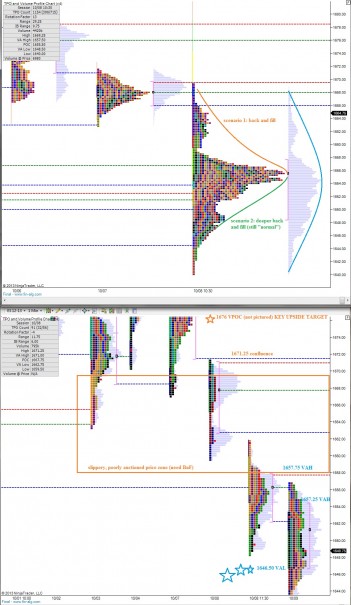

We started seeing the early signs of balance forming yesterday which prompted us we are trading in a back-and-fill environment. The beauty of market profile is the same as your favorite swimsuit super model—symmetry. Nature has the fascinating ability to form near-perfect symmetry everywhere from plants to galaxies.

So when we began observing an incomplete, but early forming balance (read symmetrical bell curve) we had a contextual cake to begin baking. We saw a fantastic distribution forming last week too after the selloff. What is important when building these concepts is not only anticipating its formation, but also watching how the market behaves post formation.

Our last formation broke lower. Perhaps this one will do the opposite.

On my bar chart, I again see an inverse head and shoulder pattern. It forms as follows:

Left shoulder – 10/08, 16:30 – 1647

Head – 10/09, 11:26 – 1640

Right shoulder – 10/09, 17:14 – 1647

Neck – 1657

MM target – 1674

Again, nature is offering us symmetry. Does that guarantee we trade in a straight line to 1674? Of course not, we are still backing and filling. But the formation is in place and our second favorite mathematician Fibonacci and our market profiles point to a major upside target of 1676 on the next rotation higher.

The market is attempting to establish value in a volatile environment. A huge seller could come in and change all of this. But sans large sell flow, by vision for today is backing and filling with an eventual attempt to rotate higher.

Note: A breakdown below 1646.50 could jeopardize this entire formation. Caution if trade sustains below this level.

I have highlighted the forming distribution via a few scenarios and also important price levels on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter