NASDAQ futures are coming into Friday trade flat after an overnight session featuring normal range and volume. Price held Thursday range overnight on balanced trade.

On the economic front, we have the primary read of Confidence from U. of Michigan at 10am. Leading Indicators are also out at 10am, then at 1pm the Baker Hughes rig count.

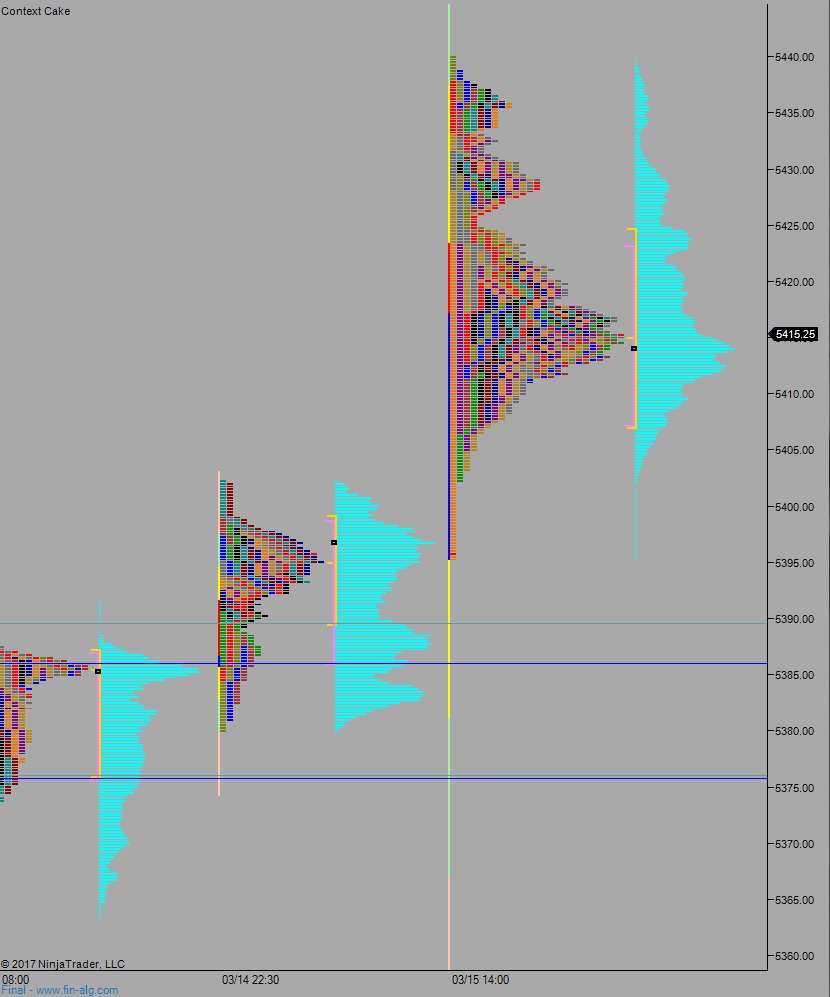

Yesterday we printed a normal variation down. A gap up was quickly faded lower and price continued lower, down through overnight, then catching a bid just ahead of the 5400 century mark. Two-way trade ensues afterwards.

Heading into today my primary expectation is for sellers to work down through overnight low 5411. Look for a test below Thursday low 5402.25 and a continued move lower down to 5400 before two way trade ensues.

Hypo 2 buyers press up through overnight high 5424.50 and continue higher, up through weekly high 5431.50, working toward the globex swing high at 5440 before two way trade ensues.

Hypo 3 strong selling pushes down to 5389.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Any validity to the theory that Quad-witching causes sell-off’s shortly afterwards?

I haven’t even witnessed that from an observational level, let alone a statistical study, so I’m not sure.