It was a week of setbacks in the market for yours truly, being on the receiving end of two major blows. Going into the weekend, I had to rid myself of one of these losers and of the two, TPX and ENPH, I decided to cut ENPH.

It was not an easy choice but it was most certainly a necessary choice. I want loose capital, ready to pounce of fresh ideas. Hell, I may even buy some ENPH next week, who really knows?

There were big winners this week. Zillow spent most of the week pressing into the necks of their high short float…I wish I hadn’t sold, but perhaps we’ll get a downdraft next week to latch onto.

Facebook was hands down the darling of the market, perhaps restoring the confidence of the disheartened retail investor. I knew this day would come, where I would have a low cost basis in the name, able to now kick back and let the future pan out.

I made OCZ full size early last week, a rare move even for me. To go full size in a sub $2.00 stock takes a certain amount of gumption and laser clear risk parameters. As dicey as it seemed to hold the position for 8 sessions with zero progress, it continued to behave constructive. It was only a matter of time until the shorts were spooked. Today, I sold ¼ @ 1.75 earning around 5% and another ¼ at 1.825 (damn algos) earnings over 8%. It’s a great trade so far: a very constructive chart with lots of shorts to fuel a rally and a company that creates wonderful value for the world. I love it.

I’m beginning to see the potential of smoking shorts out of their favorite hiding places in this aging bull market. With the tools this site provides, I intend to do exactly that.

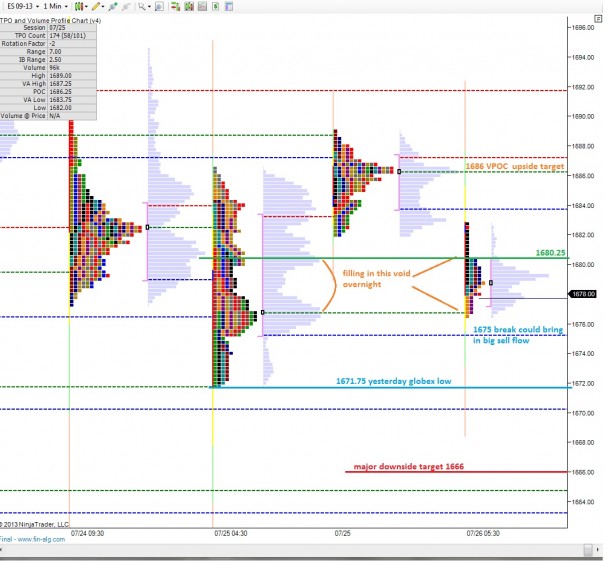

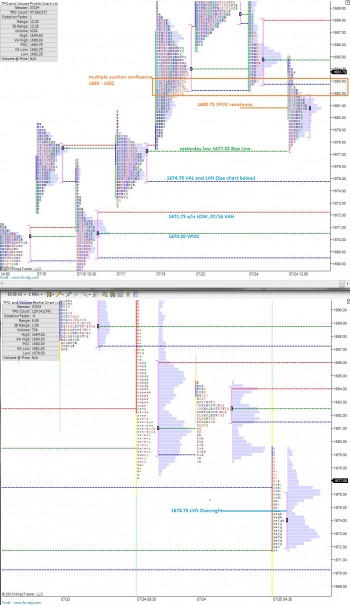

I backed off the futures this week, taking a more passive approach. They intrigue me to no end, and I see huge potential in trading them, but my interest is shifting to day trading these momentum stocks. There’s an edge to be had in sousing short sellers with the buy cannon and grabbing .40-.50 cents in movement. If you align your orders with a change in trend in the /es, you’re riding the tide holding a water bazooka. It just sounds fun! And I want to put more capital towards this new sport.

I’ve accepted that TPX will likely trade down to $35.00. Then I want to see how this price level is met as it is of HUGE importance. I may buy more shares, I may sell, or I may simply hold on to what I have.

This has been another fantastic week working alongside the brightest minds in finance, and I look forward to doing it all again next week. Have a great weekend.

I’m such a sucker for Bruno Mars, I can’t help it…he reminds me of James Brown in this video, enjoy:

Comments »