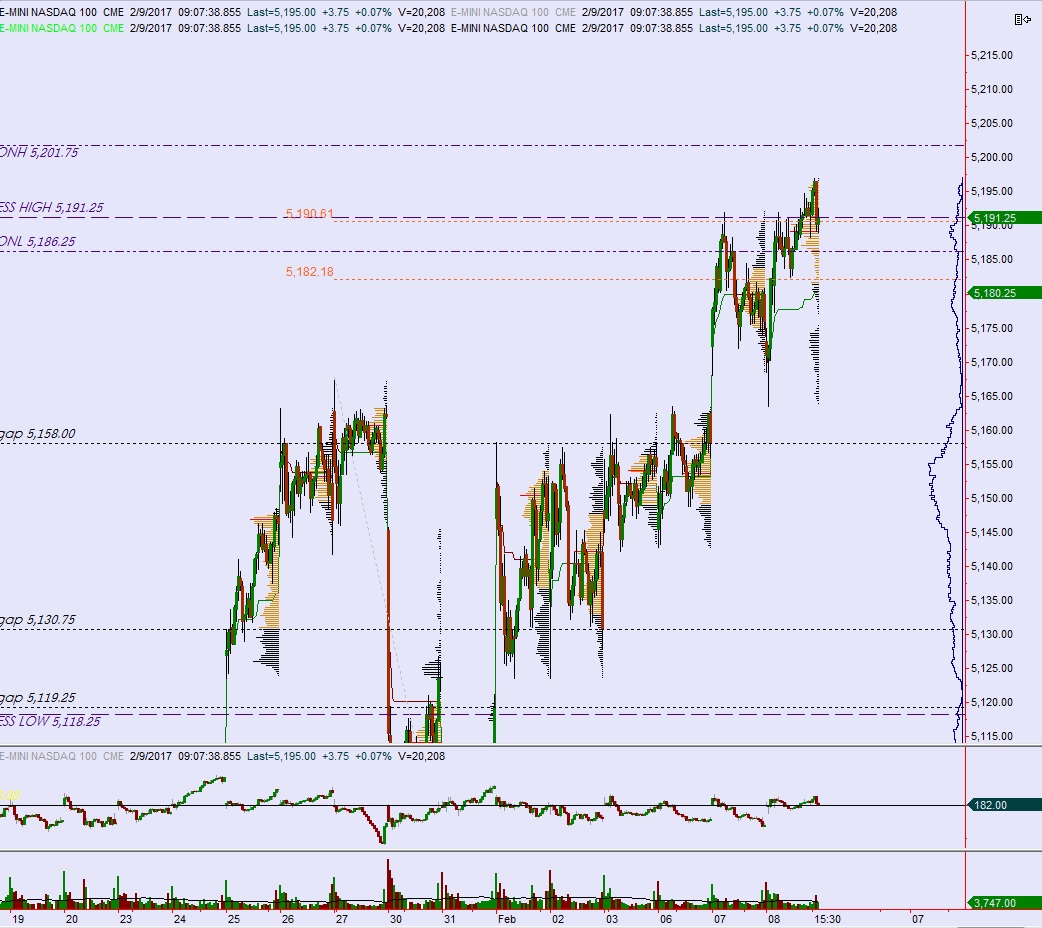

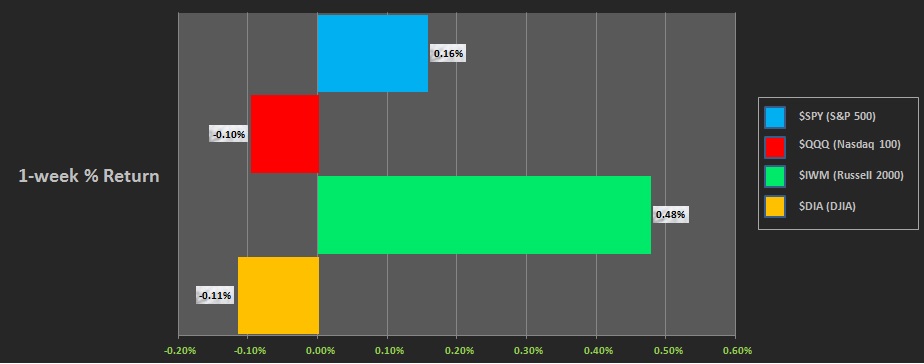

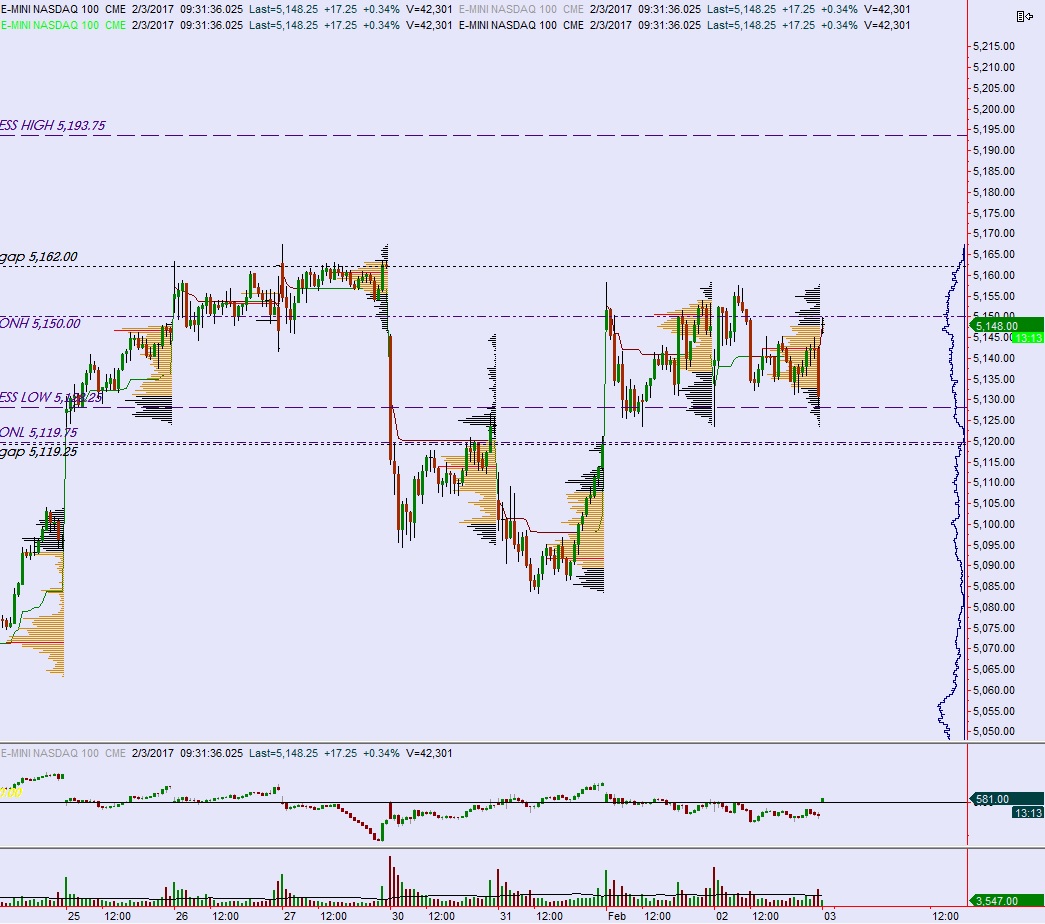

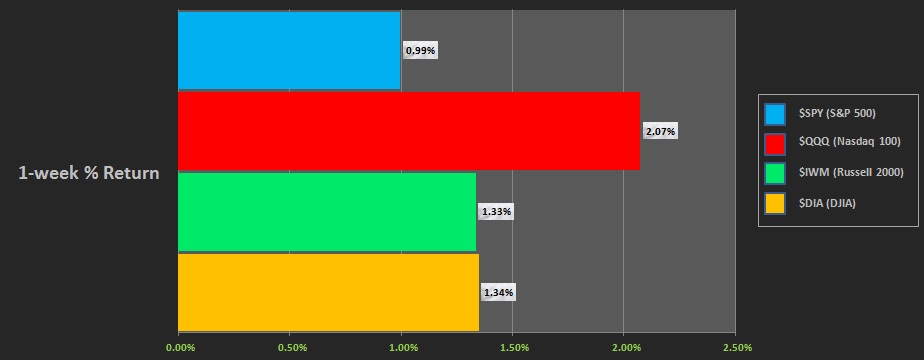

NASDAQ futures are coming into Thursday flat after an overnight session featuring normal range and volume. Price worked to new highs briefly, around 6am, before flattening back out. At 8:30am Initial/Continuing jobless claims data came out mixed.

Also on the economic docket today we have Wholesale Inventories at 10am and a 30-year bond auction at 1pm.

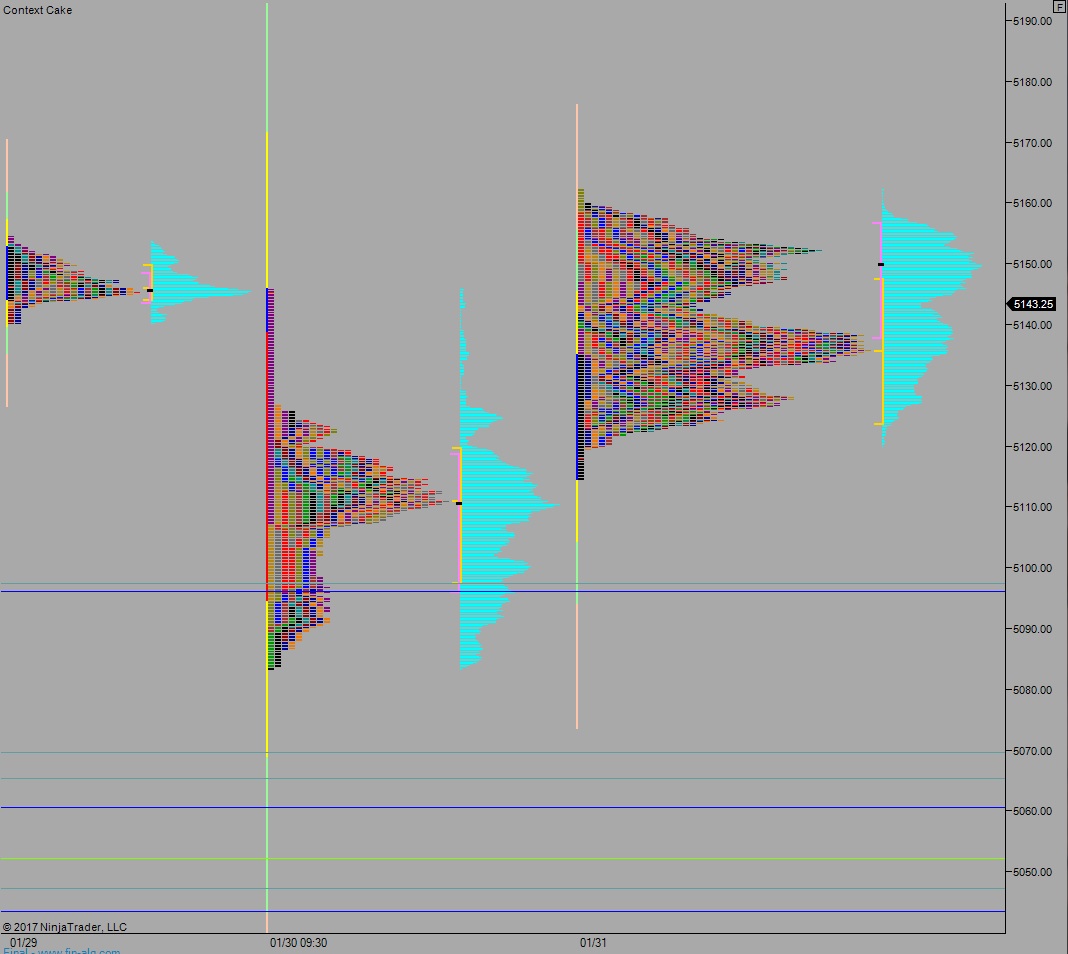

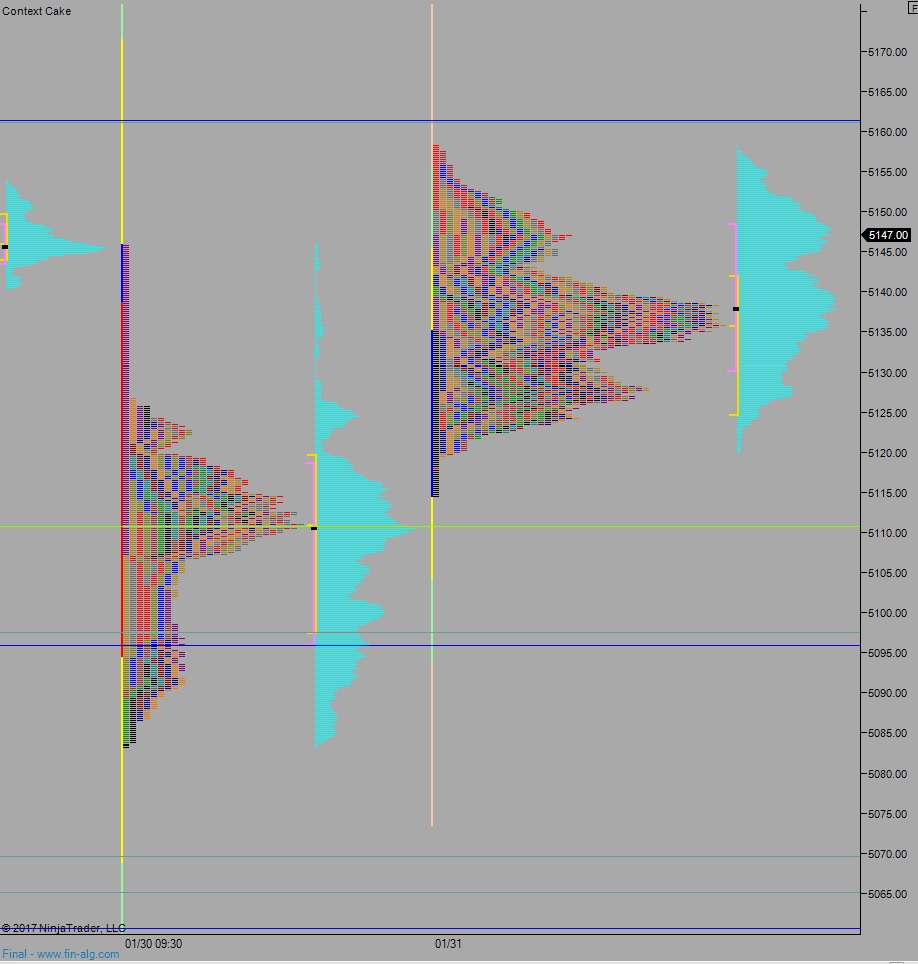

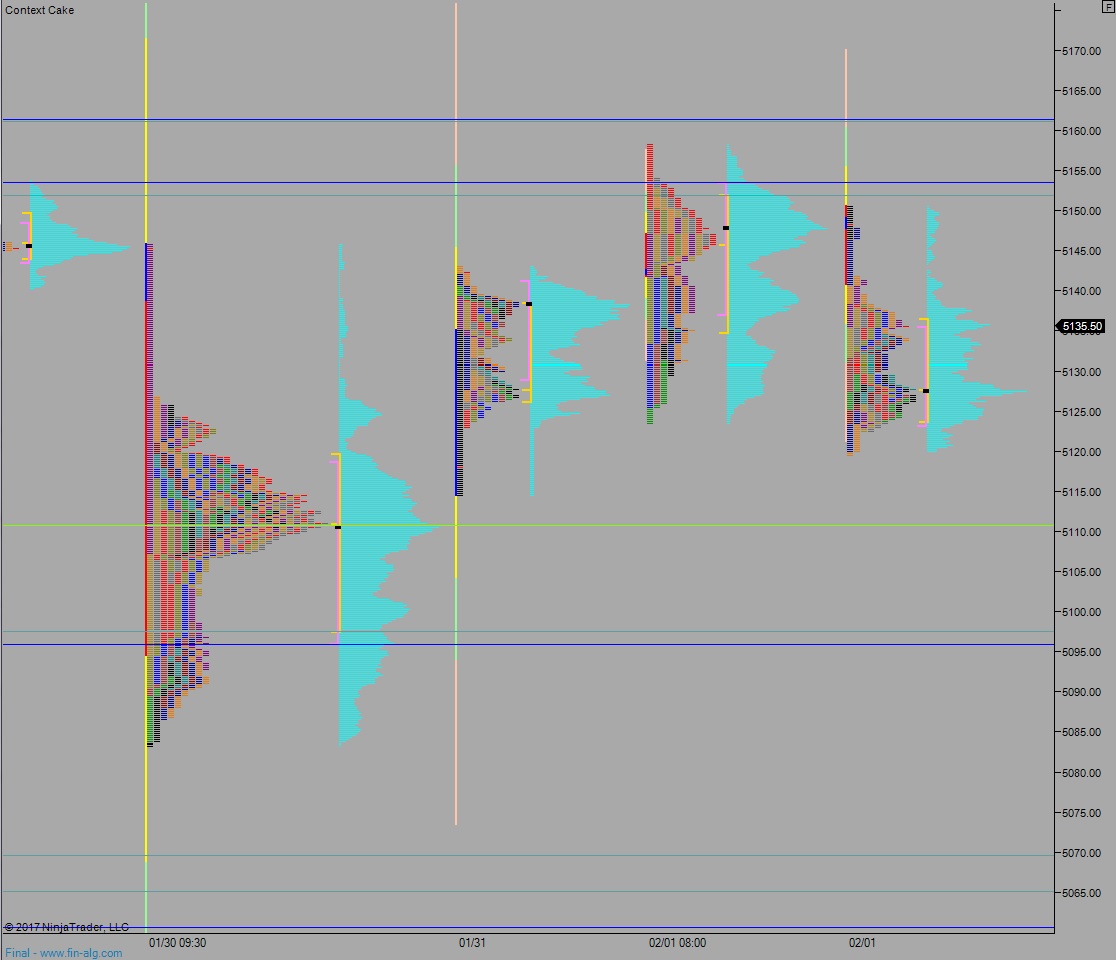

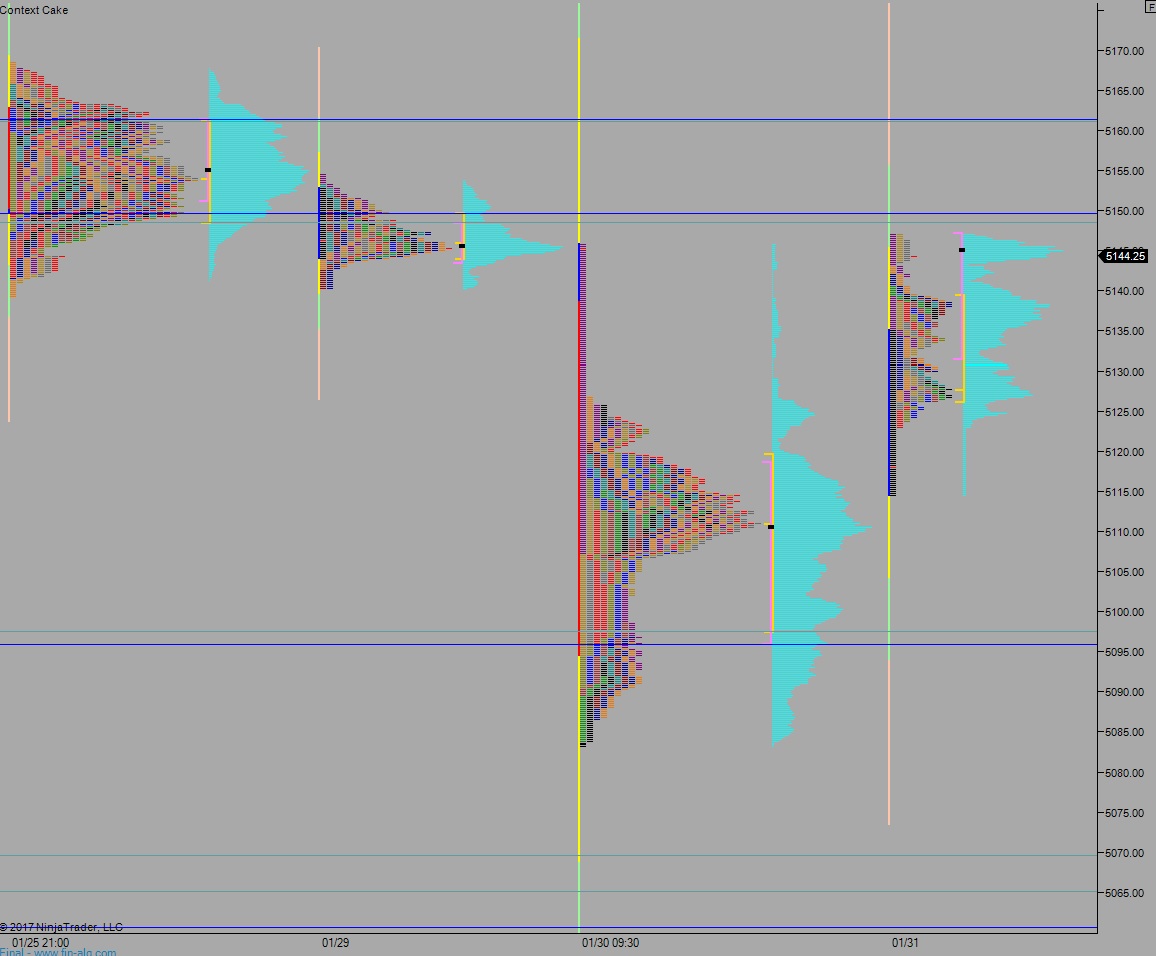

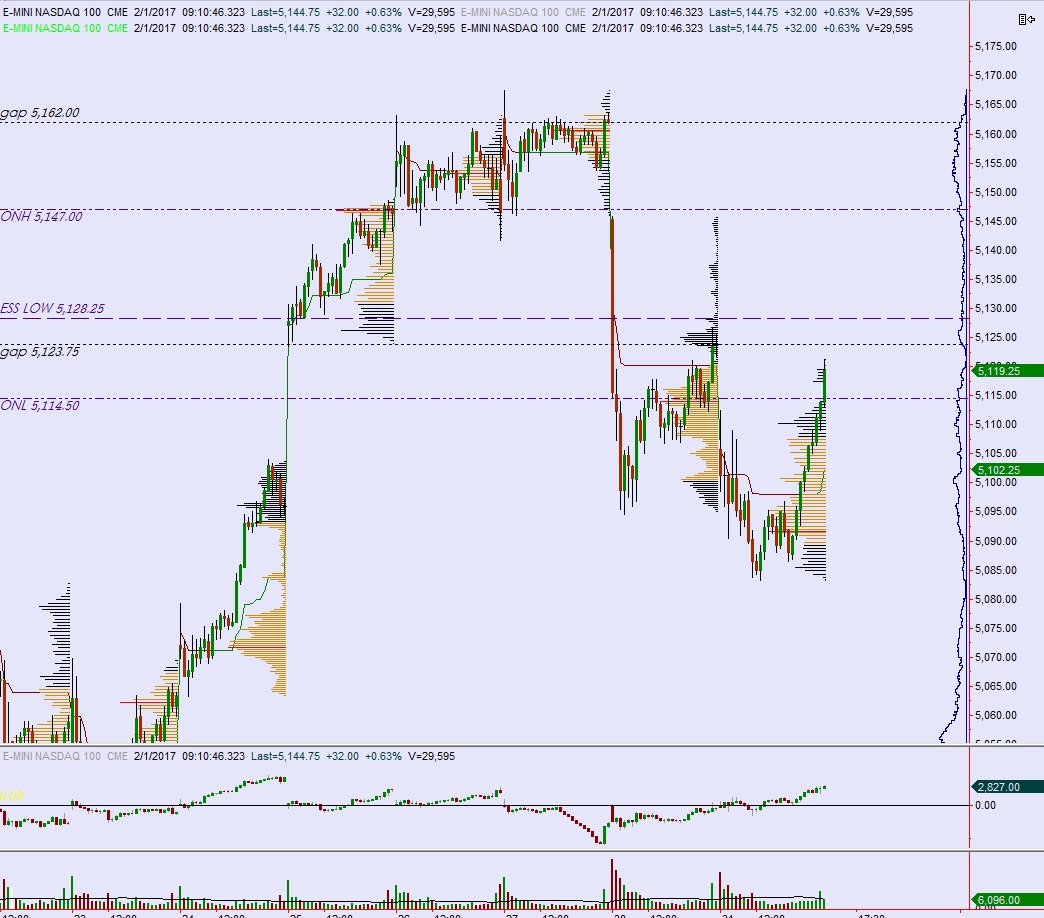

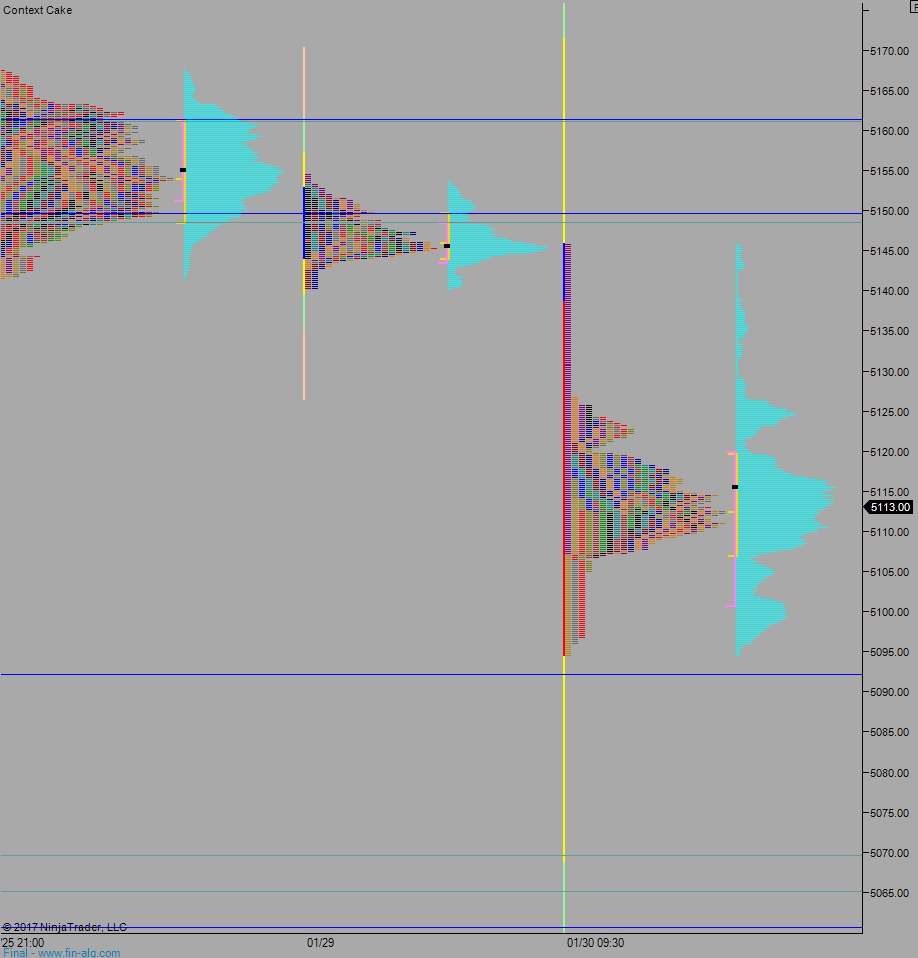

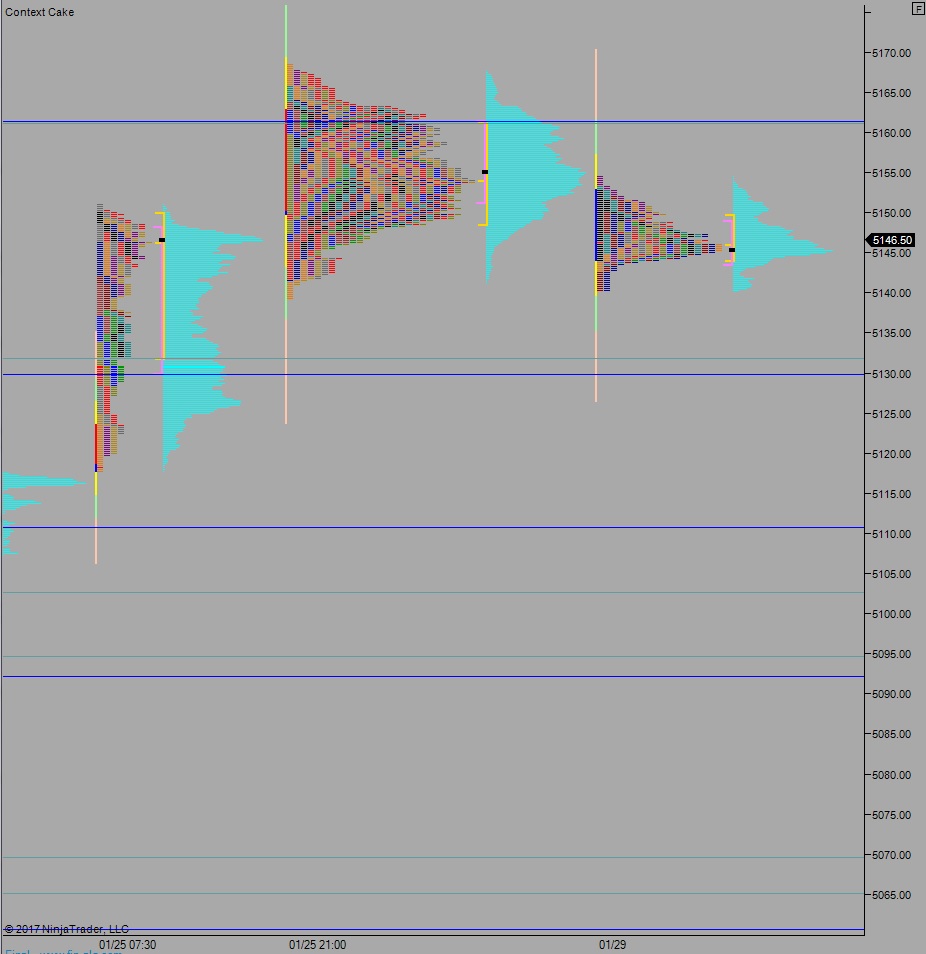

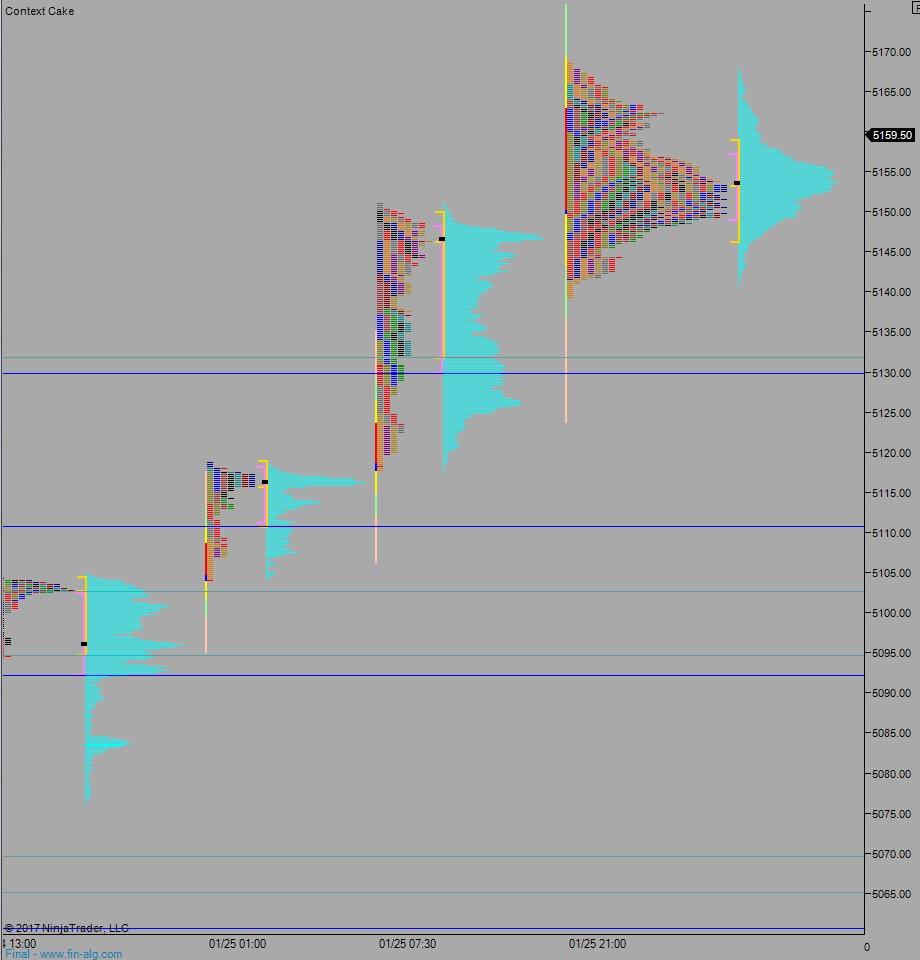

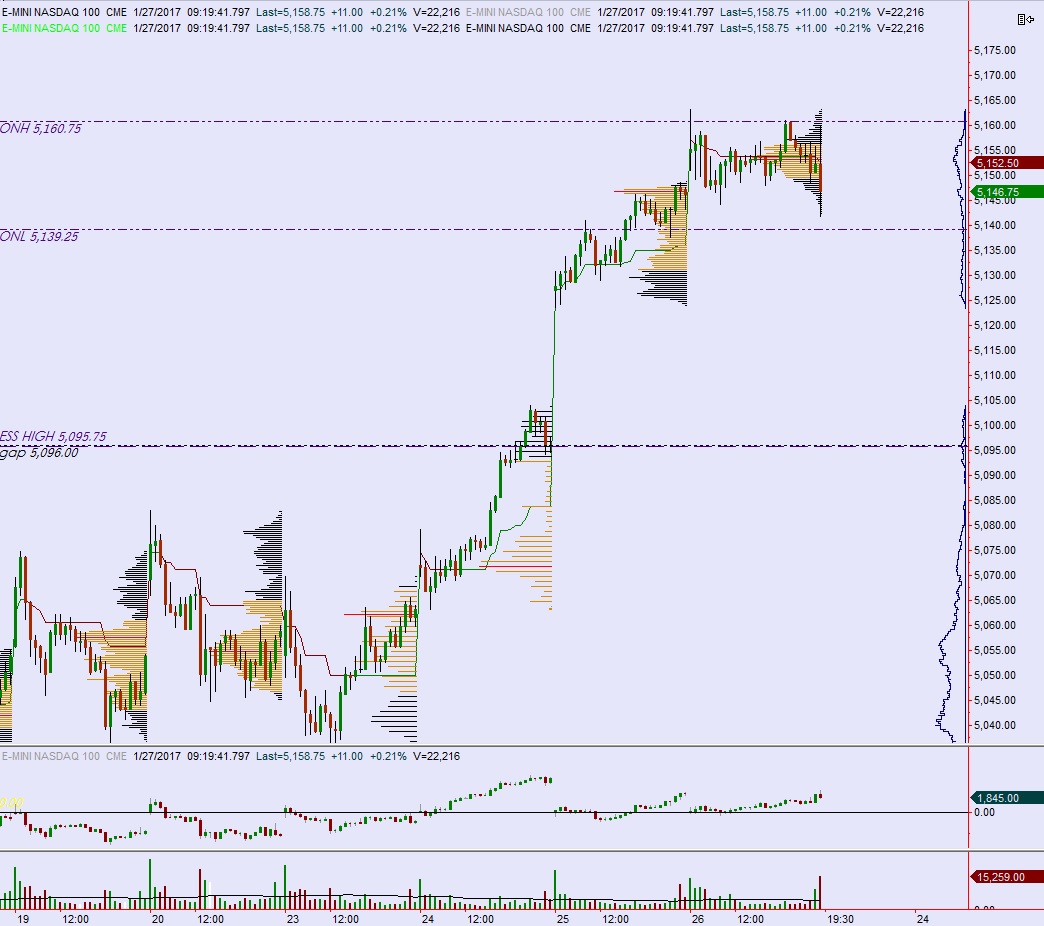

Yesterday we printed a double distribution trend up. A gap down was sold early on but quickly formed an excess low suggesting the presence of strong responsive buying. We then rallied up through the Tuesday high and sustained above it. A late-day ramp higher was faded.

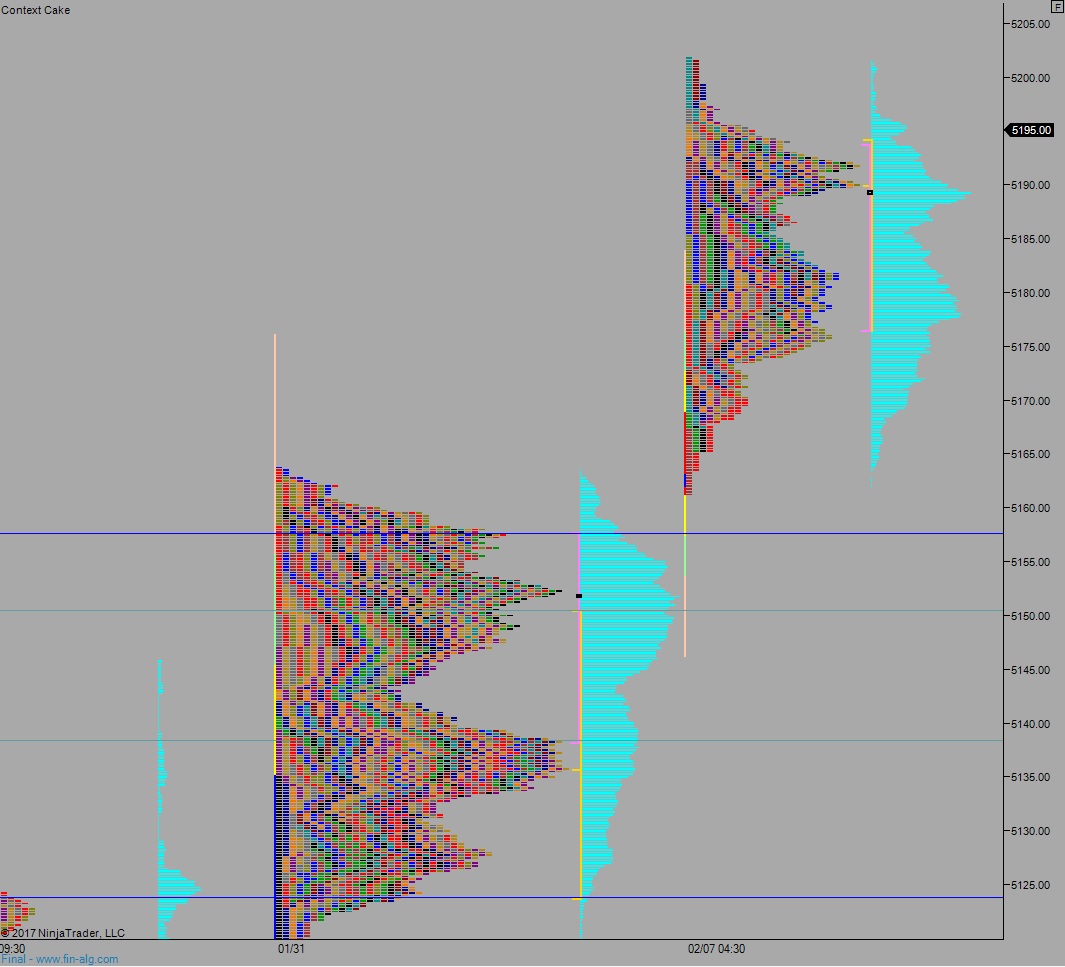

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the small gap down to 5191.25 then continue lower through overnight low 5186.25. Look for buyers down around 5175 and two way trade to ensue.

Hypo 2 buyers continue exploring higher prices, take out overnight high 5201.75 and probe higher. Open air.

Hypo 3 stronger sellers trigger a liquidation down to 5157.75 before two way trade ensues.

Levels:

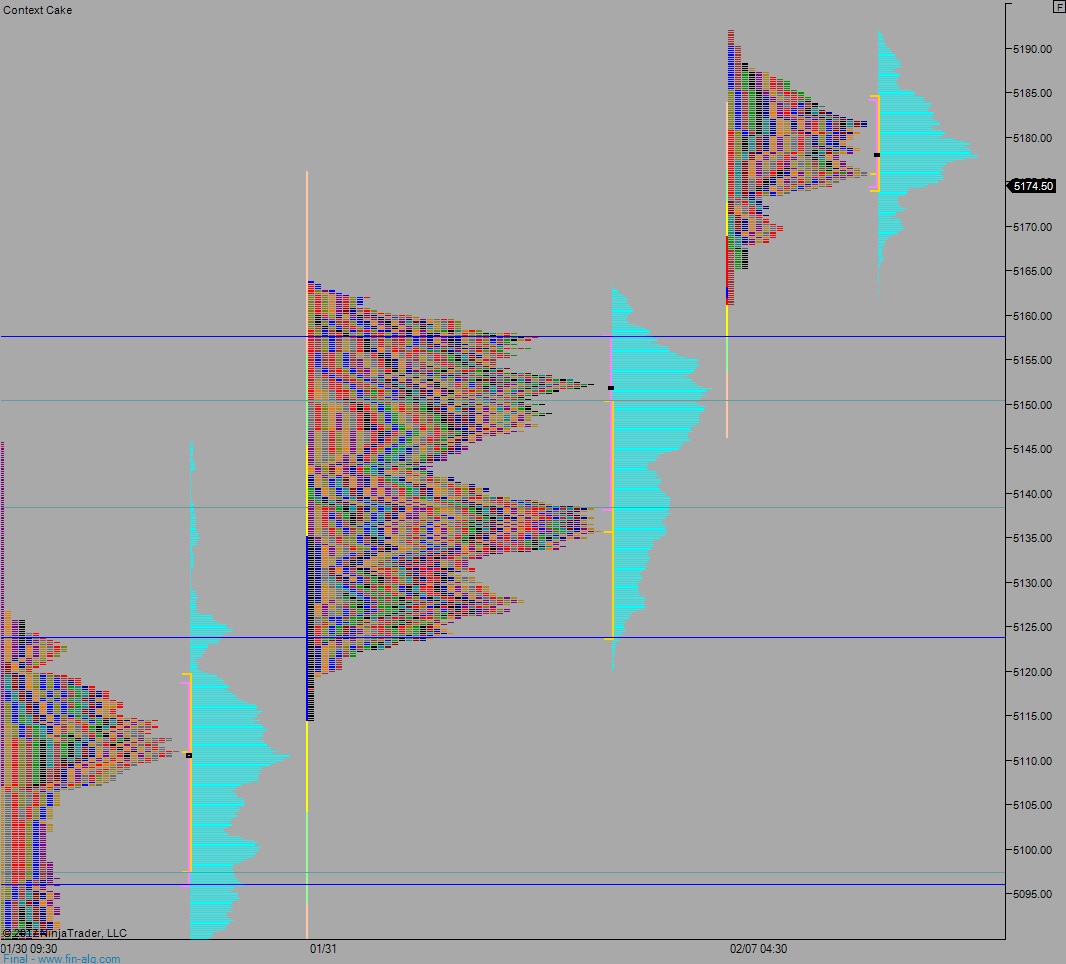

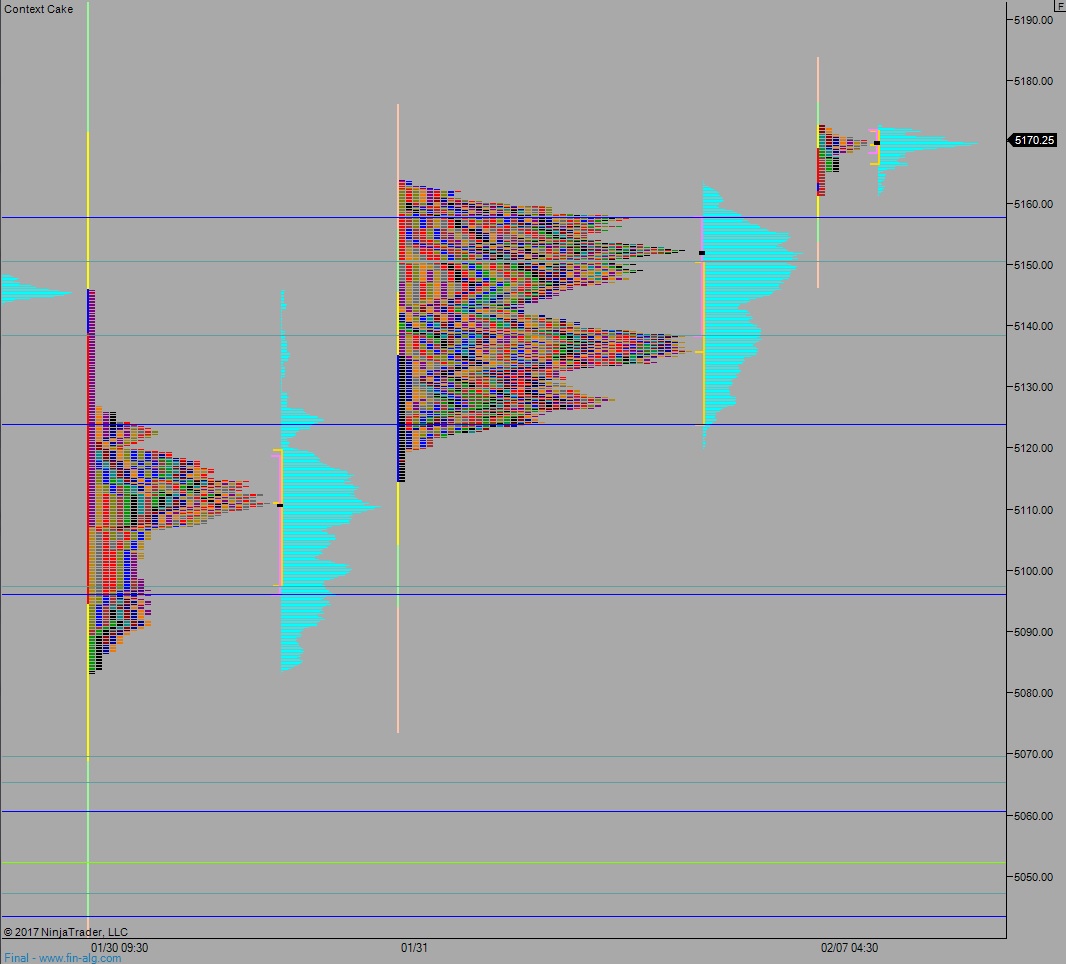

Volume profiles, gaps, and measured moves: