One of the greatest weaknesses of elder generations is their resistance to change. Perhaps in their younger, scrappier years they would take changes in stride while walking two miles in the snow to school. But with the routine comes comfort and stubbornness. Eventually obsolescence sets in.

With that in mind, I will not damn my future’s platform for completing a major update over the weekend, an update so grand it succeeded in killing all of my helper robots (algorithms). Instead I simply await word from my team of scientists and engineers working around the clock to integrate the new technology into my platform.

Unfortunate for me, this means I will be trading “VFR” today. Unfortunate for you, my morning market analysis will be a bit lacking today.

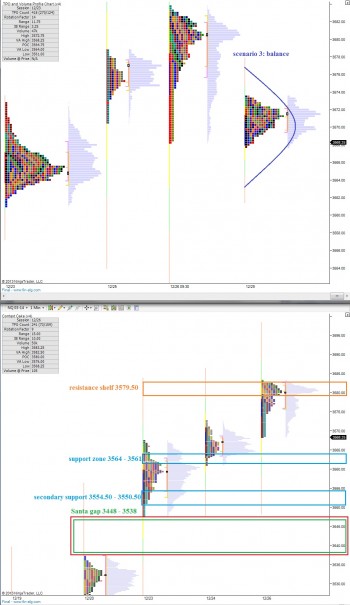

You will have to look up a daily chart on your own to see Friday’s trade printed an outside day in the NASDAQ composite meaning we exceeded Thursday’s high and low during the Friday session. These type of prints signal indecision and suggest the violent act of balance is beginning.

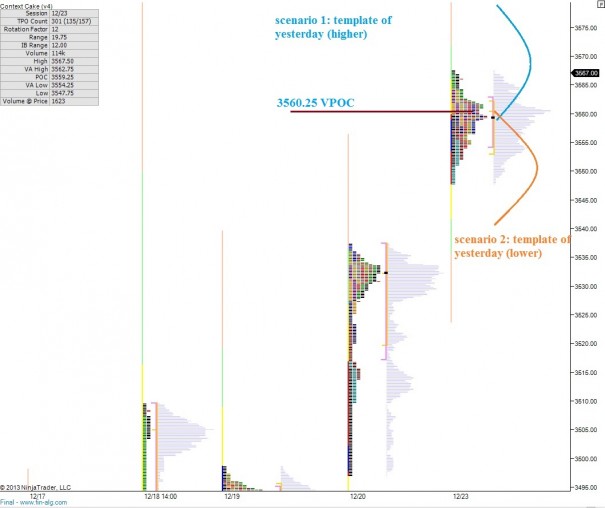

From here three things can happen. The market can reject the idea of balancing due to strong demand for stocks. This would propel us higher and away from the Thursday/Friday range. The opposite can occur to the downside due to a flood of supply entering the marketplace. The third is the balancing dance, much like the courting rituals of a finch—jumpy, choppy, and everyone gets horny at the extremes before getting faded.

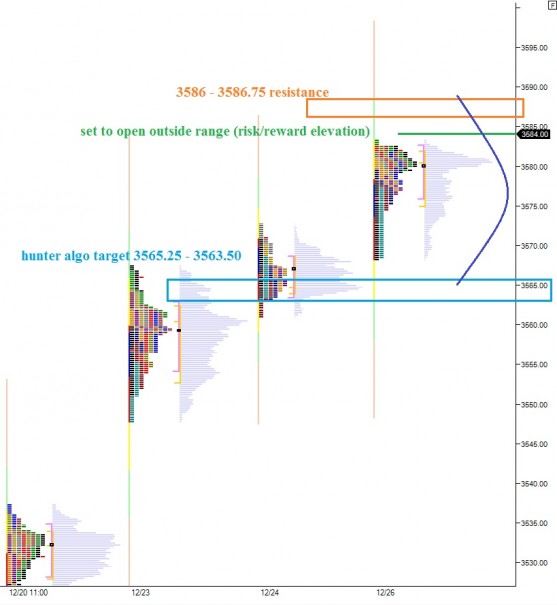

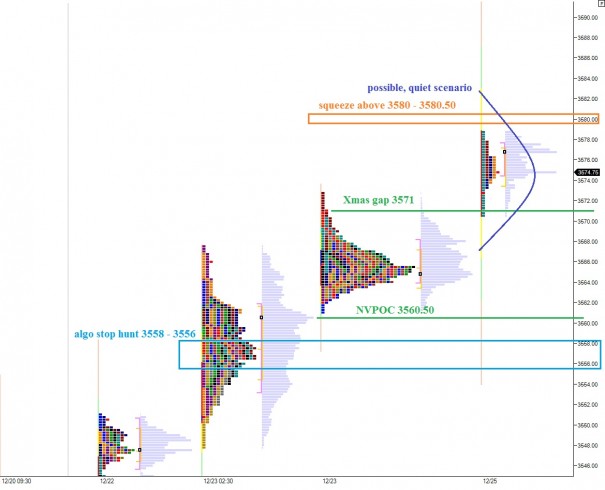

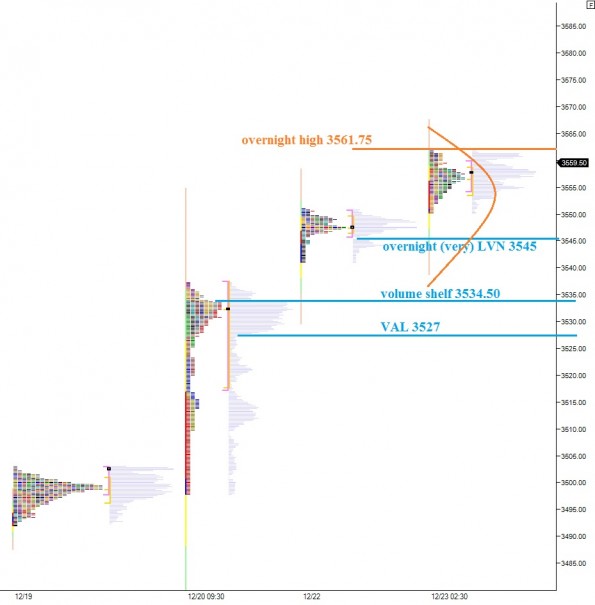

I have highlighted key market profile notes on the following charts with the caveat that Friday’s data has been vaporized and is not presented below:

Comments »