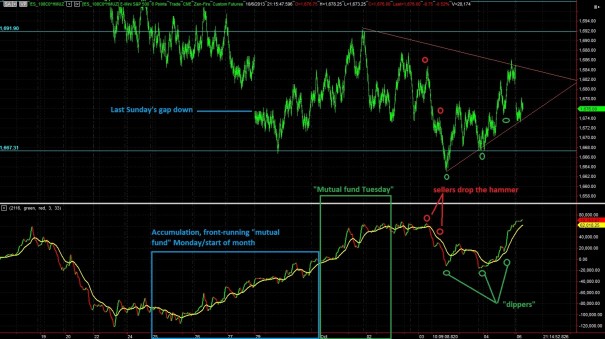

As I have discussed in the past, one of my favorite data to gather and track is cumulative volume delta (CVD) on the front-month index futures. Considering the S&P futures are the most liquid financial instrument in the world it is important evaluate the volume a bit further.

CVD = volume traded at offer – volume traded at bid

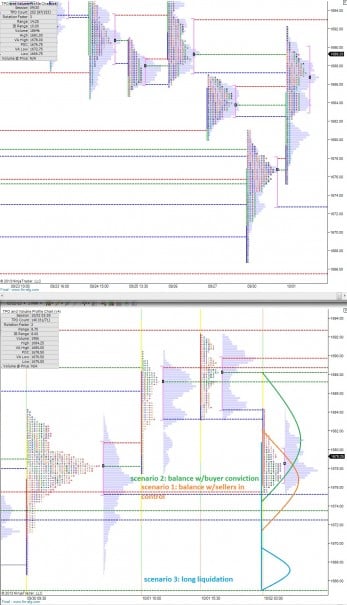

Taking a look at the price action to start the month in conjunction with a moving average of the CVD offers us interesting insight into the overall market behavior.

The futures opened trade last Sunday in a similar fashion to tonight’s gap lower.

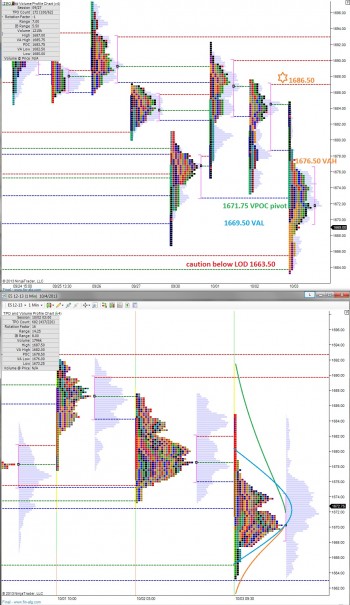

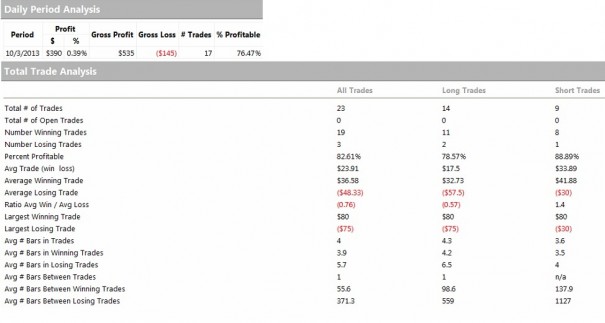

You can see pressure being exerted on the offer early in the week, especially when Tuesday hit and all the hot new money was put to work. Unfortunately, all of the power exertion was effective at only retracing into the upper bracket of our prior range. Like our distant relatives would study the stars and name constellations, the near-perfect distribution of volume formed during our prior range was named Da Vinci’s Brush. All that buy flow was capable of testing value area high and nothing more. There we found a patient, quiet seller resting on the offer. Actually, the seller may have been large enough absorb all of Monday’s buy flow. A whale, if you will.

It seems as if the more aggressive sellers caught the scent of this whale around the third and began pressing hard on the bid. The selling force was enough to reject the Da Vinci range and send us to new lows where again, we found dip buyers.

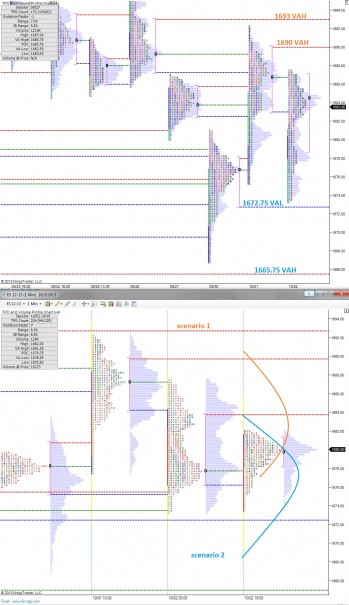

So we know where the buyers are and where the sellers are. Most importantly we know their battle lines are converging. The victor has much to gain with volatility on the rise.

The seller, our whale, feels bigger and more patient than the buy flow. If the buyers are to pull a victory this week, we are going to need more power. However this market has been unforgiving to bears all year long. We have distracted minds watching the bureaucrats and political emotions are running high. The overall climate is a combustible mixture much more volatile than a Tesla Model S battery.

Gentleman, you should take action according the how the following consolidation resolves:

Comments »