We are treading water up in the market highlands and when the air is thin thoughts tend to mend together into a blur from lack of oxygen.

I made only one adjustment to my portfolio today, reducing my exposure in CREE to a more manageable ¾ size into earnings tomorrow. I intend to carry ¾ through earnings and use up to a 1.5 position size to trade my way out of any corrections. If they gap higher, I will simply buy more shares at a greater price. However I won’t go full size into earnings because as much research as I have done on the opportunity in lighting, my edge is stronger as a technician. After the sale, I have about 20% of my equity portfolio concentrated into the LED industry via CREE, RVLT, and LEDS.

I want AIXG again, but I may take a pass because it trades in a ghetto way.

PPC has me 10 percent in the hole on a full sized position after two quick trading sessions. Sometimes all the fancy timing and indicators get smashed with the gravity hammer that is unknown risk. How was anyone to know a salmonella outbreak would occur the next day? The stock has undergone heavy selling pressure over the last two days and it is likely to continue tomorrow. We are coming into an area I believe to be support. Should it not behave as support, and buyers do not react to the prices as if they are a discount (a reaction like when you touch a hot plate) I will cut my 10% loss. Being a 10% position, this trade potentially lopped 1% off my book. It sucks, but I live to fight another day.

PPC still has to work through earnings on Halloween before it gets into its seasonal sweet spot so it appears I was at least one day early on this long.

My other menace stock is ADHD. The little bastard stock lacks discipline and needs to be made stronger by correction and medication. HEAVY MEDICATION. That will teach this stock to misbehave…talking rubbish about ghosts and imaginary friends when it should be memorizing Bible passages. No, I have not been watching too many scary movies.

CLNT is set up right to be the next winner in the Chinese lottery. Shorts, I have one simple question, are you feeling lucky punks? Well, are you!?

Everything else is just wiggling around, waiting for proper order flow to dictate direction. The RVLT daily chart has the exact picture I hunt for daily, but I suppose I am partial to the name. I still have a very large position after all.

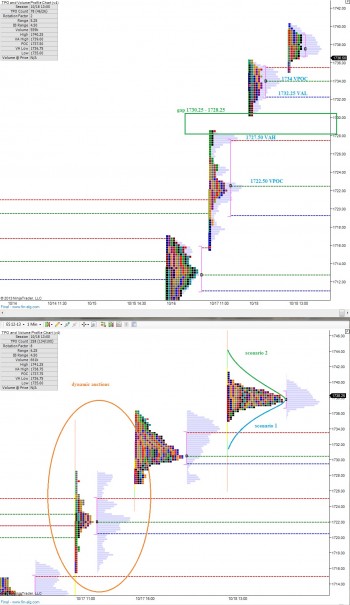

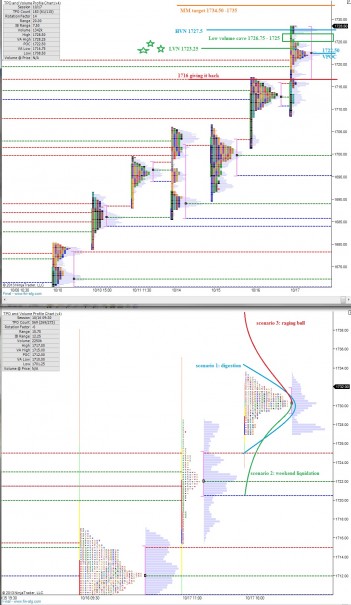

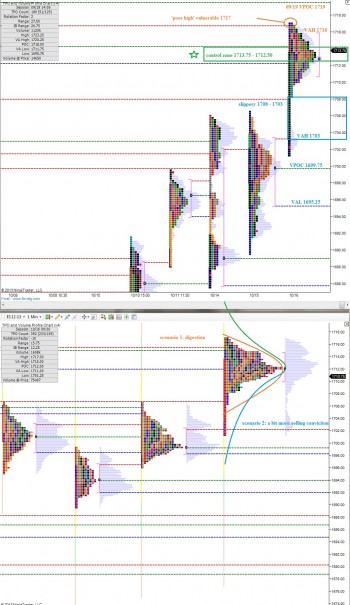

I traded the /NQ like a jackass today. I overtraded and clocked a 22% win rate. I over traded after writing less is more in my morning analysis—that’s what gets my goat. Futures trading is all about bringing you A-game and following your plan to the T. There can be no deviation.

Comments »