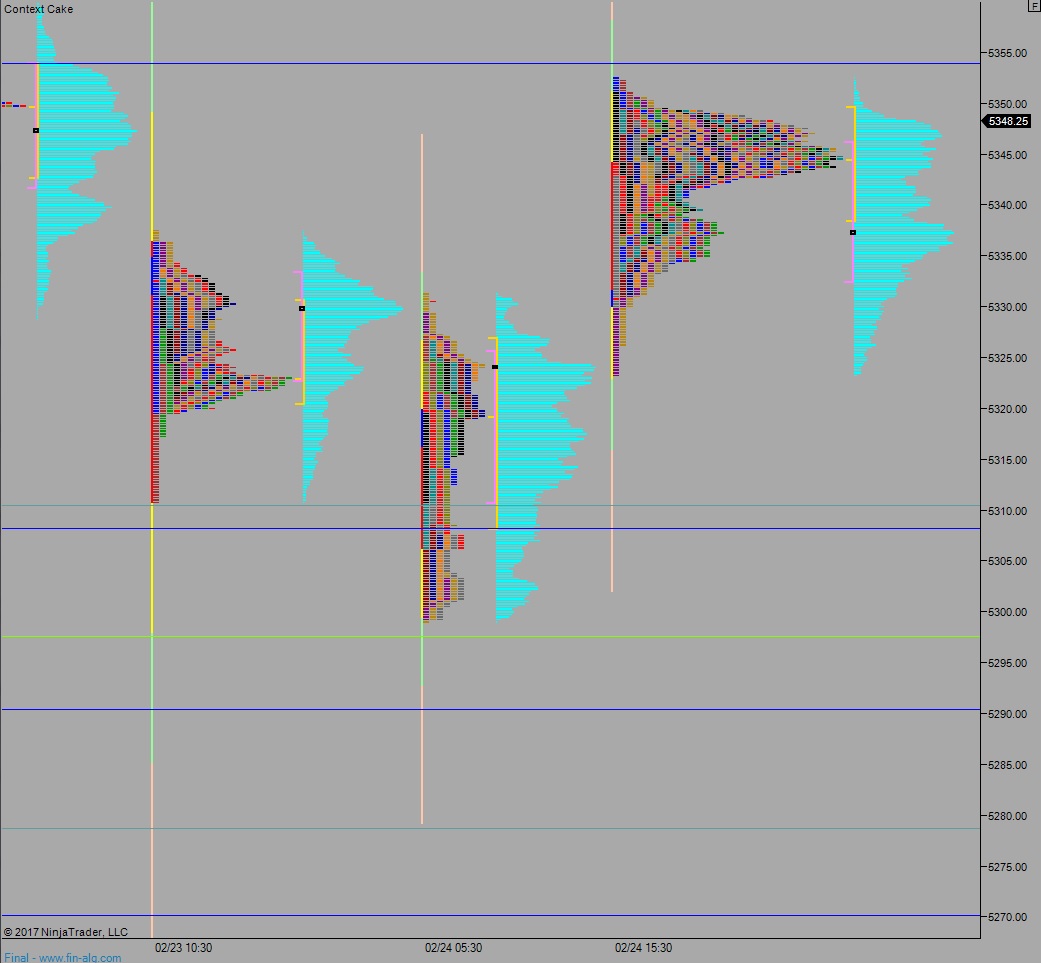

NASDAQ futures are coming into Wednesday flat after an overnight session featuring elevated range on normal volume. Price continued lower, trading down into the late-February range before settling into balance. At 7am MBA mortgage applications came in better than last week.

Also on the economic calendar today we have the House Price index at 9am, Existing home sales at 10am, and crude oil inventories at 10:30am.

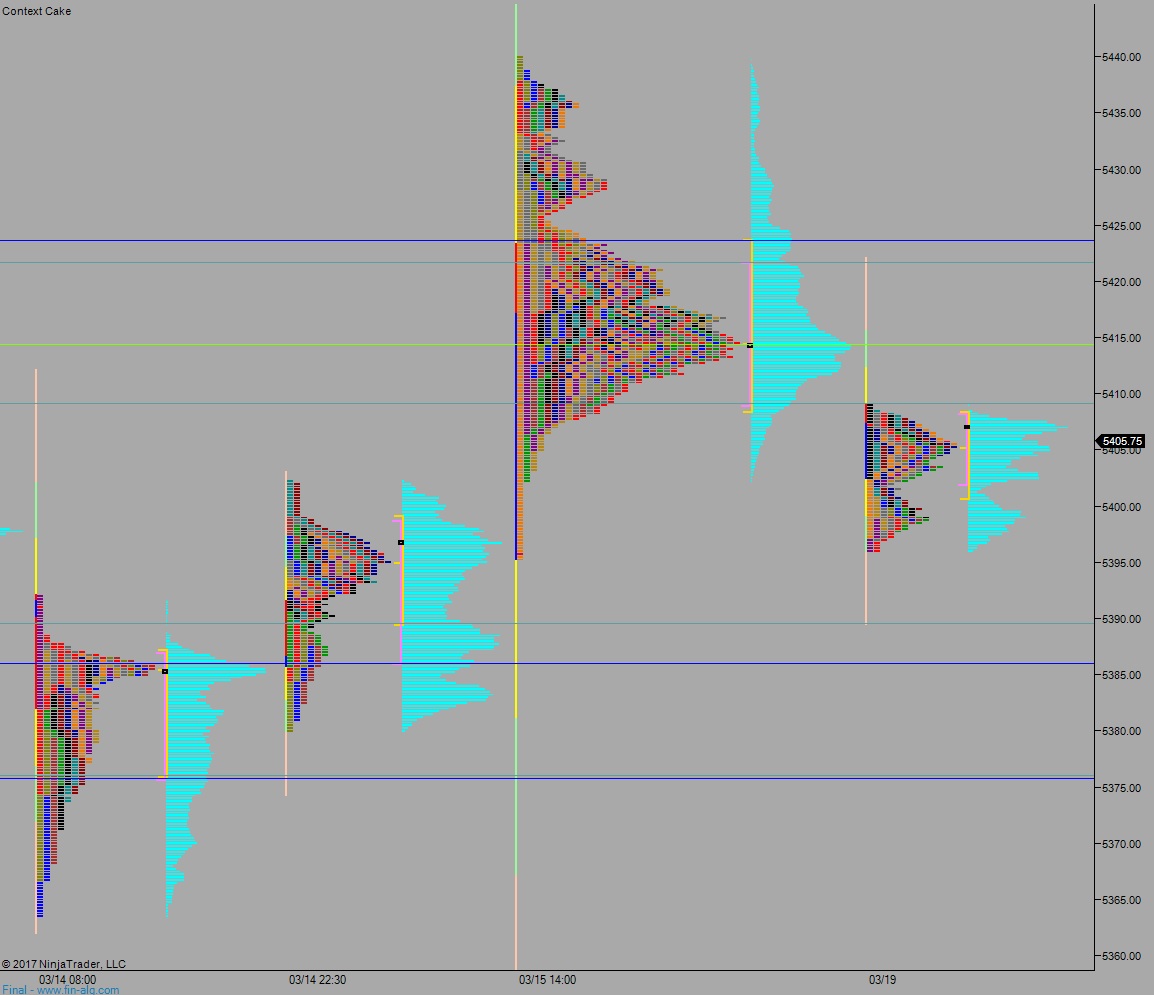

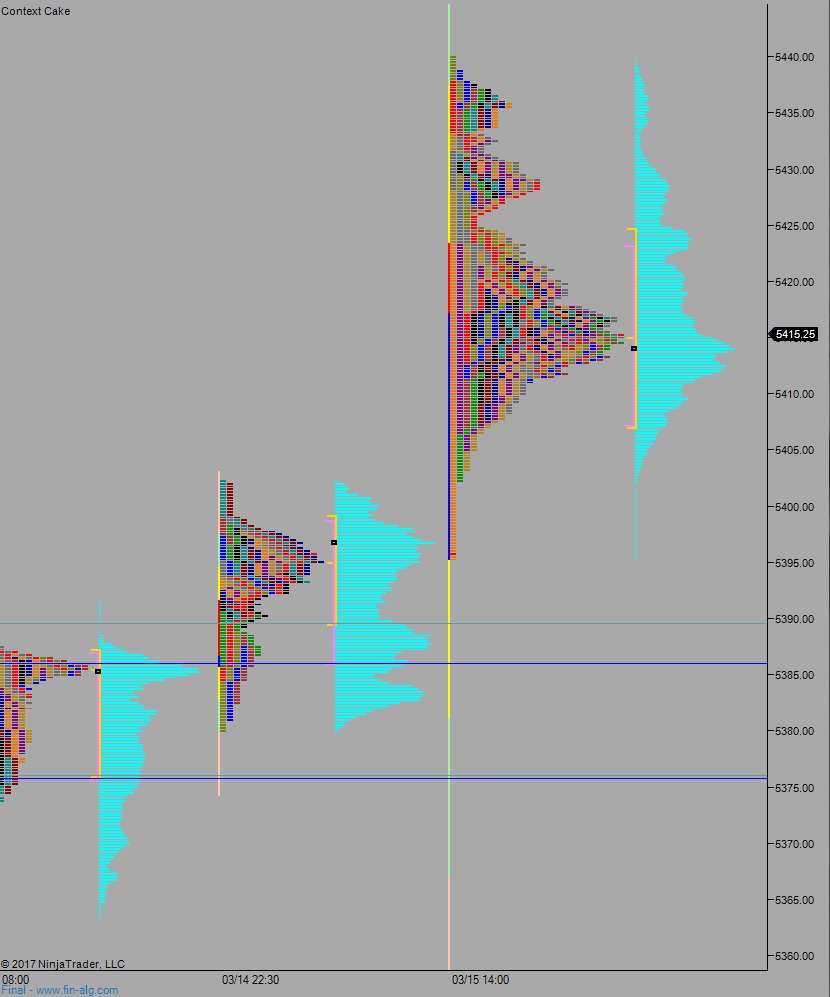

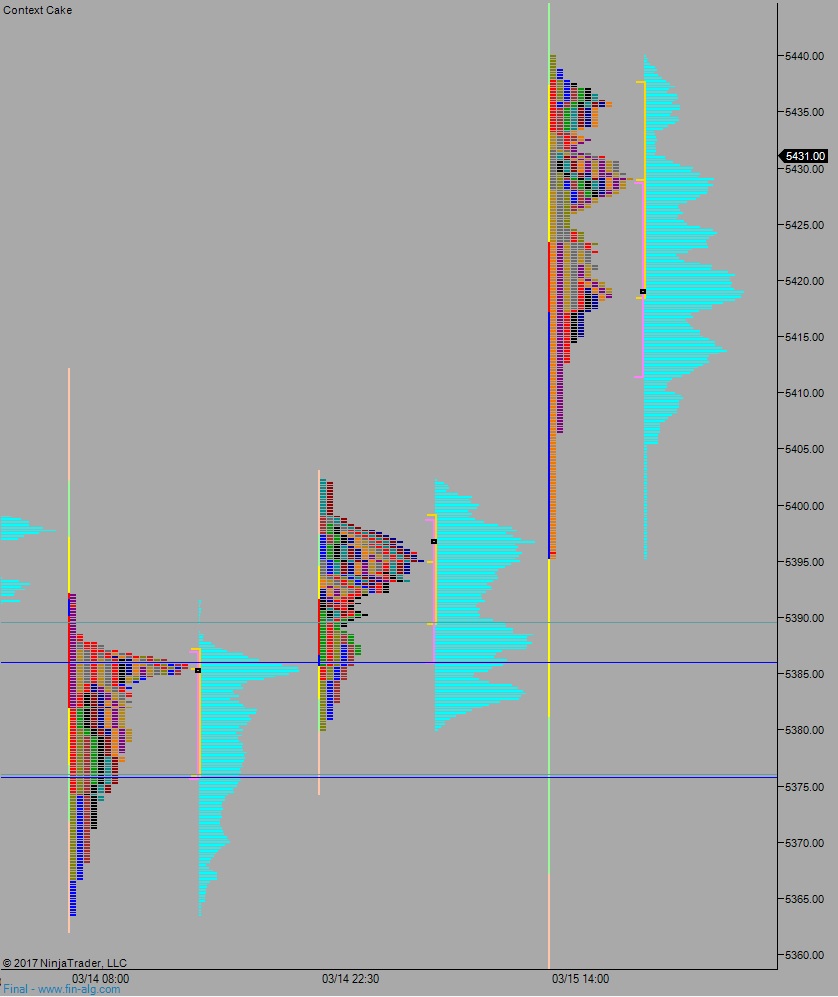

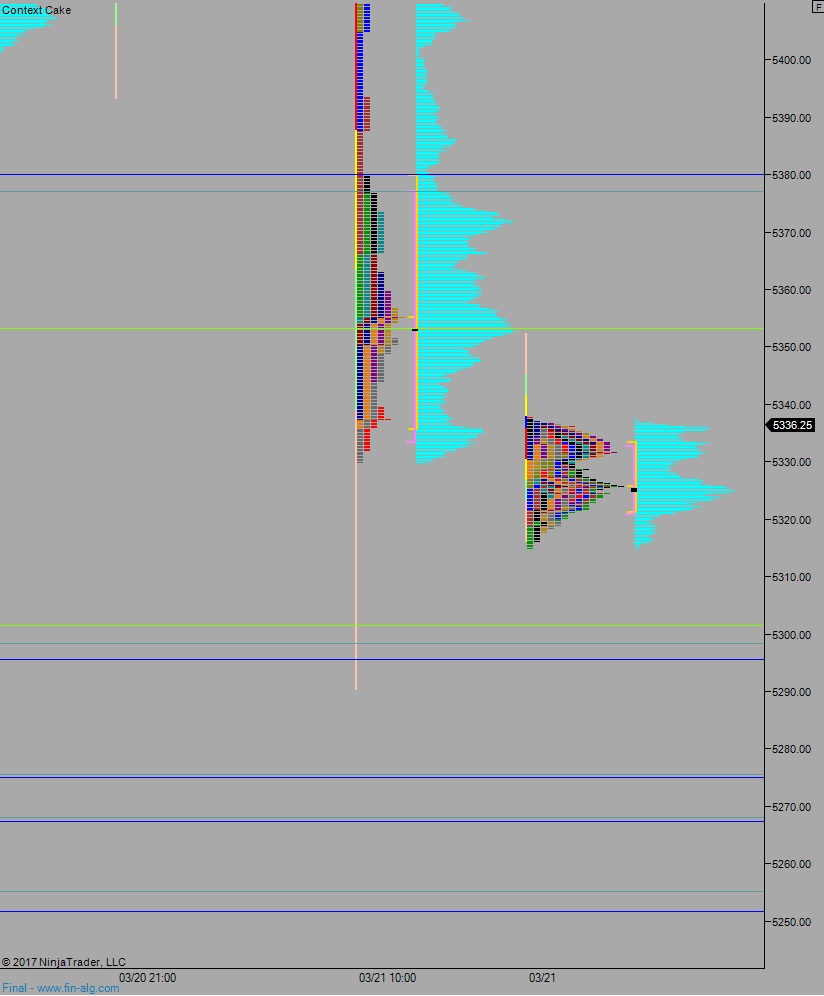

Yesterday we printed a trend down. Futures opened gap up and briefly probed above the swing high set during Globex on March 15th. Shares then quickly reversed, rejecting the breakout and liquidating hard to the downside. The selling continued for the entire session, eventually closing the February month-end gap down at 5332.

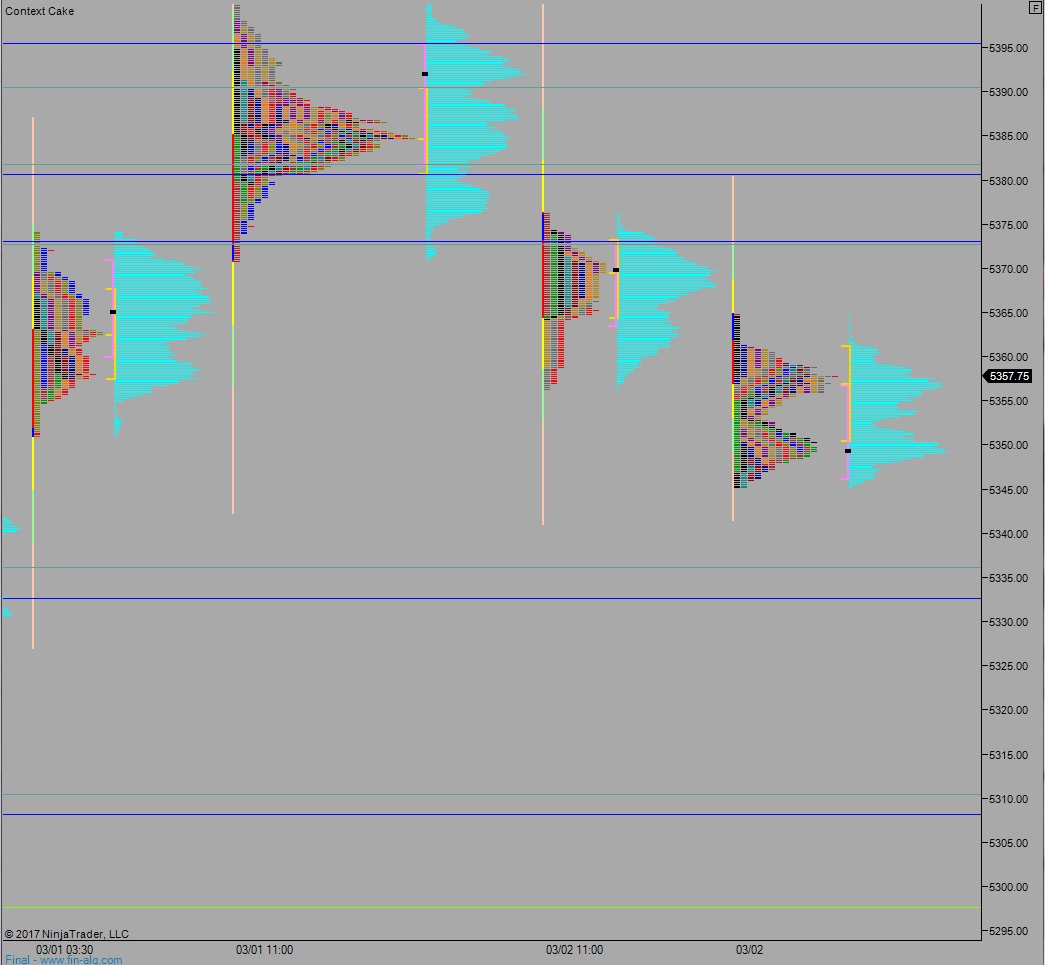

Heading into today my primary expectation is for sellers to work down through overnight low 5315 and continue lower, down to the 5300 century mark before two way trade ensues.

Hypo 2 buyers press up through overnight high 5339.50 and tag 5353.25 before two way trade ensues.

Hypo 3 liquidation continues. Sellers sustain trade below 5295.50 setting up another leg lower, down to 5275 before two way trade ensues.

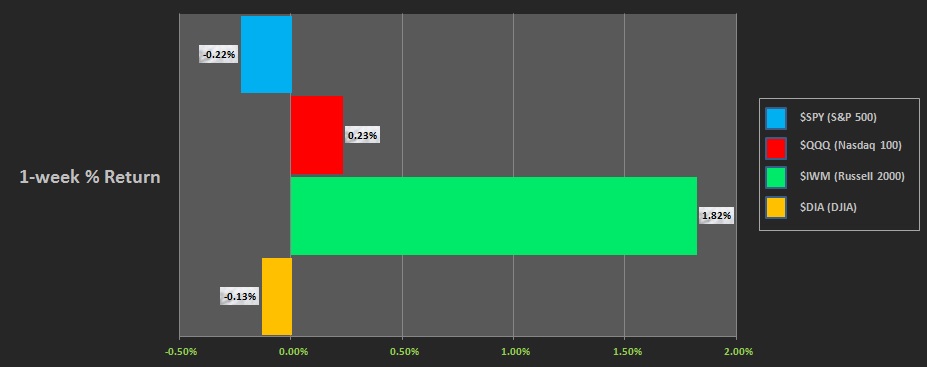

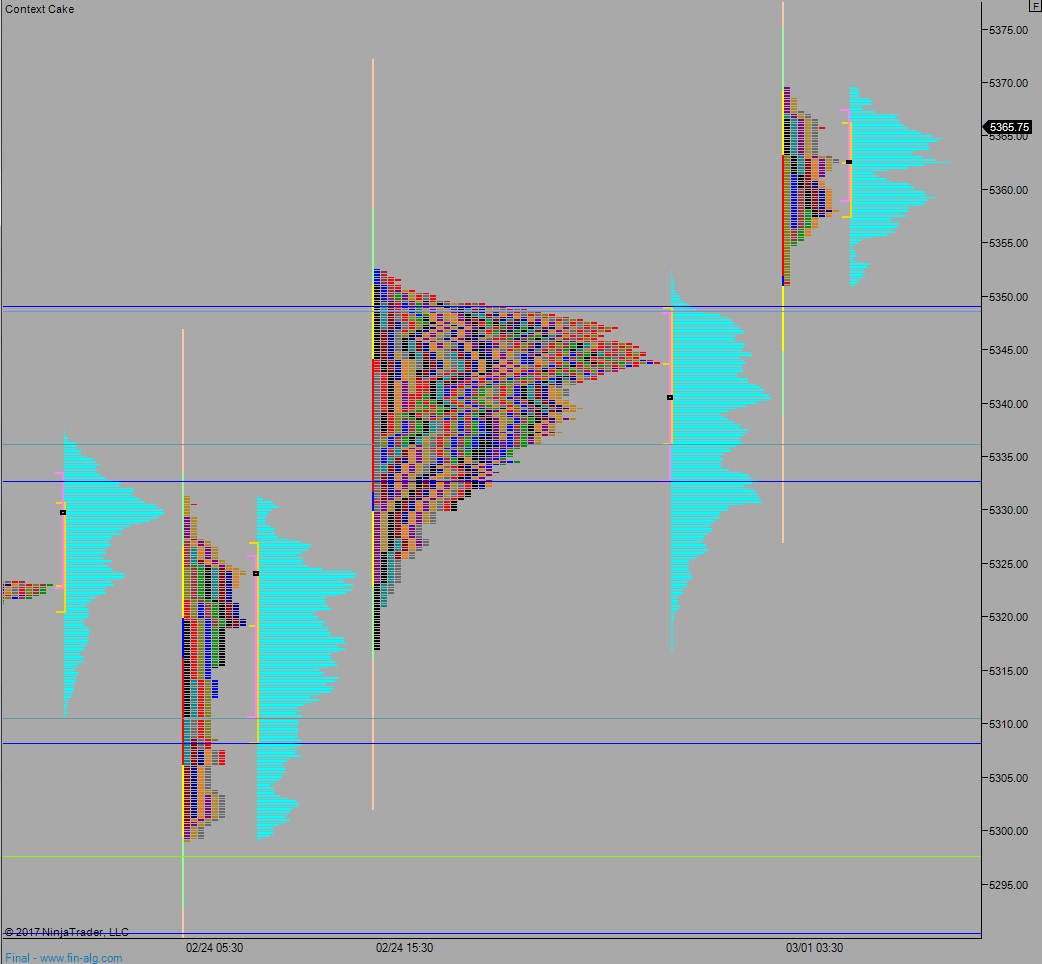

Levels:

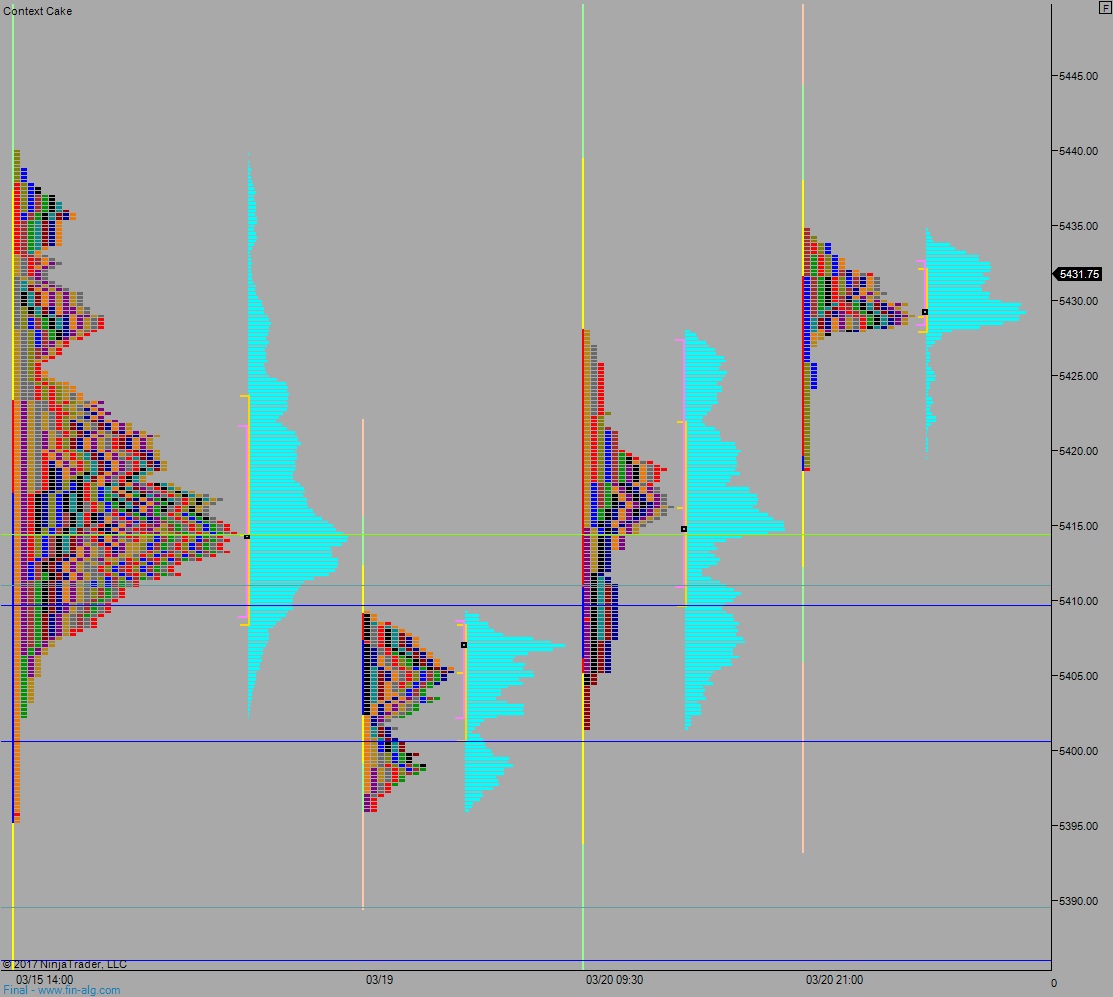

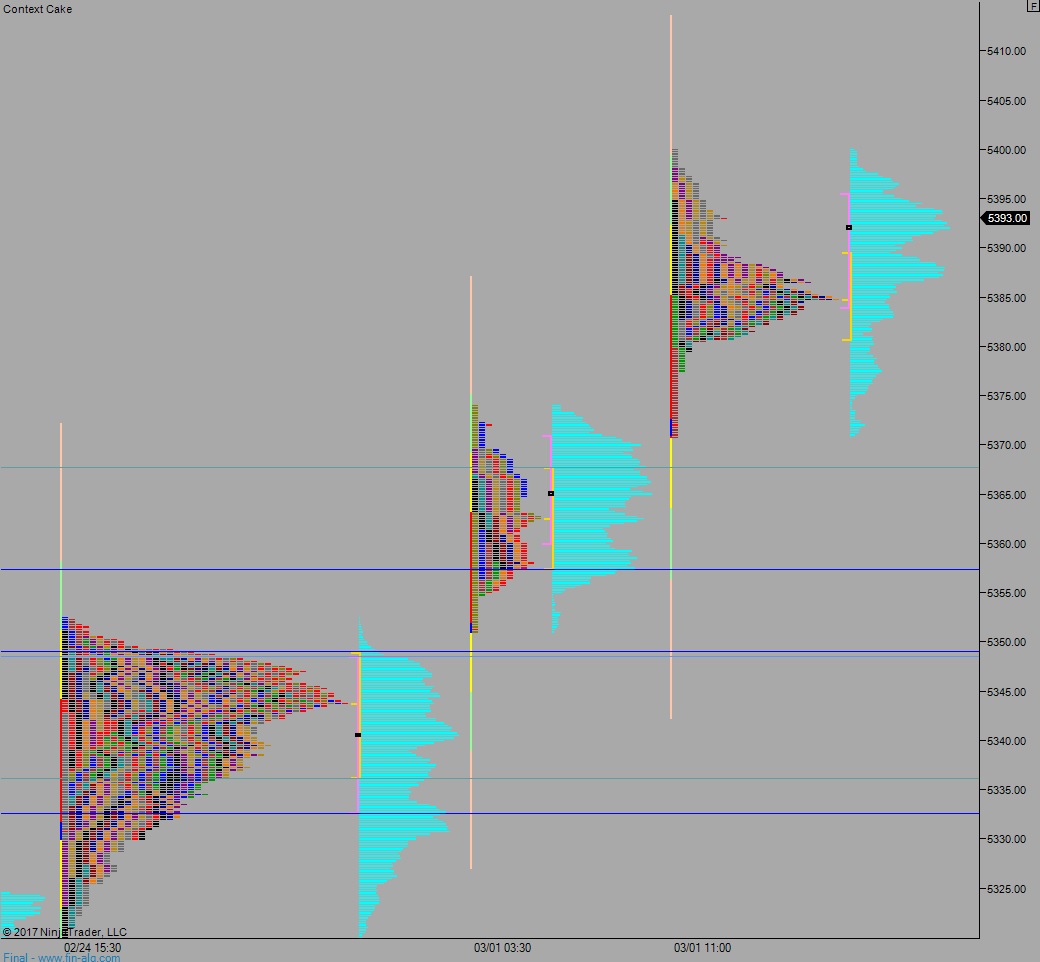

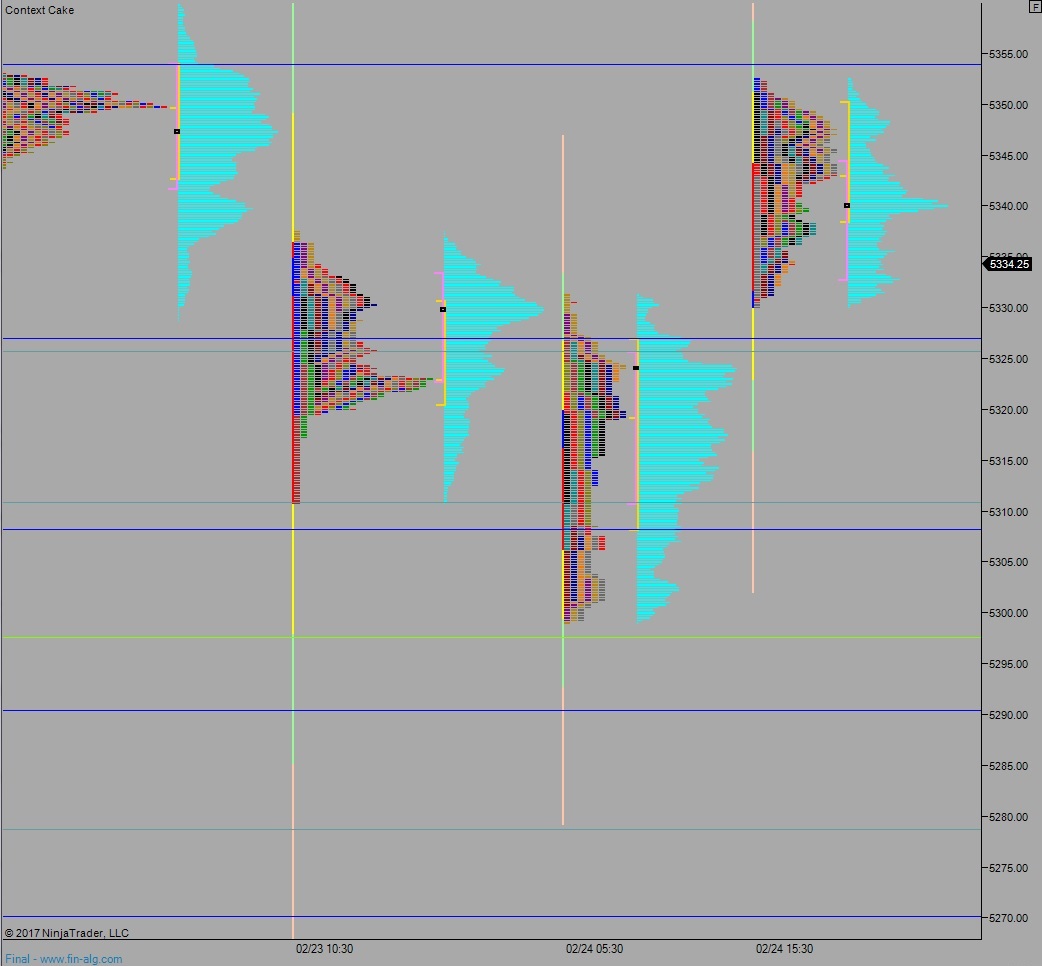

Volume profiles, gaps, and measured moves: