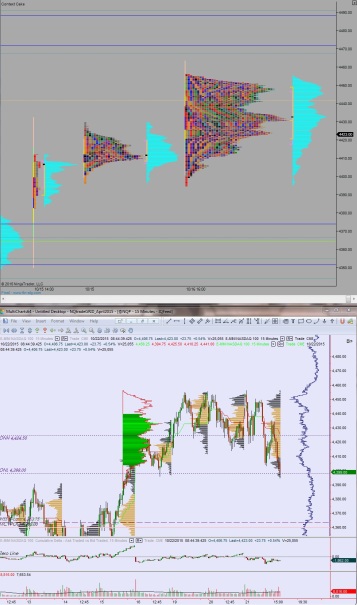

The NASDAQ is down overnight after a balanced session featuring normal range and volume. Price was contained below the cash high from yesterday but within the upper quadrant of our Monday range.

The economic calendar is quiet today—perhaps the calm before the storm. On the docket today is Factory Orders at 10am. Earnings season is in full swing with Tesla set to report after the bell and Facebook scheduled for tomorrow afternoon. Also, I was unaware Fed chair Yellen is speaking tomorrow at 10am before the House Financials Services Committee until Bloomberg reported it this morning (careful, if you head over to Bloomberg they have one of the wretched auto start videos).

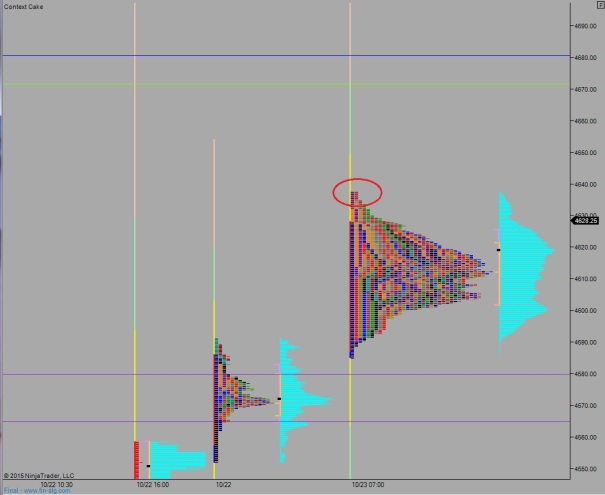

Yesterday we printed a trend day up. This day type is characterized by each successive TPO making a higher low. The strength of the trend is determined by how far the higher highs stretch. This trend day was gentle, hence my calling it a Stealth Trend Day. It was however a trend day nonetheless and it managed to press price up into new contract highs aka Open Air.

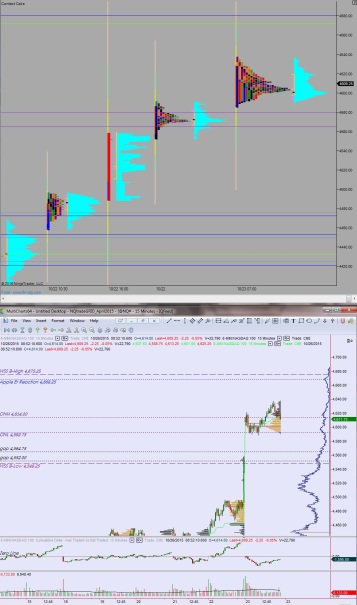

Heading into today my primary expectation is for buyers to press into the overnight inventory and close the gap up to 4693.50. From there look for them to continue higher to target the overnight high 4699 and press onward to test above the contract high 4699.50. Look for responsive sellers at 4705.25 and two way trade to ensue.

Hypo 2 buyers struggle to close the overnight gap up to 4693.50 and instead roll over ahead of it. Sellers then work to take out overnight low 4677. Look for responsive buyers around 4672.75 (interesting LVN and yesterday MID) and two trade to ensue.

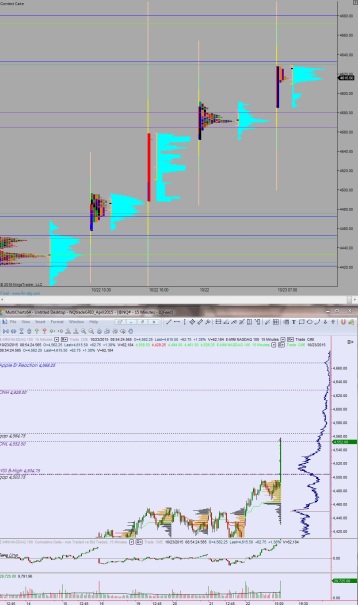

Hypo 3 sellers accelerate down through the 4672.75 LVN and continue lower to target 4656.75. Look for responsive buyers to emerge around 4653 and two way trade to ensue.

Hypo 4 we continue trending higher and exploring these uncharted prices until we find sellers. This starts with sustained trade above 4705.25.

Levels:

Comments »