NASDAQ futures are starting the week flat after an overnight session featuring normal range and volume. Price worked lower overnight, pressing all the way down into the post FOMC rate hike rally before finding bidders and returning flat.

The economic calendar starts out extra light this week. The US Treasury is auctioning off 3- and 6-month T-bills at 11:30am. The rest of the day is free. Low-level Fed Reserve official Evans is speaking at 1:10pm, but little attention will be paid to him.

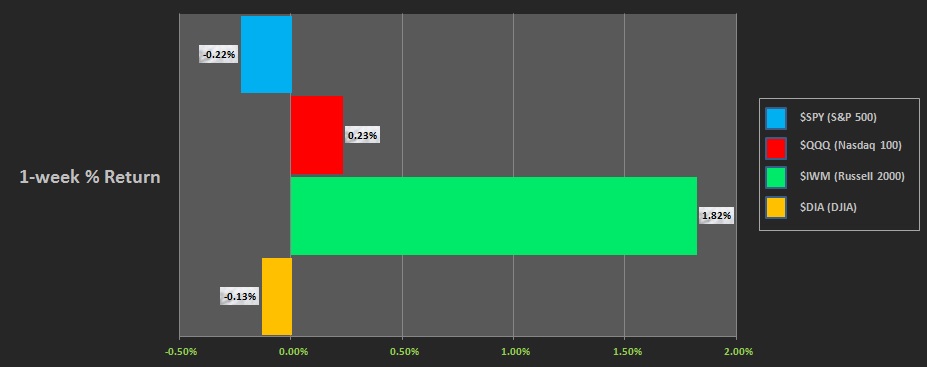

Last week the Russell rallied hard while the other indices marked time. This rally came from the low-end of a multi-month range in the Russell, which was critical for buyer to hold if the bull case were to remain intact, intermedite term. The performance of each major index can be seen below:

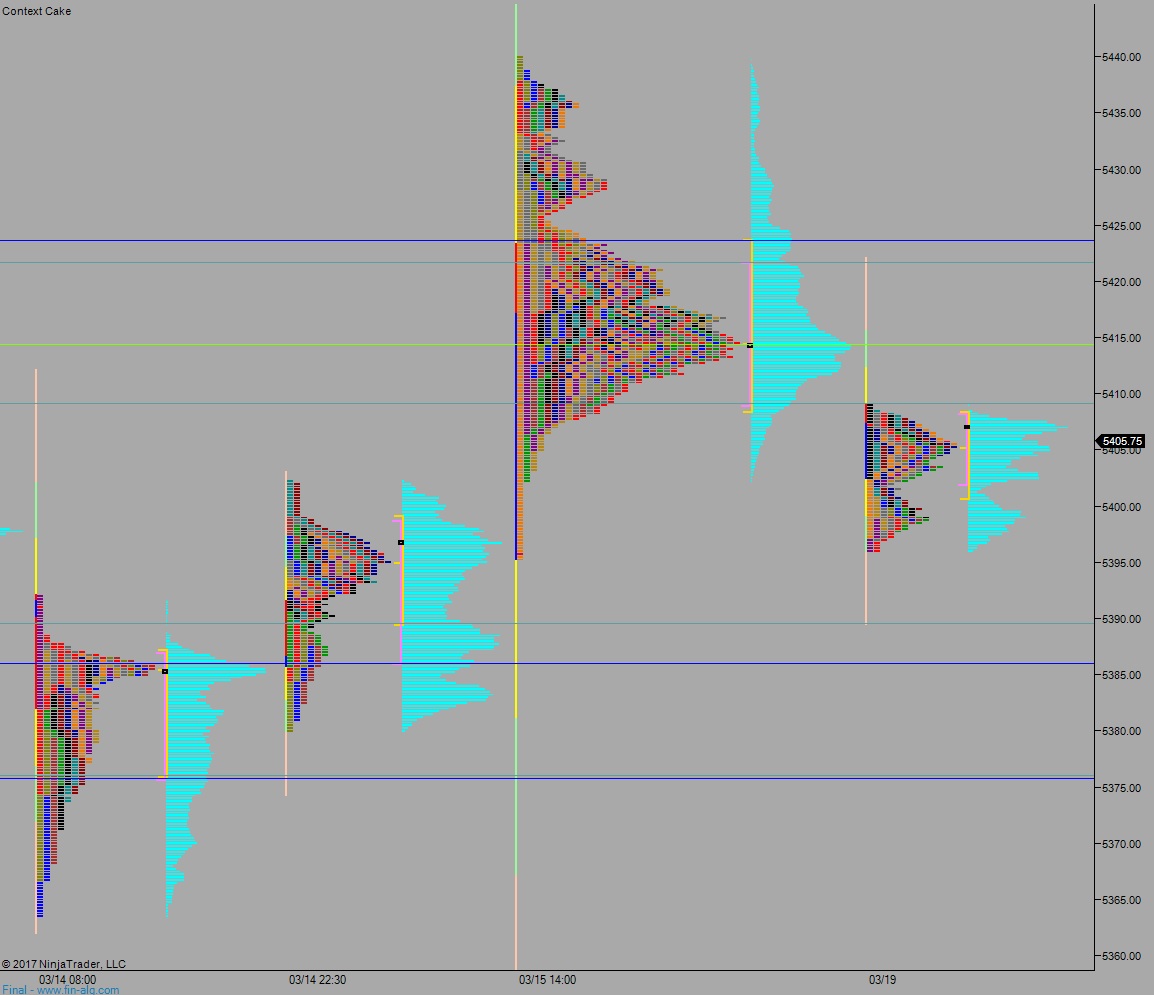

On Friday, the NASDAQ printed a neutral extreme down. Price opened flat, went range extension down. Sellers could not take out the Thursday low. Instead buyers came in and auctioned price back up through the entire daily range, making new daily highs before the entire move was reversed by sellers, back down through the entire range, to close near session low.

Heading into today my primary expectation is for buyers to work up though overnight high 5409 and tag the MCVPOC at 5414.50 before two way trade ensues.

Hypo 2 stronger buyers work up to 5421.75 before two way trade ensues.

Hypo 3 sellers press down through overnight low 5396 and trade down to 5389.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: