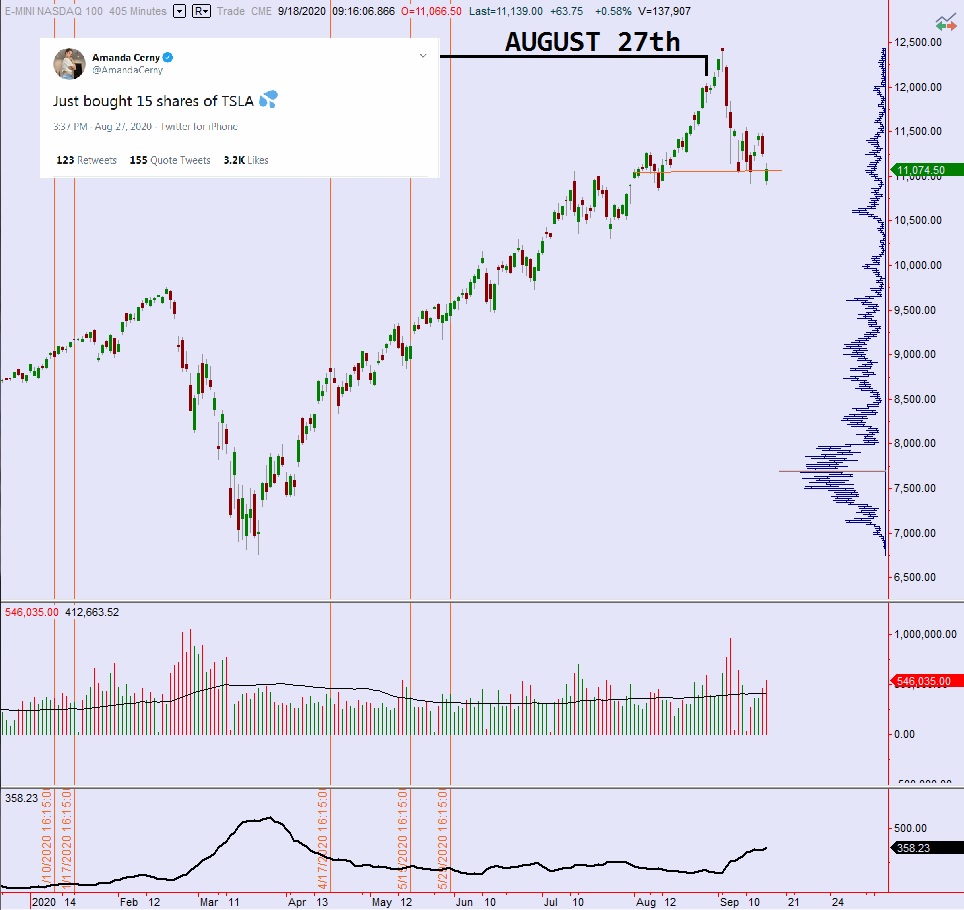

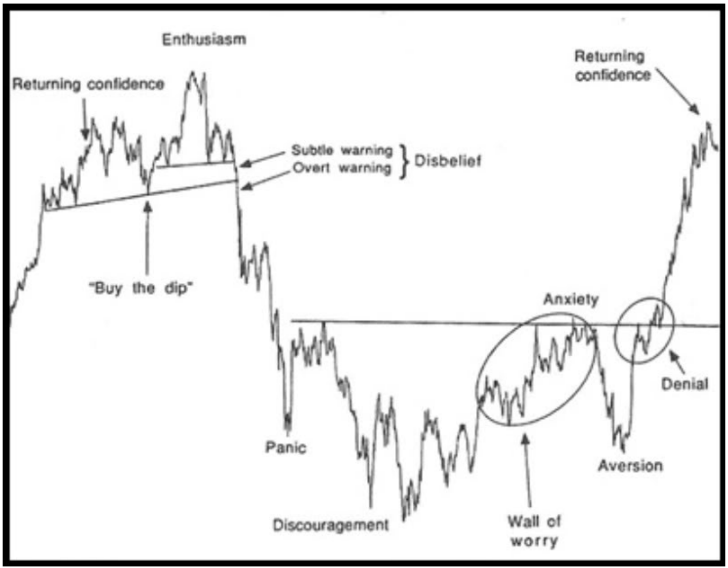

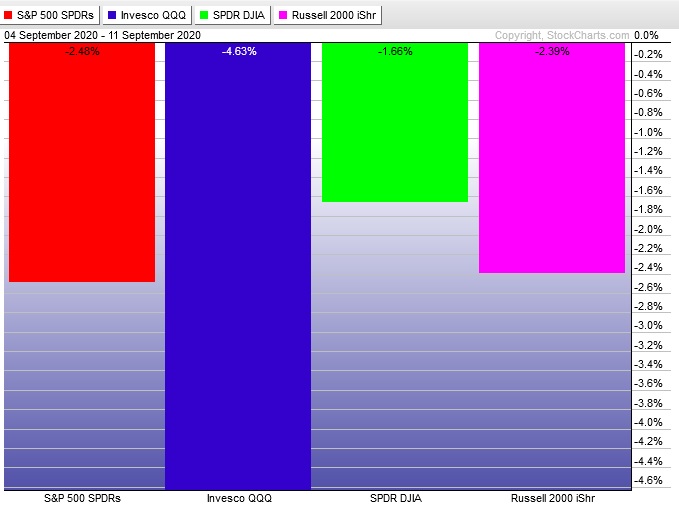

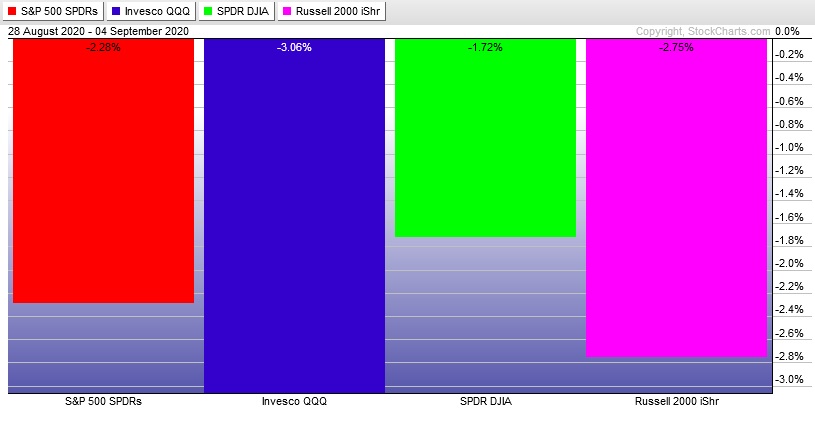

If the top is in, we’re still pretty early in the process. To sit here and type an entry saying the top is in would be irresponsible. We don’t know if a top is in. We’ve made several observations that match-up with the type of sentiment we look for near tops. There are some major upcoming events geopolitical and otherwise that at some point will force the invisible hand to slap markets around in a fit of reprice. How and when the hand strikes, we don’t know. Winter is coming but not before spooky season. The possibility of putting a good scare into everyone is present. But without a solid data set there is no way to put a probability to it, and I’d rather go sit in the woods and eat with sticks then put the fear in any of yous.

I’ve been positioning for a correction. I panicked first—some time near the end of August I raised a decent chunk of cash since then resisted the temptation to redeploy it.

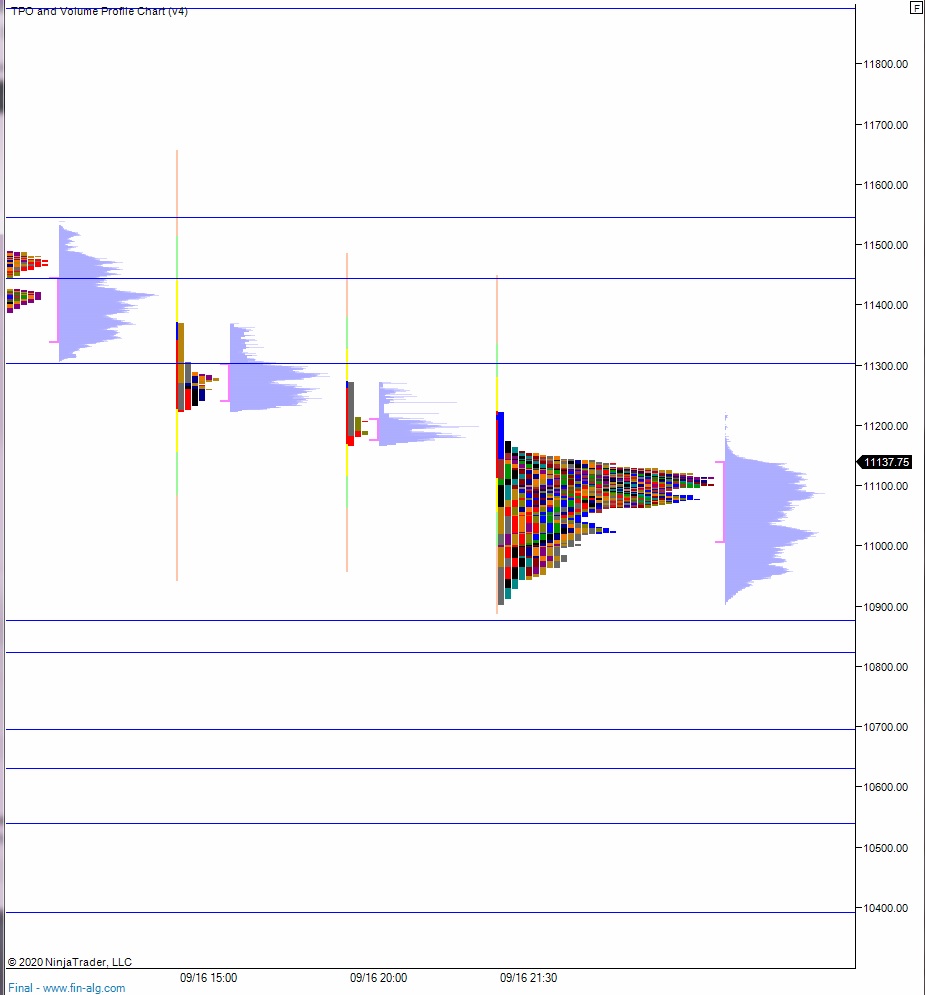

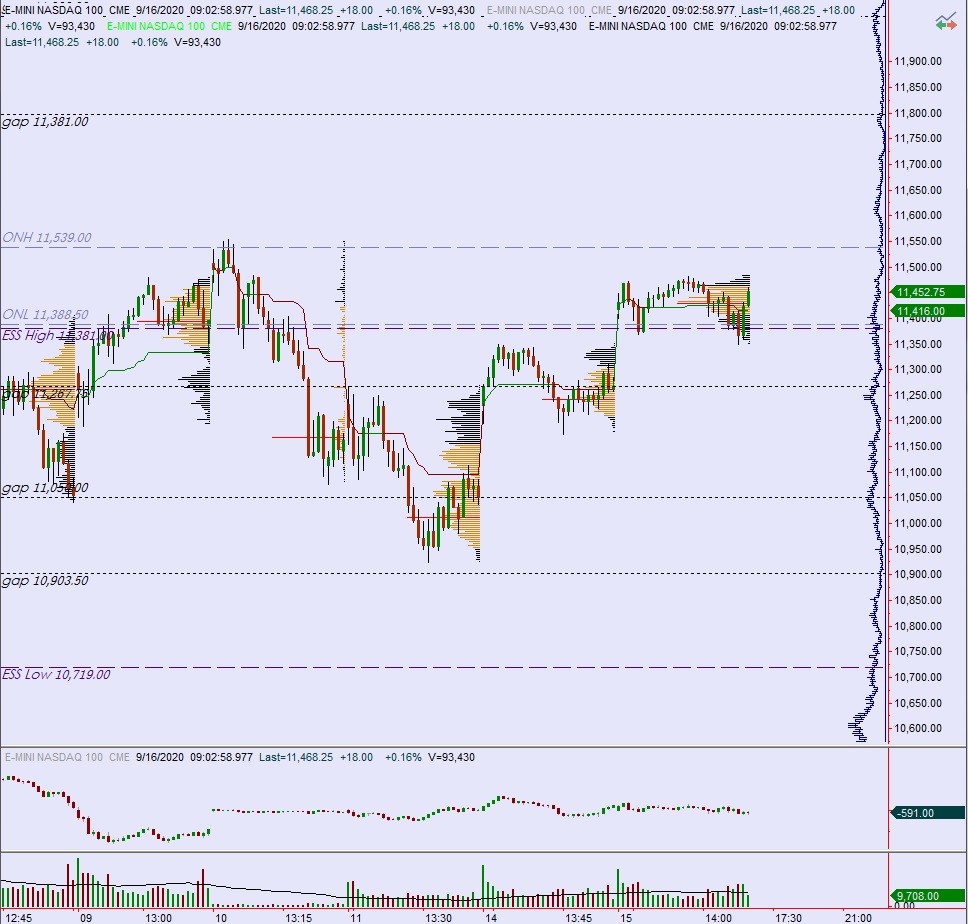

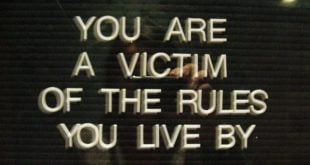

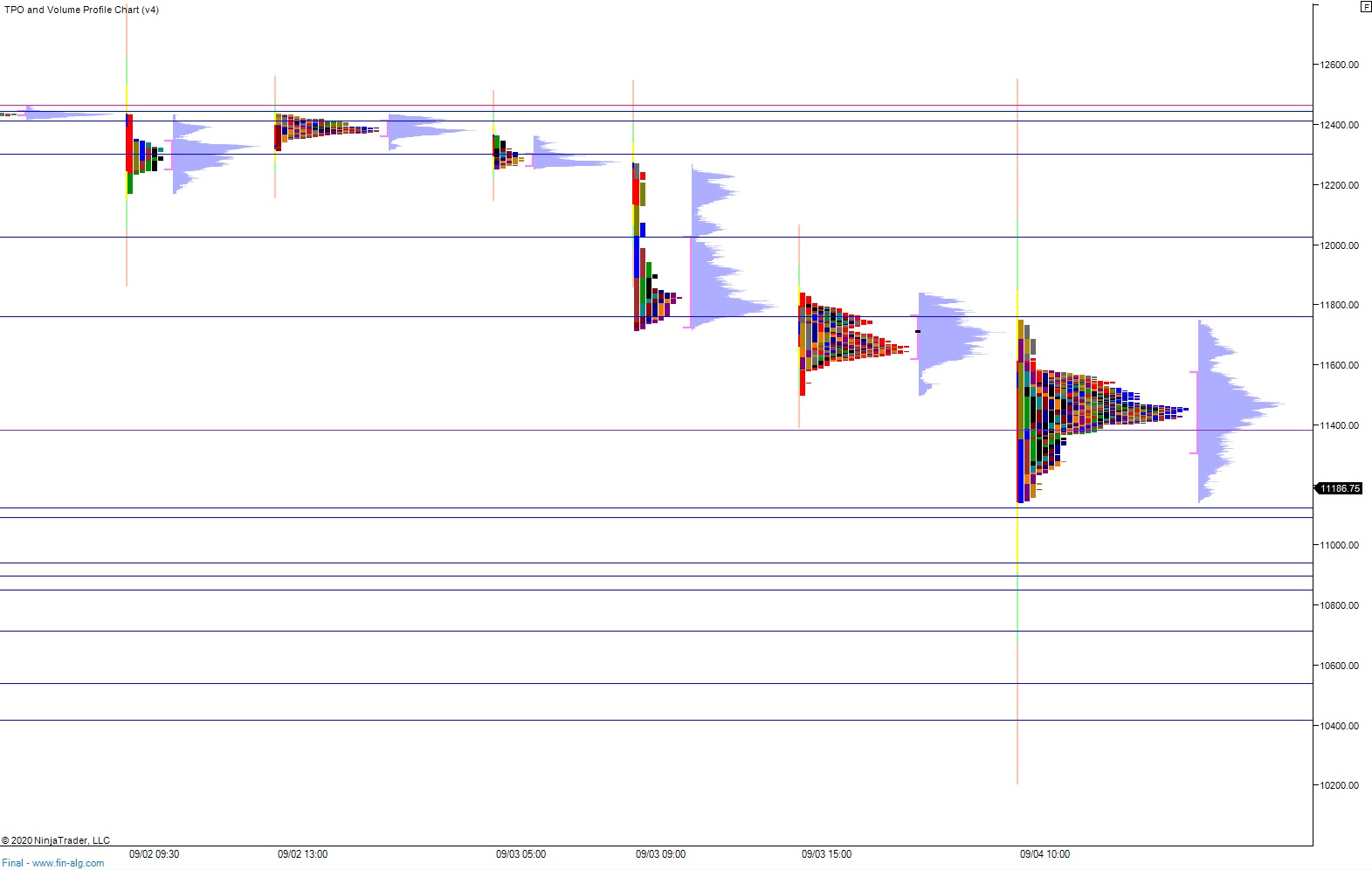

Then I put a big SQQQ position on Thursday morning. Decent entry. Not great, but certainly not as reactive and impulsive as some of the other entries I saw folks calling out:

I just loaded up an SQQQ hedge. If we rally into the close I will cut the position. But if we close week—i shall press.

— RAUL (@IndexModel) September 17, 2020

So I am cashed up and hedged. Money has met mouth and together they are synchronized in expecting some kind of a correction. Either the market will prove me wrong, moving higher, forcing me to cover the hedge at a loss then chase prices higher. Or I think and fast and wait…until a good scare sets in so I can cover the hedge and begin to pepper some buy orders in.

I won’t be gung ho to buy the next dip. Not into the election. Too much uncertainty. I’d rather have funds earmarked for my latest project—a sweat lodge. They took away my precious hot yoga. I haven’t had it since the very beginning of March. This was fine during the initial COVID freakout. I was busy gathering supplies and whatnot. Then summer came and the warmth was ever present. But now winter is coming. A long one, by any measure. I am going to need a hot and dark and quiet place to sit and think.

You want to know my secret? Thinking. Fasting. Waiting. These are skills 99% of the competition lack. Master these and you’re well on your way to competency in investing and trading.

Winters are harsh in the murder mitten. They can twist the psyche and render the mind vulnerable to self deception. Ask me how I know.

The sweat lodge must be built and there must be some damn urgency behind the project. Winter is coming.

So I will not be buying heavily into the next dip. I will pepper in some buy orders. I expect the next dip is coming soon.

I could be wrong.

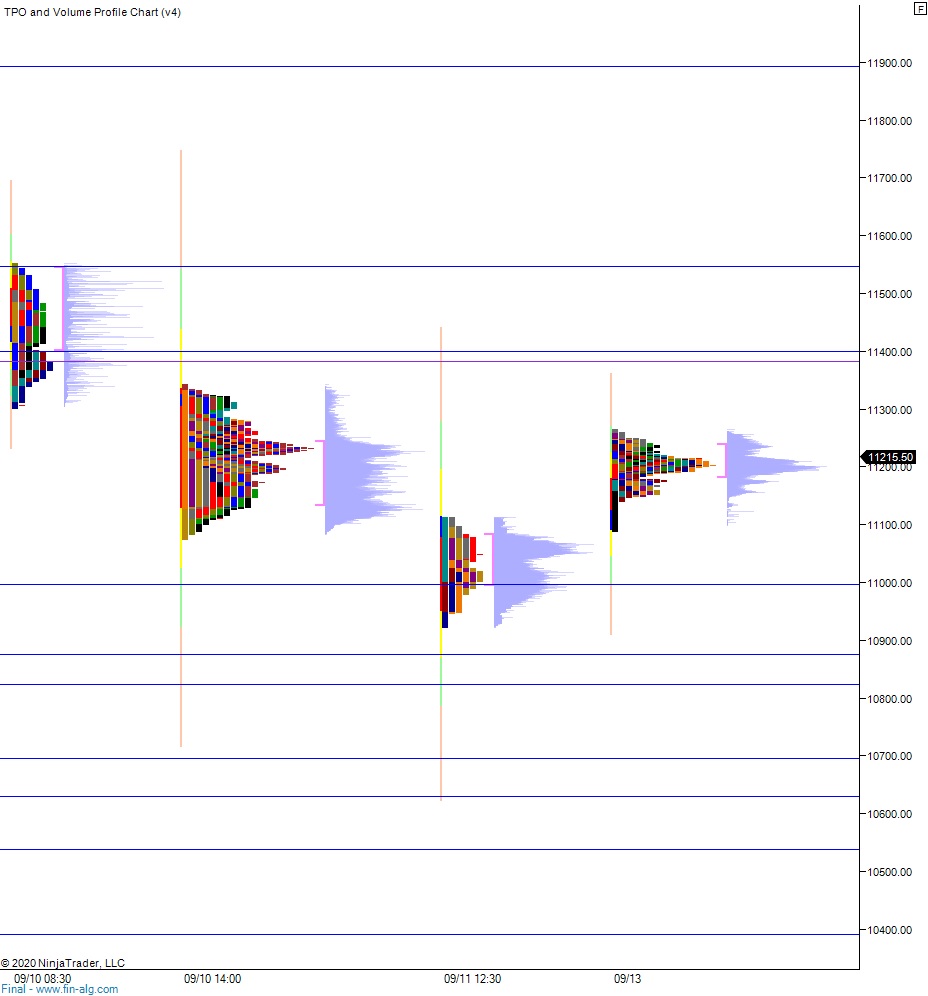

Models are neutral. There are whispers from the model and algorithims that a big down move is coming, but as of yet there is nothing probable. If selling accelerates this week. I will buy more SQQQ. Otherwise, assume your humble boy Raul is simply thinking, fasting and waiting.

Raul Santos, September 20th 2020

Exodus members, the 304th edition of Exodus Strategy Session is live. Go check it out.

Comments »