The markets caught a bit of a bounce during the early evening hours of last night’s globex session from the Yellen news and perhaps also from the Alcoa earnings beat.

The move recaptured about eleven handles of yesterday’s downside before stalling out. It appears not that aggressive sellers stalled the move, but instead that beleaguered buyers were not overly enthusiastic about the new developments. As we approach US cash open, the market is seeing a bit of selling creep back onto the tape.

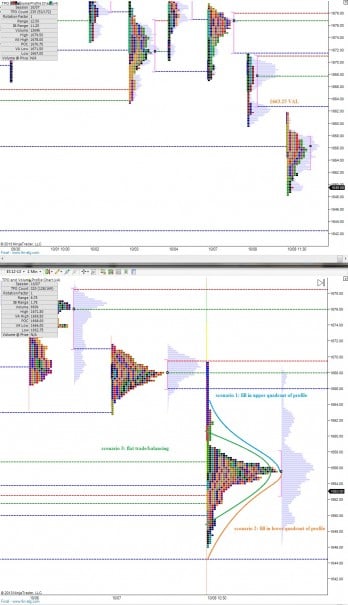

On the 24 hour profile, I see the early formations of balance which may induce some “back and fill” type trading. However, on the bar charts, I am observing the early signs of an inverse head and shoulder pattern with an upside target of 1667.

The bar chart formation paired with the over reactive nature of yesterday’s trade suggest to my eye a mean revision-type bounce higher is more likely today.

Upside targets are 1660 then the measured move target of 1667 during today’s trade

I have highlighted these levels, a few other areas of opportunity, and also the back and fill scenarios on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter