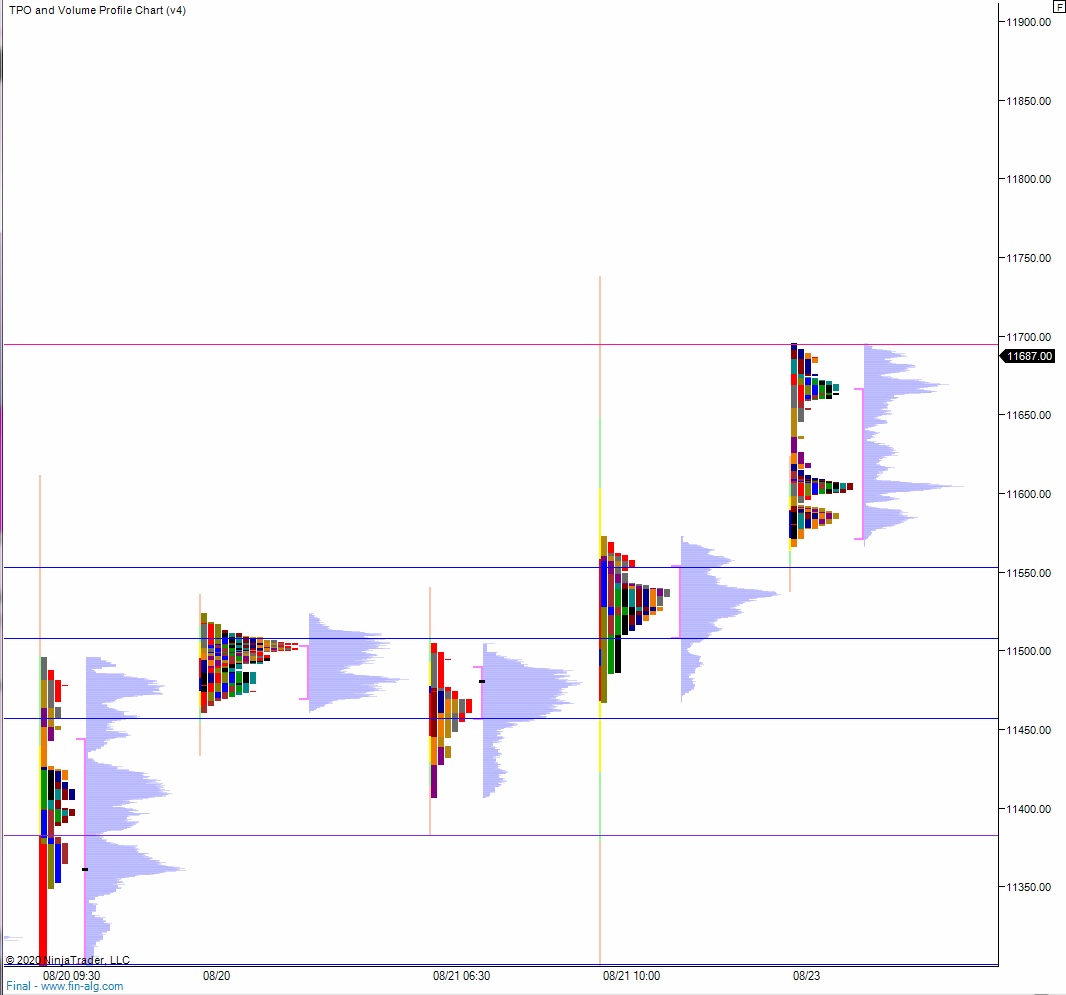

NASDAQ futures are coming into the final week of August pro gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, steadily campaigning higher for the entire globex session. As we approach cash open, price is hovering near 11,700.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

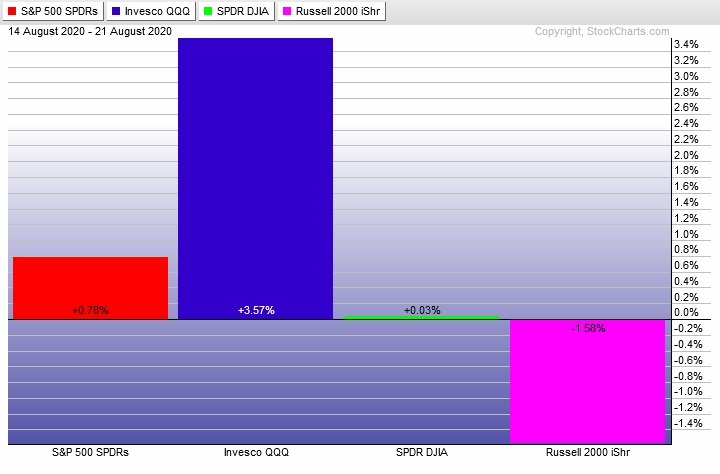

Last week the NASDAQ was strong, the Russell was divergent weak and the other two indices traded sideways. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a slight gap down and after a brief open two-way auction buyers stepped in and drove price to a new all time high. A check back to the midpoint was defended by buyers and we ended the day trading near the highs.

Heading into today my primary expectation is for sellers to work into the overnight inventory and work down to 11,650 before two way trade ensues.

Hypo 2 buyers go higher and tag 11,733.75 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 11,733.75 setting up a run to 11,800.

Levels:

Volume profiles, gaps and measured moves: