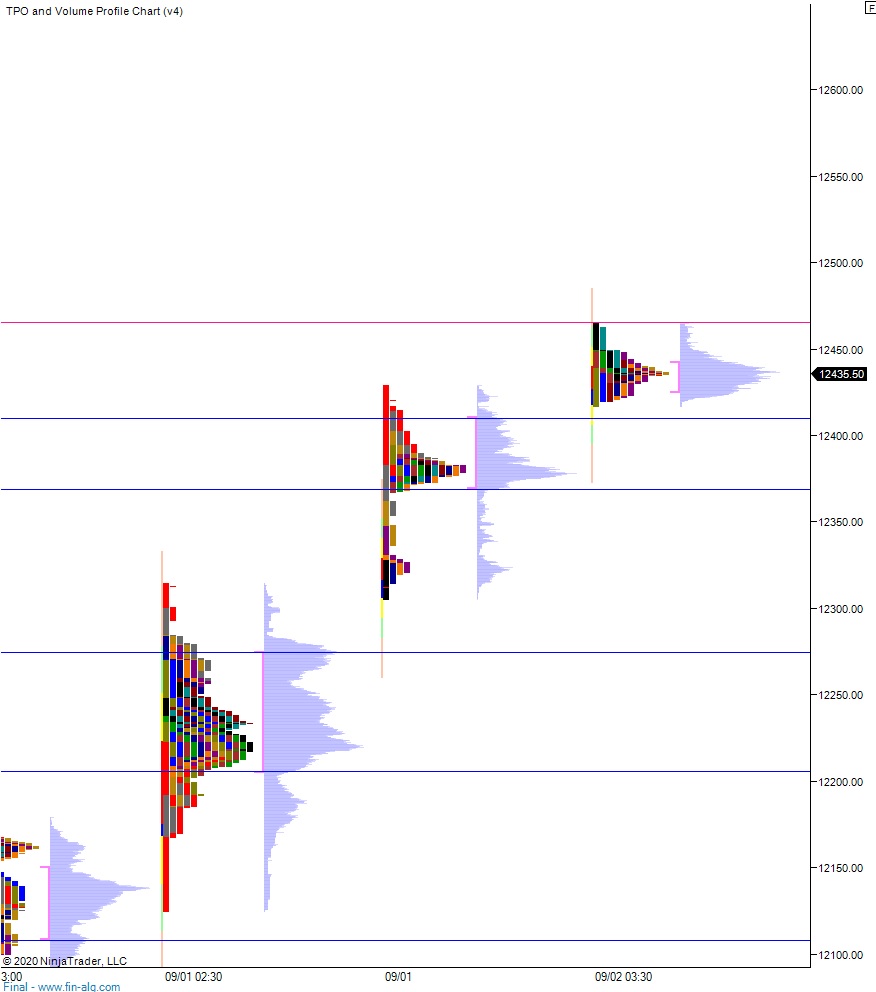

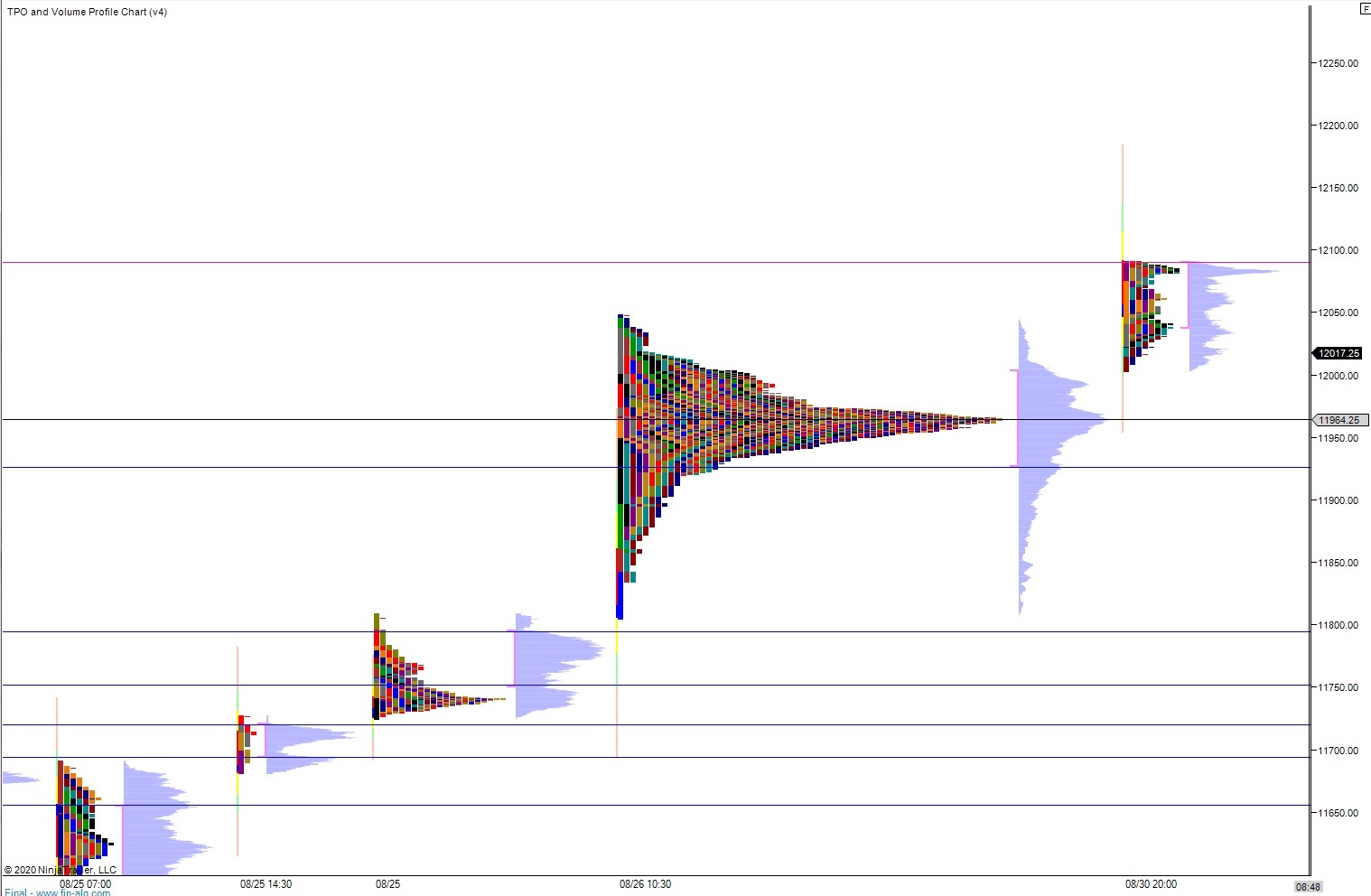

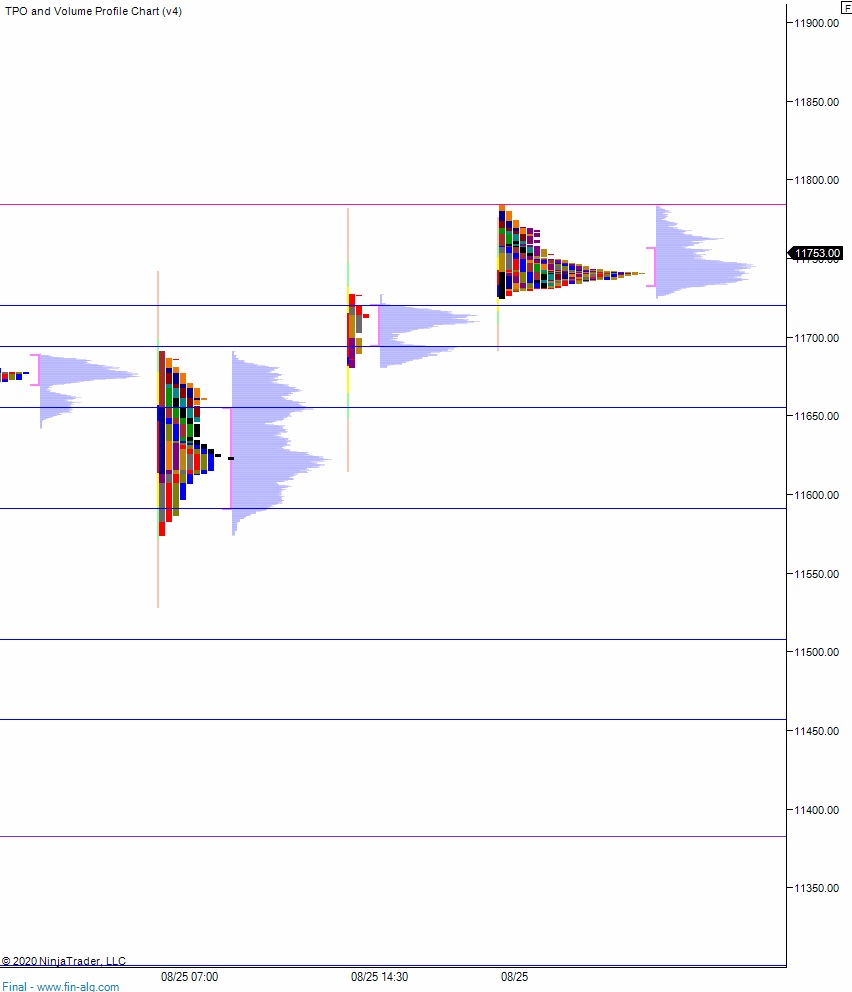

Volume profiles, gaps and measured moves: