Monday evening when I finally stopped working well after 8pm, I did what any normal person would. I ate a modest dinner. I popped open a can of home grown heirloom tomato sauce and boiled water for my stringed noodles. After such a red day, it only made sense to eat a red meal. A friend stopped over and as we exchanged pleasantries my mind was clearly elsewhere because I wanted to review my trades.

Friend often expresses interest in the markets, although he lacks the capital to participate. I had to show him the big seller, the whale I discussed Sunday night. We went into the office and I started explaining all my charts, he had seen them before. After a quick refresher on what each chart is displaying I began discussing “the seller”.

“I’m going to need two charts to explain this to you. Actually three. You know what, I actually need four.” I said.

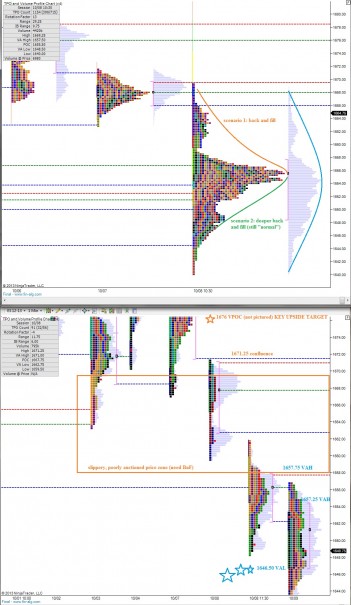

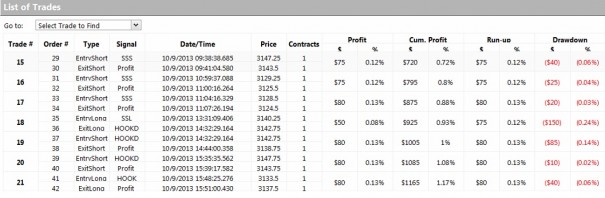

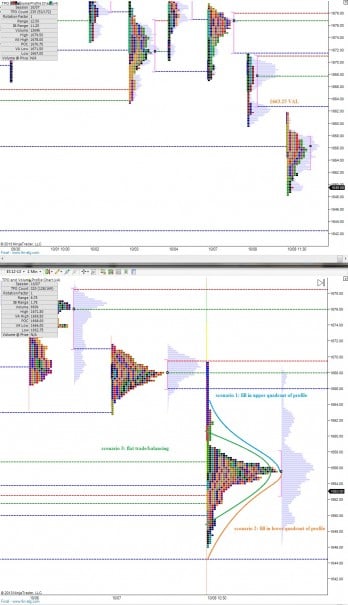

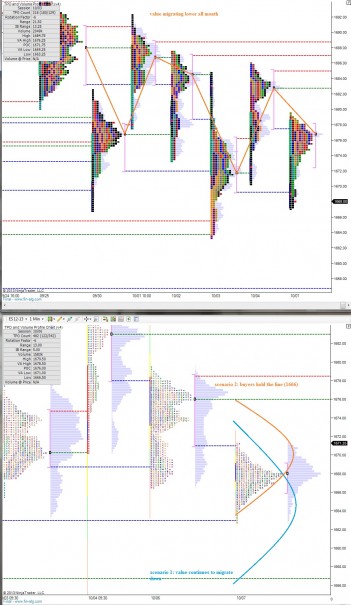

I had to laugh at this point because it already seemed overwhelming. But I had to start with a weekly bar chart to explain how far we had come, then a daily bar chart to show where we were trading, then a market profile chart to describe Da Vinci’s brush, and finally an intraday bar chart with a delta sub chart to show the seller’s footprint.

Before I realized it, I had talked for over 40 minutes without much two way conversation. I felt insane after, like a manic scientist or something. He understood and it was kind of a rush to review everything.

Long story short, I said, “But most importantly we have to ask, what is the market most likely to do from here?”

My answer was the market looks weak…damn weak. We are a bit over cooked on the downside, but this move is super long in tooth and we should be raising cash. The government is a mess and people are getting nervous.

At this very moment I heard myself and said, “But in reality we should just ignore all everything, plug our noses and go long.”

SO I BOUGHT INSTEAD, buying up GOGO and Z yesterday and GTAT today.

I don’t trust these indices here, but I am pressing longs in individual names until they tell me not to. The robots got this one right so far. CREE looks boss today, right?

More later

Comments »